Introduction

The Employee Retirement Income Security Act (ERISA) is a vital support system for workers, especially those dealing with disabilities. It sets clear standards for health and retirement plans, empowering you to understand your rights and ensuring you receive the support you deserve during tough times.

We understand that navigating the complexities of disability claims can feel overwhelming. What do you do when claims are denied, or when the information seems unclear? This article explores the essential protections ERISA provides, the benefits available for disabled individuals, and the steps you can take to secure these crucial resources.

You're not alone in this journey. We're here to help you find the answers and support you need.

Define ERISA: Understanding the Employee Retirement Income Security Act

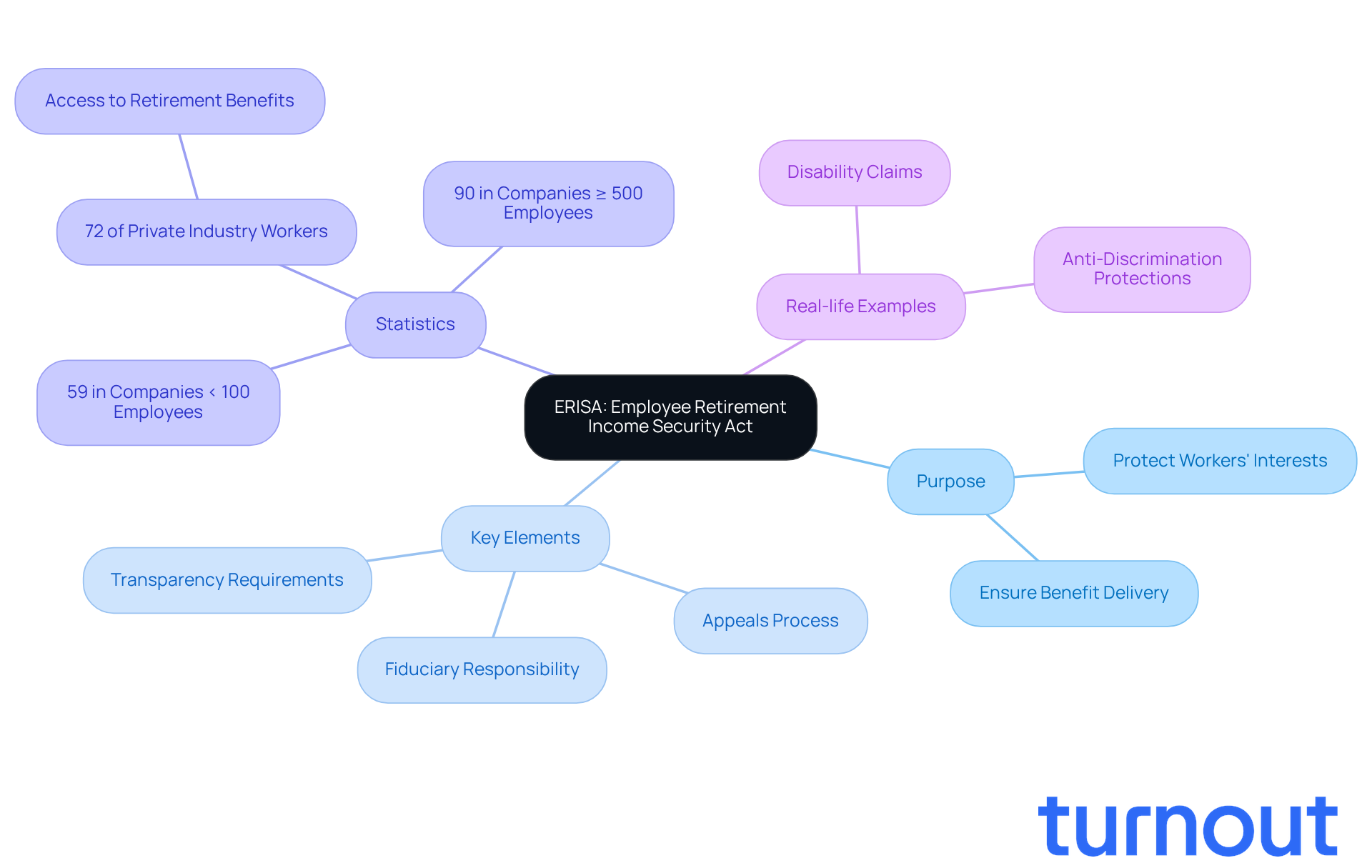

The Employee Retirement Income Security Act, enacted in 1974, plays a vital role in establishing standards for retirement and health plans in the private sector. Its primary goal is to protect workers' interests, ensuring they receive the benefits their employers promise. This legislation, ERISA, covers a wide array of worker advantages, including health insurance, retirement schemes, and disability support, creating a structured approach to managing these benefits.

For individuals with disabilities, this law is especially important. It clearly outlines their rights and the steps to claim disability assistance through employer-sponsored plans. Key elements of the legislation include:

- Requirements for transparency

- Fiduciary responsibility

- The establishment of an appeals process for denied claims

This ensures that workers have a clear path to challenge decisions regarding their entitlements.

In 2025, around 72 percent of private industry employees will have access to retirement benefits under this legislation. Notably, retirement benefits are available to 59 percent of workers in companies with fewer than 100 employees, and a remarkable 90 percent in larger establishments with 500 or more employees. This highlights the act's extensive reach and impact.

Real-life examples illustrate how ERISA covers worker rights in disability disputes. For instance, the law requires employers to provide clear information about plan features and funding, which is crucial for individuals navigating complex disability claims. Additionally, the legislation includes anti-discrimination protections to ensure fair treatment of workers based on various factors. This emphasizes the importance of equitable access to benefits.

This framework not only empowers individuals with disabilities but also reinforces employers' responsibilities in managing employee benefits. Remember, you are not alone in this journey. We're here to help you understand your rights and navigate the complexities of your benefits.

Explore ERISA's Scope: Types of Benefits and Protections Covered

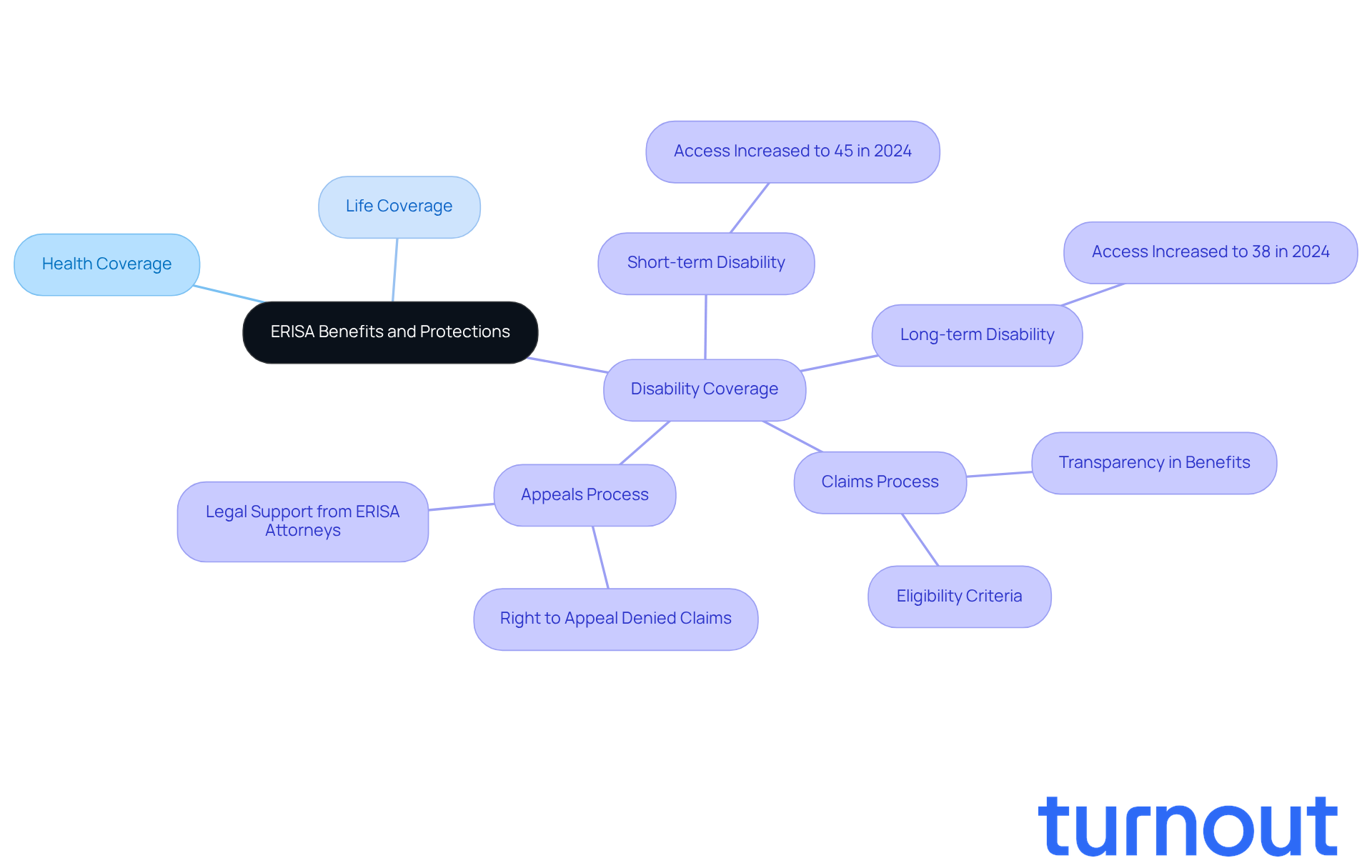

The law offers a wide range of worker benefits, including health coverage, life coverage, and importantly, disability coverage. For those living with disabilities, the short-term and long-term disability provisions are particularly vital. They provide essential financial support when someone can’t perform their job due to a disability. As we look ahead to 2024, it’s encouraging to see that access to employer-provided long-term disability assistance has risen to 38%. This reflects a growing recognition of the need for such protections.

It’s crucial that disability programs provide clear and detailed information about benefits, eligibility criteria, and claims processes. This transparency empowers employees, helping them understand their rights and navigate the complexities of their benefits effectively. Additionally, the law includes protections against discrimination based on health status, which is essential for ensuring fair treatment in the workplace.

Successful claims under this act highlight its effectiveness in supporting disabled workers. If someone faces an unjust denial of their request, they have the right to appeal. Seeking guidance from an experienced attorney who understands employee benefits can significantly enhance the chances of a successful appeal. However, Turnout is here to help those who may not have legal representation. By employing trained nonlawyer advocates, Turnout assists clients in understanding their rights and the claims processes, ensuring they receive the support needed to secure their entitlements.

The safeguards provided by this legislation are vital for individuals with disabilities. They create a framework that not only protects rights but also fosters a more inclusive work environment. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Trace the Origins of ERISA: Historical Context and Legislative Intent

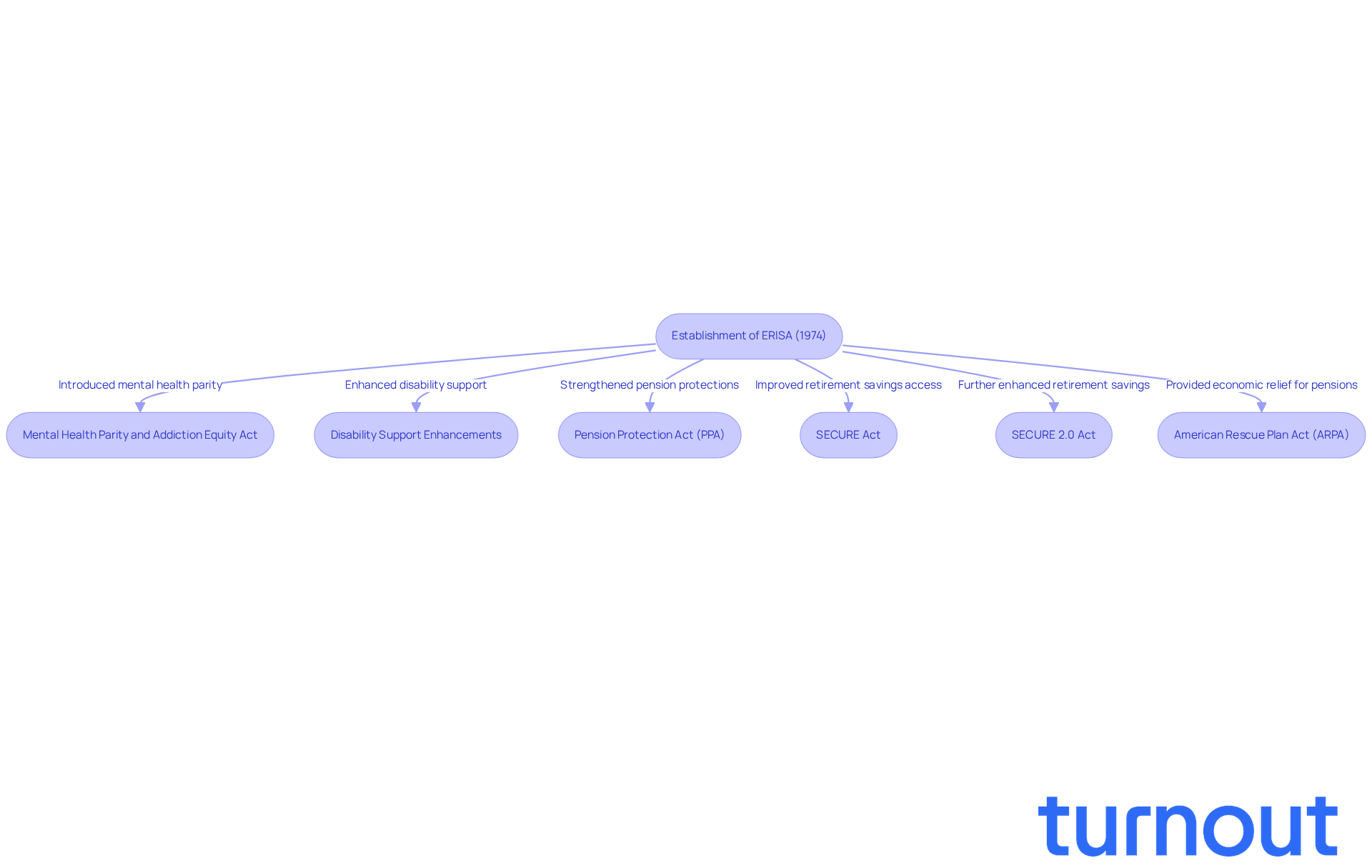

ERISA was established in 1974 in response to the deep concerns many had about the mismanagement of pension funds and the lack of protections for workers' retirement benefits. We understand that before this legislation, countless workers faced the daunting risk of losing their benefits due to corporate bankruptcies or mismanagement. This law aimed to create a consistent set of standards for employee benefit plans, ensuring that workers could rely on the benefits promised to them.

Over the years, ERISA has been revised to enhance protections, including provisions for mental health parity and the addition of disability support. These changes reflect the evolving needs of our workforce. For instance, the Mental Health Parity and Addiction Equity Act modified ERISA to ensure that mental health services are treated equally to medical services. This expansion of protections is crucial for individuals with disabilities, ensuring they receive the support they deserve.

The legislative intent behind these acts was to establish a safety net for workers, guaranteeing access to the benefits they are entitled to, even amidst corporate challenges. It's common to feel uncertain about these protections, but rest assured, various modifications have been made to address the complexities of disability claims. This highlights the importance of safeguarding the rights of disabled individuals in the workplace. Remember, you are not alone in this journey; we’re here to help you navigate these challenges.

Identify Key Characteristics: Requirements and Compliance Under ERISA

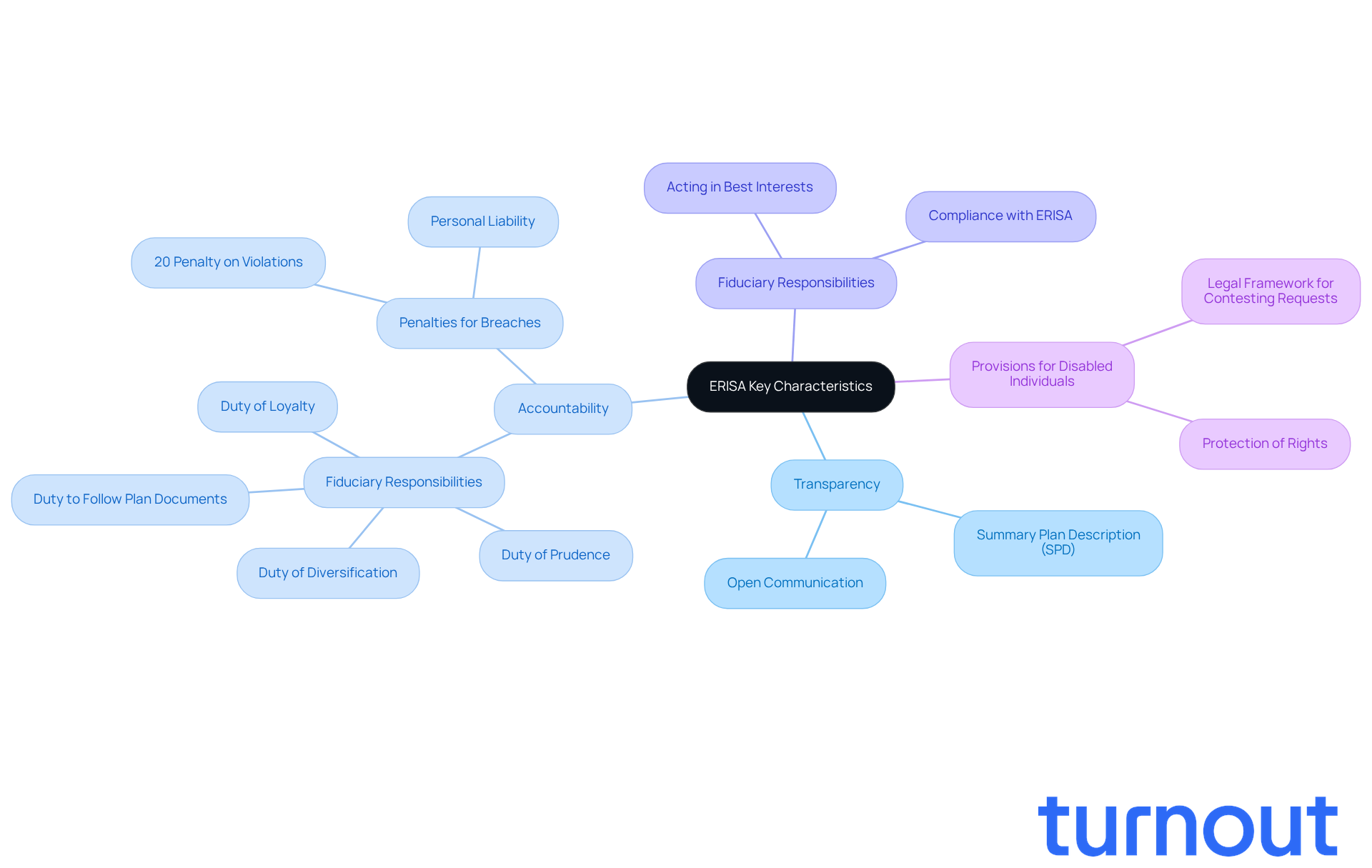

The key characteristics that ERISA covers include stringent requirements for transparency, accountability, and fiduciary responsibility. We understand that navigating these regulations can be overwhelming. Employers must provide workers with a Summary Plan Description (SPD), which outlines advantages, eligibility criteria, and claims procedures. This transparency is crucial, as it helps you comprehend your rights and the steps involved in accessing benefits.

The law imposes fiduciary responsibilities on plan administrators, requiring them to act solely in the best interests of plan participants. This means ensuring fair handling of requests and maintaining open communication about employee rights. For instance, fiduciaries must adhere to the Duty of Loyalty, which mandates that they prioritize the interests of participants above all else, and the Duty of Prudence, requiring them to act with care and diligence, just like a prudent person would in similar circumstances.

ERISA covers vital provisions for safeguarding the rights of disabled individuals. It creates a legal framework that allows you to contest rejected requests and seek remedies in cases of mismanagement. Recent data shows that breaches of fiduciary responsibilities can lead to significant penalties, often amounting to 20% of the violation's value. This underscores the importance of adhering to these regulations.

At Turnout, we’re here to help you navigate these complexities, especially when it comes to Social Security Disability (SSD) claims and tax debt relief. Our trained nonlawyer advocates are dedicated to assisting you in understanding your rights and options. You deserve the financial assistance you need, and we’re committed to ensuring you receive it without the need for legal representation.

Conclusion

The Employee Retirement Income Security Act (ERISA) is more than just legislation; it’s a vital lifeline for workers, especially those with disabilities. It ensures that you receive the benefits your employer promised. This law sets essential standards for retirement and health plans, providing crucial support for individuals navigating the often complex world of disability claims.

We understand that dealing with these issues can be overwhelming. That’s why ERISA highlights key aspects like transparency, fiduciary responsibilities for plan administrators, and a clear appeals process for denied claims. With better access to long-term disability assistance and protections against discrimination, ERISA plays a pivotal role in creating an inclusive work environment. It empowers individuals with disabilities to stand up for their rights.

As the landscape of employee benefits evolves, grasping ERISA's provisions is essential for both workers and employers. This legislation is crucial; it safeguards the financial security of disabled individuals while holding employers accountable for managing employee benefits. If you’re facing challenges in securing your rights under ERISA, remember: you’re not alone. We encourage you to seek guidance and support. Together, we can ensure you receive the benefits you deserve, fostering a more equitable workplace for everyone.

Frequently Asked Questions

What is ERISA?

The Employee Retirement Income Security Act (ERISA) is a law enacted in 1974 that establishes standards for retirement and health plans in the private sector, aiming to protect workers' interests and ensure they receive promised benefits.

What types of benefits does ERISA cover?

ERISA covers a variety of worker benefits, including health insurance, retirement plans, and disability support.

Why is ERISA important for individuals with disabilities?

ERISA is crucial for individuals with disabilities as it outlines their rights and the process to claim disability assistance through employer-sponsored plans.

What are some key elements of ERISA?

Key elements of ERISA include requirements for transparency, fiduciary responsibility, and the establishment of an appeals process for denied claims.

How does ERISA support workers in challenging denied claims?

ERISA provides a structured appeals process that allows workers to challenge decisions regarding their entitlements, ensuring they have a clear path to seek recourse.

What percentage of private industry employees are expected to have access to retirement benefits under ERISA in 2025?

In 2025, approximately 72 percent of private industry employees are expected to have access to retirement benefits under ERISA.

How does access to retirement benefits vary by company size?

Retirement benefits are available to 59 percent of workers in companies with fewer than 100 employees, while 90 percent of workers in larger companies with 500 or more employees have access to these benefits.

What protections does ERISA provide regarding discrimination?

ERISA includes anti-discrimination protections to ensure fair treatment of workers based on various factors, promoting equitable access to benefits.

How does ERISA empower individuals with disabilities?

ERISA empowers individuals with disabilities by providing clear information about plan features and funding, which is essential for navigating complex disability claims and ensuring equitable treatment.