Introduction

Receiving a Notice of Levy from the IRS can feel overwhelming, like a sudden storm threatening your financial peace. This legal document serves as a serious warning, indicating that the government may take actions such as garnishing your wages or seizing your assets. It’s crucial to recognize the urgency of addressing any outstanding tax obligations.

We understand that many individuals might overlook this important notification, but the stakes are incredibly high. Failing to respond can lead to severe financial consequences. So, what steps can you take to navigate this challenging situation and safeguard your assets before it’s too late?

You are not alone in this journey. Many people face similar challenges, and there are ways to find relief and regain control. Let’s explore the options available to you.

Define the Notice of Levy: Understanding Its Meaning for Taxpayers

A levy, which is a legal document from the Internal Revenue Service (IRS), provides a notice of levy meaning that informs you of the government's intention to confiscate your property or assets due to an outstanding tax obligation. This notice serves as a formal warning that the IRS plans to take specific actions, such as garnishing wages, levying bank accounts, or seizing other assets, which illustrates the notice of levy meaning.

We understand that receiving this notice can be overwhelming. It signifies a critical moment in the tax collection process, as the notice of levy meaning indicates that prompt action is necessary to prevent asset seizure. Statistics show that many individuals who receive a Levy notification do not respond, which can lead to serious financial consequences.

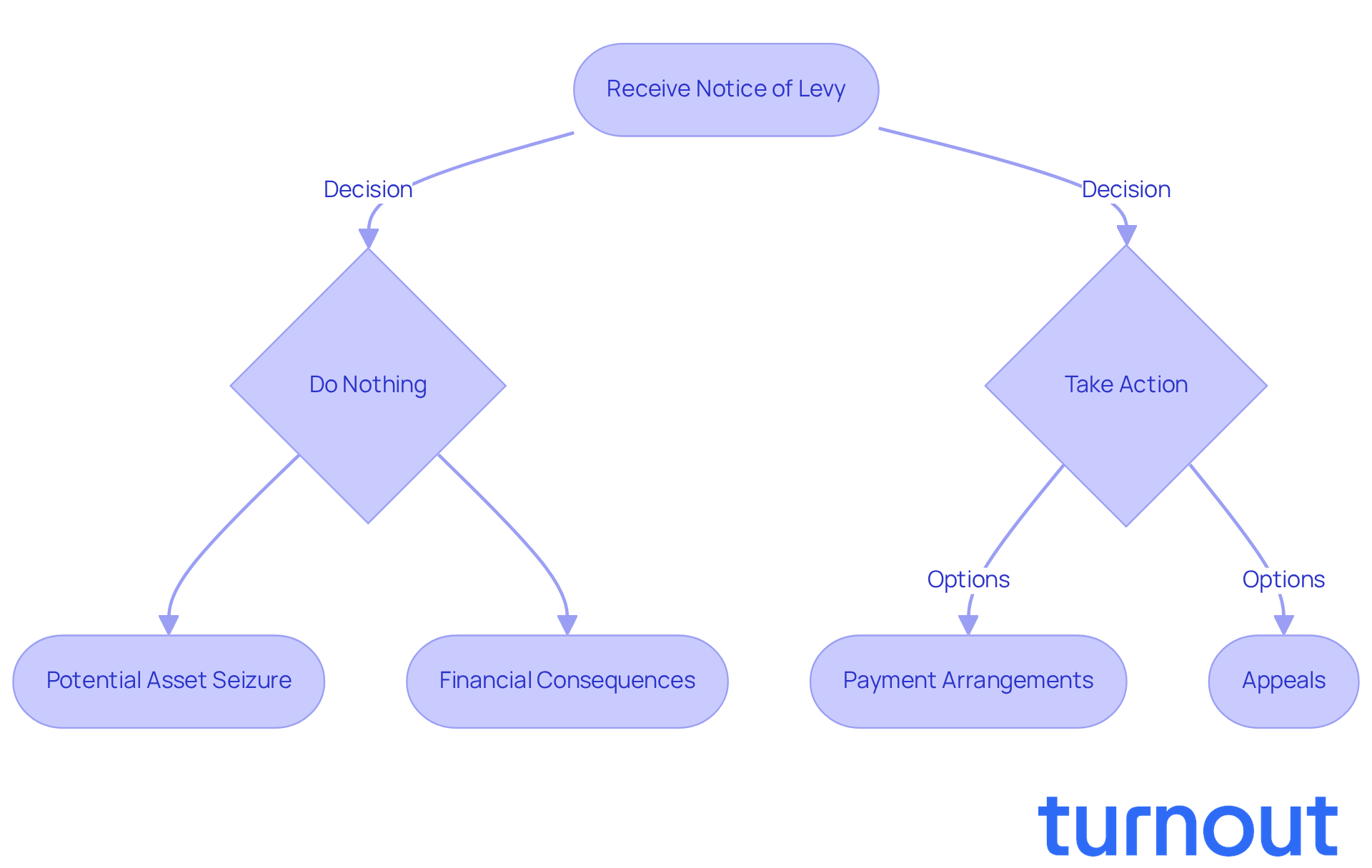

Unlike a tax lien, which is a claim against property without immediate seizure, the notice of levy meaning indicates that the IRS is ready to take action. Imagine facing a situation where your wages are seized or your bank accounts are targeted. This highlights the importance of responding quickly to the notification.

You have options! Consider alternatives like payment arrangements or appeals. Remember, you are not alone in this journey. We're here to help you navigate these challenges.

Contextualize the Notice of Levy: Importance in Tax Collection Processes

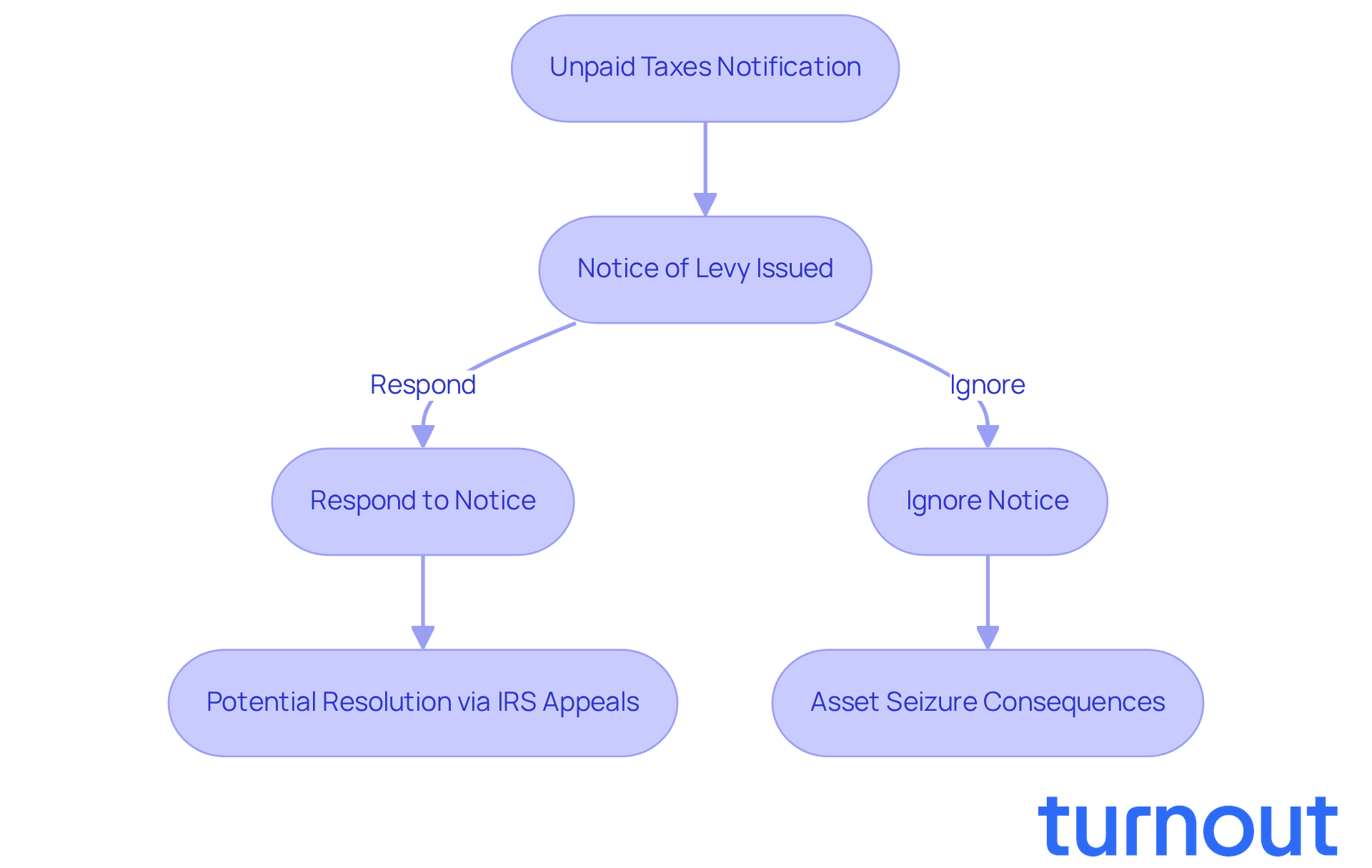

The Notice of Levy is a crucial part of the IRS's tax collection process. It usually comes after several notifications about unpaid taxes, like balance due notices and reminders. We understand that when individuals don’t respond or settle their tax obligations, the IRS escalates the situation by sending this notice. It acts as a final warning, indicating that the IRS is ready to take serious steps to recover the owed amount. This makes it vital for taxpayers to understand the notice of levy meaning.

Ignoring a Notice of Levy can lead to significant financial consequences, including asset seizures. This can disrupt your financial stability and affect your overall quality of life. In FY 2024 alone, the IRS collected over $120 billion in unpaid assessments and assessed an additional $17.8 billion in taxes for late filings. This underscores the agency's commitment to enforcing tax compliance.

It's important to recognize that the IRS has the legal authority to seize assets. Taking timely action can help mitigate potential hardships. Many taxpayers have successfully resolved their issues, especially through the IRS Independent Office of Appeals. This office is dedicated to resolving tax disputes fairly and without litigation, providing a pathway for taxpayers to address their concerns effectively.

So, understanding the notice of levy meaning and responding quickly can significantly influence the outcome of tax conflicts. Remember, you are not alone in this journey, and there are resources available to help you preserve your financial stability.

Trace the Origins: IRS Authority Behind the Notice of Levy

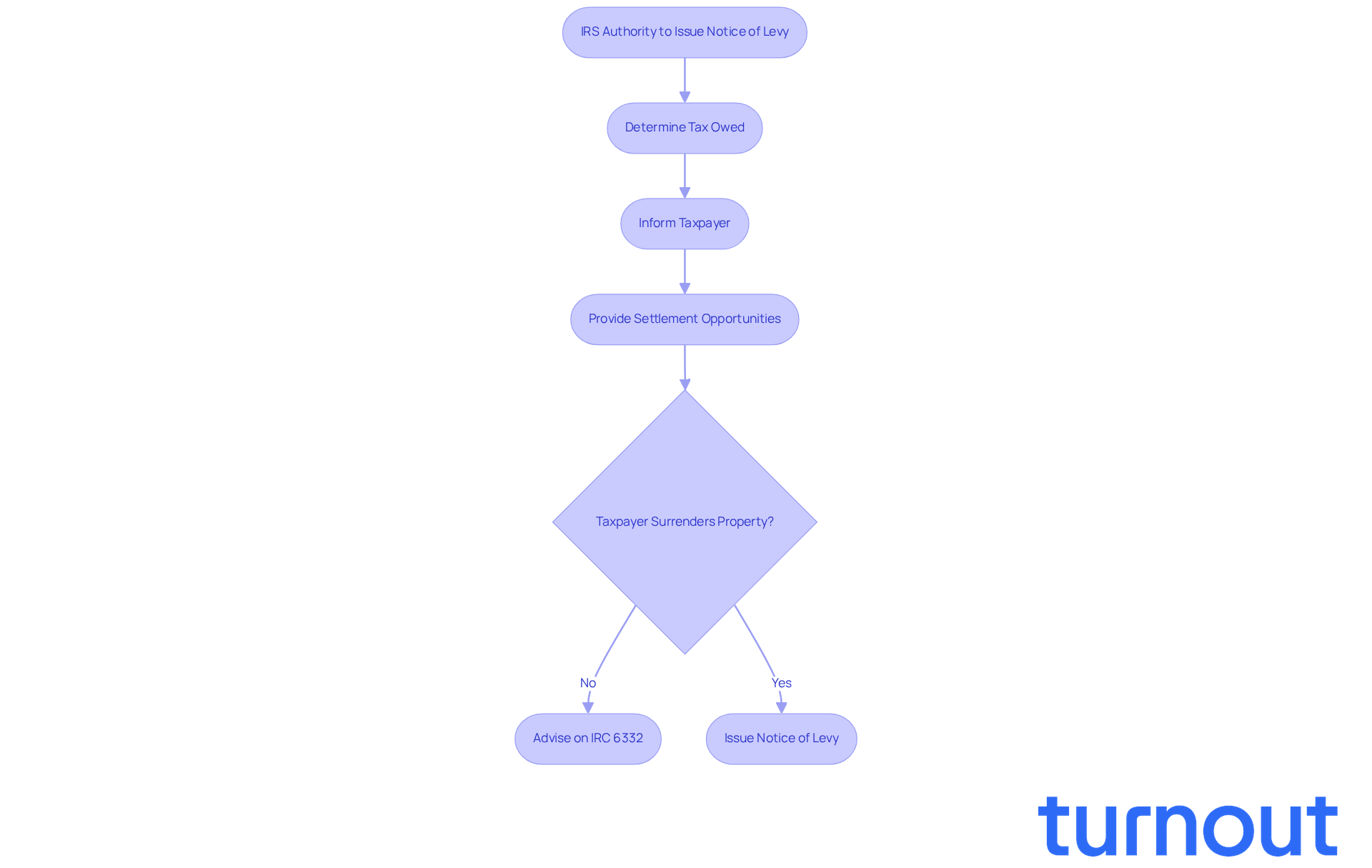

Understanding the notice of levy meaning and the IRS's power to issue such a notification can be daunting. This authority comes from the Internal Revenue Code (IRC), specifically Section 6331. It allows the IRS to impose levies on all property and rights owned by individuals who owe federal taxes. This framework has been in place for decades, enabling the IRS to enforce tax collection through various means, including levies.

We understand that the notice of levy meaning can be overwhelming when received. Before the IRS issues one, they must follow specific procedures. This includes informing you and providing opportunities to settle your tax obligations. As the IRS states, "If a person refuses to surrender the property, advise them of the provisions of IRC 6332: Requires the property to be surrendered." This structured approach highlights the seriousness of the notice of levy meaning and the significant consequences that can arise from neglecting tax obligations.

It's common to feel anxious about the potential repercussions of ignoring IRS notices, such as wage garnishment. Grasping these procedures is essential, as they are designed to protect your rights while ensuring compliance with tax obligations. Remember, you are not alone in this journey. We're here to help you navigate these challenges.

Identify Key Characteristics: Components of a Notice of Levy

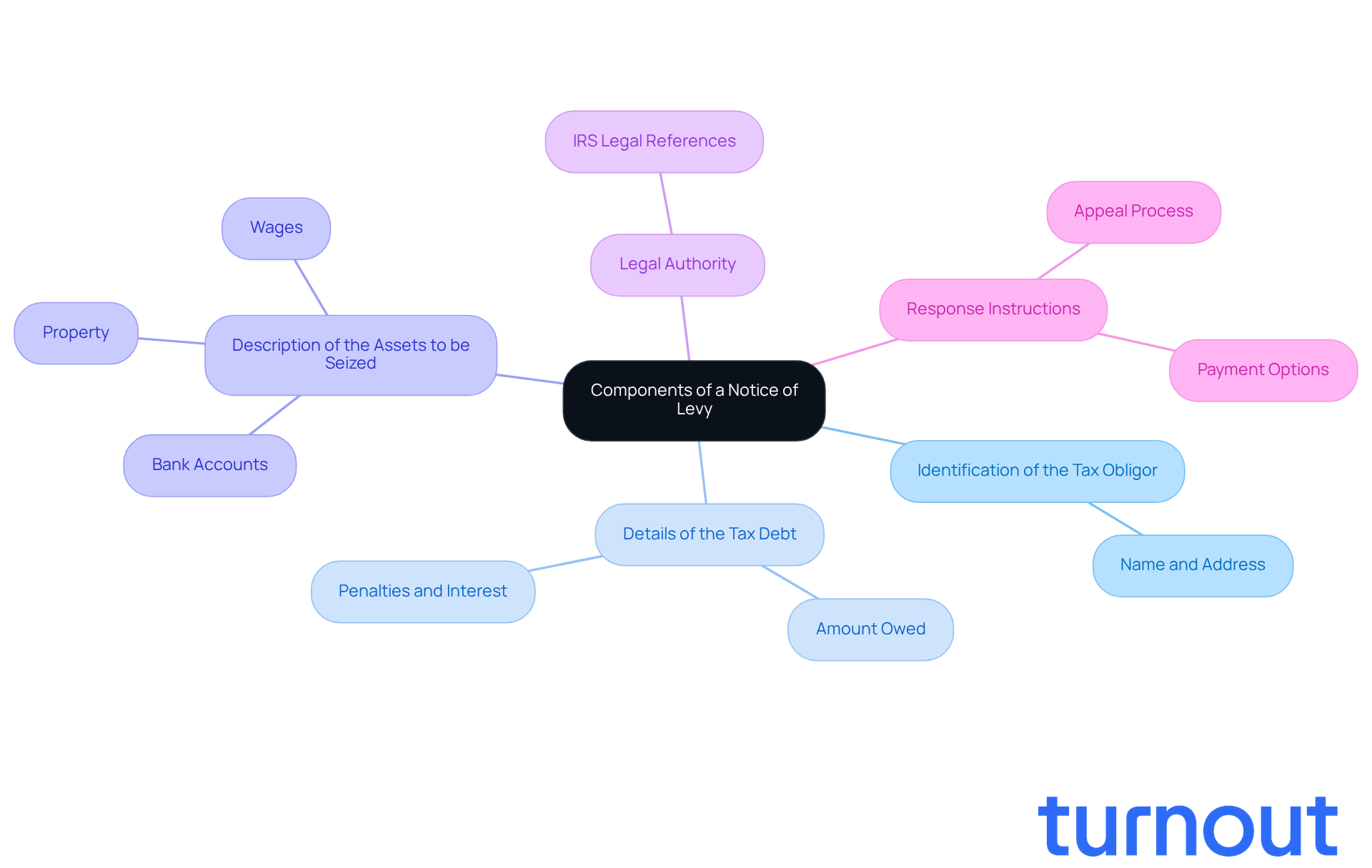

A notice of levy meaning can be a daunting document, but understanding its key components can empower you to take action. Here’s what you need to know:

- Identification of the Tax Obligor: The notice will clearly state the name and address of the tax obligor, ensuring that the intended recipient is identified.

- Details of the Tax Debt: It specifies the amount owed, including any penalties and interest that have accrued.

- Description of the Assets to be Seized: The IRS will indicate which assets are subject to levy, such as bank accounts, wages, or property.

- Legal Authority: The notice references the IRS's legal authority to levy, citing the relevant sections of the Internal Revenue Code.

- Response Instructions: Taxpayers will receive information on how to respond to the notice, including options for payment or appeal.

We understand that receiving a notice of levy meaning can be overwhelming. Knowing these characteristics is vital for you, as it equips you with the knowledge needed to take appropriate action and potentially avoid asset seizure. Remember, you are not alone in this journey; we're here to help.

Conclusion

Understanding the implications of a Notice of Levy is crucial for taxpayers facing potential asset seizure due to unpaid tax obligations. This legal document signals the IRS's intent to take significant actions, such as garnishing wages or levying bank accounts, if immediate measures are not taken. We understand that receiving such a notice can be overwhelming, but recognizing the urgency of this notification can be the key to preserving your financial stability and preventing serious repercussions.

Throughout this article, we’ve emphasized the critical nature of the Notice of Levy. It plays a vital role in the tax collection process, backed by legal authority. Key characteristics of the notice include:

- The identification of the tax obligor

- Details of the tax debt

- Response instructions

It's common to feel anxious about these matters, but timely action is essential to avoid the dire consequences that can arise from ignoring such a notice.

Ultimately, understanding the meaning of a Notice of Levy empowers you to navigate your tax obligations effectively. Remember, you are not alone in this journey. It’s vital to seek assistance if needed and explore options like payment arrangements or appeals. By taking proactive steps, you can mitigate the risks associated with tax levies and secure your financial future. We're here to help you through this process.

Frequently Asked Questions

What is a Notice of Levy?

A Notice of Levy is a legal document from the Internal Revenue Service (IRS) that informs taxpayers of the government's intention to confiscate their property or assets due to an outstanding tax obligation.

What actions can the IRS take after issuing a Notice of Levy?

After issuing a Notice of Levy, the IRS can take actions such as garnishing wages, levying bank accounts, or seizing other assets.

How should a taxpayer respond to a Notice of Levy?

Taxpayers should respond promptly to a Notice of Levy to prevent asset seizure and consider options such as payment arrangements or appeals.

How does a Notice of Levy differ from a tax lien?

A Notice of Levy indicates that the IRS is ready to take action and seize assets, while a tax lien is a claim against property without immediate seizure.

What are the potential consequences of not responding to a Notice of Levy?

Failing to respond to a Notice of Levy can lead to serious financial consequences, including the seizure of wages or bank accounts.