Overview

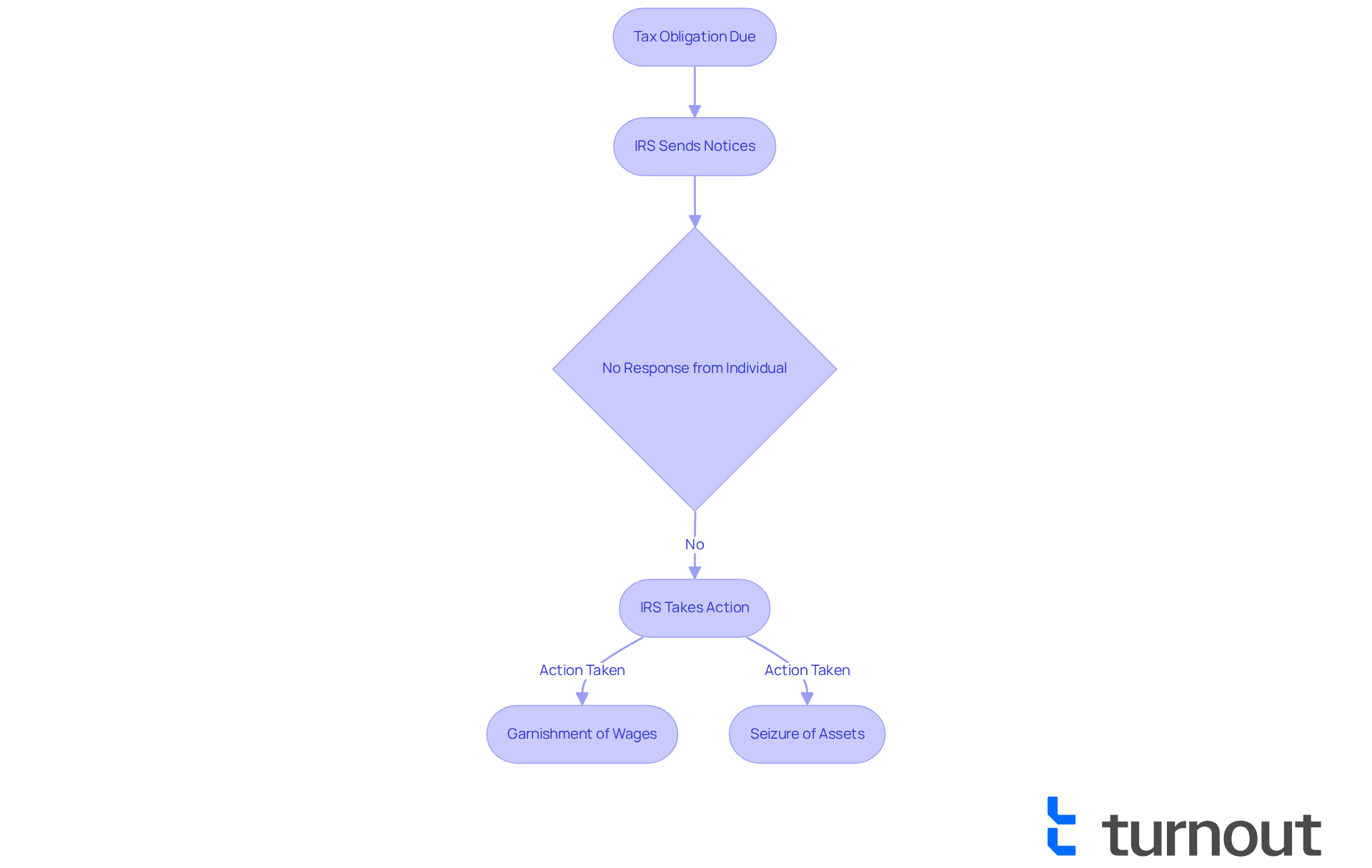

Understanding levy taxes can be daunting, but we're here to help. Levy taxes are the legal authority that government entities, such as the IRS, have to seize an individual's property or assets to satisfy unpaid tax debts. It's common to feel overwhelmed by this concept, especially when faced with IRS notices.

Failing to respond to these notices can lead to severe financial consequences, such as wage garnishment or bank account seizures. We understand that these outcomes can be frightening, but knowing the importance of proactive engagement with tax authorities can make a significant difference.

By staying informed and taking action, you can prevent these distressing situations. Remember, you are not alone in this journey. Many individuals face similar challenges, and reaching out for assistance can provide the support you need. Let's work together to navigate this process and ensure your financial well-being.

Introduction

Understanding the intricacies of levy taxes is crucial for anyone navigating the complexities of tax obligations. We understand that these taxes can create significant anxiety, as they empower governmental authorities to seize assets when individuals fail to meet their financial responsibilities. This reality poses a considerable risk for millions of people.

In this article, we will explore the various forms of levy taxes, their implications, and the processes involved. It's common to feel overwhelmed by these challenges, but proactive engagement with tax authorities can make a difference. How can you safeguard your financial stability in the face of such daunting challenges? Together, we will find ways to navigate this journey.

Define Levy Taxes: Understanding the Concept

The levy taxes meaning refers to the legal power granted to governmental bodies, such as the Internal Revenue Service (IRS), to impose a tax that allows them to confiscate an individual's property or assets to settle unpaid tax obligations. We understand that this can be a daunting prospect. Unlike a lien, which is simply a claim against property, a seizure allows for the actual confiscation of assets, including wages, bank accounts, and real estate. This process often begins after an individual has failed to respond to prior notices concerning their tax obligations, emphasizing the levy taxes meaning for those who may be unaware of their tax liabilities or the consequences of non-payment.

Every year, millions of Americans confront the risk associated with the levy taxes meaning. In FY 2024, nearly 62.2 million individuals were assisted by the IRS through calls or office visits, highlighting the scale of tax-related issues impacting the population. It's common to feel overwhelmed by these numbers. The IRS has also resumed sending collection notices using Form 668-W, which instructs employers to garnish wages or other income for unpaid tax obligations. This renewed enforcement raises the risk for individuals who have not set up payment plans, making it crucial for them to proactively interact with the IRS to prevent such actions.

Real-world examples demonstrate the levy taxes meaning and its effect on individuals. For instance, a taxpayer who fails to respond to IRS notices may find their wages garnished, leading to financial strain and difficulty meeting everyday expenses. Tax experts stress that 'creating a collection alternative is the most effective method to prevent an IRS seizure or garnishment, highlighting the levy taxes meaning.' This approach can assist in reducing the risk of seizures and offer a more manageable solution to tax problems. As one specialist pointed out, 'Grasping the levy taxes meaning and the implications of imposed charges is essential for anyone dealing with financial obligations; proactive involvement can avert significant monetary repercussions.'

In conclusion, the levy taxes meaning of imposed charges signifies a considerable danger to financial stability for numerous Americans. We want to emphasize the necessity of awareness and prompt measures in managing fiscal responsibilities. Remember, you are not alone in this journey, and we’re here to help.

Explore Types of Levy Taxes: Variations and Implications

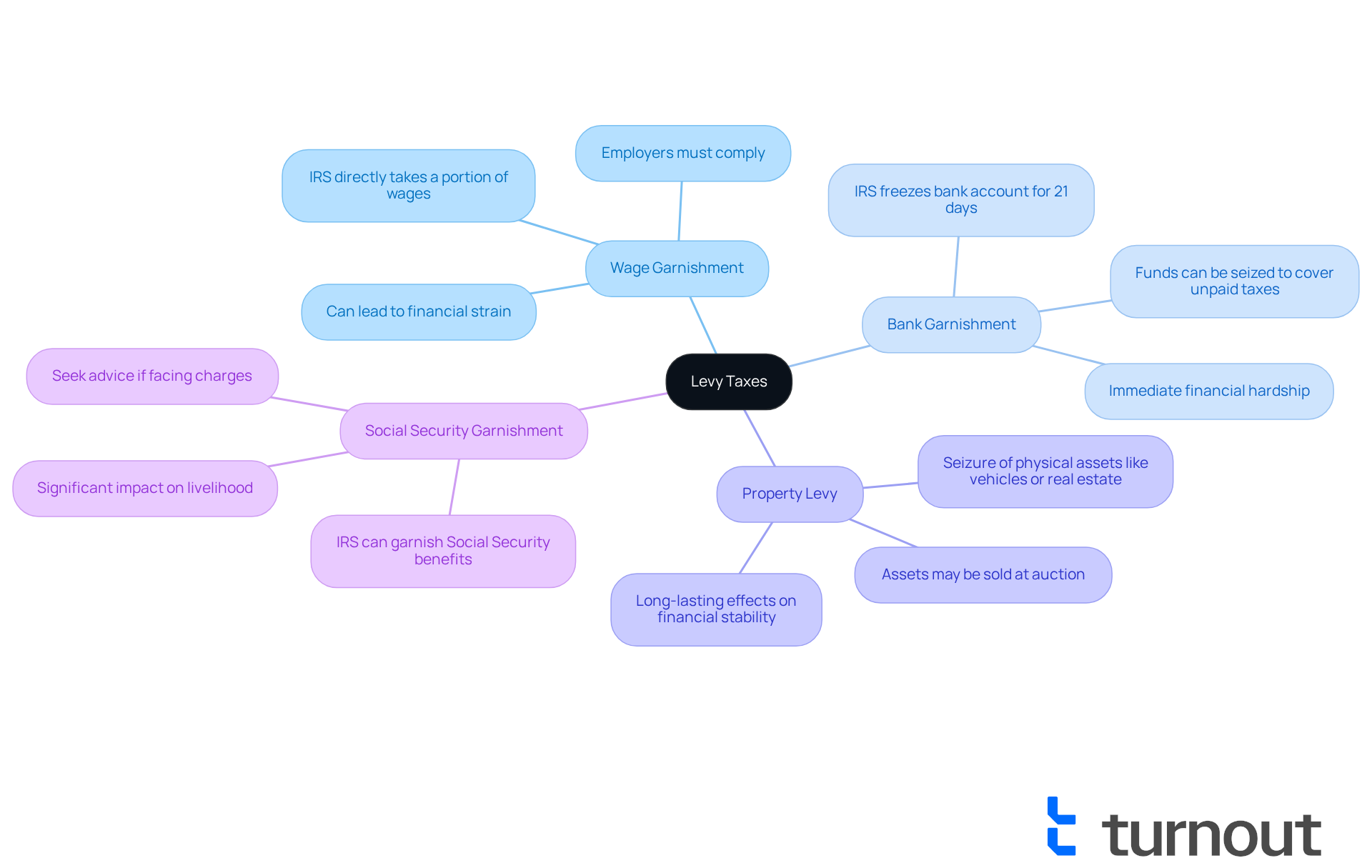

Navigating the world of taxation can be overwhelming, and it's important to understand the levy taxes meaning and the various forms of taxation that may impact you. Each type has unique consequences for individuals who pay taxes. Let's explore some of the most common ones:

-

Wage Garnishment: This type of levy allows the IRS to directly take a portion of your wages to satisfy tax debts. Employers are legally obligated to comply with these garnishments, which can significantly affect your take-home pay. We understand that wage garnishment can lead to financial strain, so it's essential to address your tax obligations proactively.

-

Bank Garnishment: A bank garnishment allows the IRS to freeze your bank account and seize funds to cover unpaid taxes. This can create immediate financial hardship, limiting your access to funds until the issue is resolved. Each year, the IRS issues a considerable number of bank seizures, emphasizing the importance of understanding this process and its implications. After imposing a tax charge, the IRS places a 21-day hold on your bank account, preventing withdrawals during this period. If the funds in your account are insufficient to settle the debt, the IRS may repeat the bank seizure process until your tax obligation is resolved.

-

Property Levy: This involves the seizure of physical assets, such as vehicles or real estate, to satisfy tax obligations. The IRS may sell these assets at auction to recover the owed amount, which can have lasting effects on your financial stability.

-

Social Security Garnishment: In certain instances, the IRS can garnish Social Security benefits to collect unpaid taxes. This can significantly impact individuals who rely on these funds for their livelihood, making it crucial to seek advice if you encounter possible charges.

Understanding the levy taxes meaning of these types of charges is vital for managing your financial responsibilities and preventing serious repercussions. Remember, you're not alone in this journey. We encourage you to consult with professionals who can help you navigate these complex situations effectively.

Examine the Levy Tax Process: Steps and Requirements

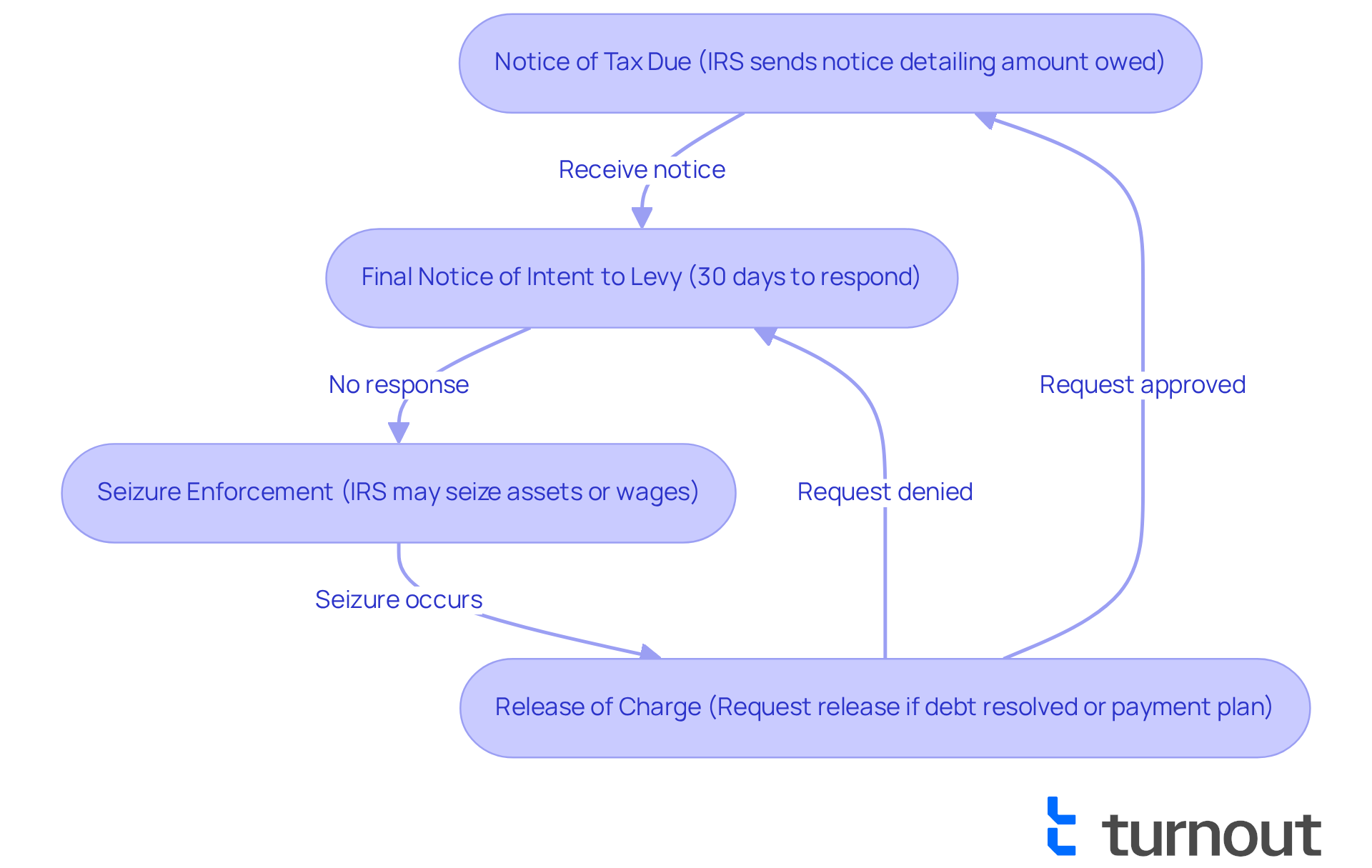

Navigating the IRS levy process can be daunting, but understanding the levy taxes meaning and the steps involved can help you take control of your situation. Here’s how the process typically unfolds:

- Notice of Tax Due: The journey begins when the IRS sends a notice detailing the amount owed and requesting payment. This is your first indication that action is required.

- Final Notice of Intent to Levy: If there’s no response, the IRS issues a final notice. This document serves as a caution about the forthcoming enforcement measure, highlighting the urgency of the situation. Importantly, you have at least 30 days to respond after receiving this notice, emphasizing the need for timely action.

- Seizure Enforcement: Should the notifications continue to be disregarded, the IRS may proceed with seizure, which can include confiscating assets or withholding wages. It's essential to know that this action can occur without court approval, as the IRS has the authority to enforce tax collection.

- Release of Charge: Fortunately, you have options. Taxpayers can request a release of the charge by demonstrating that the tax debt has been resolved or by entering into a payment agreement with the IRS. Remember, if your release request is denied, you can contest this decision, offering further choices in managing the process.

Statistics reveal that many taxpayers do not respond to IRS notifications, which can lead to serious consequences, including garnishments. Engaging promptly with the IRS can prevent escalation and open doors for resolution. For instance, individuals who acted quickly upon receiving a Final Notice of Intent to Levy often found relief through negotiation or payment plans. As Charla Suaste wisely notes, "IRS assessments can have a devastating impact on any individual - whether they are submitting as a single entity or as part of a company."

Real-life experiences underscore the importance of understanding the levy taxes meaning in the taxation process. Many individuals report feeling overwhelmed upon receiving IRS notices. However, those who sought help and responded proactively were able to manage their situations more effectively. By taking the initiative to communicate with the IRS, they frequently avoided penalties and discovered ways to address their tax debts.

You are not alone in this journey. Remember, we're here to help you navigate these challenges with compassion and understanding.

Assess the Impact of Levy Taxes: Consequences for Taxpayers

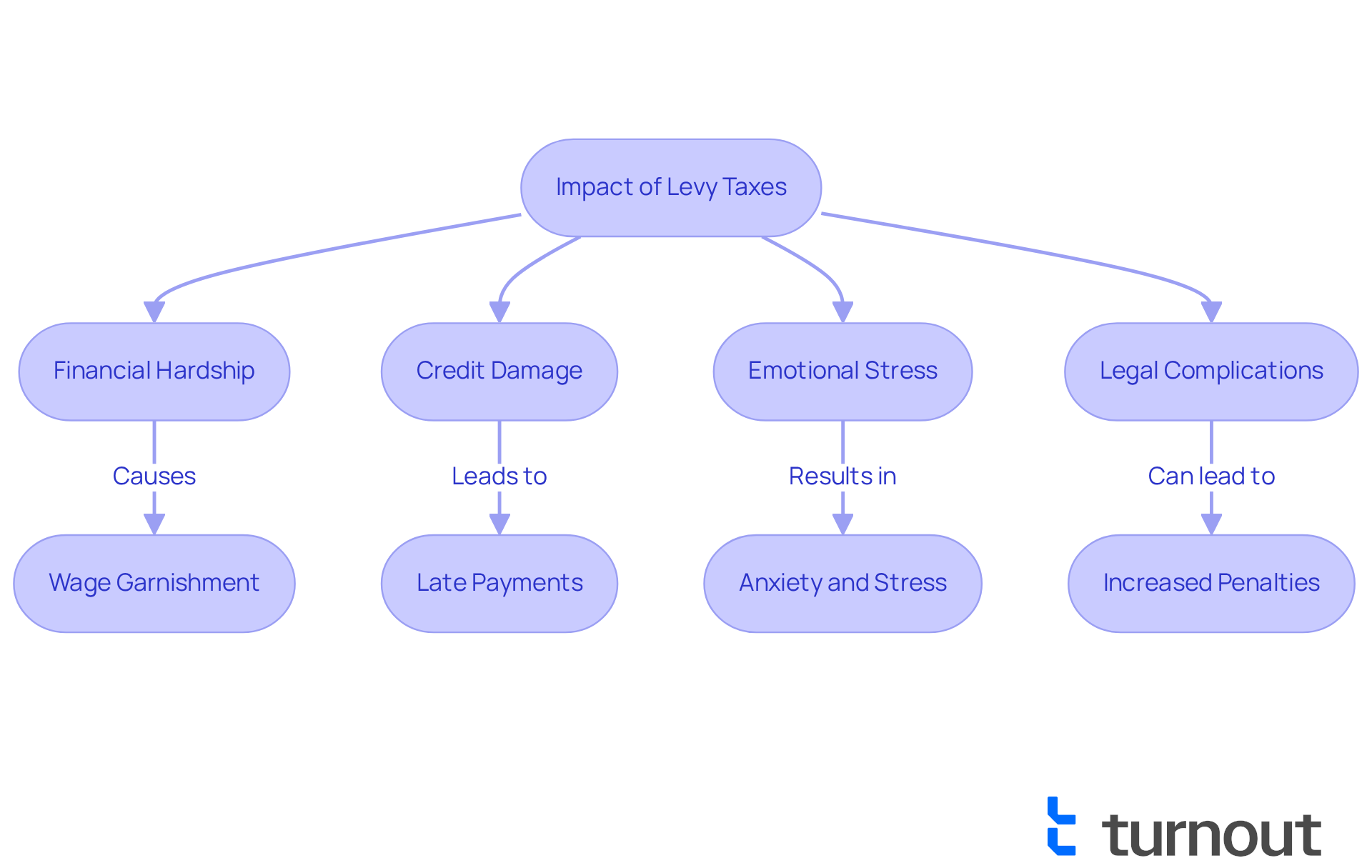

The impact of imposed taxes can be profound and far-reaching for taxpayers, especially for those navigating the complexities of Social Security Disability (SSD) claims and tax debt relief. We understand that the consequences can be overwhelming, and it’s important to recognize how they can affect your life.

-

Financial Hardship: The immediate seizure of wages or bank funds can lead to significant financial strain. It can be challenging to meet daily living expenses when, for example, the IRS garnishes wages by up to 15% of disposable earnings. This can leave individuals struggling to cover essential costs. If an entire check is seized, it may result in late payments reported to credit bureaus, remaining on credit reports for seven years and compounding the financial burden. At Turnout, we offer tools and services to help you navigate these challenges, ensuring you understand your options for relief.

-

Credit Damage: While a seizure itself may not appear on credit reports, the inability to pay other bills can lead to late payments that linger for seven years. Furthermore, tax liens no longer impact credit scores as they did before, following changes made in 2017 and 2018. This shift can severely hinder future borrowing opportunities, as lenders may interpret the situation as a sign of financial instability. Our approach at Turnout helps clients effectively manage their financial obligations and safeguard their credit.

-

Emotional Stress: The threat of asset seizure can understandably cause anxiety and stress, impacting your overall well-being. Mental health professionals note that financial stress can manifest physically, leading to symptoms such as trouble sleeping and headaches. One expert highlights that the emotional toll of tax impositions can be considerable, making it essential to seek assistance during these tough times. At Turnout, we recognize this emotional burden and provide resources to help you cope.

-

Legal Complications: Ignoring a claim can lead to further legal actions, including added penalties and interest on the owed amount, which only increases the financial burden. The IRS issues a Final Notice of Intent to Levy, giving a 30-day window for taxpayers to address the issue before assets are seized. Understanding these impacts underscores the importance of proactively addressing the levy taxes meaning. By recognizing the potential consequences of a levy taxes meaning, you can take steps to mitigate financial and emotional distress. Remember, Turnout is here to assist you in navigating these processes.

Conclusion

Understanding levy taxes is crucial for consumers. It highlights the significant legal authority that governmental bodies, like the IRS, have to seize assets for unpaid tax obligations. We understand that facing potential levies can be daunting. This proactive approach to managing tax responsibilities can prevent severe financial consequences, emphasizing the importance of awareness and timely action.

This article delves into various aspects of levy taxes, including different types such as:

- Wage garnishments

- Bank garnishments

- Property levies

Each type carries unique implications for taxpayers. It's essential for individuals to understand their rights and responsibilities. The process—from receiving a notice of tax due to the potential seizure of assets—serves as a reminder of the urgency in addressing tax obligations. Real-life examples illustrate how individuals can navigate these challenges effectively by engaging with the IRS and exploring options for relief.

Ultimately, grasping the meaning of levy taxes cannot be overstated. It is essential for individuals to take proactive steps to manage their financial obligations and seek assistance when needed. By understanding the potential impacts—ranging from financial strain to emotional stress—taxpayers can better navigate their responsibilities and protect their financial stability. Remember, you are not alone in this journey. We’re here to help.

Fostering a sense of empowerment through knowledge and support is imperative. You deserve to face these challenges with confidence, knowing that assistance is available. Together, let’s take those important steps toward financial security.

Frequently Asked Questions

What does the term "levy taxes" mean?

Levy taxes refer to the legal power granted to governmental bodies, such as the IRS, to impose a tax that allows them to confiscate an individual's property or assets to settle unpaid tax obligations.

How does a tax levy differ from a tax lien?

A tax lien is simply a claim against property, whereas a tax levy allows for the actual confiscation of assets, including wages, bank accounts, and real estate.

When does the IRS typically begin the levy process?

The IRS typically begins the levy process after an individual has failed to respond to prior notices concerning their tax obligations.

How many individuals were assisted by the IRS in FY 2024?

In FY 2024, nearly 62.2 million individuals were assisted by the IRS through calls or office visits.

What actions does the IRS take to collect unpaid taxes?

The IRS sends collection notices using Form 668-W, which instructs employers to garnish wages or other income for unpaid tax obligations.

What can individuals do to prevent a tax levy or garnishment?

Individuals can create a collection alternative, which is considered the most effective method to prevent an IRS seizure or garnishment.

What are the potential consequences of failing to respond to IRS notices?

Failing to respond to IRS notices can lead to wage garnishment, resulting in financial strain and difficulty meeting everyday expenses.

Why is it important to understand the implications of levy taxes?

Understanding the implications of levy taxes is essential for anyone dealing with financial obligations, as proactive involvement can help avoid significant monetary repercussions.