Overview

The 2025 Cost-of-Living Adjustment (COLA) for Social Security Disability Insurance (SSDI) is set to increase benefits by 2.5%. This change will raise the average monthly payment from about $1,581 to around $1,620. We understand how crucial this adjustment is for maintaining your purchasing power, especially as inflation continues to rise.

These adjustments are essential for beneficiaries like you to afford necessary goods and services. It's common to feel concerned about how these changes impact your financial planning and eligibility for other assistance programs. Knowing that support is available can make a significant difference in your daily life.

As you navigate these changes, remember that you are not alone in this journey. We're here to help you understand the implications of these adjustments and how they can support your needs. Together, we can explore the best ways to manage your finances and ensure you have access to the resources you require.

Introduction

Understanding the complexities of Cost-of-Living Adjustments (COLA) is crucial for those relying on Social Security Disability Benefits, especially as the 2025 adjustment approaches. With an increase set at 2.5%, this adjustment aims to provide essential financial relief amid rising inflation. It’s designed to help beneficiaries maintain their purchasing power during challenging times.

However, we understand that many recipients face the harsh realities of fluctuating costs for necessities like healthcare and housing. It’s common to wonder: will this adjustment truly alleviate financial burdens and enhance quality of life?

As you navigate these uncertainties, remember that you are not alone in this journey. We’re here to help you understand how these changes may impact your situation and what steps you can take to ensure your financial well-being.

Define Cost-of-Living Adjustments (COLA) and Their Importance for Disability Benefits

Cost-of-Living Adjustments are vital increments in Social Assistance and Supplemental Income payments that relate to the cola increase 2025 social security disability, designed to help ease the burden of inflation. We understand that for many, particularly individuals with disabilities, these adjustments related to the cola increase 2025 social security disability are crucial for maintaining purchasing power and meeting daily needs. The Social Security Administration (SSA) calculates these adjustments based on changes in the Consumer Price Index (CPI), which tracks average price shifts over time for a range of goods and services that urban consumers rely on. Without these adjustments, fixed benefits would lose value, making it harder for recipients to afford essentials like food, housing, and medical care.

Recently, a 2.8% cost-of-living adjustment for 2026 was announced, raising the average monthly disability benefit from $1,586 to $1,630. This increase brings much-needed relief to millions of Americans. Given the ongoing rise in inflation, this adjustment is particularly significant. While these adjustments help mitigate some effects of inflation, it's common to feel that they may not fully address the rising costs of healthcare and housing, especially considering the cola increase 2025 social security disability, which can disproportionately affect individuals with disabilities.

Real-world examples show how these adjustments can impact financial planning for individuals with disabilities. For instance, someone relying solely on Social Security benefits might find that the cost-of-living adjustment helps them manage increased medical expenses or unexpected costs, enhancing their financial stability. Moreover, these adjustments serve as a safeguard against declining purchasing power, ensuring that recipients can maintain their quality of life despite economic fluctuations.

Turnout offers valuable tools and services, including personalized guidance and resources, to help individuals understand their SSD claims and the implications of cost-of-living adjustments on their finances. We encourage beneficiaries to create a mySocialSecurity account to receive their cost-of-living adjustment notifications up to three weeks earlier. This proactive approach can empower you to manage your benefits effectively. Overall, understanding cost-of-living adjustments is essential for individuals with disabilities to navigate their financial landscape with confidence. Remember, you are not alone in this journey; we're here to help.

Analyze the 2025 COLA Increase: Key Figures and Influencing Factors

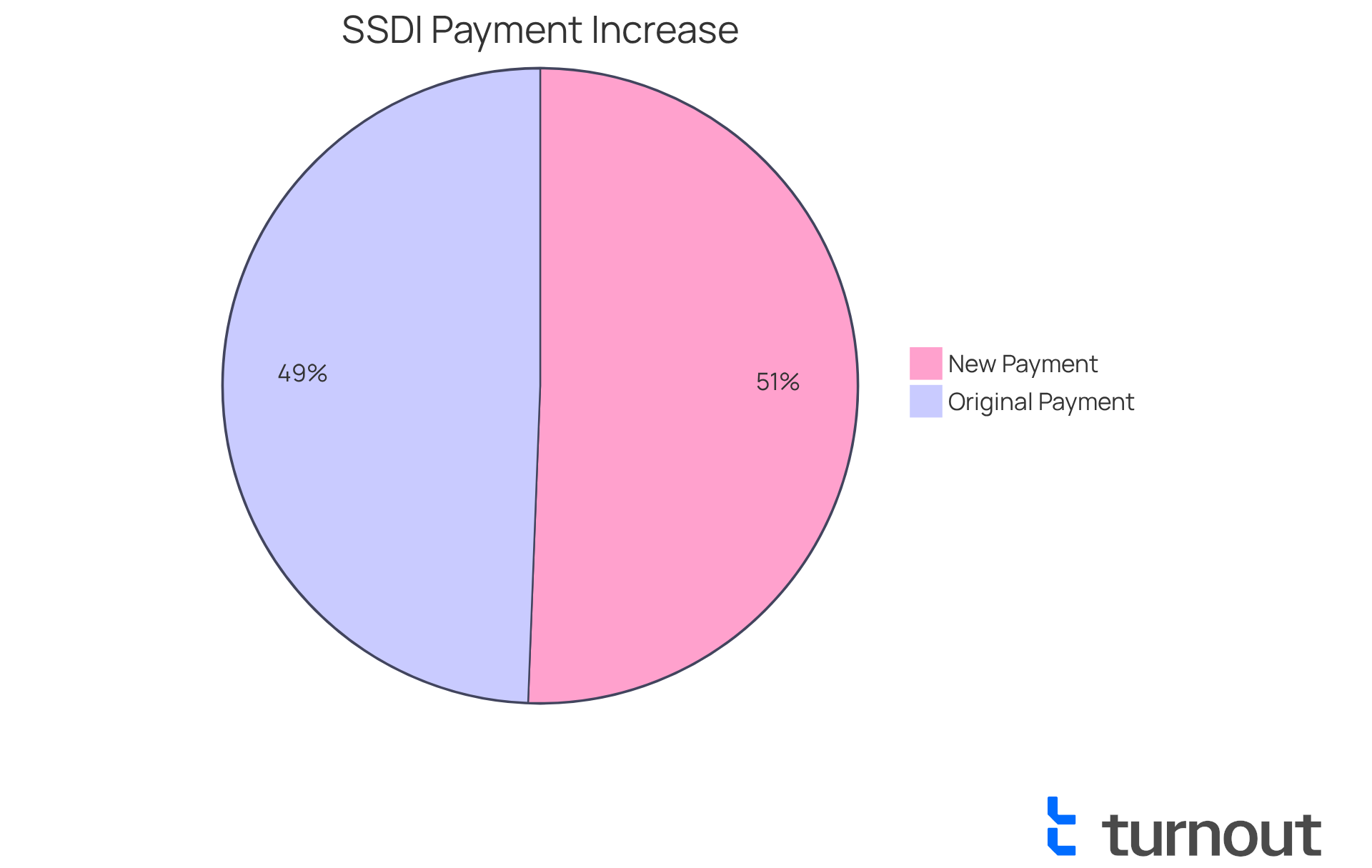

The cola increase 2025 social security disability is set at 2.5%, which translates to an average increase of about $38 each month for Social Security Disability Insurance (SSDI) recipients. This adjustment happens automatically, so you don’t have to worry about taking any action to receive this enhancement. Before this adjustment, the typical SSDI payment was $1,581, and it will rise to approximately $1,620 due to the cola increase 2025 social security disability.

Several factors influence this percentage, such as inflation rates and overall economic conditions. The Social Security Administration (SSA) determines the cost-of-living adjustment (COLA) based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index reflects the economic challenges many beneficiaries face. As inflation rises, it becomes crucial to adjust assistance to help you maintain your purchasing power.

Additionally, the cola increase 2025 social security disability has resulted in the significant gainful activity (SGA) threshold for SSDI recipients increasing to $1,620 monthly. This change allows you to earn more while still meeting eligibility criteria. Understanding these dynamics can help you anticipate changes in your monthly allowances and manage your finances more effectively.

We understand that navigating these changes can be overwhelming. That’s where Turnout comes in. We’re here to assist you in understanding your benefits, using trained non-legal advocates who provide support without the need for legal representation. It’s important to note that Turnout is not a law firm and does not offer legal advice.

You will also receive a revamped notification that clarifies the details about your new compensation amounts. This will help improve your understanding of these modifications. Remember, you are not alone in this journey; we’re here to help.

Evaluate the Impact of the 2025 COLA on Benefits and Financial Planning

The cola increase 2025 social security disability will lead to a 2.5% adjustment, raising the average monthly benefit for individuals receiving SSDI to about $1,575. While the cola increase 2025 social security disability might seem small, it plays a crucial role in helping beneficiaries cope with the rising costs of living. For many, this adjustment can make a significant difference in their ability to afford essential goods and services, potentially preventing financial hardship.

We understand that navigating financial challenges can be overwhelming. Beneficiaries should thoughtfully incorporate this enhancement into their financial planning, ensuring it aligns with their overall income and expenses. It’s also important to consider any changes in living situations that may come up throughout the year. Knowing that these adjustments take effect in January allows for better budgeting and preparation for the year ahead.

Statistics show that many SSDI recipients struggle with managing their budgets, especially in an inflationary environment. The cola increase 2025 social security disability can provide a vital buffer through cost-of-living adjustments, but it’s essential for recipients to adopt effective budgeting techniques. Turnout's trained non-legal advocates are here to help clients create tailored financial strategies that maximize the benefits of the cost-of-living adjustment. We suggest prioritizing essential expenses and exploring additional resources, such as financial advisory services, to strengthen financial stability.

You can expect alerts from the Social Welfare Administration regarding your new assistance amounts to be sent out in early December. This advance notice can help you plan better as you manage your financial situation. Remember, you are not alone in this journey; support is available to help you thrive.

Address Common Concerns: Eligibility, Taxes, and Other Benefits Related to COLA

Many beneficiaries have questions about their eligibility for cost-of-living adjustments related to the cola increase 2025 social security disability and how these changes might impact their tax situations. If you’re receiving Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI), you’re likely eligible for the cola increase 2025 social security disability adjustments, provided you meet the necessary criteria. While the cost-of-living adjustment itself isn’t taxable, a cola increase 2025 social security disability could push some recipients into a higher tax bracket, potentially making part of their benefits taxable.

For those with additional income sources, it’s essential to understand how the cost-of-living adjustment affects your total income. This knowledge is crucial for effective tax planning. It’s also important to consider how these adjustments might influence your eligibility for other assistance programs, like Medicaid or food assistance, which often have income limits that could be impacted by the cola increase 2025 social security disability payments.

As the Social Security Administration Commissioner has pointed out, the cola increase 2025 social security disability aims to reflect current economic realities, ensuring that benefits provide a solid foundation of security. We understand that navigating these changes can feel overwhelming, but staying informed about how they affect your overall financial situation is vital. Remember, you’re not alone in this journey, and we’re here to help you every step of the way.

Conclusion

Understanding the 2025 Cost-of-Living Adjustment (COLA) for Social Security Disability Benefits is crucial for you as you navigate your financial landscape. These adjustments are a vital tool to combat inflation, helping those on fixed incomes maintain their purchasing power. With the announced increase of 2.5%, you can look forward to a modest yet meaningful boost in your monthly benefits, which is essential for managing everyday expenses.

We recognize that the importance of COLA goes beyond numbers; it plays a significant role in preserving your quality of life. The adjustments are based on the Consumer Price Index, reflecting the economic realities that directly impact you. It's also important to understand how these changes might affect your taxes and eligibility for other assistance programs. This knowledge is key for effective financial planning. Resources like those offered by Turnout can provide personalized support, helping you make informed decisions.

Ultimately, being proactive about understanding and utilizing the COLA adjustments can empower you to tackle financial challenges more effectively. Staying informed and seeking help when needed can lead to greater financial stability and an improved quality of life. Embracing these adjustments isn’t just about managing your finances; it’s about ensuring that you can thrive, even amidst economic fluctuations. Remember, you are not alone in this journey, and we're here to help.

Frequently Asked Questions

What are Cost-of-Living Adjustments (COLA)?

Cost-of-Living Adjustments (COLA) are increments in Social Assistance and Supplemental Income payments designed to help recipients keep up with inflation and maintain their purchasing power.

Why are COLAs important for individuals with disabilities?

COLAs are crucial for individuals with disabilities as they help ensure that fixed benefits do not lose value over time, allowing recipients to afford essential items like food, housing, and medical care.

How does the Social Security Administration (SSA) determine COLAs?

The SSA calculates COLAs based on changes in the Consumer Price Index (CPI), which tracks average price shifts for a range of goods and services that urban consumers rely on.

What was the recent COLA adjustment announced for 2026?

A 2.8% cost-of-living adjustment for 2026 was announced, raising the average monthly disability benefit from $1,586 to $1,630.

How does inflation affect the significance of COLAs?

With ongoing inflation, COLAs are particularly significant as they help mitigate the impact of rising costs, although they may not fully cover the increasing expenses related to healthcare and housing.

Can COLAs impact financial planning for individuals with disabilities?

Yes, COLAs can enhance financial stability for individuals relying solely on Social Security benefits by helping them manage increased medical expenses or unexpected costs.

What resources does Turnout offer to assist individuals with SSD claims?

Turnout provides personalized guidance and resources to help individuals understand their SSD claims and the implications of COLAs on their finances.

How can beneficiaries stay informed about their COLA notifications?

Beneficiaries are encouraged to create a mySocialSecurity account to receive their COLA notifications up to three weeks earlier, which can help them manage their benefits effectively.