Introduction

Neglecting federal tax obligations can lead to serious repercussions that go beyond just financial penalties. We understand that facing unpaid taxes can be daunting. It’s crucial to grasp the potential consequences to maintain your financial stability and peace of mind.

What happens when tax responsibilities are ignored? The answer reveals a complex landscape of fines, legal actions, and emotional stress that can significantly impact your life. It’s common to feel overwhelmed by these challenges.

Exploring these implications not only highlights the importance of timely payments but also uncovers ways to manage tax debt effectively. Remember, you are not alone in this journey. We’re here to help you regain control over your financial future.

Define the Consequences of Not Paying Federal Taxes

Neglecting to settle federal obligations can lead to serious outcomes, including significant monetary fines and legal consequences, prompting concerns about what happens if you don't pay federal taxes and how it can deeply impact your financial stability. We understand that facing tax issues can be overwhelming. The Internal Revenue Service (IRS) imposes a failure-to-pay charge of 0.5% of the outstanding tax amount for each month the tax remains unpaid, with a maximum limit of 25%. For instance, if you owe $1,000 in taxes, the fee could reach $250 if not settled for five months. Plus, interest accrues on the unpaid balance, compounding the total amount owed.

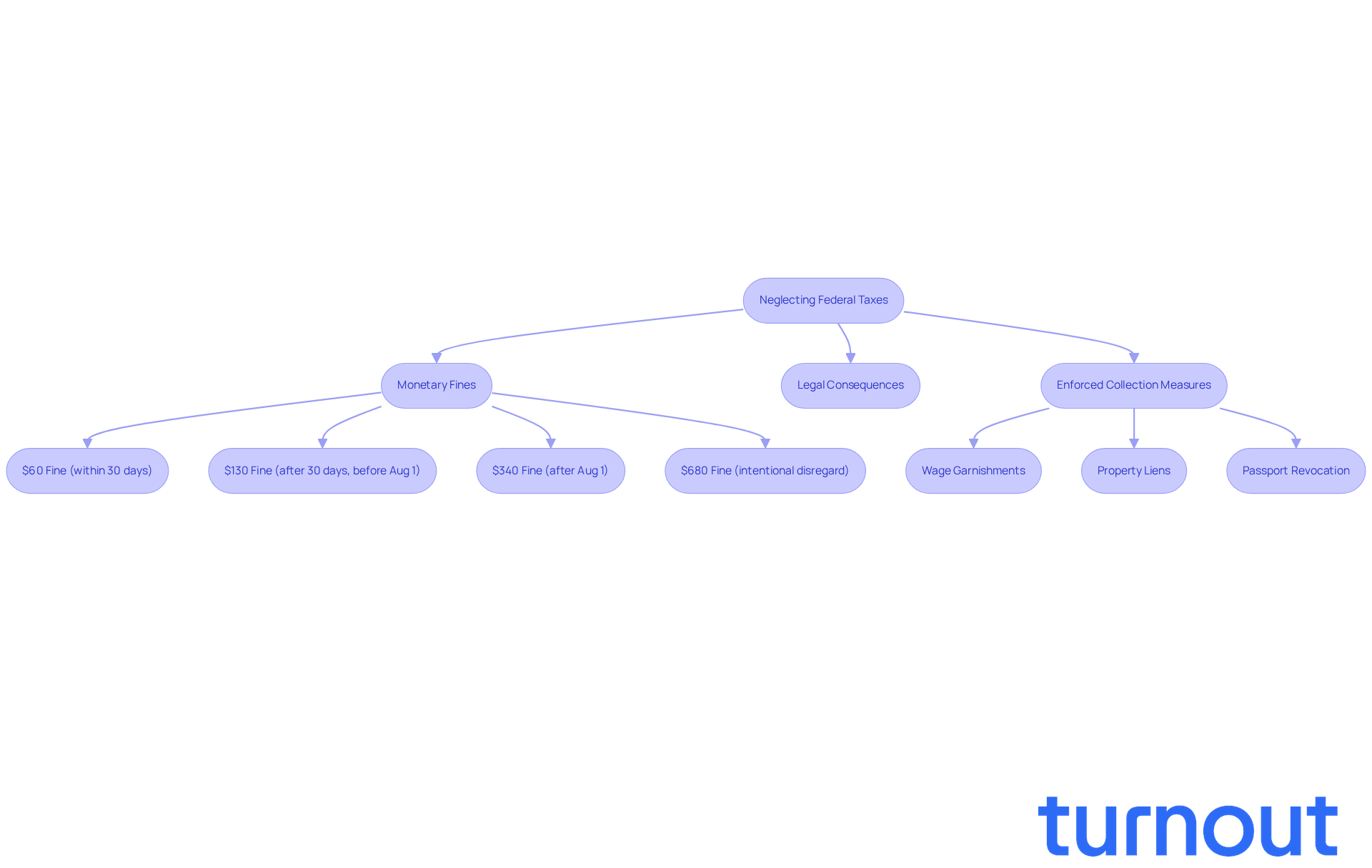

In 2026, the IRS has specified various fines for late filings:

- A $60 charge for returns submitted within 30 days late

- Increasing to $130 if submitted after 30 days but before August 1

- A staggering $340 if submitted after August 1

- If there’s intentional disregard of tax rules, the fine can be as high as $680 per return, with no maximum limit

It’s common to feel anxious about these penalties, but knowing the facts can help you take control.

In addition to these financial consequences, individuals may encounter enforced collection measures, such as:

- Wage garnishments

- Property liens

- Passport revocation in extreme cases

Such actions can create a debilitating cycle of debt and stress, especially for those already grappling with financial challenges. The IRS's recent evaluation of $17.8 billion in extra payments for late submissions highlights the urgency of addressing financial responsibilities promptly.

We encourage you to file your returns on time or request extensions to avoid these severe penalties. Interacting with the IRS in advance can also assist in reducing the repercussions of unpaid obligations. In fiscal year 2024, 7,199 offers in compromise were approved, enabling individuals to resolve their liabilities for less than the total amount due. Remember, you are not alone in this journey; we're here to help.

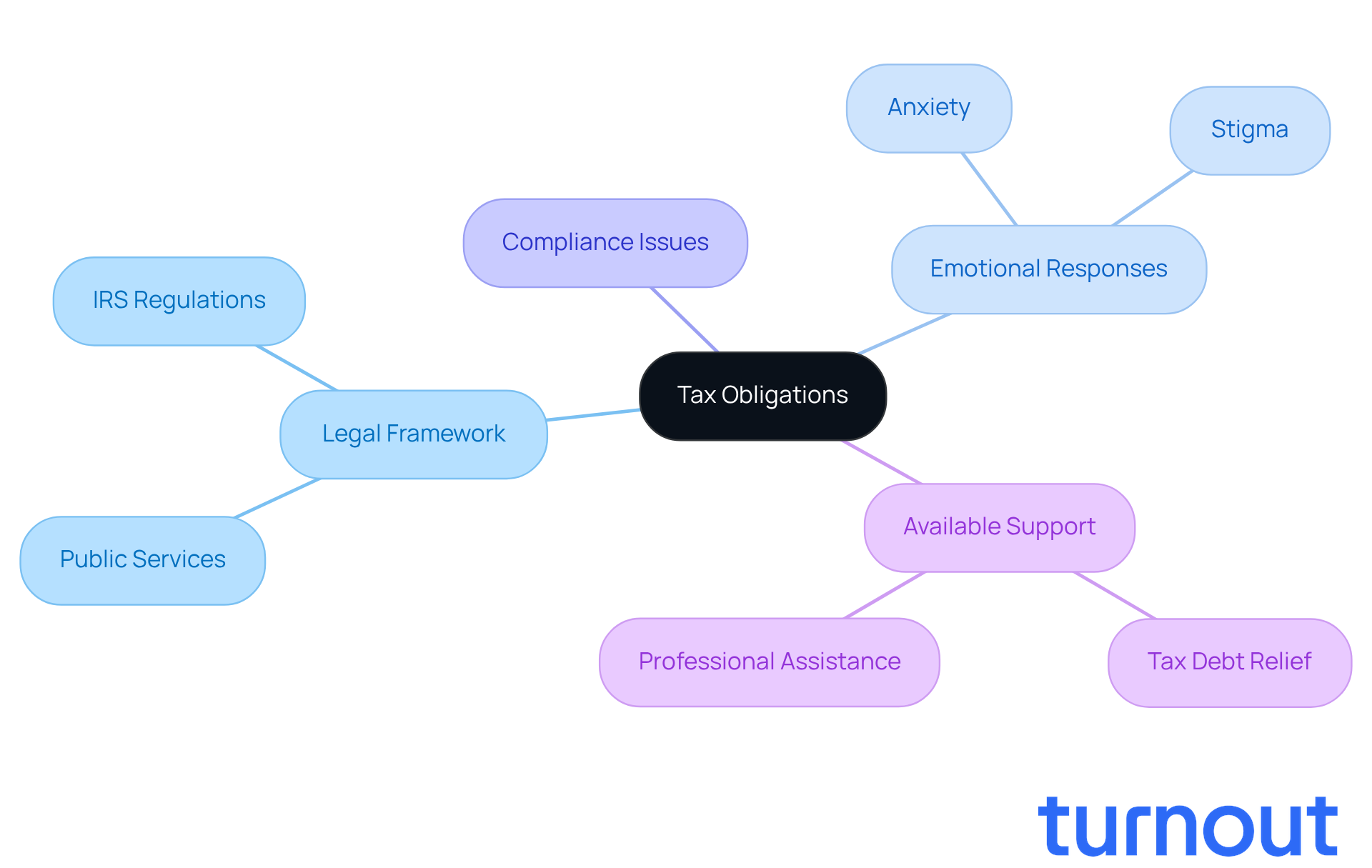

Understand the Legal and Social Context of Tax Obligations

Tax obligations can feel overwhelming, and we understand that many people struggle with them. The legal framework established by the U.S. government requires all citizens to contribute to public services and infrastructure. This system aims to ensure that everyone pays their fair share, supporting essential services like education, healthcare, and public safety.

It's common to feel anxious about compliance, particularly when contemplating what happens if you don't pay federal taxes, as it can seem like a disregard for civic duty. The IRS operates under a set of regulations that govern tax collection, and understanding these rules is crucial for managing your obligations effectively.

At Turnout, we're here to help. We offer valuable support, especially for those in vulnerable financial situations, guiding you through tax debt relief processes without the need for legal representation. Our IRS-licensed enrolled agents are qualified to assist you, providing the expertise you need.

Moreover, the stigma surrounding tax delinquency can make your challenges even harder, particularly when you think about what happens if you don't pay federal taxes. It's vital to seek assistance from qualified professionals who can help you explore your options. Remember, you are not alone in this journey. We're here to support you every step of the way.

Examine the Penalties and Legal Actions for Non-Payment

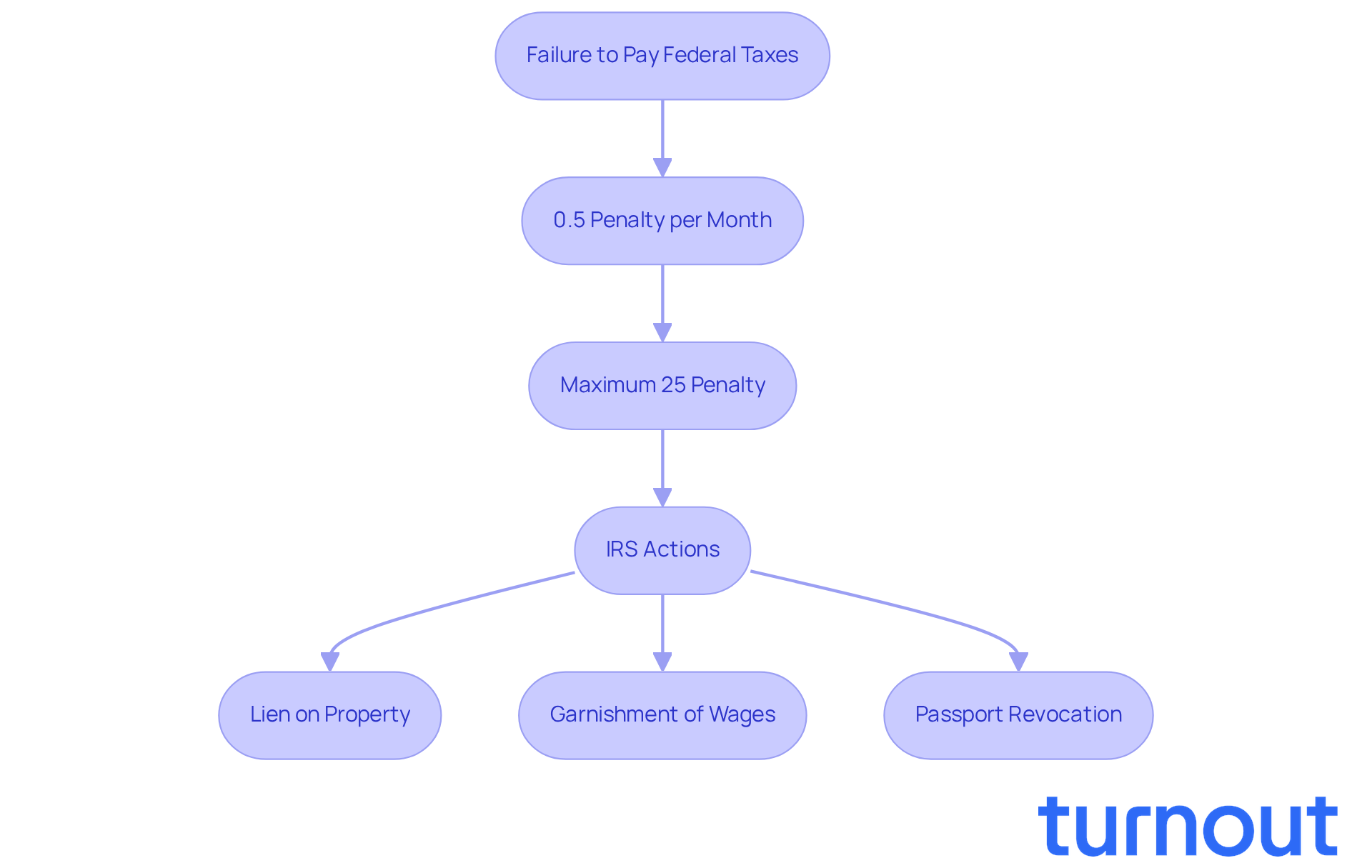

We understand that dealing with federal taxes can be overwhelming. The consequences can escalate quickly when considering what happens if you don't pay federal taxes. It starts with a failure-to-pay penalty of 0.5% per month on the unpaid amount, which can add up to a maximum of 25%. If the tax remains unsettled, you may wonder what happens if you don't pay federal taxes, as the IRS may take significant actions that can feel daunting.

One of the most severe measures is placing a lien on your property. This acts as a public claim until the debt is resolved, and it can severely impact your credit score, hindering future financial opportunities. It’s common to feel anxious about how this might affect your life.

Furthermore, the IRS has the authority to garnish wages. This means they can directly deduct a portion of your paycheck to cover the tax debt. In extreme situations, they may even revoke your passport, limiting your ability to travel internationally. Such actions not only impose immediate financial burdens but can also lead to long-term repercussions on your financial stability and creditworthiness, illustrating what happens if you don't pay federal taxes.

Statistics show that the number of IRS liens has increased significantly, reflecting the agency's aggressive approach to collecting unpaid taxes. In fact, penalty collections have quadrupled in 2023. Therefore, it’s crucial to address your tax obligations promptly. Remember, you are not alone in this journey, and we’re here to help you navigate these challenges.

Explore Options for Managing Tax Debt and Avoiding Consequences

Facing tax debt can feel overwhelming, and it’s important to know that you’re not alone in this journey. Many individuals find themselves in similar situations, and understanding what happens if you don't pay federal taxes can help manage these obligations and avoid severe consequences.

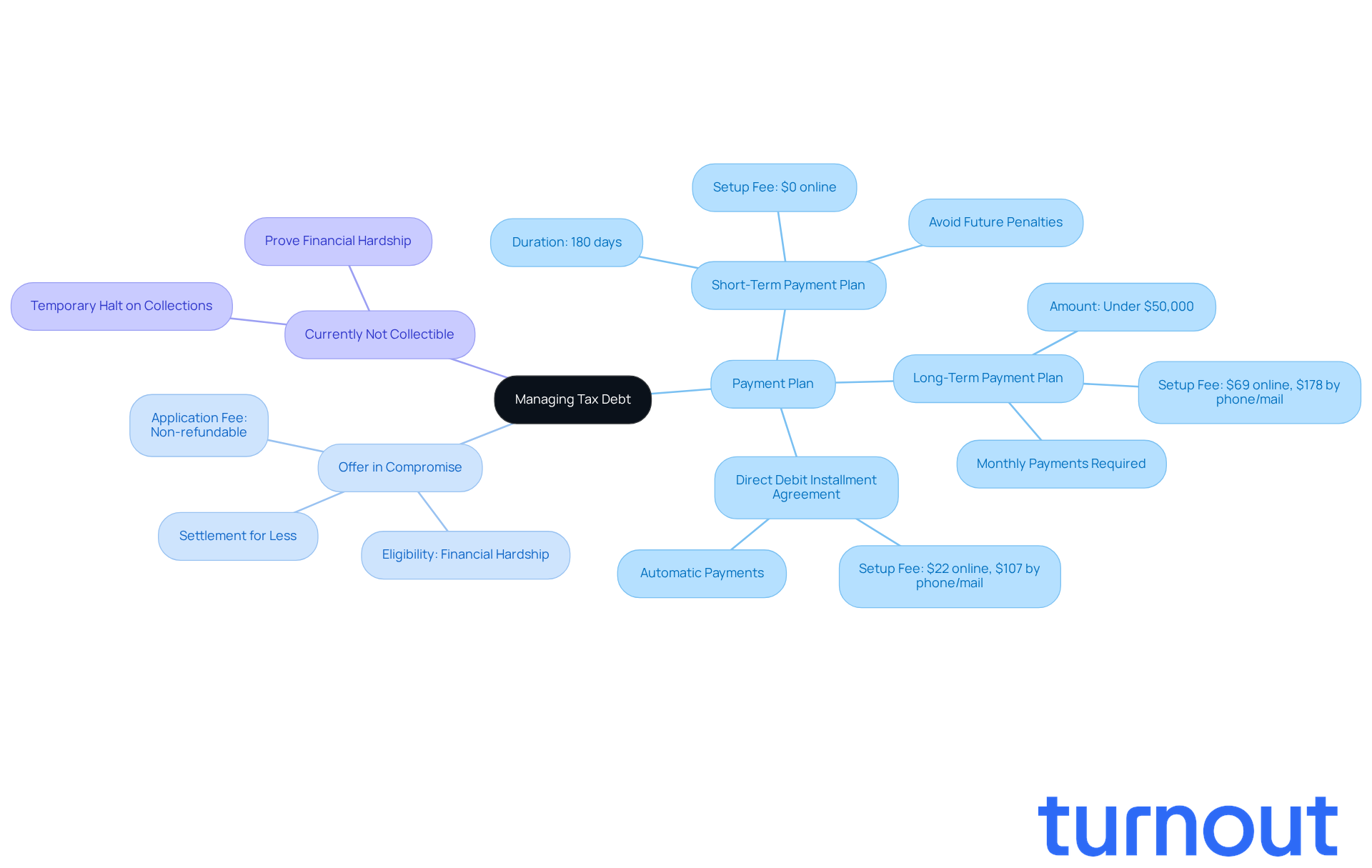

One effective strategy is to set up a payment plan with the IRS. This allows you to pay your debt in manageable installments, easing some of the financial pressure. Additionally, the IRS offers an 'Offer in Compromise' program. This program enables you to settle your tax debt for less than the total amount owed, provided you can demonstrate financial hardship.

You might also qualify for 'Currently Not Collectible' status. This status can temporarily halt collection actions if you can prove that you cannot afford to pay. It’s common to feel anxious about these options, especially when considering what happens if you don't pay federal taxes, but seeking assistance from tax professionals or consumer advocacy organizations can provide valuable guidance and support.

Remember, you don’t have to navigate this alone. We’re here to help you take proactive steps to resolve your tax issues. Consider reaching out for support today.

Conclusion

Neglecting federal tax obligations can lead to serious financial and legal troubles. We understand that this can be overwhelming, and it’s crucial to know what happens if these responsibilities are ignored. The potential consequences - accumulating penalties, wage garnishments, and even property liens - can deeply affect your financial stability and overall quality of life.

Throughout this article, we’ve highlighted key points, such as the rising penalties for late tax payments and the IRS's enforcement actions. It’s common to feel stressed about tax debt, but timely filing and payment can help you avoid a cycle of anxiety. Proactive communication with the IRS can lead to solutions like payment plans or offers in compromise, easing your burden.

Remember, tax compliance isn’t just a legal obligation; it’s a civic duty that contributes to public services. Understanding the consequences of not paying federal taxes is vital, especially if you’re facing financial difficulties. Seeking help from qualified professionals can provide the support you need to navigate these challenges effectively.

Taking action now can prevent future complications and help maintain your financial health. You are not alone in this journey; we’re here to help you avoid the daunting repercussions of unpaid taxes.

Frequently Asked Questions

What are the consequences of not paying federal taxes?

Neglecting to pay federal taxes can lead to significant monetary fines, legal consequences, and enforced collection measures, which can deeply impact your financial stability.

What is the failure-to-pay charge imposed by the IRS?

The IRS imposes a failure-to-pay charge of 0.5% of the outstanding tax amount for each month the tax remains unpaid, with a maximum limit of 25%.

How does interest affect unpaid federal taxes?

Interest accrues on the unpaid balance, compounding the total amount owed, which increases the financial burden over time.

What are the fines for late tax filings in 2026?

The fines for late tax filings in 2026 include:

- $60 for returns submitted within 30 days late

- $130 if submitted after 30 days but before August 1

- $340 if submitted after August 1

- Up to $680 for intentional disregard of tax rules, with no maximum limit.

What enforced collection measures can individuals face for unpaid taxes?

Individuals may encounter enforced collection measures such as wage garnishments, property liens, and passport revocation in extreme cases.

How can individuals manage their tax obligations to avoid penalties?

Individuals can manage their tax obligations by filing returns on time, requesting extensions, and interacting with the IRS in advance to reduce repercussions of unpaid obligations.

What is an offer in compromise?

An offer in compromise is an agreement that allows individuals to resolve their tax liabilities for less than the total amount due, with 7,199 offers approved in fiscal year 2024.

What should individuals do if they feel overwhelmed by tax issues?

If individuals feel overwhelmed by tax issues, they are encouraged to seek help and remember that they are not alone in managing their financial responsibilities.