Overview

We understand that failing to file taxes for years can feel overwhelming. The consequences can be severe, including accumulating penalties, interest on unpaid taxes, and even potential criminal charges for tax evasion. It's common to feel anxious about these issues, but knowing the facts can help you take control of the situation.

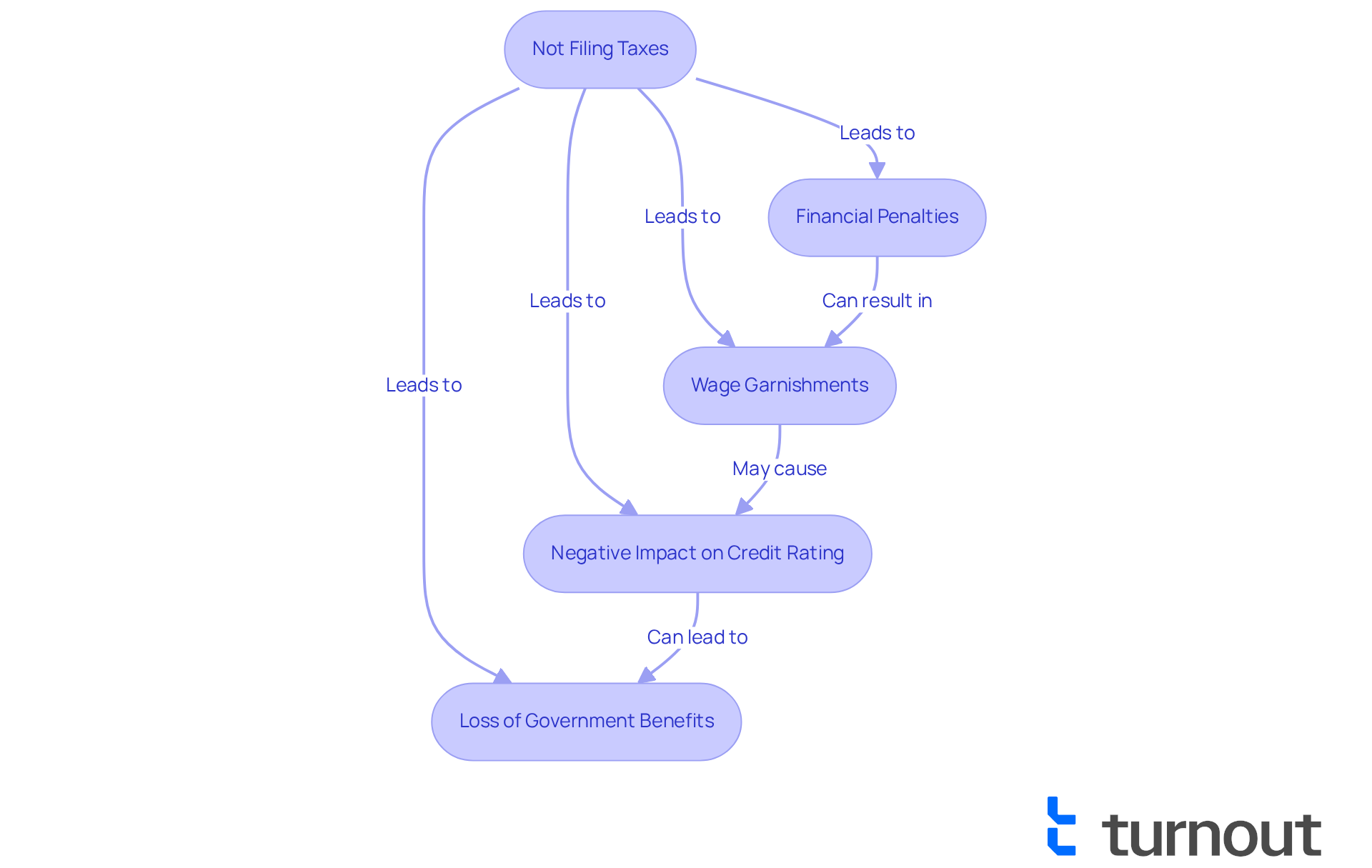

The IRS imposes significant fines and can initiate collection actions, such as wage garnishments. This can negatively impact your credit rating, making it even more challenging to navigate your financial landscape. Timely tax compliance is crucial to avoid these repercussions, and we're here to help you through this journey.

If you're feeling lost, remember that you're not alone. Many people face similar challenges, and there are solutions available. Taking action now can prevent further complications down the road. Don't hesitate to reach out for assistance; together, we can find a way forward.

Introduction

Neglecting to file taxes can lead to serious repercussions that go beyond just financial penalties. We understand that this can be overwhelming. Individuals may face hefty charges, interest on overdue amounts, and even aggressive collection measures from the IRS, such as wage garnishments or bank levies.

It's common to feel anxious about the long-term impact on your credit score and eligibility for essential government benefits. What happens if taxes go unfiled for years? How can you navigate this daunting landscape to regain your financial footing?

You're not alone in this journey. Many people find themselves in similar situations, and there are ways to address these challenges. We're here to help you explore your options and take the necessary steps toward recovery.

Understanding the Consequences of Not Filing Taxes

Neglecting to submit financial returns can lead to serious consequences, and we understand what happens if you don't file taxes for years can feel overwhelming. People may face charges and interest on overdue obligations, which can accumulate quickly, resulting in significant financial strain, particularly in light of what happens if you don't file taxes for years. For example, the IRS imposes a failure-to-file penalty of 5% of the unpaid tax obligation for each month the return is late, capping at 25% after five months. If dues remain unpaid for years, the IRS may even resort to forceful collection measures, such as wage garnishments or bank levies, leading to concerns about what happens if you don't file taxes for years. In fiscal year 2024 alone, the IRS collected nearly $120.2 billion in unpaid assessments, underscoring their commitment to enforcing tax compliance.

However, the repercussions of what happens if you don't file taxes for years extend beyond just financial penalties. Failing to submit returns can negatively impact your credit rating, leading to questions about what happens if you don't file taxes for years. A lien placed by the IRS due to unpaid taxes can significantly lower your credit score, making it harder to secure loans or credit in the future. This is especially concerning for those who rely on credit for essential purchases like homes or vehicles. Additionally, individuals may lose eligibility for certain government benefits, including Social Security Disability, which highlights what happens if you don't file taxes for years, as tax compliance is often a prerequisite for maintaining these benefits.

At Turnout, we provide access to tools and services designed to help you navigate these complex issues. Our personalized consultations and assistance from IRS-licensed enrolled agents can facilitate tax debt relief. Remember, what happens if you don't file taxes for years includes consequences that extend beyond immediate financial impacts; they can affect your long-term economic stability and access to essential resources.

You are not alone in this journey. We're here to help you find the support you need.

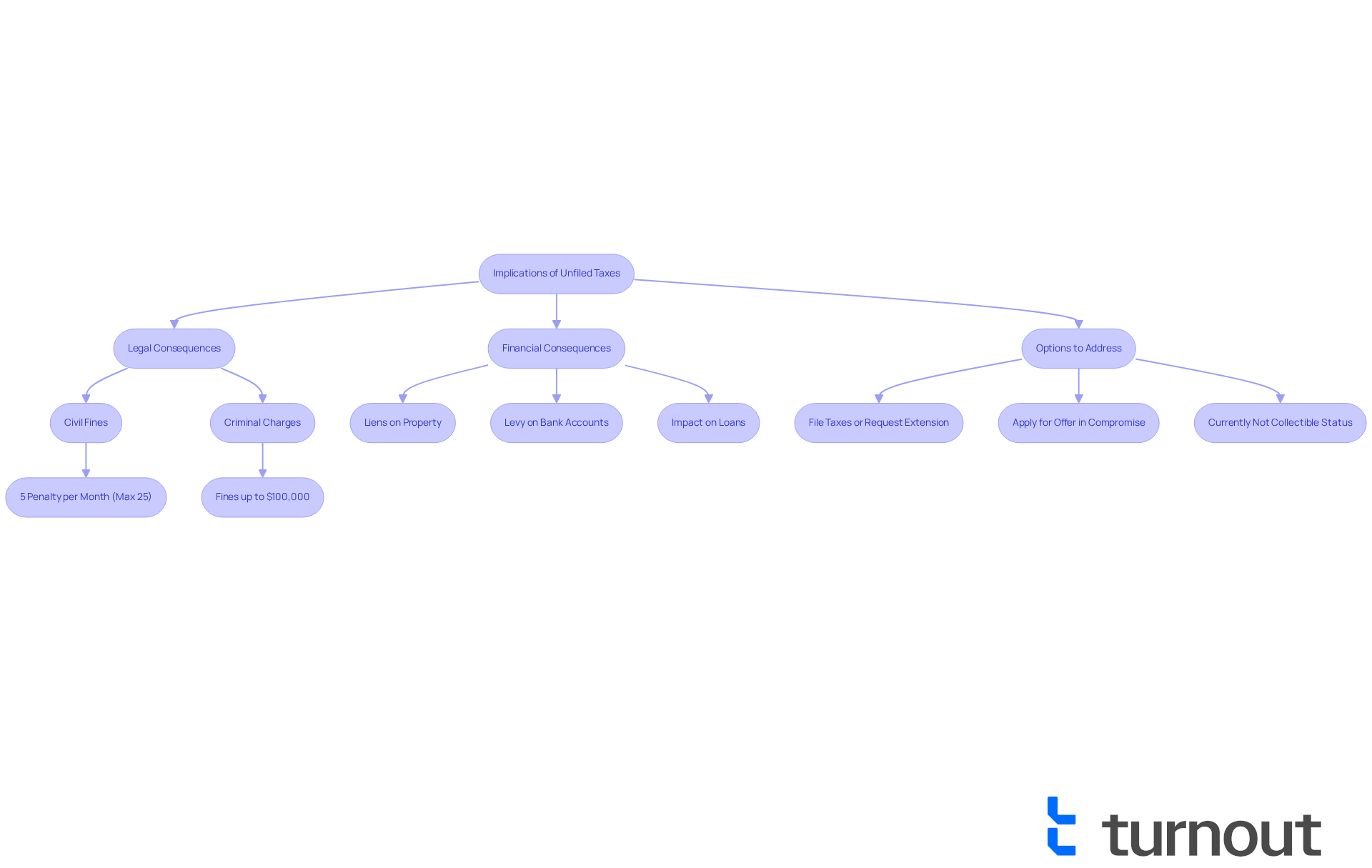

Legal and Financial Implications of Unfiled Taxes

We understand that dealing with financial returns can be overwhelming, particularly when considering what happens if you don't file taxes for years, as the legal consequences of failing to submit them on time can be quite severe. The IRS imposes civil fines for late submissions, which can add up to 5% of the unpaid tax for each month the return is overdue, reaching a maximum of 25%. For instance, if you owe $1,000 in taxes and submit your return two months late, you might face a penalty of $100. In more serious cases, the IRS may even pursue criminal charges for tax evasion, leading to fines of up to $100,000 and possible imprisonment for up to five years.

Financially, this situation can feel precarious. The IRS has the authority to place liens on property or initiate levies on bank accounts. Such actions not only disrupt your personal finances but can also hinder your ability to secure loans or mortgages, as lenders typically require proof of tax compliance. In FY 2024, the IRS collected $120.2 billion in unpaid assessments, highlighting the scale of tax compliance issues. Additionally, the IRS evaluated $17.8 billion in extra fees for returns not submitted on time.

It's essential to submit your taxes punctually or request extensions to avoid facing what happens if you don't file taxes for years, including considerable fines and potential legal consequences. If you expect to miss the deadline, you can apply for an extension by April 15, 2025, to help reduce fines. Moreover, if you're facing significant consequences, consider alternatives like the IRS's Offers in Compromise program, which allows you to resolve your tax obligations for less than what you owe. The Currently Not Collectible (CNC) status is also an option for those experiencing financial hardship, temporarily suspending IRS collection efforts.

It's important to remember that interest on unpaid taxes continues to accrue, complicating financial situations further. As Robert Nassau noted, the 'failure to file' penalty is ten times worse than the 'failure to pay' penalty, underscoring the importance of timely filing. The IRS's Fresh Start initiative has increased the threshold for streamlined agreements to $50,000, making it easier for those needing payment plans.

In FY 2024, the IRS accepted 7,199 offers in compromise, totaling $163.4 million. This illustrates the potential for taxpayers to settle their debts effectively. Remember, you are not alone in this journey, and there are options available to help you navigate these challenges.

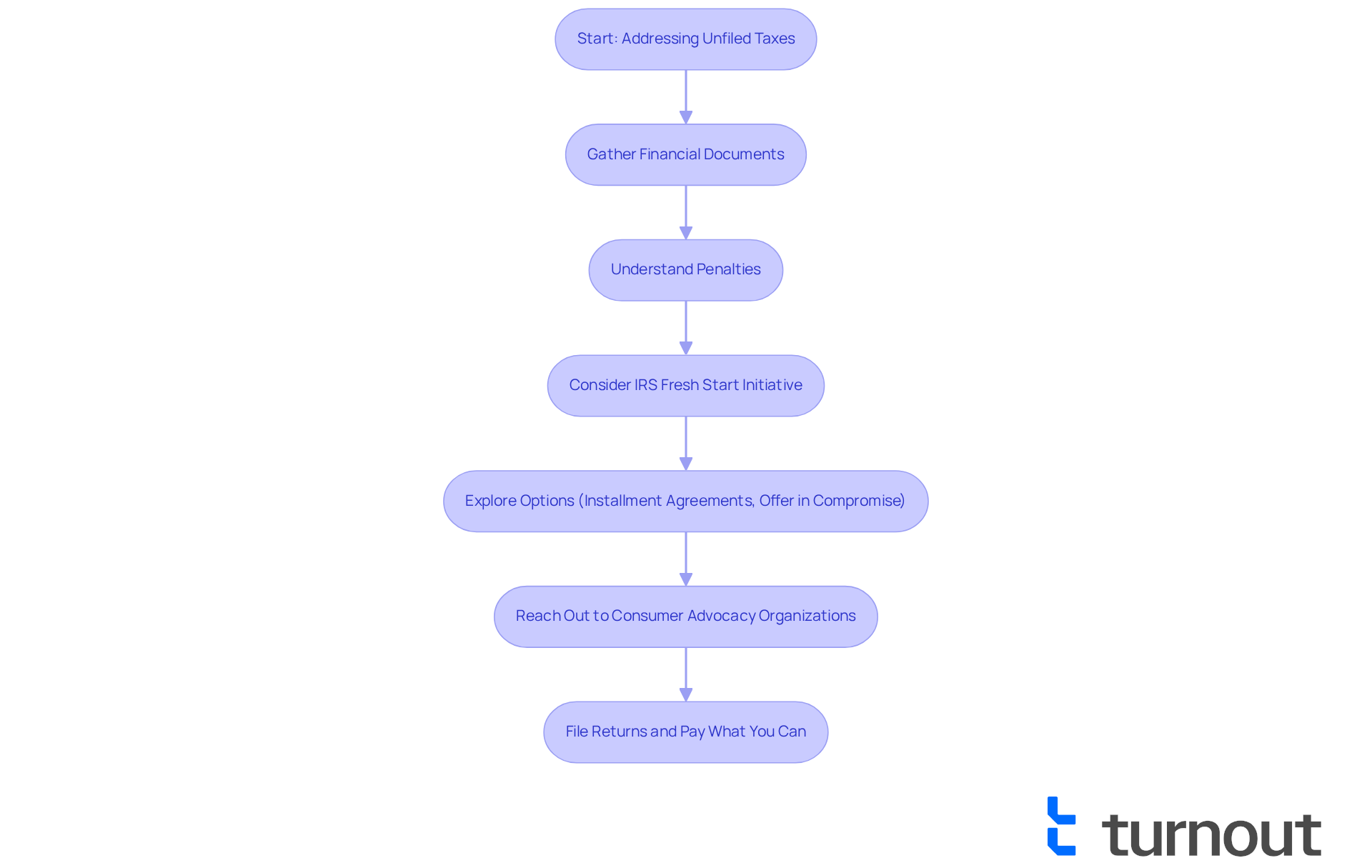

Options for Addressing Unfiled Taxes: Resources and Strategies

If you haven’t submitted your tax returns for several years, it’s essential to know what happens if you don't file taxes for years, and there are effective ways to tackle this situation. First, gather all your financial documents—like W-2s, 1099s, and bank statements. This will help you understand how much you owe the IRS. Filing those past due returns can really help reduce penalties. Remember, the IRS charges a failure-to-file penalty of 5% per month, up to a maximum of 25% of unpaid taxes. Taking action sooner rather than later can help you understand what happens if you don't file taxes for years and avoid more serious consequences.

The IRS Fresh Start Initiative is here to offer relief for those facing tax debt. This program includes options like Installment Agreements and Offer in Compromise, which can make settling your debts more manageable. For instance, if you qualify, you might be able to resolve your tax obligation for less than what you owe, easing some of that financial burden. To be eligible for the Fresh Start Program, you need to owe under $50,000.

Additionally, reaching out to consumer advocacy organizations can provide you with essential guidance and support as you navigate the complexities of tax resolution. These organizations can help you understand your rights and options, ensuring you make informed decisions.

It’s important to act quickly. The longer you wait, the more severe the consequences can become, particularly regarding what happens if you don't file taxes for years. If you owe taxes, try to file your returns and pay as much as you can to avoid further penalties and interest. Unfiled returns could lead to serious legal actions, highlighting what happens if you don't file taxes for years, including levies, liens, or wage garnishments. By using the resources available to you and taking proactive steps, you can regain control over your tax situation and work towards a resolution. Remember, you’re not alone in this journey, and there’s help available.

Conclusion

Neglecting to file taxes for multiple years can lead to serious repercussions that go beyond just financial penalties. We understand that the consequences of unfiled taxes can weigh heavily on your personal finances and legal standing. That’s why it’s so important to prioritize timely tax compliance. If you’ve fallen behind on your tax obligations, knowing what’s at stake is crucial.

Throughout this article, we’ve highlighted the financial implications of failing to file taxes. Accumulating penalties, interest, and the risk of enforced collection actions by the IRS can feel overwhelming. Additionally, the negative effects on your credit score and eligibility for government benefits serve as stark reminders of the broader ramifications of tax noncompliance. But remember, you’re not alone in this journey. There are resources and strategies available, such as the IRS Fresh Start Initiative and support from consumer advocacy organizations, that can help you navigate these challenges effectively.

Addressing unfiled taxes isn’t just about avoiding penalties; it’s about reclaiming your financial stability and securing future opportunities. Taking proactive steps to file overdue returns and seeking assistance can significantly lessen the long-term impacts of tax noncompliance. The message is clear: timely action is essential, and support is available for those who need it. Embracing these resources can lead to a brighter financial future and peace of mind regarding your tax obligations.

Frequently Asked Questions

What are the financial consequences of not filing taxes?

Neglecting to file taxes can lead to charges and interest on overdue obligations, which can accumulate quickly. The IRS imposes a failure-to-file penalty of 5% of the unpaid tax obligation for each month the return is late, capped at 25% after five months. If dues remain unpaid for years, the IRS may resort to forceful collection measures, such as wage garnishments or bank levies.

How much unpaid tax did the IRS collect in fiscal year 2024?

In fiscal year 2024, the IRS collected nearly $120.2 billion in unpaid assessments, highlighting their commitment to enforcing tax compliance.

Can not filing taxes affect my credit rating?

Yes, failing to submit tax returns can negatively impact your credit rating. A lien placed by the IRS due to unpaid taxes can significantly lower your credit score, making it harder to secure loans or credit in the future.

What government benefits can be impacted by not filing taxes?

Individuals may lose eligibility for certain government benefits, including Social Security Disability, as tax compliance is often a prerequisite for maintaining these benefits.

What services does Turnout provide to help with tax issues?

Turnout offers access to tools and services designed to help navigate tax issues, including personalized consultations and assistance from IRS-licensed enrolled agents to facilitate tax debt relief.