Introduction

Navigating the complexities of the Social Security Disability Insurance (SSDI) program can feel overwhelming. We understand that facing the mandatory five-month waiting period after the onset of a disability can leave many anxious about their financial futures. This waiting period, while intended to ensure that only those with long-term disabilities receive benefits, can create uncertainty and stress.

However, there’s hope. Understanding the exceptions to this waiting period can be a game-changer for applicants. These exceptions can provide crucial insights into how you might receive support sooner. What are these exceptions? How can they impact your financial planning during this challenging time?

Exploring these questions can illuminate pathways to relief. Remember, you are not alone in this journey. We’re here to help you take control of your financial situation and find the support you need.

Overview of the Five-Month Waiting Period for SSDI

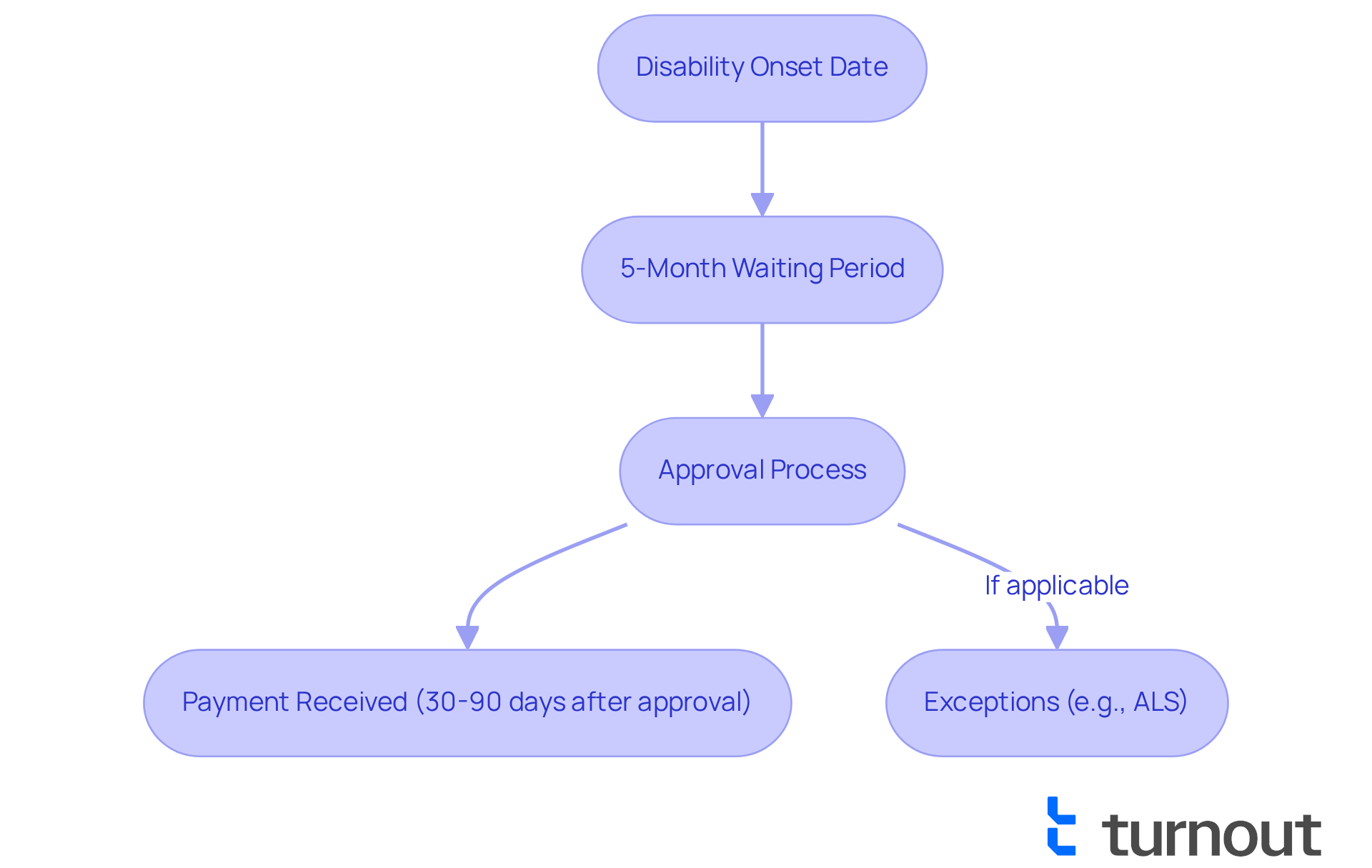

Navigating the Social Security Disability Insurance (SSDI) program can feel overwhelming, especially with the five-month waiting period that begins after your disability onset date. We understand that once the Social Security Administration (SSA) confirms your disability, you might be anxious about when assistance will actually start. For instance, if your disability began on January 1, you won’t see any support until July 1. This waiting period is designed to ensure that your condition is long-term, helping to guarantee that only those with qualifying disabilities receive the help they need.

Understanding this timeline is crucial for your financial planning. If you apply for SSDI benefits right after your disability starts, it’s important to know that your first payment will likely arrive two to three months after the waiting period ends - typically within 30 to 90 days after your approval. It’s common to feel uncertain during this time, but knowing what to expect can help ease some of that stress.

There are exceptions to the 5 month waiting period for SSDI that could affect you. For example, if you’ve been diagnosed with Amyotrophic Lateral Sclerosis (ALS) and your application is approved on or after July 23, 2020, the exceptions to the 5 month waiting period for SSDI mean you won’t have to wait at all. Staying informed about changes in disability benefits is essential, as it can significantly impact your financial planning while you await assistance.

Many applicants find it helpful to explore various financial options or support programs during this waiting period. This proactive approach can ensure you manage your expenses effectively while waiting for your disability benefits to be approved. Remember, you’re not alone in this journey. By understanding the SSDI waiting period and its implications, you can better navigate your financial situation during this challenging time.

Key Exceptions to the Five-Month Waiting Period

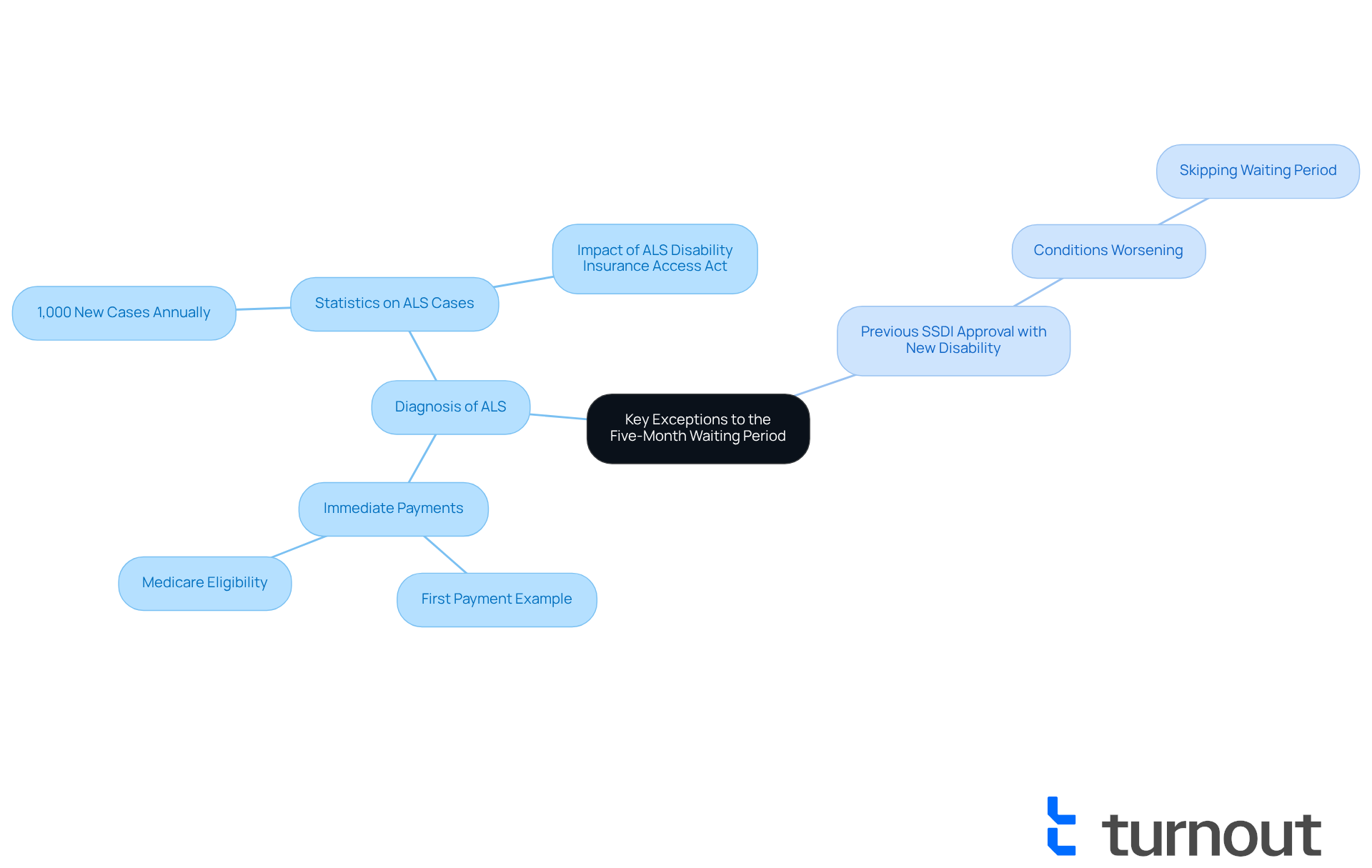

Specific circumstances can lead to exceptions to the 5 month waiting period for SSDI payments. One of the most significant exceptions is for those diagnosed with Amyotrophic Lateral Sclerosis (ALS), a progressive neurodegenerative disease. If you or a loved one has ALS, you can receive disability payments right after approval, easing the financial strain that often accompanies long delays. For instance, if a disability began on November 3, 2023, and the application was submitted on January 11, 2024, the initial payment would be issued for December 2023, marking the first full month of disability.

Moreover, if you were previously approved for SSDI assistance and experience a new disability within five years, you may also skip the waiting period. This provision is crucial for those whose conditions may worsen or change over time.

Statistics reveal that around 1,000 new cases of ALS are recorded each year in the U.S. This highlights the importance of timely access to support for those affected. The ALS Disability Insurance Access Act, passed in late 2020, has played a vital role in providing this immediate assistance, reflecting a growing awareness of the urgent needs of ALS patients.

Understanding the exceptions to the 5 month waiting period for SSDI can offer essential financial relief for those who qualify, ensuring you receive the support you need without unnecessary delays. At Turnout, we're here to help. We provide access to trained nonlawyer advocates who can guide you through the SSD claims process, ensuring you have the support needed to obtain your entitlements efficiently. You are not alone in this journey.

Financial Planning During the Waiting Period

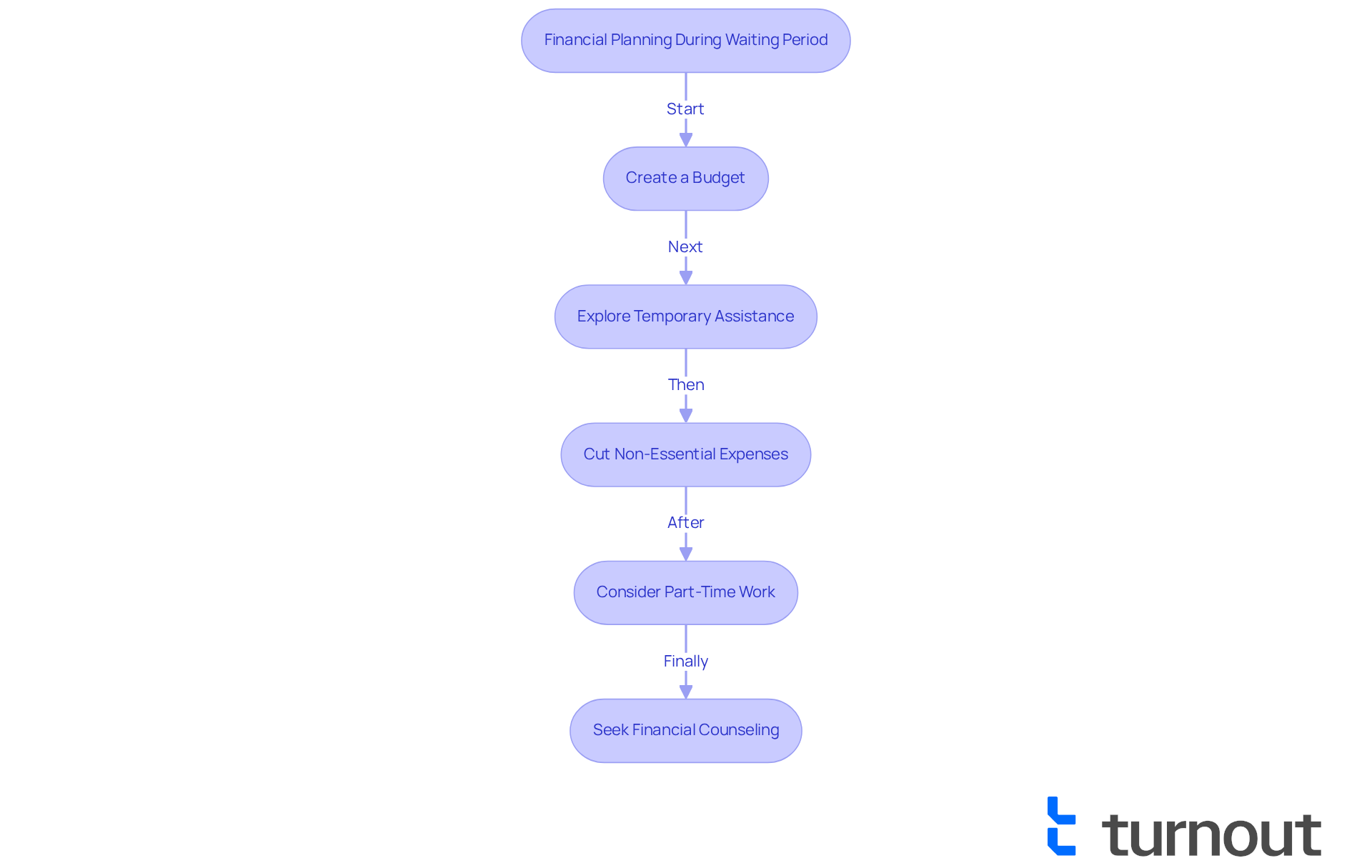

Creating a strong financial plan is essential during the exceptions to 5 month waiting period for SSDI. We understand that this can be a challenging time, and taking proactive steps can help ease your worries. Start by evaluating your current financial landscape, including your income, expenses, and savings. Here are some effective strategies to consider:

-

Create a Budget: Identify your essential expenses and prioritize them. This approach will help you manage your finances more effectively and ensure that your critical needs are met.

-

Explore Temporary Assistance: Investigate local assistance programs, such as food banks or community organizations, that can offer financial support during this transitional period. Many communities provide resources specifically designed to assist individuals waiting for disability assistance, with some offering exceptions to 5 month waiting period for SSDI. Additionally, Turnout offers tools and services to help you navigate these processes, ensuring you have access to the right resources.

-

Cut Non-Essential Expenses: Review your spending habits and identify areas where you can reduce costs, such as dining out or subscription services. This can free up funds for necessary expenses.

-

Consider Part-Time Work: If your health permits, look into part-time or gig opportunities that align with SSA guidelines. Generating extra income can ease financial strain while you await your benefits to commence.

-

Seek Financial Counseling: Consulting with a financial advisor can provide valuable insights into managing your finances and developing a sustainable budget tailored to your situation.

By applying these strategies and utilizing the resources available through Turnout, you can navigate this delay with increased confidence and financial stability. Remember, you are not alone in this journey; we're here to help.

Required Documentation and Eligibility for Exceptions

Navigating the SSDI application process can feel overwhelming, but you’re not alone. To be eligible for SSDI assistance and the exceptions to the 5 month waiting period for SSDI, it’s crucial to submit specific documentation. Here’s what you need to know:

-

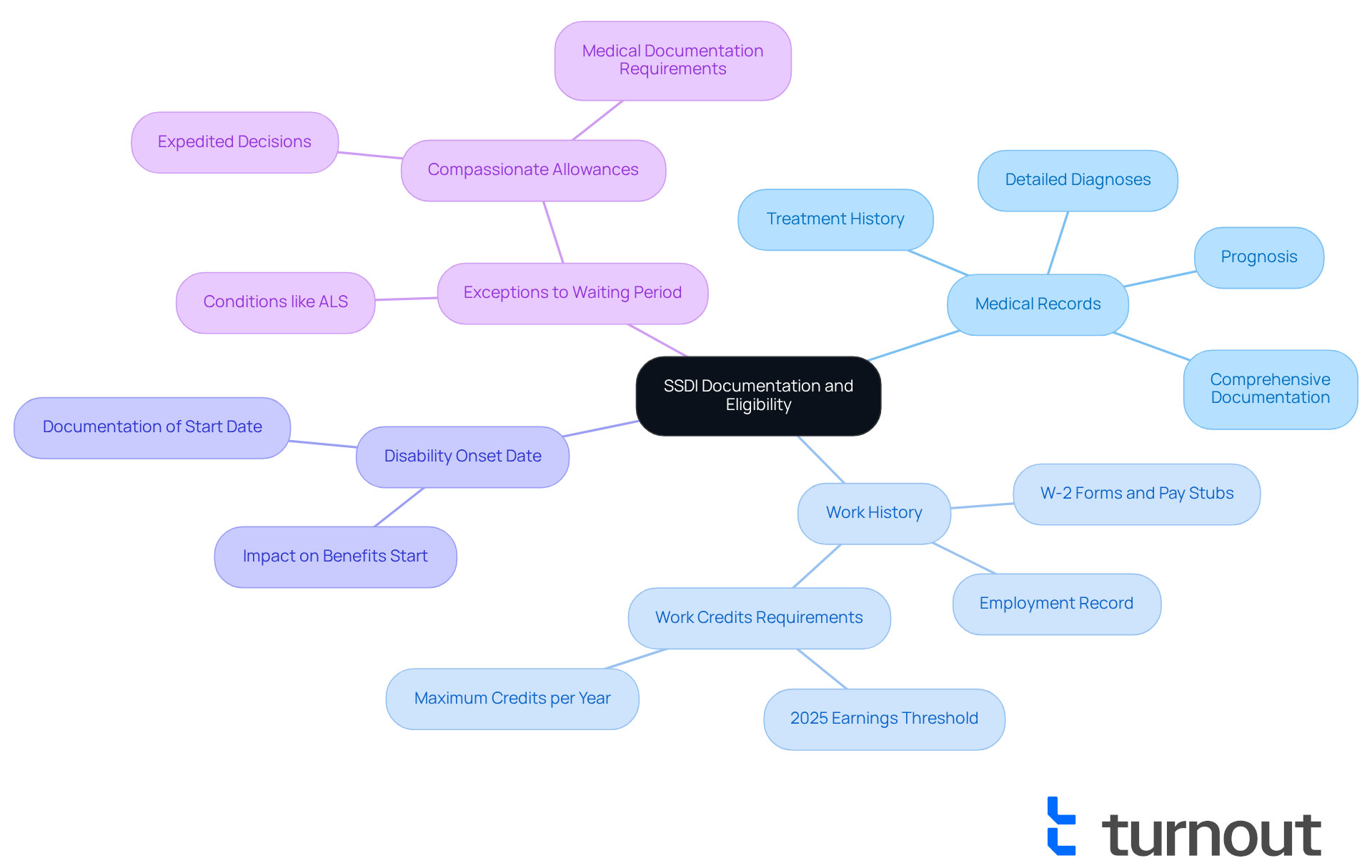

Medical Records: Comprehensive medical documentation is essential to support your disability claim. This should include detailed diagnoses, treatment history, and prognosis. The Social Security Administration (SSA) requires proof of a medically determinable impairment that prevents substantial gainful activity (SGA).

-

Work History: A complete record of your employment history, including W-2 forms and pay stubs, is necessary to demonstrate your work credits. For 2025, applicants must earn at least $1,810 in covered earnings to qualify for one work credit, with a maximum of four credits available per year.

-

Disability Onset Date: Clear documentation establishing the date your disability began is essential for determining the duration. This date impacts when benefits can start, making it a key factor in your application.

-

Additional Evidence for exceptions to 5 month waiting period for SSDI: If you’re asserting an exception to the delay period, such as for conditions like ALS, include relevant medical documentation confirming the diagnosis. The SSA has expanded its Compassionate Allowances list, allowing for expedited decisions on certain severe medical conditions, which can significantly reduce waiting times.

Being thorough and organized with your documentation can greatly enhance your chances of a successful application and expedite the process. We understand that staying informed about eligibility criteria and keeping thorough records can be challenging. However, with the right preparation, you can improve your chances of approval and gain the benefits you deserve.

Additionally, understanding the SSDI payment schedule for 2025, which is based on birth dates, can help you anticipate when you might receive your benefits. Remember, we’re here to help you navigate these processes, ensuring you have the support needed to manage your SSD claims effectively.

Conclusion

Navigating the complexities of the Social Security Disability Insurance (SSDI) program, especially the five-month waiting period, can feel overwhelming. We understand that this process can be daunting, but grasping the nuances of this waiting period, including specific exceptions, is essential for those seeking financial support. For instance, recognizing that conditions like Amyotrophic Lateral Sclerosis (ALS) can exempt individuals from this waiting period underscores the importance of being informed about eligibility criteria and the application process.

Throughout this article, we’ve discussed key insights, including the significance of the waiting period, applicable exceptions, and practical financial strategies for those affected. Emphasizing thorough documentation and proactive financial planning serves as a roadmap for applicants to navigate this challenging time effectively. By exploring local assistance programs, budgeting wisely, and understanding the required documentation, you can better manage your finances while awaiting SSDI benefits.

Ultimately, the message is clear: awareness and preparation are vital in ensuring timely access to support. By staying informed about the SSDI waiting period and its exceptions, you can alleviate some of the financial burdens during this transitional phase. For those facing the daunting task of applying for SSDI, leveraging available resources, such as advocacy support, can make a significant difference in achieving a smoother application process and securing the benefits you deserve. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is the five-month waiting period for SSDI?

The five-month waiting period for Social Security Disability Insurance (SSDI) begins after your disability onset date. It is designed to ensure that only those with long-term qualifying disabilities receive assistance.

When will I receive my first SSDI payment after the waiting period?

After the five-month waiting period ends, your first SSDI payment will likely arrive two to three months later, typically within 30 to 90 days after your application is approved.

What happens if my disability started on January 1?

If your disability began on January 1, you would not receive any support until July 1, following the five-month waiting period.

Are there any exceptions to the five-month waiting period?

Yes, there are exceptions. For instance, if you have been diagnosed with Amyotrophic Lateral Sclerosis (ALS) and your application is approved on or after July 23, 2020, you will not have to wait at all for your SSDI benefits.

How can I manage my finances during the waiting period?

Many applicants find it helpful to explore various financial options or support programs during the waiting period to effectively manage their expenses while awaiting SSDI benefits.

Why is it important to understand the SSDI waiting period?

Understanding the SSDI waiting period is crucial for financial planning, as it helps you know what to expect and can alleviate some anxiety during the waiting time for your benefits.