Introduction

Navigating the complexities of financial obligations can be overwhelming, especially when it comes to understanding tax levies. These legal actions, primarily enforced by the IRS, can lead to the seizure of assets, including wages and property, to settle unpaid tax debts. We understand that facing the threat of financial repercussions can be daunting. That's why grasping the nuances of tax levies is not just beneficial - it's critical.

What happens when individuals ignore these responsibilities? It's common to feel anxious about the severe consequences of a tax levy. But don’t worry; you’re not alone in this journey. This article will delve into the meaning, importance, and various types of tax levies, equipping you with the knowledge to manage your tax obligations effectively. Remember, we're here to help you navigate these challenges.

Define Tax Levy: Understanding the Core Concept

Facing a tax assessment can be overwhelming. A tax levy is a legal action where the government, primarily the IRS, seizes property to settle unpaid tax debts, which is what does tax levy mean. This process can involve taking possession of your wages, bank accounts, or even your property. Unlike a tax lien, which merely claims against your property, a seizure means your assets are actually confiscated.

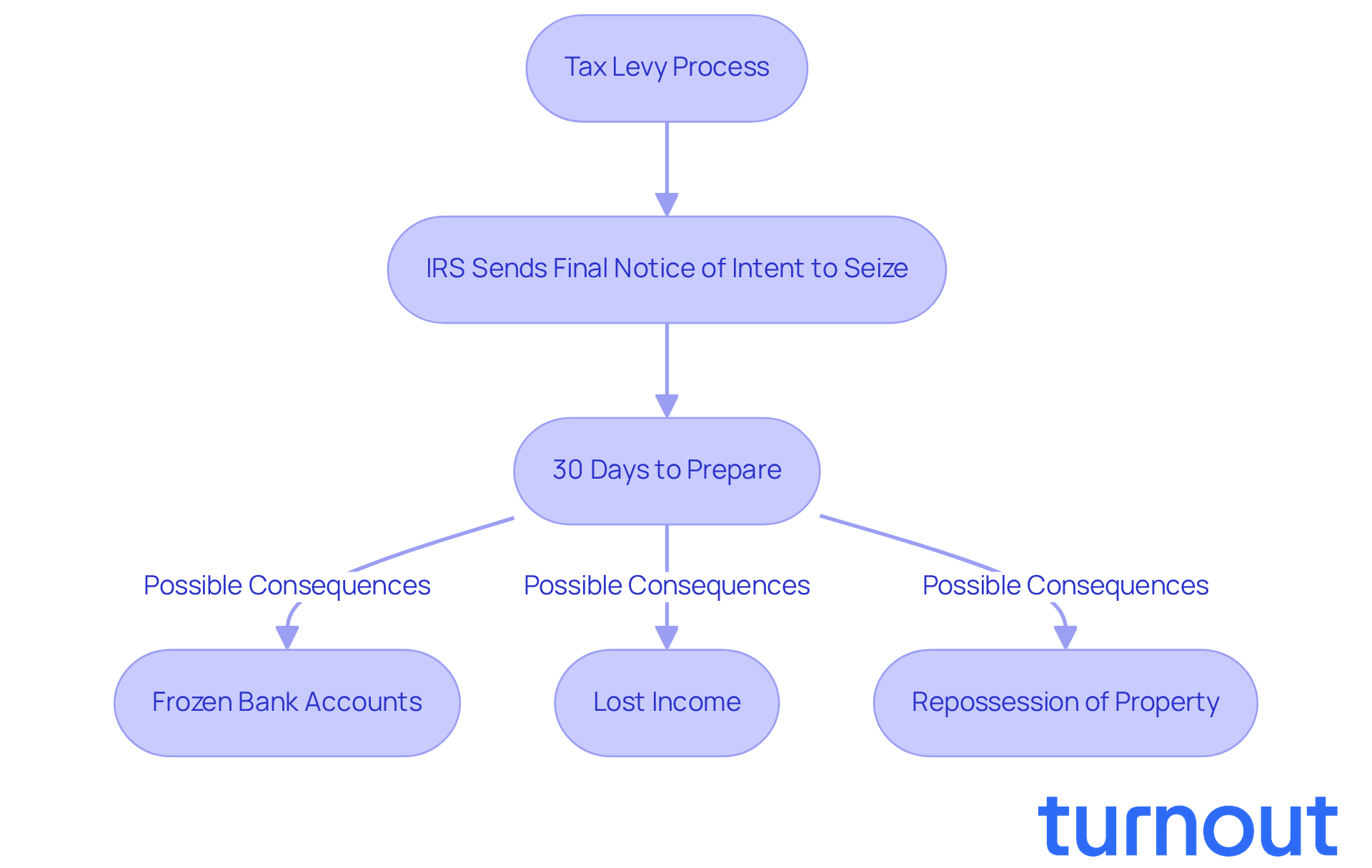

We understand that this distinction is crucial for anyone dealing with tax responsibilities. The consequences of a seizure can be severe, leading to frozen bank accounts, lost income, and even the repossession of your home. It’s common to feel anxious about these potential outcomes.

Before any enforcement actions begin, the IRS must send a final notice of intent to seize, which serves as a significant warning. This notice is sent certified, giving you 30 days to prepare. In Fiscal Year 2010 alone, the IRS issued around 667,000 demands, highlighting the scale of these actions.

It is vital to understand what does tax levy mean. Ignoring tax debts can lead to dire financial consequences, and it’s important to know that you have rights and protections. The Taxpayer Advocate Service is here to help you navigate these challenging situations. Remember, you are not alone in this journey.

If you’re feeling overwhelmed, reach out for assistance. We’re here to help you find the support you need.

Context and Importance of Tax Levies in Financial Management

Tax assessments play a crucial role in the financial management of government entities. They help ensure tax compliance and secure funding for essential public services. We understand that tax responsibilities can sometimes feel overwhelming. When individuals overlook these responsibilities, assessments become vital for the IRS to recover owed amounts, which helps maintain government income.

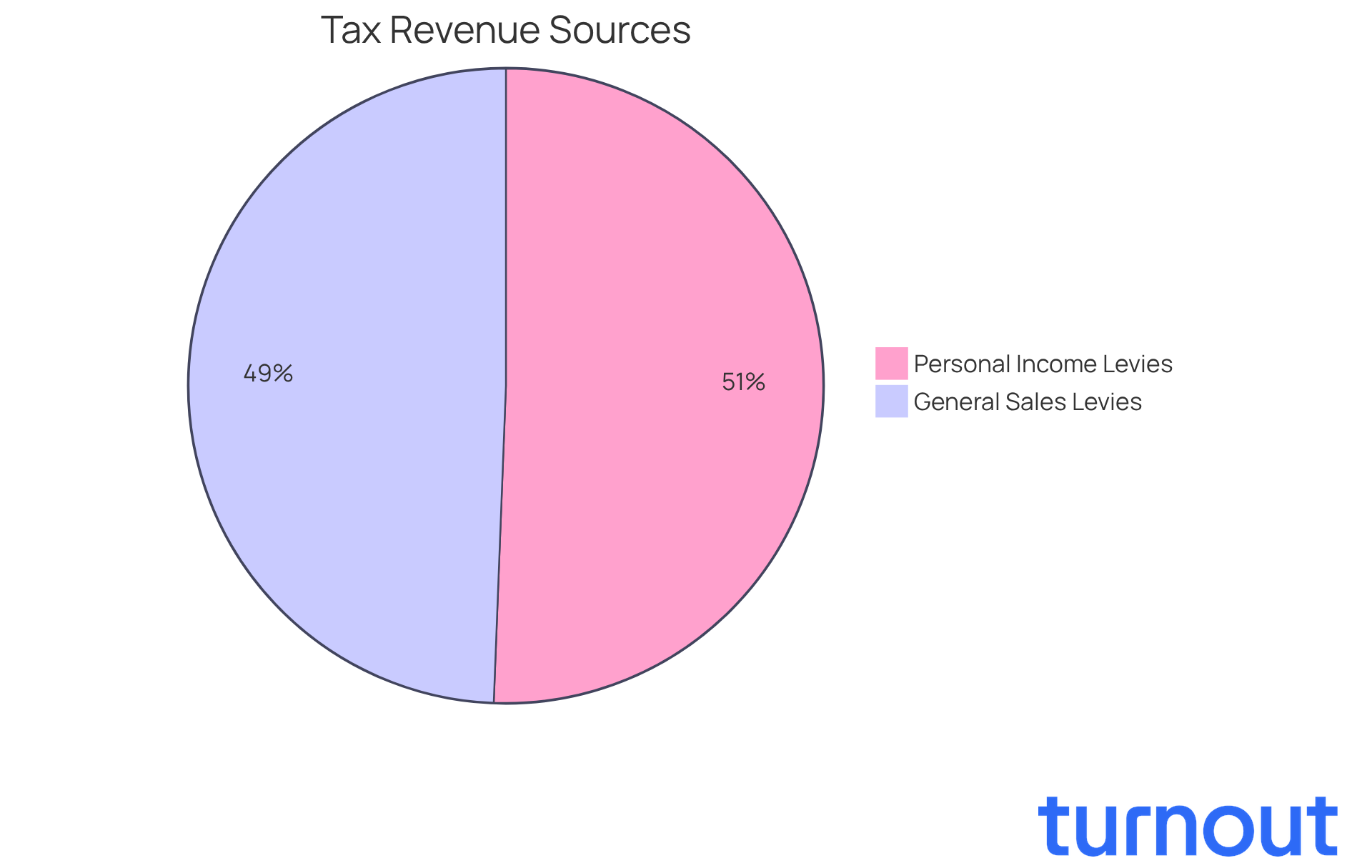

In fiscal year 2023, personal income levies contributed 33.1% and general sales levies contributed 32.3% to state revenues. This highlights how much we rely on timely payments. For taxpayers, being aware of what does tax levy mean can serve as a strong incentive to engage proactively with their tax responsibilities. This proactive approach not only helps you avoid severe financial consequences, like asset seizure or wage garnishment, but also ensures that public services remain adequately funded.

It's common to feel anxious about tax obligations, but remember, you are not alone in this journey. By taking action now, you can protect your financial well-being and contribute to the welfare of your community. We're here to help you navigate these challenges and ensure that you stay on track.

Historical Background: The Evolution of Tax Levies

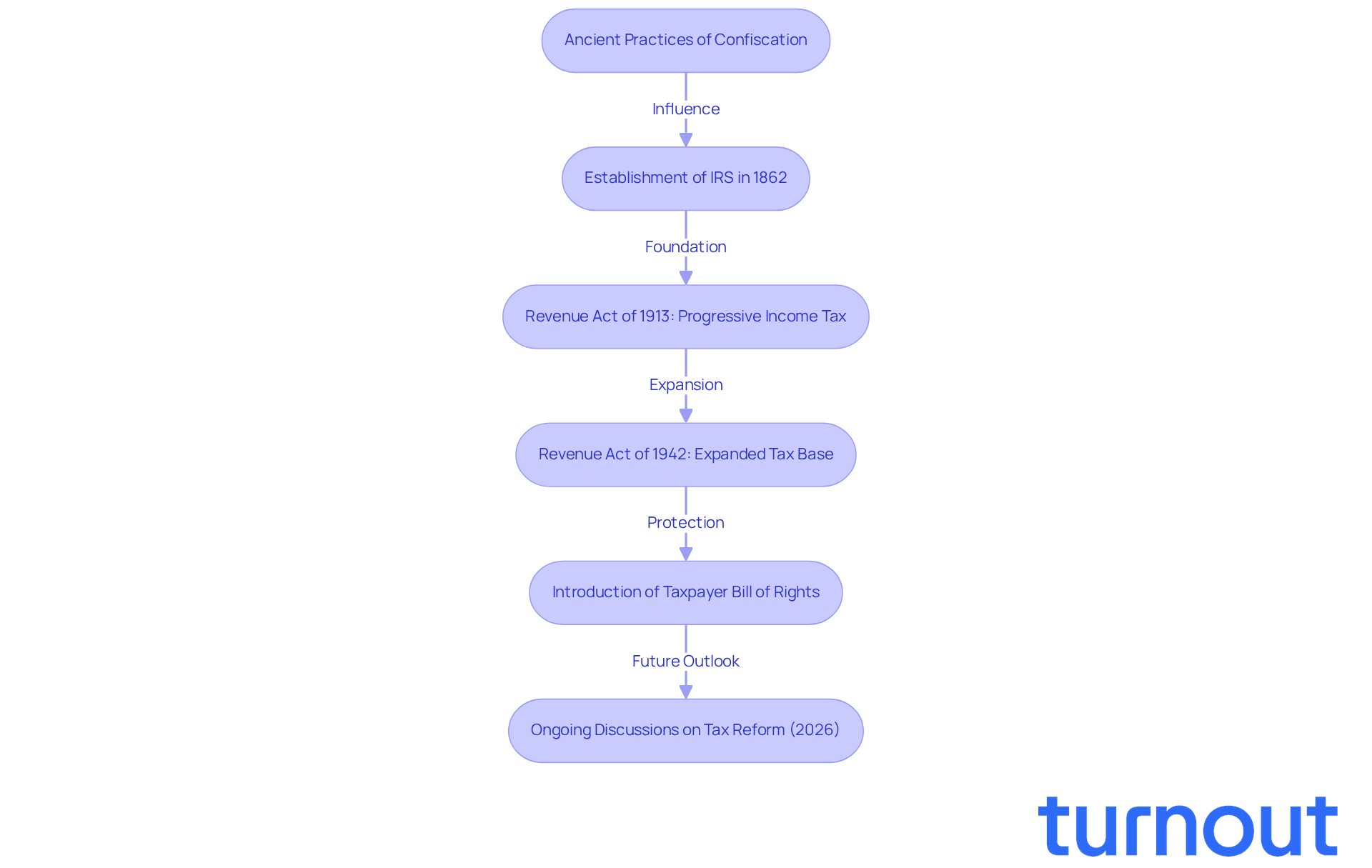

Understanding financial charges can be daunting. The concept has roots in ancient practices where authorities confiscated property to collect owed dues. In the United States, our modern tax collection system began to take shape in the early 20th century, especially with the establishment of the IRS in 1862.

Key legislation, like the Revenue Act of 1913, introduced a progressive income tax structure. Then, during World War II, the Revenue Act of 1942 expanded the income tax base and increased taxes. It’s important to recognize how these changes have shaped our current landscape.

The Taxpayer Bill of Rights has also played a significant role in how charges are applied and enforced. It enhances safeguards for individuals who pay taxes, ensuring that your rights are protected. Today, tax charges are governed by specific regulations that outline the process and your rights as a taxpayer. This reflects a balance between government authority and taxpayer protections.

As we look ahead to 2026, discussions about tax reform and evolving economic conditions are ongoing. We understand that these changes can feel overwhelming. It’s essential to stay informed about how they may impact the framework surrounding tax charges. Remember, you are not alone in this journey. We're here to help you navigate these complexities.

Types of Tax Levies: A Comprehensive Breakdown

The IRS uses various tax levies to collect unpaid taxes, and understanding what does tax levy mean can be crucial for anyone facing such challenges. Let's explore these options together, so you can feel more informed and empowered.

-

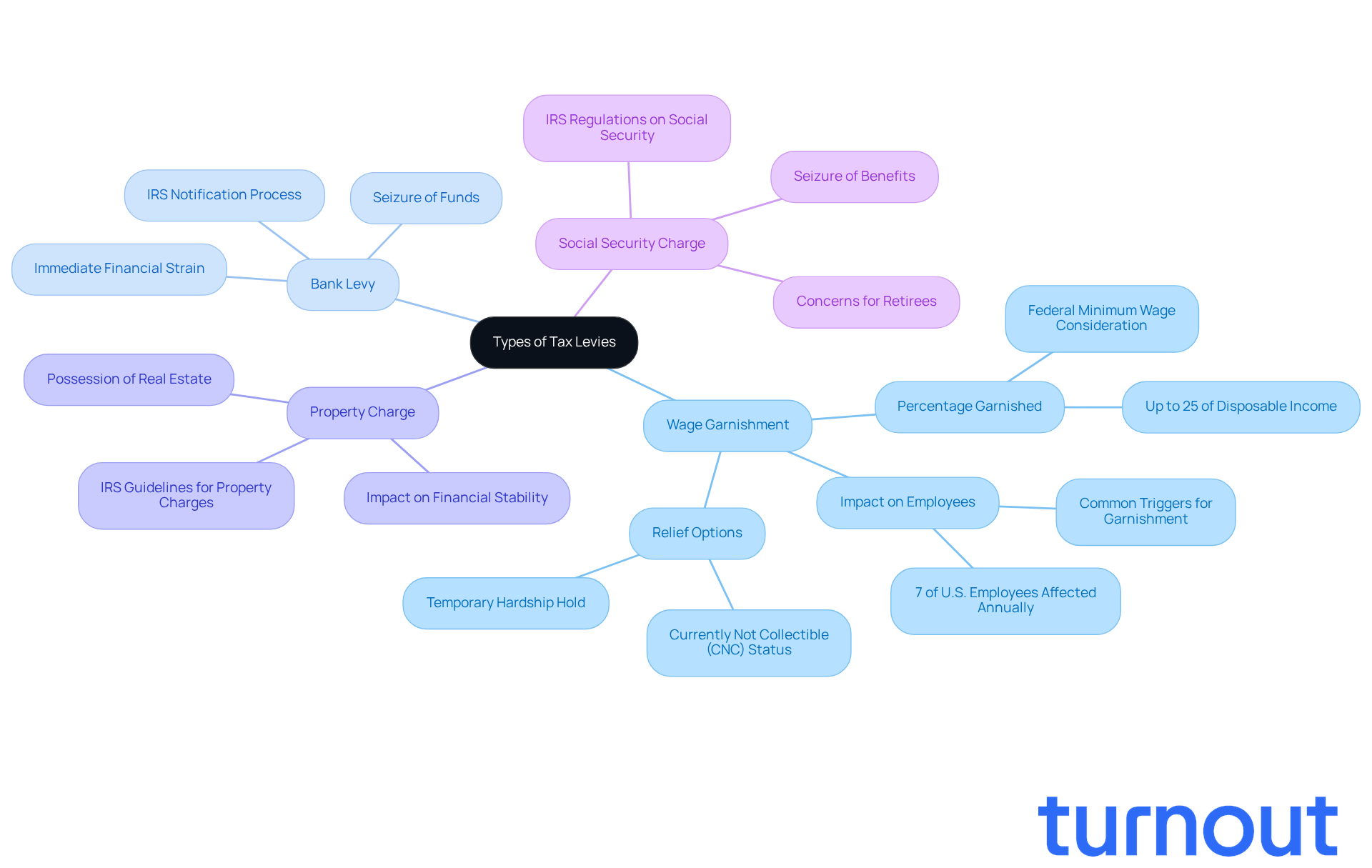

Wage Garnishment: This process allows the IRS to withhold a portion of your wages before you even see them. Did you know that about 7% of U.S. employees face wage garnishment each year? Often, this happens due to unpaid taxes, child support, or student loans. If you haven’t filed your tax returns or have ignored IRS notices, you might be at risk. If your disposable income exceeds the exempt amount set by IRS guidelines, they can garnish up to 25% of your earnings. It’s important to act quickly when you receive IRS notices - exploring your options can help protect your financial well-being.

-

Bank Levy: The IRS can also seize funds directly from your bank account, freezing it until your owed amount is settled. This can create immediate financial strain, as you may lose access to essential funds.

-

Property Charge: This charge allows the IRS to take possession of your real estate or personal property to satisfy tax debts. Such actions can significantly impact your financial stability, so it’s vital to address them promptly.

-

Social Security Charge: If you rely on Social Security benefits, be aware that the IRS can seize a portion of these to collect unpaid taxes. This can be particularly concerning for retirees or those who depend on these benefits for daily living expenses.

Understanding what does tax levy mean is essential, especially when facing IRS actions. For instance, a single parent with significant tax debt might find their wages garnished. However, with proper documentation of essential expenses, they could qualify for Currently Not Collectible (CNC) status, which may lead to the release of the garnishment. Remember, timely communication with the IRS can make a difference - it can help prevent or resolve wage garnishments effectively. You’re not alone in this journey; we’re here to help.

Key Characteristics and Processes of Tax Levies

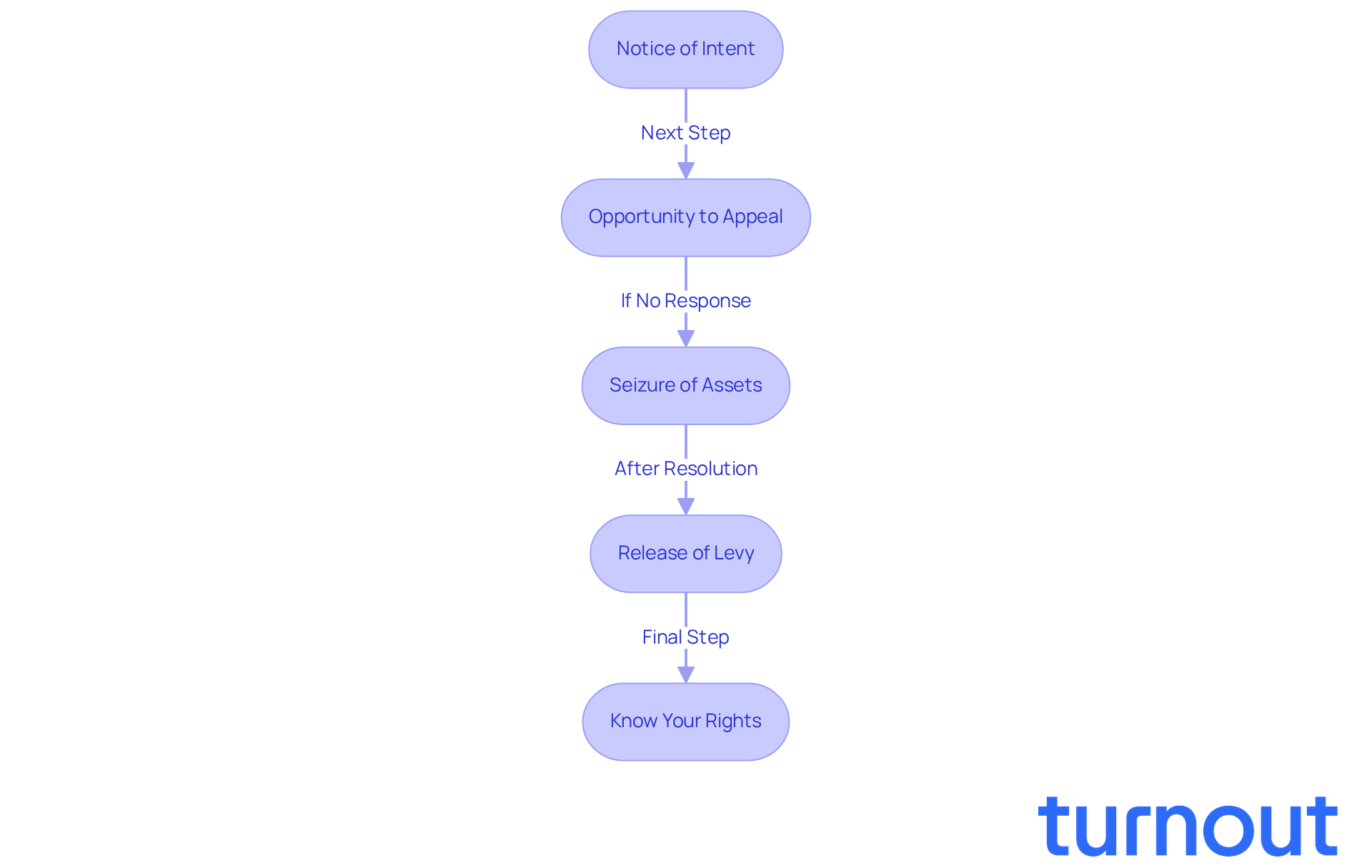

Tax levies can be daunting, but understanding what does tax levy mean can empower you to take control. Here’s a look at the critical steps involved:

-

Notice of Intent: The IRS starts by sending a Notice of Intent to Levy. This notice is your heads-up about what’s coming, giving you a chance to prepare. Along with this, the IRS sends other notifications, like CP504 and CP90, to ensure you’re well-informed before any tax collection begins.

-

Opportunity to Appeal: You have the right to challenge the levy. Within 30 days of receiving the notice, you can request a Collection Due Process (CDP) hearing. This is your opportunity to discuss your situation with the IRS and contest the action. Additionally, you can appeal through the Collection Appeals Program (CAP), which offers different rights and processes compared to CDP hearings.

-

Seizure of Assets: If you don’t respond or settle your debt, the IRS may proceed with enforcement actions. This could mean seizing bank accounts, garnishing wages, or taking other assets. It’s important to know that the IRS can even take up to 15% of Social Security benefits through the Federal Payment Levy Program, which can be particularly impactful for disabled individuals. This step can significantly affect your financial situation.

-

Release of Levy: Once you resolve your tax obligation, the IRS must lift the levy, allowing you to regain access to your assets. Remember, though, that releasing the levy doesn’t cancel your tax obligation; it simply stops the current collection action.

Understanding these steps is crucial for protecting your rights and responding effectively to what does tax levy mean. Last year, over 33,000 individuals submitted offers in compromise to settle their tax liabilities, highlighting the importance of knowing your options. Successful appeals can lead to significant reductions in what you owe. For example, one taxpayer who owed $24,445 managed to settle for just $1,143. This shows that with timely action and informed decision-making, relief is possible.

You’re not alone in this journey. If you’re feeling overwhelmed, remember that help is available. We’re here to support you every step of the way.

Conclusion

Understanding the implications of a tax levy is crucial for anyone navigating the complexities of tax obligations. We know that facing such issues can be overwhelming. A tax levy is a serious legal action taken by the government to seize assets in order to recover unpaid taxes. This process can lead to significant financial distress. It’s essential for individuals to grasp what a tax levy entails and the potential consequences of ignoring tax responsibilities.

Throughout this article, we’ve shared key insights regarding the nature and impact of tax levies. From the distinction between a tax levy and a tax lien to the various types of levies - like wage garnishments, bank levies, and property seizures - it’s clear that taxpayers must remain vigilant and proactive. The historical context of tax levies, along with the rights afforded to taxpayers, underscores the importance of being informed and prepared when facing tax issues.

Ultimately, understanding tax levies isn’t just about avoiding penalties; it’s about ensuring financial stability and contributing to the broader community through tax compliance. We encourage you to take charge of your tax situation. Seek assistance if needed, and communicate effectively with the IRS. By doing so, you can protect your assets and help sustain the vital public services that rely on tax revenues. Remember, you are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What is a tax levy?

A tax levy is a legal action taken by the government, primarily the IRS, to seize property in order to settle unpaid tax debts. This can involve confiscating wages, bank accounts, or property.

How does a tax levy differ from a tax lien?

A tax lien is merely a claim against your property, indicating that you owe taxes, whereas a tax levy involves the actual seizure of your assets.

What are the potential consequences of a tax levy?

The consequences of a tax levy can include frozen bank accounts, loss of income, and repossession of property.

What steps does the IRS take before enforcing a tax levy?

Before enforcing a tax levy, the IRS must send a final notice of intent to seize, which is sent certified and gives the taxpayer 30 days to prepare.

How many tax levy demands did the IRS issue in fiscal year 2010?

In fiscal year 2010, the IRS issued approximately 667,000 tax levy demands.

What should taxpayers do if they are facing a tax levy?

Taxpayers should understand their rights and protections and may seek assistance from the Taxpayer Advocate Service to navigate these challenging situations.

Why are tax assessments important for government financial management?

Tax assessments are crucial for ensuring tax compliance and securing funding for essential public services, helping maintain government income.

What percentage of state revenues did personal income levies and general sales levies contribute in fiscal year 2023?

In fiscal year 2023, personal income levies contributed 33.1% and general sales levies contributed 32.3% to state revenues.

How can being aware of tax responsibilities benefit taxpayers?

Being aware of tax responsibilities can incentivize taxpayers to engage proactively, helping them avoid severe financial consequences and ensuring public services remain funded.