Introduction

Understanding long-term disability insurance is crucial for anyone looking to secure their financial future against unforeseen health challenges. We understand that navigating this topic can feel overwhelming. With approximately 30% of individuals aged 35 to 65 experiencing conditions that could hinder their ability to work for extended periods, the stakes are high.

This article delves into the various factors influencing long-term disability insurance costs. Age, health status, occupation, and coverage options can dramatically affect premiums. It’s common to feel uncertain about how these elements come together. As you explore these complexities, consider this pressing question: how can you effectively balance the need for comprehensive coverage with the desire to manage costs? You're not alone in this journey, and we're here to help.

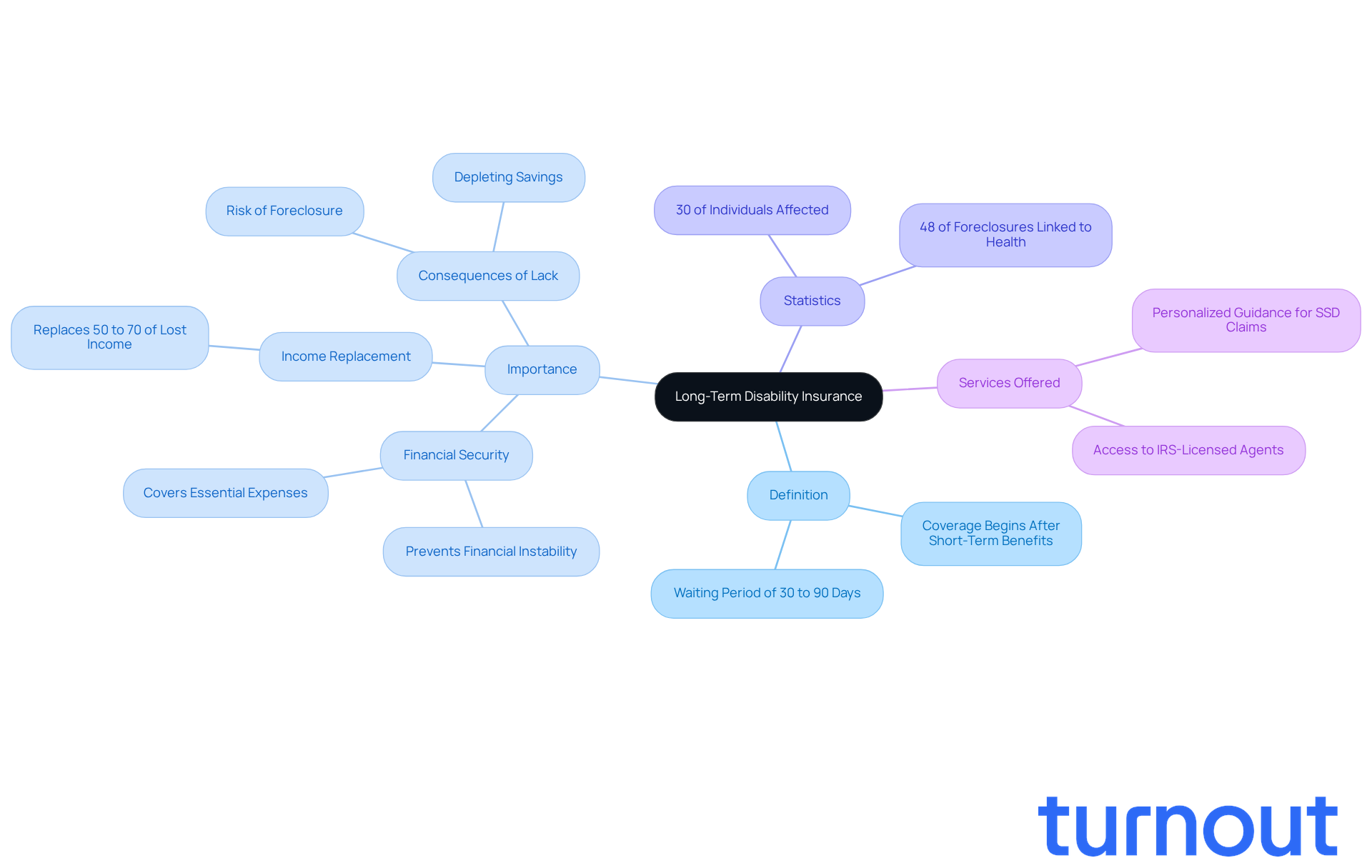

Define Long-Term Disability Insurance and Its Importance

Long-term coverage (LTD) serves as a vital safety net for those unable to work due to prolonged illness or injury. We understand that facing such challenges can be overwhelming. LTD typically begins after short-term benefits run out, with coverage starting after a waiting period of 30 to 90 days.

The significance of long term disability insurance costs lies in their ability to replace a substantial portion of lost income, usually between 50% and 70%. This financial support is crucial for covering essential expenses like housing, healthcare, and daily living costs, particularly when factoring in long term disability insurance costs during tough times. Without LTD, many individuals risk financial instability, which can lead to severe consequences such as foreclosure or depleting savings.

Statistics reveal that around 30% of individuals aged 35 to 65 will encounter a condition lasting at least 90 days. This highlights the importance of LTD in personal financial planning. Real-world examples show that 48% of home foreclosures are linked to health conditions, underscoring the need for financial security against unexpected medical issues.

LTD coverage isn’t just an option; it’s a fundamental part of protecting your financial future. We’re here to help you navigate these challenges. Turnout offers essential tools and services, including personalized guidance through the SSD claims process and access to IRS-licensed enrolled agents for tax debt relief. You are not alone in this journey; we’re committed to ensuring you receive the financial support you need during difficult times.

Explore Factors Affecting Long-Term Disability Insurance Costs

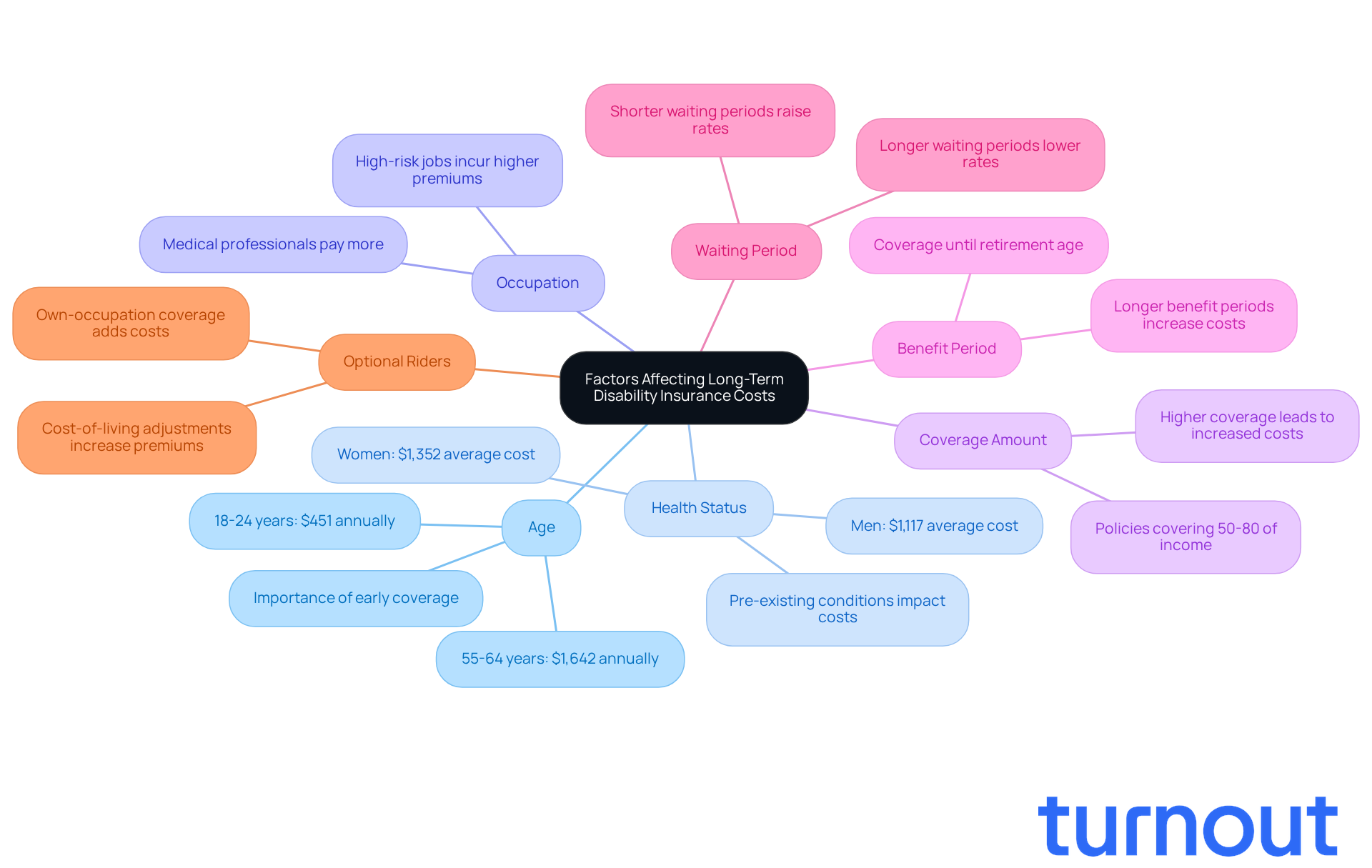

Several key factors significantly influence long term disability insurance costs, and understanding them can help you make informed decisions.

-

Age: We understand that age plays a crucial role in determining premiums. Younger individuals often enjoy lower rates because they are statistically less likely to file a claim. For instance, those aged 18-24 might pay around $451 annually, while individuals aged 55-64 could see costs rise to approximately $1,642. This trend underscores the importance of securing coverage early to lock in lower long term disability insurance costs.

-

Health Status: It's common to feel concerned about how your health might affect your insurance options. Pre-existing conditions or a history of health issues can lead to higher costs or even denial of coverage. For example, individuals with long-term health issues, like arthritis or asthma, often face increased expenses. Notably, women incur an average yearly cost of $1,352 for disability coverage, compared to $1,117 for men. Understanding this can help you better navigate the long term disability insurance costs.

-

Occupation: Your job can also impact your insurance costs. If you work in a high-risk occupation, you might pay more due to the increased likelihood of claims. Medical professionals, for instance, often face significantly higher premiums than those in lower-risk jobs. This classification reflects the insurance industry's assessment of risk.

-

Coverage Amount: The amount of coverage you desire directly affects your expenses. Policies that cover a larger portion of your income or provide higher benefit amounts typically come with increased costs. It's essential to consider what you truly need.

-

Benefit Period: Policies that offer benefits for extended durations, such as until retirement age, usually have higher expenses. Long-term disability insurance often covers 50-80% of pre-disability earnings, which can lead to increased costs for longer coverage periods.

-

Waiting Period: The waiting period, or the time before benefits begin, can also influence your costs. A longer waiting period generally results in lower rates, while a shorter one raises them. Finding the right balance between immediate coverage and affordability is key.

-

Optional Riders: Additional features, like cost-of-living adjustments or own-occupation coverage, can increase your policy's cost. While these riders offer enhanced protection, they come with an extra premium. It's vital to evaluate your needs carefully.

Understanding these elements is essential for anyone navigating the complexities of long term disability insurance costs. It ensures you make choices that align with your financial security needs. Remember, the average denial rate for impairment claims is 68%, highlighting the challenges many face when seeking coverage. Additionally, around 46% of U.S. adults feel they need some form of disability coverage, yet only 18% report having it. This gap emphasizes the difference between perceived necessity and actual possession. You're not alone in this journey, and we're here to help you find the right path.

Examine Coverage Options and Their Cost Implications

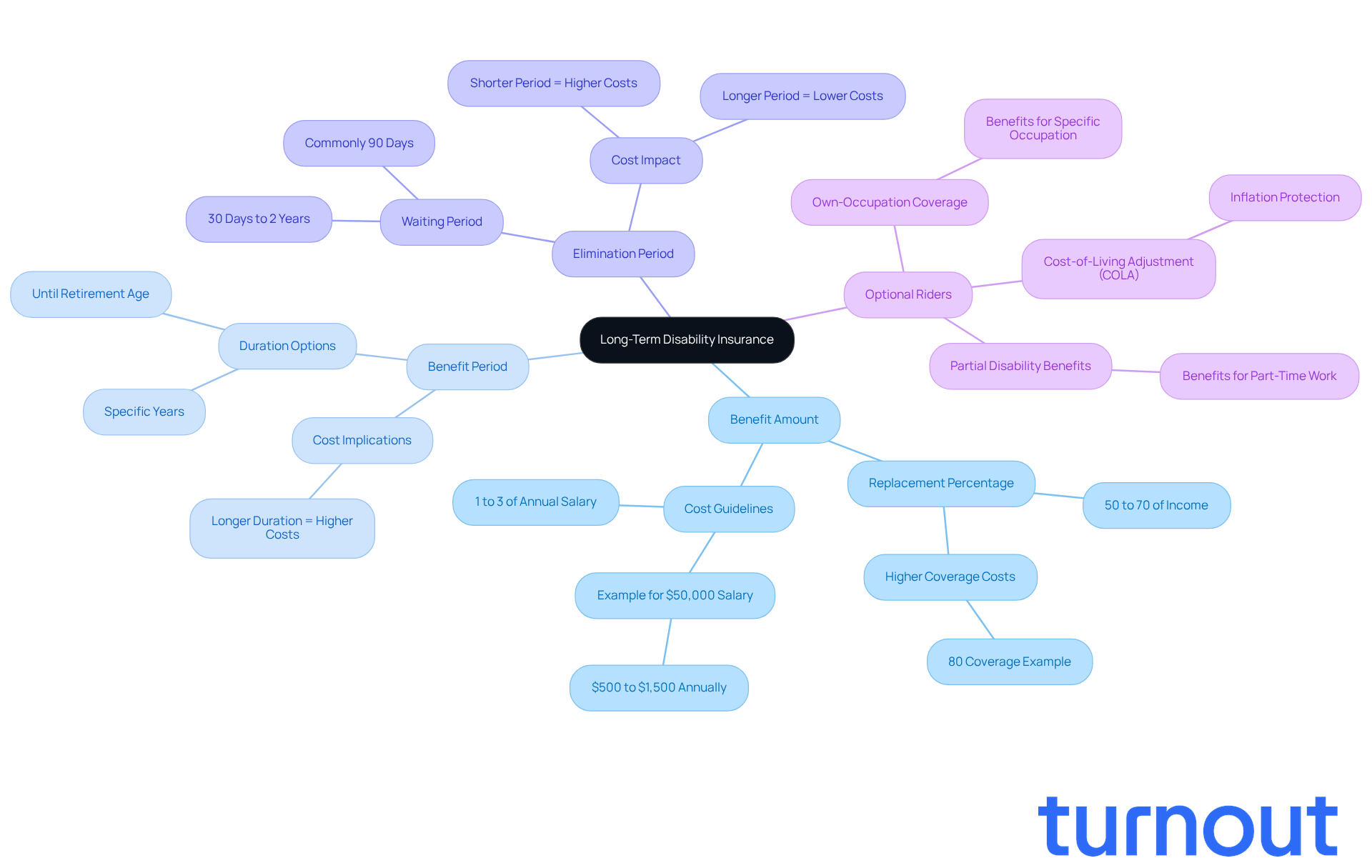

When it comes to long-term disability insurance, we understand that navigating the various coverage options can feel overwhelming. It's essential to consider how these choices impact both your protection levels and the long term disability insurance costs.

Benefit Amount: Most policies replace 50% to 70% of your income. If you opt for a larger benefit amount, be prepared for higher long term disability insurance costs. For example, a policy that replaces 80% of your pre-tax income will be significantly pricier than one covering 50%. A helpful guideline is to set aside 1% to 3% of your annual salary for the long term disability insurance costs. So, if you earn $50,000 a year, you might expect to pay between $500 and $1,500 annually.

Benefit Period: Coverage can last for a specific number of years or until you reach retirement age. Generally, longer benefit durations lead to increased long term disability insurance costs, reflecting the greater risk for insurers.

Elimination Period: This is the waiting period before your benefits kick in, and it can vary. A shorter waiting period usually results in higher long term disability insurance costs, whereas a longer waiting period can help reduce your expenses. Most policies have an elimination period ranging from 30 days to two years, with 90 days being quite common.

Optional riders can enhance your coverage, but they may also increase your long term disability insurance costs. Here are a few common ones:

- Cost-of-Living Adjustment (COLA): This rider helps your benefits grow over time to keep pace with inflation, ensuring your purchasing power remains intact.

- Own-Occupation Coverage: This provision allows you to receive benefits if you can't work in your specific occupation, even if you can perform other jobs. This is especially important for specialized professionals.

- Partial Disability Benefits: This rider provides benefits if you can work part-time but earn less than your full salary, helping to bridge income gaps during your recovery.

Understanding these factors is crucial for making informed choices about long term disability insurance costs related to your coverage. They directly affect both the extent of your protection and the long term disability insurance costs associated with it. It's also important to remember that Social Security Disability Benefits (SSDB) may not be a reliable substitute for long-term coverage due to strict criteria and modest payments. As of April 2025, the average benefit for individuals with impairments is only $1,582.

You're not alone in this journey. We're here to help you navigate these options and find the right coverage for your needs.

Outline the Application Process for Long-Term Disability Insurance

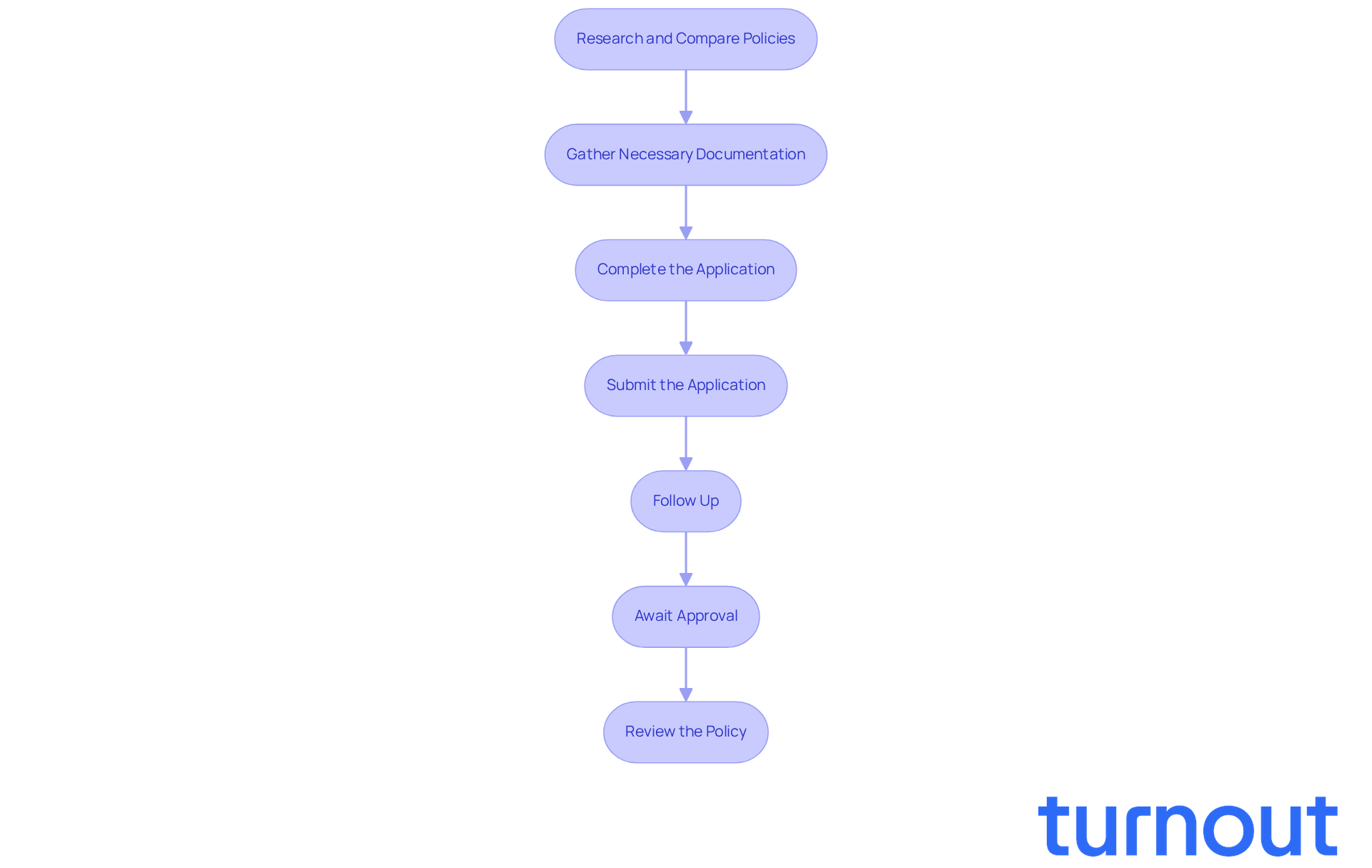

Navigating the application process for long-term disability insurance can feel overwhelming, but you’re not alone in this journey. We understand that taking the first step is crucial, and we’re here to help guide you through it. Here are some essential steps to ensure a smooth experience:

-

Research and Compare Policies: Start by exploring various insurance providers and their offerings. To find the best fit for your needs, compare premiums, coverage options, and customer reviews while considering long term disability insurance costs. Remember, this is about securing your future.

-

Gather Necessary Documentation: Compile the required documents, which typically include:

- Proof of income, such as pay stubs or tax returns

- Medical records detailing your disability

- Employment history and a description of your job duties

-

Complete the Application: Take your time to accurately fill out the application form, ensuring all requested information is provided. Thoroughness is crucial to avoid delays in processing. It’s common to feel anxious about this step, but being meticulous can make a difference.

-

Submit the Application: Once you’ve completed your application, send it along with the supporting documents to the coverage provider. Don’t forget to keep copies for your records. This is an important step in your journey.

-

Follow Up: After submission, confirm receipt with the insurer and inquire about the expected timeline for processing your application. The average duration from claim submission to the initial decision is about 45 days, but it may extend to three or four months depending on various factors. It’s perfectly normal to feel uncertain during this waiting period.

-

Await Approval: The approval process can take several weeks to months. Be prepared for potential requests for additional information from the insurer; these are common and can delay the process. Remember, patience is key.

-

Review the Policy: Once approved, carefully review the policy terms before signing to ensure it aligns with your needs and expectations. This is your opportunity to ensure everything is in order.

Understanding these steps can significantly enhance your chances of a successful application. Thorough preparation and prompt responses to requests for information are vital. Additionally, seeking legal representation can be beneficial; attorneys can help ensure that forms are filled out correctly and that all necessary documentation is submitted. You deserve support during this process, and we’re here to help.

Conclusion

Long-term disability insurance is a vital safety net for those who may find themselves unable to work due to illness or injury. We understand that navigating the costs associated with this insurance can feel overwhelming, but it’s essential for making informed financial decisions. By recognizing the importance of securing coverage early, you can prepare for unexpected challenges and avoid the potential financial strain of being uninsured.

In this article, we explored several factors that influence long-term disability insurance costs, such as:

- Age

- Health status

- Occupation

- Coverage amount

- Benefit period

- Waiting period

- Optional riders

Each of these elements significantly impacts premium rates and overall policy expenses. We also outlined the application process, highlighting the importance of thorough preparation and understanding the necessary documentation to secure coverage.

Ultimately, the importance of long-term disability insurance cannot be overstated. It offers not just financial stability during tough times but also peace of mind, knowing that essential expenses can be covered. As statistics show a concerning gap between the perceived need for coverage and actual possession, it’s crucial for individuals to take proactive steps in securing their financial future.

Engaging with knowledgeable resources and understanding the nuances of long-term disability insurance can empower you to make choices that protect your well-being and that of your family. Remember, you are not alone in this journey; we’re here to help you navigate these important decisions.

Frequently Asked Questions

What is long-term disability (LTD) insurance?

Long-term disability insurance serves as a safety net for individuals unable to work due to prolonged illness or injury, providing financial support after short-term benefits expire.

When does long-term disability insurance coverage typically begin?

LTD coverage typically begins after a waiting period of 30 to 90 days, once short-term benefits have run out.

What percentage of income does long-term disability insurance usually replace?

LTD insurance usually replaces between 50% and 70% of lost income, helping to cover essential expenses.

Why is long-term disability insurance important?

It is important because it provides financial support to cover essential expenses like housing, healthcare, and daily living costs, reducing the risk of financial instability during tough times.

What statistics highlight the need for long-term disability insurance?

Approximately 30% of individuals aged 35 to 65 will face a condition lasting at least 90 days, and 48% of home foreclosures are linked to health conditions, emphasizing the need for financial security.

How can Turnout assist individuals with long-term disability issues?

Turnout offers personalized guidance through the Social Security Disability (SSD) claims process and access to IRS-licensed enrolled agents for tax debt relief, providing essential support during difficult times.