Overview

We understand that being audited can feel overwhelming. It involves a thorough examination of your financial records or compliance with regulations. This process is essential to ensure accuracy and adherence to established standards, ultimately enhancing transparency and accountability.

The article explains the audit process in detail, shedding light on its implications for both organizations and individuals. It emphasizes the importance of maintaining accurate documentation and compliance. By doing so, you can avoid negative outcomes, such as financial penalties or denied claims.

Remember, you are not alone in this journey. We're here to help you navigate through the complexities of audits with understanding and support. Taking proactive steps can lead to a more secure and confident financial future.

Introduction

In today's world, where financial transparency and compliance are crucial, understanding the intricacies of auditing is essential. We recognize that audits can feel overwhelming, often leaving individuals and businesses with questions about their implications and outcomes. What does it truly mean to be audited? How can you navigate this complex landscape to ensure compliance and protect your interests?

Audits serve not only as a mechanism for ensuring accuracy in financial records but also as a safeguard for stakeholders. They enhance trust and accountability within organizations, providing peace of mind. It's common to feel uncertain about the audit process, but you are not alone in this journey. We’re here to help you understand and manage these challenges, ensuring that you feel supported every step of the way.

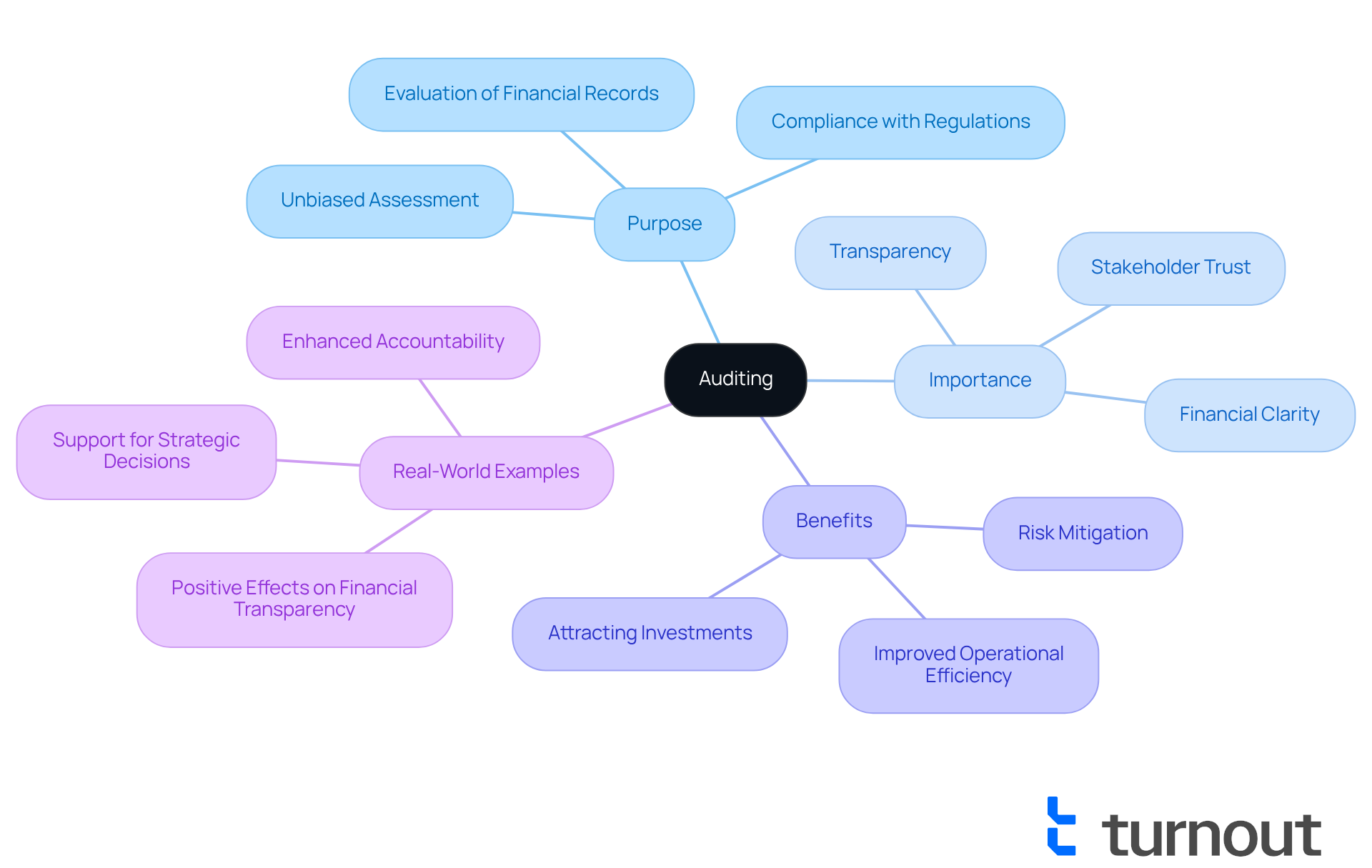

Define Auditing: Understanding Its Purpose and Importance

To understand what does it mean to be audited, one must recognize that auditing involves a thorough examination of financial records, processes, or compliance with regulations to ensure accuracy and adherence to established standards. Its primary aim is to provide an unbiased evaluation of a company's economic condition or operational efficiency, addressing what does it mean to be audited. Audits are essential in maintaining transparency, fostering trust among stakeholders, and identifying areas for improvement. For individuals navigating complex systems, such as those related to disability benefits or tax responsibilities, understanding the review process is crucial. This knowledge can empower them to ensure they receive the support they are entitled to.

The importance of evaluations, including understanding what does it mean to be audited, extends beyond mere compliance; they enhance financial clarity within organizations. For instance, external examinations provide an impartial assessment of financial statements, ensuring they accurately reflect the organization's economic status. This independent evaluation not only boosts credibility but also instills confidence among stakeholders, including consumers seeking benefits.

Expert insights emphasize the role of evaluations in promoting financial transparency. Research indicates that organizations with greater transparency in their finances attract more investments, as 75% of investors prioritize clarity. Additionally, regular evaluations help mitigate the risks of fraud and significant errors by identifying weaknesses in internal controls, thereby enhancing accountability.

Real-world examples illustrate what it means to be audited and the positive effects on financial transparency. Organizations that engage in regular auditing often consider what does it mean to be audited, leading to improved operational efficiency and reduced investment risks. This proactive approach not only enhances governance but also ensures that resources are directed toward quality care and services, ultimately benefiting individuals who rely on these systems for support.

Turnout plays a crucial role in this journey by providing tools and services that help consumers understand their rights and options regarding government benefits, including Social Security Disability (SSD) claims and tax debt relief. While Turnout is not a law firm and does not offer legal representation, it employs trained nonlawyer advocates and IRS-licensed enrolled agents to assist clients through these processes. This expert guidance simplifies access to financial support, empowering individuals to effectively manage their claims and obligations without the complexities often associated with professional representation.

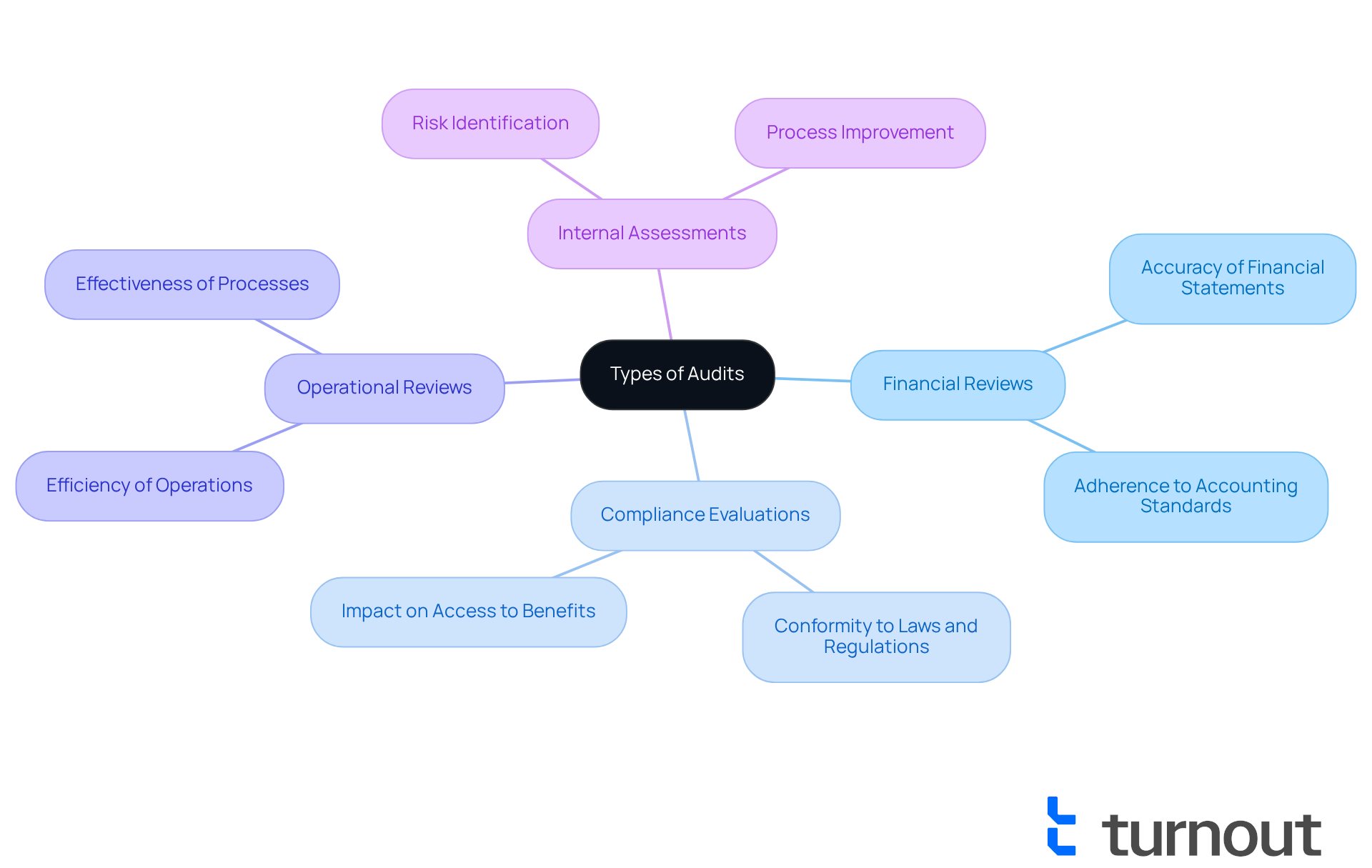

Explore Types of Audits: From Financial to Compliance

Audits can be a source of concern for many, but understanding what does it mean to be audited can help ease those worries. Financial reviews aim to confirm the accuracy of financial statements and ensure adherence to accounting standards. Compliance evaluations, on the other hand, focus on conformity to laws and regulations, which is particularly crucial for those involved in government programs. Operational reviews assess how efficiently and effectively operations are running, while internal assessments help organizations identify risks and improve their processes.

For individuals, especially those interacting with government organizations like the IRS or Social Security Administration, understanding what does it mean to be audited is vital. Compliance evaluations can significantly influence access to benefits, as they ensure that organizations follow essential regulations to protect individual rights. It's common to feel overwhelmed by these processes, but remember, compliance auditors emphasize that following regulations is not just a legal obligation; it’s a fundamental aspect of maintaining trust and ensuring individuals receive the benefits they deserve.

With the IRS conducting over 505,514 tax return examinations in FY 2024 alone, the implications for consumers can be profound. These audits can affect everything from tax refunds to eligibility for social services. Non-compliance can lead to serious financial consequences, including regulatory penalties. By staying informed and maintaining compliance, you can avoid costly penalties and secure your rights. We're here to help you navigate this journey, ensuring that you are not alone in understanding what does it mean to be audited and the significance of compliance.

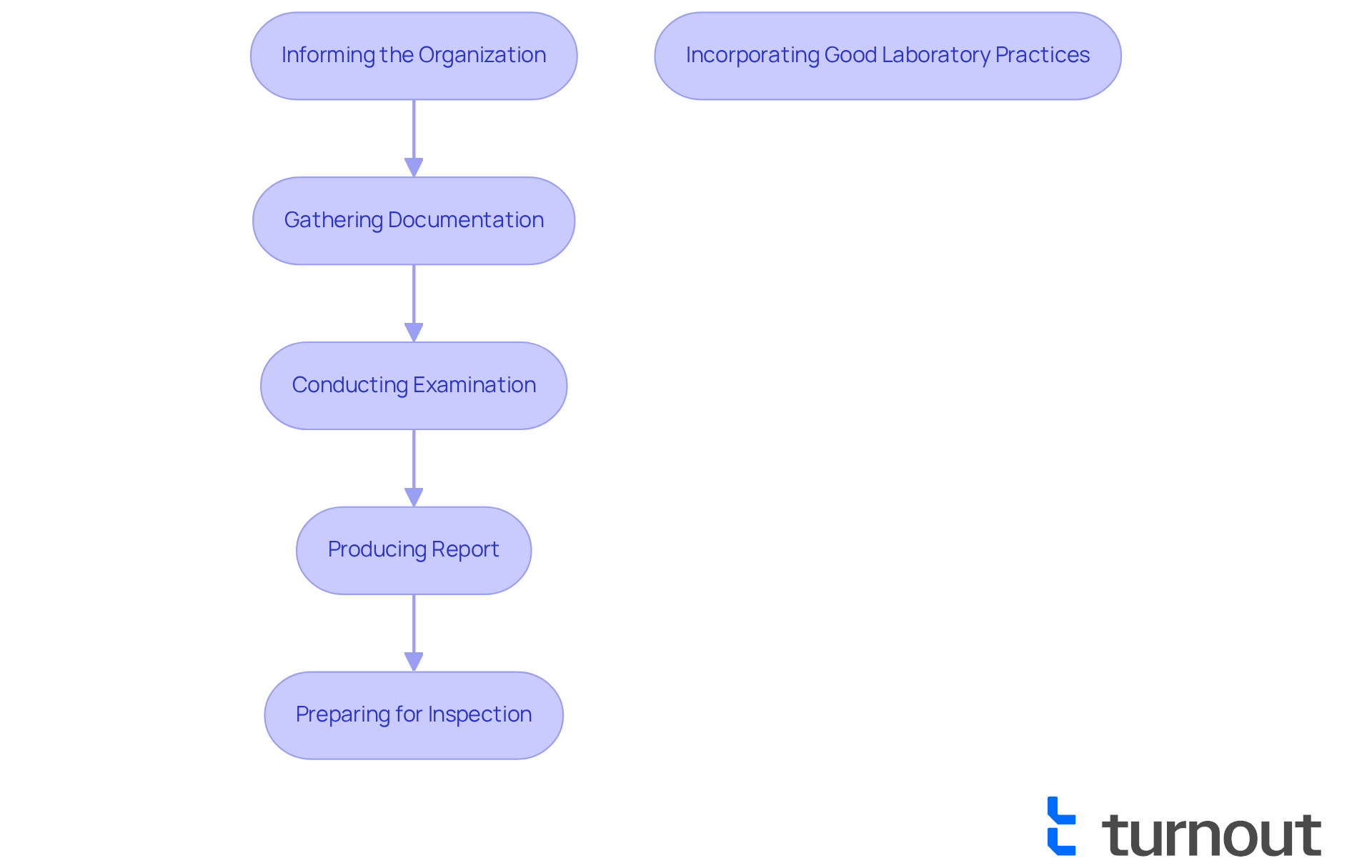

Outline the Audit Process: Steps and Expectations

The evaluation procedure generally includes several essential steps. We understand that navigating this process can be overwhelming. Initially, the auditor will inform the organization or individual of the examination, detailing the scope and objectives. Next, the auditor will gather relevant documentation, which may include financial records, tax returns, or compliance reports. Following this, the auditor conducts the examination, analyzing the information to identify discrepancies or areas of concern. After the examination, a report is produced outlining findings and suggestions. For consumers, understanding these steps can help them prepare and respond effectively, ensuring they are equipped to address any issues that may arise.

Incorporating Good Laboratory Practices (GLP) into your preparation can significantly enhance your readiness for inspections. For instance, evaluating sample stability at each step of the process is crucial, as it ensures that all documentation is accurate and reliable.

Consider the case study of 'Rolling Audits for Data Quality Assurance,' where data underwent quality checks on the same day it was processed. This approach ensured that all samples were analyzed correctly and adhered to validated storage durations, highlighting the importance of timely and organized documentation.

Furthermore, the importance of readiness is underscored by the statistic concerning the anticipated finalization of the last groups of data evaluations for database lock. It’s common to feel pressured, and this highlights the necessity for individuals to act swiftly in collecting their documentation.

By understanding what does it mean to be audited and preparing efficiently, you can better equip yourself to tackle any difficulties that may occur. Remember, you are not alone in this journey—we're here to help you every step of the way.

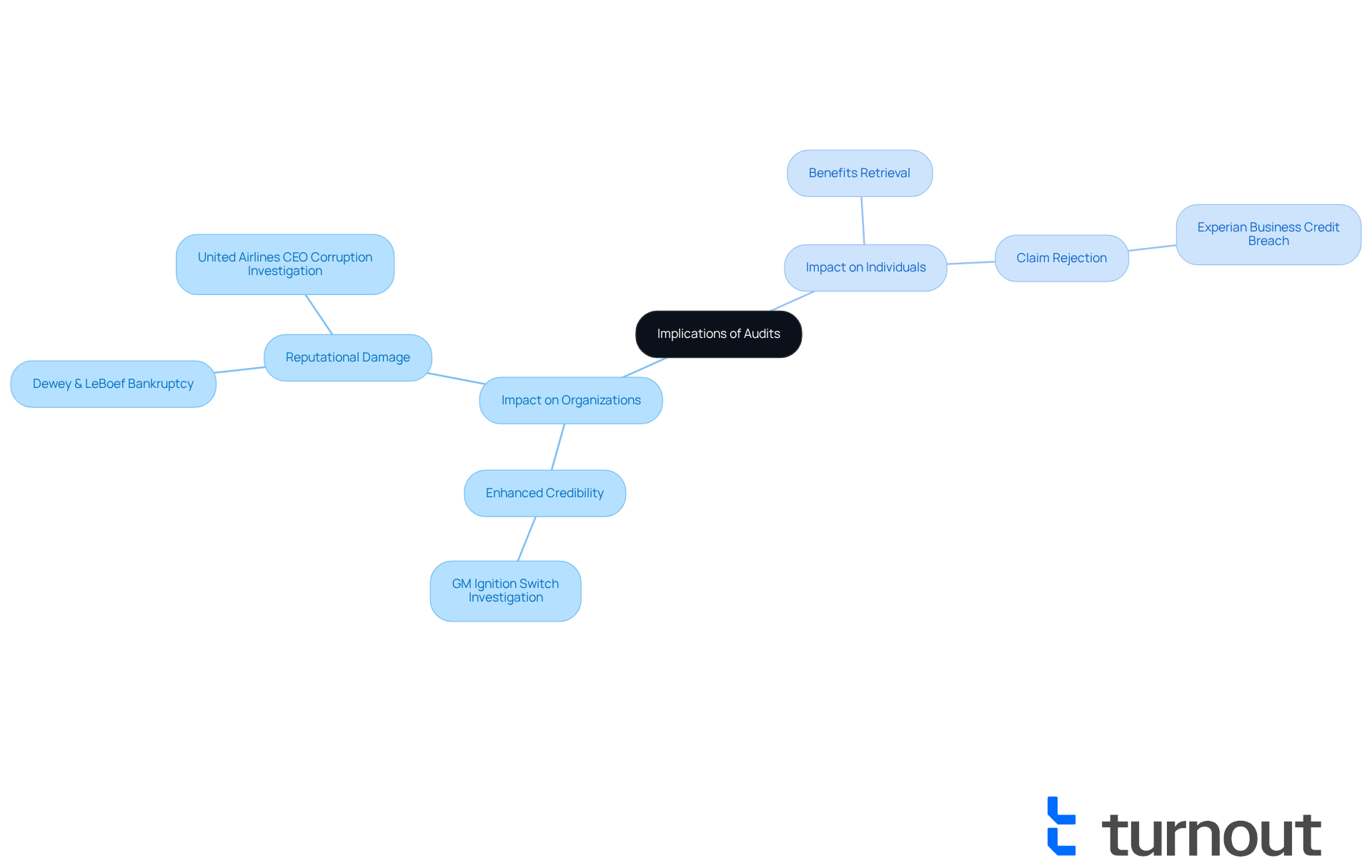

Discuss Implications of Audits: Outcomes and Impact on Stakeholders

Audits can greatly impact both businesses and individuals, and we understand the challenges involved in grasping what does it mean to be audited. For organizations, a successful evaluation can enhance credibility and build trust among stakeholders. However, a negative assessment may lead to reputational damage and financial repercussions. For individuals, particularly those managing disability benefits applications, evaluations can mean the retrieval of owed benefits or, conversely, the rejection of claims if inconsistencies arise. The financial stakes are high; organizations may face penalties that affect their operational budgets, while consumers may find their claims jeopardized by evaluation results.

Recognizing what does it mean to be audited is essential for anyone dealing with these complex systems. It underscores the importance of accurate documentation and compliance with regulations. For instance, the GM Ignition Switch Investigation illustrated how timely evaluations can set benchmarks for future corporate accountability. Similarly, the Experian Business Credit breach showed us that lapses in oversight can lead to significant identity theft, reinforcing the need for strong auditing practices to safeguard sensitive information. Ultimately, audits play a crucial role in ensuring fairness and transparency within systems, benefiting everyone involved. Remember, you are not alone in this journey, and we are here to help you navigate these challenges.

Conclusion

Understanding what it means to be audited is crucial for both organizations and individuals. We recognize that navigating the audit process can feel overwhelming. However, auditing serves as a vital mechanism for ensuring transparency, accountability, and compliance within various systems. By providing an independent evaluation of financial records and operational processes, audits not only enhance the credibility of organizations but also empower individuals to navigate complex bureaucracies effectively.

The article outlines the multifaceted nature of audits, detailing their different types, such as:

- Financial audits

- Compliance audits

- Operational audits

Each type plays a specific role in maintaining integrity and trust within the system. It’s common to feel uncertain about where to start, but the audit process can be broken down into manageable steps. Preparation and accurate documentation are key. Real-world examples highlight the significant implications audits can have, from safeguarding sensitive information to influencing access to critical benefits.

In light of this information, it becomes evident that understanding the audit process is not just beneficial but essential. You are not alone in this journey; individuals and organizations alike must prioritize compliance and transparency to avoid potential pitfalls. The journey through audits can be daunting, but with the right knowledge and support, it can lead to improved operational efficiency and trust among stakeholders. Embracing the audit process can ultimately pave the way for a more equitable and transparent system for everyone involved. Remember, we're here to help you every step of the way.

Frequently Asked Questions

What is auditing?

Auditing is a thorough examination of financial records, processes, or compliance with regulations to ensure accuracy and adherence to established standards. Its primary aim is to provide an unbiased evaluation of a company's economic condition or operational efficiency.

Why is auditing important?

Auditing is essential for maintaining transparency, fostering trust among stakeholders, and identifying areas for improvement. It enhances financial clarity within organizations and ensures that financial statements accurately reflect the organization's economic status.

How does auditing benefit stakeholders?

Independent evaluations boost credibility and instill confidence among stakeholders, including consumers. Organizations with greater financial transparency are more likely to attract investments, as many investors prioritize clarity.

What are the risks associated with a lack of auditing?

Without regular evaluations, organizations may face increased risks of fraud and significant errors due to weaknesses in internal controls. Regular audits enhance accountability and help mitigate these risks.

How do real-world examples demonstrate the benefits of auditing?

Organizations that engage in regular auditing often experience improved operational efficiency and reduced investment risks. This proactive approach enhances governance and ensures resources are directed toward quality care and services.

What role does Turnout play in the auditing process?

Turnout provides tools and services to help consumers understand their rights and options regarding government benefits, including Social Security Disability claims and tax debt relief. They offer expert guidance through trained nonlawyer advocates and IRS-licensed enrolled agents, simplifying access to financial support.

Does Turnout offer legal representation?

No, Turnout is not a law firm and does not offer legal representation, but they assist clients through the auditing and claims processes with expert guidance.