Overview

A tax levy is a legal process that can feel overwhelming. It occurs when government agencies, like the IRS, seize an individual's property or assets to settle unpaid tax obligations. This is different from a tax lien, which simply places a claim on property.

We understand that the implications of tax levies can be serious. They can lead to wage garnishments, bank account seizures, and significant financial distress. It’s common to feel anxious about these situations, but it’s crucial to know that you have rights and options available to you.

Understanding your situation is the first step toward regaining control. You are not alone in this journey; many have faced similar challenges and found ways to navigate them. Remember, seeking assistance can make a significant difference.

If you find yourself facing a tax levy, take a moment to reflect on your options. We’re here to help you through this process, ensuring you understand every step along the way. You deserve support and guidance as you work to resolve these issues.

Introduction

Understanding the complexities of tax levies is crucial for anyone navigating their financial responsibilities. We understand that dealing with taxes can be overwhelming, especially as government agencies ramp up enforcement efforts. The implications of unpaid taxes can escalate quickly, leading to severe consequences like asset seizure and wage garnishment.

This article delves into the intricacies of tax levies, offering insights into their definitions, processes, and the various forms they can take. It’s common to feel anxious about what might happen next. How can individuals protect themselves and their finances from the potential fallout of a tax levy?

You are not alone in this journey. We’re here to help you understand your options and take proactive steps to safeguard your financial future.

Define Tax Levy: Core Concept and Functionality

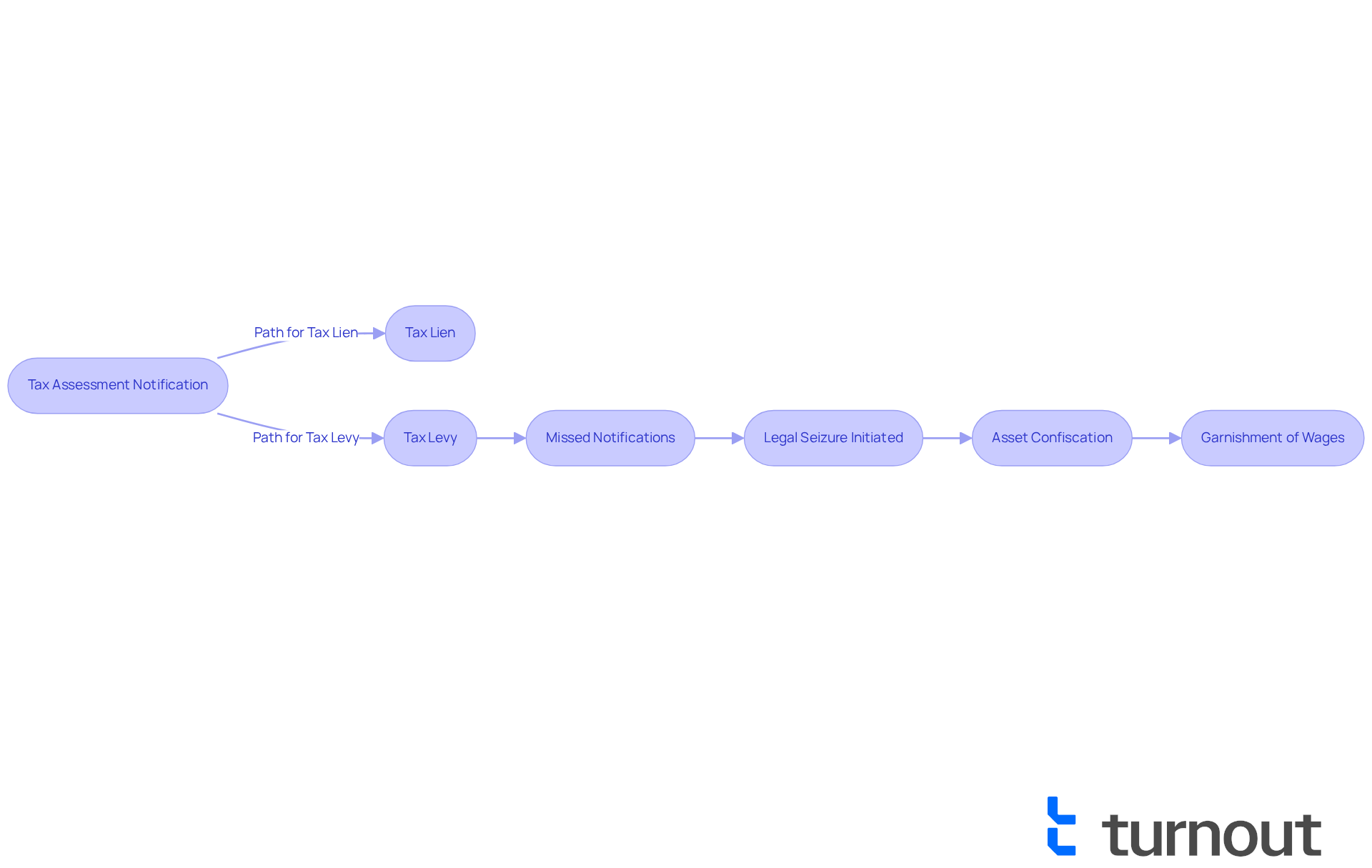

A tax assessment can feel overwhelming, and it’s important to understand what it means. Essentially, it’s a legal method used by government agencies, like the Internal Revenue Service (IRS), to confiscate an individual's property or assets to settle outstanding tax obligations. This process is different from a tax lien, which is a claim against property but doesn’t involve actual confiscation. A charge can lead to the seizure of various assets, including bank accounts, salaries, and even real estate. Typically, the IRS initiates a legal seizure after a taxpayer has missed several notifications about their tax responsibilities, signaling a serious escalation in the collection process.

We understand that facing a tax charge can be stressful. In recent years, the IRS has issued millions of tax liens annually, underscoring the seriousness of this enforcement action. For instance, in 2023 alone, the IRS reported over 1.5 million collections, reflecting their commitment to securing owed payments. Taxpayers dealing with a charge may experience significant financial strain, as the IRS can garnish wages or withdraw funds directly from bank accounts, often without prior warning. It’s crucial to know that there is a 21-day waiting period before the IRS can withdraw funds from a bank account for unpaid taxes.

Understanding the difference between a tax charge and a tax lien is essential. While a lien protects the government's claim on your property, a seizure allows for the actual appropriation of that property. This distinction is vital to grasp, as it highlights the potential consequences of unpaid tax debts.

Real-world examples can illustrate the impact of tax assessments on individuals. Imagine receiving a notice of seizure and then discovering your paycheck has significantly decreased due to wage garnishment. This can make it challenging to cover daily expenses. Additionally, the IRS can intercept Social Security benefits, complicating financial stability for those affected. Remember, you have the right to contest imposition actions, which can lead to the removal of a hold or other solutions. It’s important to understand your rights in these situations. If you owe less than $10,000, there are straightforward methods to avoid garnishments, and setting up a payment plan can help manage debts and prevent future garnishments.

You are not alone in this journey, and we’re here to help you navigate these challenges.

Explain the Purpose of a Tax Levy: Implications for Taxpayers

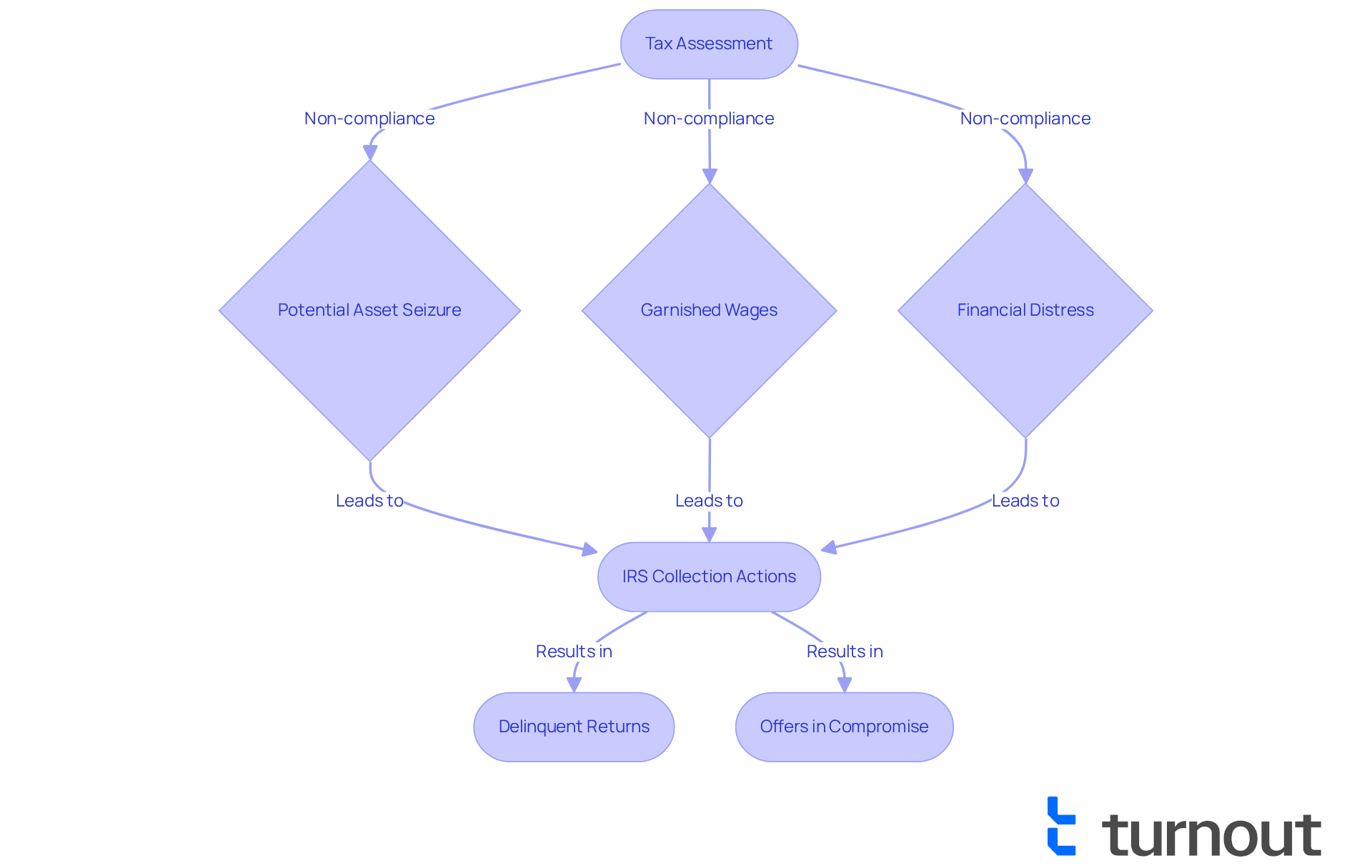

The main aim of a tax assessment is to encourage taxpayers to fulfill their financial responsibilities to the government. We understand that when individuals overlook their tax obligations, the IRS or other tax agencies may resort to seizing assets to enforce compliance. This action serves as a stark reminder of the consequences of ignoring tax debts, which can lead to the loss of essential assets, garnished wages, and a decline in financial stability. For many, facing a tax increase can feel overwhelming, especially for those already grappling with financial difficulties.

In fiscal year 2024, the IRS collected nearly $3.2 billion from delinquent returns, highlighting the agency's active role in enforcing tax compliance. This figure illustrates the serious financial consequences that tax charges can impose on individuals, pushing them deeper into economic distress. Furthermore, the IRS evaluated $17.8 billion in extra taxes for late submissions, emphasizing the broader implications of tax compliance and the financial burden it places on individuals.

Real-world examples shed light on the struggles individuals face due to the tax levy definition. In FY 2024, over 33,000 individuals submitted offers in compromise to resolve their tax obligations for less than the total amount due, indicating widespread financial distress. The IRS accepted a portion of these offers, totaling $163.4 million, showcasing the agency's willingness to negotiate while also highlighting the significant challenges many encounter in meeting their tax obligations.

Expert opinions stress the importance of understanding how tax policies impact financial well-being. As tax burdens evolve, particularly with ongoing discussions about the Tax Cuts and Jobs Act, the potential for increased financial pressure on individuals becomes a pressing concern. Ultimately, grasping the consequences of tax assessments is crucial for individuals navigating their financial landscapes. The risk of asset loss and reduced financial stability underscores the need for proactive engagement with tax obligations and seeking assistance when necessary. Remember, you are not alone in this journey; we're here to help.

Describe How a Tax Levy Works: Processes and Procedures

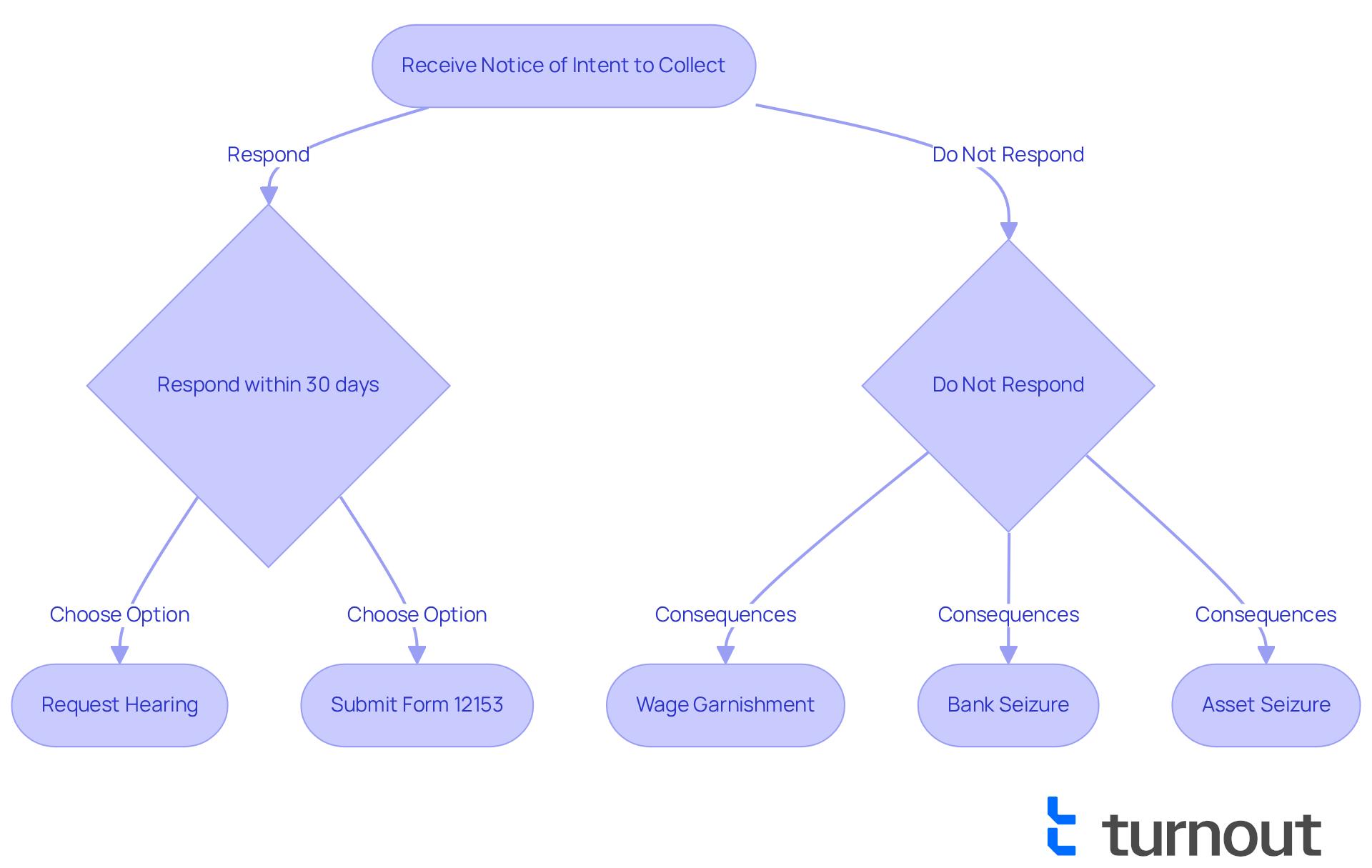

The tax collection process can feel overwhelming, especially when you receive a Notice of Intent to Collect from the IRS. This notice serves as a reminder of your outstanding tax obligation and the potential actions that may follow. If you don’t respond or settle the debt, the IRS might proceed with collection efforts, which could include:

- Garnishing your wages

- Seizing funds from your bank account

- Taking ownership of other assets

Typically, you have a 30-day window to respond after receiving this notice before any enforcement actions take place, which can happen after the IRS retains funds in your bank account for 21 days.

We understand that facing tax issues can be daunting. You have the right to contest any charges and can request a hearing to discuss your situation. Effective appeals often hinge on demonstrating financial distress or procedural errors in the assessment process. For example, you can challenge the IRS's actions by submitting Form 12153 within 30 days of the Final Notice, allowing for a review of your case. It’s important to remember that the IRS can impose up to 15% of Social Security benefits under the Federal Payment Levy Program, which can significantly impact those who rely on these funds.

Understanding the tax levy definition and the process of how tax assessments work step by step is crucial. The IRS must send at least two notifications before enforcing a seizure, including the Final Notice of Intent to Seize. If a financial claim is enforced, it can restrict access to essential funds, affecting your ability to pay for housing, utilities, and food. This can lead to considerable emotional strain. Many clients overwhelmed by tax debt have shared feelings of anxiety and uncertainty about their financial futures.

Acting quickly can help lessen the impact of a charge. Engaging with tax professionals can provide valuable support in navigating the complexities of the IRS process, ensuring you are informed of your rights and options. As specialists often highlight, clear communication and prompt action are key to effectively managing tax impositions. Furthermore, if your bank account has been seized, it’s vital to know your choices, such as:

- Requesting a release of the seizure

- Setting up a payment plan

These steps can help alleviate some of the financial pressures you may be facing.

Remember, you are not alone in this journey. We’re here to help you navigate these challenges.

Differentiate Types of Tax Levies: Understanding Variations and Applications

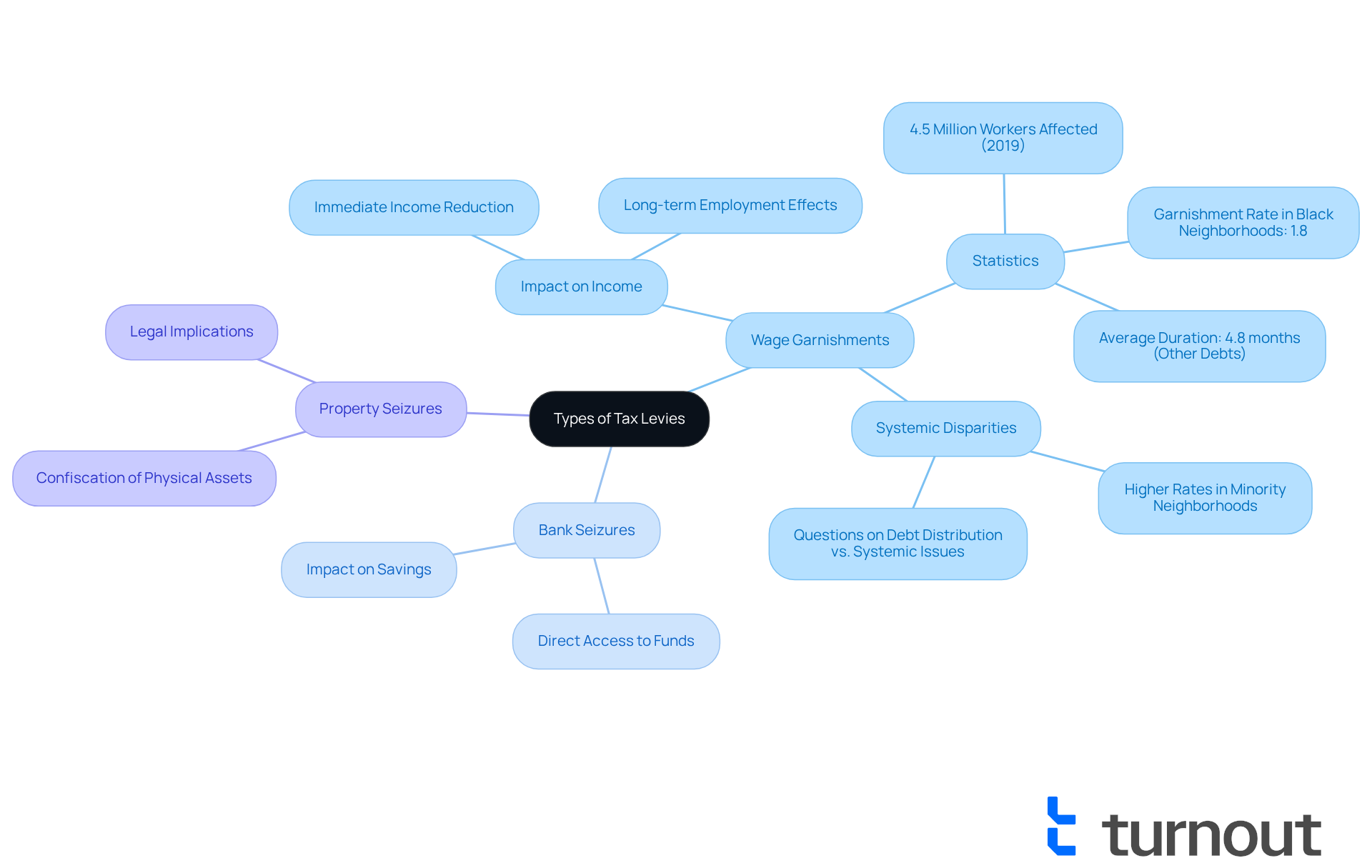

Tax charges can feel overwhelming, and it’s important to understand the different forms they take. Common types include:

- Wage garnishments, where a portion of your earnings is withheld by your employer.

- Bank seizures, which allow the IRS to take funds directly from your bank account.

- Property seizures, involving the confiscation of physical assets like vehicles or real estate.

Recognizing these distinctions is crucial for anyone paying taxes, as each type carries specific consequences and resolution procedures.

We understand that wage garnishments can significantly impact your immediate income, while bank seizures limit your access to savings, potentially threatening your financial stability. In fact, in 2019, over 4.5 million workers in the U.S. faced wage garnishments for consumer debts. The Midwest had the highest rate, 40% above the national average. Additionally, neighborhoods with higher percentages of Black residents experienced garnishment rates of 1.8%, compared to just 0.7% in areas with fewer Black residents. This highlights systemic disparities in how these charges are applied.

The reasons behind these inequalities in garnishment rates remain unclear. It raises important questions about whether wage garnishment is distributed unevenly due to debt distribution or deeper systemic issues. Recognizing these variations can empower you to take informed actions when facing potential situations related to the tax levy definition. Remember, you are not alone in this journey, and we’re here to help you navigate these challenges.

Conclusion

Understanding the tax levy definition and its implications is crucial for anyone navigating financial responsibilities. We know that dealing with taxes can be overwhelming, and this legal mechanism employed by government agencies, particularly the IRS, can lead to the confiscation of assets to settle unpaid tax debts. It’s important to recognize the differences between a tax levy and a tax lien. A tax levy involves the actual seizure of property, while a tax lien merely represents a claim against it. The potential consequences of a tax levy can significantly impact your financial stability, making it imperative to stay informed and proactive.

Throughout this article, we’ve explored key aspects of tax levies, including their purpose, processes, and various types. The IRS's role in enforcing tax compliance has been highlighted, showing the serious financial repercussions of unpaid taxes. Real-world examples illustrate the challenges individuals face when dealing with tax levies, such as wage garnishments and bank seizures. It’s common to feel anxious about these situations, but understanding your rights and options in contesting tax impositions is essential. There’s also the potential for negotiating solutions like payment plans.

Ultimately, being well-informed about tax levies empowers you to take control of your financial situation. We encourage you to engage with tax professionals and seek assistance when needed. Remember, timely action can mitigate the adverse effects of tax assessments. By understanding the nuances of tax levies and their applications, you can better navigate your obligations and safeguard your financial well-being. You are not alone in this journey; we're here to help.

Frequently Asked Questions

What is a tax levy?

A tax levy is a legal method used by government agencies, such as the IRS, to confiscate an individual's property or assets to settle outstanding tax obligations.

How does a tax levy differ from a tax lien?

A tax lien is a claim against property that does not involve actual confiscation, while a tax levy allows for the actual seizure of property or assets.

What types of assets can be seized under a tax levy?

The IRS can seize various assets, including bank accounts, salaries, and real estate.

When does the IRS initiate a tax levy?

The IRS typically initiates a tax levy after a taxpayer has missed several notifications about their tax responsibilities.

How many tax collections did the IRS report in 2023?

In 2023, the IRS reported over 1.5 million collections.

What is the waiting period before the IRS can withdraw funds from a bank account for unpaid taxes?

There is a 21-day waiting period before the IRS can withdraw funds from a bank account for unpaid taxes.

What are the potential financial impacts of a tax levy on individuals?

A tax levy can lead to wage garnishment, decreased paychecks, and the interception of Social Security benefits, which can significantly strain financial stability.

Can taxpayers contest a tax levy?

Yes, taxpayers have the right to contest imposition actions, which can lead to the removal of a hold or other solutions.

What options do taxpayers have if they owe less than $10,000?

Taxpayers who owe less than $10,000 can use straightforward methods to avoid garnishments, and setting up a payment plan can help manage debts and prevent future garnishments.