Introduction

Disability insurance is more than just a policy; it’s a vital safety net for professionals in Pennsylvania. When illness or injury strikes, this coverage provides essential income replacement, helping you maintain your financial stability. We understand that facing unexpected disabilities can be daunting, and that’s why grasping the nuances of this coverage is so important for your peace of mind.

Many individuals find themselves overwhelmed by misconceptions about disability insurance. It’s common to feel uncertain about what protection you truly need. With a significant number of workers lacking adequate coverage, it’s crucial to ask: how can you navigate the complexities of disability insurance to secure a stable financial future?

You’re not alone in this journey. We’re here to help you understand your options and make informed decisions.

Define Disability Insurance: A Key Resource for Professionals in Pennsylvania

Disability coverage is a vital safety net for those unable to work due to illness or injury. It offers essential income replacement, which can be a lifeline for individuals and their families. In Pennsylvania, having disability insurance in PA is especially important for professionals who rely on their earnings to support themselves.

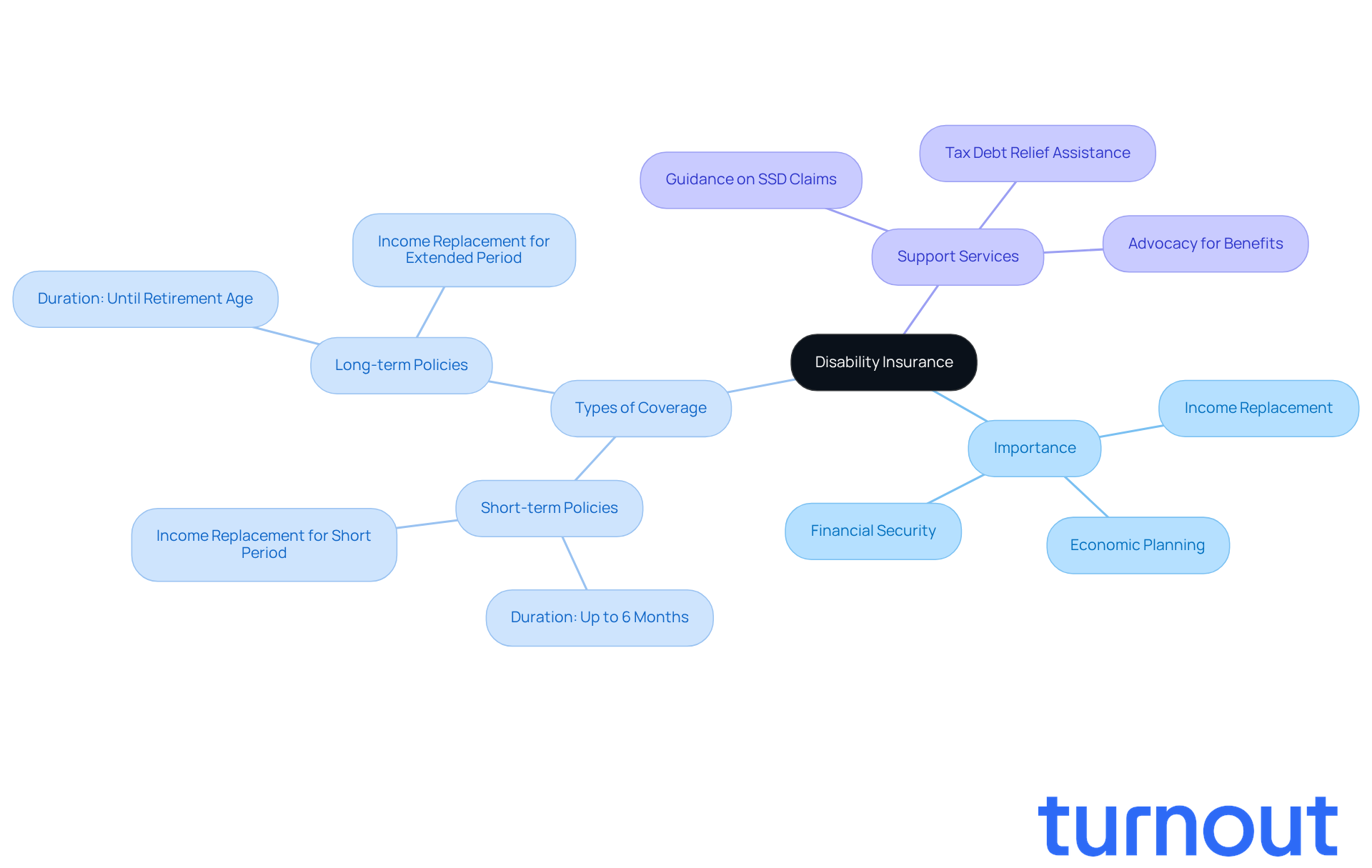

We understand that facing a disability can be overwhelming. Income protection typically replaces a portion of your salary, helping you meet financial obligations during challenging times. There are two main types of disability coverage:

- Short-term policies provide benefits for a limited duration, usually up to six months.

- Long-term policies can extend for several years or even until retirement age, depending on the specific terms.

As we look ahead to 2025, many professionals in Pennsylvania are recognizing the importance of securing disability insurance in PA. They see it as a crucial part of their economic planning. Investment consultants consistently emphasize that disability coverage is an essential asset for income replacement. It plays a significant role in protecting your financial future.

Additionally, Turnout is here to help you navigate the complexities of Social Security Disability (SSD) claims and tax debt relief. Our trained nonlawyer advocates are dedicated to guiding you through the process. This support is vital for those pursuing benefits, allowing you to focus on your recovery while ensuring you receive the assistance you need. Remember, you are not alone in this journey.

Explain the Importance of Disability Insurance for Professionals

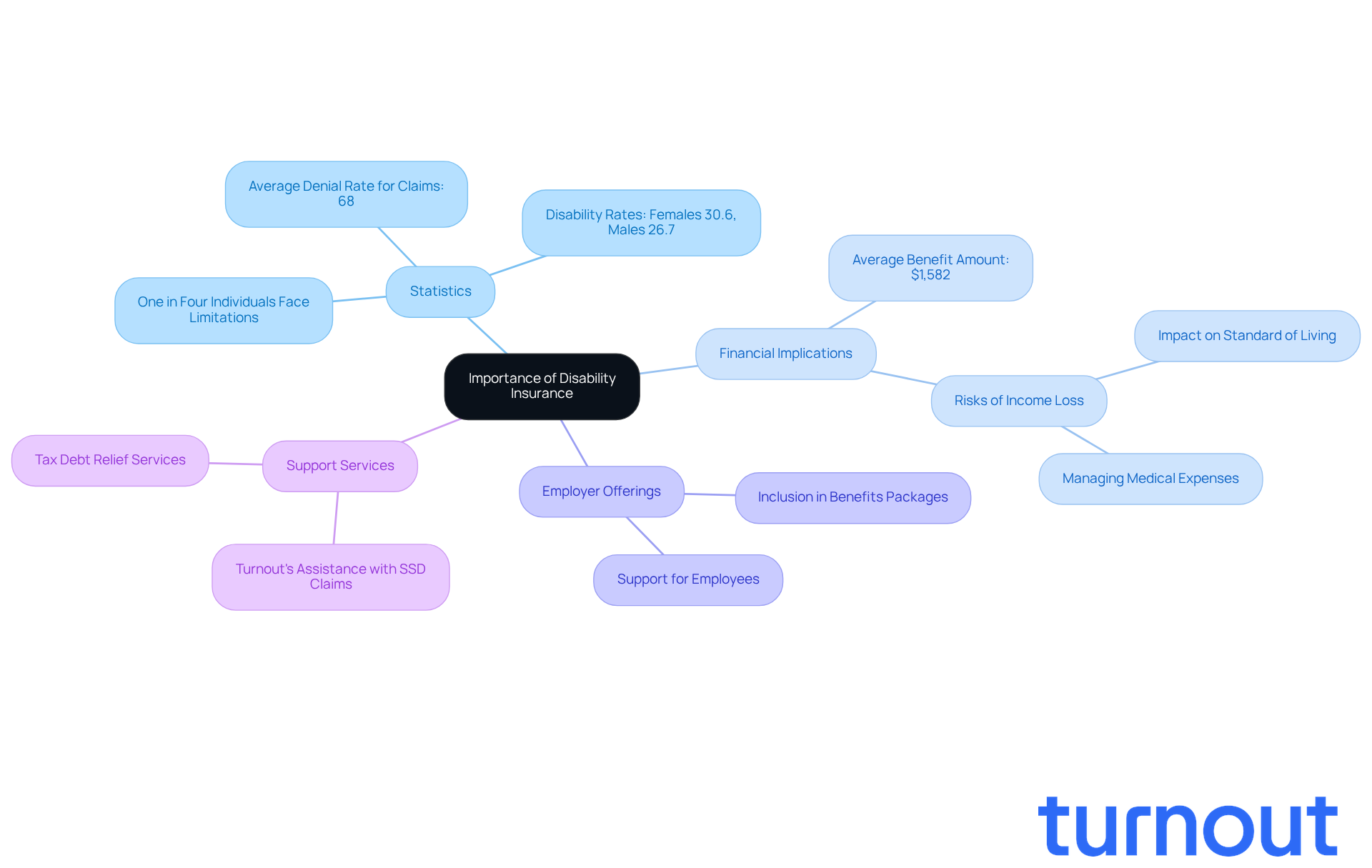

Disability insurance is more than just a policy; it’s a crucial financial safety net for professionals who may face unexpected illnesses or injuries that prevent them from working. Did you know that nearly one in four individuals will encounter a physical limitation before reaching retirement age? This statistic underscores the significant risk of income loss that many face.

As of April 2025, the average disability benefit for disabled workers is only $1,582. This reality highlights the importance of having adequate coverage. For those in demanding positions, the absence of a reliable income can lead to serious financial strain. Disability coverage not only offers peace of mind but also helps individuals maintain their standard of living, manage medical expenses, and meet financial obligations like mortgages and education costs.

Many employers understand this necessity and include disability insurance in pa within their benefits packages. This makes disability insurance in pa an essential consideration for both job seekers and current employees in Pennsylvania. We understand that navigating the complexities of Social Security Disability (SSD) claims can be overwhelming. That’s where Turnout comes in. They provide trained nonlawyer advocates who can assist you through the process, ensuring you receive the support you need without the burden of legal representation.

Turnout also offers help with tax debt relief, further supporting individuals in managing their financial challenges. This approach simplifies the application process and empowers you to access the benefits you deserve. Remember, you are not alone in this journey; we’re here to help.

Identify Types of Disability Insurance Available in Pennsylvania

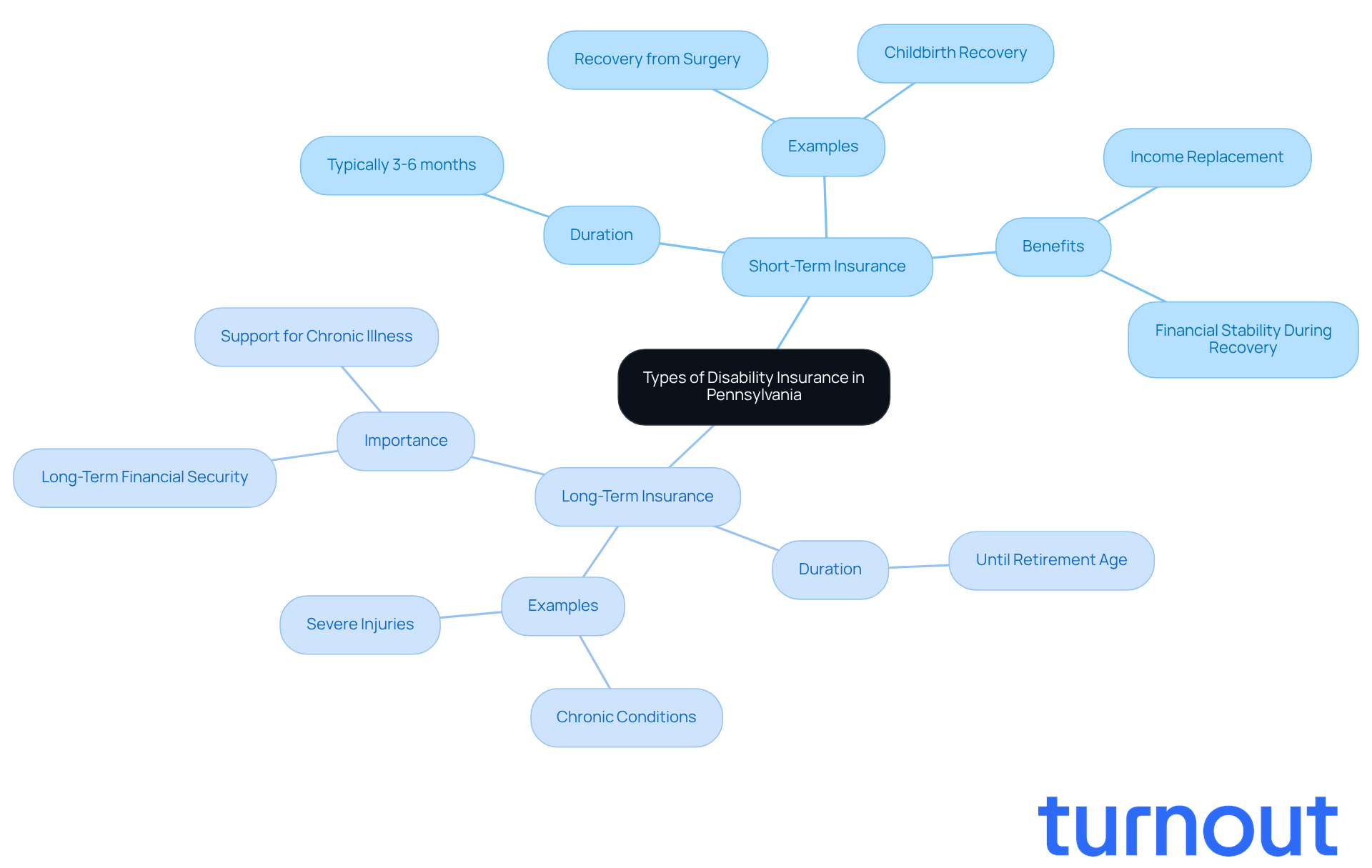

In Pennsylvania, we understand that navigating disability insurance in PA can be overwhelming. Coverage is typically categorized into two main types: short-term and long-term. Short-term income protection insurance replaces a portion of your earnings for a limited time, usually from a few weeks to six months. This coverage is particularly helpful for those recovering from temporary conditions, like surgeries or acute illnesses. For instance, many employees benefit from short-term coverage during recovery from childbirth or significant surgeries, ensuring they maintain financial stability while healing.

On the flip side, long-term coverage offers protection for extended periods, often lasting until retirement age. This type of insurance is crucial for individuals facing chronic conditions or severe injuries that affect their ability to work. Imagine a specialist diagnosed with a debilitating condition; they may rely on long-term support benefits to meet their financial responsibilities over the years.

Additionally, various policies might include riders or extra benefits tailored to specific occupations or higher payouts for catastrophic impairments. It's important to understand these options, as they help you choose the most suitable coverage based on your unique circumstances and financial needs. With about 57% of companies in Pennsylvania offering disability insurance in PA and a 95% acceptance rate among workers when available, it's vital to assess your choices carefully to ensure you have adequate protection.

Remember, keeping thorough documentation throughout the claims process is essential. Insurers depend heavily on written records. Common pitfalls, like assuming employers automatically send medical records or neglecting to update contact information, can jeopardize your claims. If you're feeling uncertain, seeking advice from a Philadelphia attorney who specializes in benefits for the disabled can provide valuable guidance as you navigate these complexities. You're not alone in this journey, and we're here to help.

Clarify Common Questions and Misconceptions About Disability Insurance

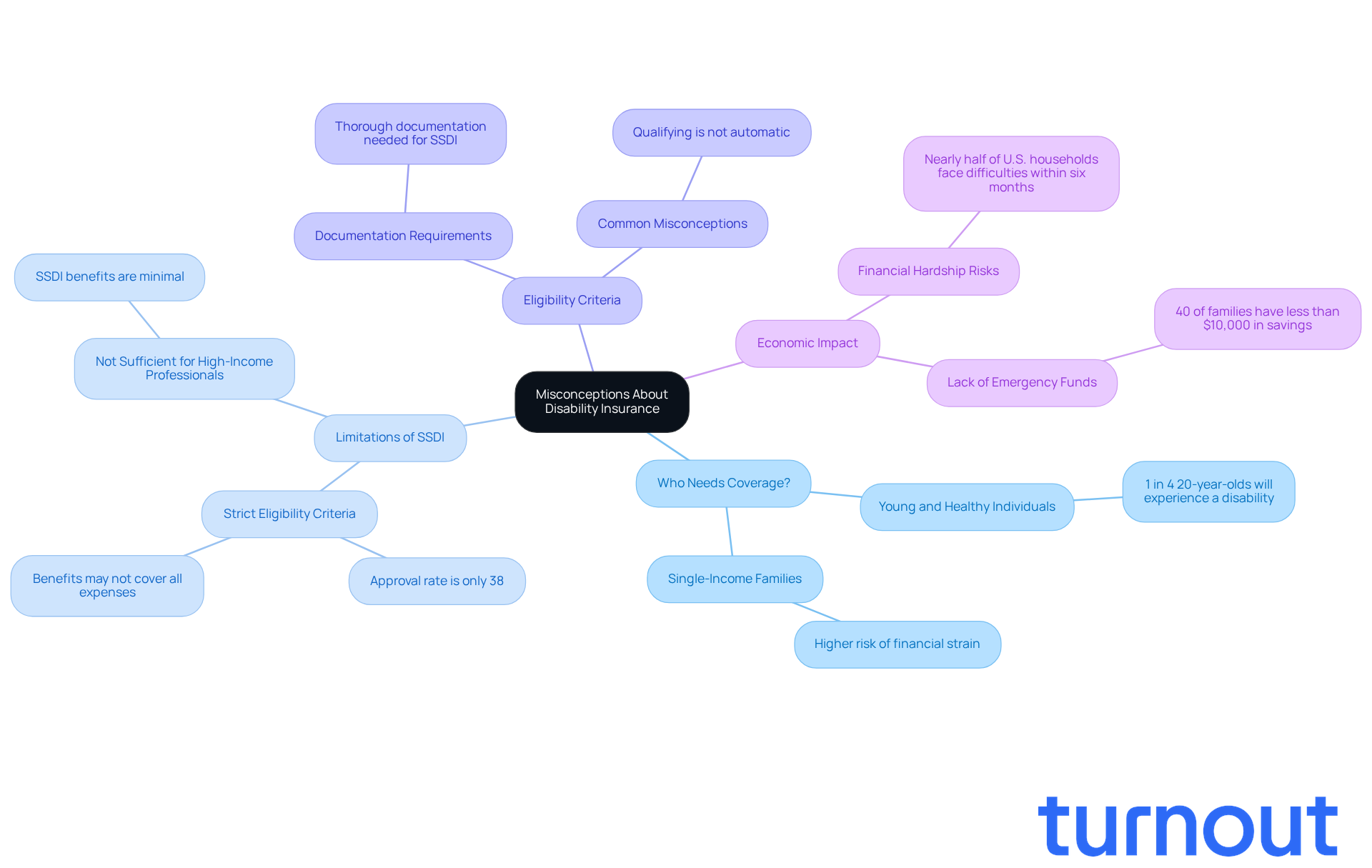

Misunderstandings about impairment protection can often stand in the way of securing essential coverage. Many people believe that income protection insurance is only important for older individuals or those in high-risk jobs. But the truth is, impairments can affect anyone, no matter their age or occupation. Did you know that nearly 90% of long-term disabilities come from illnesses like cancer, heart disease, and mental health disorders, rather than accidents?

It’s also common to think that government programs like Social Security Disability Insurance (SSDI) provide enough coverage. Unfortunately, SSDI benefits are often limited and may not cover all living expenses, leaving individuals vulnerable. Plus, many assume that qualifying for benefits is automatic once they become disabled. In reality, eligibility requires meeting specific criteria and thorough documentation. Alarmingly, at least 51 million working adults lack coverage for impairments beyond basic Social Security protection. This highlights a significant issue of insufficient security.

Almost half of U.S. households would face economic difficulties within six months if the main income provider couldn’t earn an income. This underscores the importance of obtaining sufficient protection. Understanding these misconceptions about disability insurance in PA is crucial for residents. It empowers you to take proactive steps in securing your financial future through appropriate disability insurance in PA coverage.

We want to remind you that Turnout is not a law firm and does not provide legal advice. Instead, they have trained nonlawyer advocates ready to assist clients with SSD claims. They ensure you understand your options and the necessary documentation required to secure benefits. Remember, you are not alone in this journey.

Conclusion

Disability insurance is more than just a policy; it’s a vital safety net for professionals in Pennsylvania. It provides crucial income protection during times of illness or injury, supporting you when you need it most. As more professionals recognize its importance, understanding the different types of policies - short-term and long-term - becomes essential for securing your financial future.

We understand that many workers may feel unprepared for potential income loss due to disabilities. Alarming statistics reveal that a significant portion of the workforce lacks adequate protection. Misconceptions about disability insurance can prevent individuals from securing the coverage they need. That’s why it’s so important to educate yourself on the available options and the role of support services like Turnout in navigating the claims process.

Taking proactive steps to secure your financial well-being through appropriate disability insurance coverage is crucial. By dispelling myths and addressing common concerns, you can make informed decisions that protect your livelihood. Remember, taking action today ensures that if the unexpected occurs, you’ll have a reliable safety net in place to help maintain your stability and peace of mind.

You are not alone in this journey. We’re here to help you understand your options and find the right coverage for your needs.

Frequently Asked Questions

What is disability insurance?

Disability insurance is a safety net that provides income replacement for individuals unable to work due to illness or injury, helping them meet financial obligations during challenging times.

Why is disability insurance important for professionals in Pennsylvania?

For professionals in Pennsylvania, disability insurance is crucial as it helps protect their earnings, which are essential for supporting themselves and their families.

What are the two main types of disability coverage?

The two main types of disability coverage are short-term policies, which provide benefits for up to six months, and long-term policies, which can extend for several years or until retirement age.

How does disability insurance contribute to economic planning for professionals?

Many professionals in Pennsylvania recognize disability insurance as a key part of their economic planning, as it serves as an essential asset for income replacement and helps protect their financial future.

What support does Turnout provide regarding disability claims?

Turnout offers assistance with navigating Social Security Disability (SSD) claims and tax debt relief, providing trained nonlawyer advocates to guide individuals through the process while they focus on recovery.