Introduction

Understanding the complexities of W-4 allowances is essential for anyone wanting to optimize their tax situation. We know that navigating taxes can feel overwhelming, especially with the recent redesign of the W-4 form. This change shifts the focus from a complicated allowances model to a more straightforward approach that takes personal circumstances into account.

This new process offers a chance for you to align your tax deductions more accurately with your financial realities. However, it’s common to feel uncertain about how to effectively navigate these new guidelines. Are you worried about being over- or under-withheld? You're not alone in this journey, and we're here to help you find clarity.

Define W-4 Allowances and Their Importance

We understand that navigating tax deductions can be overwhelming. Historically, the number of allowances on the W-4 has helped determine how much federal income tax was withheld from your paycheck. Each allowance claimed would reduce your taxable income, ultimately increasing your take-home pay. However, in 2020, the W-4 form underwent a redesign that eliminated allowances. This change introduced a more straightforward five-step process that focuses on your personal circumstances, such as income, dependents, and deductions.

This new approach aims to simplify tax deduction calculations and enhance accuracy. For example, the 2026 Form W-4 now requires you to enter specific amounts related to your filing status and dependents. If you're 'Single' or 'Married filing separately,' you’ll enter $8,600. For those 'Married filing jointly,' it’s $12,900. Additionally, the child tax credit has increased from $2,000 to $2,200 per qualifying child, which is an important consideration for your tax planning.

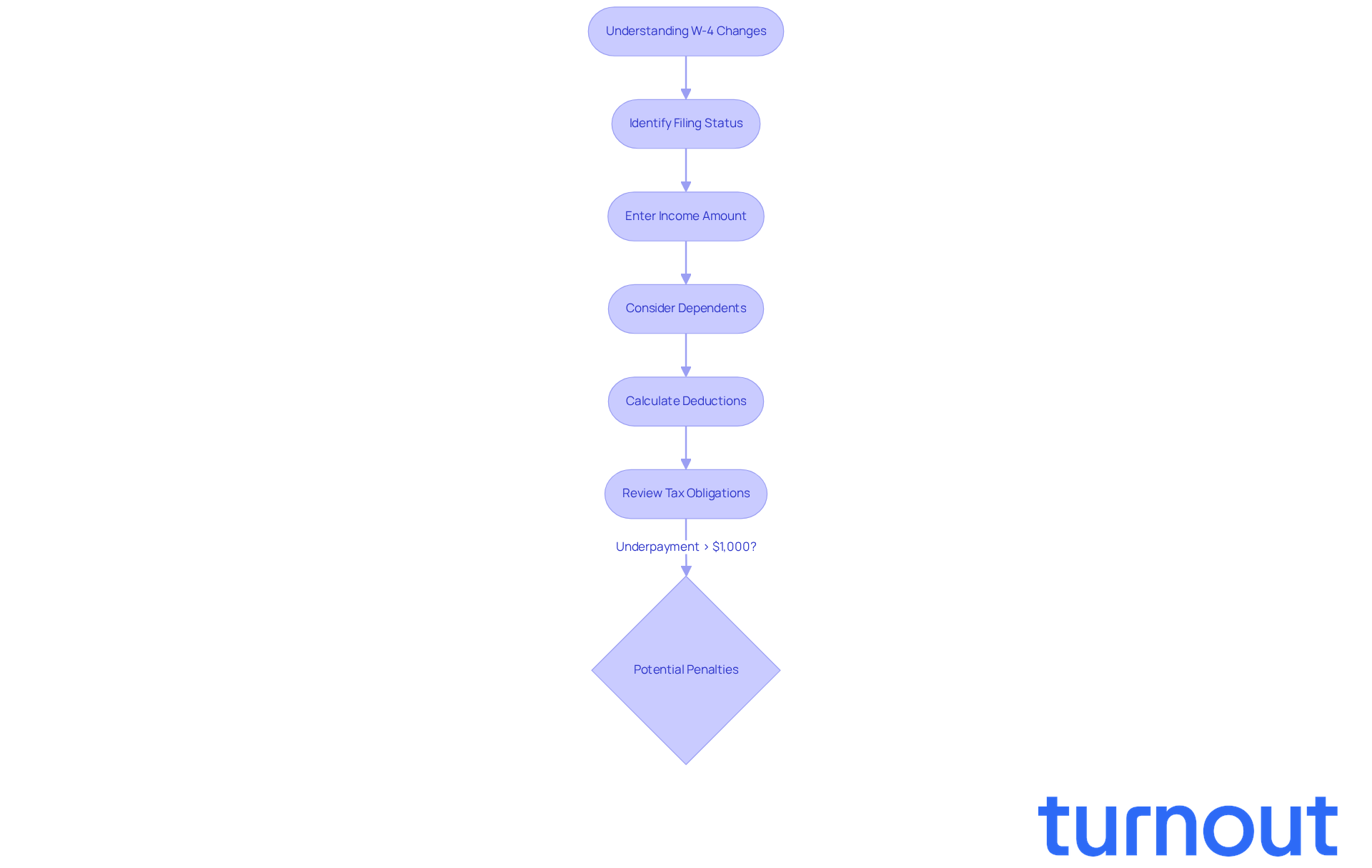

Comprehending these changes is essential for efficiently handling your tax deductions. It can help prevent unforeseen tax bills or refunds during tax season. Remember, if you underpay your taxes and owe more than $1,000 when filing your return, you may incur a penalty. Real-world outcomes show that employees who know the number of allowances on the W-4 can better align their deductions with their actual tax obligations. This leads to more reliable financial planning.

The 2026 Form W-4 has also expanded from four pages to five, reflecting the complexity of these new requirements. As Lauren DeBisschop noted, staying informed about these changes is crucial for maintaining a compliant and efficient payroll process. We're here to help you navigate this journey, ensuring you feel confident and prepared.

Assess Factors Influencing Allowance Claims

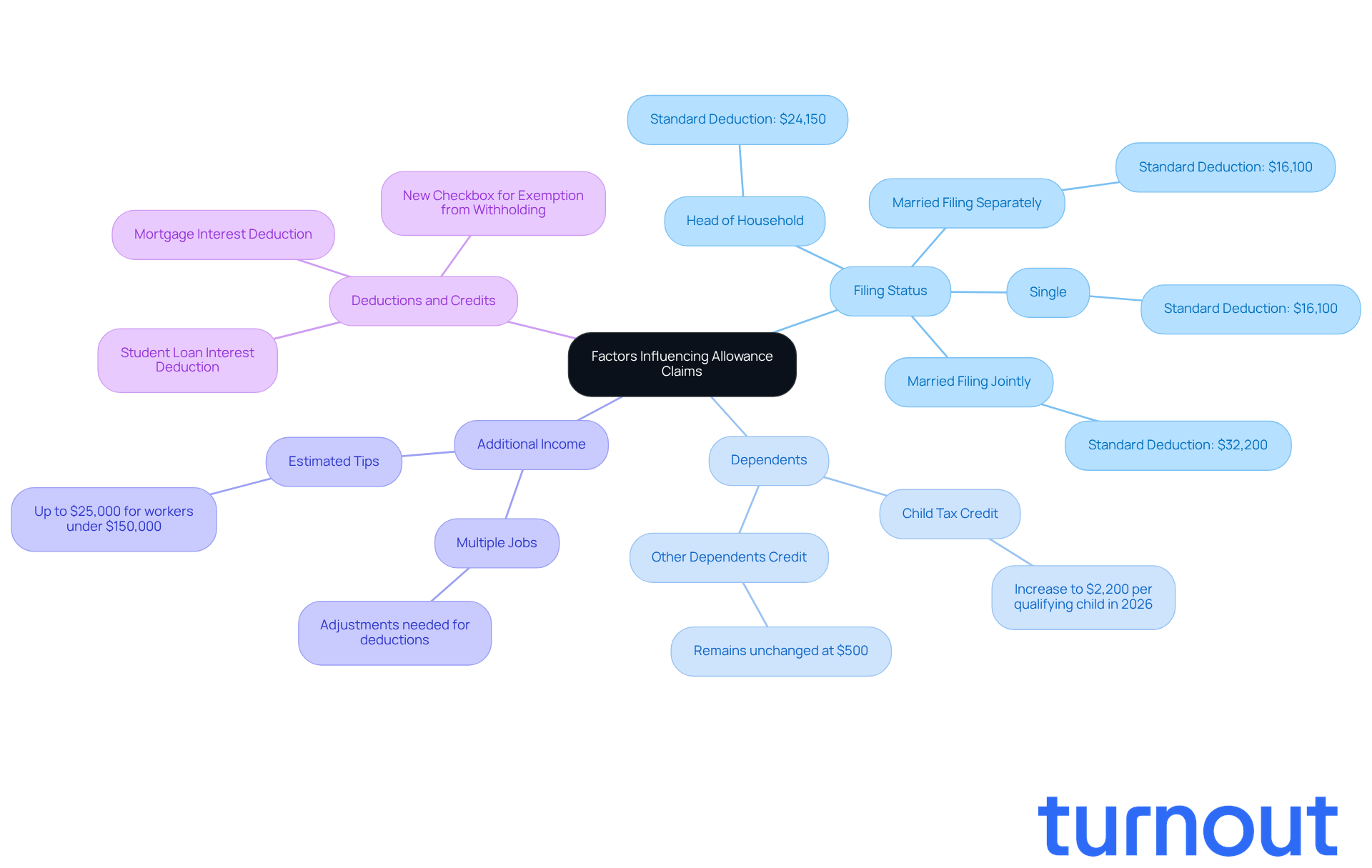

Several factors significantly influence the amount of tax withheld from your paycheck, and we understand that navigating this can be overwhelming. One of the most critical elements is your filing status. Here’s how it works:

-

Filing Status: Your marital status - whether single, married, or head of household - directly impacts your tax rate and withholding amount. For instance, single taxpayers and married individuals filing separately will see a standard deduction of $16,100 in 2026, while heads of household will receive $24,150. Additionally, married couples filing jointly will have a standard deduction of $32,200. This means that those with a head of household status may enjoy a lower effective tax rate, resulting in less tax withheld compared to single filers.

-

Dependents: Claiming dependents can reduce your taxable income, which in turn influences your deductions. For example, the Child Tax Credit will increase from $2,000 to $2,200 per qualifying child in 2026, while the credit for other dependents remains unchanged at $500. This additional tax relief can significantly affect how much you choose to withhold.

-

Additional Income: If you have multiple jobs or other sources of income, your overall tax obligation may rise, requiring adjustments to your deductions. Workers making less than $150,000 can estimate eligible tips up to $25,000, which can further complicate deduction calculations.

-

Deductions and Credits: Tax deductions, such as those for mortgage interest or student loan interest, along with various credits, can significantly impact your overall tax situation. The 2026 Form W-4 has been updated to streamline these considerations, including a new checkbox for claiming exemption from withholding, allowing for more accurate withholding based on new tax credits and deductions introduced by legislation.

By thoughtfully evaluating these factors, you can more accurately assess your tax responsibilities. Remember, you’re not alone in this journey. We’re here to help you make informed modifications to your W-4 documents, ensuring that you are neither over- nor under-withheld throughout the year.

Guide to Completing the W-4 Form

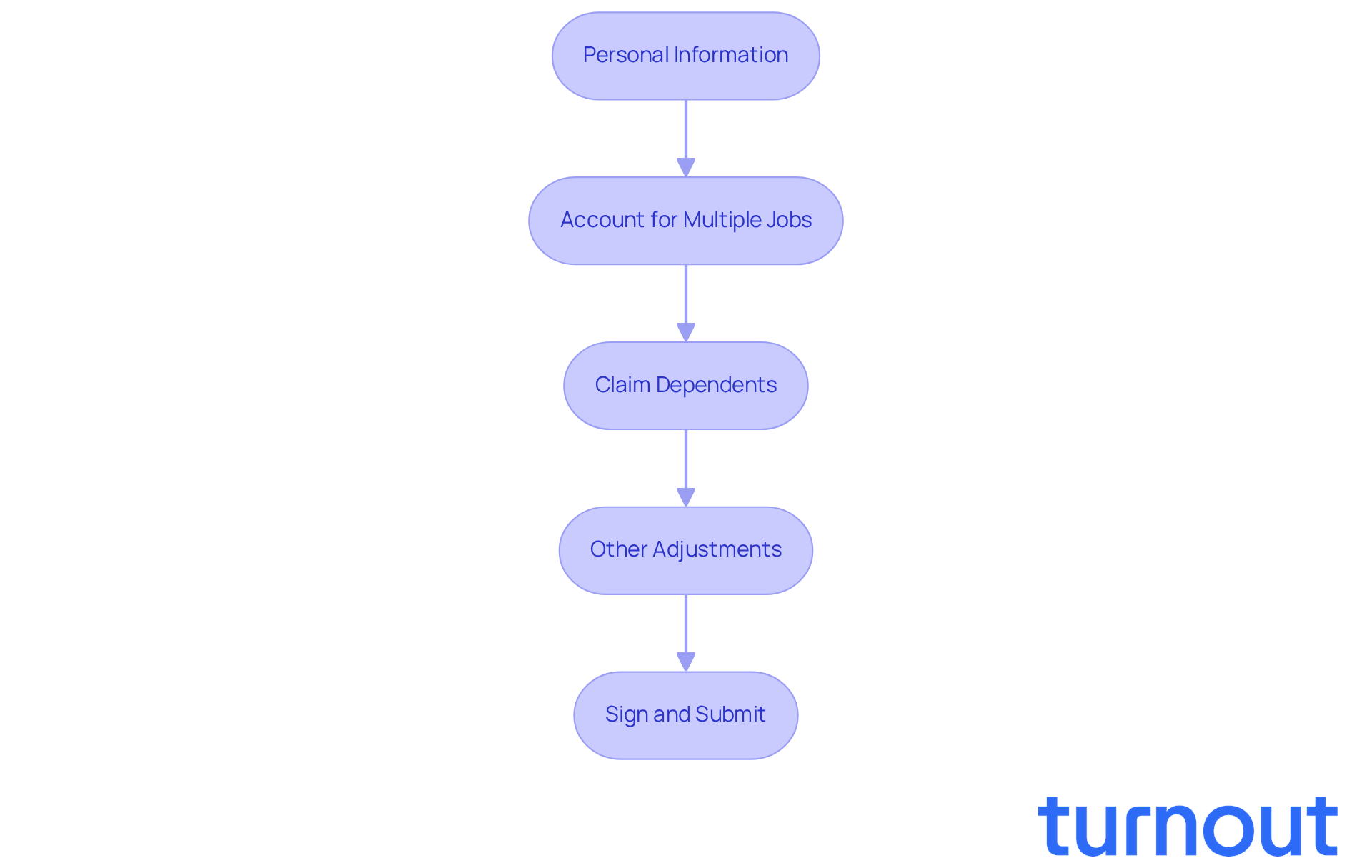

Filling out the W-4 accurately is crucial for ensuring the right amount of tax is deducted from your paycheck. We understand that navigating tax forms can feel overwhelming, but following these essential steps can make the process smoother:

- Personal Information: Start by entering your name, address, Social Security number, and filing status. Accurate personal details are vital for proper identification and processing.

- Account for Multiple Jobs: If you have more than one job or if your spouse is working, be sure to indicate this on the document. This step is important to avoid under-withholding, which can lead to unexpected tax bills.

- Claim Dependents: If you have children or other dependents, claiming them can help decrease your tax deductions. For 2026, the Child Tax Credit has increased to $2,200 per qualifying child, reflecting adjustments from the One Big Beautiful Bill Act (OBBBA). This can significantly impact your tax situation.

- Other Adjustments: If you plan to itemize deductions or have other adjustments, use the expanded deductions worksheet. This worksheet now spans a full page and includes detailed prompts to help you estimate itemized deductions accurately.

- Sign and Submit: After completing the document, make sure to sign it and send it to your employer. Regularly reviewing and updating your W-4 whenever your financial situation changes-like starting a new job, getting married, or welcoming a child-can help you stay on track.

It's common to make mistakes when filling out the W-4, and these can lead to significant financial repercussions. For example, failing to account for multiple jobs can result in under-withholding, leading to a larger tax bill at the end of the year. Financial consultants recommend reviewing your W-4 documents each year and using the Tax Estimator for precise deductions to avoid these pitfalls. Real-world examples show that individuals who frequently revise their W-4 documents are less likely to face unexpected tax obligations or substantial refunds, which can disrupt financial planning. By following these steps and being mindful of common mistakes, you can navigate the intricacies of tax deductions with confidence. Remember, you're not alone in this journey-we're here to help!

Identify When to Update Your Allowances

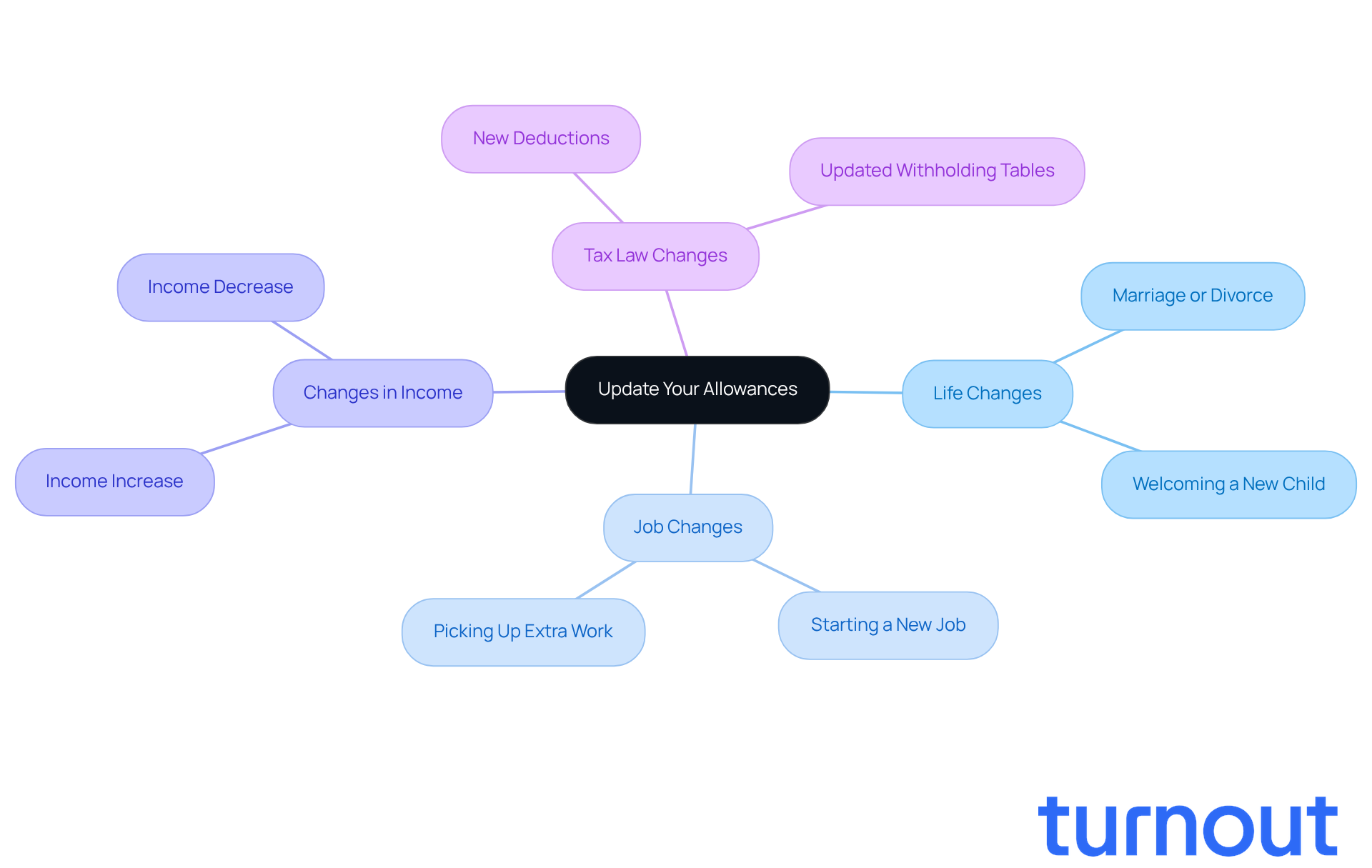

It's crucial to take a moment and review what is number of allowances on W-4 on your W-4 form, especially during certain life events.

-

Life Changes: Have you recently experienced a marriage, divorce, or welcomed a new child? These significant moments can greatly affect your tax situation.

-

Job Changes: Starting a new job or picking up extra work? It’s common to need adjustments to your tax deductions in these cases.

-

Changes in Income: If your income has shifted - whether it’s gone up or down - you might need to update your W-4 to align with your new tax obligations.

-

Tax Law Changes: Staying informed about any changes in tax regulations is essential, as they can impact your deductions.

Regularly reviewing what is number of allowances on W-4 is important to ensure you’re withholding the right amount of tax, which can save you from unexpected surprises when tax time rolls around. Remember, we’re here to help you navigate these changes with confidence.

Conclusion

Understanding W-4 allowances is essential for effective tax planning and ensuring the right amount of federal income tax is withheld from your paychecks. We know that navigating tax forms can feel overwhelming, but the transition from the traditional allowance system to the redesigned W-4 form simplifies this process. It focuses on your personal circumstances rather than a set number of allowances, aiming to enhance accuracy in tax withholding. This ultimately leads to better financial management, which is something we all strive for.

Key factors influencing your W-4 claims include:

- Your filing status

- Dependents

- Additional income

- Available deductions or credits

Each of these elements plays a significant role in determining the appropriate withholding amount. It’s important to evaluate your personal situation regularly. Completing the W-4 accurately and updating it during life changes - like marriage, job transitions, or shifts in income - ensures you avoid under- or over-withholding. This can help you steer clear of unexpected tax bills or refunds, which can be quite stressful.

In conclusion, staying informed about W-4 allowances and regularly reviewing your personal tax situation is vital for effective financial planning. By understanding the implications of life changes and tax law updates, you can make informed adjustments to your W-4 form. Embracing this proactive approach not only simplifies your tax obligations but also fosters confidence in managing your personal finances throughout the year. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Frequently Asked Questions

What are W-4 allowances and why are they important?

W-4 allowances historically helped determine the amount of federal income tax withheld from paychecks. Each allowance claimed would reduce taxable income, increasing take-home pay.

What changes were made to the W-4 form in 2020?

The W-4 form was redesigned to eliminate allowances and introduced a five-step process that focuses on personal circumstances, such as income, dependents, and deductions.

How does the new W-4 process work?

The new W-4 process requires individuals to enter specific amounts related to their filing status and dependents, simplifying tax deduction calculations.

What are the amounts to enter based on filing status on the 2026 Form W-4?

For 'Single' or 'Married filing separately,' you enter $8,600. For 'Married filing jointly,' the amount is $12,900.

Has the child tax credit changed?

Yes, the child tax credit has increased from $2,000 to $2,200 per qualifying child, which is important for tax planning.

Why is it important to understand the changes in the W-4 form?

Understanding these changes helps prevent unexpected tax bills or refunds during tax season and allows for better alignment of deductions with actual tax obligations.

What happens if you underpay your taxes?

If you owe more than $1,000 when filing your return, you may incur a penalty for underpayment.

How has the length of the W-4 form changed?

The 2026 Form W-4 has expanded from four pages to five pages to accommodate the new requirements.

Why is it crucial to stay informed about W-4 changes?

Staying informed is essential for maintaining a compliant and efficient payroll process, ensuring better financial planning and tax management.