Introduction

Understanding tax obligations can feel overwhelming, and it’s essential for both individuals and businesses. We know that failing to meet these responsibilities can lead to serious financial consequences. This article explores the importance of taxes owed, the penalties that come with late payments, and effective strategies for managing tax debt.

With a significant rise in tax fines reported recently, it’s common to feel anxious about how to navigate these challenges. How can you safeguard your financial health and ensure compliance?

We’re here to help you through this journey. Let’s delve into the solutions together.

Define Taxes Owed and Their Importance

Taxes owed are the amounts that individuals or businesses must pay to the government based on their income, property, or other taxable activities. We understand that navigating these obligations can feel overwhelming, but it’s crucial because these funds support essential public services like education, healthcare, and infrastructure. Understanding what constitutes taxes owed is essential for avoiding the penalty for not paying taxes owed and ensuring compliance with tax regulations.

Key components include:

- Income Taxes: These are based on earnings from your job or investments.

- Property Taxes: These are imposed on real estate that you or your business owns.

- Sales Taxes: These are collected on the sale of goods and services.

Recognizing these obligations can help you manage your finances effectively. Remember, you’re not alone in this journey. Understanding your tax responsibilities can prevent the pitfalls of tax debt and lead to a more secure financial future.

Explore Penalties for Late Tax Payments

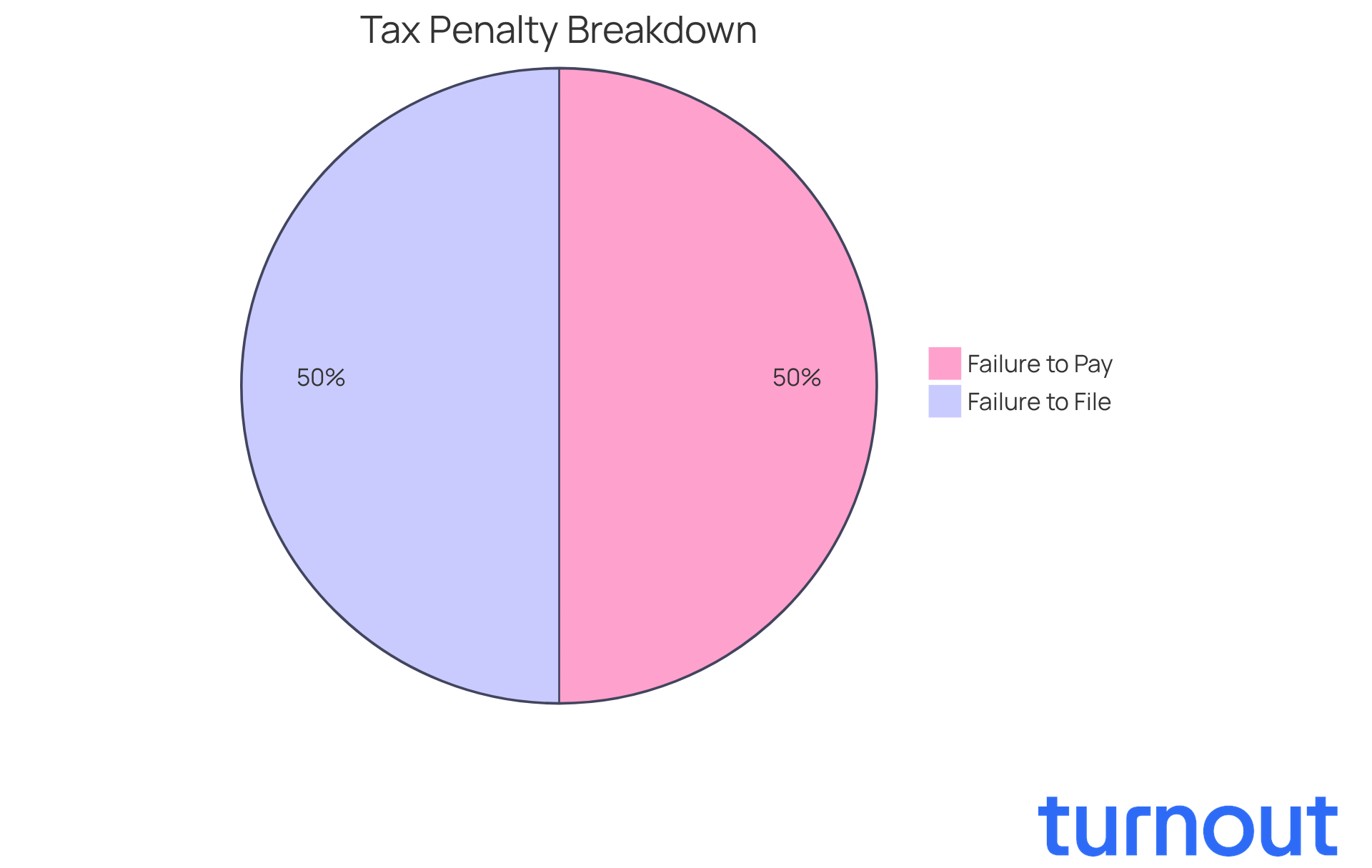

Not paying amounts due on time can lead to significant fines that add up quickly. We understand that managing taxes can be stressful, and the IRS enforces the following penalties for late payments:

- Failure to Pay Penalty: This penalty is set at 0.5% of the unpaid taxes for each month or part of a month the tax remains unpaid, with a maximum cap of 25% of the total tax due.

- Failure to File Charge: If a tax return isn’t submitted by the due date, the charge is 5% of the unpaid tax for each month the return is overdue, also capped at 25%.

For instance, if you owe $1,000 in taxes and fail to pay for three months, the charge would total $15 (0.5% x 3 months x $1,000). It’s common to feel overwhelmed by these numbers, but tax experts emphasize that prompt submission and payment are essential to prevent these consequences.

As reported by The Wall Street Journal, the IRS imposed a staggering $7 billion in tax fines on Americans in 2023, marking a nearly 300% increase from the prior year. This can feel daunting, but remember, making at least a partial payment by the deadline can help reduce possible charges. Grasping the penalty for not paying taxes owed is crucial for taxpayers to avoid unnecessary financial strain and effectively manage their responsibilities.

You are not alone in this journey. Taxpayers may qualify for fee relief under the First Time Abate program, which can provide additional options for those facing difficulties in meeting their tax obligations. We’re here to help you navigate these challenges.

Implement Strategies for Managing Tax Debt

Managing tax debt can feel overwhelming, but you’re not alone in this journey. It’s important to take a proactive approach. Here are some strategies that can help you regain control:

-

Set Up a Payment Plan: Did you know the IRS offers installment agreements? These allow you to pay your tax debt over time. If you owe less than $50,000 in total tax, fees, and interest, you can set up a Simple Payment Plan, often with low setup costs. This option can significantly ease financial pressures and help you avoid accumulating fees, which can add up at a rate of 0.5% per month.

-

Offer in Compromise: This program lets eligible taxpayers settle their tax debt for less than what they owe. As of 2026, about 36% of Offers in Compromise are accepted, based on the IRS evaluating offers using reasonable collection potential. Many middle-income taxpayers qualify for this program, challenging the common belief that only low-income individuals can receive IRS relief.

-

Seek Professional Help: Consulting with a tax professional can provide you with personalized guidance tailored to your situation. These experts can help you navigate the complexities of IRS procedures, increasing your chances of a successful outcome, especially with programs like the Offer in Compromise.

-

Prioritize Payments: If you’re juggling multiple debts, it’s crucial to prioritize your tax payments. This helps you avoid accumulating quickly the penalty for not paying taxes owed and interest. Filing on time, even if you can’t pay in full, can mitigate additional charges and keep your options open for future relief.

By applying these strategies, you can manage your tax responsibilities more effectively and reduce stress. Remember, taking these steps can lead to improved financial stability. We’re here to help you through this process.

Utilize Advocacy Resources for Tax Assistance

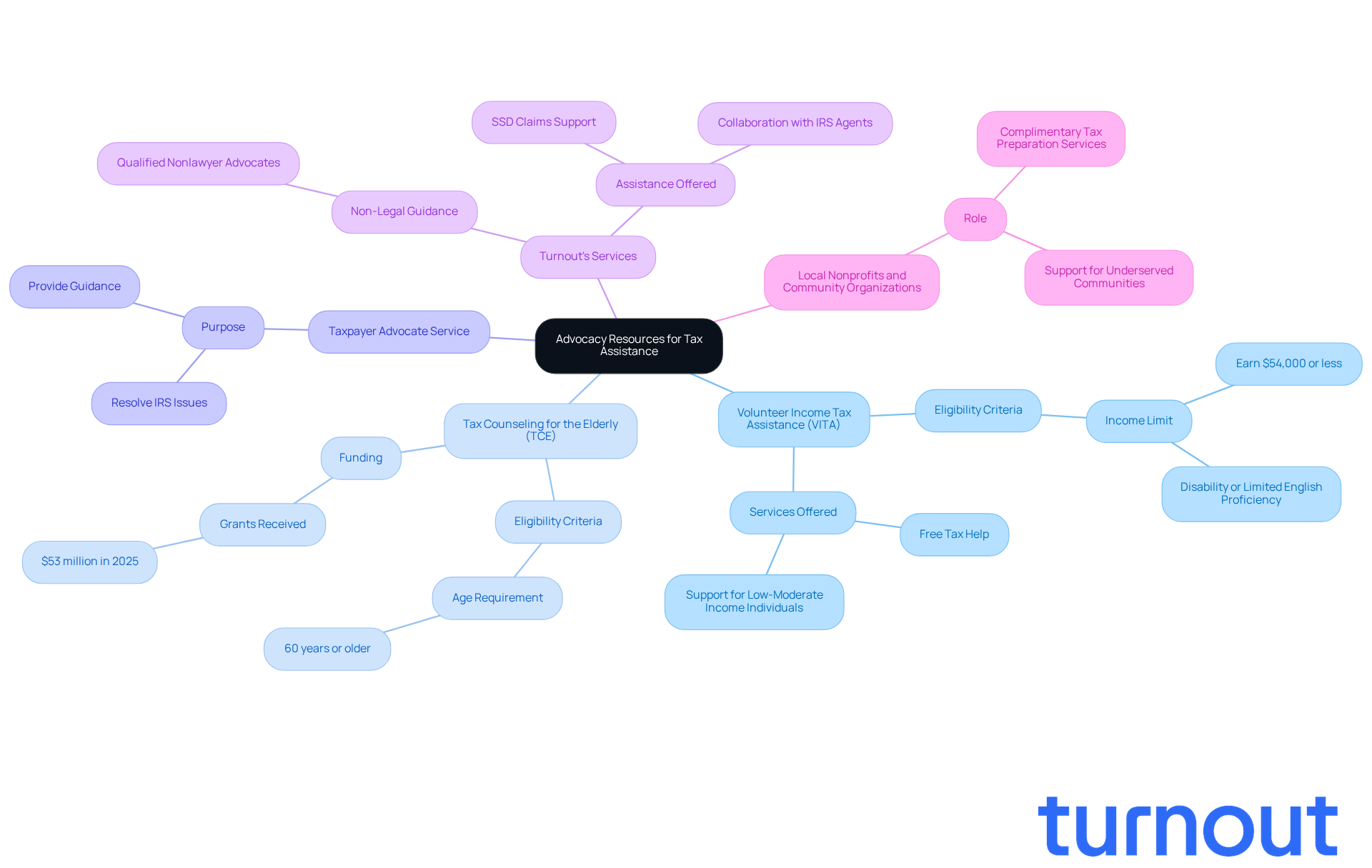

Facing tax-related challenges can be overwhelming, but you’re not alone. Numerous advocacy resources are available to help you navigate these difficulties, and Turnout plays a vital role in this supportive landscape. Here are some key programs that can make a difference:

-

Volunteer Income Tax Assistance (VITA): If you earn $54,000 or less, or if you have a disability or limited English proficiency, VITA offers free tax help. This program is designed to assist low- and moderate-income individuals, ensuring you receive the support you need to manage your tax responsibilities effectively.

-

Tax Counseling for the Elderly (TCE): For those aged 60 and older, the TCE program provides free tax assistance tailored to seniors. In 2025, TCE programs received over $53 million in grants, highlighting the growing need for specialized support among older taxpayers.

-

Taxpayer Advocate Service: This independent organization within the IRS is dedicated to helping taxpayers resolve issues with the IRS. They provide guidance on navigating complex tax matters, and their advocacy has proven invaluable for many facing bureaucratic hurdles.

-

Turnout's Services: At Turnout, trained nonlawyer advocates are here to assist you with SSD claims and collaborate with IRS-licensed enrolled agents for tax debt relief. While Turnout is not a law firm and does not provide legal advice, our professionals are qualified to guide you through your processes, ensuring you can manage your tax responsibilities without needing legal representation.

-

Local Nonprofits and Community Organizations: Many local entities offer complimentary tax preparation services, helping you understand your tax obligations. These organizations play a crucial role in ensuring that underserved communities have access to essential tax assistance.

Utilizing these resources, including Turnout's expert guidance, can significantly alleviate the stress of tax preparation. Remember, you are not alone in this journey. We’re here to help you manage your tax responsibilities more effectively.

Conclusion

Understanding the taxes you owe isn’t just about compliance; it’s a crucial part of being financially responsible. It supports essential public services that we all rely on. By recognizing the importance of these obligations, you can navigate the complexities of tax regulations more easily and avoid the heavy penalties that come with late payments. This knowledge is vital for building a secure financial future and ensuring your tax responsibilities are met on time.

Let’s talk about the penalties for failing to pay taxes on time. They can be significant, leading to serious financial repercussions if neglected. With penalties like failure to pay and failure to file, costs can add up quickly. This highlights the need for proactive management of your tax obligations. But don’t worry - there are practical strategies to help manage tax debt. Setting up payment plans or seeking professional help can provide you with actionable steps to ease financial stress and navigate your tax responsibilities more effectively.

It’s important to know that resources are available to assist you if you’re facing tax challenges. Programs like VITA and TCE, along with organizations like Turnout, offer vital support and guidance. By leveraging these resources and implementing effective strategies, you can take control of your tax situation, leading to improved financial health. Remember, taking informed action today can pave the way for a more secure tomorrow. You’re not alone in this journey, and understanding your tax obligations is the first step toward a brighter financial future.

Frequently Asked Questions

What are taxes owed?

Taxes owed are the amounts that individuals or businesses must pay to the government based on their income, property, or other taxable activities.

Why are taxes owed important?

Taxes owed are important because they fund essential public services such as education, healthcare, and infrastructure.

What are the key components of taxes owed?

The key components of taxes owed include income taxes, property taxes, and sales taxes.

What are income taxes?

Income taxes are based on earnings from your job or investments.

What are property taxes?

Property taxes are imposed on real estate that you or your business owns.

What are sales taxes?

Sales taxes are collected on the sale of goods and services.

How can understanding taxes owed help individuals?

Understanding taxes owed can help individuals manage their finances effectively and prevent the pitfalls of tax debt, leading to a more secure financial future.