Introduction

Navigating the complexities of offset taxes can feel overwhelming, and we understand that many taxpayers are facing significant challenges. These taxes, often linked to outstanding debts, can greatly affect your expected tax returns, leaving you in a tough financial spot. With millions potentially facing reduced refunds due to government programs like the Treasury Offset Program, it’s natural to wonder: how can you manage your debts to avoid unexpected financial strain?

You’re not alone in this journey. Many individuals are grappling with similar concerns, and it’s important to know that there are ways to address these issues. By taking proactive steps, you can work towards a more secure financial future.

Consider reaching out for assistance or exploring resources that can help you understand your options. Remember, we’re here to help you navigate these challenges and find a path forward.

Define Offset Taxes: Understanding the Concept

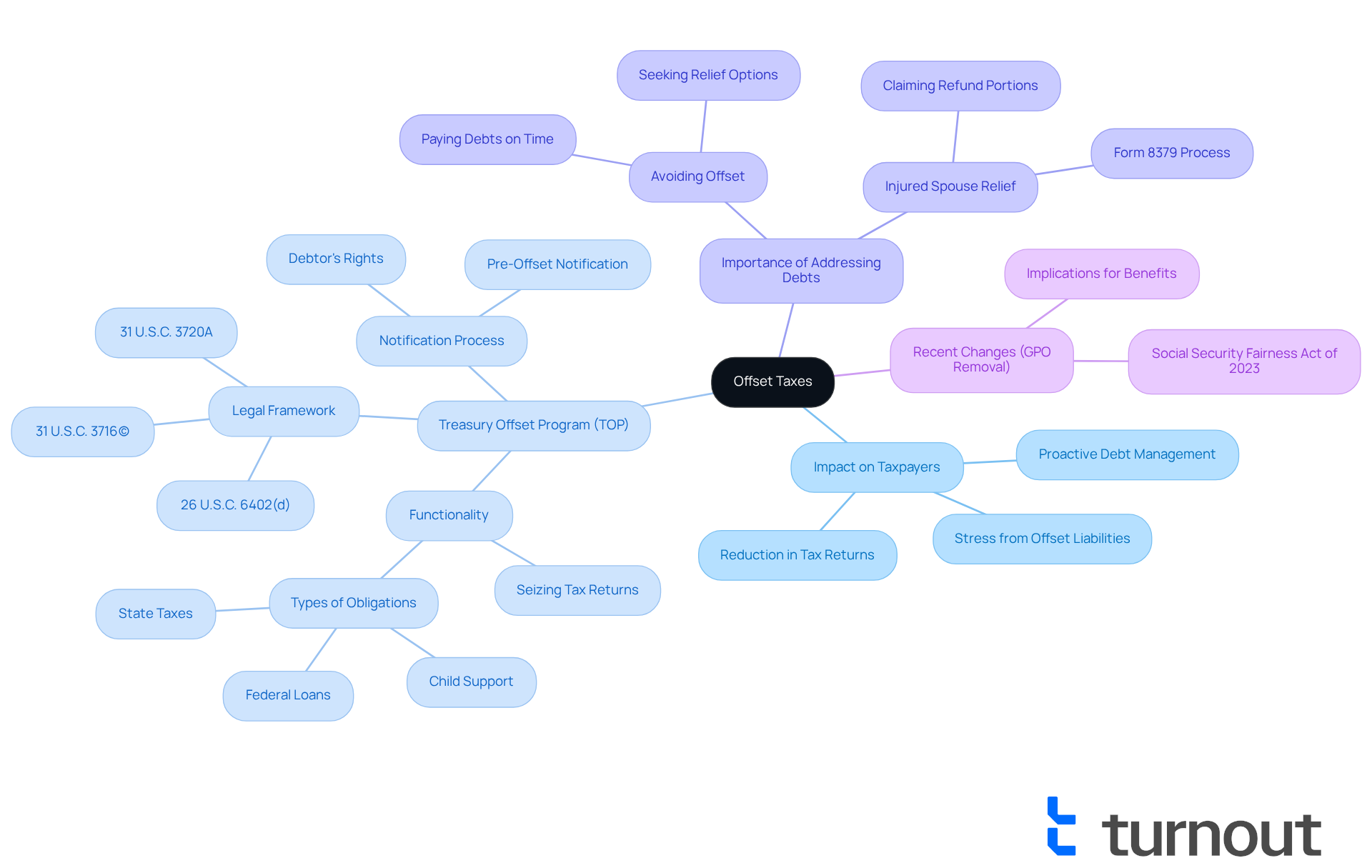

Offset liabilities can be a source of stress for many taxpayers, as they often lead to a decrease in returns or payments due to outstanding obligations owed to federal or state authorities. We understand that navigating these financial waters can be challenging. Programs like the Treasury Offset Program (TOP) exist to help, allowing the government to seize returns to fulfill obligations such as overdue payments, child support, or federal loans.

If you have an outstanding obligation, it’s important to know that the government can withhold part or all of your tax return to cover that liability. This process ensures that public funds are recouped efficiently. Each year, millions of contributors face reductions in payments, and the TOP plays a significant role in this by retaining substantial parts of financial returns.

For instance, the Department of Treasury's Financial Management Service can use this program to reclaim various obligations, including past-due child support and federal agency non-tax liabilities. Financial specialists emphasize the importance of addressing debts promptly. As Adam Middleton wisely points out, "If you owe back dues, the IRS may choose to use your reimbursement to reduce your obligation." This highlights the need for taxpayers to be proactive in managing their financial responsibilities.

Additionally, the recent removal of the Government Pension Offset (GPO) has implications for taxpayers, affecting how certain benefits may be adjusted. Understanding the offset taxes meaning and the effects of the TOP is crucial for managing your financial obligations and avoiding unexpected decreases in your returns.

You are not alone in this journey. For more detailed information, we encourage you to refer to the one-page fact sheet summarizing the general rules applicable to TOP. Remember, we're here to help you navigate these challenges.

Context and Implications of Offset Taxes

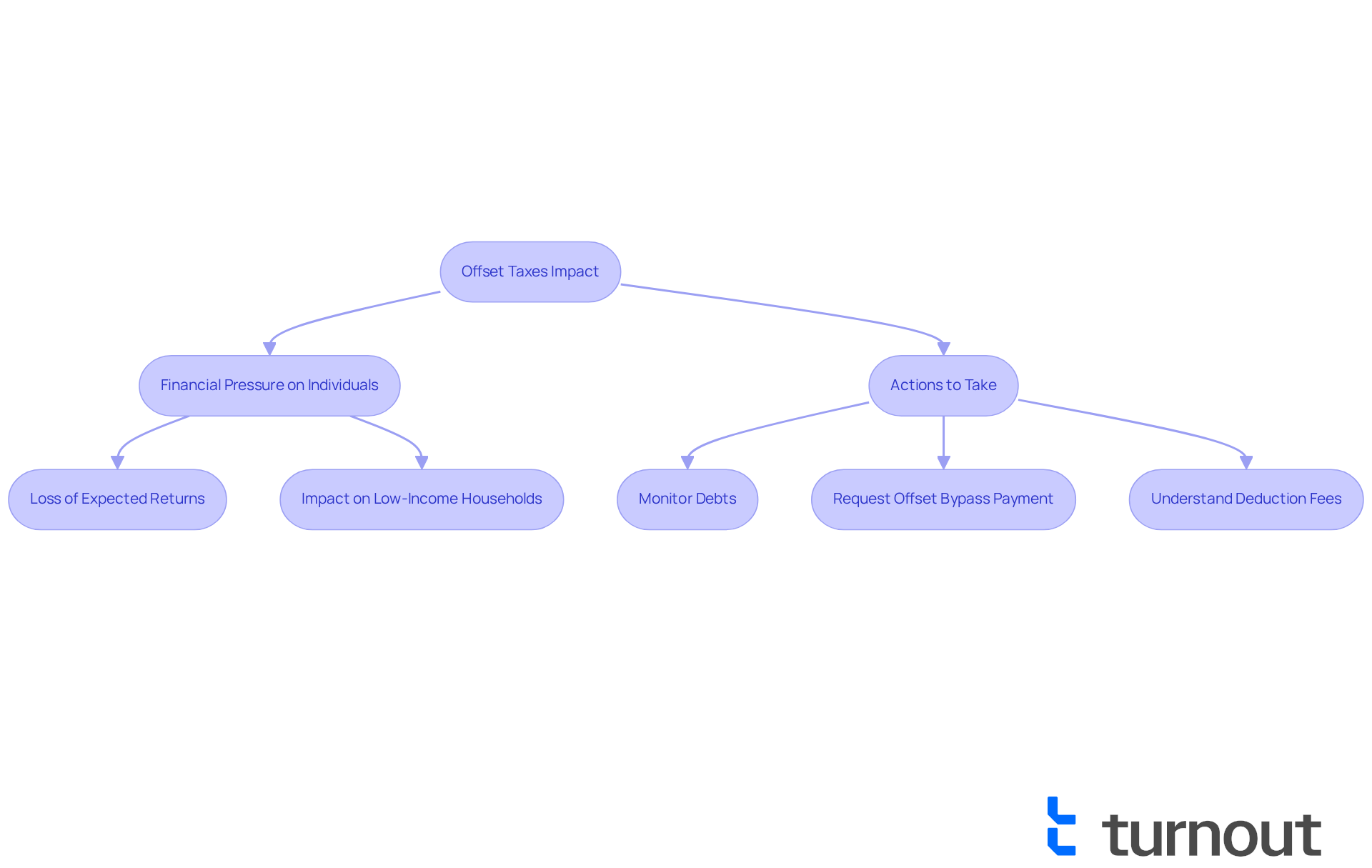

Offset taxes play a vital role in helping the government recover funds owed by individuals. They act as a deterrent against non-payment of debts and ensure that taxpayer money is used effectively. However, we understand that this system can have a significant impact on individuals, especially those who rely on tax returns for essential expenses. Imagine expecting a return of $4,000, only to find it completely offset by existing federal tax obligations. This can leave you without the financial assistance you were counting on, creating considerable pressure, particularly for low-income households that often depend on these returns to meet their basic needs.

Statistics reveal that many taxpayers rely on their returns to manage essential expenses, emphasizing the importance of understanding offset taxes meaning. The Treasury Offset Program (TOP) can even confiscate up to 15 percent of Social Security benefits for repayment, complicating the financial landscape for those already facing challenges. It’s common to feel overwhelmed, but it’s crucial to actively monitor your debts to avoid unexpected reductions in your returns. Remember, the IRS can only deposit returns into accounts in your name or a joint account, and may decline direct deposits under certain circumstances.

If you’re experiencing financial difficulties, you can request an Offset Bypass Payment (OBR) to prevent your payments from being applied to previous federal tax obligations. This option is especially important for individuals at risk of utility disconnection or eviction, as it offers a lifeline during tough times. Understanding the implications of deduction fees is essential for managing your financial responsibilities and entitlements effectively. We’re here to help you prepare for any potential impacts on your fiscal returns.

Types of Debts Leading to Tax Offsets

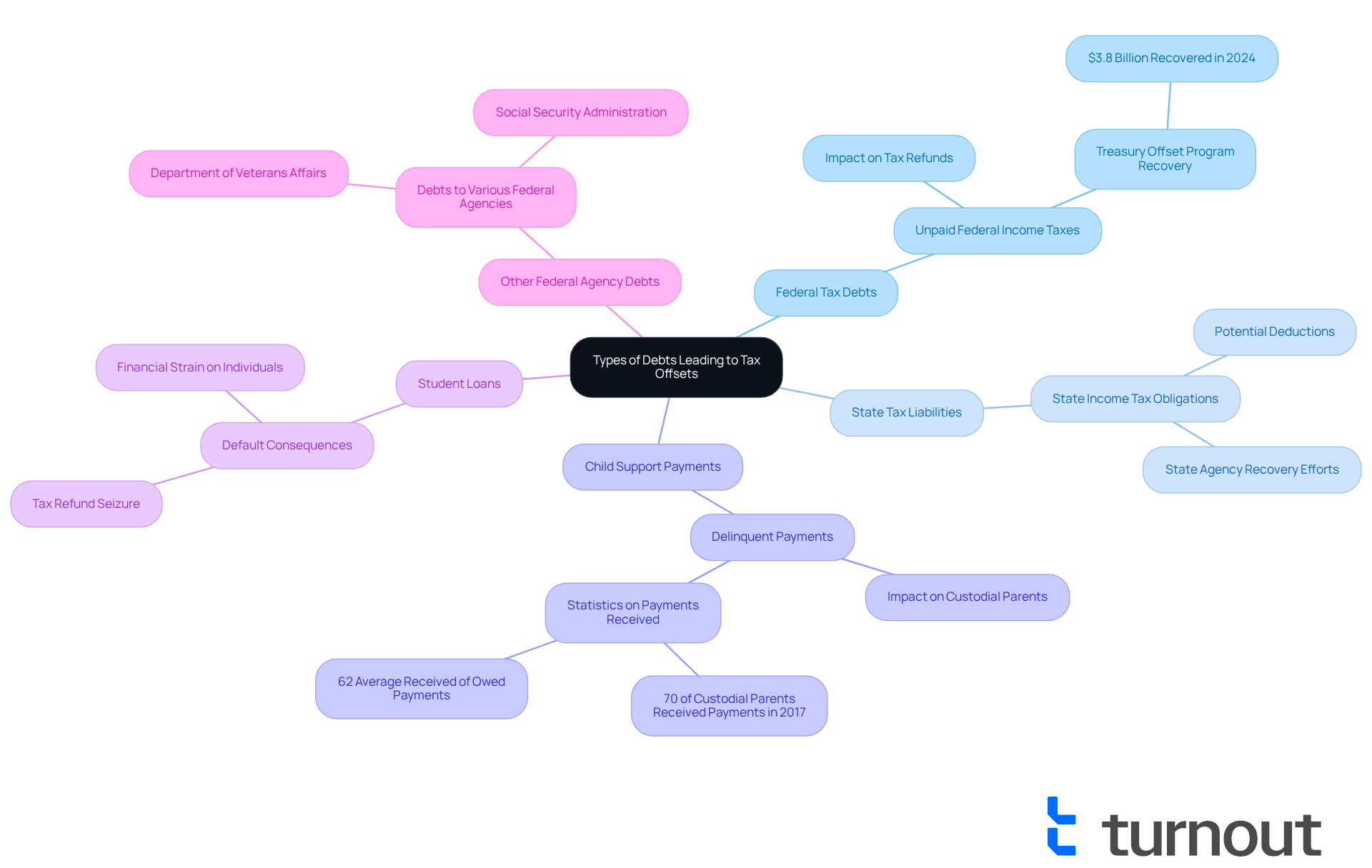

Managing financial obligations can be overwhelming, and understanding how various liabilities can lead to offset taxes meaning is crucial for your financial well-being. Here are some key categories to consider:

- Federal Tax Debts: If you have unpaid federal income taxes from previous years, they can offset your current tax refunds. In fiscal year 2024, the Treasury Offset Program (TOP) recovered over $3.8 billion in overdue federal and state obligations. This highlights just how significant this issue can be.

- State Tax Liabilities: Just like federal responsibilities, state income tax obligations can also lead to deductions. States actively pursue these debts, which can sometimes result in unexpected decreases in your offset taxes meaning.

- Delinquent child support payments are a common reason for understanding offset taxes meaning. States work diligently to recover these debts, which can greatly impact custodial parents. For instance, in 2017, 70% of custodial parents received some or all of the child support payments they were owed. However, on average, the 5.4 million parents owed child support received only 62% of what they were supposed to get, showing the ongoing challenges many face.

- If you default on federal student loans, the offset taxes meaning indicates that your tax returns may be seized to cover the outstanding balance. This can add to the financial strain for individuals already facing economic difficulties, as having refunds intercepted can worsen their situation.

- Other Federal Agency Debts: Debts owed to various federal agencies, like the Department of Veterans Affairs or the Social Security Administration, can also lead to deductions. Understanding these obligations is essential for managing your financial responsibilities and avoiding unexpected deductions.

We understand that navigating these financial obligations can be daunting. By recognizing these potential adjustments, you can take proactive steps to manage your responsibilities and protect your tax returns. Remember, you are not alone in this journey, and there are resources available to help you along the way.

Process of Tax Offsets: Implementation and Consumer Actions

Navigating the tax offset process can feel overwhelming, but understanding the offset taxes meaning and key steps can empower you. Here’s what you need to know:

-

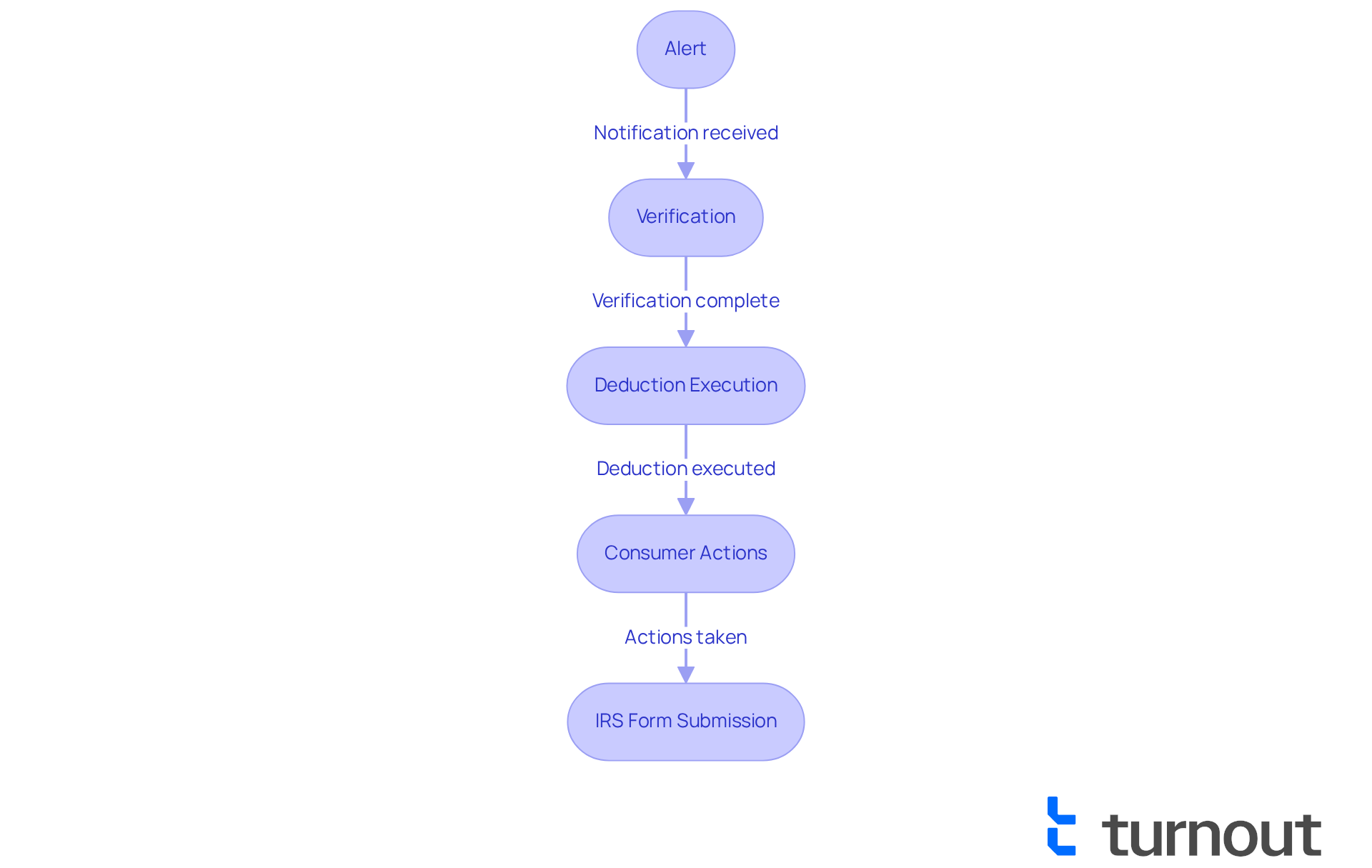

Alert: You’ll usually receive a heads-up if your refund is going to be reduced due to unpaid obligations. This notification will detail the financial specifics and the amount that will be withheld.

-

Verification: The responsible government agency will verify the accuracy of the financial obligation and confirm that the issue hasn’t been resolved yet.

-

Deduction Execution: After verification, the Treasury Offset Program (TOP) or the relevant state agency will carry out the deduction, taking the specified amount from your refund. It’s important to note that federal payments can be adjusted to cover overdue obligations owed to the federal government, highlighting the seriousness of the situation.

-

Consumer Actions: If you believe the adjustment is incorrect, don’t hesitate to reach out to the agency that issued the obligation or seek help from consumer advocacy groups. Keeping detailed records of your obligations and all communications with agencies is crucial for managing potential deductions. If you think you don’t owe the obligation causing the deduction, contact the organization mentioned in the deduction notice.

Real-world examples can illustrate the impact of tax reductions. For instance, if you were expecting a $1,000 refund, you might find that the government retains part or all of that amount to settle an obligation. In fiscal year 2024, the TOP recovered over $3.8 billion in overdue payments, showing just how many individuals are affected by these reductions.

If your spouse’s debt led to the reduction, you can submit IRS Form 8379 to claim your share of a joint refund. This form needs both spouses' Social Security numbers and can be obtained by calling the IRS at 800-829-3676 or downloading it from the IRS website. You can file it electronically or attach it to your original tax return.

Understanding these steps and knowing how to respond can help you navigate the complexities of offset taxes meaning with confidence. Remember, the Taxpayer Advocate Service has reopened its offices, ready to support taxpayers facing financial challenges. You are not alone in this journey, and we’re here to help.

Conclusion

Understanding offset taxes is essential for navigating the complexities of financial obligations. We know that many taxpayers worry about potential reductions in their returns. Offset taxes serve as a mechanism for the government to recover funds owed by individuals, impacting millions each year. This knowledge empowers you to take control of your financial situation and avoid unexpected surprises during tax season.

The various forms of debts that can lead to tax offsets include:

- federal and state tax obligations

- delinquent child support payments

- federal student loans

Each of these liabilities can significantly affect your financial stability, especially if you rely on tax refunds for essential expenses. The Treasury Offset Program (TOP) plays a pivotal role in this process, recovering billions of dollars annually to ensure that public funds are utilized effectively.

It's common to feel overwhelmed by these financial responsibilities. That's why it's crucial for you to actively monitor your debts and understand the implications of offset taxes on your financial health. By staying informed and seeking assistance when needed, you can navigate these challenges more effectively. Taking proactive steps can lead to better management of your financial responsibilities, ensuring that your tax returns can provide the necessary support during critical times.

Remember, you're not alone in this journey. We're here to help you understand and manage your financial obligations. By reaching out for support, you can take charge of your financial future.

Frequently Asked Questions

What are offset taxes?

Offset taxes refer to the reduction in tax returns or payments due to outstanding obligations owed to federal or state authorities.

What is the Treasury Offset Program (TOP)?

The Treasury Offset Program (TOP) is a government program that allows the government to seize tax returns to fulfill obligations such as overdue payments, child support, or federal loans.

How does the government use offset taxes?

The government can withhold part or all of a taxpayer's tax return to cover outstanding liabilities, ensuring efficient recoupment of public funds.

Who can be affected by offset taxes?

Millions of taxpayers can be affected by offset taxes each year, particularly those with outstanding obligations like past-due child support or federal agency non-tax liabilities.

What should taxpayers do if they have outstanding obligations?

Taxpayers should address their debts promptly, as the IRS may use tax refunds to reduce these obligations.

What recent changes have affected offset taxes?

The removal of the Government Pension Offset (GPO) has implications for taxpayers, potentially affecting how certain benefits are adjusted.

Where can I find more information about the Treasury Offset Program?

For more detailed information, you can refer to a one-page fact sheet summarizing the general rules applicable to the TOP.