Introduction

Navigating the complexities of tax obligations can often feel overwhelming. We understand that unexpected life events can disrupt compliance, leaving you feeling anxious and uncertain. Reasonable cause penalty abatement offers a potential lifeline for those facing penalties due to circumstances beyond their control, such as serious illness or natural disasters.

But what specific situations qualify for this relief? How can you effectively advocate for your case? These are important questions that deserve attention. By exploring these aspects, we can demystify the IRS guidelines and empower you to seek the assistance you need during challenging times. Remember, you are not alone in this journey, and we're here to help.

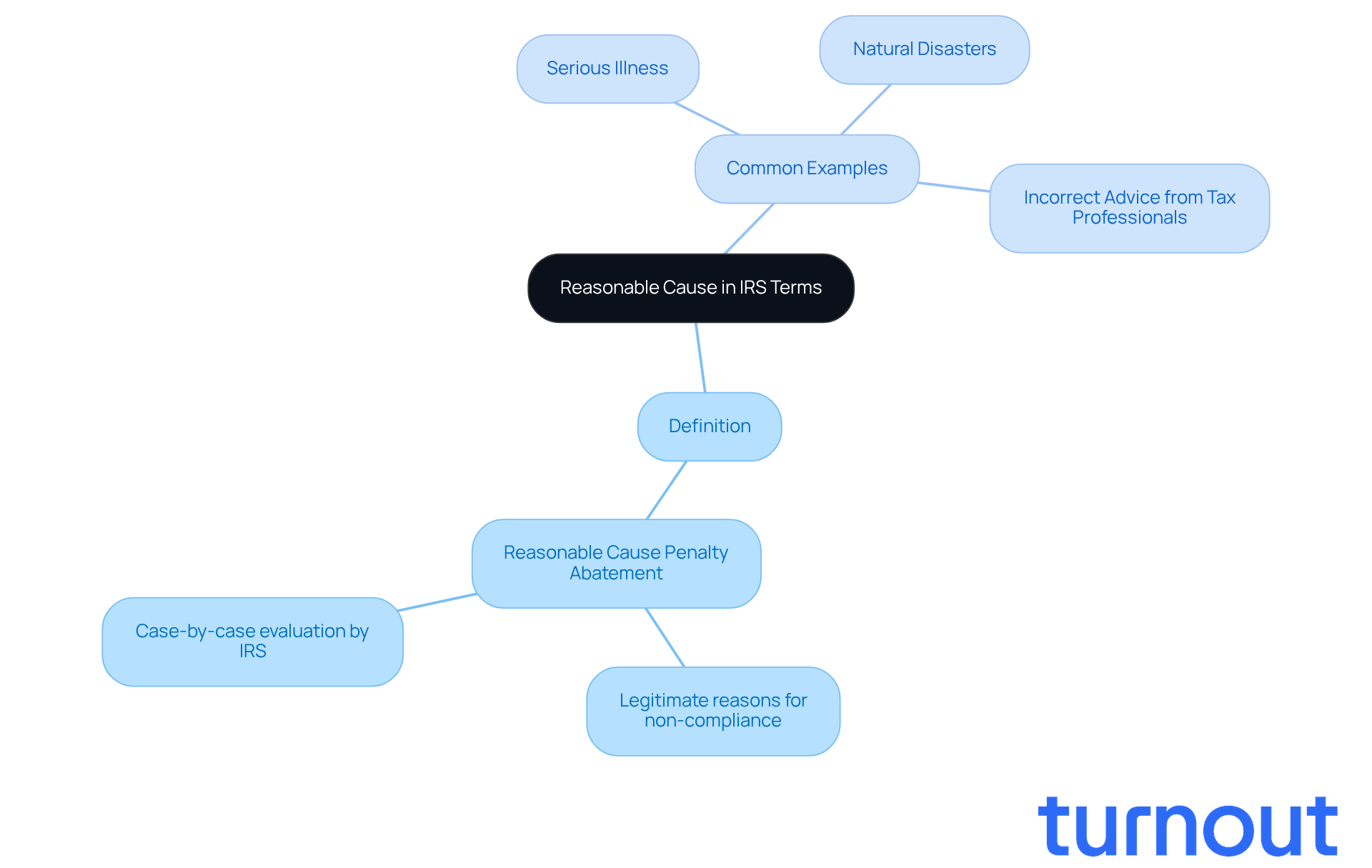

Define Reasonable Cause in IRS Terms

We understand that navigating tax obligations can be overwhelming. Reasonable cause penalty abatement, as defined by the IRS, refers to a legitimate reason that justifies why someone might not meet their tax responsibilities, such as filing or paying taxes on time. The IRS evaluates reasonable cause penalty abatement on a case-by-case basis, taking into account all the relevant facts and circumstances of each individual's situation.

Common examples of reasonable cause include:

- Serious illness

- Natural disasters

- Relying on incorrect advice from a tax professional

It's important to grasp this definition, especially if you're looking to advocate for reasonable cause penalty abatement to reduce fines. Understanding reasonable cause penalty abatement provides the framework through which your unique situation will be evaluated.

Remember, you're not alone in this journey. We're here to help you navigate these challenges and find the support you need.

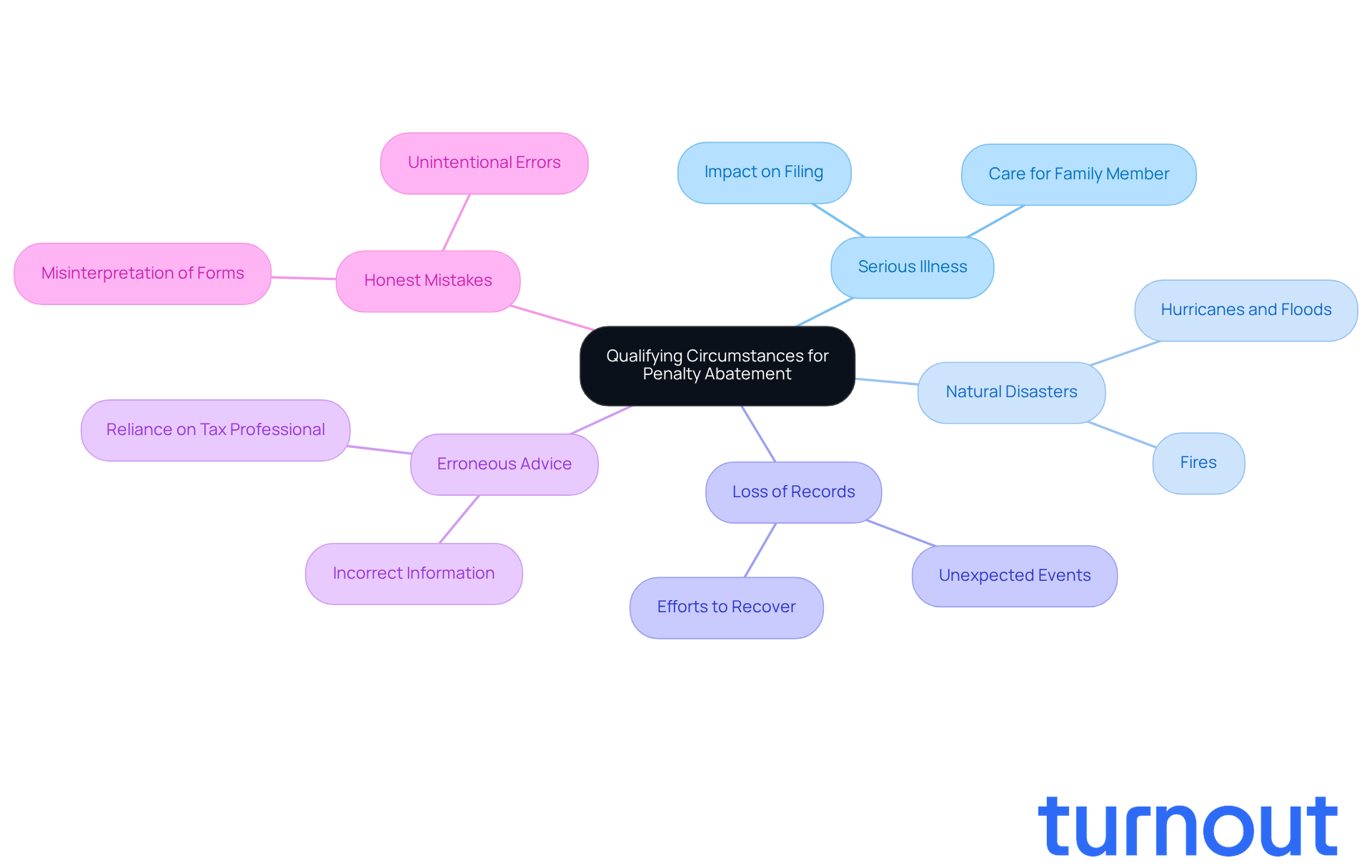

Identify Qualifying Circumstances for Penalty Abatement

Navigating tax compliance can be overwhelming, and we understand that sometimes life throws unexpected challenges your way. To qualify for reasonable cause penalty abatement, it’s essential to show that your failure to comply was due to circumstances beyond your control. Here are some common situations that may help you in your journey:

- Serious illness: If you or an immediate family member faced a serious illness, this could justify a delay in filing or payment. Imagine trying to meet tax deadlines while caring for a loved one - this is a legitimate reason to seek relief.

- Natural disasters: Events like hurricanes, floods, or fires can disrupt your normal operations. If you’ve been impacted by such disasters, you’re not alone. Many taxpayers find it incredibly challenging to remain compliant during these times, making this a crucial aspect of your reduction request.

- Loss of records: Losing vital documents due to unexpected events, such as a fire or theft, can happen to anyone. If you can show that this loss was beyond your control and that you took reasonable steps to recover your documents, you may qualify for relief.

- Erroneous advice: Have you ever relied on incorrect information from a tax professional? If you acted based on professional advice that turned out to be wrong, you might have grounds for relief. As tax advisor Matthew L. Roberts wisely says, "If you don’t ask, you don’t get."

- Honest mistakes: We all make mistakes, and sometimes simple errors made in good faith can be grounds for reduction. For instance, if you misinterpreted a complex tax form, you could qualify for relief if you can show that the error was unintentional.

Understanding these conditions can empower you to articulate your situation effectively when seeking relief. It’s important to present a persuasive argument for fee reduction. Plus, with automatic FTA waivers scheduled for 2026, you may find new opportunities for relief from fines that align with these qualifying conditions. Remember, you’re not alone in this journey, and we’re here to help.

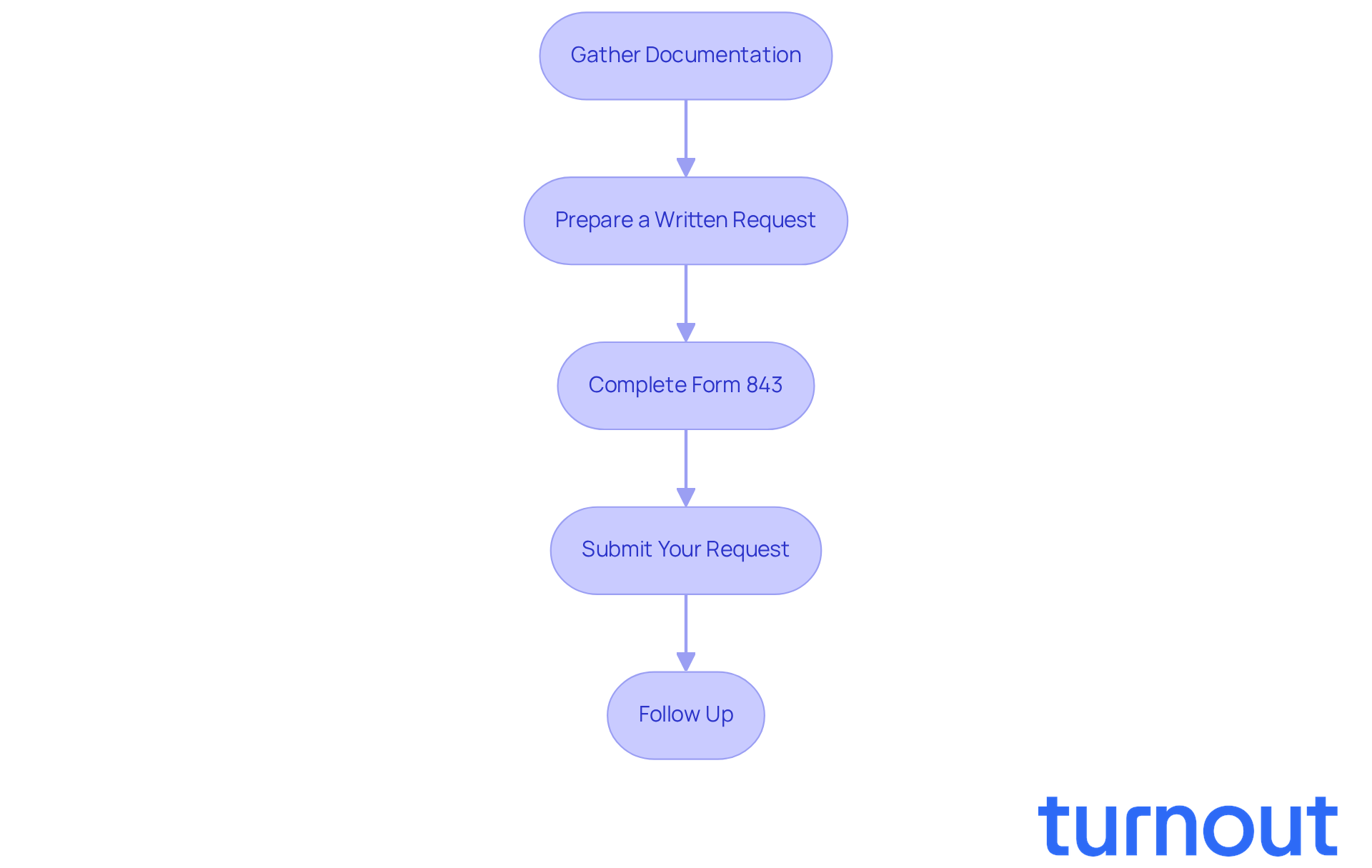

Outline the Process for Requesting Penalty Abatement

Requesting penalty abatement can feel overwhelming, but we're here to help you navigate the process with care and understanding. Here are some key steps to guide you:

-

Gather Documentation: Start by collecting all relevant documents that support your claim for reasonable cause. This might include medical records, disaster reports, or correspondence with tax professionals. Remember, thorough documentation is crucial for a successful request. If you're claiming disaster-related losses, don’t forget to include the FEMA disaster declaration number (3629 EM-) on your return.

-

Prepare a Written Request: Next, draft a letter to the IRS that clearly outlines your situation. Be sure to include your taxpayer identification number, the specific charges you’re contesting, and the reasons for your request. Common examples of reasonable cause penalty abatement include natural disasters, serious illness, or erroneous advice from the IRS. The clearer and more specific you are, the better your chances of approval.

-

Complete Form 843: If it applies to your situation, fill out IRS Form 843, 'Claim for Refund and Request for Abatement.' This form is your formal request for relief from fees. Make sure all required fields are accurately completed to avoid any delays.

-

Submit Your Request: Once everything is ready, send your written request along with any supporting documents to the appropriate IRS address. You can find this information on the IRS website or in the instructions for Form 843. Prompt submission is crucial, especially if you’re responding to a specific violation notice.

-

Follow Up: After you’ve submitted your request, keep an eye on its status. The IRS usually takes several weeks to respond, and you may need to provide additional information if they ask for it. Staying informed about your submission can help you feel more in control of the situation.

By following these steps, you can manage the reasonable cause penalty abatement process more effectively, thereby increasing your chances of receiving the assistance you need. And remember, it’s important to stay updated on recent IRS changes, like the new rules introduced on January 8, 2026, which could affect your request. You are not alone in this journey; we’re here to support you every step of the way.

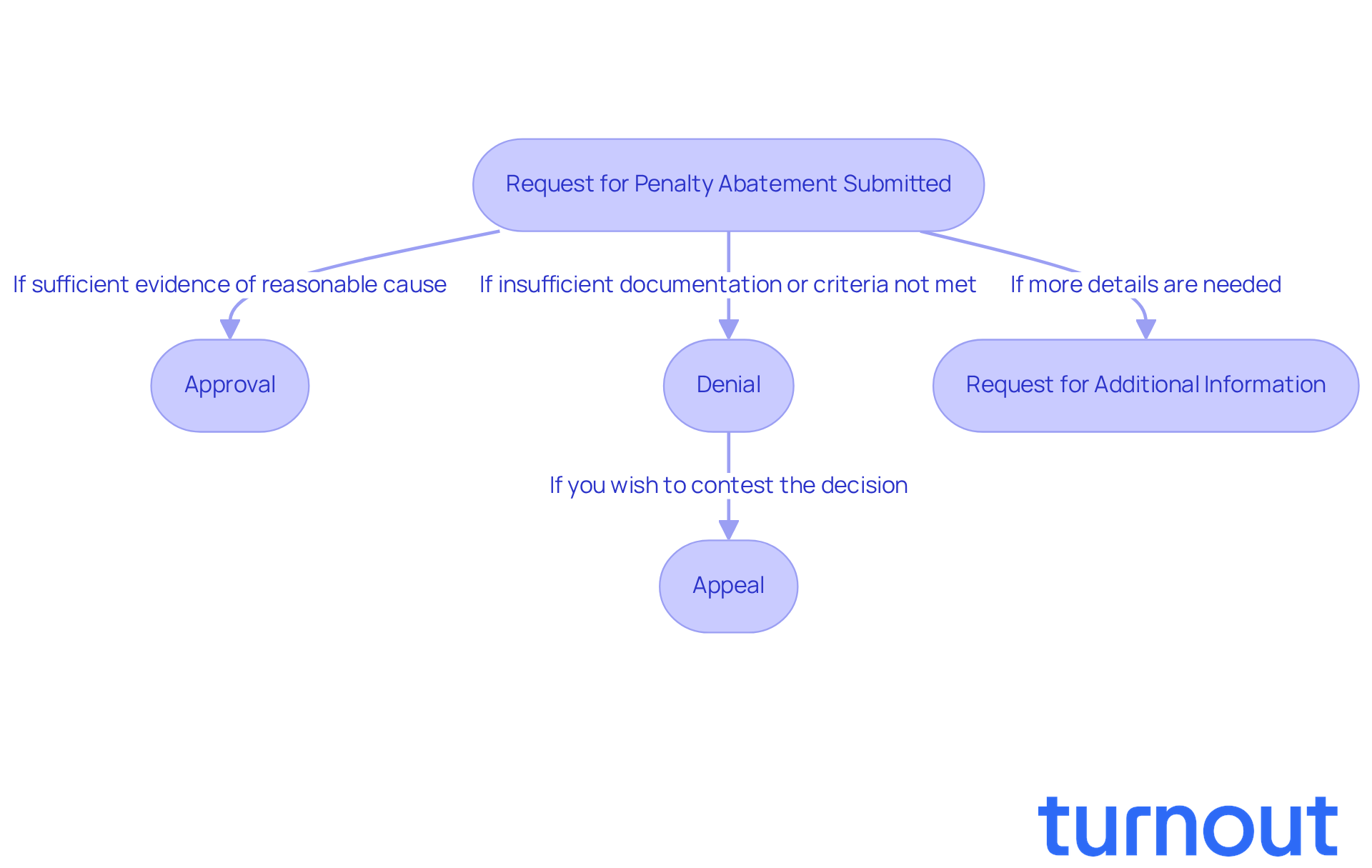

Discuss Possible Outcomes and Next Steps After Submission

After submitting a request for penalty abatement, you might be feeling a mix of hope and anxiety about what comes next. Let’s explore the possible outcomes together:

- Approval: If the IRS finds sufficient evidence of reasonable cause, your abatement will be granted. This means penalties could be removed or reduced, and you’ll receive written confirmation of this positive news.

- Denial: If your request is denied, the IRS will send a letter explaining why. Common reasons for the reasonable cause penalty abatement include insufficient documentation or not meeting the criteria. It’s worth noting that in 2026, the IRS is expected to automatically provide first-time penalty reductions to around 1 million individuals, which may influence approval rates.

- Request for Additional Information: Sometimes, the IRS may reach out for more details or documentation to support your claim. Responding promptly can help speed up the process and improve your chances of a favorable outcome.

- Appeal: If your request is denied, remember that you have the right to contest the decision. You can submit a written appeal to the IRS Office of Appeals within 30 days of receiving the denial letter. Tax professionals often recommend being thorough in this process, as many denials arise from misunderstandings or lack of clarity in the initial submission.

Understanding these outcomes can empower you to prepare for your next steps. Whether it’s gathering additional information, appealing a decision, or celebrating a successful abatement, know that you’re not alone in this journey. We’re here to help!

Conclusion

Understanding reasonable cause penalty abatement is crucial for anyone facing challenges in meeting tax obligations. We understand that life can throw unexpected hurdles your way, making it tough to comply with tax requirements. This concept offers a pathway for individuals to justify their inability to meet these obligations due to legitimate circumstances, providing potential relief from penalties. By grasping the intricacies of reasonable cause, you can effectively advocate for your situation and seek the assistance you deserve.

Throughout this article, we’ve explored key arguments regarding the definition of reasonable cause, qualifying circumstances for abatement, and the detailed process for requesting relief. From serious illnesses and natural disasters to erroneous advice from tax professionals, various scenarios can support a claim for penalty abatement. Remember, thorough documentation and clear communication with the IRS are essential steps that can significantly improve your chances of a favorable outcome.

Navigating the IRS penalty abatement process can feel daunting, but understanding these elements empowers you to take control of your situation. Whether you face an approval, denial, or a request for additional information, it’s common to feel overwhelmed. Staying proactive and informed is essential. By doing so, you can not only mitigate your penalties but also foster a sense of confidence in managing your tax responsibilities.

We’re here to help you through this journey. Seeking professional guidance and staying updated on IRS changes can further enhance your ability to navigate this process successfully. Remember, you are not alone in this journey.

Frequently Asked Questions

What is reasonable cause in IRS terms?

Reasonable cause refers to a legitimate reason that justifies why someone might not meet their tax obligations, such as filing or paying taxes on time.

How does the IRS evaluate reasonable cause penalty abatement?

The IRS evaluates reasonable cause penalty abatement on a case-by-case basis, considering all relevant facts and circumstances of each individual's situation.

What are some common examples of reasonable cause?

Common examples of reasonable cause include serious illness, natural disasters, and relying on incorrect advice from a tax professional.

Why is it important to understand reasonable cause penalty abatement?

Understanding reasonable cause penalty abatement is important because it provides the framework through which your unique situation will be evaluated if you are seeking to reduce fines.

Can I get support in navigating tax obligations related to reasonable cause?

Yes, there are resources available to help you navigate these challenges and find the support you need.