Overview

Navigating the world of Supplemental Security Income (SSI) benefits can be challenging, especially for those who may be feeling vulnerable. We understand that many individuals are seeking financial support during difficult times. To qualify for SSI benefits, it is essential to meet certain requirements: you must be aged 65 or older, blind, or disabled, and adhere to specific income and resource limits.

The eligibility criteria include important details such as income caps and resource thresholds. These guidelines are in place to ensure that assistance reaches those who need it most. It’s common to feel overwhelmed by the complexities of these requirements, but know that you are not alone in this journey.

The SSI program plays a crucial role in providing financial support to vulnerable populations, helping to alleviate some of the burdens faced by individuals and families. We’re here to help you understand these benefits and support you in your quest for assistance. Remember, you are not alone, and there are resources available to guide you through this process.

Introduction

Understanding the intricacies of Supplemental Security Income (SSI) can feel overwhelming. We recognize that many Americans are relying on this essential support, and that number is expected to grow. With over 68 million individuals anticipated to receive Social Security benefits by 2025, grasping the eligibility requirements for SSI is crucial for those facing financial hardships.

What challenges do potential beneficiaries encounter in meeting these criteria? It's common to feel uncertain about how to secure the assistance you need. This article delves into the key requirements for SSI benefits, offering insights that empower you to take control of your financial future. Remember, you are not alone in this journey, and we’re here to help.

Define Supplemental Security Income (SSI)

Supplemental Security Income (SSI) is a federal assistance program managed by the Social Security Administration (SSA) that provides monthly cash payments to those with limited income and resources. This program is designed to support individuals who are aged (65 or older), blind, or disabled, ensuring they have the financial backing necessary to meet their basic needs. Unlike Social Security Disability Insurance (SSDI), SSI is not based on employment history but rather on financial necessity, making it accessible to a broader range of individuals who may not have a significant work record but still require support due to their circumstances.

As we look ahead to 2025, over 68 million Americans will be receiving , with many relying on SSI to navigate financial challenges. Starting in October 2025, eligible individuals will receive up to $1,450 each month, while couples can receive up to $2,900. This increase, driven by the , reflects the rising costs of living and aims to provide better . Additionally, individuals under the full retirement age in 2025 will have an earnings cap of $23,400, which is crucial for understanding SSI benefits eligibility.

Real-world examples highlight how SSI assists disabled individuals in covering essential expenses. For example, a single parent with a disability may depend on SSI payments to manage housing costs, food, and medical expenses, ensuring their family can maintain a basic standard of living. The SSA emphasizes that , including those who are blind or disabled, meet the , reinforcing the program's vital role in supporting vulnerable populations.

Payments are scheduled to be made on the first day of every month, a vital logistical detail for beneficiaries. Recent changes to the SSI program include transitioning to electronic payments, which aims to streamline the disbursement process and enhance accessibility for beneficiaries. As of September, approximately 390,000 Americans were still receiving paper checks, highlighting the shift in payment methods. As stated by the SSA, "Individuals who qualify for SSI are those over age 65 and the blind or disabled with little income and few resources will get ." This commitment to improving the program ensures that those who depend on SSI can receive their benefits efficiently and effectively.

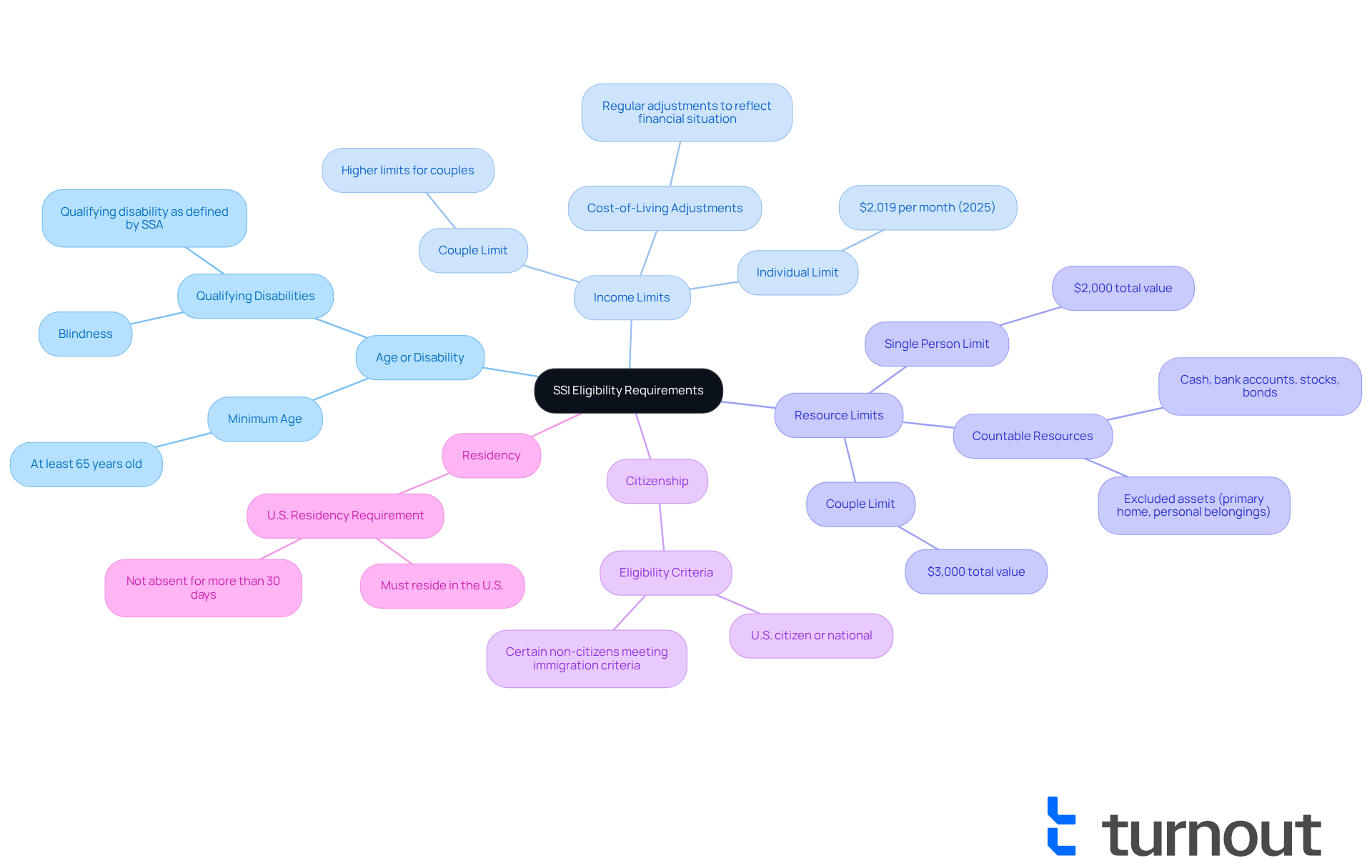

Outline SSI Eligibility Requirements

Navigating the world of can feel overwhelming, but is the first step towards securing the support you need. Let’s explore what you need to know:

- Age or Disability: You must be at least 65 years old, or you may qualify if you are blind or have a qualifying disability as defined by the SSA.

- Income Limits: As of 2025, the is $2,019 per month, with higher limits for couples. This figure is adjusted regularly to reflect cost-of-living increases, ensuring that benefits are relevant to your financial situation.

- Resource Limits: The should not exceed $2,000 for a single person or $3,000 for couples. Countable resources include cash, bank accounts, stocks, and bonds, while certain assets like your primary home and personal belongings are excluded.

- Citizenship: You must be a U.S. citizen, U.S. national, or a certain non-citizen meeting specific immigration criteria.

- Residency: It’s essential to reside in the United States and not be absent from the country for more than 30 days.

In 2025, the is expected to align closely with these limits, reflecting the financial realities many face. It’s common to feel anxious about meeting these thresholds, but many individuals successfully navigate the SSI income and resource limits through budgeting and resource management strategies.

Additionally, recent initiatives, like the one-time supplemental SSP payment of $600 authorized for SSI/SSP recipients in California, have provided crucial . We want you to know that understanding the [SSI benefits eligibility](https://myturnout.com/resources) requirements is vital in the context of available support. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Compare SSI with Other Disability Benefits

When considering disability benefits, it’s essential to understand the distinctions between and Insurance (SSDI). We recognize that can be overwhelming, and we're here to help you through it.

- Funding Source: SSI is funded by general tax revenues, while SSDI relies on payroll taxes collected from workers. The indicate that it is a needs-based program that does not require a work history, making it accessible to people with limited income and resources. Conversely, SSDI necessitates a sufficient work history and contributions to the Social Security system.

- Benefit Amounts: In 2025, the is $967 for individuals, whereas SSDI benefits are determined by the applicant's earnings record, often exceeding $1,500 per month.

- Process for SSI: The SSI procedure can be less intricate for individuals without a work history, whereas SSDI requests necessitate thorough documentation of work history and medical conditions. It's important to note that SSDI has a five-month waiting period following the disability onset date, whereas the the month after submission. Turnout's trained nonlawyer advocates provide unique support in navigating these processes effectively, distinguishing their assistance from traditional legal representation.

- Impact on Other Benefits: Individuals automatically qualify for Medicaid upon receiving SSI, which can significantly influence their overall support. In contrast, SSDI recipients typically qualify for Medicare after a 24-month waiting period.

Understanding these differences is essential for navigating the complexities of disability benefits effectively. Remember, you are not alone in this journey, and Turnout is here to guide you every step of the way.

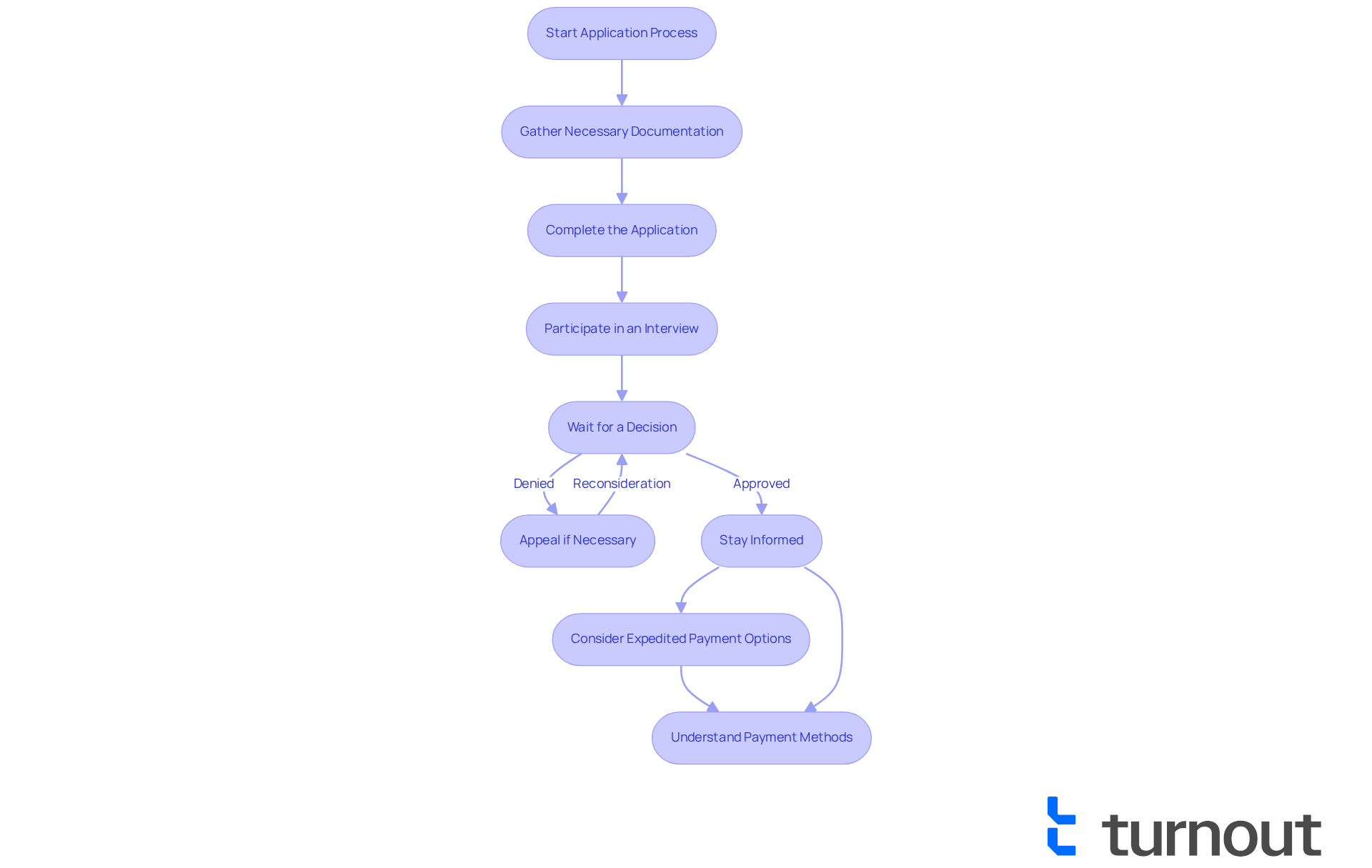

Understanding the Application Process for SSI

Navigating the application process for can feel overwhelming, but you are not alone. Here are some essential steps to guide you through this journey:

- Gather Necessary Documentation: Before applying, collect all required documents, including proof of income, resources, and medical records to support your . Remember, accurate documentation is crucial; incomplete or incorrect information can lead to delays or denials.

- Complete the Application: You can submit your application online via the SSA website, by phone, or in person at your local SSA office. Make sure all information is accurate and complete to avoid unnecessary setbacks. In 2022, the approval rate for initial requests was only 38%. This highlights the importance of diligence in your submission.

- Participate in an Interview: After submitting your request, you may need to attend an interview with an SSA representative. Be prepared to discuss your financial situation and health condition in detail, as this can significantly influence the outcome of your request.

- : The SSA will evaluate your request and make a determination. This process typically takes 3-5 months, but it can extend longer if additional information is needed. According to a 2020 Government Accountability Office study, the median wait time for a final decision on claims filed in 2015 was 839 days. Patience is key during this time.

- Appeal if Necessary: If your request is denied, remember that you have the right to contest the decision. The appeals process includes several stages, such as reconsideration and a hearing before an administrative law judge. Understanding this process can empower you to navigate potential setbacks effectively.

- Stay Informed: Throughout the process, keep track of your status and respond promptly to any requests for additional information from the SSA. Utilizing resources like the 'my Social Security' account can help you stay informed about your status and any necessary steps you may need to take.

- Consider Expedited Payment Options: If you are facing , be aware that the SSA offers expedited payment options for those in need. You may also be eligible for temporary benefits under presumptive disability or blindness while waiting for your claim review.

- : Once approved, SSI payments are typically made electronically through direct deposit or a Direct Express debit card, ensuring you receive your benefits efficiently.

By following these steps and being diligent in your preparation, you can enhance your chances of meeting the SSI benefits eligibility for a successful application. Remember, utilizing can provide valuable assistance through , helping you and ensuring you receive the support you need. We're here to help you every step of the way.

Conclusion

Understanding Supplemental Security Income (SSI) benefits eligibility is crucial for individuals seeking financial support due to age, blindness, or disability. This program provides essential assistance to those who may not have a strong employment history but need help to meet their basic living expenses. By grasping the key eligibility requirements and application processes, you can navigate the complexities of SSI with greater confidence and clarity.

We understand that delving into SSI can feel overwhelming. Throughout this article, we highlighted several critical aspects of SSI, including:

- Specific eligibility criteria based on age

- Income limits

- Resource restrictions

We also explored the distinctions between SSI and Social Security Disability Insurance (SSDI), emphasizing the unique benefits and application processes of each program. Real-world examples underscored the importance of SSI in offering financial relief to vulnerable populations, while recent updates to payment methods and support initiatives were discussed to enhance accessibility for recipients.

Ultimately, understanding SSI benefits eligibility is not just about meeting requirements; it is about empowering you to secure the support you deserve. As the landscape of financial assistance evolves, staying informed about eligibility criteria and available resources is essential. Remember, you are not alone in this journey. Seeking guidance and support can make a significant difference in achieving financial stability and peace of mind. We’re here to help you take the next steps toward a brighter future.

Frequently Asked Questions

What is Supplemental Security Income (SSI)?

Supplemental Security Income (SSI) is a federal assistance program managed by the Social Security Administration (SSA) that provides monthly cash payments to individuals with limited income and resources, specifically those who are aged (65 or older), blind, or disabled.

How does SSI differ from Social Security Disability Insurance (SSDI)?

Unlike SSDI, which is based on employment history, SSI is not contingent on work history but rather on financial necessity, making it accessible to a wider range of individuals who may not have a significant work record.

What are the monthly payment amounts for SSI in 2025?

Starting in October 2025, eligible individuals will receive up to $1,450 each month, while couples can receive up to $2,900.

What is the reason for the increase in SSI payments in 2025?

The increase in SSI payments is driven by the Cost-of-Living Adjustment (COLA), which reflects the rising costs of living to provide better financial support for those in need.

Is there an earnings cap for individuals under the full retirement age receiving SSI in 2025?

Yes, individuals under the full retirement age in 2025 will have an earnings cap of $23,400, which is important for understanding SSI benefits eligibility.

How does SSI assist disabled individuals in real-life situations?

SSI helps disabled individuals cover essential expenses, such as housing costs, food, and medical expenses, ensuring they can maintain a basic standard of living.

When are SSI payments scheduled to be made?

SSI payments are scheduled to be made on the first day of every month.

What recent changes have been made to the SSI payment process?

The SSI program has transitioned to electronic payments to streamline the disbursement process and enhance accessibility for beneficiaries.

How many Americans were still receiving paper checks for SSI as of September?

As of September, approximately 390,000 Americans were still receiving paper checks for SSI.

Who qualifies for SSI benefits?

Individuals who qualify for SSI are those over age 65 and those who are blind or disabled with little income and few resources.