Introduction

Understanding the audit process is essential for any organization that wants to be transparent and accountable in its financial practices. We know that as stakeholders increasingly seek assurance about the accuracy and reliability of financial statements, audits become a vital tool for building trust and ensuring compliance. Yet, it’s common to feel overwhelmed by the complexities of what an audit truly involves.

What misconceptions linger in the minds of those facing an audit? How can organizations transform this seemingly daunting process into an opportunity for improvement?

We’re here to help you navigate these challenges. Remember, you are not alone in this journey. Together, we can turn the audit process into a stepping stone for growth and better practices.

Define the Audit Process

We understand that navigating the audit process can feel overwhelming. It involves a systematic review of a company's statements, records, and operations, all aimed at ensuring precision and adherence to established standards and regulations. Whether conducted internally by your own staff or externally by independent auditors, the goal remains the same: to provide you with confidence that the financial information presented is an accurate and honest reflection of your entity's economic standing.

This process typically includes several key stages:

- Planning

- Fieldwork

- Reporting

- Follow-up

Each step is designed to thoroughly examine all aspects of your monetary practices. It's common to feel uncertain about what does getting audited mean, but rest assured, we’re here to help you through it. By understanding the audit process, you can better appreciate its value in maintaining the integrity of your financial reporting.

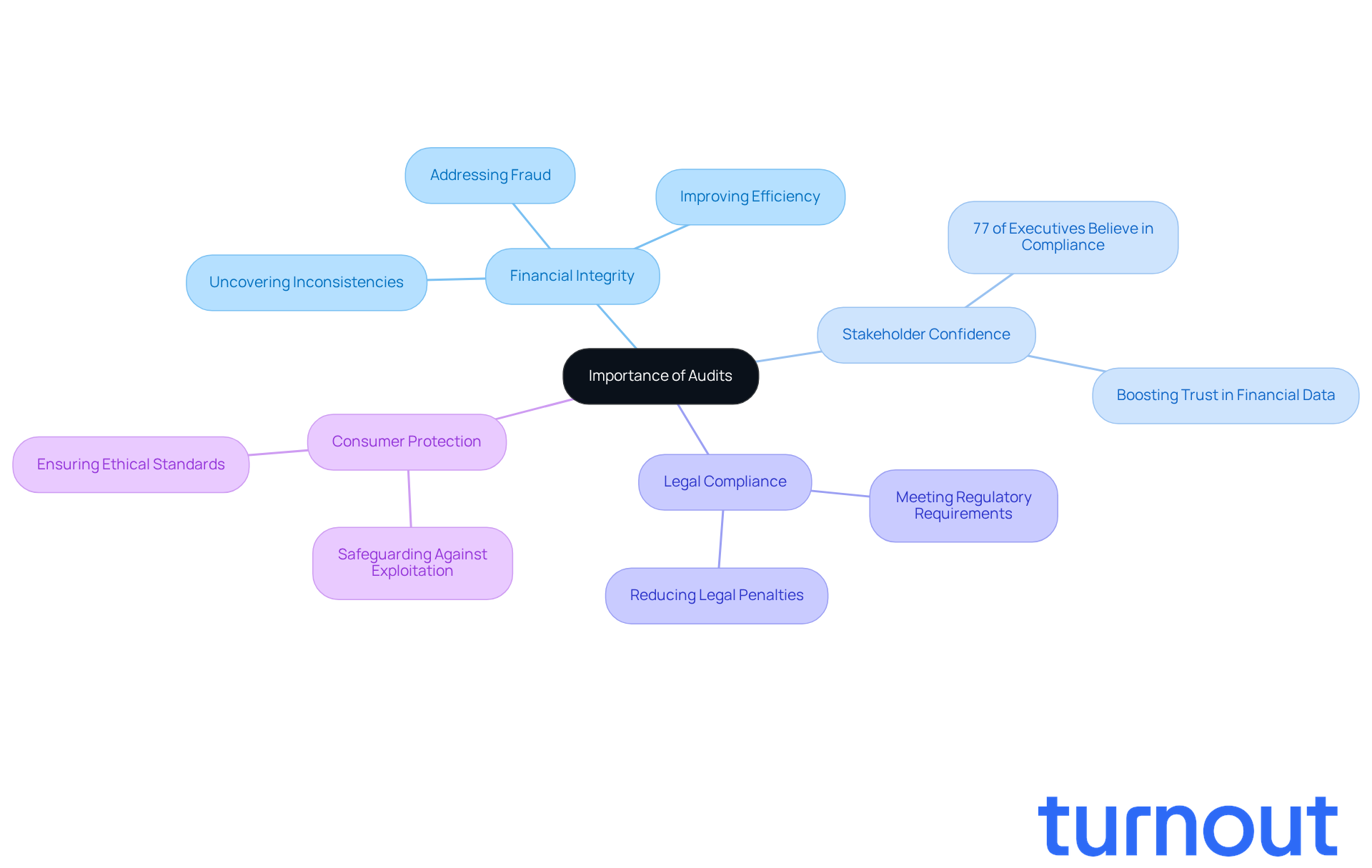

Explain the Importance of Audits

Audits are essential for maintaining the integrity of financial statements, and they play a vital role in boosting stakeholder confidence in the data presented. We understand that navigating financial complexities can be daunting, but systematic reviews of financial documents can help uncover inconsistencies, fraud, and inefficiencies. This proactive approach allows organizations to address these issues before they escalate.

In fact, organizations that conducted four or more evaluations in 2025 found themselves in a stronger position to meet legal and regulatory requirements. This not only reduces the risk of legal penalties but also fosters a culture of accountability. As Anna Fitzgerald points out, 77% of global C-suite executives believe that compliance significantly influences company goals. This highlights how crucial assessments are in promoting transparency and trust.

For consumers, evaluations act as a safeguard against potential exploitation. They ensure that organizations adhere to ethical standards, which is especially important in today’s complex economic landscape, where the risk of fraud looms large. By enhancing the credibility of financial statements, evaluations protect consumers and bolster the overall reliability of the financial system.

Remember, you are not alone in this journey. We’re here to help you navigate these challenges and ensure that your organization remains accountable and transparent.

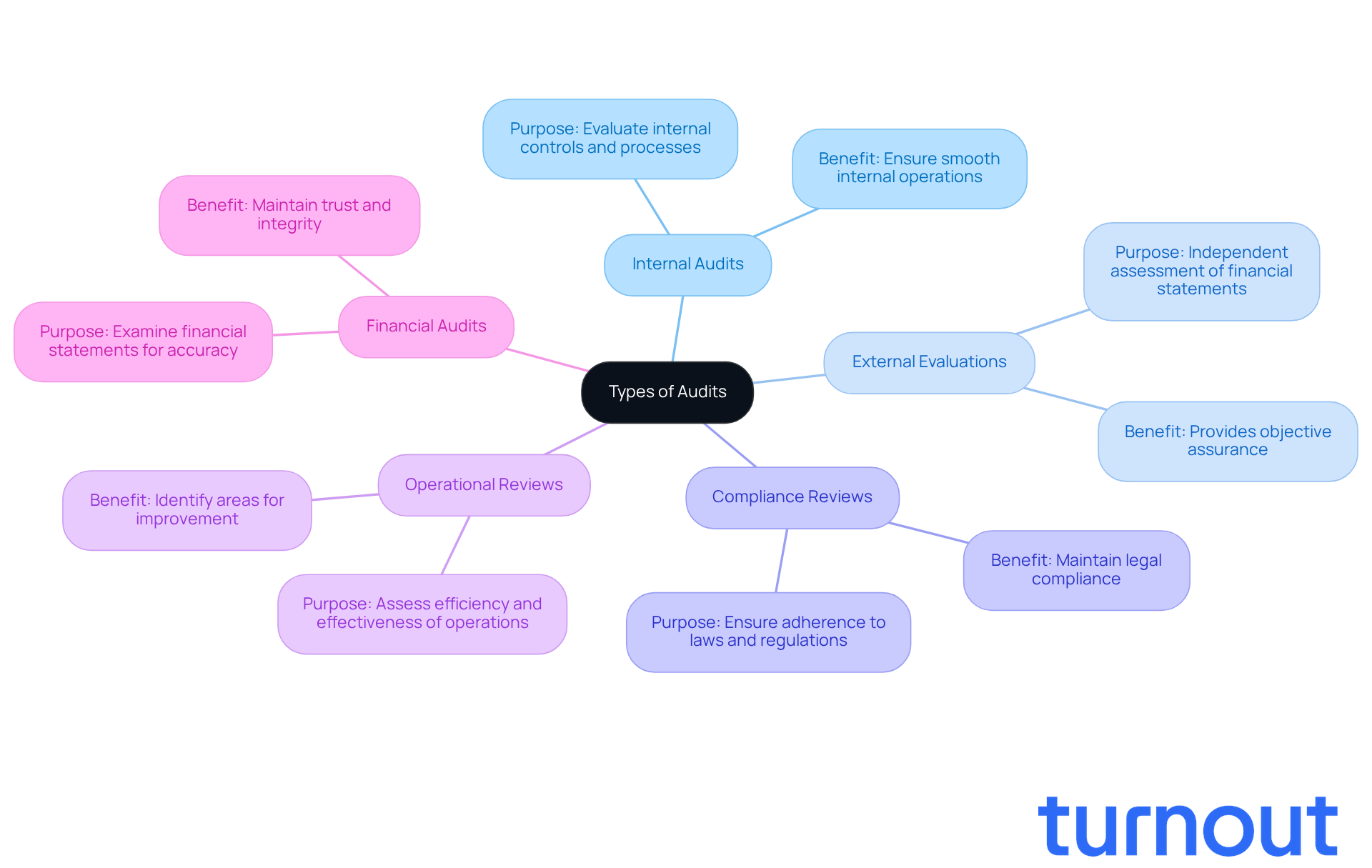

Identify Different Types of Audits

We understand that navigating the world of audits can feel overwhelming, particularly when you are unsure of what does getting audited mean. There are several types of audits, each serving a unique purpose that can help your organization thrive. Let’s explore them together:

- Internal Audits: These are conducted by your own staff, focusing on evaluating internal controls and processes. They help ensure everything runs smoothly from within.

- External Evaluations: Independent auditors carry out these assessments, providing an objective look at your financial statements. This can offer peace of mind, knowing that your finances are in good hands.

- Compliance Reviews: These audits focus on adherence to laws and regulations, ensuring that your organization meets all legal requirements. It’s essential to stay compliant, and these reviews help you do just that.

- Operational Reviews: Here, the efficiency and effectiveness of your operations are assessed. Identifying areas for improvement can lead to significant benefits for your organization.

- Financial Audits: These examine your financial statements to ensure accuracy and compliance with accounting standards. They play a crucial role in maintaining trust and integrity.

Understanding what does getting audited mean is crucial, as each type of audit plays a vital role in supporting your organization’s integrity and accountability. Remember, you’re not alone in this journey; we’re here to help you navigate these processes with confidence.

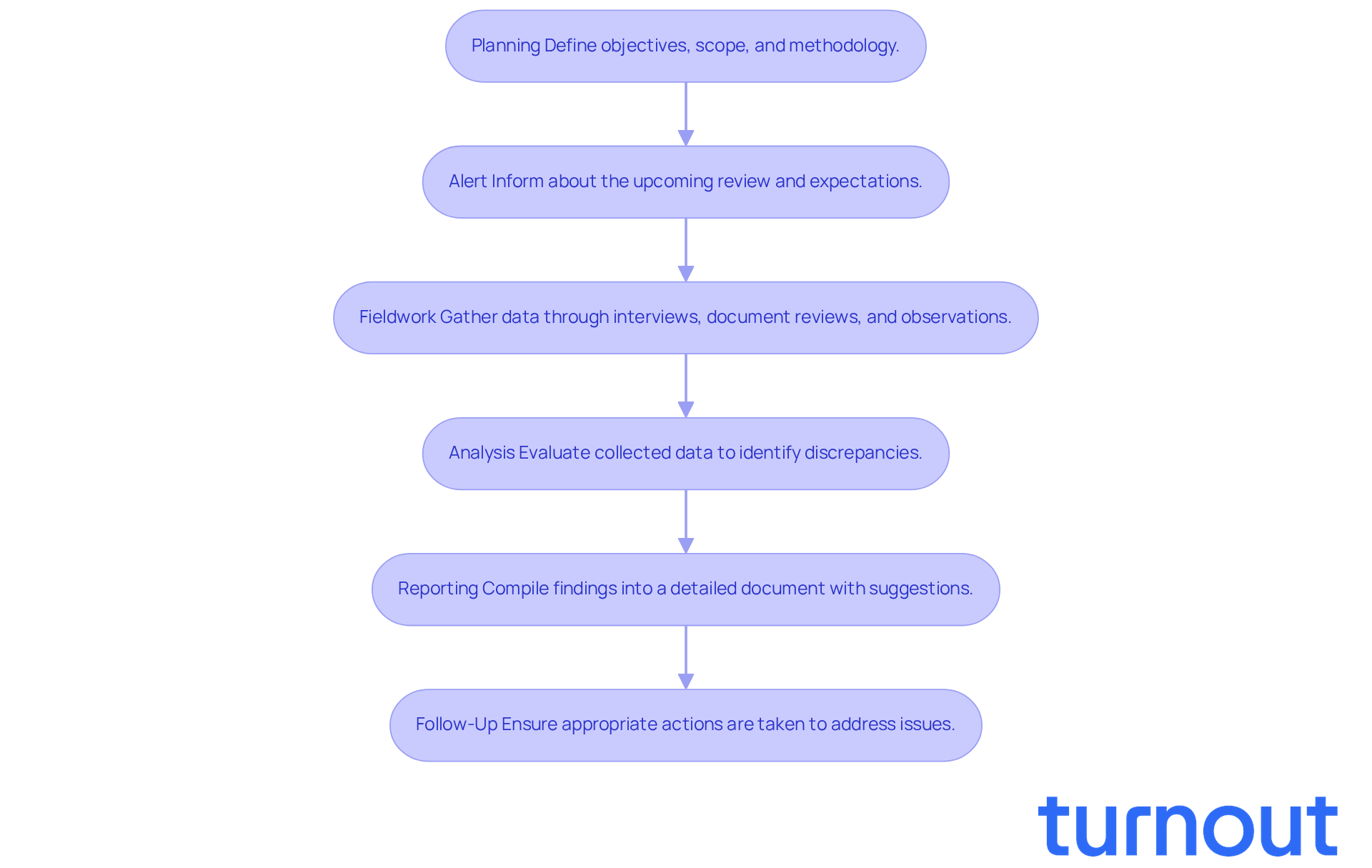

Outline the Audit Process Steps

The audit process is designed with several essential steps that prioritize thoroughness and transparency, ensuring you feel supported every step of the way:

-

Planning: This initial phase is all about defining the evaluation's objectives, scope, and methodology. It sets a solid foundation for the entire process. Effective planning is crucial, especially for individuals with disabilities navigating claims with the help of Turnout's trained nonlawyer advocates. We understand that this can be a challenging time, and we're here to help.

-

Alert: You’ll be informed about the upcoming review, including its purpose and what to expect. This promotes a culture of collaboration, making the process feel more manageable.

-

Fieldwork: During this phase, auditors gather data through interviews, document reviews, and observations. This information is vital for a comprehensive assessment. Turnout's IRS-licensed enrolled agents are available to assist you in understanding what information may be needed during this phase, ensuring you feel prepared.

-

Analysis: Here, the collected data is evaluated to identify any discrepancies or areas of concern. This step is essential for ensuring that individuals with disabilities receive the support they deserve in their claims. It’s common to feel overwhelmed, but know that we’re committed to addressing any issues that arise.

-

Reporting: Findings are compiled into a detailed document that outlines the assessment results and offers actionable suggestions for improvement. Effective reporting can significantly influence how entities tackle compliance challenges, which is crucial for clients relying on Turnout's services.

-

Follow-Up: This final step ensures that the organization takes appropriate action to address any issues identified during the review, reinforcing accountability. Turnout's advocates are here to help you navigate the follow-up process, ensuring your claims are properly addressed.

This systematic approach not only enhances the efficiency of the evaluation but also fosters transparency and accountability-key elements in building trust throughout the assessment process. For individuals with disabilities seeking benefits, understanding these steps can empower you to manage the complexities of evaluations related to your claims. Remember, you are not alone in this journey; Turnout's services are here to support you.

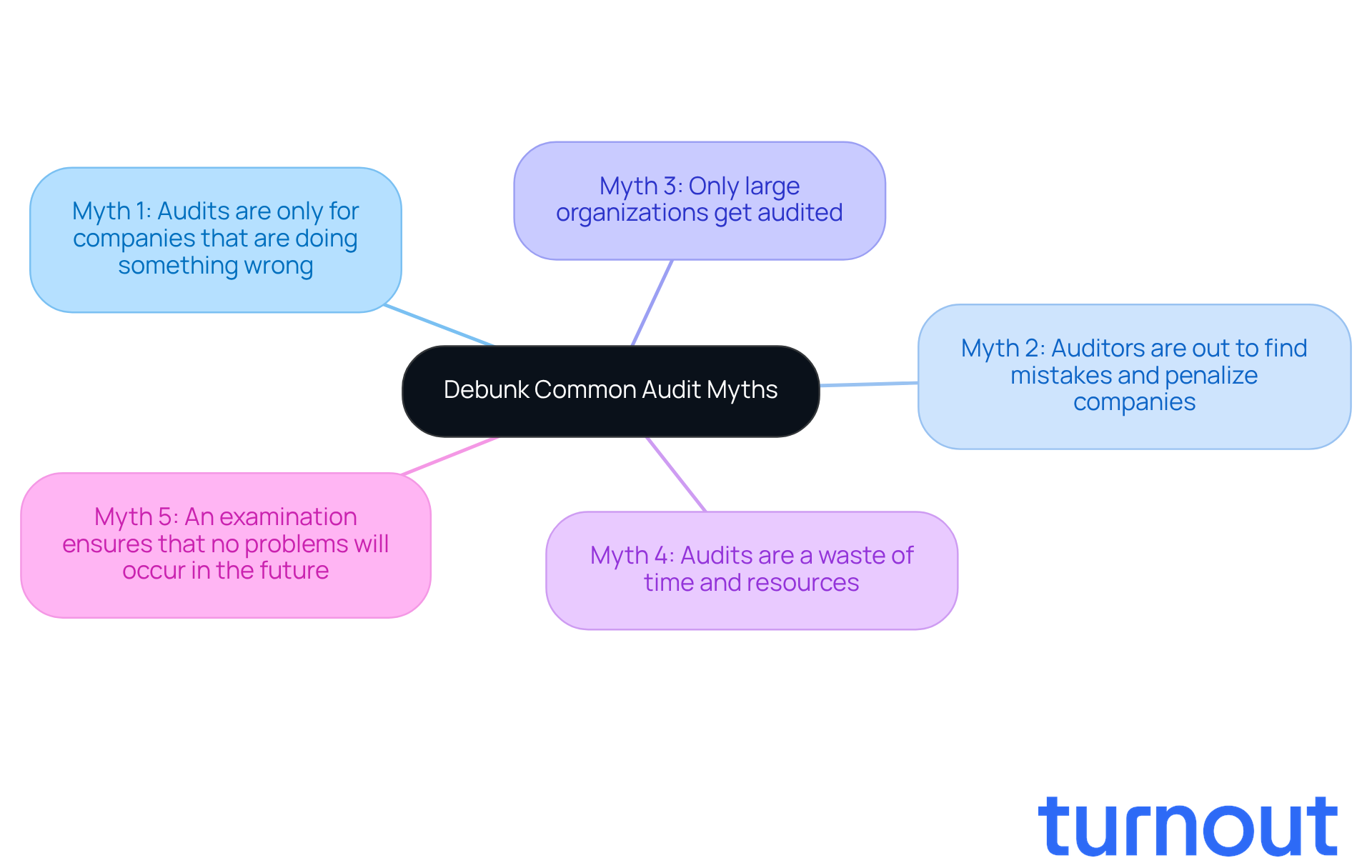

Debunk Common Audit Myths

Many people feel anxious about audits, often due to common myths that can create unnecessary worry about what does getting audited mean. Let’s take a moment to address these misconceptions together:

- Myth 1: Audits are only for companies that are doing something wrong.

- Myth 2: Auditors are out to find mistakes and penalize companies.

- Myth 3: Only large organizations get audited.

- Myth 4: Audits are a waste of time and resources.

- Myth 5: An examination ensures that no problems will occur in the future.

It’s common to feel overwhelmed by these ideas, but what does getting audited mean in reality is quite different. Audits are actually a proactive measure designed to clarify what does getting audited mean, ensuring compliance and improving processes. They benefit both organizations and consumers alike.

We understand that navigating the world of audits can be daunting, but remember, you are not alone in this journey. We're here to help you see audits in a new light-one that highlights their value and importance.

Conclusion

Understanding the audit process is essential for any organization aiming to maintain financial integrity and transparency. We understand that navigating this process can feel overwhelming. However, it’s important to recognize that audits are not just a bureaucratic requirement; they are a vital practice that ensures compliance, fosters trust, and enhances operational efficiency. By demystifying the audit process, we can see how these evaluations serve as a safeguard against potential discrepancies and inefficiencies.

Key points discussed include the systematic stages of the audit process, the various types of audits available, and the importance of regular evaluations in promoting accountability. Each type of audit - whether internal or external, compliance-focused or operational - plays a crucial role in fortifying an organization's financial health. It’s common to feel apprehensive about audits, but addressing common myths surrounding them helps alleviate fears and misconceptions. Audits are a proactive measure, not a punitive one.

In light of these insights, embracing the audit process can empower organizations to meet legal requirements and build a culture of transparency and trust among stakeholders. The call to action is clear: prioritize audits as a strategic tool for growth and compliance. By ensuring that financial practices are not just followed but continuously improved, organizations can navigate the complexities of financial reporting with confidence and integrity. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is the audit process?

The audit process is a systematic review of a company's statements, records, and operations aimed at ensuring accuracy and adherence to established standards and regulations. It can be conducted internally or externally, with the goal of providing confidence in the financial information presented.

What are the key stages of the audit process?

The key stages of the audit process include Planning, Fieldwork, Reporting, and Follow-up. Each step is designed to thoroughly examine all aspects of a company's monetary practices.

Why are audits important?

Audits are essential for maintaining the integrity of financial statements and boosting stakeholder confidence. They help uncover inconsistencies, fraud, and inefficiencies, allowing organizations to address these issues proactively.

How do audits affect compliance and accountability?

Regular audits help organizations meet legal and regulatory requirements, reducing the risk of legal penalties and fostering a culture of accountability. They are seen as crucial assessments that promote transparency and trust.

What benefits do audits provide to consumers?

Audits act as a safeguard against potential exploitation by ensuring organizations adhere to ethical standards. They enhance the credibility of financial statements, protecting consumers and bolstering the overall reliability of the financial system.

How can organizations navigate the audit process effectively?

Organizations can navigate the audit process effectively by understanding its stages and recognizing the value it brings in maintaining the integrity of financial reporting. Support is available to help organizations remain accountable and transparent throughout the process.