Introduction

Navigating the maze of tax obligations can feel overwhelming for both individuals and businesses. We understand that as tax laws grow more complex, the stress can become unmanageable. Tax resolution services have emerged as a crucial lifeline, offering personalized strategies to ease the burden of tax debts and compliance issues.

With a staggering amount of unpaid taxes reported, you might be wondering: how can these services truly help you regain your financial footing? It's common to feel lost in this process, but know that you're not alone. These services are designed to bridge the gap between taxpayers and their path to financial stability, providing the support you need to move forward.

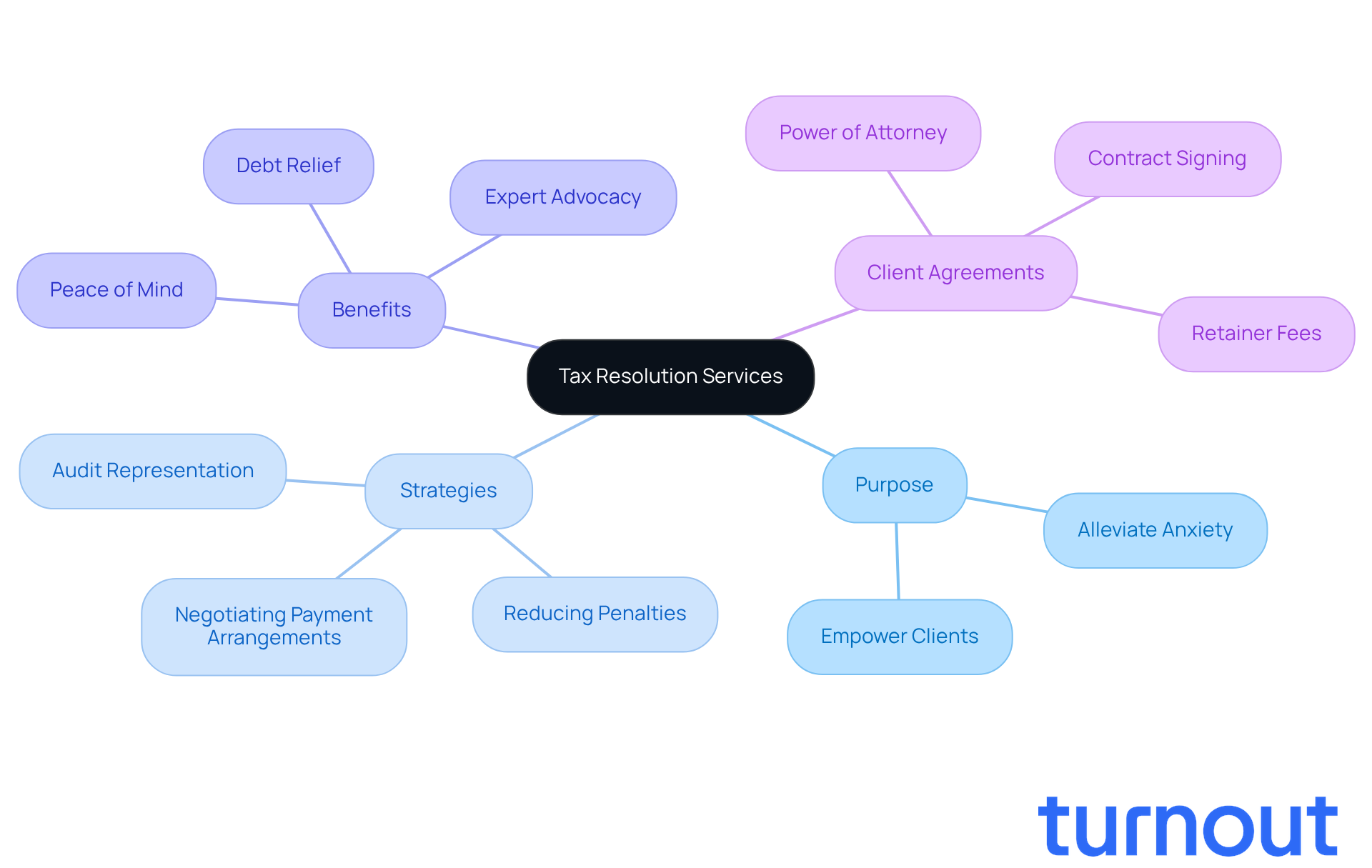

Define Tax Resolution Services and Their Purpose

To understand what is tax resolution services, one must recognize that these are specialized professional options designed to help individuals and businesses navigate tax-related challenges with federal, state, or local tax authorities. These services include strategies like negotiating payment arrangements, reducing penalties, and representing clients during audits. Understanding what is tax resolution services is essential as its primary goal is to alleviate the anxiety and uncertainty that often accompany tax liabilities, empowering individuals to manage the complexities of tax legislation with confidence.

We understand that many individuals facing tax issues seek help from these resources, highlighting their growing importance in today’s financial landscape. What is tax resolution services enables individuals to achieve favorable outcomes, such as settling debts for less than what they owe or establishing manageable payment plans, by providing expert advice. For example, numerous clients have successfully lowered their tax liabilities through programs like Offer in Compromise, which allows them to negotiate a reduced payment based on their financial circumstances.

Turnout offers a mix of complimentary services and those that require payment, known as Fees. Additionally, any Government Fees charged by agencies must be settled before Turnout can submit paperwork on your behalf. The benefits of utilizing tax assistance options extend beyond mere debt relief; they also offer peace of mind and the assurance that skilled professionals are advocating for the taxpayer. This support is vital, especially given the increasing complexity of tax regulations and the potential repercussions of unresolved tax issues.

Moreover, clients agree to receive all communications electronically, including notices, agreements, and disclosures. Overall, understanding what is tax resolution services plays a crucial role in helping clients regain control over their financial futures. Remember, you are not alone in this journey; we’re here to help.

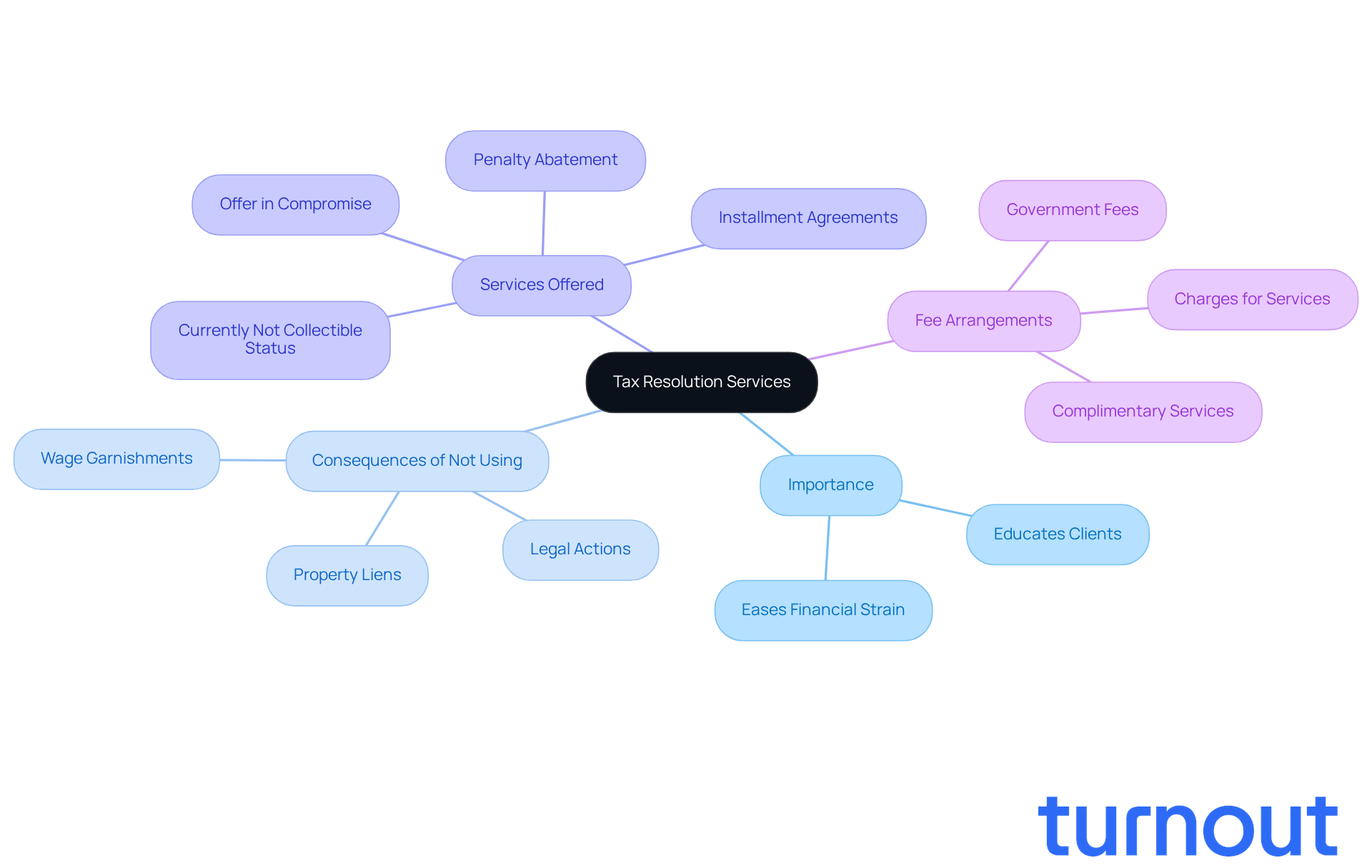

Explore the Importance of Tax Resolution Services in Modern Finance

In today’s financial landscape, we understand what tax resolution services are and why they are crucial. Millions of Americans are grappling with tax debts and the complexities of the IRS. With over $688 billion in unpaid tax debts reported, the need for effective solutions has never been more pressing.

These services provide timely help, easing financial strain and helping individuals understand what tax resolution services are to avoid serious consequences like wage garnishments, property liens, and legal actions. What are tax resolution services? They involve facilitating communication with tax authorities and offering tailored solutions that empower you to regain financial stability and meet your tax obligations.

Moreover, understanding what tax resolution services are plays a vital role in educating clients about their rights and available options. For instance, the Currently Not Collectible status can temporarily halt IRS collections if paying the debt would lead to severe financial hardship.

It’s important to understand Turnout's fee arrangement: some services are complimentary, while others involve charges, and government fees must be settled separately before any documentation can be submitted on your behalf.

As the IRS strengthens its enforcement capabilities, understanding what tax resolution services are becomes increasingly important, especially for those facing significant tax burdens. Remember, you are not alone in this journey, and we’re here to help.

Break Down the Types of Tax Resolution Services Available

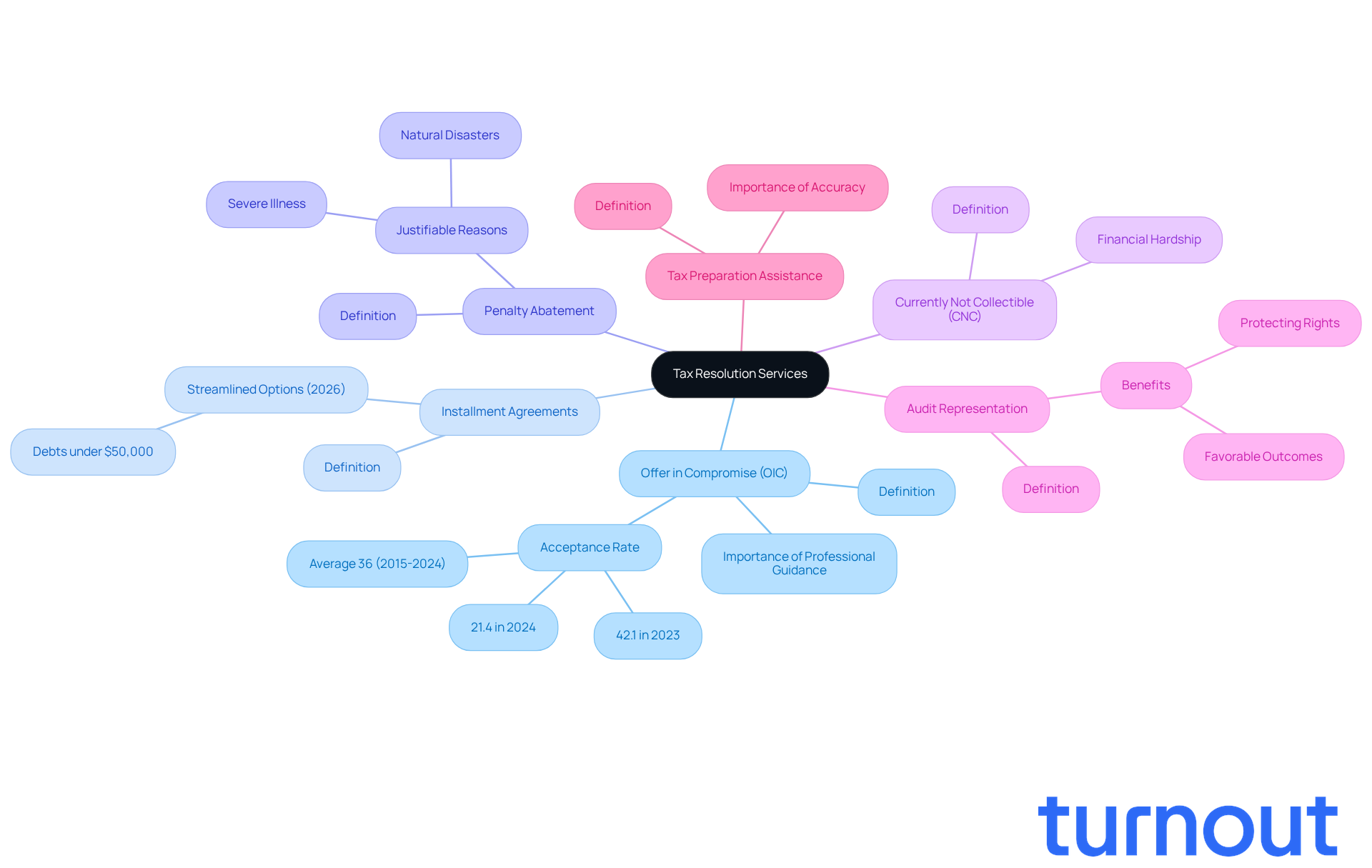

What is tax resolution services? They offer various strategies designed to effectively tackle specific tax issues. We understand that dealing with taxes can be overwhelming, but there are options available to help you navigate these challenges. Here are some key types of solutions:

-

Offer in Compromise (OIC): This program allows you to settle your tax debts for less than what you owe, based on your financial situation. The IRS typically approves OICs when the offered amount reflects what they can reasonably expect to collect. Between 2015 and 2024, taxpayers submitted 499,095 Offers in Compromise, with the IRS approving 183,407 of them. The acceptance rate has varied, averaging around 36% over the last decade. This highlights the importance of a well-prepared application. As TaxRise states, "The biggest difference-maker is having professional guidance to make sure your offer is realistic, your paperwork is complete, and your case is as strong as possible."

-

Installment Agreements: If you're struggling to pay off your debts, negotiating a payment plan can make repayment more manageable. Starting in 2026, the IRS will offer streamlined installment agreements for debts under $50,000, providing more flexible terms than before.

-

Penalty Abatement: If you have a justifiable reason, such as severe illness or natural disasters, you may seek the elimination of penalties. Tax professionals often emphasize that demonstrating a valid reason can significantly enhance your chances of penalty relief.

-

Currently Not Collectible (CNC): If you're facing financial hardship, you might qualify for CNC status, which temporarily halts collection efforts. This status can provide much-needed relief for those unable to meet their tax obligations.

-

Audit Representation: During IRS audits, having a professional represent you can ensure your rights are protected and guide you through the process. Expert representation can lead to more favorable outcomes, as tax professionals are skilled at negotiating with IRS agents.

-

Tax Preparation Assistance: These services help you submit accurate tax returns, reducing the likelihood of future complications with tax authorities. Proper preparation is crucial, as errors can trigger audits and penalties.

Each of these services addresses different aspects of tax settlement, helping you understand what tax resolution services are and allowing you to choose what fits your unique circumstances best. Remember, engaging with a qualified tax professional can significantly improve your chances of achieving favorable outcomes. Ignoring IRS notices can lead to serious consequences, including accumulating penalties and interest. Taking timely action is essential, and we're here to help you through this journey.

Identify Common Challenges in Tax Resolution Processes

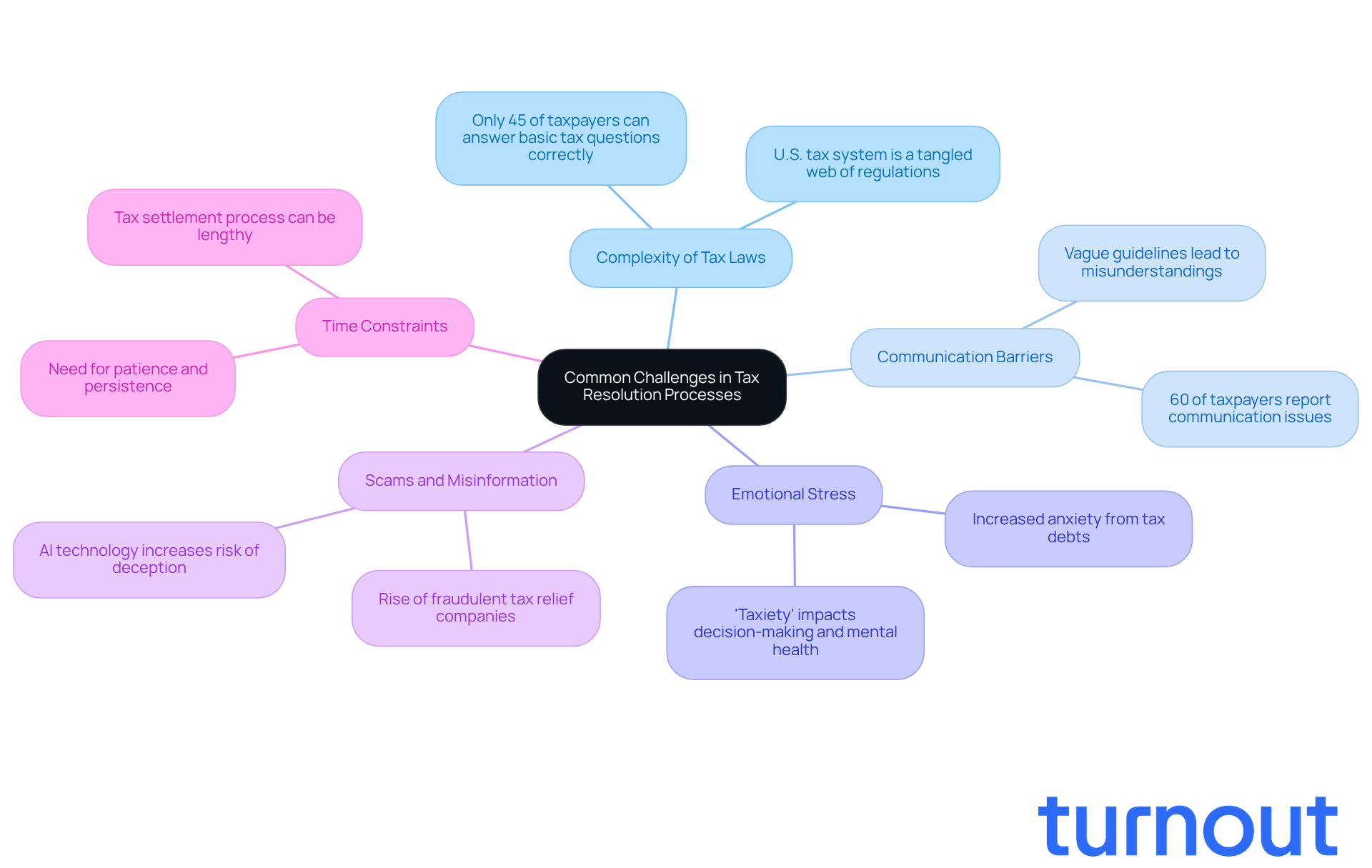

Navigating the tax settlement process can feel overwhelming, and it’s completely understandable to face challenges along the way. Here are some key issues that many taxpayers encounter:

-

Complexity of Tax Laws: The U.S. tax system is a tangled web of federal, state, and local regulations that change frequently. This complexity can leave you feeling confused about your rights and obligations. In fact, studies show that only 45 percent of taxpayers can answer basic tax questions correctly. This highlights a significant gap in understanding tax laws, as noted by researchers Elizabeth Lyon and Jesse Catlin.

-

Communication Barriers: Many people struggle to communicate effectively with tax authorities. Misunderstandings can arise from vague guidelines or slow responses, leading to frustrating delays. Approximately 60 percent of taxpayers report facing these communication issues, according to a study by Sacramento State professors. This can add to your financial stress, making it even harder to find a resolution.

-

Emotional Stress: The weight of tax debts can lead to increased anxiety and stress, impacting your decision-making and overall mental health. This emotional burden, often referred to as 'taxiety,' can make it difficult to seek the help you need. The complexity of tax laws only adds to this strain, leaving many feeling overwhelmed.

-

Scams and Misinformation: Unfortunately, the rise of fraudulent tax relief companies poses a real threat. Many individuals fall prey to misleading claims, which can lead to poor financial decisions and further complications. With the emergence of AI technology, fraudsters can create convincing fake content, increasing the risk of deception.

-

Time Constraints: The tax settlement process can be lengthy, requiring patience and persistence. For those already facing financial difficulties, this can feel like an insurmountable challenge. Experts recommend simplifying tax codes and incorporating tax education into high school curricula to better prepare individuals for these hurdles.

Understanding what is tax resolution services is crucial for anyone seeking a resolution to their challenges. By recognizing these issues, you can set realistic expectations and develop informed strategies to effectively navigate the complexities of what is tax resolution services. Remember, you’re not alone in this journey, and there are resources available to help you through.

Conclusion

Understanding tax resolution services is essential for anyone facing tax-related challenges. We know how overwhelming it can feel when dealing with tax issues. These specialized services not only provide expert guidance but also empower individuals and businesses to navigate the complexities of tax laws with confidence. By alleviating the stress and uncertainty associated with tax liabilities, tax resolution services play a crucial role in helping clients regain control over their financial futures.

Throughout this article, we’ve explored various aspects of tax resolution services, including their:

- Definition

- Importance

- Types

- Common challenges faced during the resolution process

Key strategies such as Offer in Compromise, Installment Agreements, and Audit Representation demonstrate how these services can effectively address specific tax issues. It’s common to feel lost in the maze of tax regulations, and recognizing the emotional and logistical hurdles that taxpayers encounter emphasizes the need for professional support in navigating these complexities.

Ultimately, engaging with tax resolution services is not just about resolving current tax debts; it’s a proactive step towards ensuring long-term financial health and compliance. By taking action and seeking assistance, you can avoid severe consequences and pave the way for a more secure financial future. Remember, you are not alone in this journey. Embracing the resources available can lead to favorable outcomes, allowing you to focus on your life without the looming burden of tax issues.

Frequently Asked Questions

What are tax resolution services?

Tax resolution services are specialized professional options designed to help individuals and businesses navigate tax-related challenges with federal, state, or local tax authorities.

What is the primary purpose of tax resolution services?

The primary goal of tax resolution services is to alleviate the anxiety and uncertainty associated with tax liabilities, empowering individuals to manage the complexities of tax legislation confidently.

What types of strategies do tax resolution services include?

Tax resolution services include strategies such as negotiating payment arrangements, reducing penalties, and representing clients during audits.

How can tax resolution services benefit individuals facing tax issues?

These services can help individuals achieve favorable outcomes, such as settling debts for less than owed or establishing manageable payment plans, by providing expert advice.

What is an example of a program offered through tax resolution services?

An example is the Offer in Compromise program, which allows clients to negotiate a reduced payment based on their financial circumstances.

Are there fees associated with tax resolution services?

Yes, tax resolution services may include a mix of complimentary services and those that require payment, known as fees. Additionally, any government fees charged by agencies must be settled before paperwork can be submitted on behalf of the client.

What additional benefits do tax resolution services provide?

Beyond debt relief, these services offer peace of mind and the assurance that skilled professionals are advocating for the taxpayer, which is vital given the increasing complexity of tax regulations.

How do clients receive communications regarding tax resolution services?

Clients agree to receive all communications electronically, including notices, agreements, and disclosures.

Why is understanding tax resolution services important?

Understanding tax resolution services is crucial for helping clients regain control over their financial futures and navigate tax-related challenges effectively.