Introduction

Cost-of-Living Adjustments (COLA) are vital for the financial well-being of millions who depend on Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). We understand that as inflation continues to chip away at purchasing power, it’s crucial for beneficiaries to grasp these adjustments. After all, maintaining your quality of life is what matters most.

Yet, with living costs and healthcare expenses on the rise, it’s common to feel uncertain. Many recipients wonder if the current COLA calculations truly reflect their economic realities. How can you navigate these complexities? We’re here to help you stay informed and prepared for the financial changes ahead.

Define Cost-of-Living Adjustments (COLA) and Their Importance for Social Security Disability

Cost-of-Living Adjustments are vital increases in Social Welfare benefits designed to help ease the burden of inflation. We understand that as living costs rise, it can be challenging to maintain your purchasing power. For those relying on cola for social security disability or Supplemental Security Income (SSI), these adjustments are crucial for preserving quality of life during economic shifts.

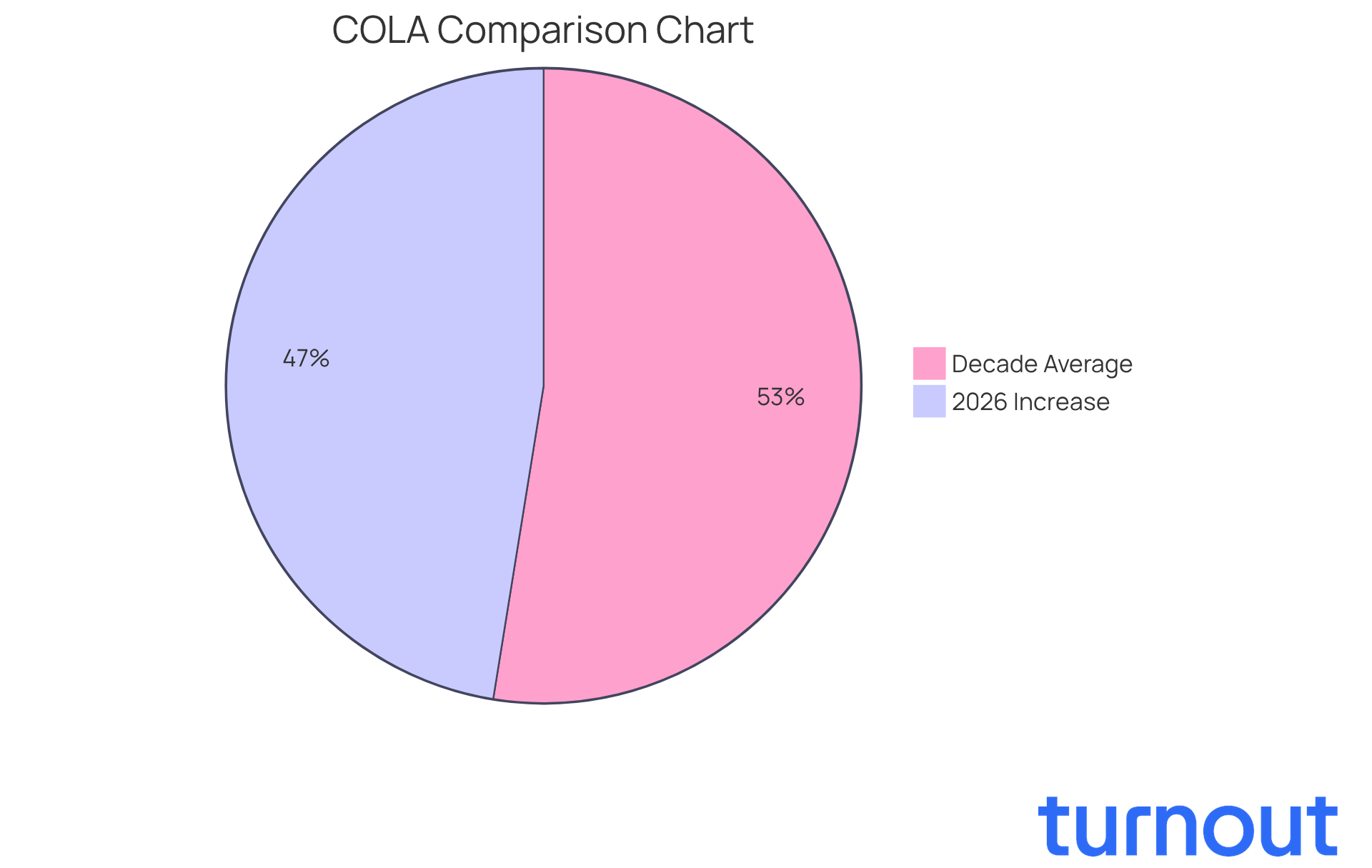

Starting in January 2026, nearly 71 million recipients are expected to see a 2.8 percent increase in their cost-of-living adjustments, translating to an average monthly payment boost of about $56. Without these adjustments, fixed allowances would lose value, making it increasingly difficult for recipients to afford essential goods and services.

Over the past decade, the average cost-of-living adjustment has been around 3.1 percent, reflecting the ongoing economic pressures that impact beneficiaries' ability to meet their needs. We recognize that navigating the SSD claims process can be overwhelming. That’s where Turnout comes in.

By employing skilled nonlawyer advocates, Turnout is here to help you understand and access your resources effectively. We want to ensure you can make the most of your financial support, particularly cola for social security disability, especially in light of cost-of-living adjustments. Remember, you are not alone in this journey.

Explain How COLA is Calculated for Social Security Disability Benefits

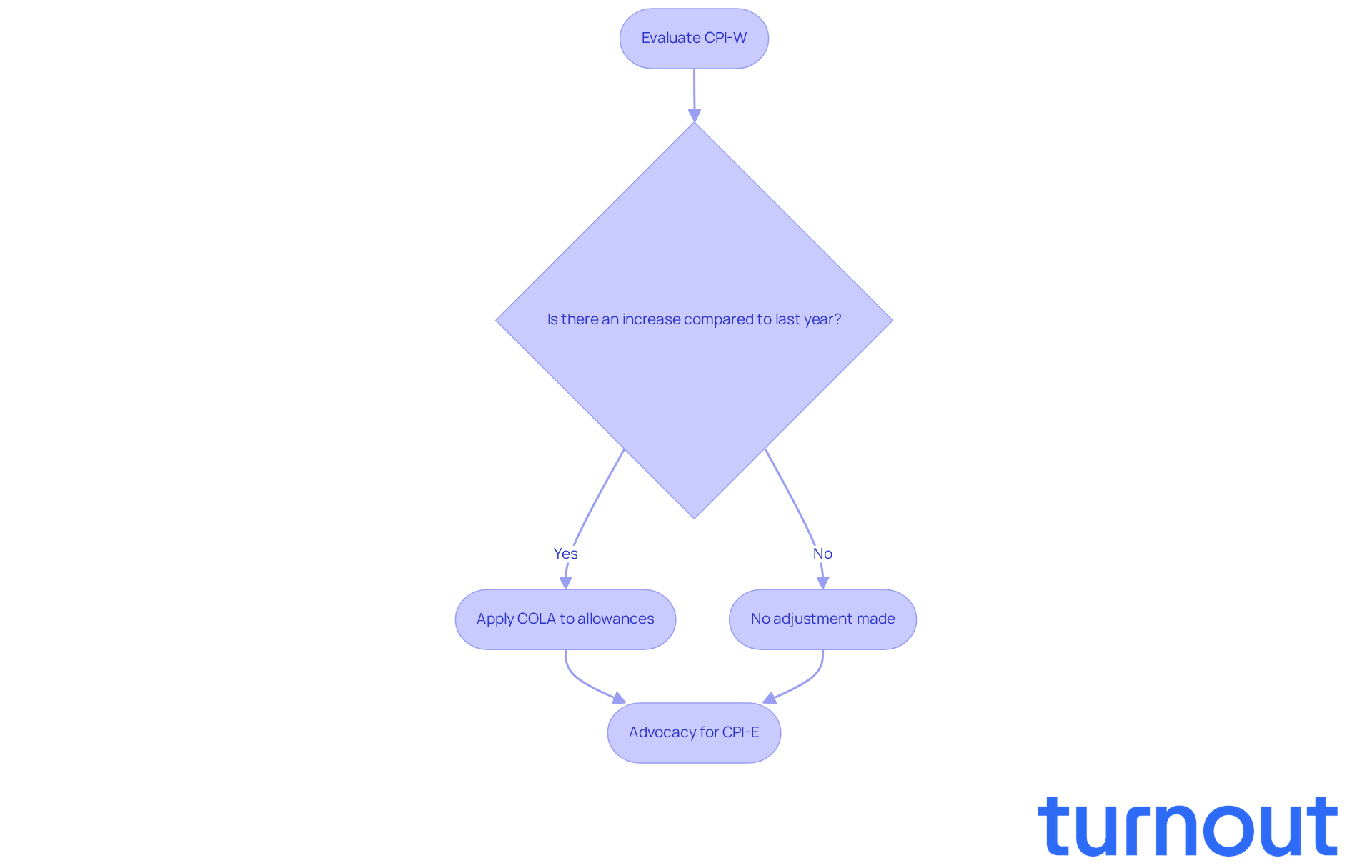

We understand that navigating the complexities of Social Assistance payments can be challenging. The adjustment for the cost of living is calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Each year, the Social Security Administration (SSA) evaluates the average CPI-W from the third quarter of the current year against the previous year's average. If there's an increase, a corresponding cola for social security disability is applied to the allowances.

For example, a 2.8% rise in the CPI-W translates to an average increase of about $56 in monthly payments, effective January of the following year. This systematic approach aims to ensure that cola for social security disability benefits keeps pace with inflation, thereby providing essential financial support to recipients. However, it's common to feel that these adjustments don't fully reflect the rising costs, especially in healthcare and living expenses.

Many recipients have voiced their concerns regarding cola for social security disability, prompting advocacy organizations to call for a reassessment of the cost-of-living adjustment calculation. They propose alternatives like the Consumer Price Index for the Elderly (CPI-E) to better reflect the economic realities faced by older adults and individuals with disabilities. Furthermore, the anticipated rise in Medicare premiums by $21 underscores the financial pressure on recipients, leading to feelings that the cost-of-living adjustment may not adequately address escalating expenses.

You're not alone in this journey. Together, we can advocate for changes that truly reflect the needs of our community.

Discuss the Impact of COLA on SSDI and SSI Benefits

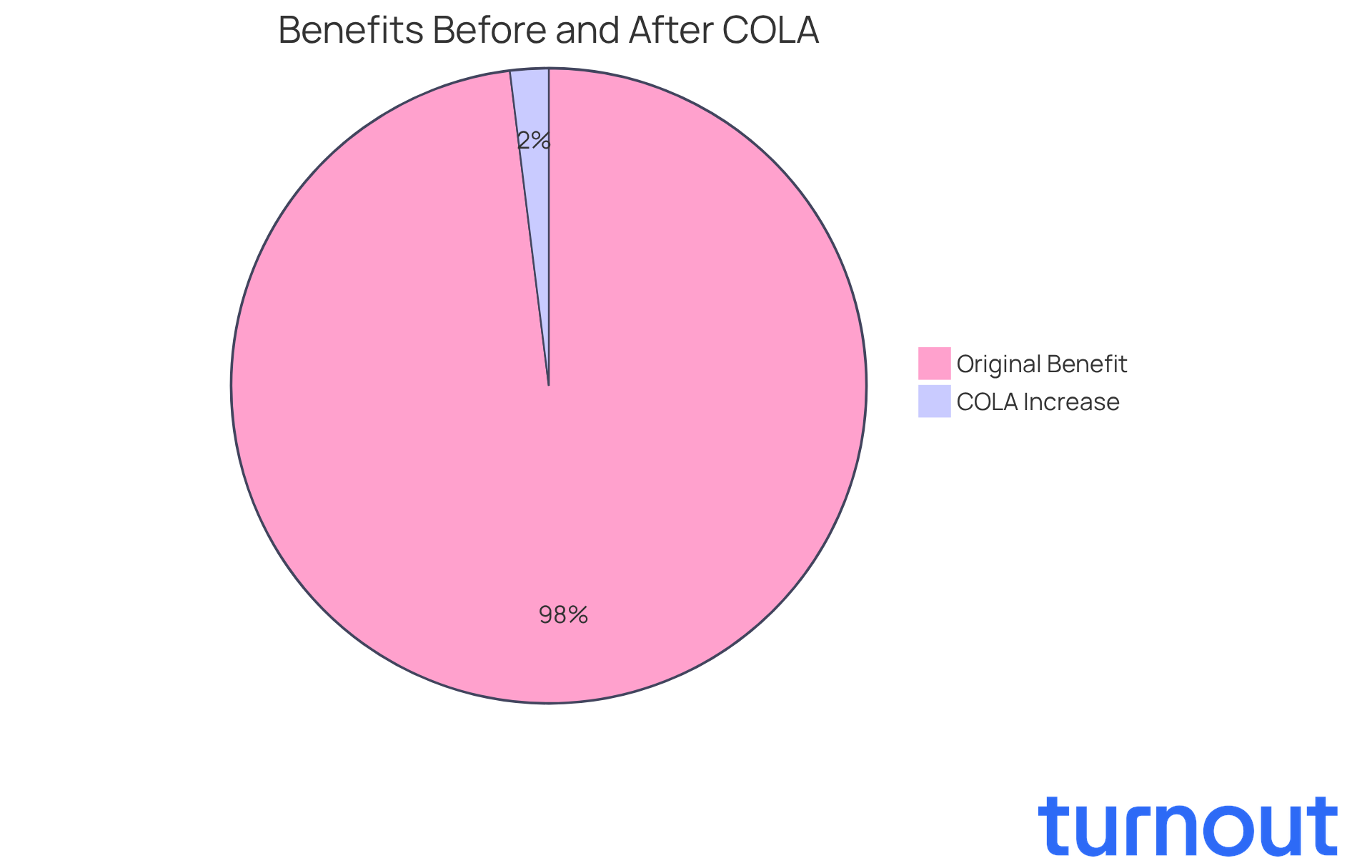

The impact of the 2.8% cost-of-living adjustment (COLA) for social security disability benefits and Supplemental Security Income (SSI) is truly significant. Starting in January 2026, around 71 million recipients will experience this increase. For example, if your monthly SSDI payment is $1,500, it will rise to $1,530, which means an average increase of about $56 each month.

While this adjustment might seem modest, it plays a crucial role in providing financial relief for those who rely on fixed incomes. We understand that every bit helps, especially when it comes to managing essential expenses like housing and healthcare. These COLA adjustments are vital for recipients of COLA for social security disability to keep pace with rising costs.

It's also important to know the payment schedule. For instance, if you were born between the 21st and 31st of your birth month, you can expect your payments on December 24, 2025. By understanding these adjustments, you can better manage your budget and plan for future financial needs, ensuring you maintain your quality of life even amidst economic fluctuations.

Remember, you’re not alone in this journey. Turnout is here to assist you in navigating these changes. We provide tools and services to help you understand your SSD claims and how COLA for social security disability affects your benefits. As Frank J. Bisignano, Commissioner of the Social Assistance Administration, said, 'The cost-of-living adjustment is a vital part of how Social Assistance delivers on its mission.' We're here to help you every step of the way.

Guide on Accessing COLA Information and Updates for Beneficiaries

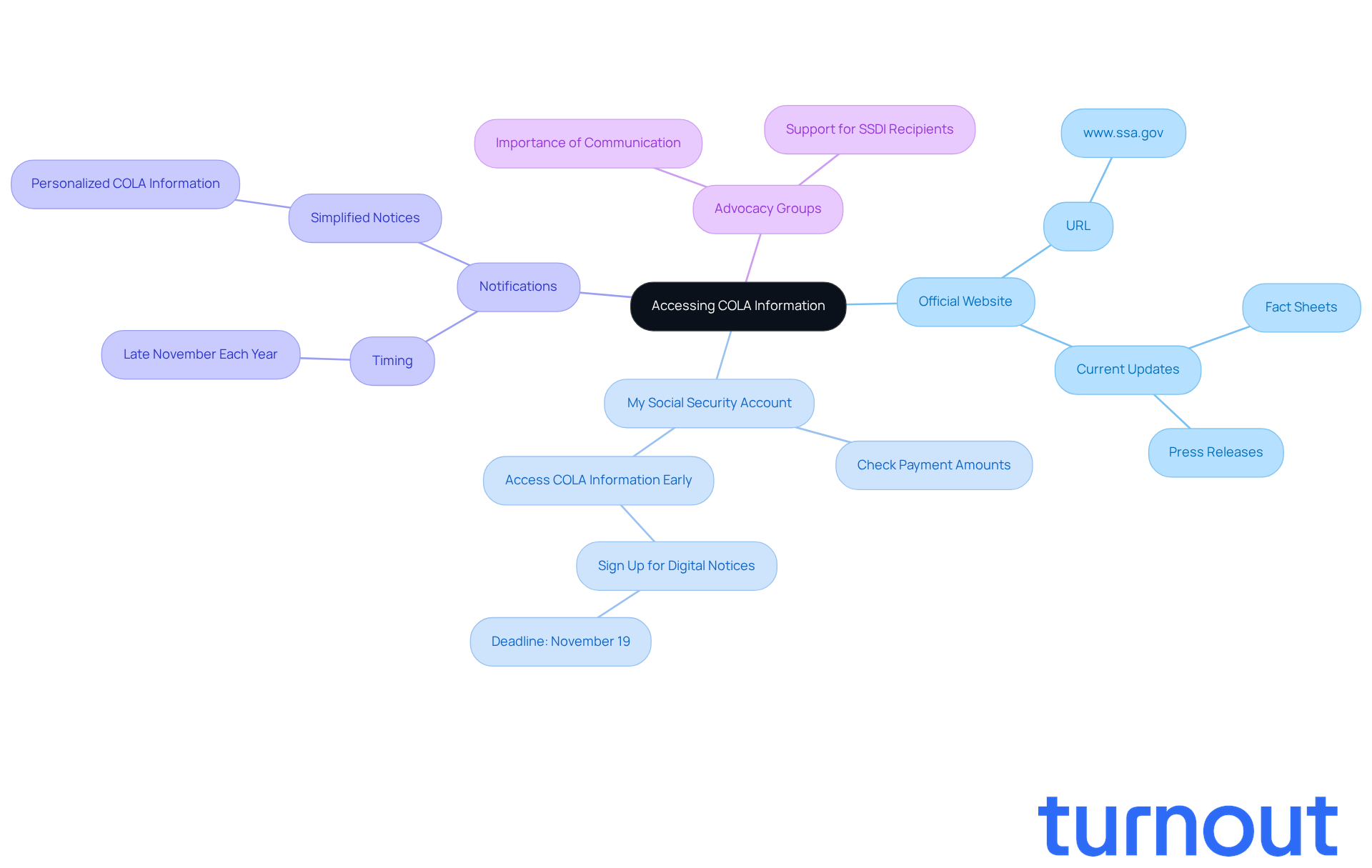

We understand that navigating Cost-of-Living Adjustments can be challenging. Beneficiaries can access vital information through several channels. The Social Welfare Administration's official website (www.ssa.gov) is a great starting point, offering current updates on cost-of-living adjustments, including detailed fact sheets and press releases.

Additionally, you can create a 'my Social Security' account to check your payment amounts and any cost-of-living adjustments directly. Notifications about these adjustments are typically sent out in late November each year, giving you time to prepare for the upcoming changes. Staying informed about COLA is essential for effective financial planning. It helps ensure that you understand how your benefits will evolve over time.

In 2026, monthly Social Security payments and Supplemental Security Income disbursements will rise by 2.8 percent for 75 million Americans. Nick Perrine, Chief Communications Officer, shared this encouraging news, stating, "Today, we announced that monthly Social Security payments and Supplemental Security Income disbursements for 75 million Americans will rise by 2.8 percent in 2026."

Advocacy groups highlight the importance of clear communication strategies to keep SSDI recipients updated on these changes. Many individuals rely on these benefits for their daily living expenses, and we’re here to help you stay informed. Remember, you are not alone in this journey.

Conclusion

Understanding the significance of Cost-of-Living Adjustments (COLA) for Social Security Disability benefits is crucial for those who rely on these essential financial resources. These adjustments help maintain purchasing power as living costs rise, ensuring beneficiaries can afford the necessities of life. The anticipated 2.8 percent increase in 2026 is more than just a number; it’s a vital lifeline for millions. Staying informed about these changes is important for everyone involved.

We understand that navigating financial matters can be overwhelming. Throughout this article, we’ve shared key insights on how COLA is calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). We’ve also discussed the impact of these adjustments on monthly payments and the ongoing advocacy for more accurate measures that reflect the economic realities faced by individuals with disabilities. Additionally, we highlighted resources for accessing COLA information, empowering you to manage your financial planning effectively.

Ultimately, understanding COLA goes beyond numbers; it’s about ensuring that you can maintain your quality of life amid economic fluctuations. Advocacy for clearer communication and better calculation methods is essential. By staying informed and utilizing available resources, you can better manage your benefits and advocate for the adjustments that truly reflect your needs. Remember, you are not alone in this journey. It’s vital to remain proactive in seeking information and support, ensuring that you have the tools to face these challenges with confidence.

Frequently Asked Questions

What are Cost-of-Living Adjustments (COLA)?

Cost-of-Living Adjustments (COLA) are increases in Social Welfare benefits designed to help individuals maintain their purchasing power as living costs rise due to inflation.

Why are COLA important for Social Security Disability recipients?

COLA are crucial for Social Security Disability and Supplemental Security Income (SSI) recipients as they help preserve quality of life during economic shifts by offsetting the effects of inflation on fixed incomes.

When will the next COLA increase take effect and what will it be?

Starting in January 2026, nearly 71 million recipients are expected to see a 2.8 percent increase in their COLA, resulting in an average monthly payment boost of about $56.

How has the average COLA changed over the past decade?

Over the past decade, the average cost-of-living adjustment has been around 3.1 percent, reflecting ongoing economic pressures that affect beneficiaries' ability to meet their needs.

How can Turnout assist individuals with Social Security Disability claims?

Turnout employs skilled nonlawyer advocates to help individuals understand and access their resources effectively, ensuring they can make the most of their financial support, particularly regarding COLA for Social Security Disability.