Overview

Dealing with IRS tax debt can be overwhelming, but there are compassionate options available to help you. IRS tax debt forgiveness offers various programs designed to assist individuals in reducing or even eliminating their tax obligations. Options like the Offer in Compromise, Currently Not Collectible status, and penalty relief can provide a lifeline.

Understanding the specific eligibility criteria for each option is crucial. We recognize that navigating these requirements can feel daunting, but knowing your options is the first step toward relief. Many individuals find significant reductions in their tax liabilities when they qualify and can demonstrate financial hardship.

You are not alone in this journey. The potential benefits of these programs can be life-changing, providing you with the opportunity to regain financial stability. We encourage you to explore these options and seek the support you need. Remember, help is available, and taking action today can lead to a brighter tomorrow.

Introduction

Navigating the complexities of tax obligations can often feel like an uphill battle, especially for those facing financial hardships. We understand that the weight of IRS tax debt can be overwhelming. However, IRS tax debt forgiveness programs offer a beacon of hope, providing individuals with opportunities to lessen or even eliminate their tax responsibilities.

Yet, the intricacies of these options can be daunting. How can one effectively navigate the maze of eligibility requirements and application processes to secure relief? It’s common to feel lost in the details. Understanding the available programs and their specific criteria is essential for anyone looking to reclaim financial stability. Remember, you are not alone in this journey, and we’re here to help.

Define IRS Tax Debt Forgiveness

IRS tax debt forgiveness encompasses various programs designed to help individuals lessen or eliminate their tax responsibilities. These options can include settling obligations for less than the total owed or obtaining relief from penalties. Understanding these opportunities is crucial for those facing financial hardship, as they can provide much-needed relief from tax burdens. However, it’s important to note that tax obligation forgiveness is not a one-size-fits-all solution; it requires meeting specific IRS criteria that vary based on individual circumstances.

A notable example of tax forgiveness is the Offer in Compromise (OIC). This program allows qualified individuals to negotiate a settlement with the IRS for less than the full amount due. It is particularly beneficial for those who are unable to pay their tax debts in full and meet certain financial criteria. The IRS charges a $205 application fee for an Offer in Compromise, which can be waived for low-income applicants. In fiscal year 2024, individuals proposed 33,591 offers in compromise, with the IRS accepting 7,199, resulting in settlements totaling $163.4 million.

Additionally, the IRS provides streamlined plans that cover balances up to $50,000 with a 72-month term. This structure offers manageable payment options for taxpayers. You might also qualify for penalty relief under specific conditions, which can further reduce your overall tax liability. The IRS frequently grants penalty relief, having provided it to nearly 5 million tax returns between 2020 and 2021. It’s essential to recognize that the IRS will never eliminate payroll taxes, and penalties apply for late filing or payment, which can complicate tax obligation situations.

Understanding these options and the eligibility criteria is vital for effectively managing the complexities of tax forgiveness. As Patrick Semrad observes, the IRS tax debt forgiveness program can serve as a valuable resource for individuals dealing with significant tax burdens. However, it necessitates careful planning, thorough documentation, and a clear understanding of the process. Clients who have sought assistance from the Tax Hardship Center have reported shaving an average of 81 percent off the amount the IRS initially demanded, highlighting the potential benefits of seeking help. Remember, you are not alone in this journey; we’re here to support you.

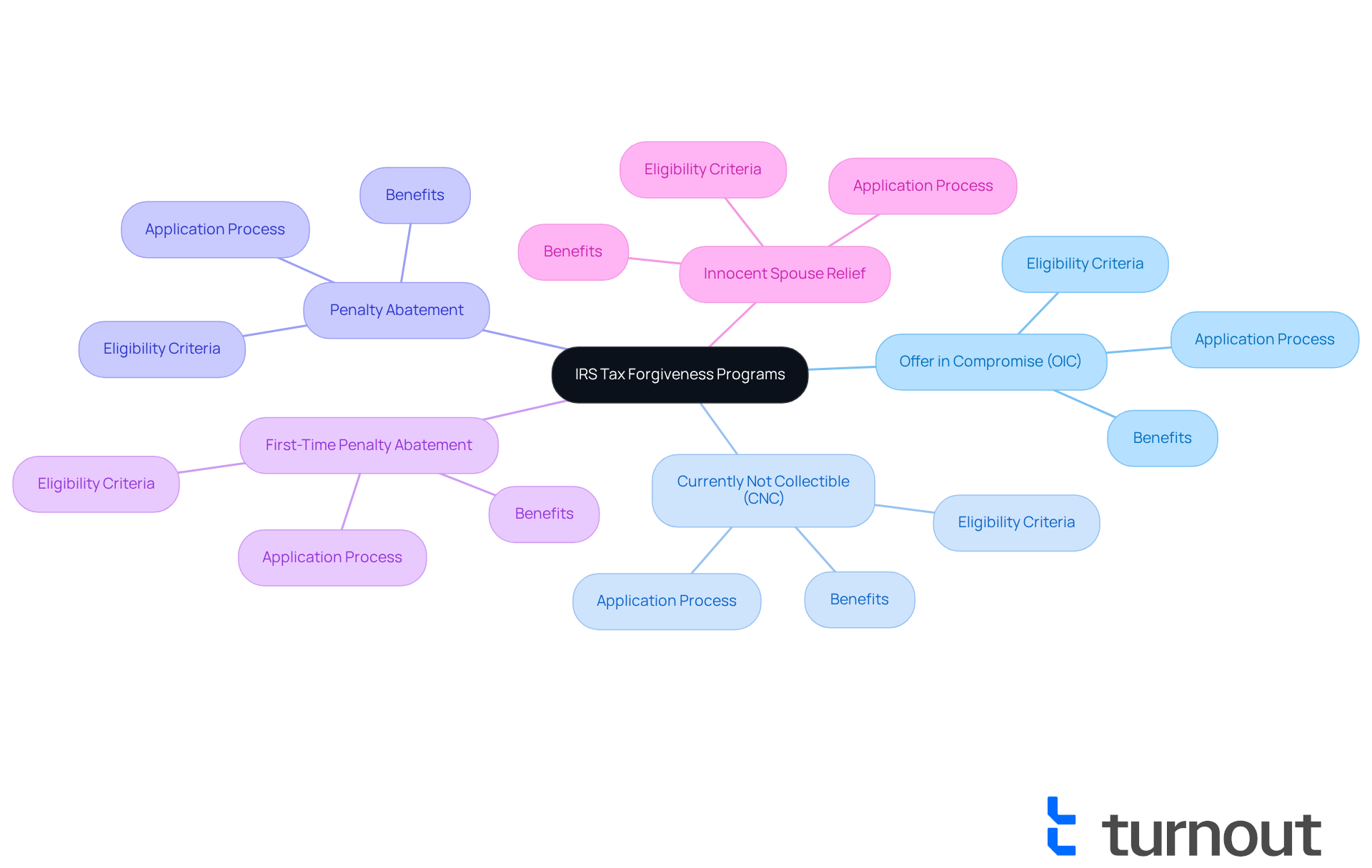

Explore Available IRS Tax Forgiveness Programs

Navigating financial obligations can be overwhelming, but numerous IRS forgiveness programs are here to help you find relief. Let’s explore some notable options that might ease your burden:

-

Offer in Compromise (OIC): This program allows eligible individuals to settle their tax obligations for less than the total amount owed. To qualify, you must demonstrate an inability to fully meet your tax obligations, showing that a reduced amount benefits both you and the IRS. The application process involves a fee and detailed financial information, with most cases resolved within nine months.

-

Currently Not Collectible (CNC) Status: If you’re facing significant financial hardship, you may qualify for CNC status, which temporarily halts IRS collection efforts. While this status doesn’t erase the debt, it provides a much-needed break from immediate collection actions, giving you time to improve your financial situation. Many individuals successfully obtain CNC status, offering a crucial lifeline during tough times. You can also postpone collections until your finances improve, further easing your stress.

-

Penalty Abatement: If you can show reasonable cause for failing to meet your tax obligations—such as serious illness or natural disasters—you may qualify for penalty relief. The IRS can waive penalties, thereby reducing your overall tax liability. Each year, approximately $5 billion in penalties are written off or reduced by the IRS, highlighting the potential for relief through this program.

-

First-Time Penalty Abatement: This specific relief is available to taxpayers with a clean compliance history for the past three years. If you meet the criteria, you can request a waiver of penalties for a single tax period, significantly lightening your financial load.

-

Innocent Spouse Relief: If you filed jointly with a partner and are now facing tax obligations due to their actions, this program allows you to seek relief from that tax liability. This option can be vital for those who feel unfairly burdened by their partner’s tax issues.

Each of these programs, such as IRS tax debt forgiveness, has specific eligibility requirements and application processes. We encourage you to carefully review your options and gather your financial documentation to support your claims. This preparation is crucial for navigating the complexities of the IRS system effectively. Remember, resources like the Taxpayer Advocate Service (TAS) and Low Income Taxpayer Clinics (LITCs) can provide valuable assistance during these challenging times. You are not alone in this journey, and help is available.

Understand Eligibility Requirements

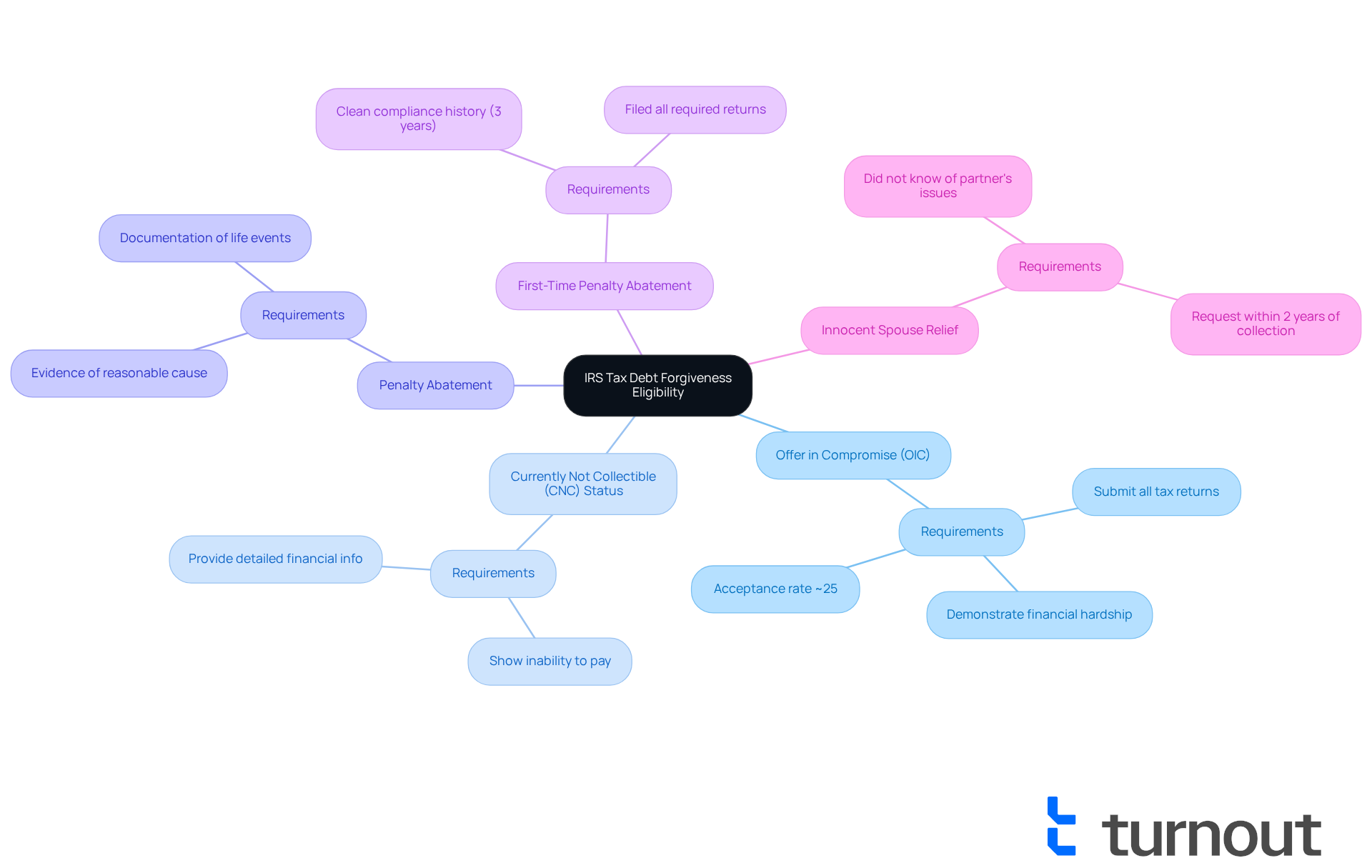

The eligibility requirements for IRS tax debt forgiveness can vary significantly, and we understand that navigating these options can feel overwhelming. Here are some common criteria that you should be aware of:

-

Offer in Compromise (OIC): To qualify, individuals must have submitted all required tax returns and made all necessary estimated payments. You must also demonstrate that paying the full tax liability would create a financial hardship. The IRS assesses your income, expenses, and asset equity to determine eligibility. It's important to note that only about 25% of OIC claims submitted to the IRS are accepted, emphasizing the importance of thorough preparation.

-

Currently Not Collectible (CNC) Status: Taxpayers must show that their financial situation prevents them from paying any portion of their tax debt. This typically involves providing detailed financial information to the IRS, including income, expenses, and assets. Many individuals may qualify for this status, which can offer you temporary relief from collection efforts.

-

Penalty Abatement: If you're seeking penalty relief, you must provide evidence of reasonable cause for your non-compliance. This could include documentation of medical emergencies, natural disasters, or other significant life events that impacted your ability to meet tax obligations.

-

First-Time Penalty Abatement: To qualify, individuals must have a clean compliance history for the past three years, meaning you have filed all required returns and paid any taxes owed during that period. This program is designed to assist those who have maintained good standing with the IRS.

-

Innocent Spouse Relief: Eligibility requires that you did not know, and had no reason to know, that your partner was underreporting income or claiming improper deductions. The request must be made within two years of the IRS's first collection attempt against the innocent spouse.

Understanding these eligibility requirements is crucial for you as you navigate your options for IRS tax debt forgiveness. We encourage you to gather all necessary documentation and consider seeking assistance to ensure compliance with IRS guidelines. Remember, you are not alone in this journey; many individuals have successfully followed the proper procedures and submitted the necessary forms to negotiate settlements with the IRS regarding their tax liabilities.

Conclusion

Understanding IRS tax debt forgiveness is crucial for individuals facing financial difficulties. It opens the door to various relief programs that can significantly alleviate tax burdens. Options like Offers in Compromise and penalty abatement offer tailored solutions for those who qualify. Knowing the available resources and requirements is vital.

Throughout this article, we have explored the various programs available for IRS tax debt forgiveness. The Offer in Compromise allows for settling debts for less than owed, while Currently Not Collectible status provides temporary relief from collection efforts. Additionally, penalty relief options, including First-Time Penalty Abatement and Innocent Spouse Relief, offer avenues for reducing overall tax liabilities. Each program has specific eligibility criteria, highlighting the importance of thorough preparation and understanding of the process.

Ultimately, the significance of IRS tax debt forgiveness cannot be overstated. It represents a lifeline for many individuals struggling with tax obligations, providing opportunities for financial recovery and peace of mind. Engaging with resources such as the Taxpayer Advocate Service and seeking professional assistance can further enhance the chances of successfully navigating these complex options. Remember, taking the first step towards understanding and utilizing these programs can lead to a brighter financial future. You are not alone in this journey; we're here to help.

Frequently Asked Questions

What is IRS tax debt forgiveness?

IRS tax debt forgiveness includes various programs designed to help individuals reduce or eliminate their tax responsibilities, such as settling obligations for less than the total owed or obtaining relief from penalties.

What is the Offer in Compromise (OIC)?

The Offer in Compromise (OIC) is a program that allows qualified individuals to negotiate a settlement with the IRS for less than the full amount due, particularly beneficial for those unable to pay their tax debts in full and who meet specific financial criteria.

Is there a fee associated with the Offer in Compromise?

Yes, the IRS charges a $205 application fee for an Offer in Compromise, which can be waived for low-income applicants.

How many offers in compromise were accepted in fiscal year 2024?

In fiscal year 2024, the IRS accepted 7,199 offers in compromise, resulting in settlements totaling $163.4 million.

What are streamlined plans offered by the IRS?

The IRS provides streamlined plans that cover balances up to $50,000 with a 72-month term, offering manageable payment options for taxpayers.

Can individuals qualify for penalty relief?

Yes, individuals may qualify for penalty relief under specific conditions, which can further reduce their overall tax liability.

How many tax returns received penalty relief from the IRS between 2020 and 2021?

The IRS granted penalty relief to nearly 5 million tax returns between 2020 and 2021.

Are there any types of taxes that the IRS will not forgive?

The IRS will never eliminate payroll taxes, and penalties apply for late filing or payment.

Why is understanding tax forgiveness options important?

Understanding tax forgiveness options and eligibility criteria is vital for effectively managing tax burdens and navigating the complexities of the forgiveness process.

What kind of support is available for individuals dealing with tax burdens?

Individuals dealing with significant tax burdens can seek assistance from organizations like the Tax Hardship Center, which has helped clients reduce the amount owed by an average of 81 percent from the initial IRS demand.