Overview

We understand that navigating disability insurance can be overwhelming, especially when considering the elimination period. This waiting time, which typically spans from 30 days to two years after you become incapacitated, is crucial to grasp. It directly impacts your financial planning, affecting both out-of-pocket costs and insurance premiums.

It's common to feel uncertain about how these waiting periods work. Generally, longer elimination times lead to lower premiums. However, this means you may need to manage your expenses independently during this waiting phase. Knowing this can help you make informed decisions that suit your financial situation.

As you reflect on your options, remember that understanding the elimination period is not just about numbers—it's about securing your peace of mind. We’re here to help you navigate these choices, ensuring you feel supported every step of the way. You are not alone in this journey.

Introduction

The elimination period in disability insurance plays a crucial role in your journey toward financial security. This waiting period, which can range from 30 days to two years, serves as a buffer between the onset of a disabling condition and the benefits you need. We understand that navigating this time can be challenging, and it’s essential to grasp how it affects your out-of-pocket costs and insurance premiums.

It’s common to feel overwhelmed by the decision of how long to endure this waiting period. You may wonder: how do you balance the need for timely support with the potential financial strain of higher premiums? This is a significant consideration for many individuals seeking to protect their financial well-being during tough times.

Define the Elimination Period in Disability Insurance

The waiting time in income protection coverage corresponds to the elimination period for disability insurance, which is the duration that must pass after a policyholder becomes incapacitated before benefits can be received. The elimination period for disability insurance typically ranges from 30 days to two years, depending on the policy. During this waiting phase, the insured individual must manage their own expenses without financial support from the insurance provider.

We understand that grasping this timeframe is crucial for organizing finances during what can be a challenging time of disability. A policy with a longer waiting duration may lead to significant out-of-pocket costs, potentially creating financial strain. Conversely, a shorter waiting time can provide quicker access to benefits, but it might come with higher premiums.

Many policies feature a waiting duration of around 90 days, which is a popular choice among policyholders seeking a balance between affordability and timely assistance. Understanding the implications of the elimination period for disability insurance is essential for anyone considering income protection insurance, as it directly influences financial preparedness in the event of an unexpected incapacity.

Engaging with this aspect of your policy can empower you to make informed decisions. Remember, you are not alone in this journey; much like how Turnout simplifies access to government benefits and financial support, we are here to help you navigate these complexities with confidence.

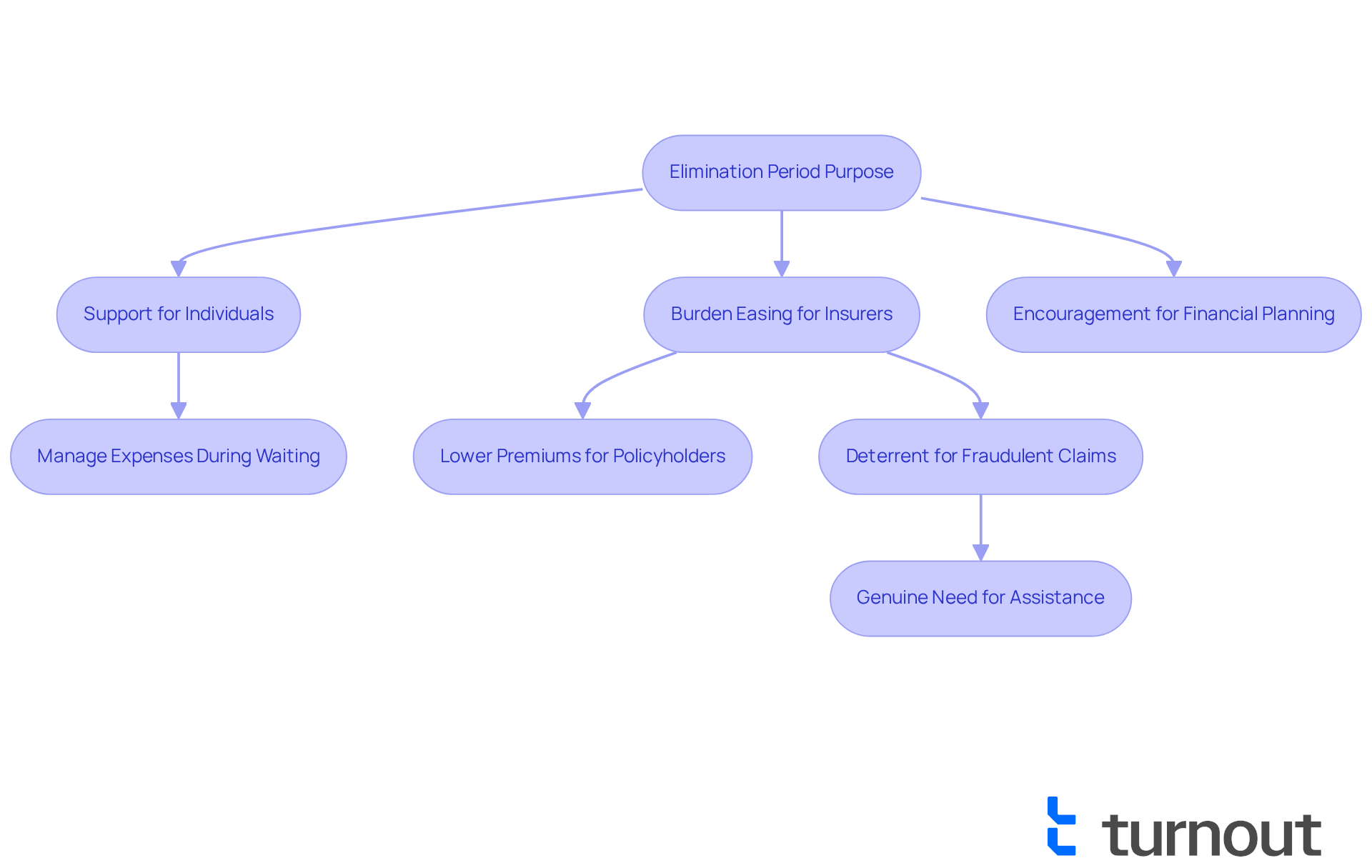

Explain the Purpose of the Elimination Period

The primary goal of the elimination period for disability insurance is to support individuals facing short-term disabilities while also easing the burden on insurance providers. By implementing an elimination period for disability insurance, insurers can effectively manage the number of claims related to temporary conditions. This not only helps keep premiums lower for policyholders but also encourages individuals to develop a financial plan. It's important to ensure that you can manage your expenses during the elimination period for disability insurance while waiting for assistance to begin.

We understand that navigating the complexities of Social Security Disability (SSD) claims can be overwhelming. That’s why Turnout provides support through trained nonlegal advocates, who are here to guide you during the elimination period for disability insurance. This time is crucial as it also serves to deter fraudulent claims, requiring a genuine need for assistance before any payments are made.

Remember, you are not alone in this journey. We’re here to help you through every step, ensuring that you receive the support you need.

Analyze the Impact of Elimination Period Length on Premiums

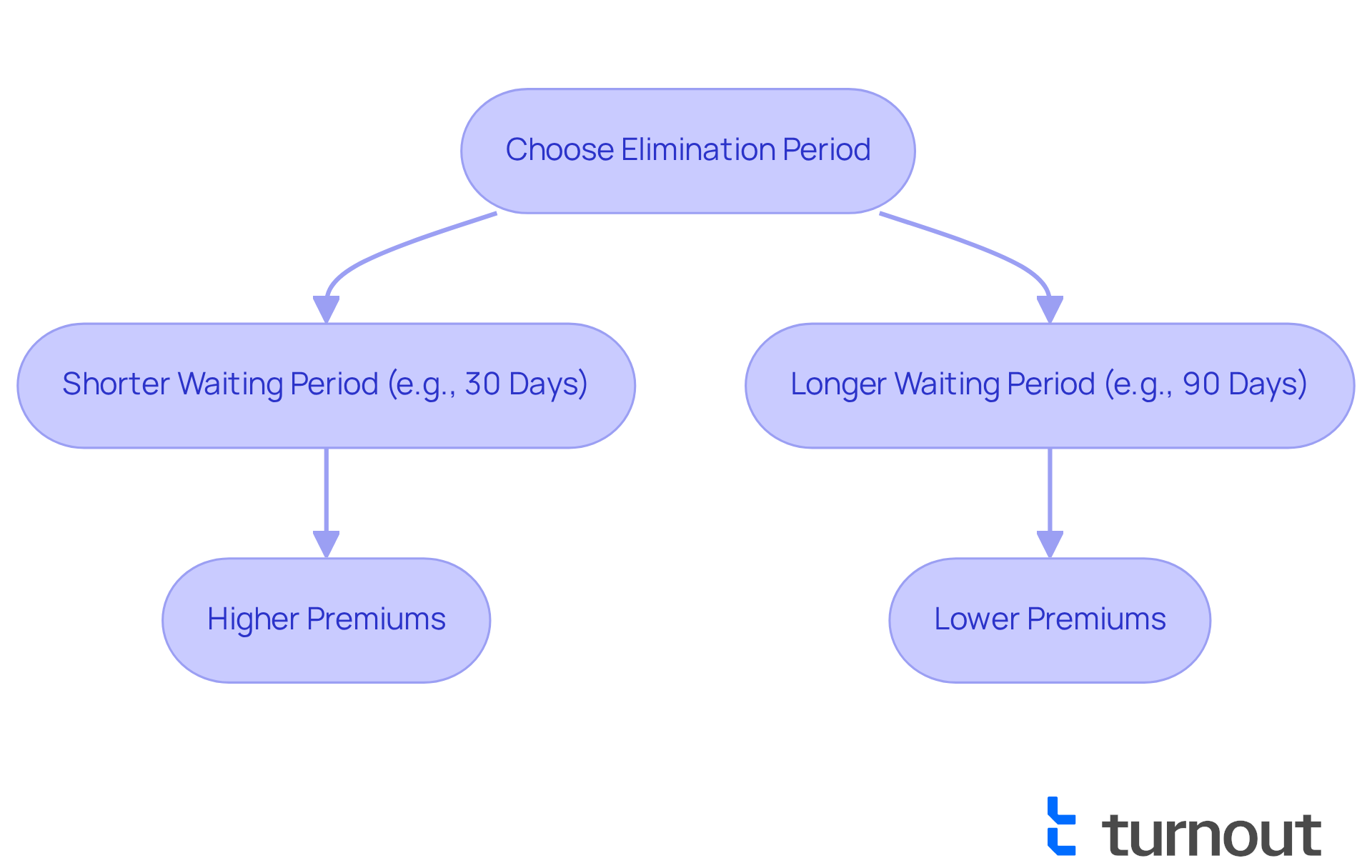

Navigating the world of disability insurance can be overwhelming, especially when considering how the duration of the exclusion timeframe impacts your premiums. We understand that this decision can weigh heavily on your mind. Typically, a shorter waiting duration leads to increased premiums. This is because the insurer takes on more risk by providing benefits earlier. On the other hand, opting for a longer waiting time generally results in reduced premiums, as it decreases the likelihood of immediate claims.

For instance, you might find that a policy featuring a 30-day waiting time is considerably more expensive than one with a 90-day duration. It's common to feel uncertain about which option is best for your financial situation. Therefore, we encourage you to evaluate your financial condition carefully. Consider how long you can support yourself without income when selecting the duration of your waiting time. Remember, you are not alone in this journey; we're here to help you make the best choice for your future.

Guide on Choosing the Right Elimination Period

Choosing the right elimination period for disability insurance is a crucial decision that necessitates careful consideration of several key factors.

-

Financial Stability: We understand that evaluating your savings and monthly expenses is crucial. How long can you sustain yourself without income? If you have a strong emergency fund, opting for a longer waiting period could significantly reduce your premium expenses. For instance, an extended waiting duration can lower costs by allowing more time for healing before assistance is needed.

-

Health Status: It's common to feel uncertain about your health condition and the likelihood of needing to file a claim. For those with long-term health conditions, a shorter waiting time may provide quicker financial support, enabling faster access to assistance.

-

Income Sources: Consider any additional income you might receive during the waiting period, such as savings, temporary disability assistance, or help from family. This can greatly influence your decision on how long you can afford to wait for benefits.

-

Policy Comparison: We encourage you to examine different policies and their waiting times. Strive for a balance between premium expenses and the waiting time that meets your financial needs. For example, a 90-day waiting time is often viewed as a reasonable compromise between coverage and cost, offering a balance that many policyholders find manageable.

-

Consultation: If you feel uncertain about your options, seeking advice from a specialist in disability assistance can provide valuable insights tailored to your situation. They can clarify that the waiting time begins on the day of the disabling event, not when a claim is submitted, which is crucial for understanding the timeline.

By carefully evaluating these factors, you can select an elimination period for disability insurance that aligns with your financial circumstances and personal needs. Remember, you are not alone in this journey, and we're here to help you navigate the waiting period before benefits commence.

Conclusion

Understanding the elimination period for disability insurance is essential for anyone seeking financial protection during unexpected incapacities. We recognize that navigating this critical phase can be overwhelming. This waiting time before benefits are disbursed directly impacts your financial preparedness and the overall cost of your policy. By grasping the nuances of this period, you can make informed decisions that align with your unique circumstances and needs.

Throughout this article, we highlighted key points, including:

- The typical duration of elimination periods

- The trade-off between waiting times and premium costs

- The importance of evaluating your personal financial situation

Factors such as your financial stability, health status, and available income sources play a pivotal role in determining the most suitable elimination period for you. Each of these considerations helps create a comprehensive understanding of how to navigate the complexities of disability insurance.

Ultimately, the elimination period serves not only as a protective measure for insurers but also as a crucial time for you to strategize your financial plans. We understand that it’s imperative to take the time to assess your personal circumstances and seek guidance if needed. By doing so, you can ensure you choose an elimination period that meets your immediate needs and secures your financial future in times of uncertainty. Remember, you are not alone in this journey; we're here to help.

Frequently Asked Questions

What is the elimination period in disability insurance?

The elimination period in disability insurance is the duration that must pass after a policyholder becomes incapacitated before they can start receiving benefits.

How long does the elimination period typically last?

The elimination period for disability insurance typically ranges from 30 days to two years, depending on the specific policy.

What happens during the elimination period?

During the elimination period, the insured individual must manage their own expenses without any financial support from the insurance provider.

Why is understanding the elimination period important?

Understanding the elimination period is crucial for organizing finances during a challenging time of disability, as it directly influences financial preparedness and can lead to significant out-of-pocket costs.

What is a common duration for the elimination period that policyholders choose?

Many policies feature a waiting duration of around 90 days, which is a popular choice among policyholders seeking a balance between affordability and timely assistance.

How does the length of the elimination period affect insurance premiums?

A longer elimination period may lead to significant out-of-pocket costs, while a shorter waiting time can provide quicker access to benefits but might come with higher premiums.