Introduction

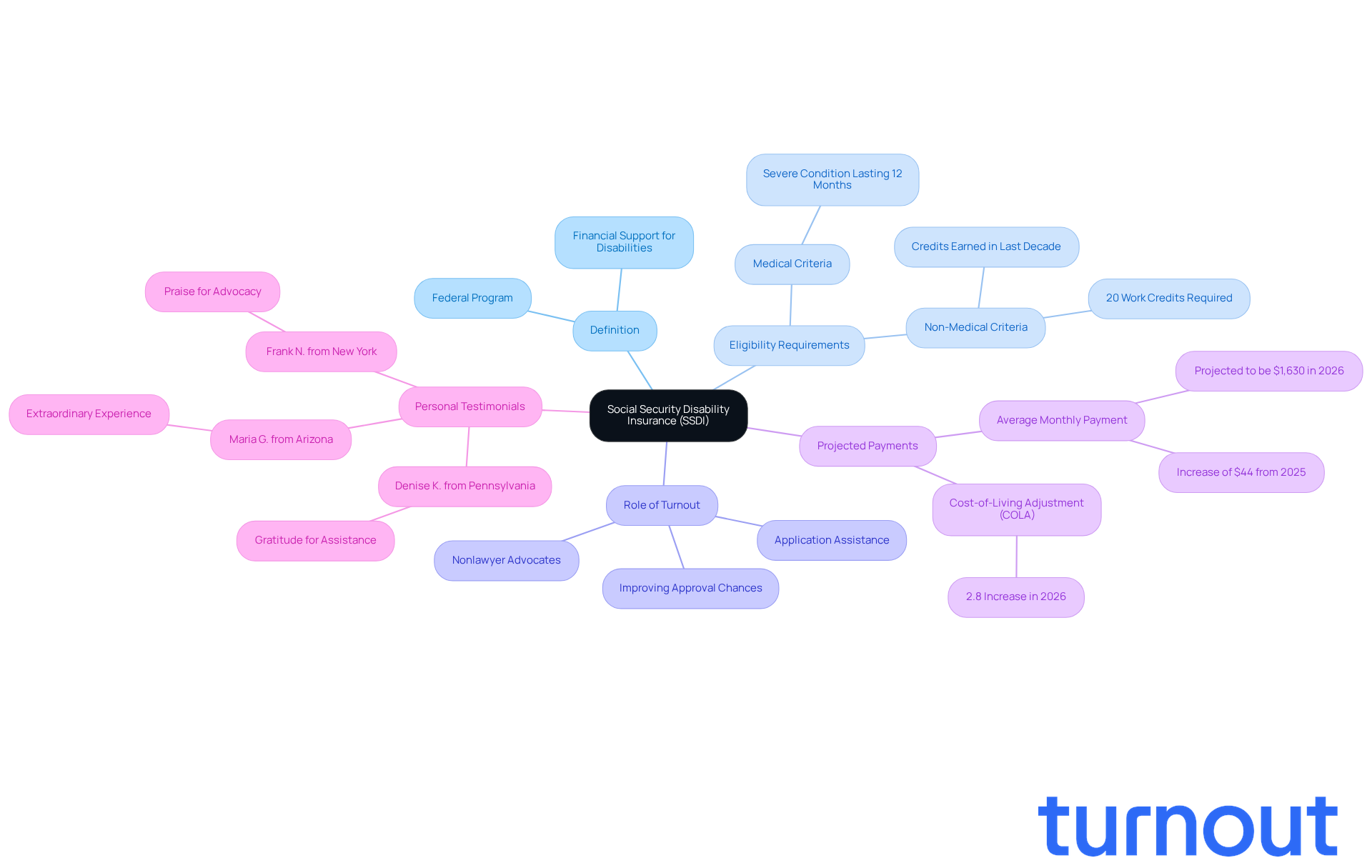

Understanding the nuances of Social Security Disability Insurance (SSDI) is crucial for millions of Americans facing the challenges of disability. We understand that navigating this complex system can often lead to confusion and uncertainty. As the average monthly payment is projected to rise to $1,630 in 2026, grasping the calculation process and eligibility requirements becomes increasingly important for those seeking financial stability.

It's common to feel overwhelmed by the evolving regulations and fluctuating living costs. How can you ensure that you’re maximizing your potential benefits? By taking the time to understand your options and the support available, you can find a path forward. Remember, you are not alone in this journey; we're here to help you every step of the way.

Define Social Security Disability Insurance (SSDI) Payments

Social Security Disability Insurance is a crucial federal program designed to provide financial support to those unable to work due to qualifying disabilities. As we look ahead to 2026, about 7.5 million Americans will rely on this vital assistance, which is determined by a person's average lifetime income based on their highest-earning years. To qualify for Social Security Disability Insurance, applicants need to show a solid work history - typically requiring 20 work credits earned within the last decade - along with meeting medical criteria that confirm a severe condition lasting at least 12 months.

Turnout plays an essential role in making access to these benefits easier. They offer various tools and services, including personalized guidance through the application process and help with gathering necessary documentation. By employing trained nonlawyer advocates, Turnout ensures that individuals receive the support they need to navigate the Social Security Disability Insurance application effectively, boosting their chances of obtaining the financial assistance they deserve.

Understanding Social Security Disability Insurance is vital, as it significantly impacts the quality of life for those facing financial challenges due to disabilities. For instance, the average social security disability amount monthly is projected to rise to $1,630 in 2026, reflecting a $44 increase from the previous year. This adjustment is crucial for helping beneficiaries manage rising living costs, especially in areas like housing, food, and medical care.

Real-life stories highlight the profound effect of Social Security Disability Insurance on individuals' lives. Take Denise K. from Pennsylvania, who expressed her heartfelt gratitude for the assistance she received. She shared that without it, she might have given up on securing the benefits she truly deserved. Such testimonials underscore the importance of disability benefits in providing economic stability and support for those navigating the complexities of disability claims.

In 2026, SSDI eligibility requirements will remain unchanged, offering a sense of stability for individuals as they plan for their financial futures. Knowing that the program will continue to provide essential support is reassuring. Understanding these benefits is crucial for individuals with disabilities, as it empowers them to navigate the system with confidence and obtain the assistance they need. Remember, you are not alone in this journey, and we're here to help.

Calculate Your SSDI Payment Amount

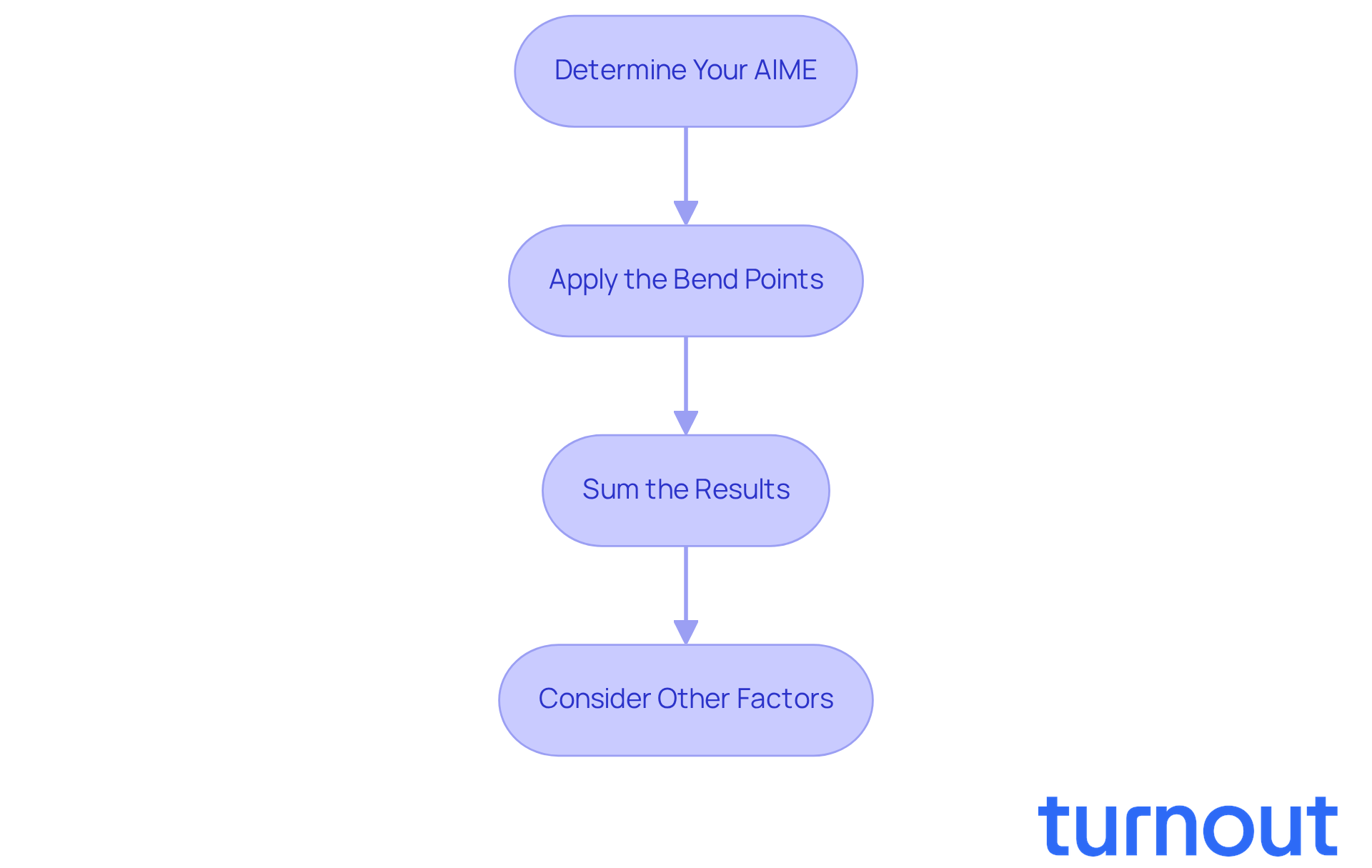

Calculating your social security disability amount monthly can feel overwhelming, but we're here to help you through it. Follow these steps to gain clarity:

-

Determine Your Average Indexed Monthly Earnings (AIME): This figure comes from your highest-earning years, adjusted for inflation, and averaged over your working lifetime. Understanding your AIME is crucial, as it directly impacts the social security disability amount monthly.

-

Apply the Bend Points: The Social Security Administration (SSA) uses bend points to figure out how much of your AIME contributes to your payment calculation. For 2026, the first $1,115 of your AIME will be multiplied by 90%. The amount between $1,115 and $6,721 will be multiplied by 32%, and any amount over $6,721 will be multiplied by 15%. This tiered approach ensures that lower earners receive a higher percentage of their earnings.

-

Sum the Results: Add the results from the bend points to calculate your Primary Insurance Amount (PIA). This represents the social security disability amount monthly before any deductions. Knowing your PIA is essential for understanding your baseline support.

-

Consider Other Factors: Adjust your PIA based on any applicable deductions, like those for workers' compensation or other benefits. These adjustments can significantly affect your final monthly amount.

By following these steps, you can estimate your social security disability amount monthly and gain a clearer understanding of your financial support options. In 2026, the average monthly SSDI payment is projected to rise to $1,630, reflecting a $44 increase from the previous year due to the 2.8% cost-of-living adjustment (COLA). This highlights the importance of accurately calculating your benefits to ensure financial stability.

At Turnout, we understand that navigating the SSD claims process can be complex. That’s why we provide assistance through trained nonlawyer advocates and various tools to help you receive the support you need. Remember, you are not alone in this journey.

Explore Factors Influencing SSDI Payment Amounts

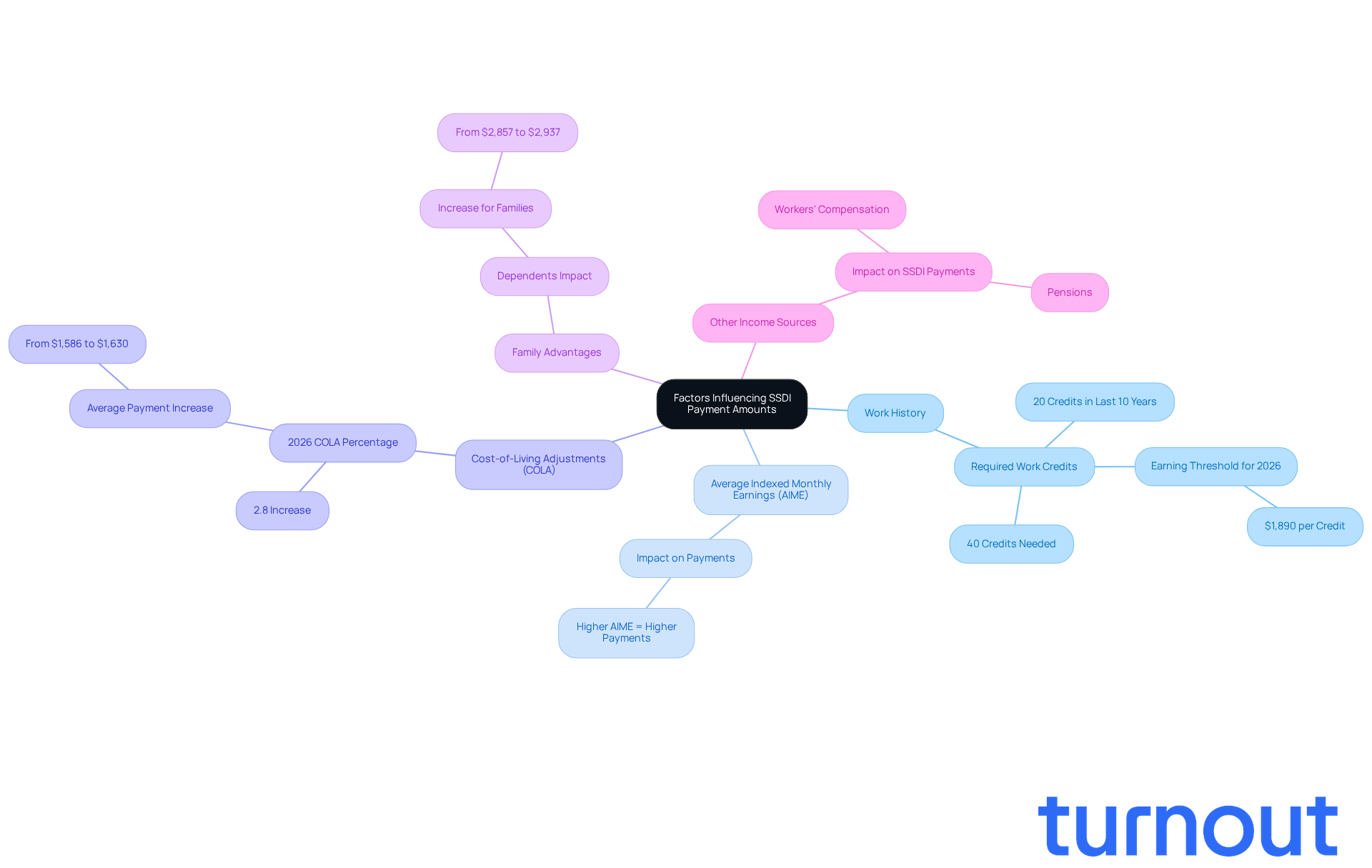

Several factors significantly influence the social security disability amount monthly, and understanding them can make a real difference in your journey.

-

Work History: Accumulating work credits is essential for eligibility and determining payment amounts. Typically, you need 40 credits, with at least 20 earned in the last 10 years. As of 2026, the earning threshold for one work credit has risen to $1,890. This means you’ll need to earn more each year to qualify for assistance.

-

Average Indexed Monthly Earnings (AIME): Your AIME plays a crucial role in determining your disability payments. It reflects your earnings throughout your working life. The higher your AIME, the greater your potential advantage in receiving a higher social security disability amount monthly.

-

Cost-of-Living Adjustments (COLA): We understand that inflation can be a concern. Each year, the social security disability amount monthly is modified to reflect this, ensuring that assistance aligns with increasing living expenses. For 2026, the COLA is set at 2.8%, raising the average monthly disability payment from $1,586 to $1,630.

-

Family Advantages: If you have dependents, extra advantages may be available to you. This can increase the total sum you receive. For instance, the social security disability amount monthly for a recipient with a spouse and children will rise from $2,857 to $2,937 in January 2026.

-

Other Income Sources: It’s common to feel uncertain about how other income sources, like workers' compensation or pensions, may affect your disability payments. Understanding these interactions is essential for navigating the benefits system effectively.

By grasping these components, you can better prepare for your disability benefits application. Remember, you’re not alone in this journey, and we’re here to help you maximize your potential advantages.

Understand SSDI Payment Schedules and Start Dates

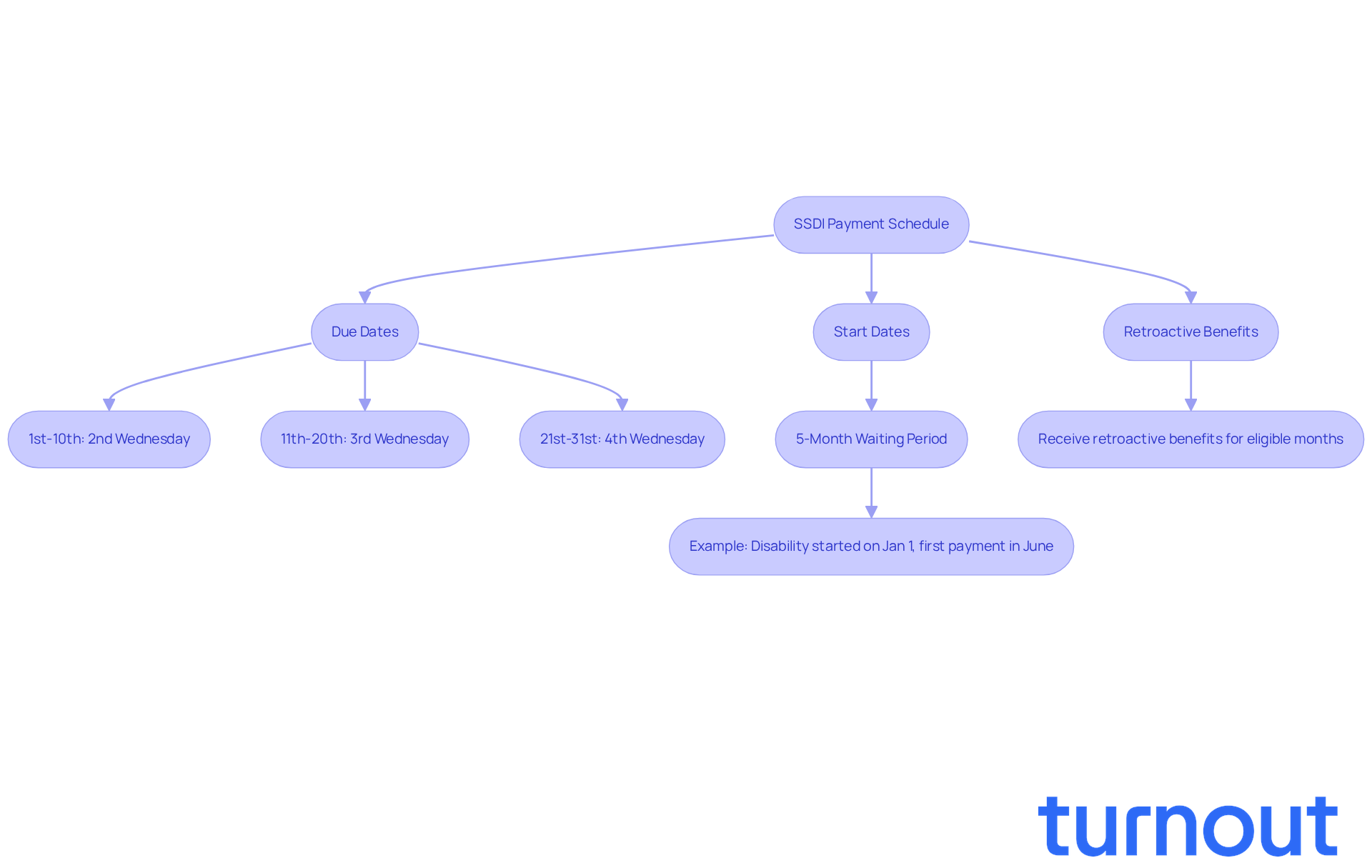

The social security disability amount monthly is issued as SSDI payments, and the schedule is based on your birth date.

Due Dates: If your birthday falls between the 1st and 10th, you can expect disbursements on the second Wednesday of each month. For those born from the 11th to the 20th, payments are issued on the third Wednesday. If your birthday is between the 21st and 31st, funds will arrive on the fourth Wednesday.

Start Dates: Payments begin after a five-month waiting period from when the Social Security Administration (SSA) establishes your disability onset. For example, if your disability started on January 1, your first payment would come in June.

Retroactive Benefits: Once you’re approved for Social Security Disability Insurance, you may receive retroactive benefits for months when you were eligible but didn’t receive assistance. Understanding this billing schedule is crucial for managing your finances effectively.

In 2026, the projected social security disability amount monthly is expected to rise to $1,630, reflecting a cost-of-living adjustment (COLA) of 2.8%. This increase is vital for maintaining your purchasing power amidst inflation. It’s also important to know that up to 50% of Social Security payments may be taxed for individuals with a combined income between $25,000 and $34,000, and up to 85% for those with higher incomes. As Pilzer Klein emphasizes, understanding payment timing and back pay is essential for effective financial management. Being aware of these factors can help you budget appropriately during the waiting period until your assistance starts.

At Turnout, we’re committed to simplifying access to these government benefits. We offer expert guidance to help you navigate the complexities of SSD claims and tax debt relief without needing legal representation. Our trained nonlawyer advocates are here to support you through the process, ensuring you understand your rights and options as you await your benefits. Remember, you are not alone in this journey.

Conclusion

Understanding the complexities of Social Security Disability Insurance (SSDI) payments is crucial for those facing the challenges of living with disabilities. This program not only provides financial support but also serves as a lifeline for millions who rely on these benefits for their daily needs. With an average monthly payment expected to reach $1,630 in 2026, it’s vital for beneficiaries to understand how their payments are calculated and what factors can influence those amounts.

Throughout this article, we’ve explored key components of SSDI, including:

- How benefits are calculated based on Average Indexed Monthly Earnings (AIME)

- The impact of work history

- The importance of cost-of-living adjustments

We also highlighted the role of organizations like Turnout in assisting individuals through the application process, underscoring the value of having support while navigating these complex systems. Real-life testimonials have illustrated the profound impact SSDI can have on individuals' lives, reinforcing the necessity of understanding and accessing these benefits.

The journey to securing SSDI benefits may feel overwhelming, but remember, knowledge is power. By familiarizing yourself with how SSDI payments work, the eligibility requirements, and the factors that can affect payment amounts, you can better prepare for your financial future. It’s essential to seek assistance and utilize available resources to ensure that you maximize all potential benefits.

You are not alone in this journey; support is available to help you achieve the stability and security that SSDI is designed to provide. We’re here to help you navigate this path with confidence.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

Social Security Disability Insurance (SSDI) is a federal program that provides financial support to individuals unable to work due to qualifying disabilities.

How many Americans are expected to rely on SSDI by 2026?

By 2026, approximately 7.5 million Americans are projected to rely on Social Security Disability Insurance.

What are the eligibility requirements for SSDI?

To qualify for SSDI, applicants must demonstrate a solid work history, typically requiring 20 work credits earned within the last decade, and meet medical criteria confirming a severe condition lasting at least 12 months.

How does Turnout assist individuals with SSDI applications?

Turnout provides various tools and services, including personalized guidance through the application process and assistance with gathering necessary documentation, employing trained nonlawyer advocates to enhance the chances of obtaining benefits.

What is the average monthly SSDI payment projected for 2026?

The average monthly SSDI payment is projected to rise to $1,630 in 2026, reflecting a $44 increase from the previous year.

Why is the adjustment in SSDI payments important?

The adjustment in SSDI payments is crucial for helping beneficiaries manage rising living costs, particularly in areas such as housing, food, and medical care.

Can you provide an example of how SSDI has impacted someone's life?

Denise K. from Pennsylvania shared her gratitude for the assistance she received from SSDI, stating that without it, she might have given up on securing the benefits she deserved, highlighting the program's role in providing economic stability.

Will the SSDI eligibility requirements change in 2026?

No, the SSDI eligibility requirements are expected to remain unchanged in 2026, providing stability for individuals as they plan for their financial futures.