Introduction

Understanding the complexities of Social Security Disability Insurance (SSDI) is crucial for many Americans facing long-term medical challenges. This federal program offers not just financial support but also guidance through the often confusing eligibility and benefit calculations.

We understand that navigating SSDI can feel overwhelming, especially with changes in benefit amounts and eligibility criteria on the horizon. You might be wondering: how can you ensure you receive the maximum benefits you deserve?

In this article, we’ll explore:

- How SSDI benefits are calculated

- The necessary documentation for your application

- Additional resources available to support you

Remember, you are not alone in this journey, and we’re here to help.

Define Social Security Disability Insurance (SSDI)

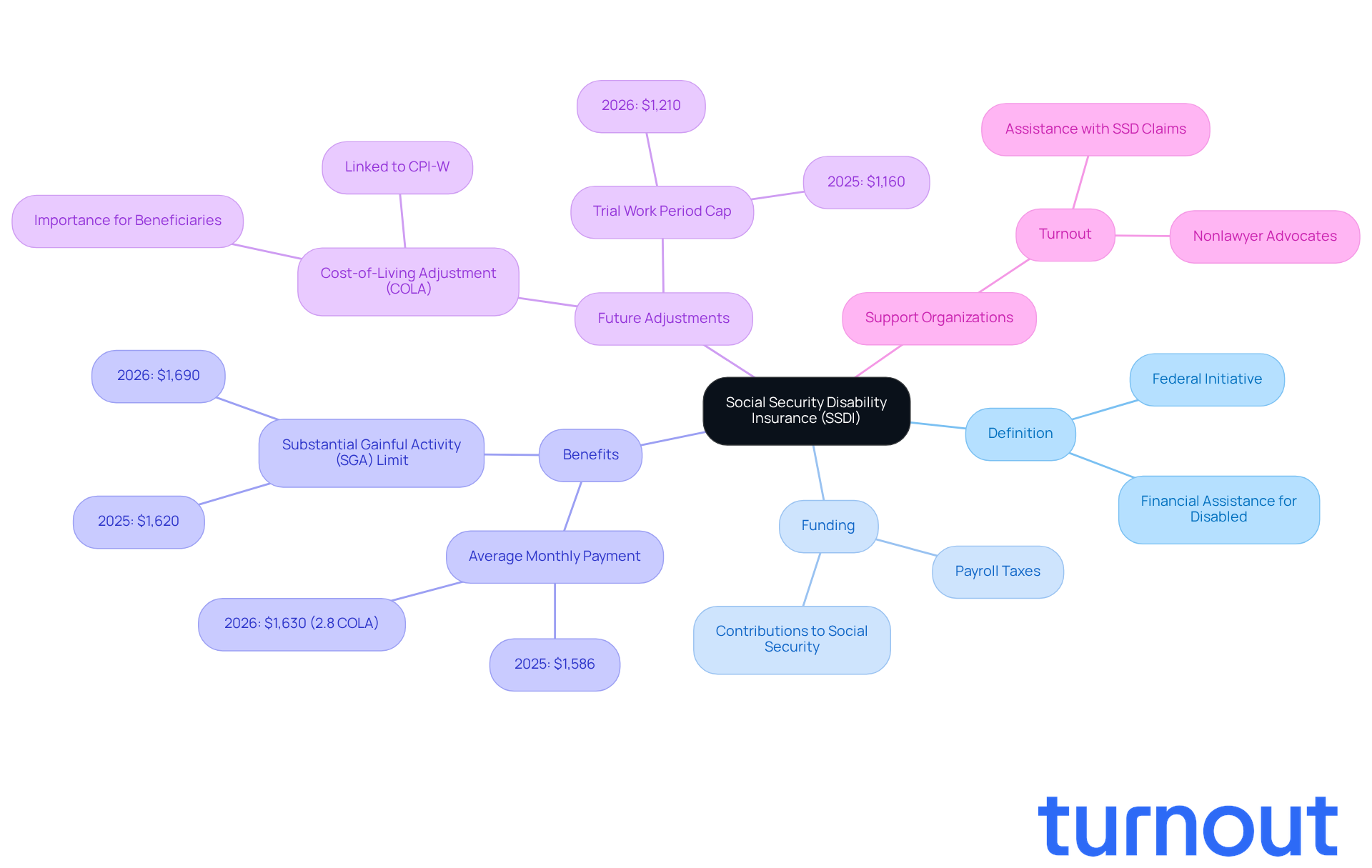

Social Insurance Disability Benefits is a vital federal initiative that offers financial assistance to those unable to work due to a medical condition expected to last at least a year or lead to death. Funded through payroll taxes, this program supports individuals who have contributed to the Social Security system and have become disabled. It aims to replace a portion of lost income, which is determined by the social security disability calculation of benefits, helping beneficiaries maintain a basic standard of living during their time away from work.

As of December 2023, over 8.7 million Americans rely on disability support, underscoring its crucial role in providing financial stability. In 2026, the average monthly disability payment is set to rise to $1,630, reflecting a 2.8% cost-of-living adjustment (COLA). This adjustment is designed to help beneficiaries manage rising living expenses. According to the Social Security Administration, "the annual cost-of-living adjustment is essential for ensuring that benefits reflect current economic realities." This is especially important for those who depend on SSDI to sustain their living standards amid inflation.

Additionally, the Substantial Gainful Activity (SGA) limit will increase from $1,620 to $1,690 per month in 2026, which will affect eligibility criteria for many applicants. We understand that navigating these changes can be overwhelming. That’s where organizations like Turnout come in. They provide access to trained nonlawyer advocates who assist clients in managing SSD claims, ensuring they receive the benefits they deserve without needing legal representation.

Financial specialists emphasize the importance of the social security disability calculation of benefits in protecting the economic welfare of disabled individuals. This program truly serves as an essential safety net within the American social support system. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Identify Eligibility Requirements for SSDI Benefits

Navigating the world of Social Security Disability Insurance (SSDI) can feel overwhelming, but understanding the eligibility criteria is a crucial first step. Here’s what you need to know:

-

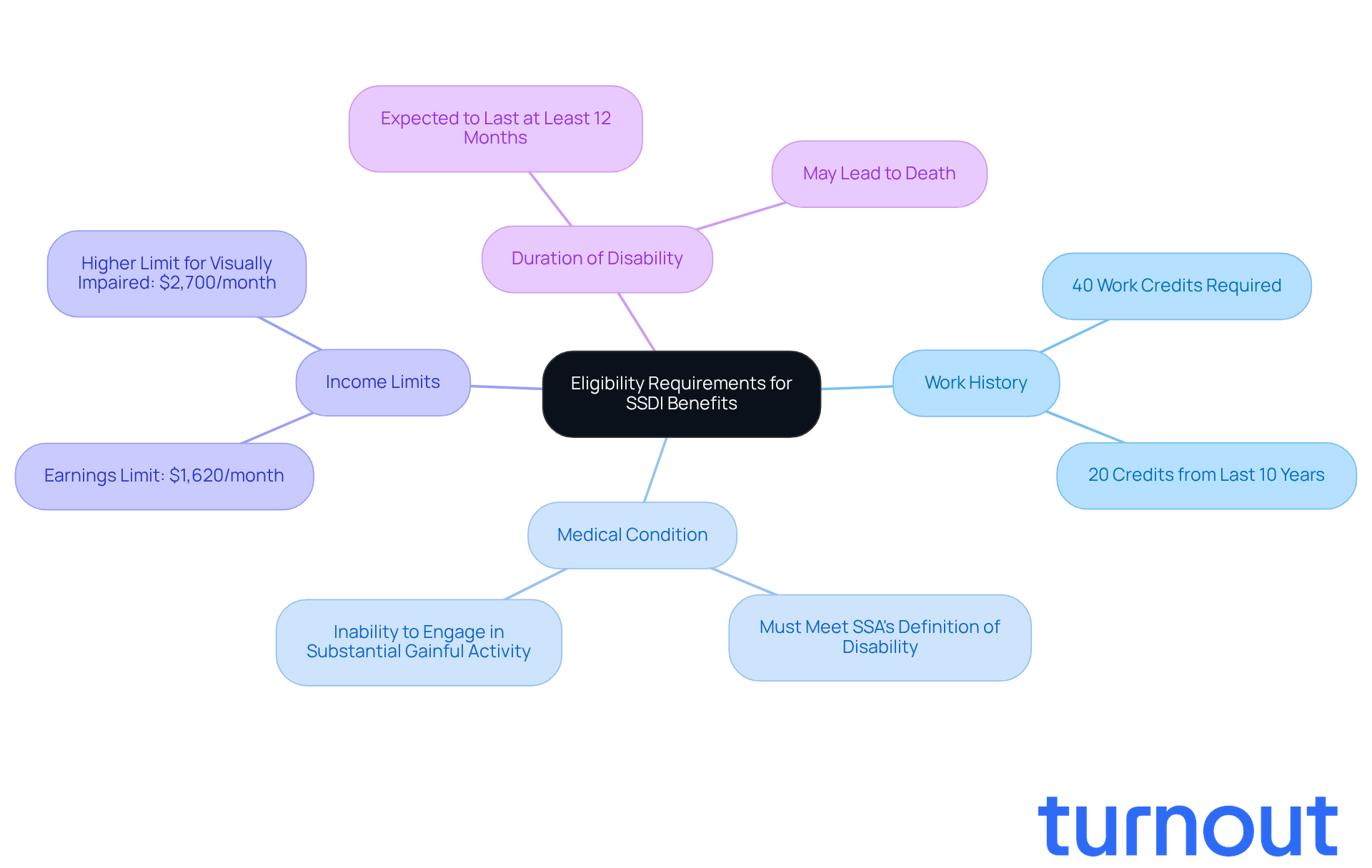

Work History: To qualify, you typically need to have worked in jobs covered by Social Insurance, earning at least 40 work credits-20 of which must be from the last 10 years before your disability began.

-

Medical Condition: It’s essential to show that your medical condition meets the Social Security Administration's (SSA) strict definition of disability. This means you’re unable to engage in substantial gainful activity (SGA) due to your condition.

-

Income Limits: In 2025, if your earnings exceed $1,620 per month (or $2,700 if you’re visually impaired), you may not qualify for assistance.

-

Duration of Disability: Your medical condition should be expected to last at least 12 months or lead to death.

As of July 2025, about 8.1 million individuals with disabilities are receiving SSDI benefits. This highlights just how important it is to understand these eligibility criteria. Many people seeking support meet the work history requirements, which are vital for receiving assistance.

It’s also worth noting that changes to disability benefits eligibility criteria in 2026 could impact applicants. Staying informed about your rights and available resources is essential. Remember, you’re not alone in this journey, and we’re here to help you every step of the way.

Explain How SSDI Benefits Are Calculated

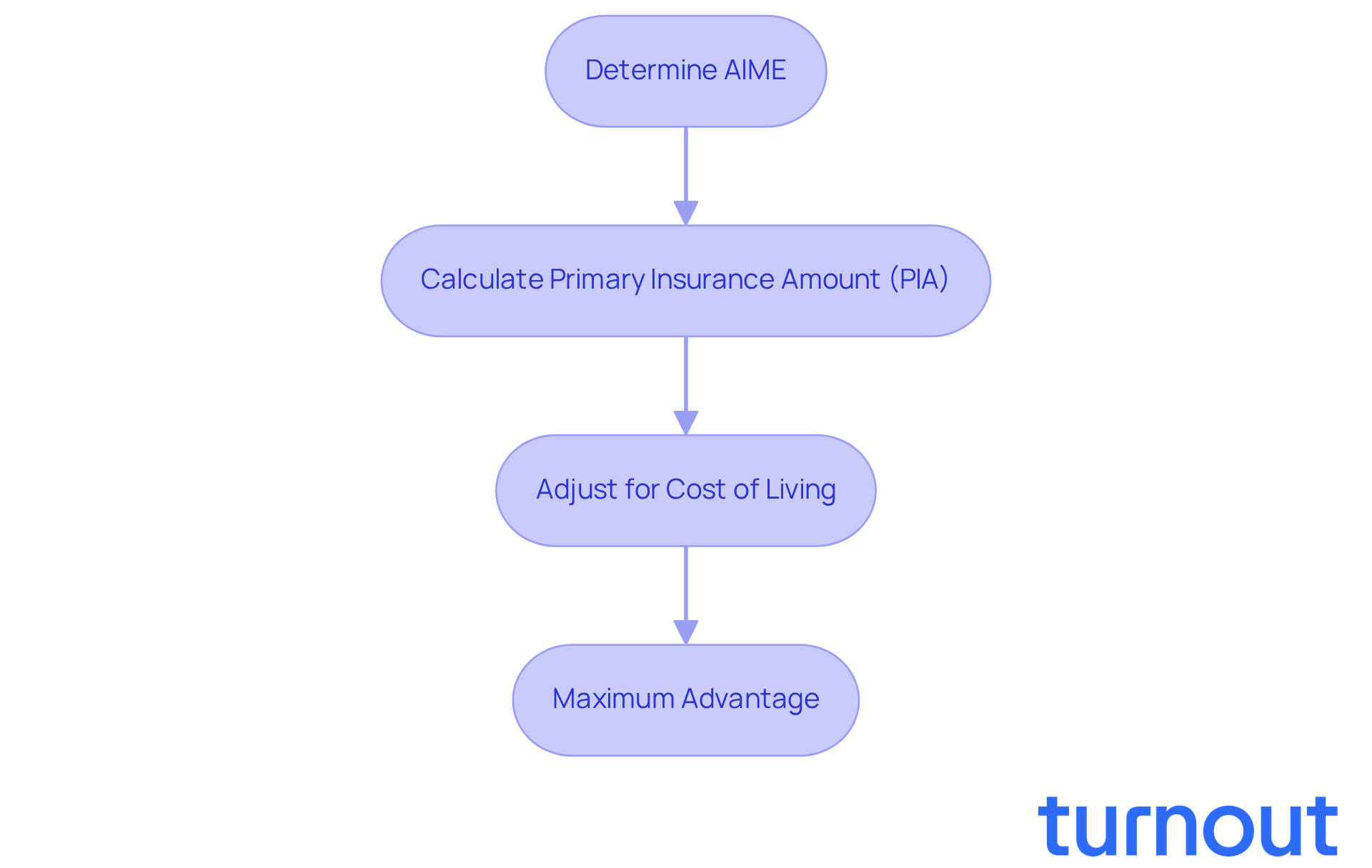

Understanding SSDI assistance can feel overwhelming, but we're here to help you navigate it. The social security disability calculation of benefits begins with determining your Average Indexed Monthly Earnings (AIME), which is crucial for your benefits.

-

Determine AIME: The Social Security Administration (SSA) looks at your highest-earning 35 years of work history. They adjust these earnings for inflation using the Average Wage Index (AWI), which for 2023 is $66,621.80. This figure will be used for workers eligible in 2025. By dividing the total earnings by the number of months in those years, you find your AIME.

-

Calculate Primary Insurance Amount (PIA): Your PIA is calculated using a formula that applies different percentages to portions of your AIME. For 2025, it works like this: 90% of the first $1,115 of AIME, 32% of the AIME over $1,115 and up to $6,721, and 15% of the AIME over $6,721. This structured approach ensures that your benefits reflect your earnings history.

-

Adjust for Cost of Living: It's common to feel concerned about maintaining your purchasing power. That's why benefits are adjusted annually based on cost-of-living adjustments (COLA). For 2026, disability payments will increase by 2.8%, raising the average monthly amount from $1,586 to $1,630.

-

Maximum Advantage: In 2025, the maximum monthly SSDI payment is around $4,018. However, most recipients typically receive between $1,200 and $1,600. This range highlights the variability in benefits based on personal earnings records.

Understanding the social security disability calculation of benefits is essential for making informed decisions regarding your financial future. Remember, you are not alone in this journey. At Turnout, we want to clarify that we are not a law firm and do not provide legal advice. Our trained nonlawyer advocates are here to assist you in understanding these calculations and guide you through the application process, ensuring you receive the benefits you deserve.

Outline Required Documentation for SSDI Application

Applying for Social Security Disability Insurance (SSDI) can feel overwhelming, but you’re not alone in this journey. To help ensure a smooth application process, it’s important to gather several key documents:

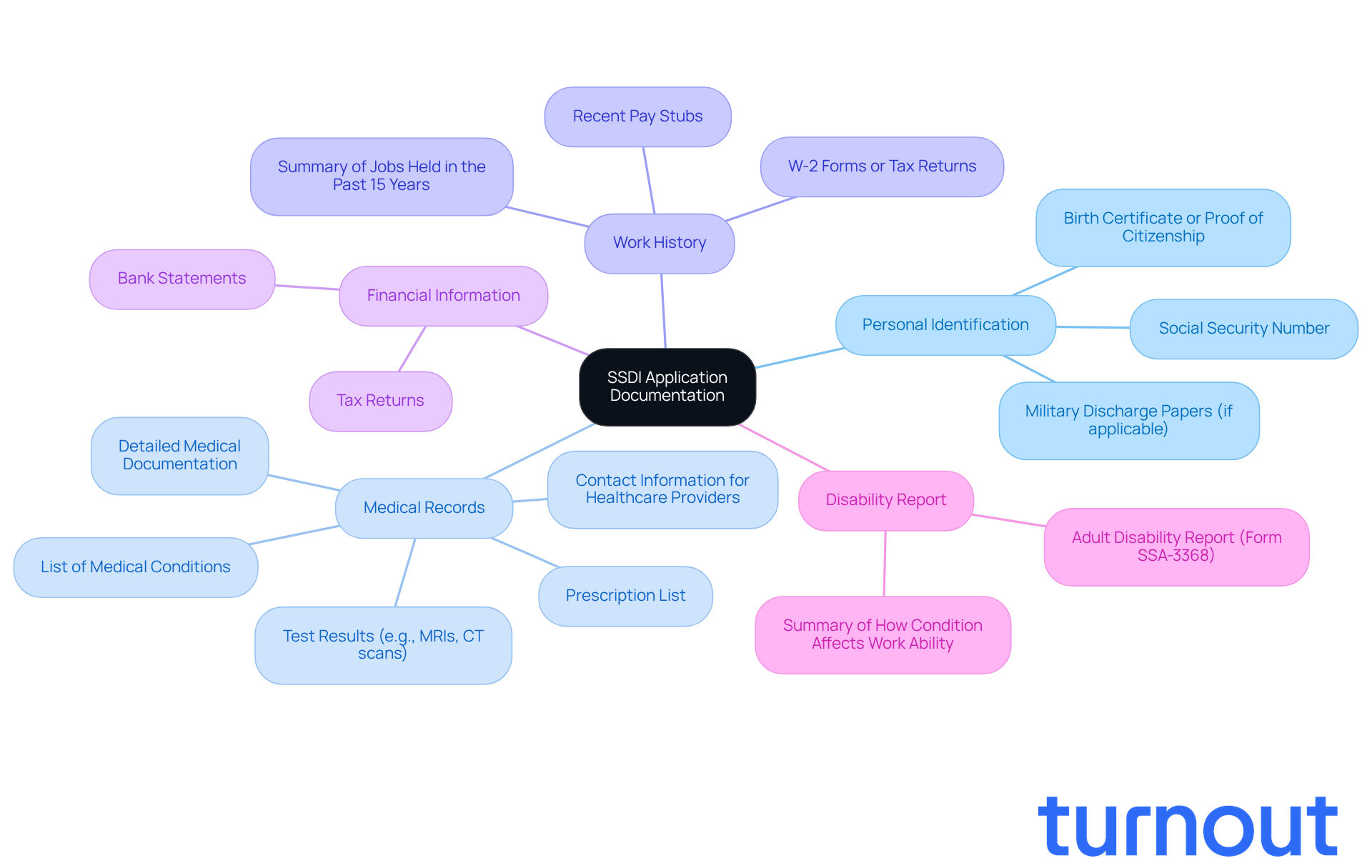

- Personal Identification: You’ll need to provide a birth certificate or proof of U.S. citizenship, along with your Social Security number. This verification is essential for establishing your eligibility.

- Medical Records: Comprehensive medical documentation is vital. This should include detailed records from your healthcare providers that outline your diagnosis, treatment history, and the limitations imposed by your disability. Thorough medical evidence significantly increases your chances of approval, as it demonstrates the seriousness of your condition.

- Work History: A complete work history for the past 15 years is required. This includes W-2 forms or self-employment tax returns, which help the Social Security Administration (SSA) evaluate your employment history and how your medical condition affects your ability to work.

- Financial Information: Documentation of your income and resources is necessary, including bank statements and tax returns. This information assists the SSA in assessing your financial situation, particularly for the social security disability calculation of benefits, especially if you’re also applying for Supplemental Security Income (SSI).

- Disability Report: Completing the Adult Disability Report (Form SSA-3368) is a critical step. This form provides detailed information about your condition and how it affects your ability to engage in substantial gainful activity (SGA).

It’s common to feel anxious about the application process, especially since statistics show that many disability claims are denied due to incomplete documentation. Just one missing document can delay your claim for months or even lead to outright rejection. That’s why it’s essential to ensure that all required paperwork is organized and submitted upfront. Remember, providing well-organized documents can significantly speed up the approval process and improve your chances of success. We’re here to help you navigate this process.

Explore Additional Benefits Available with SSDI

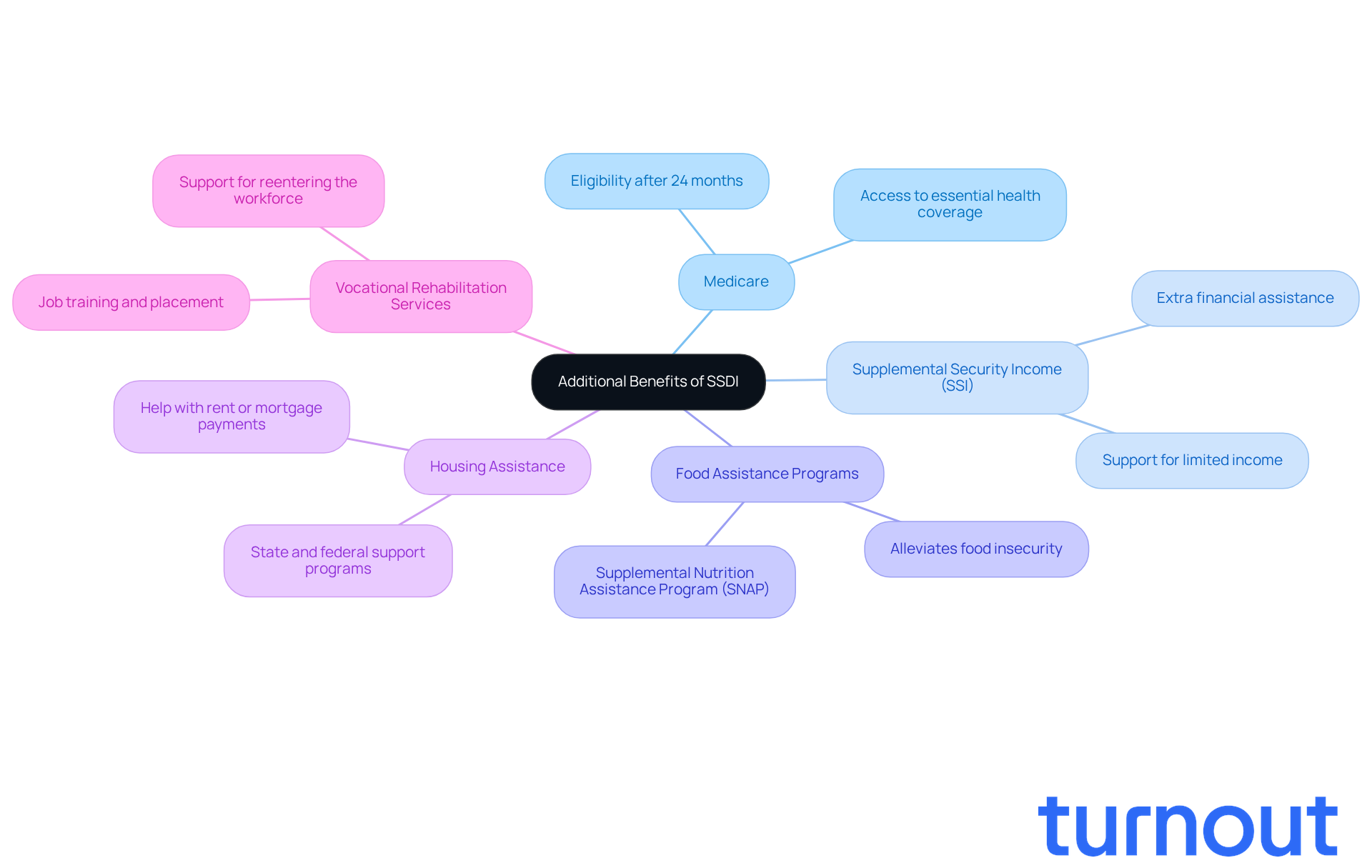

In addition to SSDI benefits, you may find that there are several additional programs available that can truly enhance your quality of life:

-

Medicare: After 24 months of receiving disability benefits, you automatically qualify for Medicare. This ensures you have access to essential health coverage. Healthcare professionals emphasize that timely access to medical services can significantly improve health outcomes for those with disabilities.

-

Supplemental Security Income (SSI): If you’re receiving Social Security Disability Insurance, you might also qualify for SSI. This program offers extra financial assistance for individuals with limited income and resources, which can be a lifeline during tough economic times.

-

Food Assistance Programs: Programs like the Supplemental Nutrition Assistance Program (SNAP) provide food benefits to disability beneficiaries. This support helps alleviate food insecurity and ensures you have access to nutritious meals.

-

Housing Assistance: There are various state and federal housing support programs designed to help with rent or mortgage payments. These resources can provide the stability and security you need as a disability benefit recipient.

-

Vocational Rehabilitation Services: These services are here to help you reenter the workforce. They offer training, job placement, and support services, empowering you to reclaim your independence and financial security.

We understand that navigating these additional advantages can feel overwhelming. That’s where Turnout comes in. They provide tax debt relief services and utilize trained nonlawyer advocates to guide you through the complexities of SSD claims and financial support options. It’s important to note that Turnout is not a law firm and does not provide legal representation.

It is crucial for SSDI recipients to understand the social security disability calculation of benefits. They can offer vital support in managing daily life and improving your overall well-being. Remember, you are not alone in this journey, and there are resources available to help you thrive.

Conclusion

Understanding the complexities of Social Security Disability Insurance (SSDI) is vital for anyone seeking financial support due to a disabling condition. This federal program not only offers monetary assistance but also acts as a crucial safety net for millions of Americans. By familiarizing yourself with how benefits are calculated, the eligibility requirements, and the necessary documentation, you can navigate the SSDI landscape more effectively, ensuring you receive the support you truly deserve.

Throughout this article, we've highlighted key aspects of SSDI, such as the significance of work history, how Average Indexed Monthly Earnings (AIME) are calculated, and the various benefits available beyond SSDI itself. It's important to be aware of adjustments for cost of living and the changes in eligibility criteria coming in 2026. These factors underscore the need for awareness and preparation. Additionally, understanding the required documentation can significantly streamline your application process, reducing the risk of delays or denials.

We understand that the journey toward securing SSDI benefits may feel overwhelming. However, it's crucial to remember that numerous resources and support systems are available to assist you. Engaging with organizations like Turnout can provide valuable guidance and advocacy throughout this process. By staying informed and proactive, you can better position yourself to access the financial relief and additional benefits that SSDI and related programs offer, ultimately enhancing your quality of life. Remember, you are not alone in this journey; we're here to help.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

SSDI is a federal program that provides financial assistance to individuals who are unable to work due to a medical condition expected to last at least a year or lead to death. It is funded through payroll taxes and aims to replace a portion of lost income for those who have contributed to the Social Security system.

How many Americans rely on SSDI?

As of December 2023, over 8.7 million Americans rely on disability support from SSDI, highlighting its importance in providing financial stability.

What is the average SSDI payment expected to be in 2026?

In 2026, the average monthly disability payment is projected to rise to $1,630, reflecting a 2.8% cost-of-living adjustment (COLA) to help beneficiaries manage rising living expenses.

What is the Substantial Gainful Activity (SGA) limit, and how will it change in 2026?

The SGA limit is the maximum amount an individual can earn while still qualifying for SSDI benefits. In 2026, this limit will increase from $1,620 to $1,690 per month.

What are the eligibility requirements for SSDI benefits?

To qualify for SSDI, you generally need to have:

- Worked in jobs covered by Social Security, earning at least 40 work credits (20 must be from the last 10 years before your disability began).

- A medical condition that meets the SSA's definition of disability, preventing you from engaging in substantial gainful activity (SGA).

- Earnings below the income limits, which are $1,620 per month (or $2,700 if visually impaired) as of 2025.

- A medical condition expected to last at least 12 months or lead to death.

How many individuals are currently receiving SSDI benefits?

As of July 2025, approximately 8.1 million individuals with disabilities are receiving SSDI benefits.

What resources are available for individuals navigating the SSDI application process?

Organizations like Turnout provide access to trained nonlawyer advocates who assist clients in managing SSD claims, ensuring they receive the benefits they deserve without needing legal representation.