Introduction

Understanding short-term disability benefits can feel overwhelming, especially when tax implications come into play. These benefits are meant to provide financial support during tough times, but the tax obligations can often catch you off guard. We understand that navigating this complex landscape can be stressful.

This article aims to guide you through the nuances of short-term disability taxes withheld. We want to help you understand your tax responsibilities and maximize your financial well-being. How can you avoid unexpected tax liabilities while receiving the support you need during challenging times? You're not alone in this journey, and we're here to help.

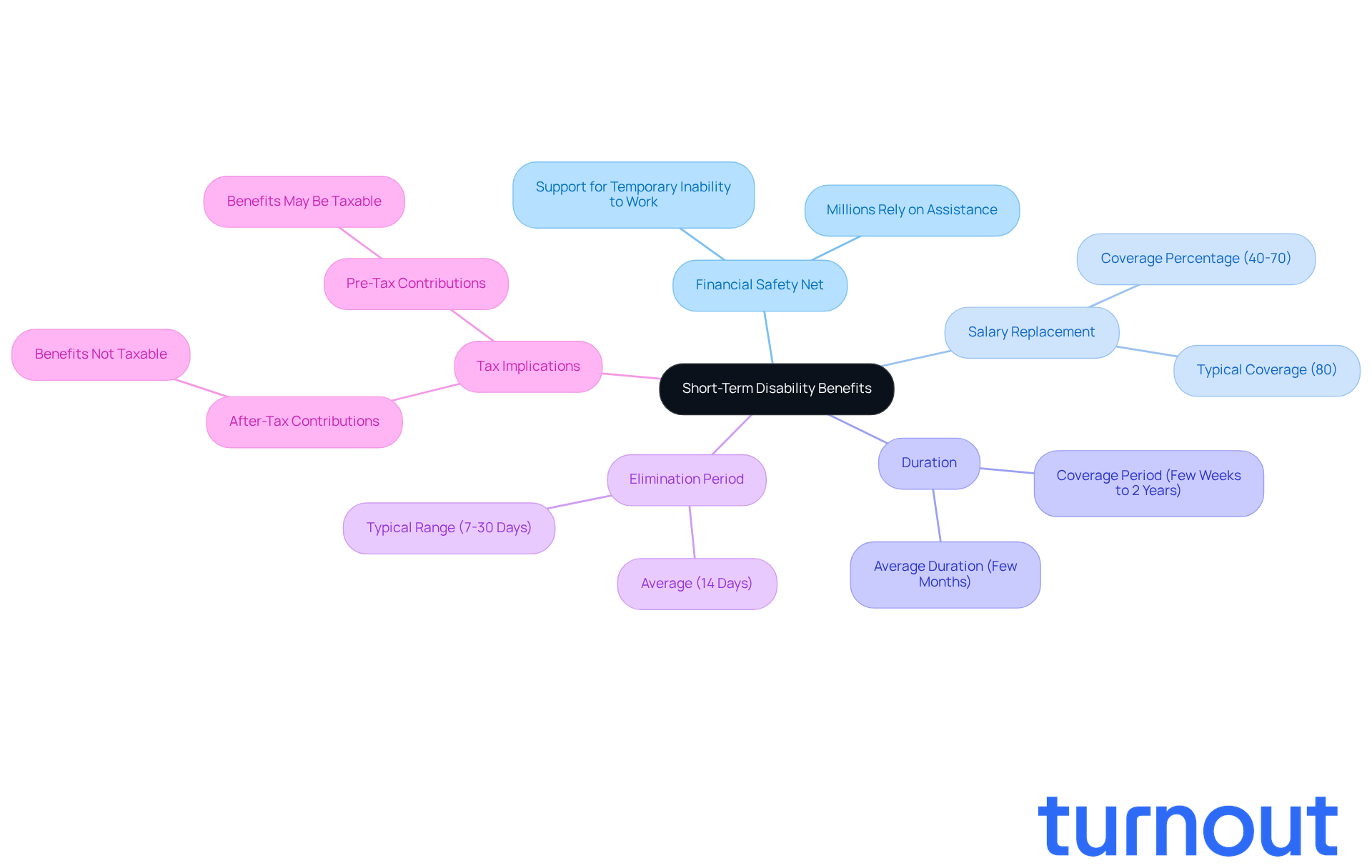

Define Short-Term Disability Benefits and Their Tax Implications

Short-term disability assistance serves as a vital financial safety net for those temporarily unable to work due to medical conditions, injuries, or illnesses. We understand that facing such challenges can be overwhelming. Typically, these benefits replace a portion of an employee's salary, covering between 40% and 70% for a limited duration. This period can range from a few weeks to several months, with an average often cited as a few months to two years, depending on the policy. The elimination period for these benefits usually spans from 7 to 30 days, with 14 days being the average.

It's important to recognize that the tax consequences of these benefits, particularly the short-term disability taxes withheld, depend greatly on how the contributions are financed. When payments are made with after-tax funds, the benefits received are generally not subject to taxation. However, if short-term disability taxes withheld are deducted from pre-tax income, the benefits may be taxable. This distinction is crucial for recipients to understand, as it directly impacts their overall tax liabilities, specifically regarding short-term disability taxes withheld.

For instance, if a worker receives temporary disability assistance after contributing funds with pre-tax money, they may face unexpected responsibilities related to short-term disability taxes withheld. On the other hand, those who have paid premiums with after-tax dollars can enjoy their benefits without additional tax burdens. Tax experts emphasize the importance of understanding these nuances to accurately report adjusted gross earnings, including how short-term disability taxes withheld can affect overall tax reporting and help avoid surprises during tax season. As one CPA pointed out, "Understanding the tax on benefits from disability policies can help you plan your finances more effectively and possibly reduce your income tax."

With millions of Americans relying on short-term disability support, grasping the tax implications is essential for effective financial management during tough times. We’re here to help individuals navigate these complexities, especially for those seeking Social Security Disability (SSD) claims and tax relief. You are not alone in this journey; we ensure you understand your options without the need for legal representation.

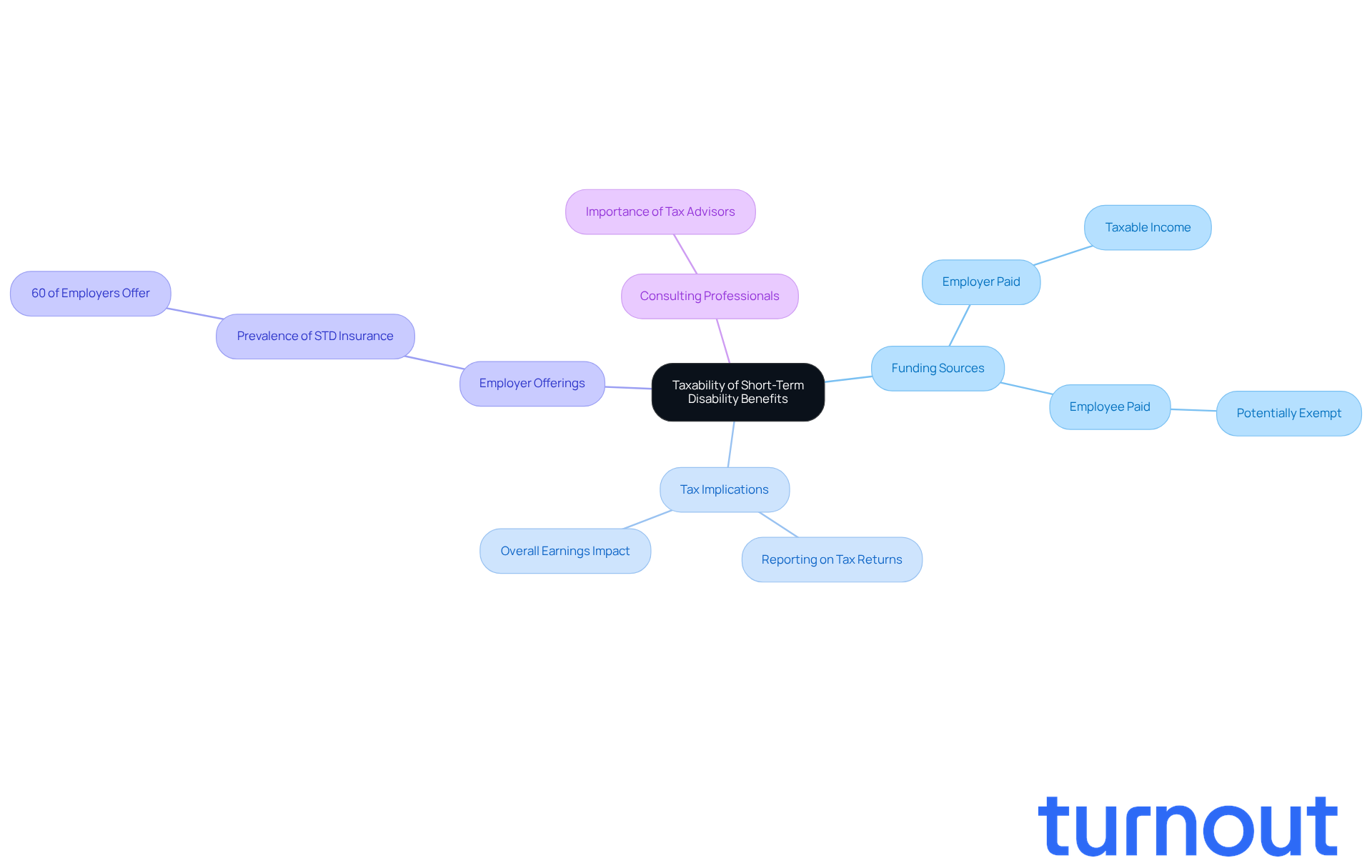

Explore Taxability of Short-Term Disability Benefits

Understanding the tax status of short-term disability taxes withheld can feel overwhelming, but we're here to help. The way these payments are taxed largely depends on how they are funded. If your employer covers the costs entirely, those benefits are usually considered taxable income. However, if you pay the premiums with after-tax dollars, you might find that those benefits are exempt from federal taxes, according to IRS guidelines.

It's essential to remember that these benefits, along with any short-term disability taxes withheld, must be included in your total earnings, which means you'll need to report them on your tax returns. Did you know that around 60% of employers offer short-term disability insurance? Often, it's part of a broader compensation package. This makes it crucial for you to understand the implications of short-term disability taxes withheld tied to your coverage.

If you file as an individual, you may face tax liabilities based on your overall earnings, which can affect how your benefits are taxed. We understand that navigating these details can be tricky, and that's why consulting with a tax professional is a wise step. They can help you understand your specific situation and ensure you're compliant with tax regulations. As one tax advisor wisely noted, "It's crucial to understand how your premiums were paid to determine your tax obligations accurately."

You're not alone in this journey. Seeking guidance can make a significant difference in managing your tax responsibilities.

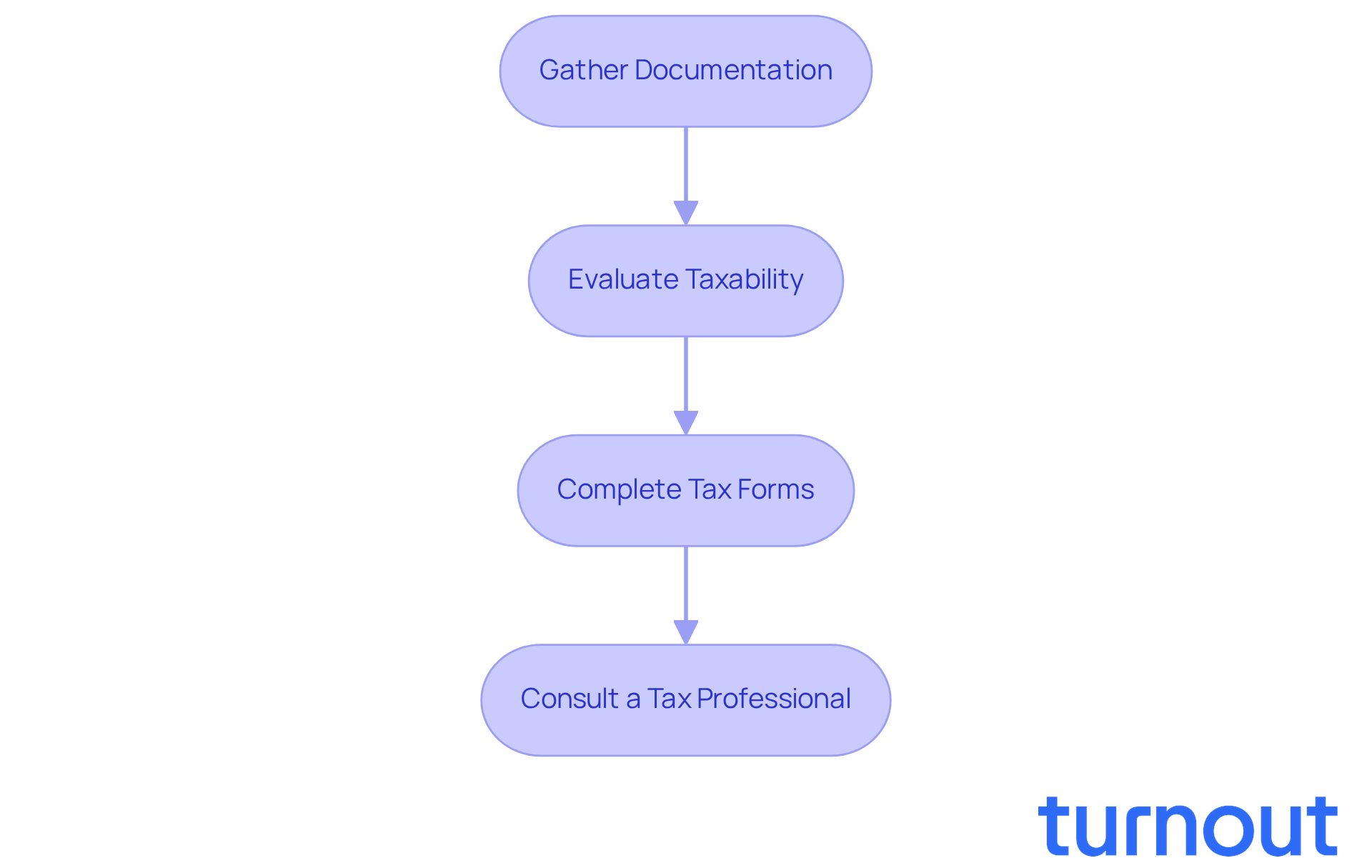

Guide on Reporting Short-Term Disability Income on Tax Returns

When it comes to reporting short-term disability taxes withheld on your tax returns, we understand that it can feel overwhelming. But don’t worry; we’re here to help you through it. Here are some steps to guide you:

-

Gather Documentation: Start by collecting all relevant documents, like your W-2 forms or 1099 forms that report the disability income you’ve received. Having everything in one place can make the process smoother.

-

Evaluate Taxability: It’s important to analyze whether the short-term disability taxes withheld are applicable to your benefits. If you paid premiums with after-tax dollars, generally, those benefits aren’t taxable. However, if you paid with pre-tax dollars, the benefits may be subject to federal income tax, including any short-term disability taxes withheld. Understanding this can help you avoid surprises later.

-

Complete Tax Forms: Use IRS Form 1040 to report your earnings. Make sure to include the total amount of short-term disability taxes withheld in the section for wages or other earnings. Accurately reflecting this income is crucial to avoid any discrepancies.

-

Consult a Tax Professional: If you’re feeling unsure about the reporting process or the tax implications, it’s perfectly okay to seek advice from a tax professional. They can provide valuable insights into common mistakes, like failing to report taxable benefits or misclassifying your income. Remember, you’re not alone in this journey, and getting professional help can ensure you file accurately and comply with IRS regulations.

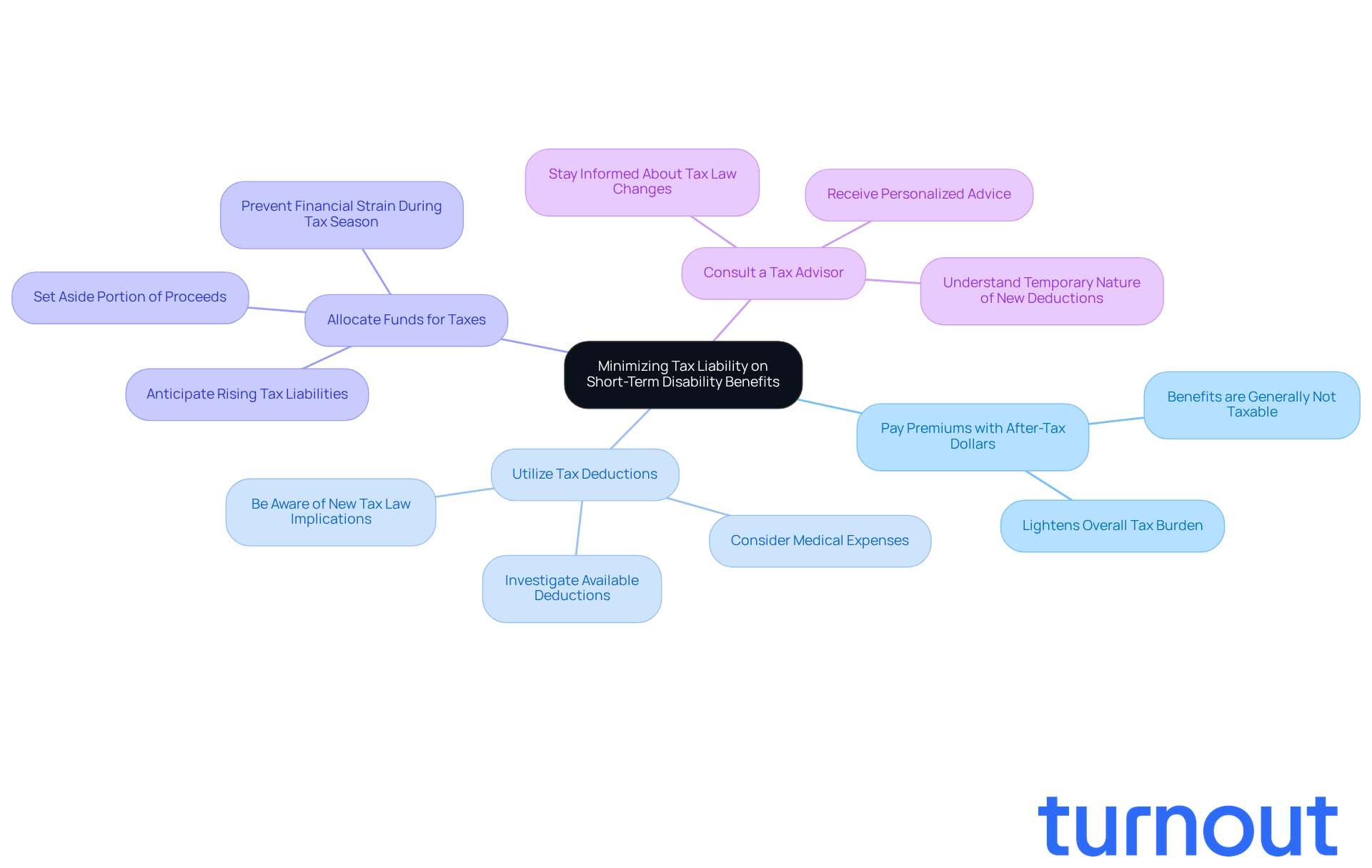

Strategies to Minimize Tax Liability on Short-Term Disability Benefits

To effectively minimize tax liability on short-term disability benefits, it’s important to consider a few supportive strategies that can make a real difference:

-

Pay Premiums with After-Tax Dollars: By choosing to pay for disability insurance premiums with after-tax dollars, you can ensure that the benefits you receive are generally not taxable. This approach can significantly lighten your overall tax burden, as most earnings are taxable unless specifically exempted.

-

Utilize Tax Deductions: We understand that navigating taxes can be overwhelming. Investigate available tax deductions that may apply to your situation, such as medical expenses or other relevant deductions. These can help decrease your taxable earnings and potentially lessen the amount you owe. Keep in mind that new tax law implications for SSDI recipients may affect your overall tax obligations.

-

Allocate Funds for Taxes: If you anticipate that your gains will be taxable, it’s wise to proactively set aside a portion of your proceeds. This can help cover potential tax obligations and prevent unexpected financial strain during tax season. Projections suggest that the percentage of beneficiary families liable for income tax on their assistance is expected to rise considerably in the coming years.

-

Consult a Tax Advisor: Regular consultations with a tax advisor are crucial for staying informed about changes in tax laws. Personalized advice tailored to your financial situation can help you navigate complex tax implications effectively. Remember, financial experts emphasize the importance of understanding these strategies, especially with the temporary nature of the new tax deduction set to expire in 2028.

By implementing these strategies, you can better manage your tax obligations with respect to short-term disability taxes withheld. We’re here to help you ensure a more favorable financial outcome. You are not alone in this journey.

Conclusion

Navigating the complexities of short-term disability benefits and their tax implications can feel overwhelming, especially when you’re relying on this support during tough times. It’s important to understand how these benefits are funded - whether through pre-tax or after-tax contributions - as this directly affects your tax liabilities and overall financial planning. Recognizing this distinction empowers you to make informed decisions about your financial future.

We understand that accurately reporting short-term disability income on your tax returns is crucial. Consulting with tax professionals can help you avoid potential pitfalls. There are strategies available to minimize your tax liability, such as:

- Paying premiums with after-tax dollars

- Utilizing available tax deductions

These practical steps can significantly ease your financial burdens.

Ultimately, being well-informed about the taxes withheld from your short-term disability benefits can lead to better financial management and peace of mind. As tax laws evolve and the landscape of financial assistance changes, staying proactive and seeking expert advice is essential. Remember, taking these steps not only ensures compliance but also fosters a more secure financial future for you as you navigate temporary disabilities. You are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What are short-term disability benefits?

Short-term disability benefits provide financial assistance to individuals temporarily unable to work due to medical conditions, injuries, or illnesses. These benefits typically replace a portion of an employee's salary, covering between 40% and 70% for a limited duration.

How long do short-term disability benefits typically last?

The duration of short-term disability benefits can range from a few weeks to several months, with an average duration often cited as a few months to two years, depending on the policy.

What is the elimination period for short-term disability benefits?

The elimination period for these benefits usually spans from 7 to 30 days, with 14 days being the average.

How do tax implications affect short-term disability benefits?

The tax implications of short-term disability benefits depend on how the contributions are financed. If payments are made with after-tax funds, the benefits received are generally not subject to taxation. Conversely, if short-term disability taxes withheld are deducted from pre-tax income, the benefits may be taxable.

What should recipients understand about short-term disability taxes withheld?

Recipients should understand that if they contributed with pre-tax money, they may face unexpected tax responsibilities related to short-term disability taxes withheld. Those who paid premiums with after-tax dollars can receive benefits without additional tax burdens.

Why is it important to understand the tax implications of short-term disability benefits?

Understanding the tax implications is crucial for accurately reporting adjusted gross earnings and avoiding surprises during tax season. It can also help individuals plan their finances more effectively and potentially reduce their income tax.

How can individuals navigate the complexities of short-term disability benefits and taxes?

Individuals can seek assistance in understanding their options related to short-term disability benefits and tax implications, especially when dealing with Social Security Disability (SSD) claims and tax relief, without the need for legal representation.