Introduction

Navigating the complexities of IRS backup withholding can feel overwhelming. We understand that the nuances of income reporting and tax obligations are not always clear. This tax mechanism, which requires a 24% deduction from certain payments when a valid Taxpayer Identification Number (TIN) isn’t provided, is designed to protect against potential tax evasion. However, being subjected to backup withholding can significantly impact your cash flow and financial planning.

It's common to feel anxious about how this might affect your financial goals. How can you ensure compliance while still managing your finances effectively? You're not alone in this journey, and there are ways to navigate these challenges with confidence.

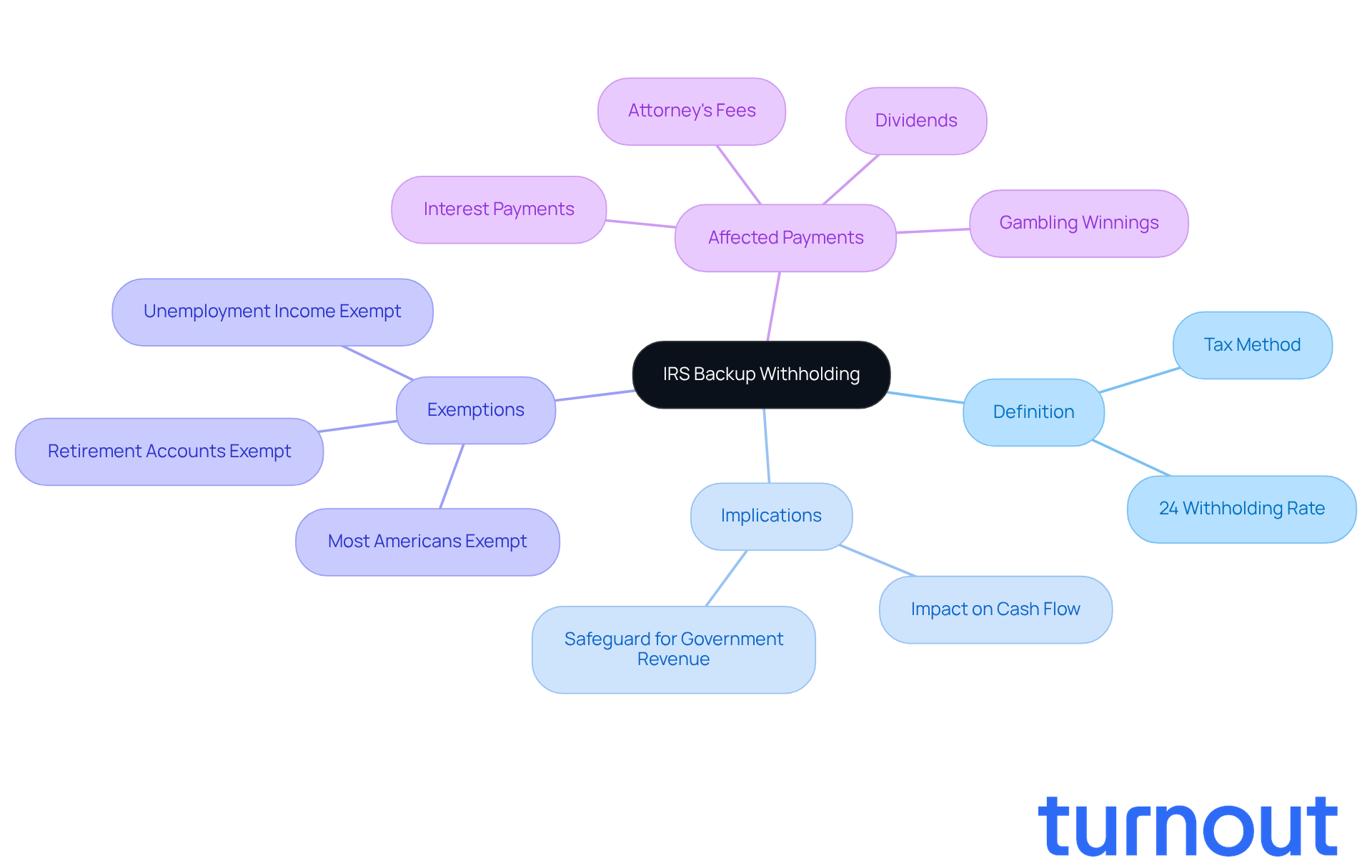

Define IRS Backup Withholding

Understanding the IRS backup withholding meaning can feel overwhelming, especially when it comes to managing your finances. The IRS backup withholding meaning indicates that this tax method requires payers to deduct 24% from certain payments if recipients don’t provide a valid Taxpayer Identification Number (TIN) or if they underreport their income. It mainly affects payments documented on Forms 1099 and W-2G, ensuring that the IRS collects taxes on income that might otherwise go unreported.

We understand that this can be concerning. The mechanism acts as a safeguard for government revenue, collecting taxes upfront when there’s uncertainty about the payee’s tax compliance. For instance, if you don’t provide your correct TIN, a portion of your payments may be withheld, which can significantly impact your cash flow. However, there’s good news! Most Americans are exempt from backup tax deductions as long as a Social Security number or taxpayer ID is on file and matches the personal information of the brokerage account holder. This exemption highlights the importance of keeping your identification information accurate to avoid unnecessary retention.

Payments that may be subject to IRS backup withholding meaning include:

- Attorney's fees

- Interest payments

- Dividends

- Certain gambling winnings

- Among others

Understanding these requirements is crucial for navigating your tax obligations effectively. Remember, you’re not alone in this journey. We’re here to help you make sense of it all.

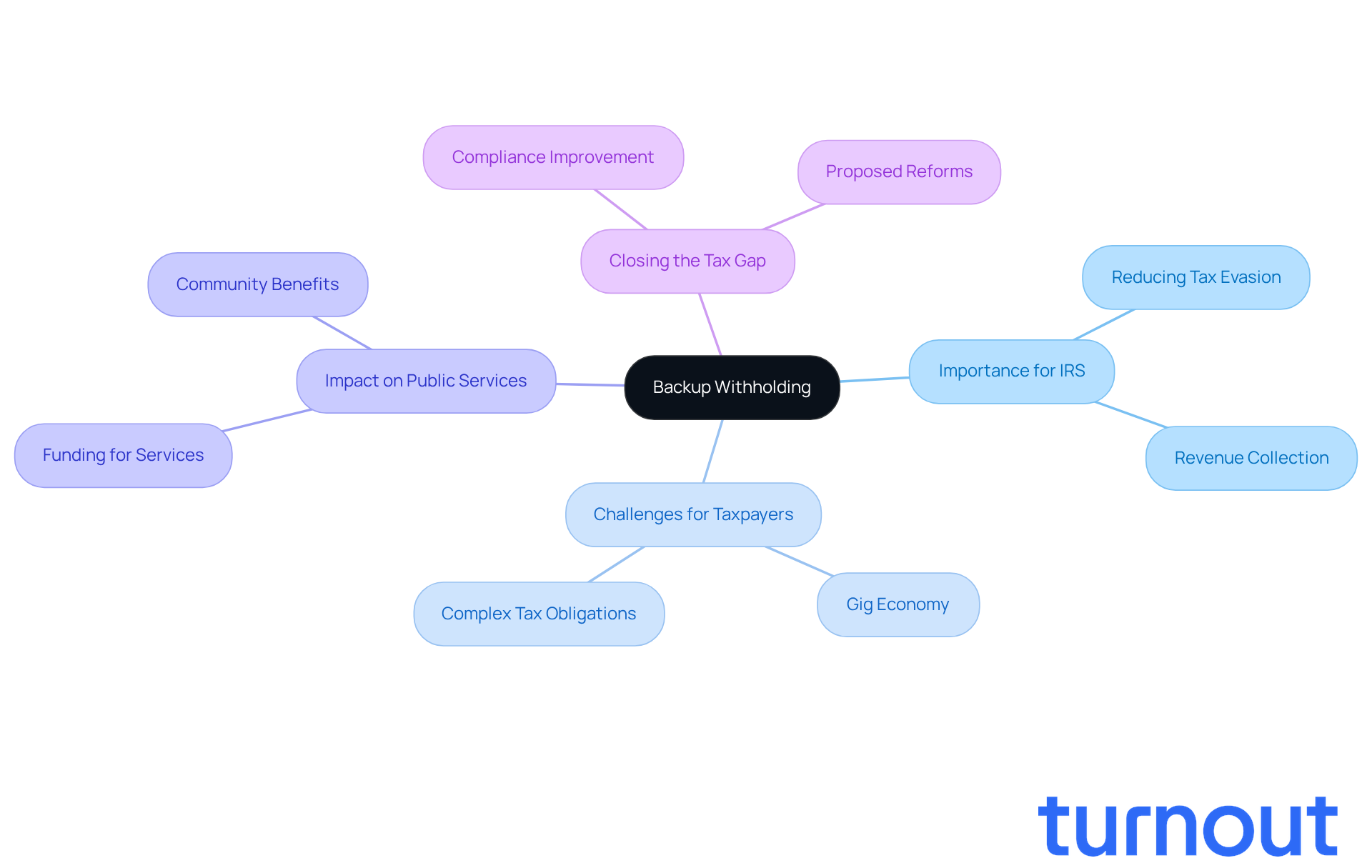

Context and Importance of Backup Withholding

Backup retention is a vital tool for the IRS, helping to reduce the risk of tax evasion. We understand that navigating tax obligations can be challenging, especially when dealing with independent contractors or vendors who may not always share their tax information. The requirement for deductions by the IRS relates to the irs backup withholding meaning, ensuring it can collect revenue on earnings that might otherwise go underreported.

In today’s economy, where gig work and freelance arrangements are becoming more common, it’s essential for the IRS to maintain oversight and compliance. This approach not only helps the IRS but also supports public services that rely on tax revenue.

The execution of backup deductions is essential for understanding the irs backup withholding meaning and plays a crucial role in closing the tax gap - the difference between taxes owed and taxes paid. By addressing this gap, we can all contribute to the public services that benefit our communities. Remember, you are not alone in this journey; we’re here to help you understand and navigate these complexities.

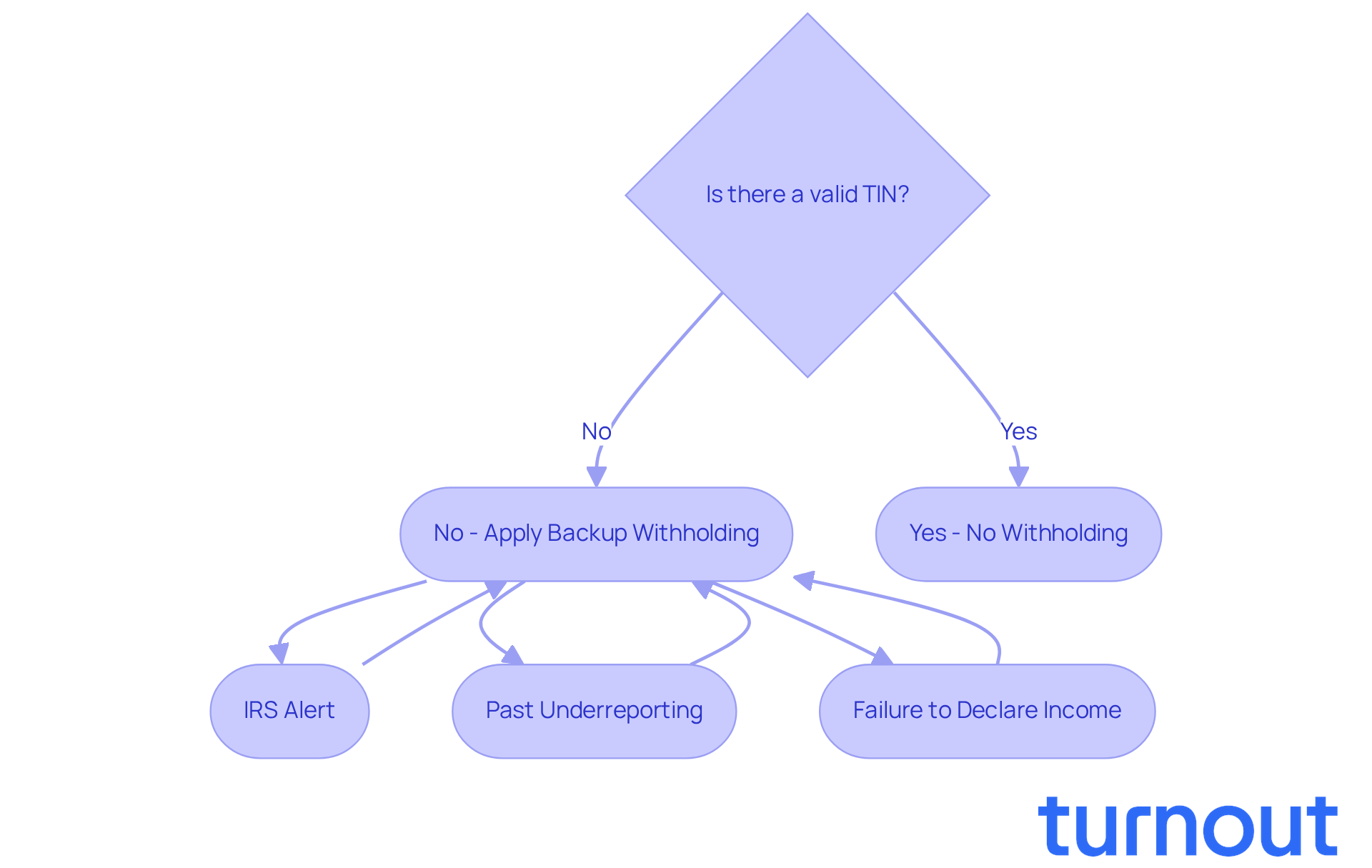

Criteria for Backup Withholding Application

Backup tax collection can feel overwhelming, but understanding it is crucial to avoid unexpected tax obligations. We know that navigating these rules can be challenging, so let’s break it down together. Here are the main reasons why backup withholding might apply:

- Inability to provide a valid Taxpayer Identification Number (TIN) to the payer.

- IRS alerts indicating that the recipient is subject to backup withholding due to past income underreporting.

- Failure to declare interest or dividends on federal tax returns.

In these situations, the payer must withhold 24% of the payment and send it to the IRS. It’s important to note that the IRS will notify the payer to start these deductions after sending four notices over at least 120 days.

Understanding the IRS backup withholding meaning is essential for both payers and recipients. It helps ensure compliance with IRS regulations and minimizes the risk of penalties. Remember, it’s essential for recipients to confirm that their payer has the correct name and TIN to avoid backup deductions. Many recipients may unintentionally forget to provide valid TINs, leading to automatic backup deductions.

We’re here to help you navigate these requirements. The IRS has set clear guidelines to assist both parties in this process. You are not alone in this journey; with the right information, you can manage your tax obligations with confidence.

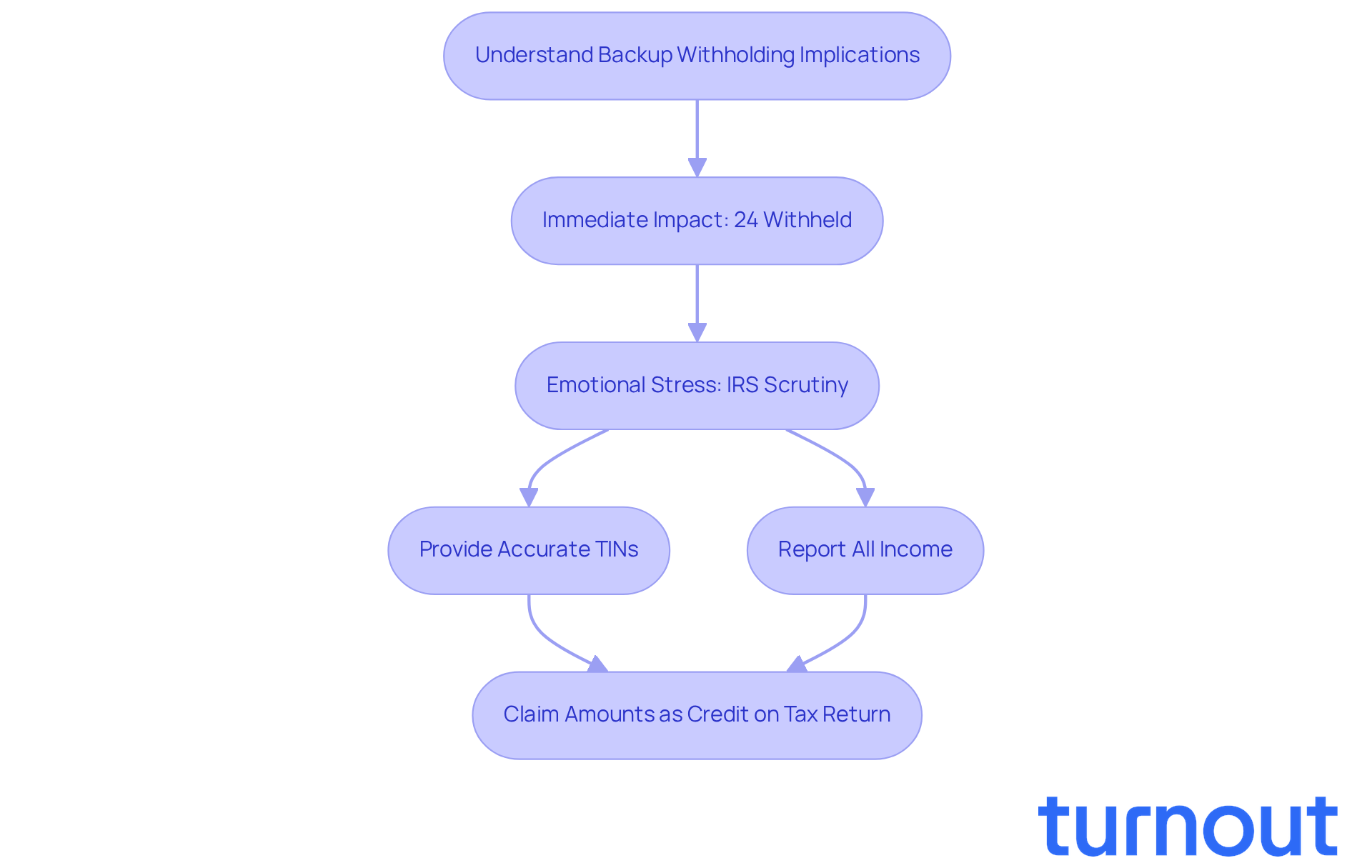

Implications of Being Subject to Backup Withholding

We understand that being subject to backup tax deductions can feel overwhelming and may have significant financial consequences for you. The immediate impact is a reduction in the amount of money you receive, as 24% of payments are withheld and sent to the IRS. This can really affect your cash flow, especially if you're an independent contractor or a small business owner who relies on timely payments.

It's common to feel anxious about the increased scrutiny from the IRS, especially considering the IRS backup withholding meaning that can come with it. This could lead to audits or additional compliance reviews, which can be stressful. To help avoid these complications, it’s essential to:

- Provide precise Tax Identification Numbers (TINs)

- Report all income accurately

Remember, the amounts withheld can be claimed as a credit on your tax return. However, this requires careful record-keeping and a solid understanding of your tax obligations. You're not alone in this journey; we're here to help you navigate these challenges.

Conclusion

Understanding IRS backup withholding is crucial for anyone navigating the complexities of tax obligations. We know that tax matters can feel overwhelming, especially when it comes to ensuring compliance. This tax mechanism requires a 24% deduction from certain payments when a valid Taxpayer Identification Number (TIN) isn’t provided or income is underreported. It plays a vital role in safeguarding government revenue and ensuring that everyone contributes their fair share.

Throughout this article, we’ve explored key aspects of IRS backup withholding. We’ve discussed the criteria for its application, the types of payments affected, and the implications of being subject to these deductions. It’s common to feel anxious about the potential consequences, such as reduced cash flow and increased scrutiny from the IRS. By understanding these factors, you can better prepare and manage your financial responsibilities.

Ultimately, grasping the concept of IRS backup withholding isn’t just about compliance; it’s about empowering you to take control of your financial health. By ensuring accurate TIN reporting and understanding the criteria for withholding, you can minimize the risk of unexpected tax obligations. Remember, staying informed and proactive in managing your tax responsibilities will contribute to a smoother financial journey. You are not alone in this journey, and we’re here to help you navigate these challenges.

Frequently Asked Questions

What is IRS backup withholding?

IRS backup withholding is a tax method that requires payers to deduct 24% from certain payments if recipients do not provide a valid Taxpayer Identification Number (TIN) or if they underreport their income.

Why does backup withholding occur?

Backup withholding occurs to ensure that the IRS collects taxes on income that might otherwise go unreported, acting as a safeguard for government revenue.

Who does backup withholding mainly affect?

Backup withholding mainly affects payments documented on Forms 1099 and W-2G.

What happens if I don’t provide a correct TIN?

If you do not provide a correct TIN, a portion of your payments may be withheld, which can significantly impact your cash flow.

Are most Americans subject to backup withholding?

No, most Americans are exempt from backup tax deductions as long as a Social Security number or taxpayer ID is on file and matches the personal information of the brokerage account holder.

What types of payments may be subject to IRS backup withholding?

Payments that may be subject to IRS backup withholding include attorney's fees, interest payments, dividends, and certain gambling winnings, among others.

Why is it important to keep identification information accurate?

It is important to keep identification information accurate to avoid unnecessary withholding of payments and ensure compliance with tax obligations.