Introduction

Navigating the complexities of tax obligations can be overwhelming, especially when it comes to understanding state tax liens. We know that these governmental claims can weigh heavily on your financial stability, impacting everything from property ownership to your credit rating. It’s common to feel the pressure of unpaid dues, and the stakes can be high. Ignoring these claims can lead to serious consequences, such as foreclosure and legal actions.

So, how can you effectively manage these challenges while protecting your financial future? You're not alone in this journey, and there are steps you can take to regain control. Let's explore how to address these issues with care and support.

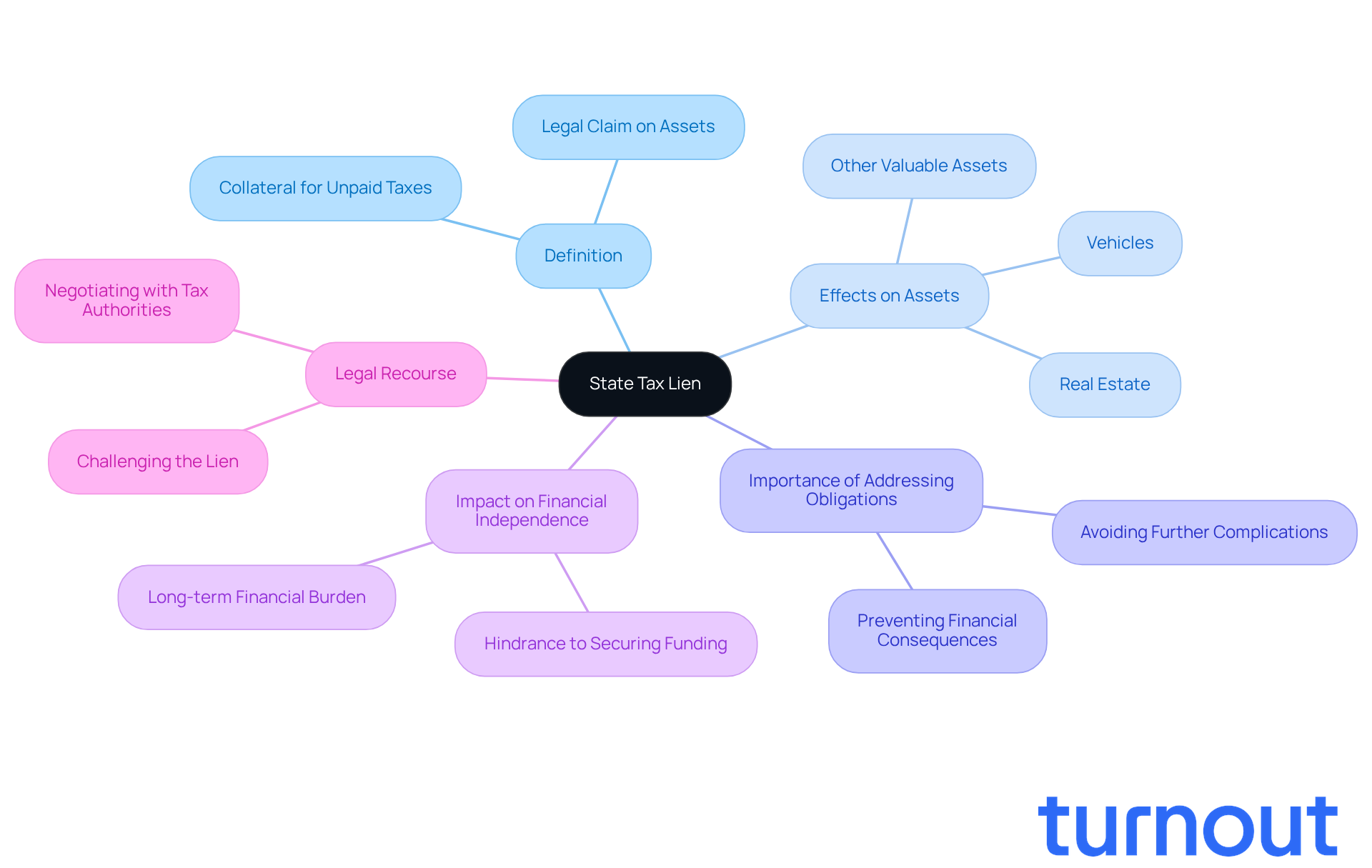

Define State Tax Lien

A governmental claim is more than just a legal term; it’s a serious matter that can weigh heavily on your shoulders. When a regional authority makes a claim on your assets due to unpaid dues, it illustrates the state tax lien meaning, which ensures they can collect the taxes owed. This claim can affect all your property within that jurisdiction - think real estate, vehicles, and other valuable assets. It stays in place until your tax debt is fully settled, including any interest and penalties that may have accrued.

We understand that receiving multiple notices before a public Notice can make the state tax lien meaning overwhelming. It’s crucial to address your tax obligations promptly to avoid further complications. Remember, these claims can significantly impact your financial independence and flexibility, potentially hindering your ability to secure funding when you need it most.

Interestingly, regional tax encumbrances no longer affect credit scores, which changes how these claims are perceived. In some cases, if your rights have been violated, legal measures can be taken against the government to remove a tax claim. Recognizing these aspects is vital for you to understand the serious consequences of not fulfilling your obligations related to the state tax lien meaning.

You are not alone in this journey. We’re here to help you navigate these challenges and find a way forward.

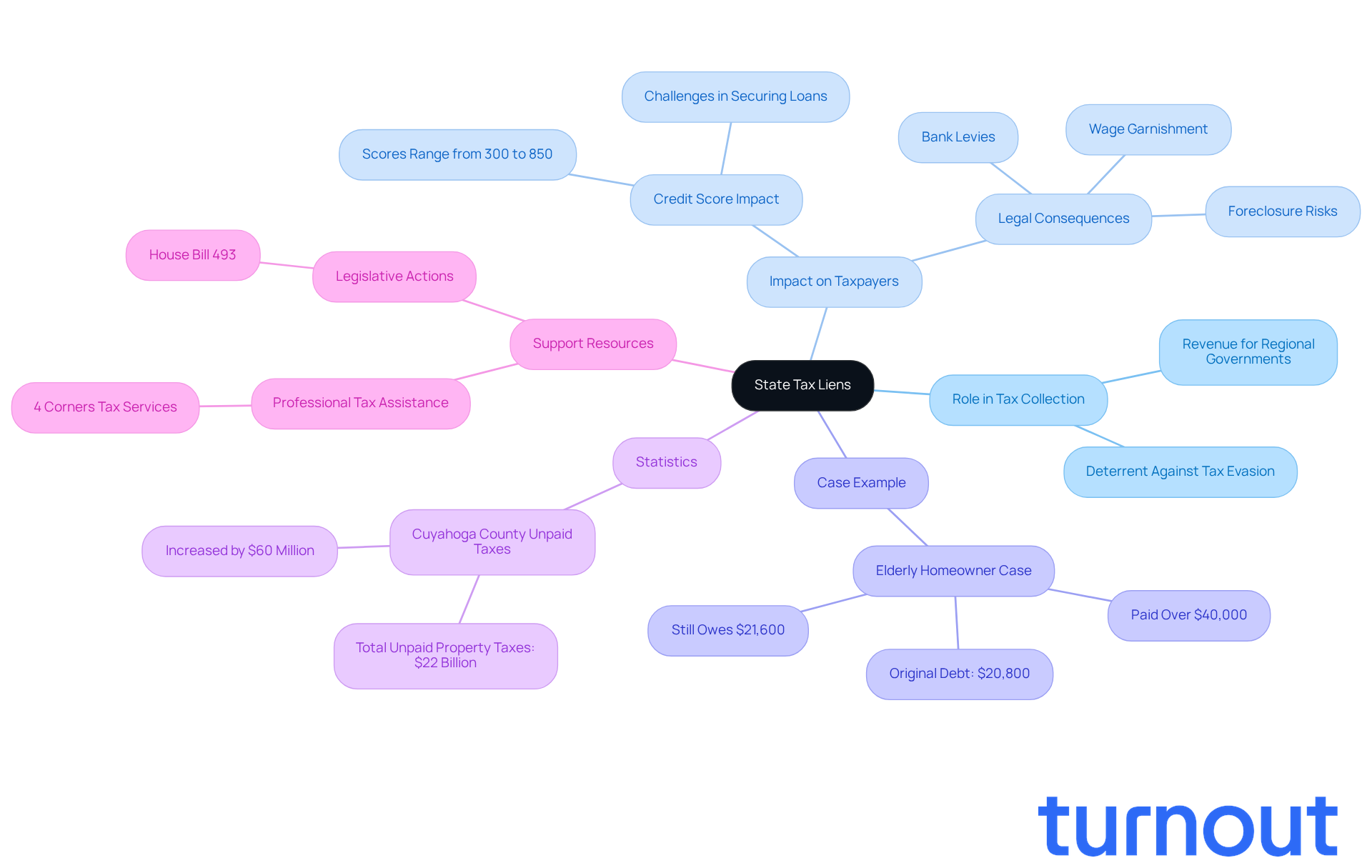

Context and Importance of State Tax Liens

Provincial tax claims play a vital role in our tax collection system, acting as a lifeline for regional governments to secure necessary revenue. We understand that when individuals or businesses fall behind on their payments, it can feel overwhelming. The government has the right to impose a claim to protect its financial interests, which not only helps recover owed taxes but also serves as a deterrent against tax evasion.

For taxpayers, facing a claim can lead to serious repercussions. It can impact credit scores, complicate the sale or refinancing of real estate, and even lead to legal actions like wage garnishment or bank levies. Did you know that tax claims can significantly lower your credit score, which ranges from 300 to 850? This can make it challenging to secure loans or favorable interest rates.

Consider the case of an elderly homeowner in Ashtabula County. Initially owing $20,800 in real estate dues, they ended up paying over $40,000 to a debt collection agency, yet still faced foreclosure due to additional charges. This situation underscores the importance of understanding the implications of state tax lien meaning and seeking help to navigate these financial hurdles.

With a staggering $22 billion in property taxes left unpaid across America last year, and Cuyahoga County's unpaid property taxes soaring to $60 million more than the previous year, the scale of this issue is alarming. Rep. Dave Thomas has voiced concerns about the predatory nature of tax practices, highlighting the ethical implications for vulnerable homeowners.

It's crucial for individuals managing their financial obligations to grasp the context of regional tax encumbrances. Remember, you are not alone in this journey. We’re here to help you overcome these administrative challenges and find a way forward.

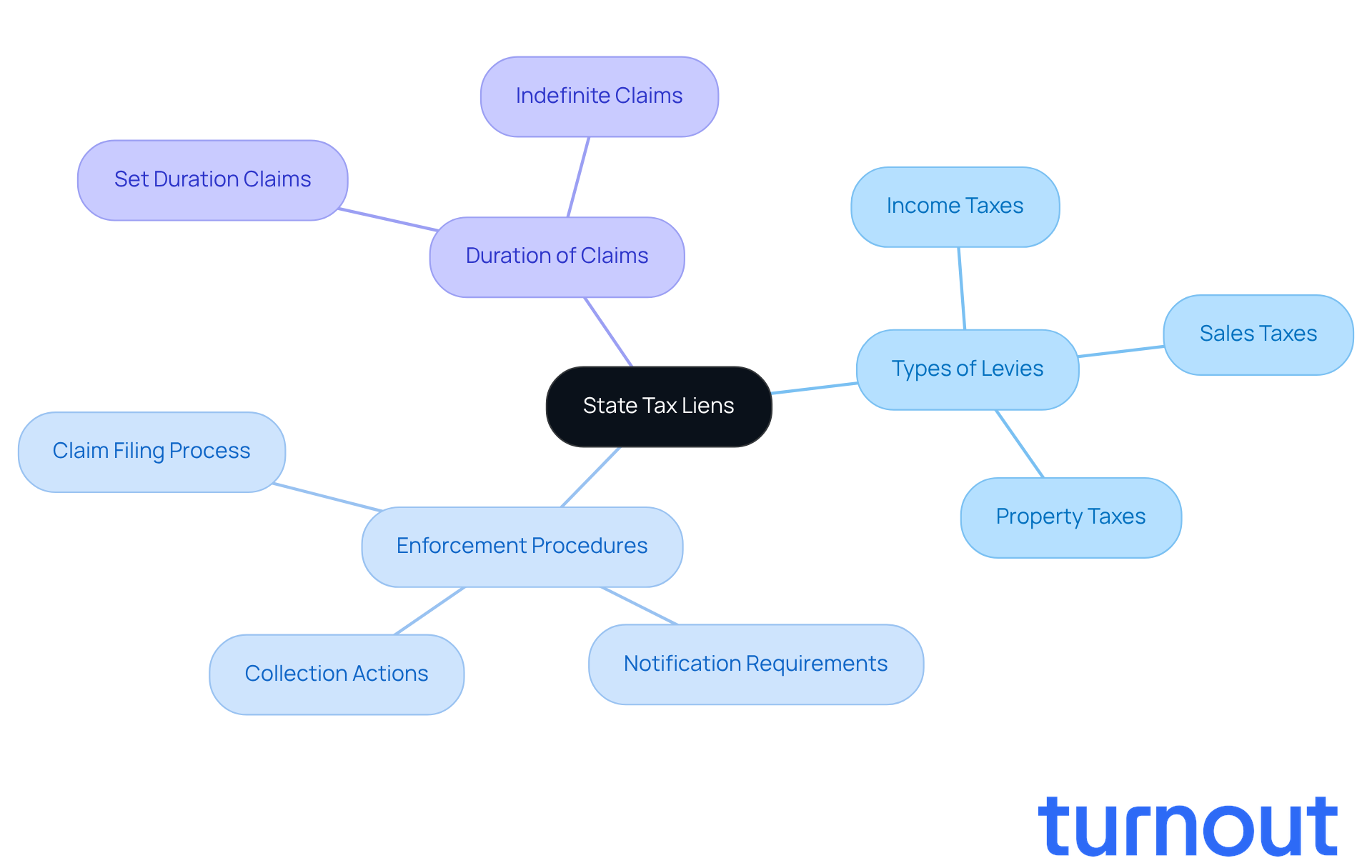

Characteristics and Variations of State Tax Liens

Navigating state financial claims can be overwhelming, and we understand that. These claims can vary widely in their attributes, from the types of levies that may lead to a claim to the specific procedures for enforcement. For instance, some regions enforce claims for unpaid income taxes, sales taxes, or property taxes, while others have different criteria.

It's also important to note that the duration of a claim can differ. In some areas, a claim might last for a set number of years unless renewed, while in others, it could remain in effect indefinitely until the obligation is settled.

Understanding these variations is crucial for you as a taxpayer. They can significantly influence your strategies for resolving tax debts and the potential consequences of non-compliance. Remember, you are not alone in this journey, and we're here to help you navigate these complexities.

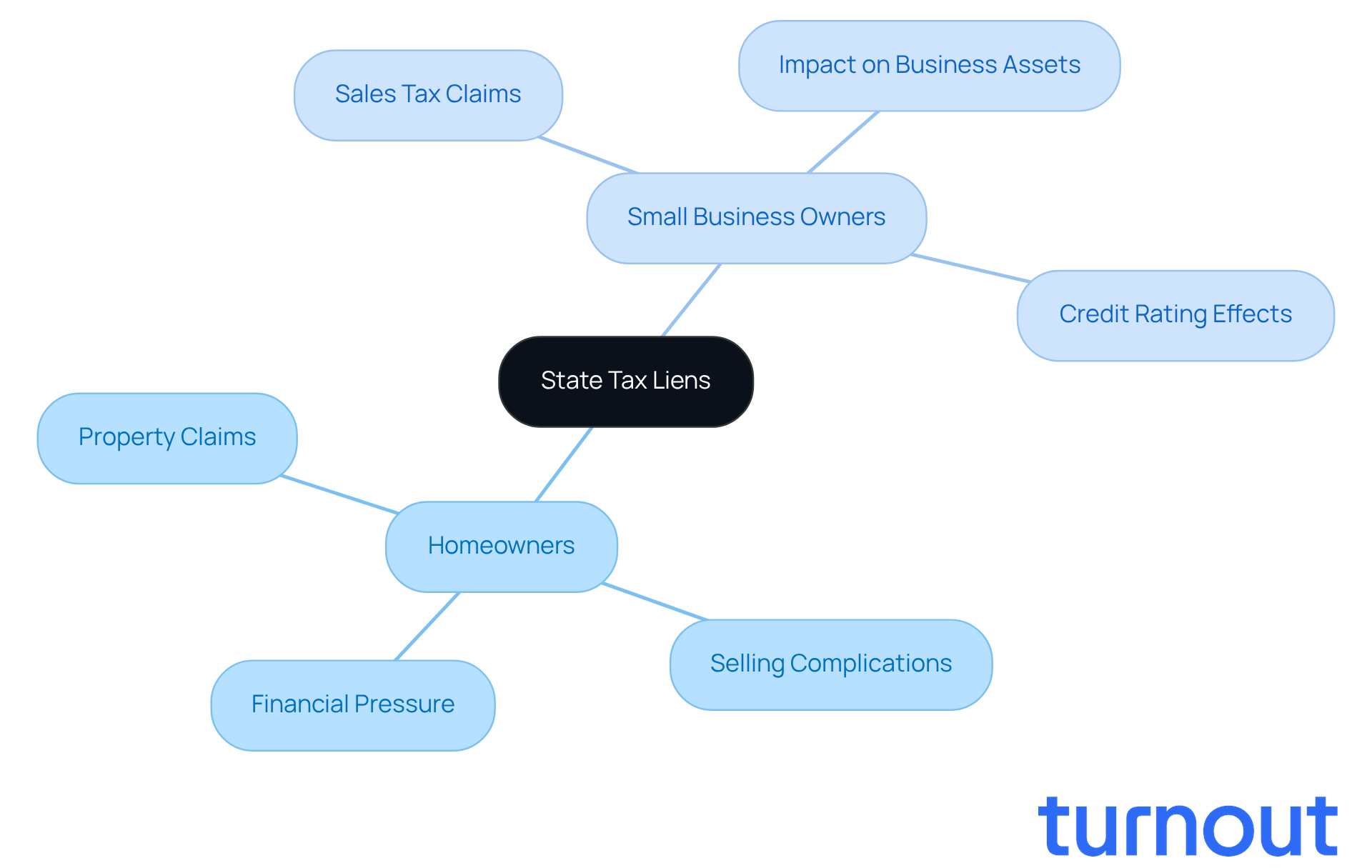

Examples and Real-World Implications of State Tax Liens

The real-world consequences of state tax claims can be overwhelming. We understand that homeowners who don’t settle property dues may find a claim placed on their residence. This can complicate efforts to sell or refinance the property, leading to significant financial pressure. The claim must be resolved before any transaction can proceed, which can feel daunting.

Similarly, small business owners who overlook paying sales taxes may face claims that burden their business assets. This situation can also negatively impact their personal credit ratings. It’s common to feel anxious about how these claims can hinder your ability to secure loans or attract investors, ultimately putting your business at risk.

These examples highlight the far-reaching consequences of the state tax lien meaning. They underscore the critical need for timely tax payments. Moreover, they illustrate the importance of having effective advocacy and support systems in place for individuals navigating these challenges.

By understanding these implications, you can take proactive steps to manage your tax obligations. Remember, you are not alone in this journey. We’re here to help you protect your financial future.

Conclusion

Understanding state tax liens is crucial for protecting your financial well-being. These governmental claims can have a significant impact on both personal and business assets, which is why addressing tax obligations promptly is so important. By learning how state tax liens work, you can navigate your financial responsibilities more effectively and steer clear of the serious consequences that can come from ignoring them.

We understand that dealing with state tax liens can feel overwhelming. These liens are a vital tool for governments to ensure taxes are paid, and they also serve as a deterrent against tax evasion. The different characteristics of these liens, including their duration and the types of debts they cover, can make things even more complicated for taxpayers. Real-life examples show just how severe the consequences of unpaid taxes can be, highlighting the need for proactive management and awareness of your financial obligations.

Ultimately, grasping the concept of state tax liens goes beyond mere compliance; it’s about empowering you to take charge of your financial future. By seeking help and staying informed about the legal and financial aspects of tax liens, you can protect yourself from the potential pitfalls these claims may bring. Remember, taking action now can lead to a more secure financial landscape and peace of mind in the long run. You're not alone in this journey, and we're here to help.

Frequently Asked Questions

What is a state tax lien?

A state tax lien is a governmental claim on your assets due to unpaid taxes, which allows the state to collect the owed taxes. This claim can affect all property within that jurisdiction, including real estate, vehicles, and other valuable assets.

How long does a state tax lien remain in effect?

A state tax lien remains in effect until the tax debt is fully settled, including any interest and penalties that may have accrued.

What are the consequences of a state tax lien?

A state tax lien can significantly impact your financial independence and flexibility, potentially hindering your ability to secure funding when needed.

Do state tax liens affect credit scores?

No, regional tax encumbrances no longer affect credit scores, which changes how these claims are perceived.

What should I do if I receive multiple notices regarding a state tax lien?

It is crucial to address your tax obligations promptly to avoid further complications related to the state tax lien.

Can I take legal action against a state tax lien?

Yes, if your rights have been violated, legal measures can be taken against the government to remove a tax claim.

How can I get help with a state tax lien?

There are resources available to help you navigate the challenges associated with state tax liens and find a way forward.