Introduction

Dealing with tax debt can feel like an overwhelming burden, especially when financial hardships threaten your basic living conditions. We understand that this situation can be incredibly stressful. Currently Not Collectible (CNC) status offers a crucial lifeline for taxpayers like you, allowing you to pause IRS collection efforts and focus on your essential expenses.

While this designation provides temporary relief, it’s important to remember that it doesn’t eliminate the underlying debt or its accruing penalties. This raises significant questions about long-term financial management. How can you navigate the complexities of CNC status to ensure you maximize its benefits while preparing for future obligations?

You're not alone in this journey. Many people face similar challenges, and there are ways to find your footing again. Let's explore how you can make the most of this opportunity.

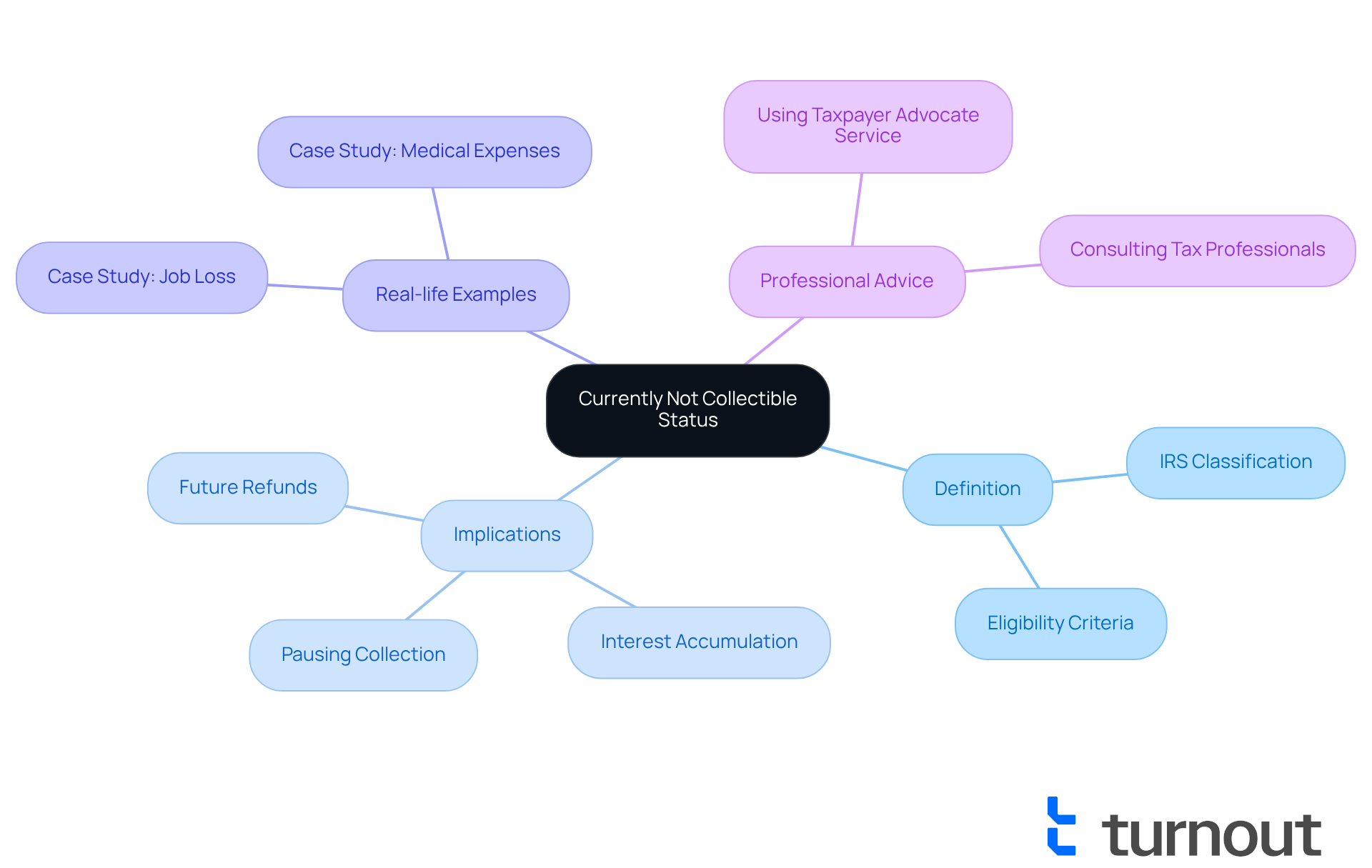

Define Currently Not Collectible Status

The non collectible status designation is an important classification by the IRS for taxpayers who are unable to pay their tax debt without facing severe financial hardship. When your account is given a non collectible status, the IRS pauses collection activities, allowing you to focus on essential living expenses. This is especially crucial for those dealing with challenges like medical bills, unemployment, or other financial strains that make it tough to meet tax obligations.

As of 2025, over 1.5 million taxpayers are identified with non collectible status, highlighting the growing need for relief among individuals struggling with economic difficulties. While this designation provides temporary relief from collection efforts, it’s important to remember that it grants non collectible status, which doesn’t erase the underlying tax debt, as interest and penalties continue to accumulate during this time. Additionally, taxpayers who are in non collectible status may still have their future tax refunds applied to their outstanding debts, which can complicate their path to financial recovery.

Real-life stories illustrate the impact of CNC status. For example, consider a taxpayer who lost their job and faced mounting medical expenses. By obtaining CNC designation, they could concentrate on essential costs while ensuring their non collectible status without the immediate pressure of tax collection. However, it’s vital to stay alert, as the IRS periodically reviews financial situations to see if your ability to pay has changed.

Tax professionals emphasize the importance of understanding the non collectible status: 'Negotiating the non collectible status indicates to the IRS that you are serious about your responsibility to pay off taxes you may owe but do not have the funds to pay at this time.' This highlights the proactive approach needed for taxpayers seeking relief through CNC designation, ensuring they can effectively manage their financial challenges.

We understand that navigating tax issues can be overwhelming, but remember, you are not alone in this journey. We're here to help you find the best path forward.

Identify Eligibility Requirements for CNC Status

If you're feeling overwhelmed by tax debt, you’re not alone. Many taxpayers find themselves in a tough spot, and the non collectible status designation can offer some relief. To qualify, you need to show that paying your tax debt would cause significant financial hardship. Here’s what you need to know:

- Income Level: Your income must fall below the IRS's allowable living expenses, which vary based on your family size and where you live. If your income barely covers or falls short of your essential needs, you may qualify for non collectible status.

- Financial Hardship: It’s crucial to demonstrate that paying your tax debt would compromise your essential living needs, like housing, food, and healthcare. High medical bills, job loss, or unexpected expenses can all contribute to financial hardship.

- Compliance: You must have all required tax returns filed, and you shouldn’t be in bankruptcy proceedings. This compliance helps the IRS accurately assess your financial situation. Remember, even while in CNC status, you need to keep filing tax returns and making federal tax deposits on time.

- Documentation: Be prepared to provide detailed financial documentation, including income statements, monthly expenses, and a list of your assets. This information supports your claim for CNC designation and helps the IRS evaluate your eligibility based on your current financial situation.

It’s important to understand that being classified as having a non collectible status doesn’t erase your tax debt; it simply means the IRS recognizes that you can’t afford to pay right now. While you’re in this status, the IRS will periodically check your ability to pay, and unfortunately, penalties and interest will continue to accrue until the debt is fully settled.

Understanding these criteria is essential for anyone seeking relief from tax debt through CNC designation. It can help you navigate the application process with clarity and confidence. Remember, you’re not alone in this journey, and we’re here to help.

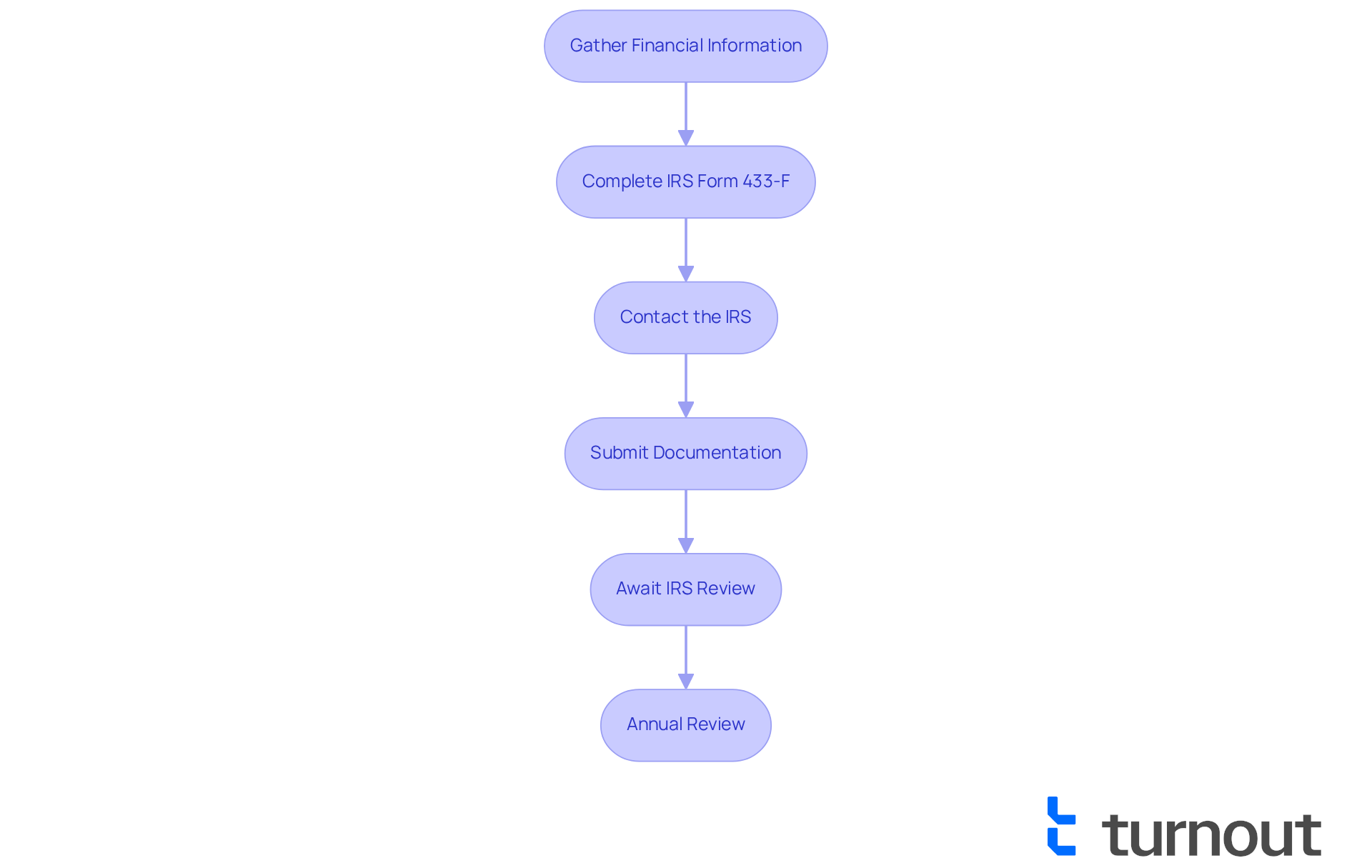

Outline the Application Process for CNC Status

Applying for non collectible status can feel overwhelming, especially when you're experiencing financial hardship. But don’t worry; we’re here to help you navigate this process effectively. Here’s a step-by-step guide to assist you:

-

Gather Financial Information: Start by collecting all relevant financial documents, such as income statements, expense reports, and any applicable tax returns. This information is vital for demonstrating your financial situation.

-

Complete IRS Form 433-F: This Collection Information Statement is essential for providing the IRS with a detailed overview of your finances. Depending on your specific circumstances, you may also need to complete Form 433-A or 433-B for a more comprehensive assessment.

-

Contact the IRS: Reach out to the IRS at 1-800-829-1040 to discuss your situation and express your intention to apply for CNC classification. Handling this process over the phone is often more efficient and allows for immediate clarification of any questions you may have.

-

Submit Documentation: After completing Form 433-F, submit it along with any supporting documents to the IRS, either by mail or electronically, as directed during your call. Ensure that all information is accurate and complete to avoid delays.

-

Await IRS Review: Once your application is submitted, the IRS will review your case. This review process can take several weeks, and you may be asked to provide additional information to support your application.

-

Annual Review: It’s important to note that the IRS examines your financial situation each year after obtaining CNC designation. This means you must continue to show financial hardship to retain your position.

-

Long-Term Implications: Remember that the IRS can no longer collect taxes after 10 years unless the collection statute is extended. This provides a long-term perspective on the advantages of obtaining CNC designation, particularly regarding its non collectible status.

By following these steps and ensuring your documentation is comprehensive, you can improve your chances of successfully achieving CNC classification. This can provide substantial relief from tax collection efforts. Consulting with a tax professional can also help you navigate this process effectively, as they can offer valuable insights and assistance. You are not alone in this journey.

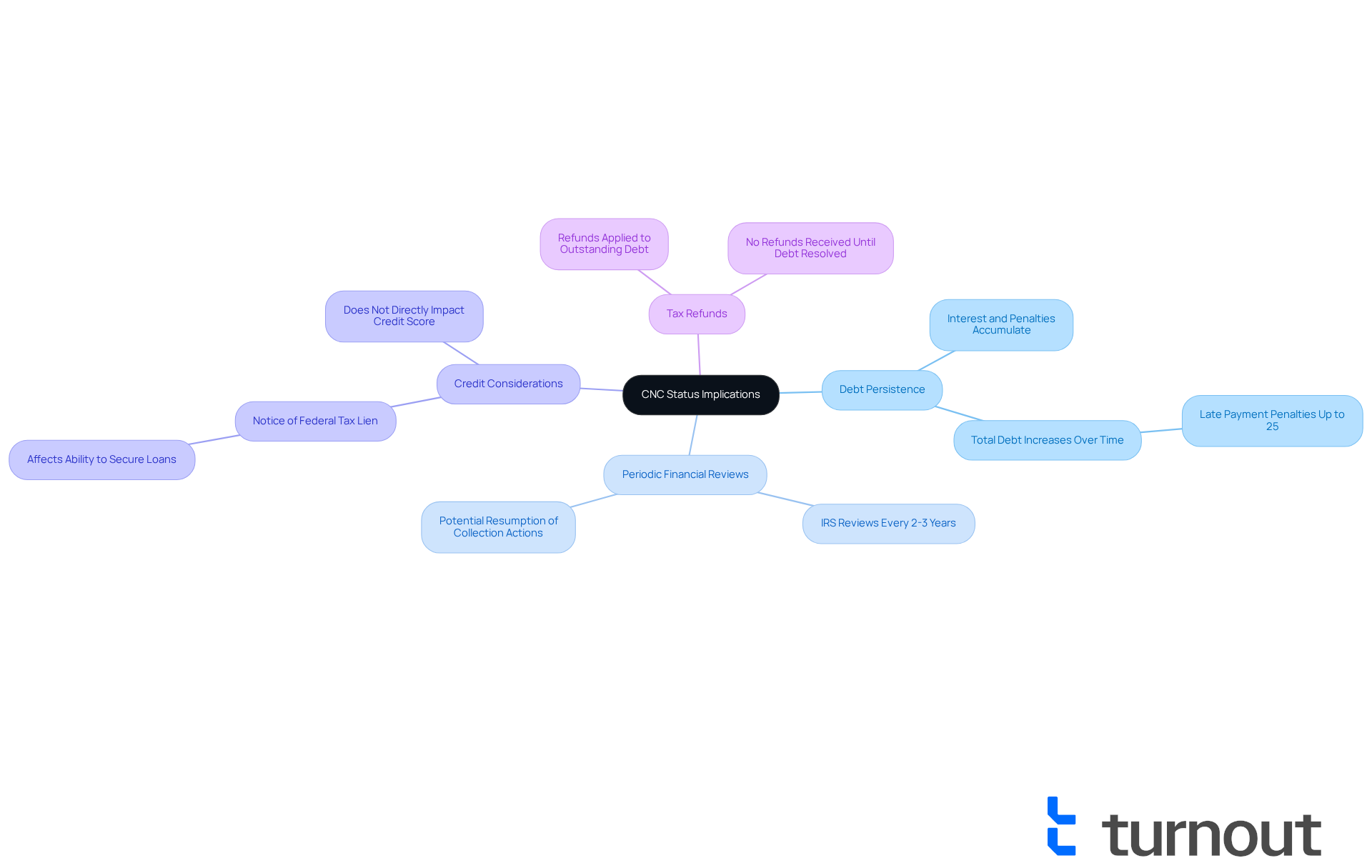

Explain the Implications of CNC Status

If you're feeling overwhelmed by IRS collection actions, the non collectible status can provide you with immediate relief. This status allows you to focus on your essential expenses without the stress of wage garnishments or bank levies. However, it’s important to understand the ongoing implications of this designation:

- Debt Persistence: While CNC status pauses collection efforts, your underlying tax debt doesn’t disappear. Interest and penalties continue to accumulate, which can increase the total amount you owe over time. Did you know that late payment penalties can add up to 25%? This can significantly affect your overall debt.

- Periodic Financial Reviews: The IRS typically reviews CNC classifications every 2 to 3 years to see if you still qualify. If your financial situation improves, they may resume collection actions. Staying informed about your finances is crucial. In fiscal year 2024, the IRS managed over 5.3 million overdue accounts, highlighting how common non collectible status is among taxpayers.

- Credit Considerations: While CNC designation doesn’t directly impact your credit score, the IRS might file a Notice of Federal Tax Lien. This can affect your ability to secure loans or credit in the future. This lien protects the IRS's interest in your property and can show up on public records.

Tax Refunds and non collectible status: If you’re entitled to any tax refunds while under non collectible status, those funds will automatically go toward your outstanding tax debt. This means you won’t receive those refunds until your debt is resolved.

Understanding these implications is vital for effectively managing your tax situation and planning for the future. Remember, acting early can help preserve your rights and avoid serious financial consequences. As J. David Tax Law points out, the IRS collected nearly $77.6 billion in fiscal year 2024. You are not alone in this journey, and we’re here to help you navigate these challenges.

Conclusion

The designation of Currently Not Collectible (CNC) status serves as a crucial lifeline for taxpayers facing severe financial hardship. We understand that navigating tax obligations can feel overwhelming, especially when essential living expenses are at stake. By allowing individuals to pause IRS collection efforts, CNC status enables them to prioritize what truly matters during challenging times. However, it’s important to remember that while this status offers temporary relief, the underlying tax debt remains, and interest and penalties will continue to accrue.

Throughout this guide, we’ve explored the key aspects of CNC status, including:

- Eligibility requirements

- The application process

- The implications of this designation

Taxpayers must demonstrate financial hardship, comply with IRS regulations, and prepare comprehensive documentation to successfully obtain CNC status. Understanding the long-term consequences, such as the persistence of tax debt and periodic reviews by the IRS, is vital for managing your financial future effectively.

Recognizing the significance of CNC status is paramount. It not only provides immediate relief but also emphasizes the importance of proactive financial management. For those who qualify, taking the necessary steps to apply for CNC status can lead to a path of recovery and stability. Remember, you are not alone in this journey. Seeking assistance from tax professionals can further enhance your chances of successfully navigating this process, ensuring that you have the support you need on your path toward financial recovery.

Frequently Asked Questions

What does Currently Not Collectible (CNC) status mean?

Currently Not Collectible status is a designation by the IRS for taxpayers who cannot pay their tax debt without experiencing severe financial hardship. It pauses IRS collection activities, allowing individuals to focus on essential living expenses.

Who qualifies for CNC status?

Taxpayers facing challenges such as medical bills, unemployment, or other financial strains that hinder their ability to meet tax obligations may qualify for CNC status.

How many taxpayers are currently in CNC status?

As of 2025, over 1.5 million taxpayers are identified with Currently Not Collectible status, indicating a growing need for relief among individuals facing economic difficulties.

Does CNC status erase my tax debt?

No, CNC status does not erase the underlying tax debt. Interest and penalties continue to accumulate during this time.

Can my future tax refunds be affected if I have CNC status?

Yes, taxpayers in CNC status may have their future tax refunds applied to their outstanding tax debts, which can complicate their financial recovery.

How does the IRS monitor CNC status?

The IRS periodically reviews the financial situations of taxpayers in CNC status to determine if their ability to pay has changed.

What is the importance of negotiating CNC status?

Negotiating CNC status shows the IRS that you are serious about your responsibility to pay taxes, even if you currently do not have the funds to do so. This proactive approach can help manage financial challenges effectively.

Where can I find support for navigating tax issues related to CNC status?

There are resources available to help taxpayers navigate tax issues, and individuals are encouraged to seek assistance to find the best path forward.