Introduction

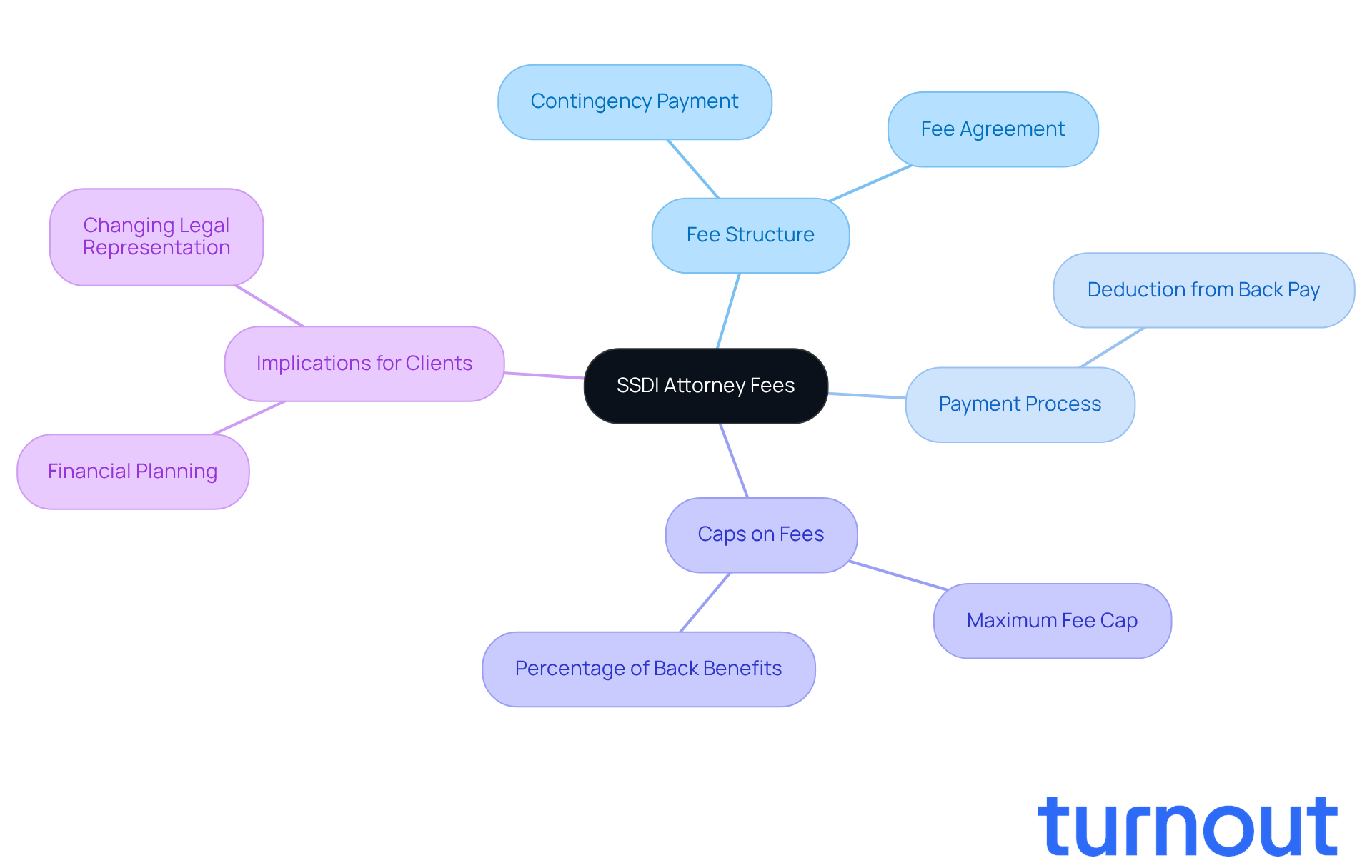

Navigating the world of SSDI attorney fees can feel overwhelming, especially when you're already facing challenges in your life. Understanding these fees is crucial for anyone embarking on the Social Security Disability Insurance claims journey. Typically structured as contingency payments, these fees ensure that you can access legal assistance without any upfront costs. This approach offers peace of mind during financially tough times.

However, with various fee structures and factors influencing costs, it’s common to feel uncertain. How can you effectively navigate this complex landscape? We’re here to help you make informed decisions about your legal representation. Remember, you are not alone in this journey.

Define SSDI Attorney Fees: What They Are and Why They Matter

Understanding SSDI attorney fees is essential for anyone navigating the Social Security Disability Insurance claims process. These costs, often referred to as SSDI attorney fees, typically arise from hiring a lawyer to assist with your claim, and they’re often structured as a contingency payment. This means your lawyer only gets paid if you win your case, which can be a relief when you're already facing financial challenges.

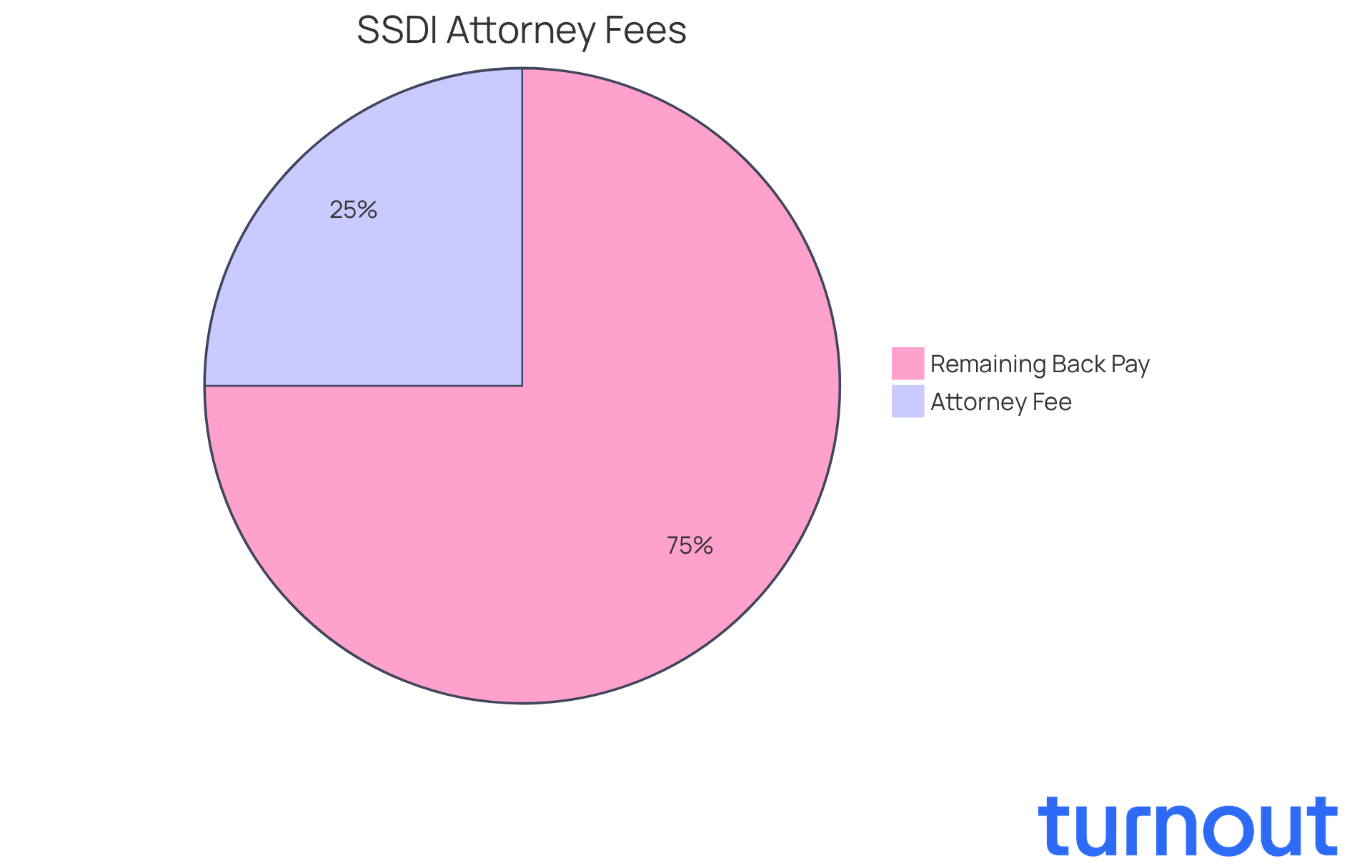

The SSDI attorney fees are capped at 25% of the past-due benefits you receive, with a maximum limit of $9,200 set by the Social Security Administration (SSA). To ensure transparency, you or your legal guardian must sign a fee agreement. We understand that SSDI attorney fees can feel overwhelming, but knowing how they work can help you plan your finances better and make legal support more affordable.

For instance, if your claim is approved, the SSA will deduct the lawyer's fee from your back pay and send the rest to you. This system is designed to make legal assistance accessible without requiring upfront costs, which includes SSDI attorney fees. If you ever need to change your legal representative, rest assured that the overall fee limit applies to all lawyers involved, protecting you from excessive expenses.

Having a clear understanding of these costs empowers you to make informed decisions about your legal representation. At Turnout, we’re here to help. Our trained nonlawyer advocates are dedicated to guiding you through the SSD claims process, ensuring you receive the support you need without the burden of traditional legal fees. Remember, you are not alone in this journey.

Explore Fee Structures: Types of SSDI Attorney Fees Explained

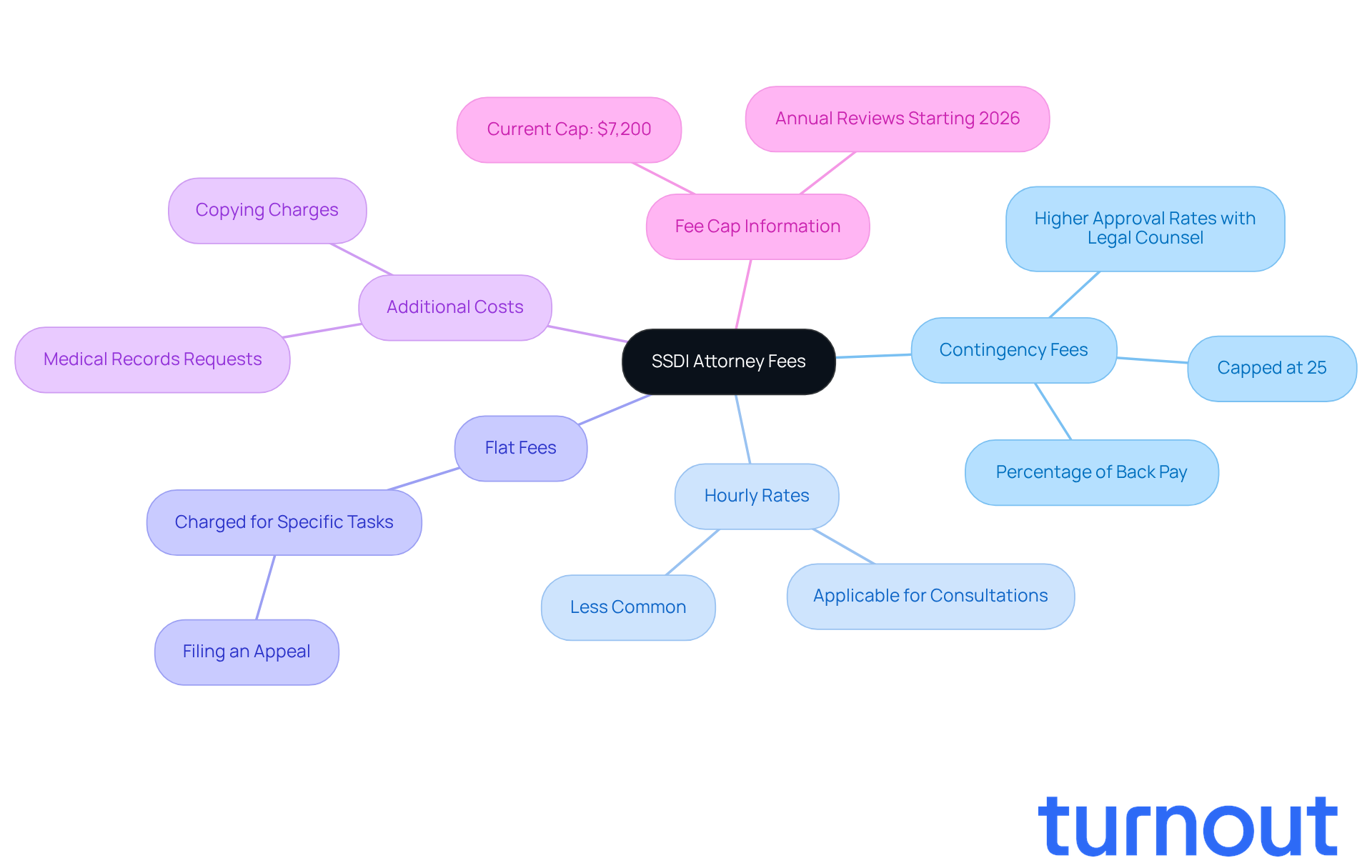

Navigating ssdi attorney fees can feel overwhelming, but having a clear understanding of your options can make a significant difference. There are several types of fees to consider:

- Contingency fees

- Hourly rates

- Flat fees

The most common arrangement for ssdi attorney fees is the contingency fee, where your lawyer receives a percentage of the back pay granted to you, typically capped at 25%. This setup aligns your lawyer's interests with yours, as they only get paid if your claim is successful.

It's important to know that applicants with legal counsel often have higher approval rates, especially during the appeal process. This highlights the value of having a lawyer by your side. However, if you're looking for a more affordable option, Turnout offers trained nonlawyer advocates for SSD claims. These advocates provide valuable assistance without the costs associated with traditional lawyers, making the process more accessible for you.

While hourly rates are less common in SSDI cases, they may apply in certain situations, particularly for consultations or additional legal services. Flat fees might also be charged for specific tasks, like filing an appeal. Understanding the ssdi attorney fees structures can help you choose the right support based on your financial situation and the complexity of your case.

Remember, it's crucial to file for benefits promptly if you expect to be out of work for a year or more. Delays can impact your claims. Additionally, while legal costs are usually deducted from back pay, there may be minor expenses related to the SSD claim process, such as requests for medical records and copying charges.

In 2022, the SSA increased the fee limit to $7,200, with yearly evaluations starting in 2026 to account for cost-of-living adjustments. This ensures steady expectations for both claimants and legal representatives. We're here to help you through this journey, and you are not alone.

Identify Factors Affecting SSDI Attorney Fees: What Influences Costs?

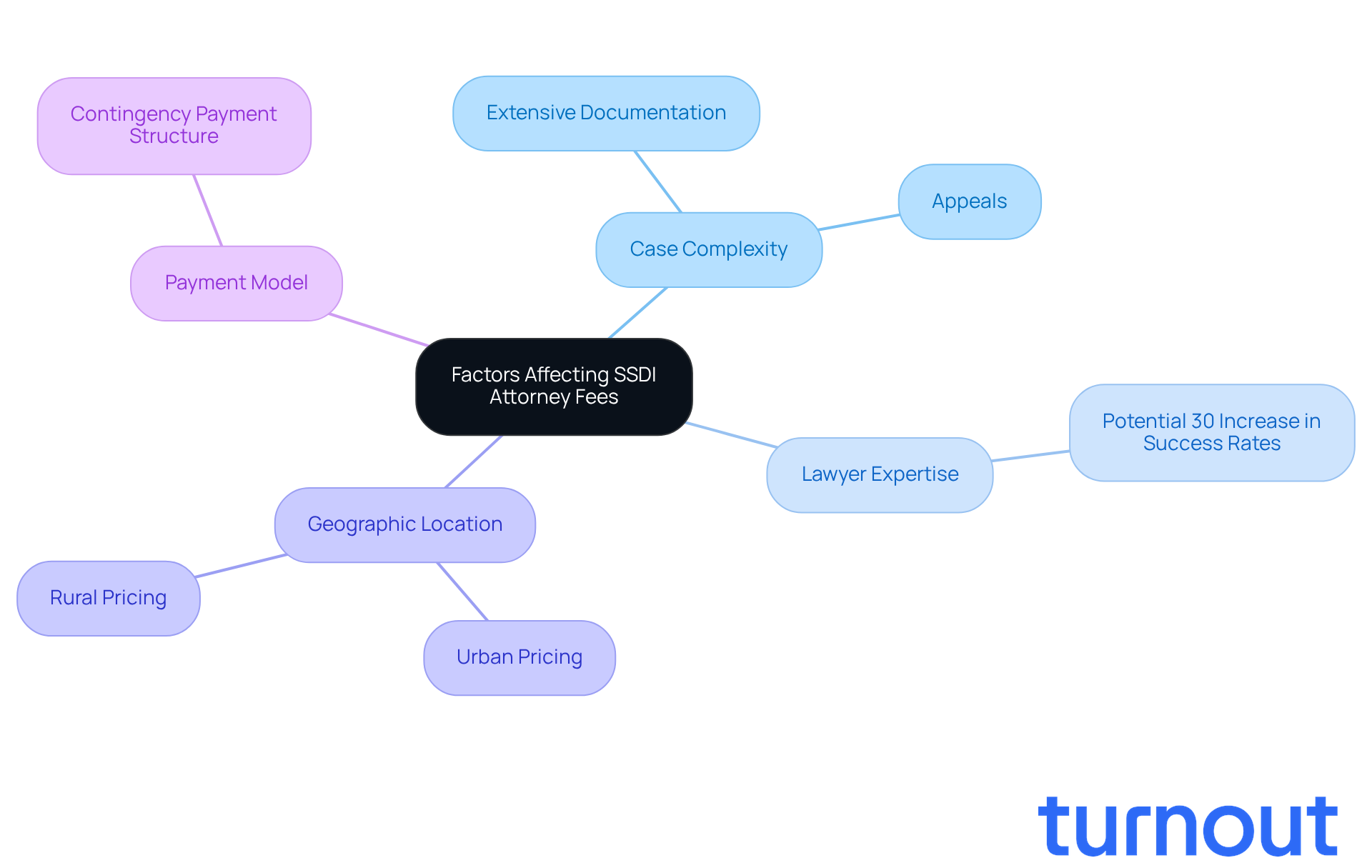

Navigating SSDI attorney fees can feel overwhelming. We understand that multiple factors come into play, such as the complexity of your case, the expertise of your lawyer, and even where you live. Complex cases, like those needing extensive documentation or appeals, often lead to higher fees. This is because they require more time and effort to prepare thoroughly. For instance, if your case is particularly intricate, your legal representative's fees might reflect the extra work involved, potentially reaching up to $9,200 if significant overdue benefits are at stake. Remember, this cap applies to all legal representatives who worked on your case combined.

It's also important to consider that lawyers with specialized knowledge in disability claims may charge higher fees. Their expertise can greatly enhance your chances of a successful outcome. In fact, statistics show that hiring an experienced lawyer can boost your chances of securing SSDI and SSI benefits by as much as 30%. As the American Disability Action Group highlights, seasoned legal professionals offer invaluable insights and help prepare you to be a compelling witness during hearings, significantly improving your chances of obtaining benefits.

Your geographic location plays a crucial role in determining legal fees as well. Lawyers in urban areas may have different pricing compared to those in rural regions, reflecting local market conditions. Understanding these factors can empower you to make informed decisions when selecting legal representation and help you anticipate the potential costs associated with your disability claims, such as SSDI attorney fees.

Lastly, it's comforting to know that under the contingency payment model, you only pay legal costs if you win your case. This reduces financial pressure and makes legal representation more accessible. Remember, you are not alone in this journey; we're here to help you every step of the way.

Review Typical SSDI Attorney Fees: Examples and Additional Costs

We understand that navigating the world of SSDI attorney fees can feel overwhelming. Typically, SSDI attorney fees are capped at 25% of the past-due benefits granted, with a maximum fee of $9,200 starting in 2025. For example, if you receive $40,000 in back pay, your legal fee would be capped at $9,200. On the other hand, if your back pay totals $10,000, the lawyer would earn $2,500.

But here’s the good news: Turnout is here to support you with SSD claims through trained nonlawyer advocates. This means you can navigate the claims process without the burden of standard legal costs. We want you to feel empowered and informed every step of the way.

It's also important to be aware of potential extra expenses that may arise during the claims process. These can include costs for obtaining medical records, filing fees, and other administrative expenses. We make sure to discuss these additional costs with you upfront, ensuring transparency and clarity.

Looking ahead, starting in 2026, the SSA will review the attorney fee cap annually. This allows for adjustments that reflect the Cost-of-Living Adjustment (COLA), helping to prevent long delays between updates. Understanding SSDI attorney fees along with typical fees and potential additional costs is crucial for budgeting effectively. Remember, you are not alone in this journey, and we’re here to help you prepare for the financial implications of your SSDI claims.

Conclusion

Understanding SSDI attorney fees is essential for anyone starting the Social Security Disability Insurance claims process. We know that navigating this journey can be overwhelming, and these fees are crucial in making legal assistance accessible when you need it most. This allows you to focus on your health and well-being without the stress of upfront costs. The structured fee system, primarily based on a contingency model, provides a safety net that aligns your interests with those of your attorney.

Throughout this article, we’ve highlighted the different types of SSDI attorney fees, including:

- Contingency fees

- Hourly rates

- Flat fees

It’s important to grasp these structures, as factors like the complexity of your case, the attorney's expertise, and your geographic location can significantly influence overall costs. Additionally, be aware that there may be extra expenses during the claims process, which underscores the need for thorough financial planning.

Being informed about SSDI attorney fees empowers you to make educated decisions regarding your legal representation. It can also ease some of the financial stress that often accompanies the claims process. Remember, you don’t have to navigate this path alone. Seeking support from knowledgeable advocates can guide you through this journey, ensuring you’re well-prepared for the financial implications of your SSDI claims.

We’re here to help you every step of the way. You are not alone in this journey; there are resources available to assist you.

Frequently Asked Questions

What are SSDI attorney fees?

SSDI attorney fees are costs associated with hiring a lawyer to assist with your Social Security Disability Insurance claims process. They are often structured as a contingency payment, meaning the lawyer only gets paid if you win your case.

How are SSDI attorney fees structured?

SSDI attorney fees are typically structured as a contingency payment, capped at 25% of the past-due benefits you receive, with a maximum limit of $9,200 set by the Social Security Administration (SSA).

Do I need to pay SSDI attorney fees upfront?

No, SSDI attorney fees do not require upfront payments. If your claim is approved, the SSA will deduct the lawyer's fee from your back pay and send the remaining amount to you.

What is a fee agreement in the context of SSDI attorney fees?

A fee agreement is a document that you or your legal guardian must sign to ensure transparency regarding the attorney's fees associated with your case.

What happens if I need to change my legal representative?

If you change your legal representative, the overall fee limit still applies to all lawyers involved, protecting you from excessive expenses.

How can understanding SSDI attorney fees help me?

Having a clear understanding of SSDI attorney fees empowers you to make informed decisions about your legal representation and helps you plan your finances better.

What support does Turnout offer for SSDI claims?

Turnout provides trained nonlawyer advocates who guide you through the SSD claims process, ensuring you receive support without the burden of traditional legal fees.