Introduction

Understanding the complexities of the Federal Payment Levy Program (FPLP) is crucial for taxpayers who might be facing unexpected financial difficulties. We know that this automated tax collection initiative can feel overwhelming. The IRS has the power to seize federal disbursements - like Social Security benefits and federal salaries - often without much prior notice. This can create significant challenges for those who owe taxes.

As more taxpayers find themselves affected, it’s common to feel anxious about how to navigate this system. How can you protect your financial well-being in such uncertain times? We’re here to help you explore effective strategies to manage these challenges and find peace of mind.

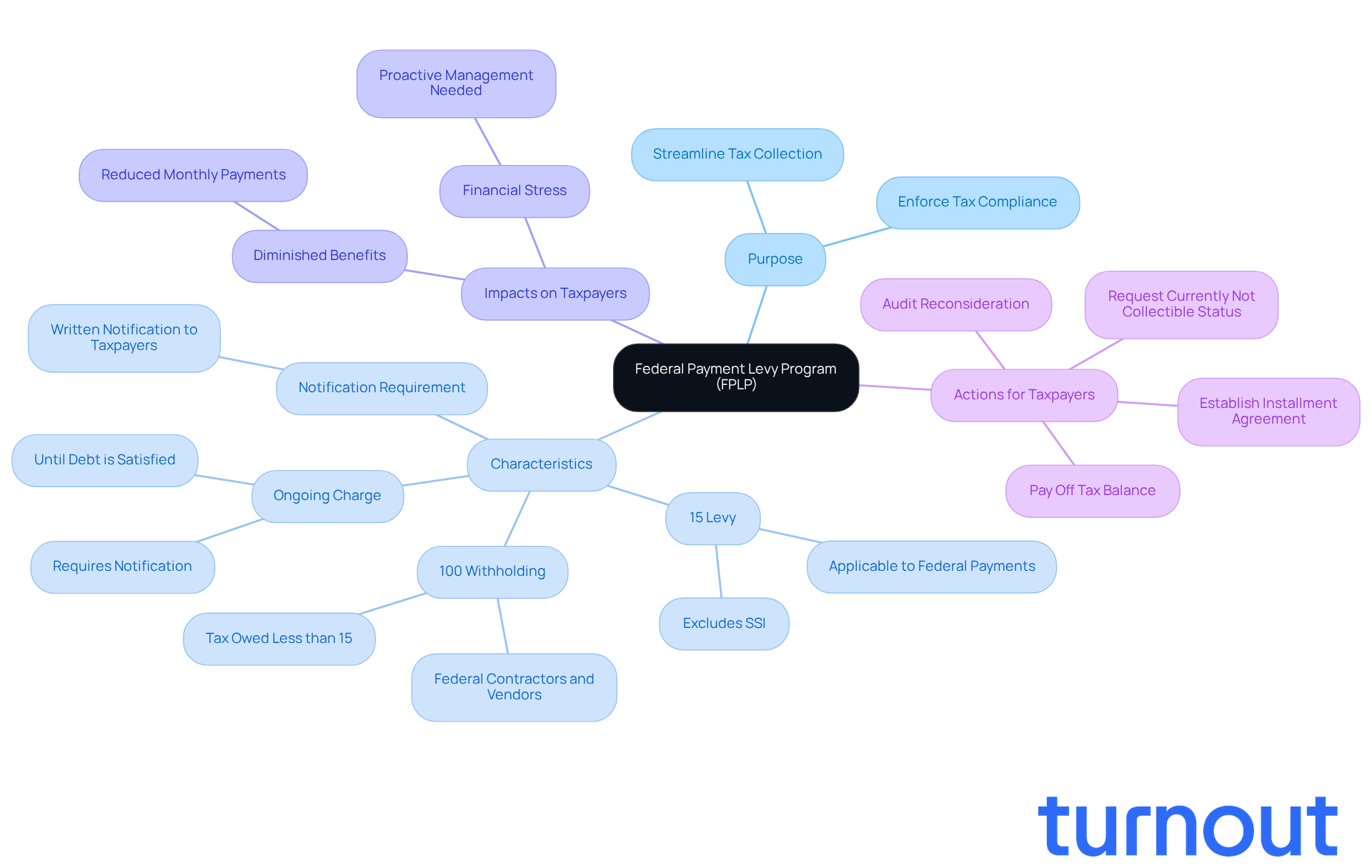

Define the Federal Payment Levy Program (FPLP)

The automated tax collection initiative established by the Internal Revenue Service (IRS) is known as the federal payment levy program (FPLP). It allows the agency to collect overdue federal taxes by utilizing the federal payment levy program to levy specific federal disbursements. The federal payment levy program helps the IRS consistently seize amounts owed to taxpayers, including Social Security benefits, federal salaries, and other federal disbursements, to settle overdue tax debts. The federal payment levy program was established to streamline the collection process, ensuring that tax obligations are met efficiently.

As of 2026, around 525,000 taxpayers are affected by the FPLP. The federal payment levy program has become a vital tool for the IRS in enforcing tax compliance. Operating under the jurisdiction of Internal Revenue Code Section 6331, the FPLP was launched in July 2000. It enables the IRS to automatically seize federal disbursements without requiring extensive prior notification.

Key characteristics of the federal payment levy program include:

- The ability to impose up to 15% on specific federal disbursements, such as Social Security benefits (excluding SSI), federal salaries, and retirement benefits.

- In certain situations, the IRS can withhold 100% of amounts due to federal contractors and vendors if the tax owed is less than 15% of the total and tax debts remain unresolved.

- This ongoing charge stays in effect until the unpaid debt is satisfied or arrangements for settlement are established.

- Importantly, the IRS must inform taxpayers in writing when a charge is applied as part of the federal payment levy program.

We understand that the federal payment levy program can significantly impact taxpayers. For instance, individuals receiving federal payments may find their monthly benefits considerably diminished due to ongoing taxes. If you’re facing this situation, know that you can take action to halt the federal payment levy program. You can either pay off your tax balance in full or establish an Installment Agreement with the IRS. Additionally, if you’re struggling to cover essential living costs, you may request that your debt be categorized as presently uncollectible under the federal payment levy program. This can temporarily suspend collections, including assessments from the federal payment levy program.

Comprehending the federal payment levy program is crucial for taxpayers who may face possible charges. It emphasizes the importance of tackling tax responsibilities proactively to prevent financial stress. Remember, you are not alone in this journey, and we’re here to help.

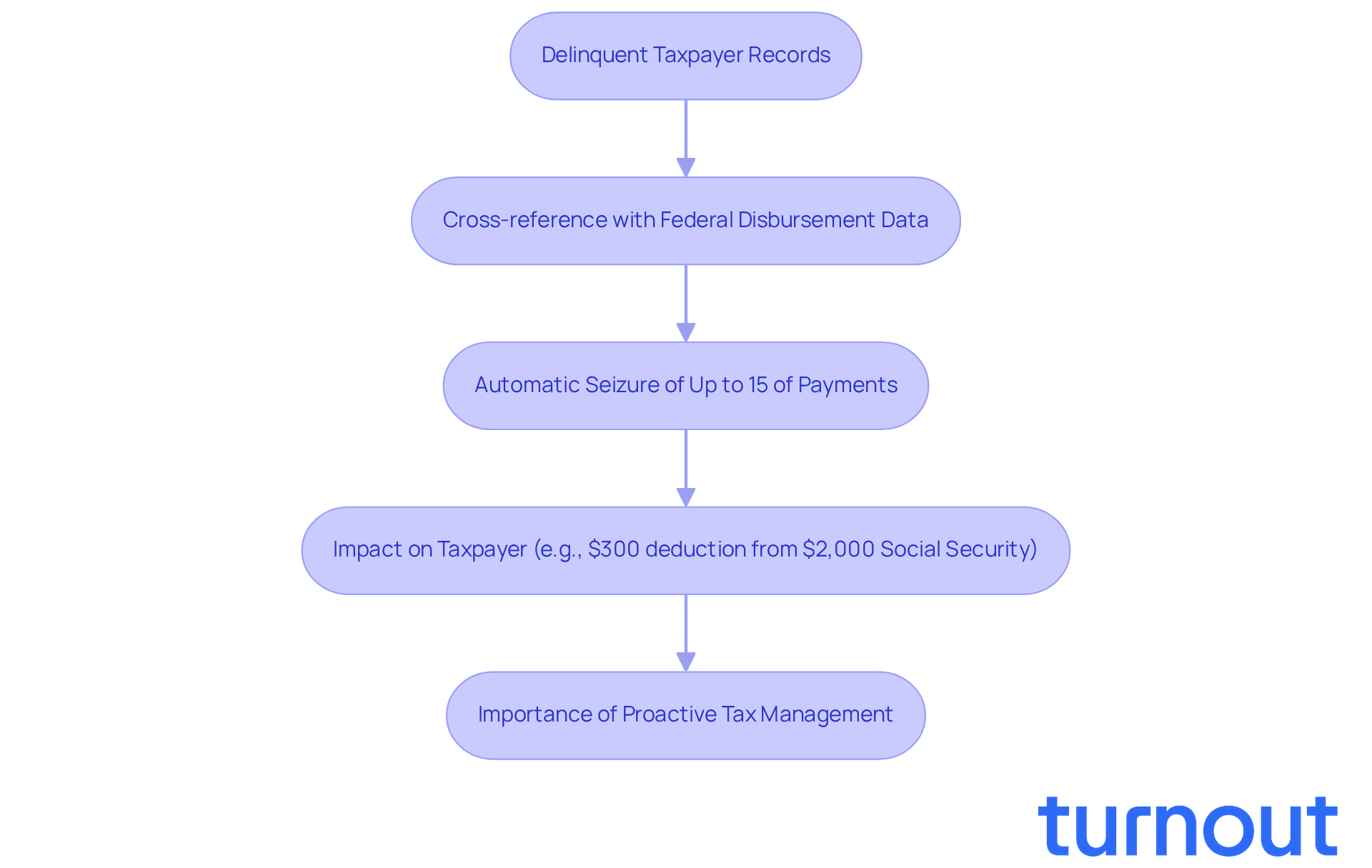

Explain How the FPLP Works

We understand that dealing with tax obligations can be overwhelming. The process of the federal payment levy program (FPLP) can catch many off guard. It works by cross-referencing the IRS's records of delinquent taxpayers with federal disbursement data from the Bureau of Fiscal Service (BFS). When a taxpayer has an outstanding tax duty, the IRS can automatically seize up to 15% of certain federal disbursements, including Social Security benefits, under the federal payment levy program.

This charge operates continuously, remaining in effect until the tax debt is settled or alternative arrangements are made. It's important to note that the IRS is not required to give prior notice before starting the seizure. This can lead to unexpected deductions from vital payments, which can be quite distressing.

For example, if you receive a Social Security benefit of $2,000, a 15% tax would subtract $300, leaving you with only $1,700. This lack of notification highlights the importance of managing your tax obligations proactively. You are not alone in this journey; many face similar challenges.

Taking steps to understand and address your tax situation can help prevent sudden financial strain. We're here to help you navigate these waters and find solutions that work for you.

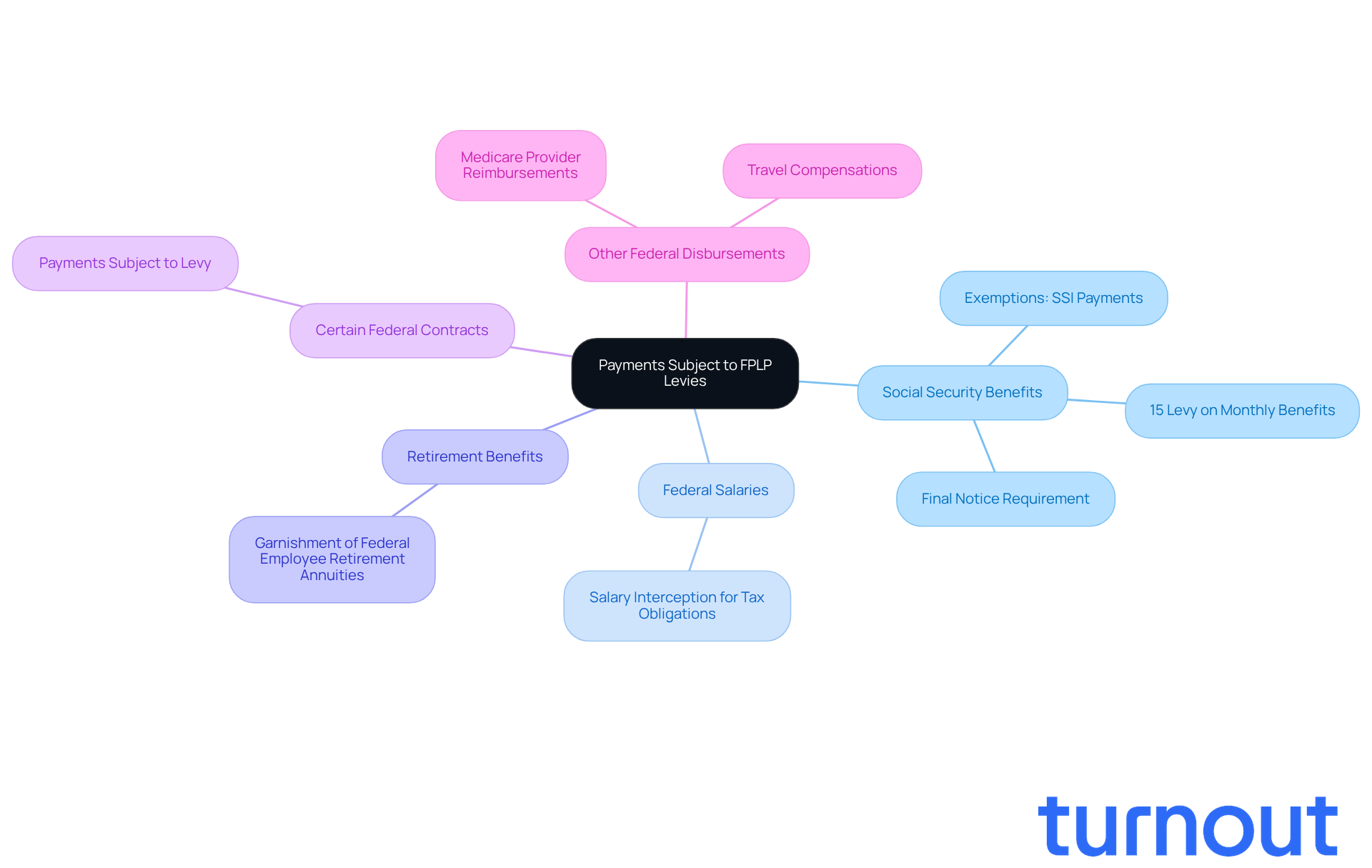

Identify Payments Subject to FPLP Levies

Payments that fall under the federal payment levy program (FPLP) can be daunting, especially for those seeking assistance from Turnout. We understand that navigating these financial challenges can feel overwhelming. Here are some key categories that may impact your finances:

- Social Security Benefits: Did you know that up to 15% of your monthly benefits could be levied to cover delinquent tax debts? This includes benefits under Title II, such as old-age, survivors, and disability insurance. However, the federal payment levy program does not affect Supplemental Security Income (SSI) payments and those with partial withholding to repay Social Security debts. Turnout is here to help you understand your rights and options in this complex landscape.

- Federal Salaries: If you’re a federal employee, a portion of your salary might be intercepted to meet tax obligations. This can be a significant concern for many working in government roles. Turnout offers support to help you manage these financial responsibilities effectively.

- Retirement Benefits: For retirees, federal employee retirement annuities can also be garnished, which may disrupt your financial planning. Our expert guidance at Turnout can help you explore your options and protect your hard-earned benefits.

- Certain Federal Contracts: If you’re engaged in federal contracting work, payments made to you could be levied if you owe taxes. Turnout is ready to assist you in navigating these responsibilities with confidence.

- Other Federal Disbursements: This includes various federal allocations, such as Medicare provider reimbursements and travel compensations, which may also be subject to deductions. We want to ensure you’re informed about how these could impact your income streams.

Before any Social Security benefits are levied, the IRS will send a final notice of intent to impose, giving you a chance to address your tax obligations. Understanding these categories is crucial for recognizing potential vulnerabilities in your income. Remember, you’re not alone in this journey. Turnout is here to help you take proactive steps in managing your financial obligations.

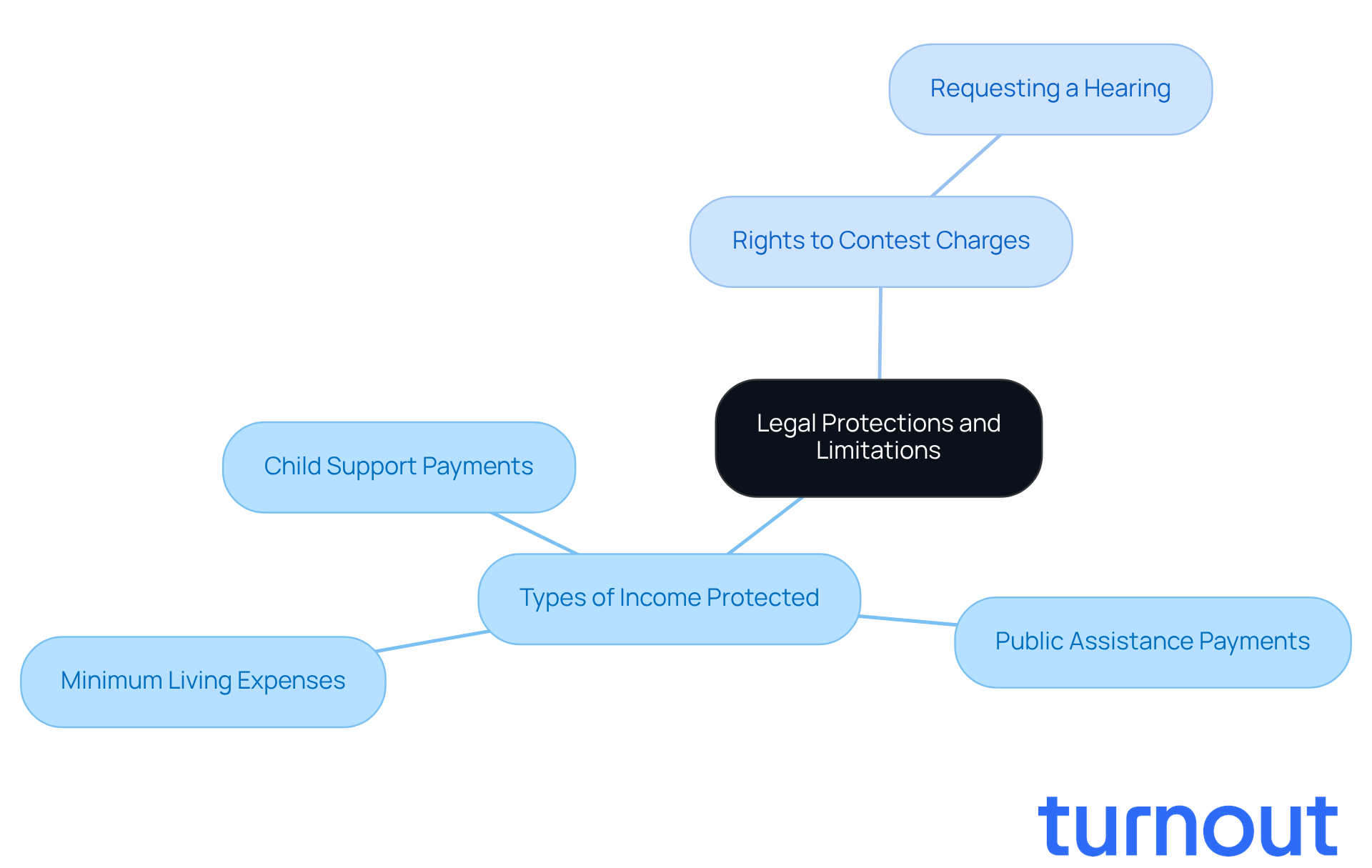

Outline Legal Protections and Limitations

The Federal Payment Collection Program (FPLP) allows the IRS to impose certain charges, but it’s important to recognize the legal protections that safeguard taxpayers. We understand that facing these charges can be overwhelming, and knowing your rights can make a significant difference. Notably, the IRS cannot levy specific types of income, including:

- Child Support Payments: These payments are explicitly protected from levy actions.

- Certain Public Assistance Payments: Welfare benefits and similar assistance are exempt from taxes.

- Minimum Living Expenses: The IRS must leave taxpayers with enough income to cover basic living necessities.

Moreover, you have the right to contest a charge. If you believe a charge is unjustified, you can request a hearing to challenge it. Understanding these safeguards is essential for anyone facing a charge, as it empowers you to respond appropriately and protect your financial well-being.

At Turnout, we’re dedicated to helping clients navigate these complexities, especially those seeking assistance with SSD claims and tax relief. It’s important to note that while we’re not a law firm and don’t provide legal advice, we utilize trained nonlawyer advocates and work with IRS-licensed enrolled agents to support our clients. This ensures that you are informed about your rights and the protections available to you.

Additionally, systemic failures have led to taxpayer rights violations, highlighting the importance of being aware of these protections. Remember, you are not alone in this journey; we’re here to help.

Provide Strategies to Avoid or Stop an FPLP Levy

To effectively avoid or stop an FPLP levy, consider implementing the following strategies:

-

Stay Compliant with Tax Obligations: We understand that managing taxes can be overwhelming. Timely filing of all tax returns and promptly settling any owed taxes is crucial. This proactive approach can help prevent the initiation of levy actions. Remember, the IRS can intercept up to 15% of federal disbursements like Social Security benefits through the federal payment levy program, making compliance essential.

-

Set Up a Payment Plan: If you owe taxes, negotiating a payment plan with the IRS can be a viable solution. Many taxpayers have successfully created arrangements that allow them to settle their debts gradually, avoiding confiscations. As the IRS reminds us, 'Receiving a notice from the IRS is one of the most crucial warnings that your tax debt has reached a serious level.'

-

Request Currently Not Collectible Status: It's common to feel financial strain, and if you're experiencing hardship, you may qualify for Currently Not Collectible (CNC) status. This designation can temporarily pause collection actions, including garnishments, giving you some breathing space. Tax attorneys skilled in tax controversy law can file for emergency relief and negotiate with the IRS to assert your rights.

-

Communicate with the IRS: Keeping open lines of communication with the IRS is essential. Addressing any issues or concerns before they escalate can help prevent the IRS from taking enforcement actions. Understanding your rights, including the right to contest enforcement actions or request a Collection Due Process hearing, is vital.

-

Seek Professional Help: Consulting with a tax professional or advocate can provide tailored strategies specific to your situation. Their expertise can be invaluable in navigating complex tax issues and negotiating with the IRS. Dallo Law Group emphasizes the importance of acting quickly to stop IRS levies, stating, "When facing IRS wage garnishment or the threat of a levy, time is not on your side."

By implementing these strategies, you can better protect your income from being levied and maintain financial stability. Remember, you're not alone in this journey, and we're here to help.

Conclusion

Understanding the Federal Payment Levy Program (FPLP) is crucial for taxpayers who may be navigating unexpected financial challenges. This program aims to simplify the collection of overdue federal taxes, allowing the IRS to automatically levy a portion of federal disbursements - like Social Security benefits and federal salaries - to settle tax debts. The implications of the FPLP can be significant, making it essential for individuals to be aware of their rights and the potential impacts on their financial well-being.

We understand that facing such situations can be overwhelming. Throughout this guide, we’ve explored key aspects of the FPLP, including:

- How it operates

- The types of payments that can be levied

- The legal protections available to you as a taxpayer

We’ve also outlined strategies for avoiding or halting an FPLP levy, emphasizing the importance of proactive tax management, effective communication with the IRS, and seeking professional assistance when needed. While the FPLP can seem daunting, understanding it is the first step toward maintaining your financial stability.

Ultimately, we encourage you to take charge of your tax obligations to prevent the distress that can accompany the FPLP. By staying informed and utilizing available resources, you can navigate these challenges with confidence. Remember, proactive engagement with your tax responsibilities not only protects your income but also fosters peace of mind in your financial planning. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is the Federal Payment Levy Program (FPLP)?

The Federal Payment Levy Program (FPLP) is an automated tax collection initiative established by the IRS that allows the agency to collect overdue federal taxes by levying specific federal disbursements, such as Social Security benefits and federal salaries.

When was the FPLP established and under what authority does it operate?

The FPLP was established in July 2000 and operates under the jurisdiction of Internal Revenue Code Section 6331.

How many taxpayers are affected by the FPLP as of 2026?

As of 2026, approximately 525,000 taxpayers are affected by the FPLP.

What percentage of federal disbursements can the IRS levy under the FPLP?

The IRS can impose up to 15% on specific federal disbursements under the FPLP.

Are there circumstances where the IRS can withhold 100% of amounts due to federal contractors and vendors?

Yes, in certain situations, the IRS can withhold 100% of amounts due to federal contractors and vendors if the tax owed is less than 15% of the total and the tax debts remain unresolved.

How long does the charge from the FPLP remain in effect?

The ongoing charge from the FPLP remains in effect until the unpaid debt is satisfied or arrangements for settlement are established.

Will taxpayers be notified when a charge is applied under the FPLP?

Yes, the IRS must inform taxpayers in writing when a charge is applied as part of the FPLP.

What options do taxpayers have if they are affected by the FPLP?

Taxpayers can either pay off their tax balance in full, establish an Installment Agreement with the IRS, or request that their debt be categorized as presently uncollectible to temporarily suspend collections.

How does the FPLP work in practice?

The FPLP works by cross-referencing IRS records of delinquent taxpayers with federal disbursement data from the Bureau of Fiscal Service. If a taxpayer has an outstanding tax duty, the IRS can automatically seize up to 15% of certain federal disbursements.

What should taxpayers do to manage their tax obligations proactively?

Taxpayers should understand their tax responsibilities and address any outstanding obligations to prevent unexpected financial strain from deductions under the FPLP.