Introduction

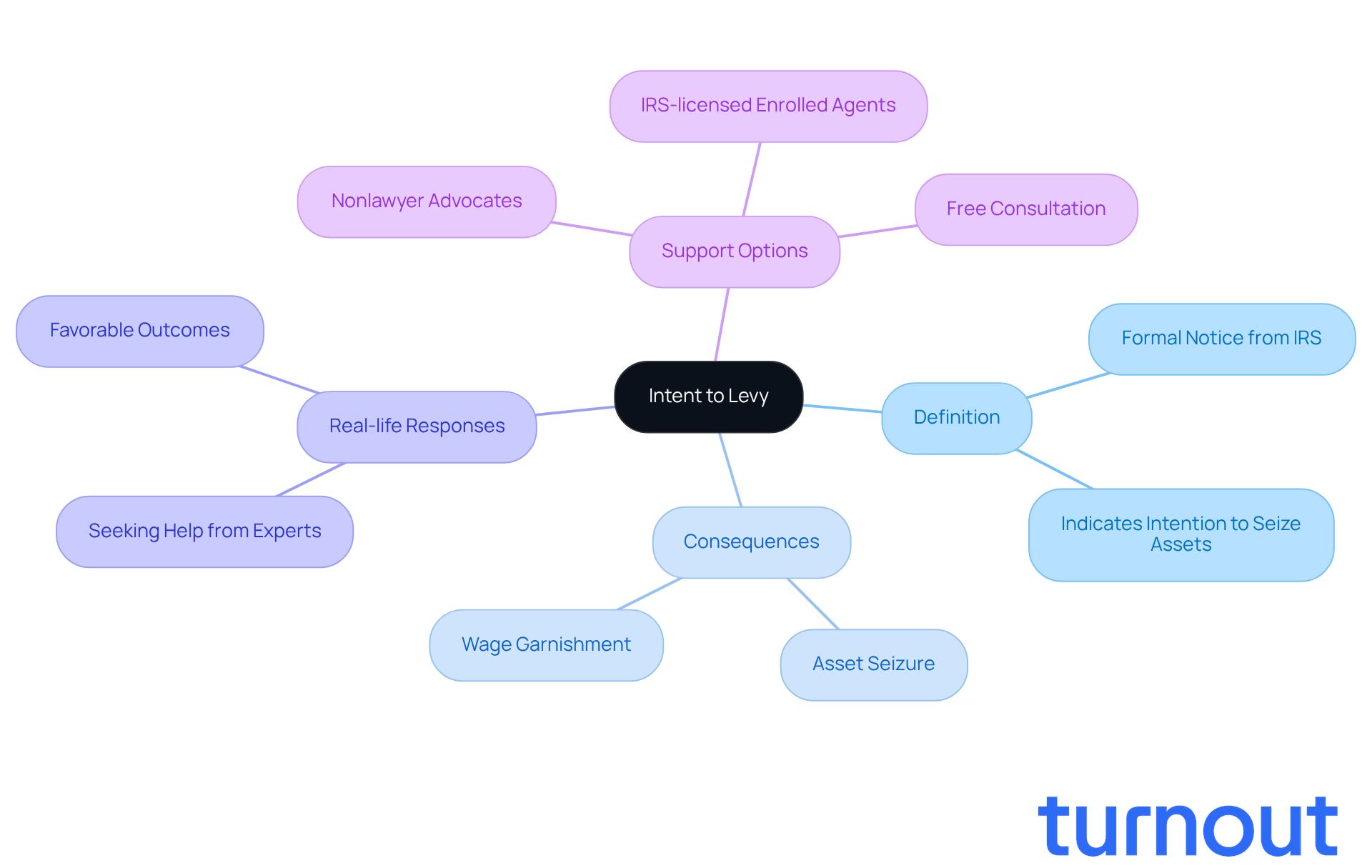

Understanding the 'intent to levy' is crucial for anyone navigating the complexities of tax obligations. We understand that receiving a formal notice from the IRS can be overwhelming. This notice signals a serious intention to seize assets for unpaid taxes, making it essential to be informed about your rights and options.

As taxpayers face increasing pressures and potential repercussions, it’s common to feel anxious about how to respond. How can you effectively address such notices and protect your financial well-being? This article delves into the meaning of intent to levy, the rights you have as a consumer, and the resources available to help you manage these daunting situations. Remember, you are not alone in this journey; we're here to help.

Define Intent to Levy: Core Concept and Significance

The 'intent to levy meaning' is a formal notice from the Internal Revenue Service (IRS) that indicates the agency's intention to seize a taxpayer's property or assets to settle a tax debt. This notice is a crucial part of the tax enforcement process, serving as a serious reminder that financial obligations should not be taken lightly.

We understand that grappling with tax issues can be overwhelming. It's essential to grasp this concept, as it highlights the potential consequences of unpaid taxes, which can include asset seizure or wage garnishment. In 2026, the stakes are particularly high, with many taxpayers facing severe repercussions due to inaction.

Real-life stories show that many individuals have responded to Intent to Collect alerts by seeking help from experts, often leading to more favorable outcomes. We're here to help! Turnout offers support through trained nonlawyer advocates and IRS-licensed enrolled agents, providing essential guidance for those navigating tax debt relief without legal representation.

The urgency of addressing tax liabilities cannot be overstated. Ignoring these issues can lead to dire financial consequences. As Albert Bushnell Hart wisely noted, 'Taxation is the price which civilized communities pay for the opportunity of remaining civilized.' This underscores the importance of understanding your tax responsibilities and the serious nature of a communication regarding intent to levy meaning. Remember, you are not alone in this journey; seeking assistance can make all the difference.

Contextualize Intent to Levy: Tax Enforcement and Consumer Rights

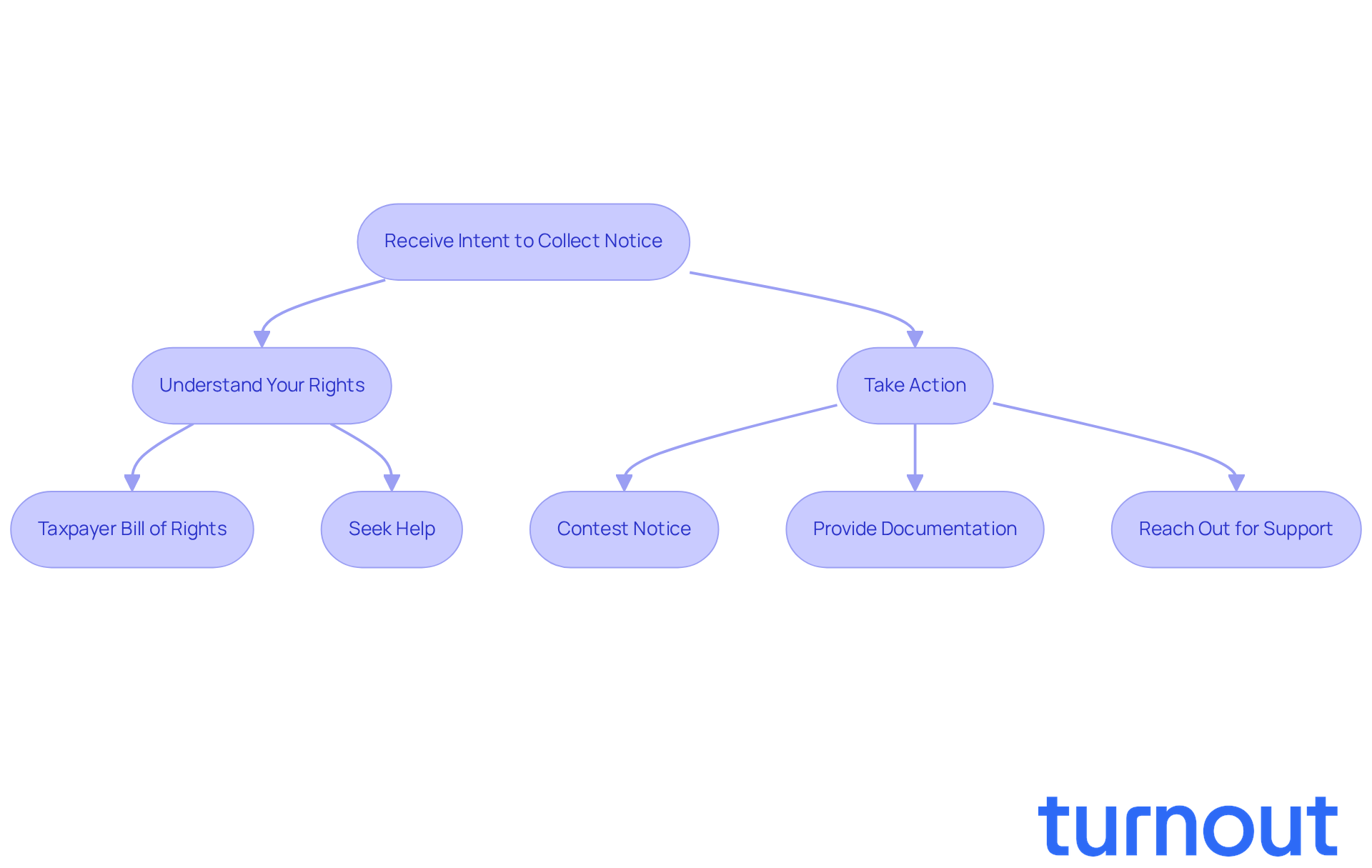

The 'Intent to Collect' is a crucial part of the IRS's tax enforcement strategy, aimed at helping individuals meet their tax obligations. When taxes go unpaid, the IRS may send this notice before taking more serious actions, like seizing assets or garnishing wages. But remember, you have rights! The Taxpayer Bill of Rights offers vital protections against unfair treatment. You can contest an Intent to Collect and seek help in settling your tax debts, which is essential for navigating the often confusing world of tax resolution.

We understand that many people may not be fully aware of their rights. Recent surveys reveal that only a fraction of individuals grasp the implications of the intent to levy meaning. This highlights the need for better education and advocacy. The upcoming 2026 updates to the Taxpayer Bill of Rights aim to strengthen these protections, ensuring that you are more informed about your rights and the tax enforcement process.

Successful appeals against Intent to Collect notices illustrate the intent to levy meaning and how you can assert your rights. For instance, individuals who provide adequate documentation and justification have successfully challenged levies, leading to outcomes that alleviate their financial burdens. Organizations like Turnout play a vital role in empowering consumers by guiding them through the complex tax resolution process. They utilize trained nonlawyer advocates and IRS-licensed enrolled agents to help you navigate these challenges with confidence.

You are not alone in this journey. If you find yourself facing an intent to levy meaning, it is important to reach out for support. Together, we can work towards a resolution that eases your financial worries.

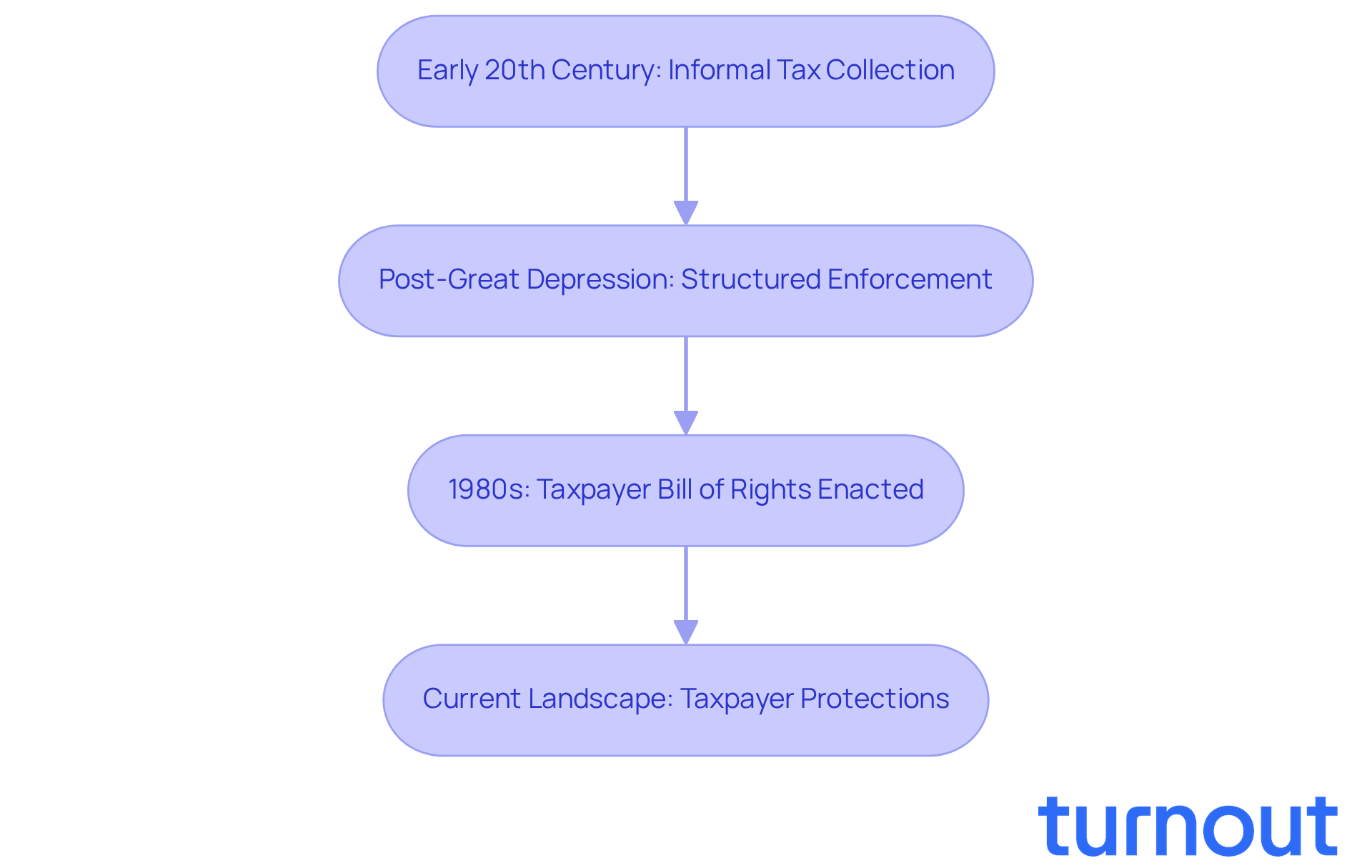

Trace the Origins of Intent to Levy: Historical Development in Tax Law

Understanding tax legislation can feel overwhelming, especially when it comes to the concept of 'Intent to Collect.' This idea traces back to the early 20th century, around the time the IRS was established. Initially, tax collection methods were quite informal. However, as the government aimed to boost revenue during and after the Great Depression, more structured enforcement mechanisms came into play.

In the 1980s, the Taxpayer Bill of Rights was enacted, marking a significant shift. This legislation introduced vital protections for individuals, including the IRS's obligation to notify taxpayers of the intent to levy meaning. We understand that navigating these changes can be daunting, but knowing this history is crucial for grasping the current landscape of tax enforcement.

Today, you have rights that help protect you as a consumer. Remember, you are not alone in this journey. If you ever feel uncertain or overwhelmed, we're here to help guide you through the process.

Identify Key Characteristics of Intent to Levy: Components and Implications

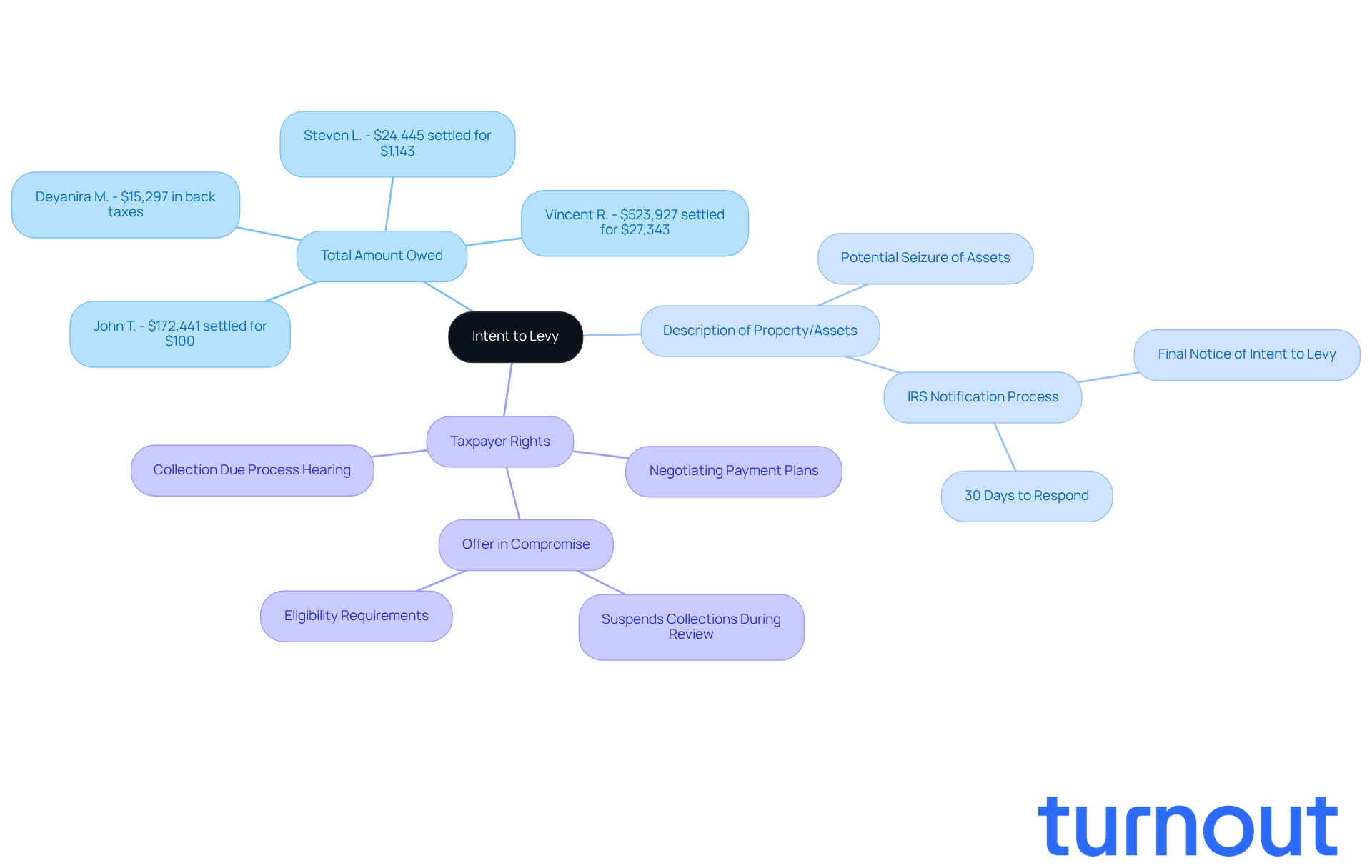

Receiving an 'Intent to Levy' communication from the IRS can be a daunting experience, especially considering the intent to levy meaning behind it. This important notice outlines key details:

- The total amount owed

- A description of the property or assets that may be seized

- Information about your rights as a taxpayer

It’s a formal warning that the IRS is ready to take action if the debt isn’t addressed. We understand that this can feel overwhelming, but you typically have 30 days to respond. This could mean negotiating a payment plan or disputing the levy.

Understanding these elements is crucial. It empowers you to take proactive steps in managing your tax liabilities. For instance, many who receive an Intent to Collect notice owe significant amounts. Take John T., who faced a debt of $172,441 but managed to settle for just $100 through negotiation. Similarly, Vincent R. had a debt of $523,927 and successfully negotiated it down to $27,343. These stories show that there is hope and help available.

Tax advisors stress the importance of acting quickly when you receive a notice that includes the intent to levy meaning. It’s common to feel anxious, but reaching out to the IRS right away can open up options for payment plans or even an Offer in Compromise, which can pause collections while your request is reviewed. This proactive approach can help you avoid further complications and additional costs. Remember, you have rights and options.

Organizations like Turnout are here to help. They utilize trained nonlawyer advocates and work with IRS-licensed enrolled agents to guide you through these complex processes. You don’t have to face this challenge alone. We’re here to support you every step of the way.

Conclusion

Understanding the meaning of 'intent to levy' is crucial for anyone facing the challenges of tax obligations. This formal notice from the IRS acts as a significant warning about the potential seizure of assets to settle unpaid taxes. Recognizing the seriousness of this communication can empower you to take proactive steps in managing your financial responsibilities and asserting your rights.

We understand that dealing with tax issues can be overwhelming. Throughout this article, we’ve shared key insights about the implications of an intent to levy. This includes:

- The historical context of tax enforcement

- The rights you have under the Taxpayer Bill of Rights

- The importance of seeking assistance when faced with such notices

Real-life examples show that timely action and proper guidance can lead to favorable outcomes, easing the stress associated with tax debts.

Ultimately, understanding the intent to levy goes beyond just recognizing a notice; it’s about taking control of your financial future. We encourage you to educate yourself about your rights and seek support from organizations that can provide expert guidance. By doing so, you can navigate the complexities of tax enforcement with confidence, ensuring you are well-equipped to address your obligations and protect your assets. Remember, you are not alone in this journey.

Frequently Asked Questions

What does "intent to levy" mean?

"Intent to levy" is a formal notice from the Internal Revenue Service (IRS) indicating the agency's intention to seize a taxpayer's property or assets to settle a tax debt.

Why is the intent to levy notice significant?

The intent to levy notice is significant because it serves as a serious reminder of the potential consequences of unpaid taxes, which can include asset seizure or wage garnishment.

What are the potential consequences of ignoring an intent to levy notice?

Ignoring an intent to levy notice can lead to severe financial repercussions, including asset seizure and wage garnishment.

How can taxpayers respond to an intent to levy notice?

Many individuals respond to intent to levy notices by seeking help from experts, which can lead to more favorable outcomes in managing their tax debt.

What support does Turnout offer for those facing tax issues?

Turnout offers support through trained nonlawyer advocates and IRS-licensed enrolled agents, providing essential guidance for individuals navigating tax debt relief without legal representation.

What is the importance of understanding tax responsibilities?

Understanding tax responsibilities is crucial as it highlights the serious nature of tax obligations and the potential consequences of failing to address them, as emphasized by the quote from Albert Bushnell Hart regarding taxation.