Overview

If a Form 8300 has been filed against you, it means that you or your business have received over $10,000 in cash. We understand that this situation can feel overwhelming, and it may lead to significant scrutiny and potential penalties from the IRS if not handled properly. It's important to act promptly. Failing to file can result in fines and audits, which can add to your stress.

To help you navigate this challenging time, we want to outline the steps you can take if a filing occurs:

- Start by reviewing the transaction details carefully.

- It’s also wise to consult with a financial compliance expert who can guide you through the process.

- Remember, you're not alone in this journey, and there are resources available to support you.

Introduction

Navigating the complexities of financial regulations can feel overwhelming, especially when it comes to significant cash transactions. We understand that IRS Form 8300 is a critical tool for the government to monitor large monetary exchanges and deter illegal activities. Yet, many individuals and businesses may not fully grasp its implications.

What happens if a Form 8300 is filed against someone? This question carries significant weight, as the consequences can range from hefty fines to increased scrutiny from the IRS. It can even lead to audits or criminal investigations.

Understanding this process is essential for anyone involved in cash transactions exceeding $10,000. This knowledge can mean the difference between compliance and costly penalties. Remember, you are not alone in this journey; we’re here to help you navigate these complexities with confidence.

Define IRS Form 8300 and Its Purpose

IRS Form 8300 is an important document that individuals and companies must in a single exchange or connected exchanges. We understand that navigating these requirements can be overwhelming, but this form plays a crucial role in helping the IRS monitor significant , ultimately deterring money laundering and other unlawful actions. By submitting this form, you provide the IRS with essential details about the exchange, including the payer's identity, the amount received, and the nature of the transaction. It is vital for anyone involved in to understand , as it helps ensure compliance with federal regulations and avoid potential .

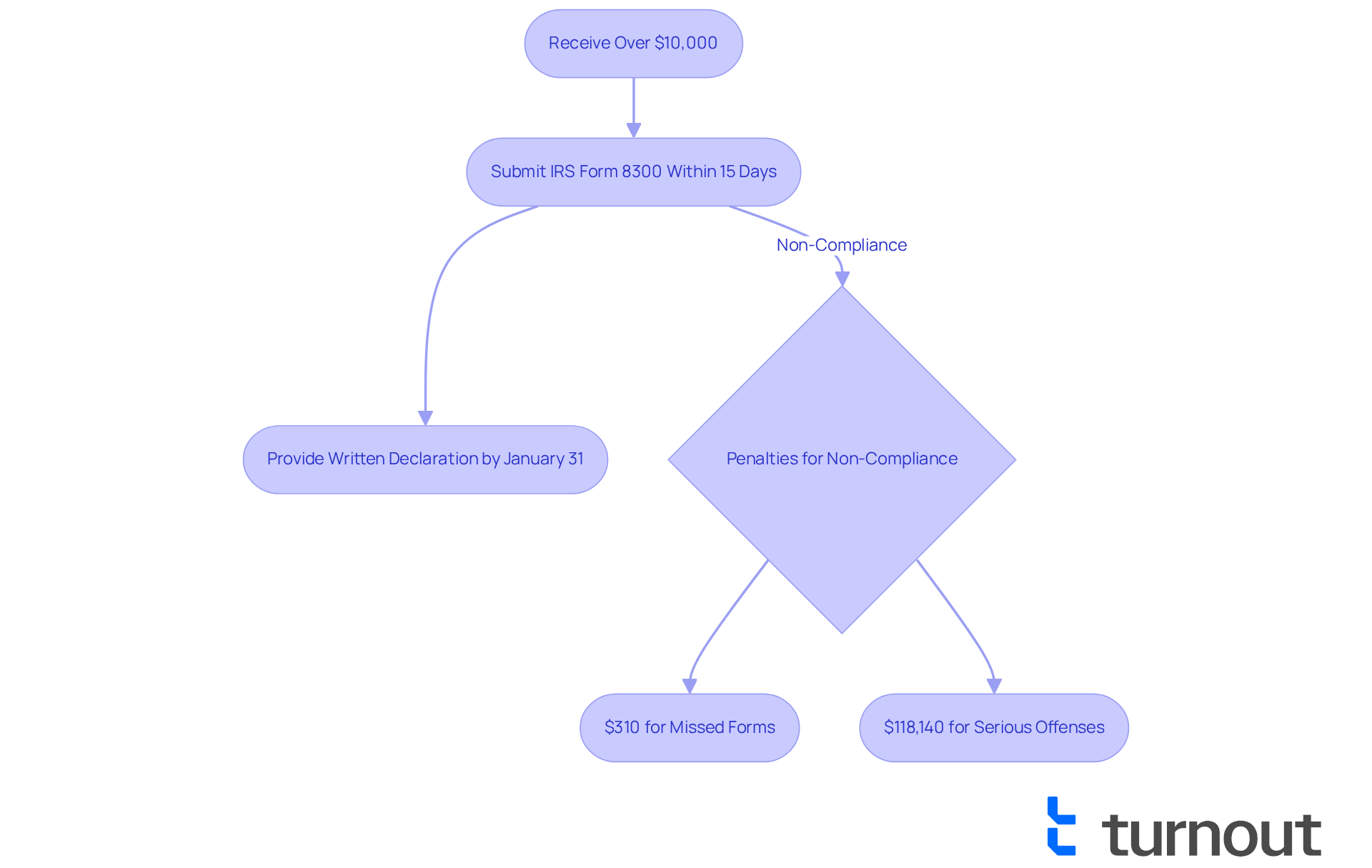

In 2025, the importance of cannot be overstated. that , which can amount to $310 for each missed form, with even higher penalties for intentional noncompliance. It's common to feel anxious about these repercussions—just ask the Arizona car dealer who faced a shocking fine of $118,140 for not knowing what happens if a form 8300 is filed on you. This example illustrates what happens if a form 8300 is filed on you, emphasizing the significant consequences of neglecting these requirements.

Additionally, companies are required to submit the designated document within 15 days of obtaining monetary payments that surpass the limit. They must also provide a written declaration to each individual listed on the document by January 31 of the following year. Last year, thousands of filings were documented, showcasing how prevalent monetary exchanges are across different sectors. Liquid assets, like cashier’s checks and money orders, are included in the definition of funds for report 8300, which is crucial for understanding what constitutes monetary exchanges under this report. Businesses that successfully navigate these requirements often implement robust , ensuring they meet their reporting obligations while avoiding penalties. As the IRS continues to modify rules, including the latest updates concerning digital assets, being aware of the relevant reporting is essential for any organization managing large monetary exchanges. Remember, you are not alone in this journey; we're here to help you through the process.

Identify Who Must File Form 8300

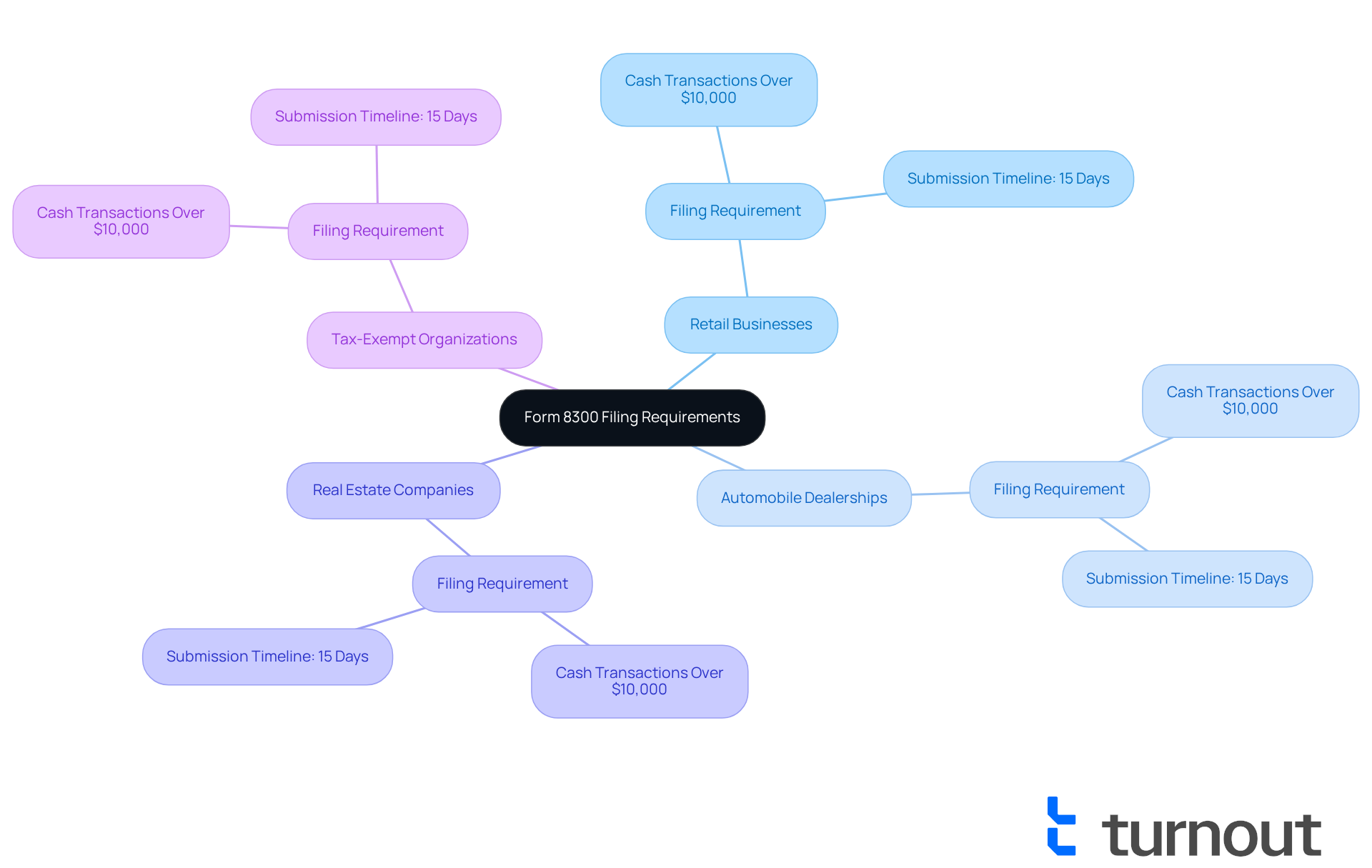

If you or your enterprise receive more than $10,000 in currency, it's crucial to understand . You are required to . This requirement applies to various entities, including:

- Retail businesses

- Automobile dealerships

- Real estate companies

- Tax-exempt organizations in specific situations

We understand that navigating these regulations can be overwhelming. If multiple related activities occur that together exceed $10,000, you must still submit the form. Remember, 'cash' isn't just physical currency; it also includes negotiable instruments like checks and money orders. As the Internal Revenue Service states, 'Generally, if you're engaged in a trade or business and in a single transaction or in related transactions, you are required to submit the appropriate document.'

It is essential for your compliance to understand what happens if a form 8300 is filed on you. Failure to do so can lead to , and research suggests that , particularly concerning what happens if a form 8300 is filed on you. You're not alone in this journey; seeking guidance can make a difference.

Moreover, the specific document must be submitted within 15 days of receiving cash. Overlooking this obligation can result in fines that could total as much as $3,532,500 annually. We're here to help you and .

Explore Consequences of Form 8300 Filing

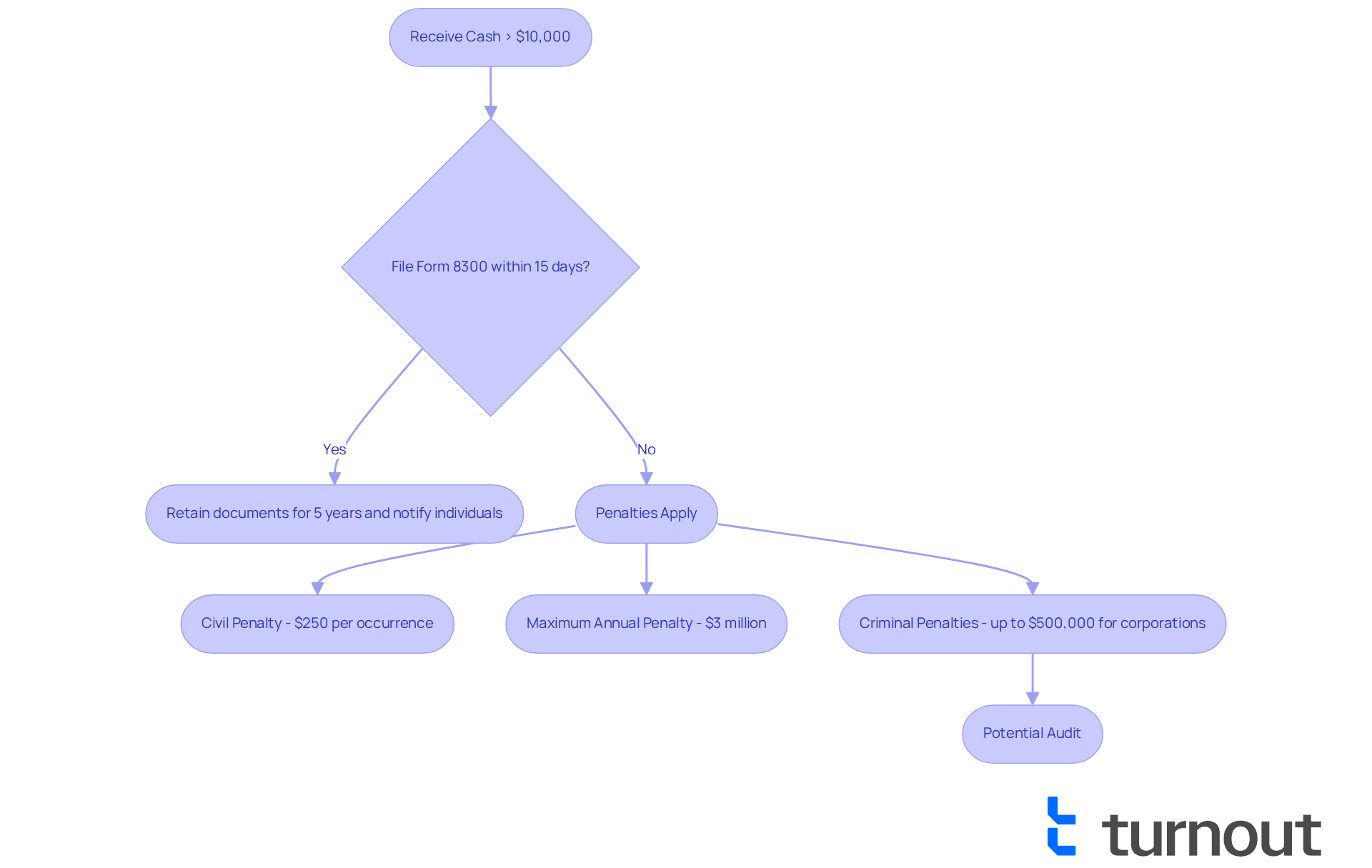

Submitting the necessary document is not just an administrative task; it carries . We understand that navigating these requirements can feel overwhelming. If a business fails to file the form when required, it may face , potentially amounting to thousands of dollars. Civil penalties for failing to file can reach $250 per occurrence, with a maximum annual penalty of $3 million for businesses. For willful violations, penalties can escalate to $100,000 for non-corporations and $500,000 for corporations. Additionally, if the IRS suspects that a business is attempting to evade reporting requirements, it may trigger an audit or further investigation, leading to even more severe consequences, including , raising the question of .

People mentioned on the document may also face increased scrutiny, particularly regarding what happens if a form 8300 is filed on you, as the IRS uses this paperwork to identify possible illicit actions like money laundering and tax evasion. It’s common to feel stressed by the prospect of audits and investigations into financial activities, which can create significant pressure.

Real-life examples highlight the stakes involved. Companies that have neglected to submit the required document have encountered audits, resulting in significant penalties and damage to their reputation. For instance, dealerships that repeatedly overlook this requirement risk losing manufacturer approvals and business licenses, complicating their operations even further.

It is crucial for anyone involved in significant monetary transactions to understand what happens if a form 8300 is filed on you. within 15 days of receiving cash exceeding $10,000 and are required to retain copies of each document filed along with supporting materials for five years. They must also provide a written notice to each individual for whom they completed a designated form during the tax year. As tax experts emphasize, the applicable to them, and ignorance of these requirements is not typically accepted as a valid excuse. Therefore, adhering to the requirements of the specified documentation is vital to prevent fines and ensure smooth financial transactions. Remember, you are not alone in this journey—we're here to help you .

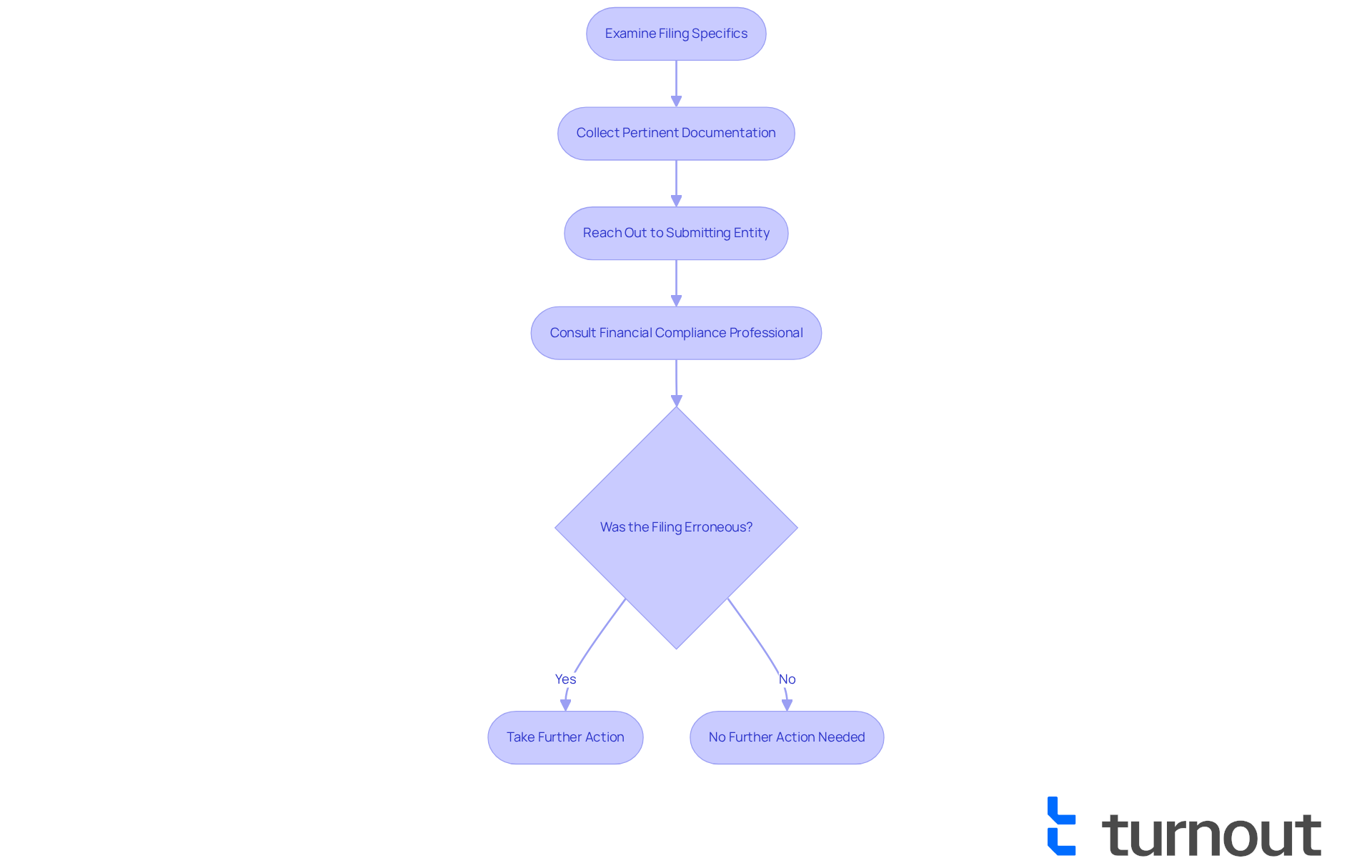

Outline Steps to Take After Being Filed

If you find out , it is crucial to take . We understand that this situation can be concerning. Begin by examining the filing specifics to grasp the essence of the deal and the individuals involved. Collect any pertinent documentation that supports your stance regarding the transaction. If you suspect the filing was erroneous, reach out to the entity that submitted the form to discuss the matter and seek clarification. Consulting with a professional specializing in can also be beneficial, as they can help you understand your rights and obligations. These steps are essential for navigating the complexities of the situation and safeguarding your interests.

Statistics show that inconsistencies in filings can lead to . Fines for careless non-filing can reach up to $250 per submission, decreasing to $50 if rectified within 30 days. Moreover, purposeful neglect of the relevant regulations may lead to fines surpassing $25,000 or even the monetary amount received, reaching $100,000. The IRS examines the document to monitor substantial cash dealings and guarantee adherence to tax regulations, emphasizing the document's importance.

Instances of individuals effectively challenging IRS submissions underscore the significance of and . For instance, Deyanira M. faced four years of back taxes totaling $15,297 but found assistance that helped her navigate the complexities of her situation. In 2022, over 400,000 Forms were submitted, highlighting the frequency of these transactions. By taking proactive measures and seeking professional advice, you can effectively tackle any problems that may arise from understanding what happens if a Form 8300 is filed on you. Remember, for five years. Starting in 2024, certain businesses will be required to electronically file Form 8300, which is an important change to be aware of. You're not alone in this journey; we're here to help you through it.

Conclusion

Understanding the implications of IRS Form 8300 is essential for anyone involved in significant cash transactions. We recognize that navigating these requirements can feel overwhelming. This form serves as a critical tool for the IRS to monitor large monetary exchanges, helping to prevent illegal activities such as money laundering. Timely and accurate filing is vital, as it helps avoid severe penalties and legal complications that can arise from noncompliance.

Who is required to file Form 8300? It's important to know the potential consequences of failing to do so. If a form has been filed against you, understanding the next steps can be daunting. Businesses and individuals alike must remain vigilant about these requirements. The penalties for noncompliance can be substantial, ranging from fines to audits and even criminal charges in severe cases. The case studies highlighted demonstrate the real-world stakes involved, emphasizing the need for robust compliance strategies and professional guidance.

In conclusion, staying informed about IRS Form 8300 and its requirements is crucial for safeguarding your financial interests and ensuring compliance with federal regulations. We understand that proactive measures, such as consulting with tax professionals and maintaining thorough documentation, can mitigate risks and protect against the potential fallout from filing errors. Embracing these practices not only fosters compliance but also contributes to a more transparent and accountable financial landscape. Remember, you are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What is IRS Form 8300 and why is it important?

IRS Form 8300 is a document that individuals and companies must submit when they receive over $10,000 in currency in a single exchange or connected exchanges. It helps the IRS monitor significant monetary exchanges to deter money laundering and other unlawful actions.

What information is required on Form 8300?

The form requires essential details about the exchange, including the payer's identity, the amount received, and the nature of the transaction.

What are the consequences of not filing Form 8300?

Failing to file Form 8300 can result in penalties, which can amount to $310 for each missed form, with higher penalties for intentional noncompliance. For example, an Arizona car dealer faced a fine of $118,140 for not understanding the requirements.

When must companies file Form 8300?

Companies must submit Form 8300 within 15 days of receiving monetary payments that exceed $10,000. They must also provide a written declaration to each individual listed on the document by January 31 of the following year.

What types of funds are included under Form 8300 reporting?

Liquid assets such as cashier’s checks and money orders are included in the definition of funds for Form 8300, which is important for understanding what constitutes monetary exchanges under this report.

How can businesses ensure compliance with Form 8300 requirements?

Businesses can implement robust compliance plans to ensure they meet their reporting obligations and avoid penalties, especially as the IRS continues to update rules regarding reporting, including those related to digital assets.