Introduction

Understanding the complexities of tax levies can feel overwhelming. We know that navigating financial obligations is no easy task. A tax levy is a powerful tool that governments use to enforce compliance and recover unpaid taxes. Unfortunately, this can lead to serious consequences for both individuals and businesses.

But what happens when you find yourself facing this daunting process? This article will help you understand the definition, purpose, and various types of tax levies. We’ll shed light on their implications and offer insights on how to effectively manage your tax responsibilities.

How can you prepare for or respond to a tax levy to minimize its impact? You're not alone in this journey, and we're here to help.

Define Levy: Understanding the Concept and Its Importance

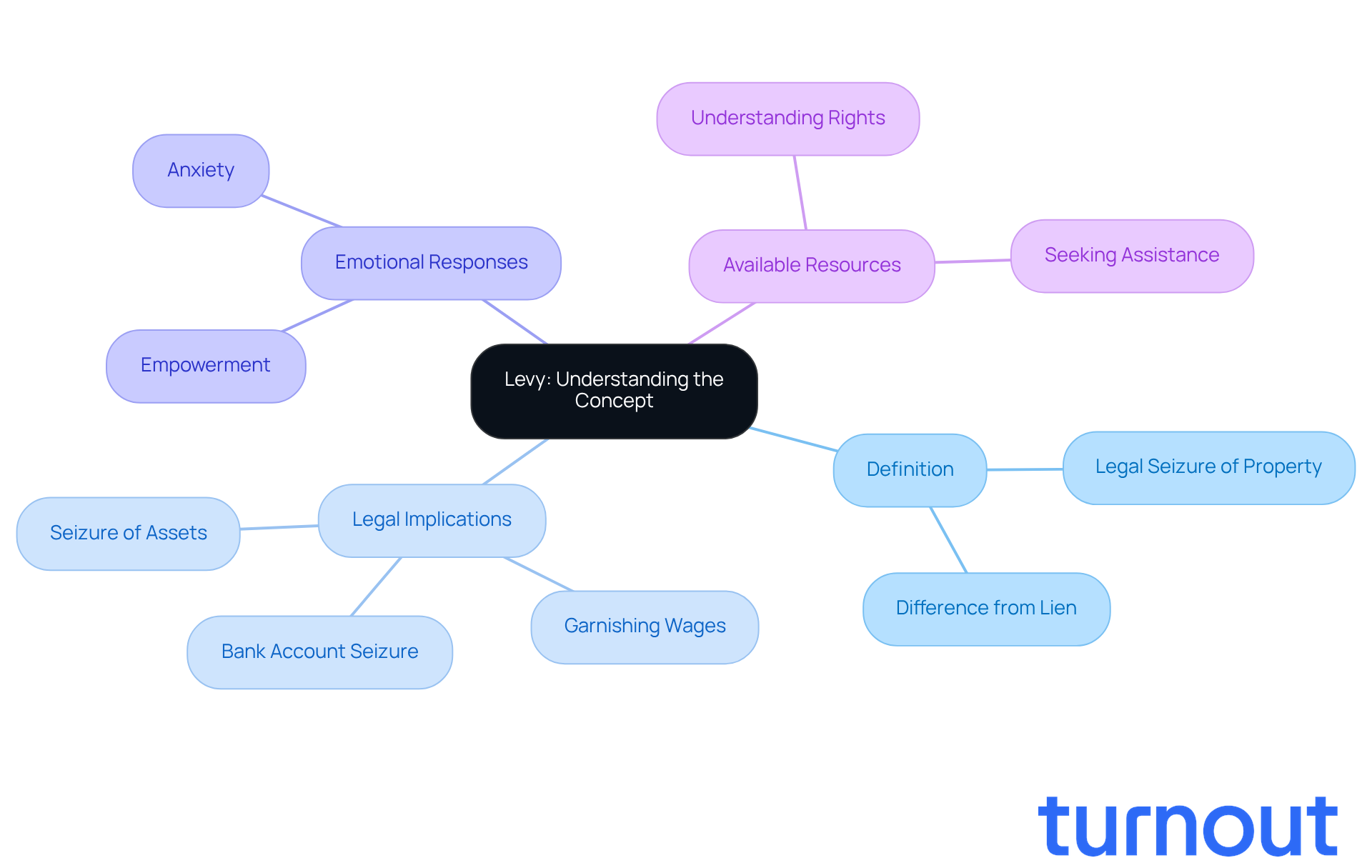

For every taxpayer, understanding what does it mean to levy a tax is essential. When discussing what does it mean to levy a tax, it refers to a legal seizure of your property or assets by the government, often due to unpaid taxes. Unlike a lien, which merely claims against your property, a seizure allows the government to take possession of your assets. This can mean garnishing your wages, seizing your bank accounts, or even taking physical property.

We understand that this can be overwhelming. The implications of what it means to levy a tax can be severe, leading to financial distress for both individuals and businesses. It’s common to feel anxious about these situations, but understanding what does it mean to levy a tax can empower you to take action.

So, what can you do? First, recognize that you’re not alone in this journey. Many people face similar challenges, and there are resources available to help you navigate these waters. Understanding your rights and options is crucial.

If you find yourself in this situation, reach out for assistance. We're here to help you understand your responsibilities and explore solutions. Remember, taking the first step can make a significant difference.

Purpose of a Levy: Why Governments Impose Taxes

We understand that dealing with taxes can be overwhelming. When discussing how governments impose charges, it is important to understand what does it mean to levy a tax in order to collect unpaid taxes and enforce tax regulations. The aim of these charges is to ensure that everyone meets their responsibilities, prompting the question of what does it mean to levy a tax, especially when voluntary compliance falls short.

When tax authorities seize assets, they are working to recover funds that are essential for public services, infrastructure, and other vital government functions. This enforcement mechanism serves as a deterrent against tax evasion, helping individuals grasp what does it mean to levy a tax and encouraging them to adhere to their tax obligations.

It's common to feel anxious about tax responsibilities. For instance, when individuals overlook their tax duties, the IRS may take collection action as a last resort to recover owed amounts. This emphasizes the importance of making timely tax payments. Remember, you are not alone in this journey; we're here to help you navigate these challenges.

How a Levy Works: The Process and Mechanisms Involved

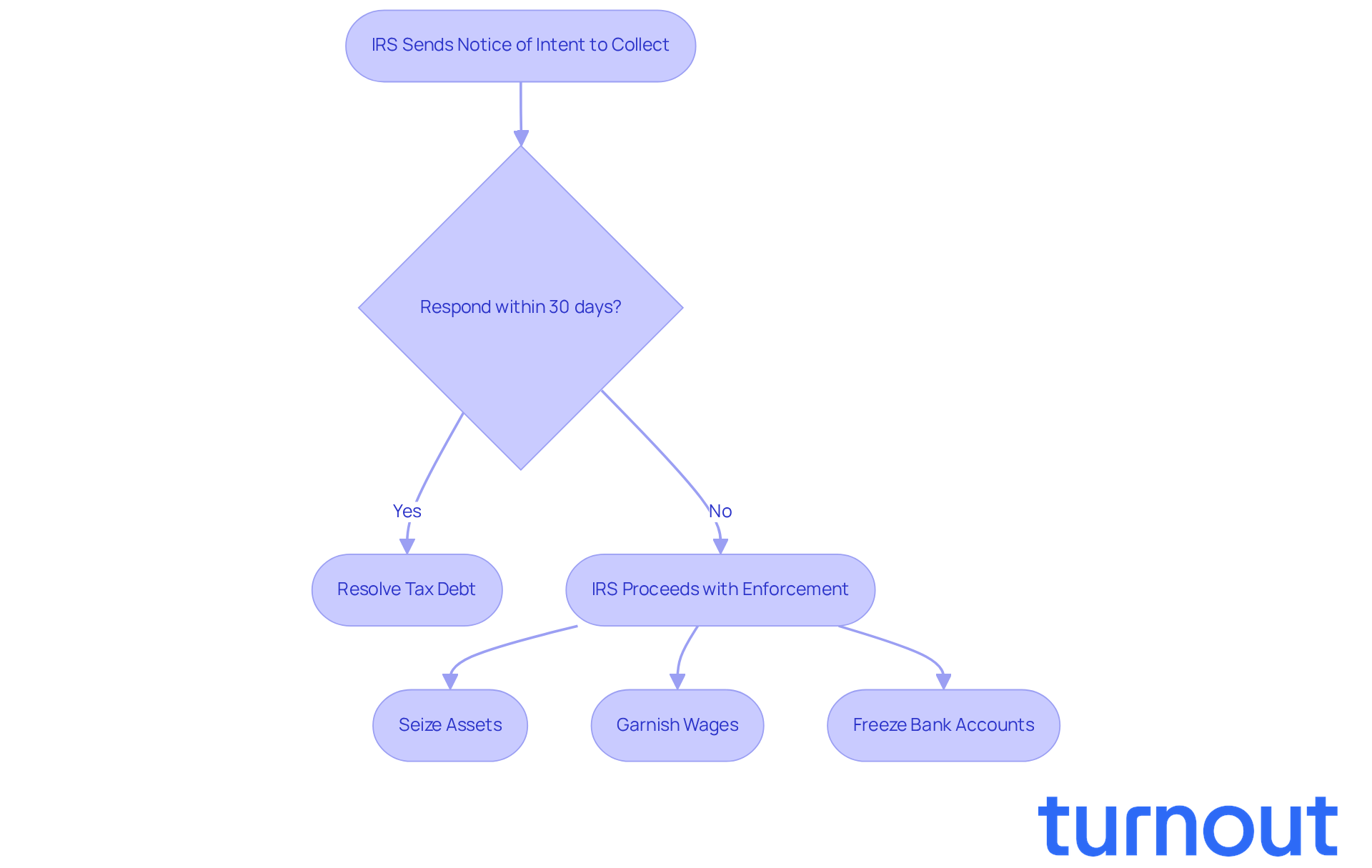

The collection process begins when the IRS sends a Notice of Intent to Collect. This notice serves as a formal alert, letting you know about the upcoming actions regarding your tax obligations. It’s crucial because it gives you a chance to settle your tax debt before any enforcement measures are taken. If you don’t respond or resolve the debt within the specified time frame, the IRS can proceed with enforcement. This means they could potentially seize various assets, including your wages, bank accounts, and property. Once these assets are taken, they may be sold or applied directly to your outstanding tax obligation.

It’s important to understand that the IRS can execute a charge without needing a court order. This highlights how powerful this tool is for tax authorities. For example, in 2025, the IRS primarily managed personal tax debts under $250,000 through their Automated Collection System. Notably, 55% of collections involved bank levies, while 30% involved wage garnishments. This underscores the importance of acting quickly; if you ignore the Notice of Intent to Levy, you could face serious financial consequences, which raises the question of what does it mean to levy a tax, such as losing essential income and possibly facing federal tax liens that can impact your credit and asset management.

You should know what does it mean to levy a tax, as the IRS typically allows a 30-day window after sending the Notice of Intent to Levy for you to respond. If you don’t act within this period, immediate enforcement actions could follow, like freezing your bank accounts or garnishing your wages. Tax experts emphasize that proactive communication with the IRS can significantly reduce the risk of seizures. In fact, over 85% of taxpayers who engage regularly manage to avoid such actions. Understanding the implications of a charge and the importance of addressing your tax responsibilities promptly is vital for steering clear of harmful outcomes.

We understand that dealing with tax issues can be overwhelming, but you are not alone in this journey. Taking the first step by reaching out can make a world of difference. Remember, we’re here to help you navigate this process.

Types of Levies: Exploring Tax Levies and Their Variations

Tax assessments can feel overwhelming, especially when dealing with tax debts. Understanding what it means to levy a tax and the different types of tax levies is important for grasping how they can impact your financial situation. Let’s explore these options together, so you can navigate this challenging time with confidence.

-

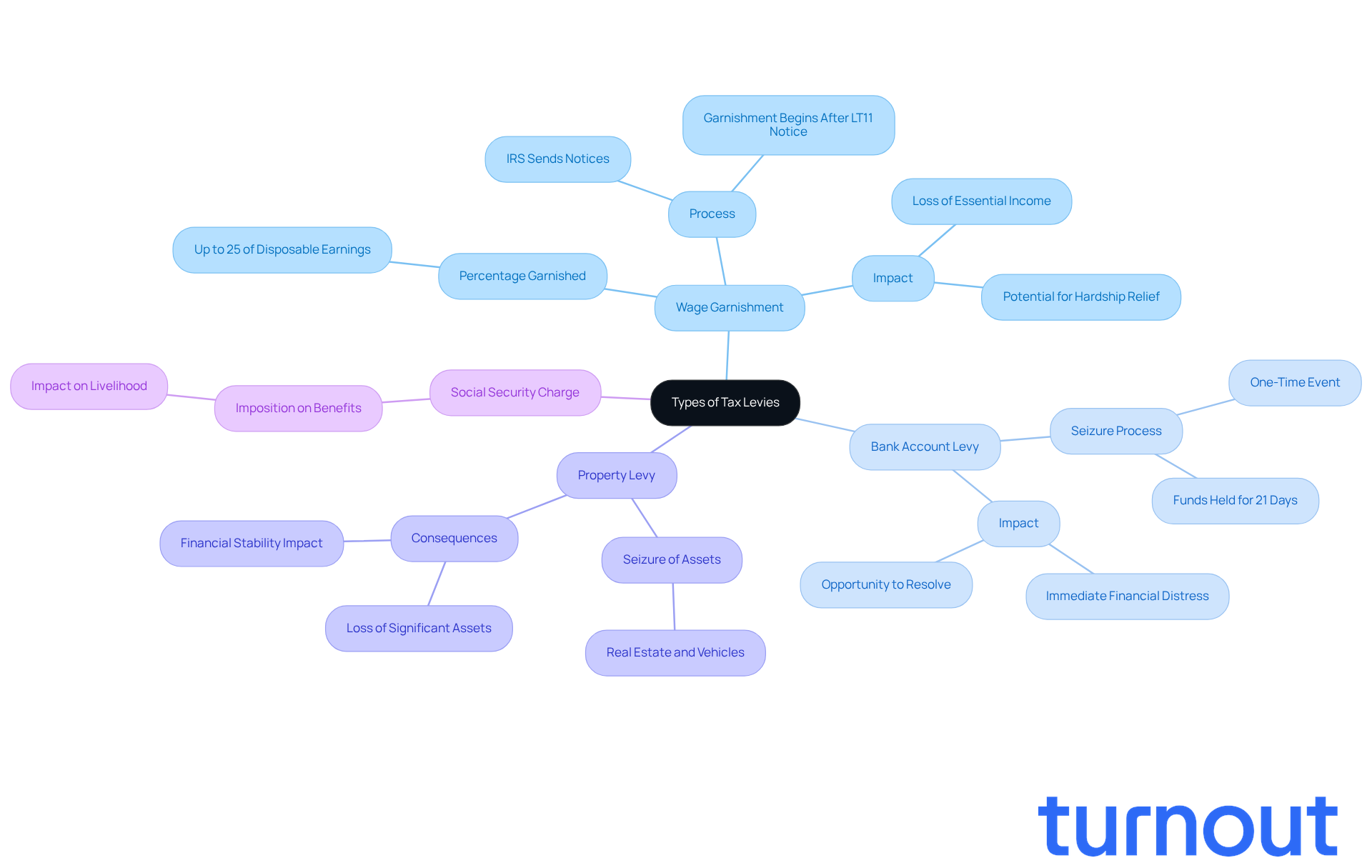

Wage Garnishment: This levy allows the IRS to withhold a portion of your wages directly from your paycheck to cover unpaid taxes. In 2025, nearly 2 million Americans are facing wage garnishment, with the IRS able to take up to 25% of disposable earnings. For example, if your gross monthly income is $4,500, after mandatory deductions, you might see around $1,038 garnished, leaving you with only $2,362 for essential living expenses. Understanding the exempt income determination process is crucial, as it affects how much can be taken. Remember, acting quickly upon receiving IRS notices can help you avoid further complications.

-

Bank Account Levy: The IRS can also seize funds directly from your bank account, which can lead to immediate financial distress. This type of levy is usually a one-time event but may recur if the tax debt remains unpaid. It’s important to know that the bank must hold the seized funds for 21 days before transferring them to the IRS, giving you a brief opportunity to resolve the issue.

-

Property Levy: This involves the seizure of physical assets, like real estate or vehicles, which the IRS can sell to cover unpaid taxes. The consequences of a property levy can be severe, affecting not just your financial stability but also your ownership of significant assets.

-

Social Security Charge: In some cases, the IRS may impose on Social Security benefits to recover tax debts. This can significantly impact those who rely on these benefits for their livelihood.

It's crucial to understand what it means to levy a tax, as each type of tax levy carries its own implications, and it's vital to act promptly when you receive notices from the IRS. Financial advisors emphasize the importance of understanding these processes and taking proactive steps to manage the effects of wage garnishments and other deductions. For instance, submitting an Offer in Compromise or requesting a Collection Due Process hearing can halt levy actions and lead to more manageable solutions.

As the IRS resumes its collection activities, staying informed and engaged is crucial. Remember, you are not alone in this journey. We’re here to help you navigate these challenges and find the best path forward.

Conclusion

Understanding tax levies is essential for anyone facing financial responsibilities. A tax levy is a legal action taken by the government to seize assets or property due to unpaid taxes. This highlights the importance of staying compliant with tax obligations. Recognizing this definition empowers you to take steps to protect your financial well-being and avoid serious consequences.

We understand that navigating tax responsibilities can be overwhelming. Tax levies serve as a mechanism for governments to enforce compliance and recover funds for public services. The article explains the processes involved, including:

- How the IRS notifies taxpayers

- The various types of levies, such as:

- Wage garnishments

- Bank account seizures

- Property levies

Each type carries significant implications, reinforcing the need for timely communication and action regarding tax debts.

Ultimately, understanding tax levies is about more than just compliance; it’s about taking control of your financial future. By being informed and proactive, you can navigate the complexities of tax responsibilities and avoid the pitfalls of non-compliance. Remember, seeking assistance and understanding your options can lead to manageable solutions, ensuring that tax obligations don’t lead to overwhelming financial distress. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What does it mean to levy a tax?

To levy a tax means the government legally seizes your property or assets due to unpaid taxes. This can involve garnishing wages, seizing bank accounts, or taking physical property.

How is a levy different from a lien?

A levy involves the government taking possession of your assets, while a lien is merely a claim against your property.

What are the potential consequences of a tax levy?

The consequences of a tax levy can be severe, leading to financial distress for both individuals and businesses.

What should I do if I am facing a tax levy?

If facing a tax levy, it is important to recognize that you are not alone and to seek assistance. Understanding your rights and options is crucial.

Are there resources available to help with tax levy situations?

Yes, there are resources available to help you navigate tax levy situations, including assistance in understanding your responsibilities and exploring solutions.