Introduction

Neglecting to file taxes for an extended period can lead to a cascade of dire consequences that many individuals may not fully grasp. We understand that facing the IRS can be overwhelming. The penalties can be significant, with a failure-to-file penalty reaching up to 25% of unpaid taxes. The financial implications can be staggering, and it’s common to feel anxious about what this means for your future.

Beyond the monetary costs, the potential for legal repercussions, including criminal charges for tax evasion, adds an alarming layer of complexity. It’s important to recognize that you are not alone in this journey. Many people find themselves in similar situations, feeling lost and unsure of how to proceed.

So, what steps can you take to mitigate these risks and regain compliance after five years of non-filing? Let’s explore some supportive options together.

Understand the Consequences of Not Filing Taxes

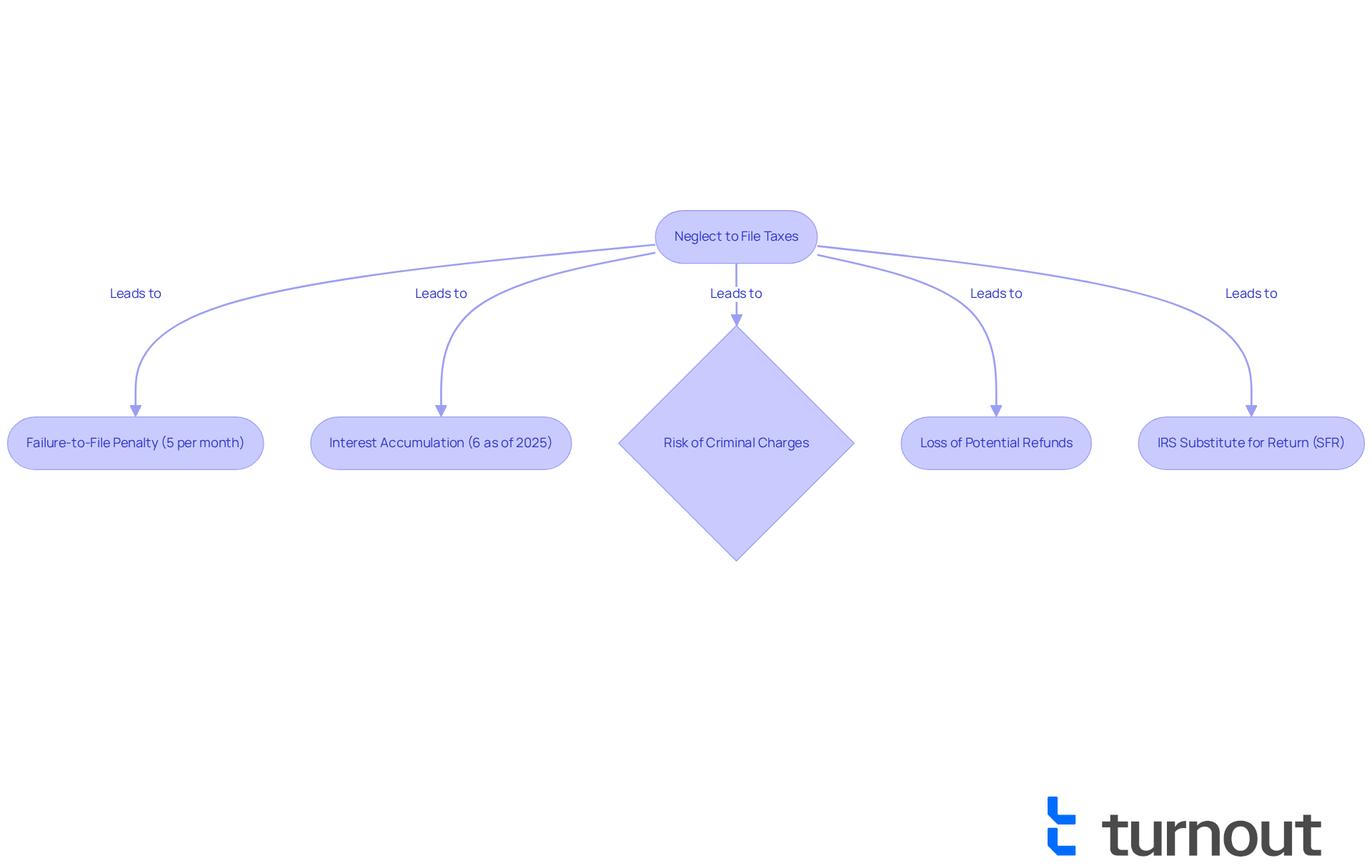

Neglecting to submit your financial obligations can lead to serious repercussions that extend beyond just monetary fines. We understand that dealing with taxes can be overwhelming, and the Internal Revenue Service (IRS) imposes a failure-to-file penalty of 5% of the unpaid tax for each month the return is late, capped at a maximum of 25%. For example, if you owe $10,000 and file your return four months late, you could face a penalty of $2,000. Additionally, interest on overdue payments accumulates over time, further increasing the total amount due. As of 2025, the interest rate on outstanding dues is set at 6%, and the failure-to-pay penalty remains at 0.5% per month after the initial five months. This can significantly add to your financial burden.

It's common to feel anxious about the legal consequences of failing to submit your taxes. If the IRS determines that the neglect to file was intentional, it may lead to criminal charges for tax evasion. The penalties can be severe, reaching as high as $100,000 for individuals and $500,000 for corporations, along with the possibility of incarceration for up to five years.

Moreover, if you haven’t filed, you risk losing any potential refunds. The IRS only allows requests for refunds within three cycles of the original filing deadline. So, since I haven’t filed taxes in 5 years, any reimbursements for withholdings or estimated payments during that time are permanently lost. Furthermore, the IRS can file a substitute for return (SFR) after a return is twelve months overdue, which often results in a higher tax obligation due to the omission of deductions and credits. This highlights the importance of addressing unreported payments promptly to avoid escalating penalties and to protect your financial future.

Remember, you are not alone in this journey. We're here to help you navigate these challenges and find a way forward.

Explore the Implications of Five Years Without Tax Filing

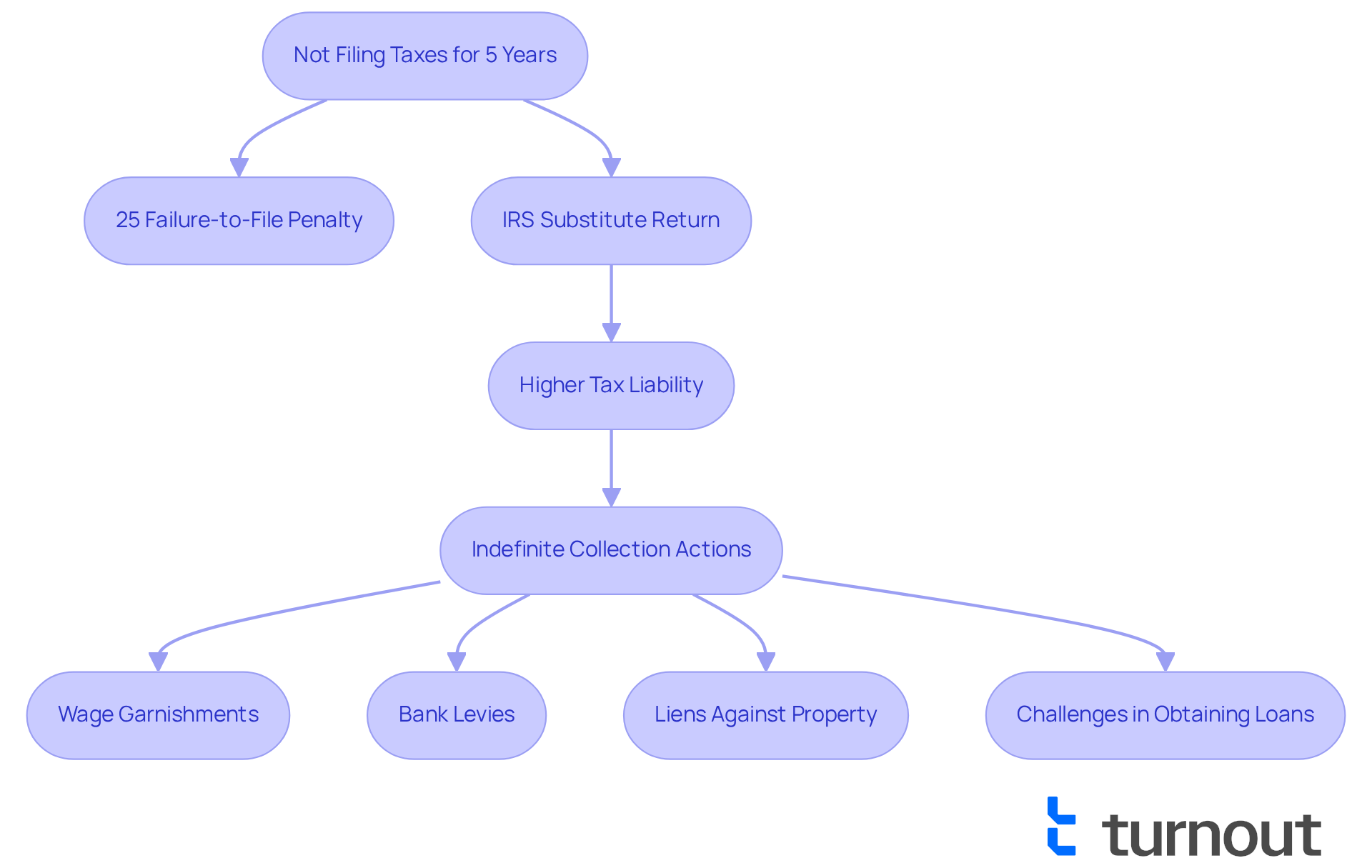

We understand that the situation of not filing taxes can feel overwhelming, especially since I haven’t filed taxes in 5 years. The consequences can be significant, both financially and legally. After five years, the IRS can impose a maximum failure-to-file penalty of 25% on the unpaid tax amount. It’s common to feel anxious about this, especially since I haven’t filed taxes in 5 years and the IRS may file a substitute return on your behalf, often without considering deductions or credits. This can lead to a higher tax liability, which adds to the stress.

Moreover, it’s important to know that the IRS has no statute of limitations on collecting unpaid dues if I haven’t filed taxes in 5 years. This means they can pursue collection indefinitely, which can lead to aggressive actions like wage garnishments, bank levies, and liens against your property. We recognize that this can be a daunting prospect.

Additionally, individuals may face challenges in obtaining loans or mortgages, as lenders typically require proof of tax compliance. The psychological burden of unresolved tax issues can lead to significant stress and anxiety. Remember, you are not alone in this journey. We’re here to help you navigate these challenges and find a way forward.

Identify Steps to Take After Five Years of Non-Filing

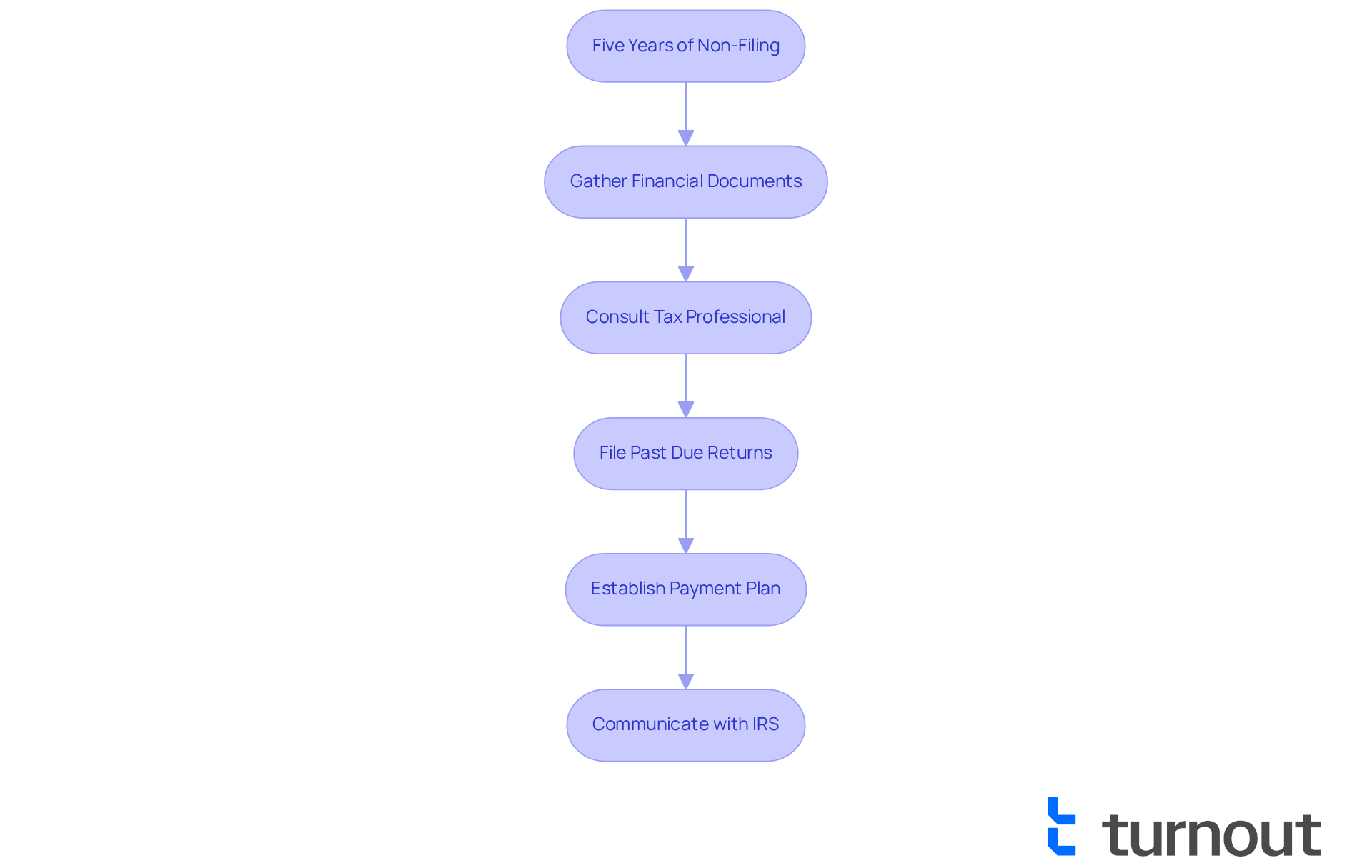

If I haven't filed taxes in 5 years, I understand how overwhelming that can feel. The first step is to gather all your important financial documents, like W-2s, 1099s, and any other income statements. This foundational step is crucial for accurate filing and can help ease your worries.

- Consulting with a tax professional or advocate can provide you with tailored guidance based on your unique situation.

- They can help you navigate the complexities of the tax system, making the process less daunting.

- Filing your past due returns promptly is essential; it can significantly reduce penalties and interest, giving you some peace of mind.

The IRS typically requires you to submit returns for the past six years to ensure compliance. This step is vital in resolving any uncertainties about your tax status. If you owe taxes, consider establishing a payment plan with the IRS to manage your debt effectively. Remember, you are not alone in this journey.

Additionally, you may qualify for penalty relief if you can demonstrate reasonable cause for your failure to file. This can alleviate some financial burdens and help you move forward. Maintaining proactive communication with the IRS is key; it can help reduce stress and foster a more manageable resolution to your tax issues. We're here to help you through this process.

Conclusion

Neglecting to file taxes for an extended period can lead to severe consequences that are both financially and legally daunting. We understand that the implications of not addressing tax obligations for five years extend beyond mere penalties; they can significantly affect your financial stability and peace of mind. Recognizing the gravity of these repercussions is essential for anyone who finds themselves in this situation.

Throughout this article, we’ve highlighted key points about the various penalties imposed by the IRS, including the failure-to-file penalty and the accumulation of interest on unpaid taxes. It’s common to feel overwhelmed by the risk of criminal charges for tax evasion, the potential loss of refunds, and the indefinite nature of the IRS's collection efforts. This underscores the importance of taking action. Additionally, we emphasize the necessity of filing past due returns and seeking professional guidance to navigate the complexities of tax compliance.

Ultimately, addressing the issue of unfiled taxes is crucial for safeguarding your financial future. Taking proactive steps, such as gathering necessary documents, consulting with tax professionals, and filing overdue returns, can significantly alleviate stress and reduce penalties. By confronting these challenges head-on, you can reclaim control over your financial situation and pave the way for a more secure future. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What are the consequences of not filing taxes?

Not filing taxes can lead to serious repercussions, including monetary fines, penalties, and potential criminal charges for tax evasion.

What is the failure-to-file penalty imposed by the IRS?

The IRS imposes a failure-to-file penalty of 5% of the unpaid tax for each month the return is late, capped at a maximum of 25%.

How does the failure-to-file penalty work in practice?

For example, if you owe $10,000 and file your return four months late, you could face a penalty of $2,000.

What happens to interest on overdue payments?

Interest on overdue payments accumulates over time, with a rate set at 6% as of 2025.

What is the failure-to-pay penalty after the first five months?

The failure-to-pay penalty is 0.5% per month after the initial five months.

What are the legal consequences of intentionally failing to file taxes?

If the IRS determines that the neglect to file was intentional, it may lead to criminal charges for tax evasion, with penalties reaching up to $100,000 for individuals and $500,000 for corporations, along with possible incarceration for up to five years.

Can I lose potential refunds if I do not file my taxes?

Yes, if you haven’t filed, you risk losing any potential refunds, as the IRS only allows requests for refunds within three cycles of the original filing deadline.

What happens if my tax return is over a year overdue?

The IRS can file a substitute for return (SFR) after a return is twelve months overdue, which often results in a higher tax obligation due to the omission of deductions and credits.

Why is it important to address unreported payments promptly?

Addressing unreported payments promptly can help avoid escalating penalties and protect your financial future.