Introduction

Navigating the complexities of long-term disability (LTD) and Social Security Disability Insurance (SSDI) can feel overwhelming, especially when facing the challenges of a prolonged illness or injury. These financial safety nets are here to support you, but understanding their differences in eligibility, payment structures, and interactions can be daunting.

We understand that you may be wondering: how can you ensure you receive the maximum benefits available? This article aims to shed light on the nuances of LTD and SSDI, offering insights that empower you to make informed decisions during these difficult times. Remember, you are not alone in this journey; we're here to help.

Define Long Term Disability and Social Security Disability Insurance

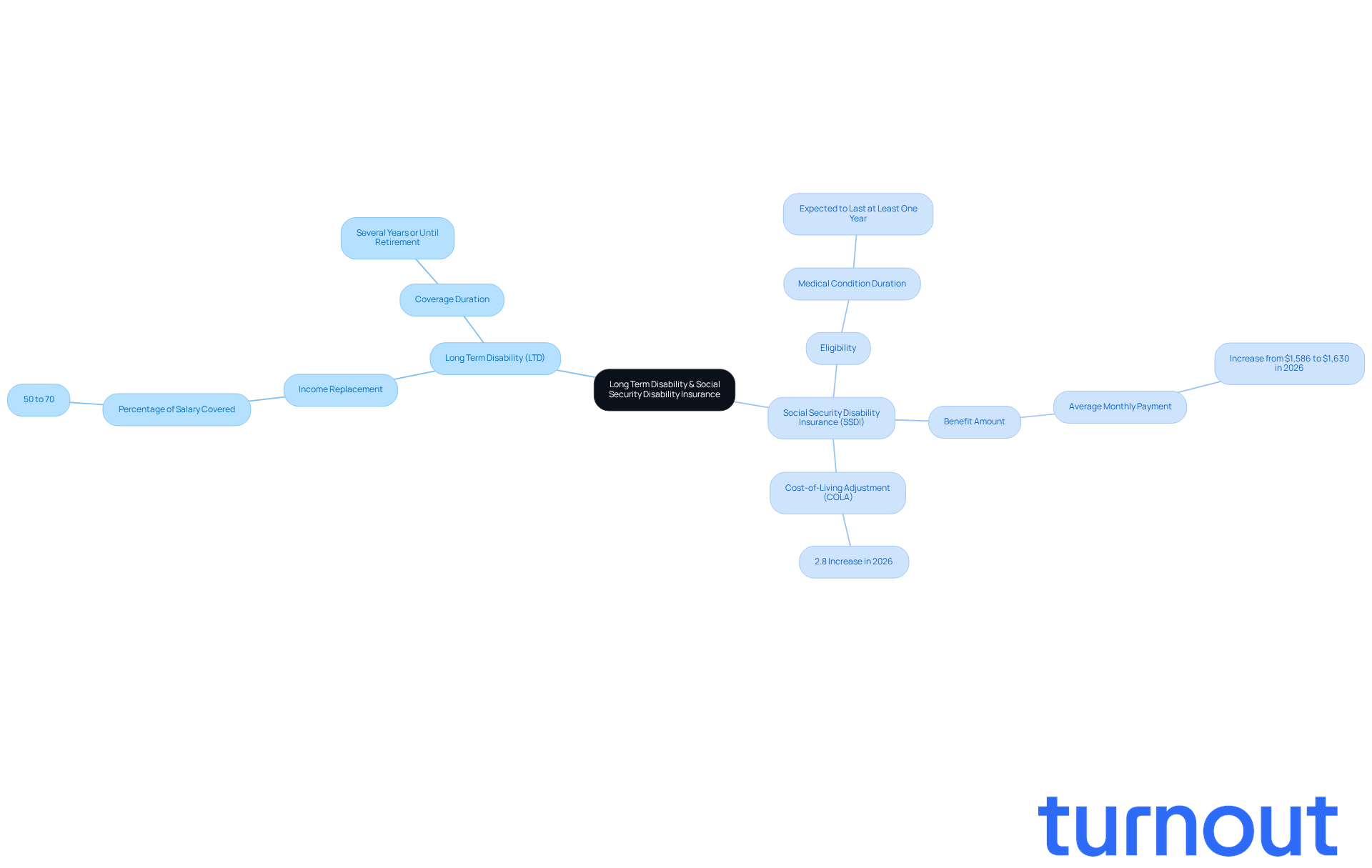

Long Term Disability (LTD) insurance is designed to provide income replacement for those who find themselves unable to work due to a prolonged illness or injury, in conjunction with long term disability and social security benefits. It typically covers a percentage of your salary, usually between 50% and 70%, and can last for several years or even until retirement age, depending on the policy terms. This financial support is vital for maintaining stability during tough times.

On the other hand, long term disability and social security are represented by the Social Security Disability Insurance (SSDI), a federal program that offers financial assistance to individuals who cannot work because of a medical condition expected to last at least one year or result in death. The benefits you receive depend on your work history and income, which means the amount can vary significantly based on your previous earnings. As of 2026, those receiving disability benefits will see an average monthly payment increase from $1,586 to $1,630, reflecting a 2.8% cost-of-living adjustment (COLA) aimed at helping beneficiaries cope with rising living costs.

Understanding these options is crucial for anyone exploring financial assistance during times of disability. We know that navigating the complexities of long term disability and social security can be overwhelming. That's why seeking guidance from financial advisors can be incredibly beneficial. They can provide valuable insights into the best strategies for maximizing your benefits and ensuring your financial security.

Remember, you are not alone in this journey. We're here to help you find the support you need.

Compare Eligibility Requirements for LTD and SSDI

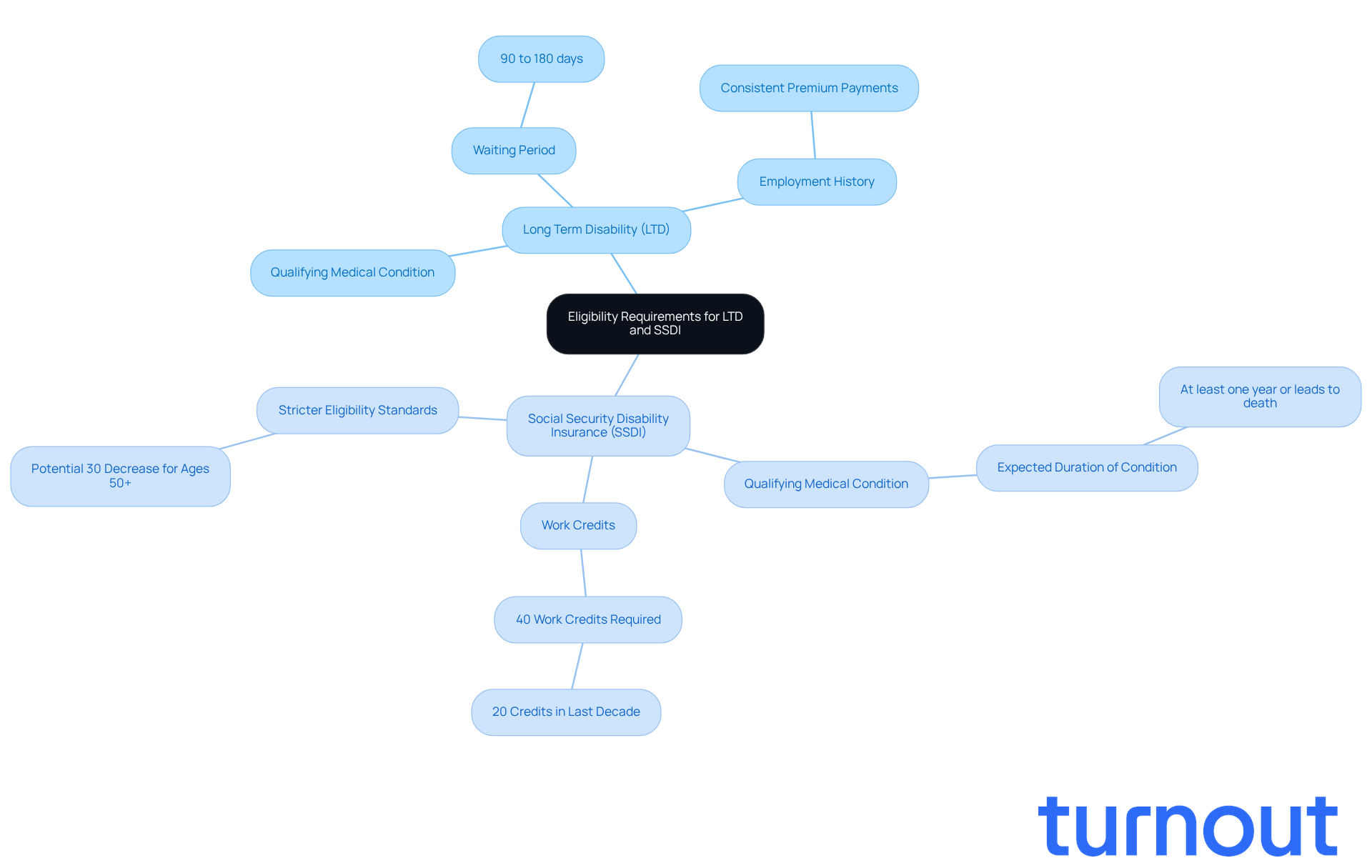

Navigating the world of long term disability and social security insurance can feel overwhelming, especially when facing health challenges. Eligibility typically hinges on having a qualifying medical condition that makes it hard to fulfill your job responsibilities. While policies can differ, most require a waiting period of 90 to 180 days before benefits kick in. It's also important to note that you must have been employed and consistently paying premiums into the LTD policy.

On the other hand, the eligibility standards for long term disability and social security, such as Social Security Disability Insurance (SSDI), are stricter. To qualify, you generally need at least 40 work credits, with 20 of those earned in the last decade. Plus, you must demonstrate that your disability meets the Social Security Administration's (SSA) definition, which requires that your medical condition is expected to last at least one year or lead to death.

It's common to feel discouraged, especially considering recent analyses that show disability benefits eligibility could decrease by up to 30 percent for those aged 50 and older. Many individuals face significant hurdles when trying to navigate the disability benefits application process, often due to misinformation or excessive documentation. This complexity highlights the importance of seeking help from knowledgeable advocates. For instance, Turnout's trained nonlawyer advocates can assist you in improving your chances of approval without needing legal representation.

Understanding these differences is crucial for anyone seeking assistance. The application procedures and criteria for long term disability and social security vary greatly, which can significantly impact your access to the support you need. Remember, you are not alone in this journey. We're here to help you every step of the way.

Analyze Benefits and Payment Structures of LTD and SSDI

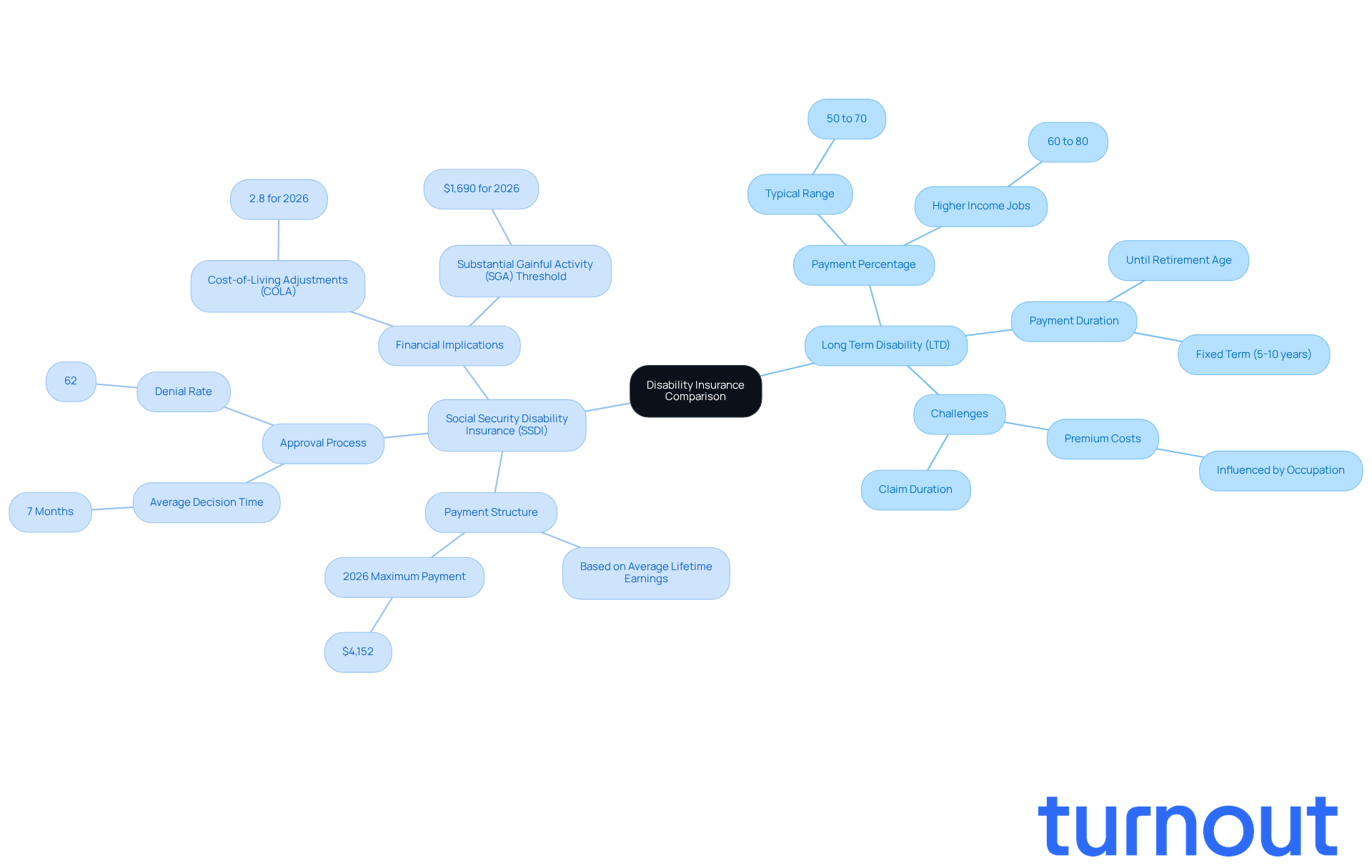

Long Term Disability insurance typically pays a percentage of your pre-disability income, often between 50% and 70%. We understand that the length of these payments can vary significantly depending on the policy. Some policies offer support until retirement age, while others may have a fixed term, like 5 or 10 years.

In contrast, Social Security Disability Insurance payments are based on your average lifetime earnings. For 2026, the highest monthly payment is around $4,152. It's important to note that these payments are subject to yearly cost-of-living adjustments (COLA), which can increase the amount you receive over time. In 2026, the significant gainful activity (SGA) threshold will rise to $1,690 per month for most recipients. For those who are statutorily blind, it will increase to $2,830 per month, which can affect eligibility and the calculation of assistance.

Navigating the approval process for SSDI can be particularly challenging. Initial decisions average nearly seven months, and the denial rate is about 62%. This means that the approval rate is only around 38%. We know this lengthy process can create significant financial strain for applicants, who may find themselves waiting for essential support. For instance, if you earn $40,000 in 2026, you could see a reduction of $7,760 in your payments because your earnings surpass the SGA threshold.

Understanding these distinctions in payment systems is crucial for anyone relying on these resources. It can feel overwhelming, but you are not alone in this journey. Turnout provides tools and services to help consumers, including trained nonlawyer advocates for SSD claims. We’re here to ensure that you can advocate for yourself and secure the necessary resources without needing legal representation. Financial specialists emphasize the importance of being knowledgeable about these systems to effectively manage the challenges related to acquiring benefits.

Explore the Interaction Between LTD and SSDI Benefits

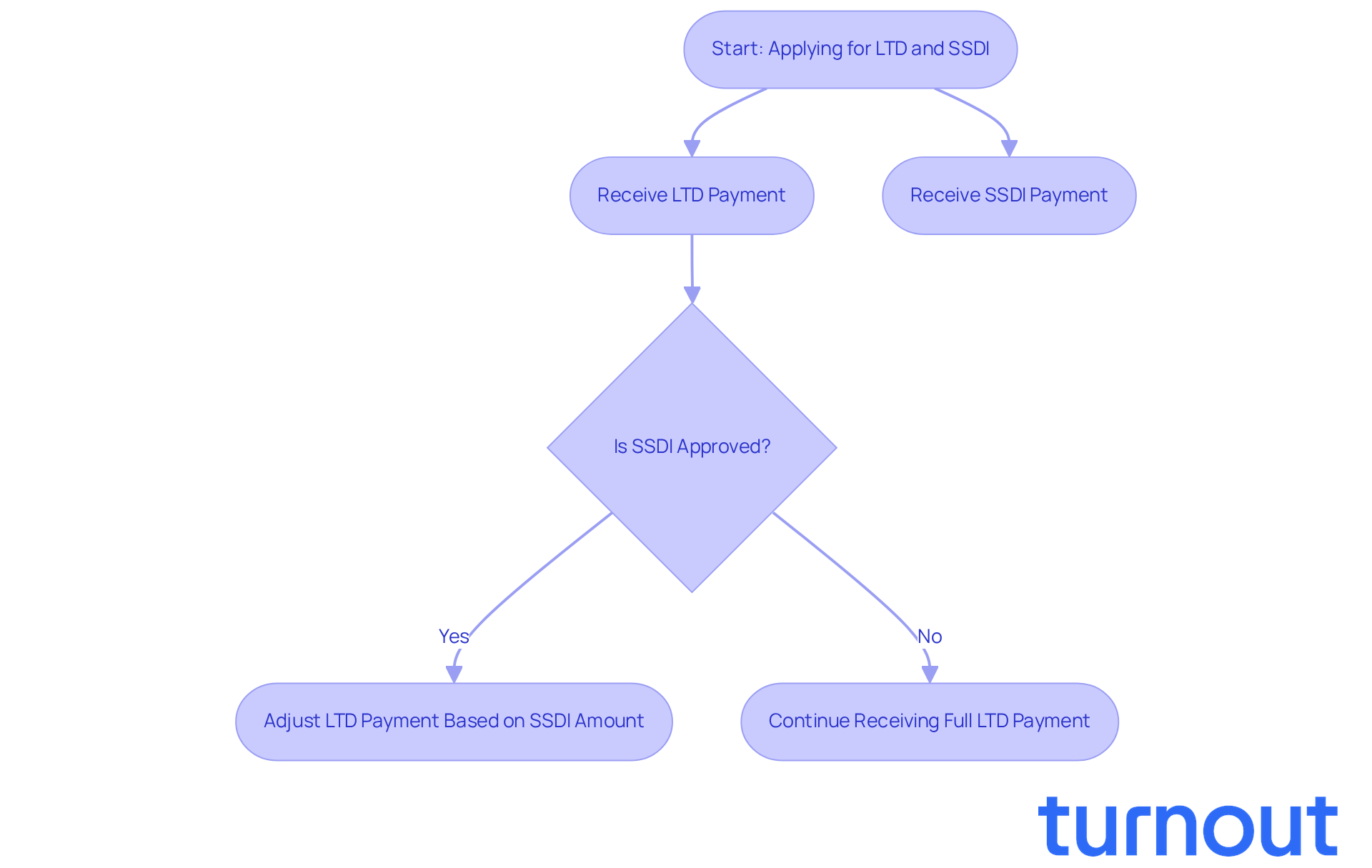

Navigating long term disability and social security assistance can be challenging, as many individuals may also qualify for Social Security Disability Insurance. However, it’s important to understand that some policies related to long term disability and social security allow insurers to reduce LTD payments by the amount received from Social Security Disability Insurance. This means that while you can access both forms of support, the total financial assistance may not be as high as you expect.

For instance, if you receive $2,000 monthly from your LTD policy and later qualify for $1,500 from Social Security Disability Insurance, your LTD payment could be adjusted down to $500 to account for the Social Security benefit. Additionally, some LTD policies require applicants to seek disability assistance before they can receive LTD payments.

Understanding how long term disability and social security benefits interact is crucial for anyone seeking to maximize their financial support during difficult times. Many people find themselves navigating both long term disability and social security benefits, highlighting the importance of being informed about how these systems affect one another. Disability lawyers often emphasize that the relationship between long term disability and social security can significantly impact your overall financial situation. Seeking professional advice can be a vital step in managing these complex systems.

Real-life experiences illustrate the challenges faced by individuals in this situation. For example, a claimant who initially relied on long term disability and social security benefits might find their financial landscape shifting once they are approved for Social Security Disability Insurance. This change necessitates careful planning to ensure that their total income meets their needs. By being proactive and understanding the details of their policies, individuals can better manage their finances during tough times. It’s also essential to remember that SSDI cases heavily rely on medical documentation, which is key to proving eligibility and ensuring a smoother application process.

Turnout simplifies access to government benefits by guiding you through the complexities of SSD claims and tax relief, all without the need for legal representation. This approach empowers you to make informed decisions about your financial resources. Remember, you’re not alone in this journey; we’re here to help.

Conclusion

Understanding long-term disability insurance and Social Security Disability Insurance (SSDI) is crucial for anyone navigating the often overwhelming landscape of financial support during times of illness or injury. Both options serve as lifelines, providing essential income replacement, but they come with distinct eligibility requirements, payment structures, and interactions. By recognizing these differences, you can empower yourself to make informed decisions about your financial future.

We understand that the complexities of applying for these benefits can be daunting. Long-term disability insurance typically offers a percentage of your pre-disability income, usually between 50% and 70%. In contrast, SSDI benefits are based on your average lifetime earnings and come with strict eligibility criteria. The potential overlap and adjustments between LTD and SSDI can add to the confusion, which is why seeking professional guidance is so important. You don’t have to navigate this process alone.

Ultimately, grasping the nuances of long-term disability and Social Security benefits goes beyond just securing financial support; it’s about finding stability and peace of mind during challenging times. Engaging with knowledgeable advocates or financial advisors can significantly enhance your ability to access and maximize these vital resources. Remember, taking proactive steps to understand and coordinate these benefits can lead to better financial management and improved outcomes for you and your loved ones. You are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What is Long Term Disability (LTD) insurance?

Long Term Disability (LTD) insurance provides income replacement for individuals unable to work due to a prolonged illness or injury. It typically covers 50% to 70% of your salary and can last for several years or until retirement age, depending on the policy terms.

How does Social Security Disability Insurance (SSDI) relate to long term disability?

Social Security Disability Insurance (SSDI) is a federal program that offers financial assistance to individuals who cannot work due to a medical condition expected to last at least one year or result in death. It is a form of long term disability support.

How are SSDI benefits determined?

SSDI benefits depend on your work history and income, meaning the amount you receive can vary significantly based on your previous earnings.

What is the expected change in SSDI benefits by 2026?

As of 2026, those receiving SSDI benefits will see an average monthly payment increase from $1,586 to $1,630, reflecting a 2.8% cost-of-living adjustment (COLA) to help beneficiaries cope with rising living costs.

Why is it important to understand long term disability and social security options?

Understanding these options is crucial for individuals exploring financial assistance during times of disability, as it can help them maintain financial stability.

How can financial advisors assist with long term disability and social security?

Financial advisors can provide valuable insights and strategies for maximizing benefits and ensuring financial security during times of disability.