Introduction

Navigating the world of disability benefits can feel overwhelming, especially when you're facing the challenges of financial support due to medical conditions. We understand that these benefits are more than just numbers; they represent a crucial safety net, providing the income you need when work isn’t an option. But figuring out how much you might receive can be daunting.

With so many programs out there, each with its own eligibility criteria and calculations, it’s common to feel lost. How can you ensure you’re getting the right support? This guide is here to help. We’ll break down the complexities of disability benefits, empowering you to confidently explore your options and secure the financial assistance you deserve. Remember, you’re not alone in this journey - we’re here to help.

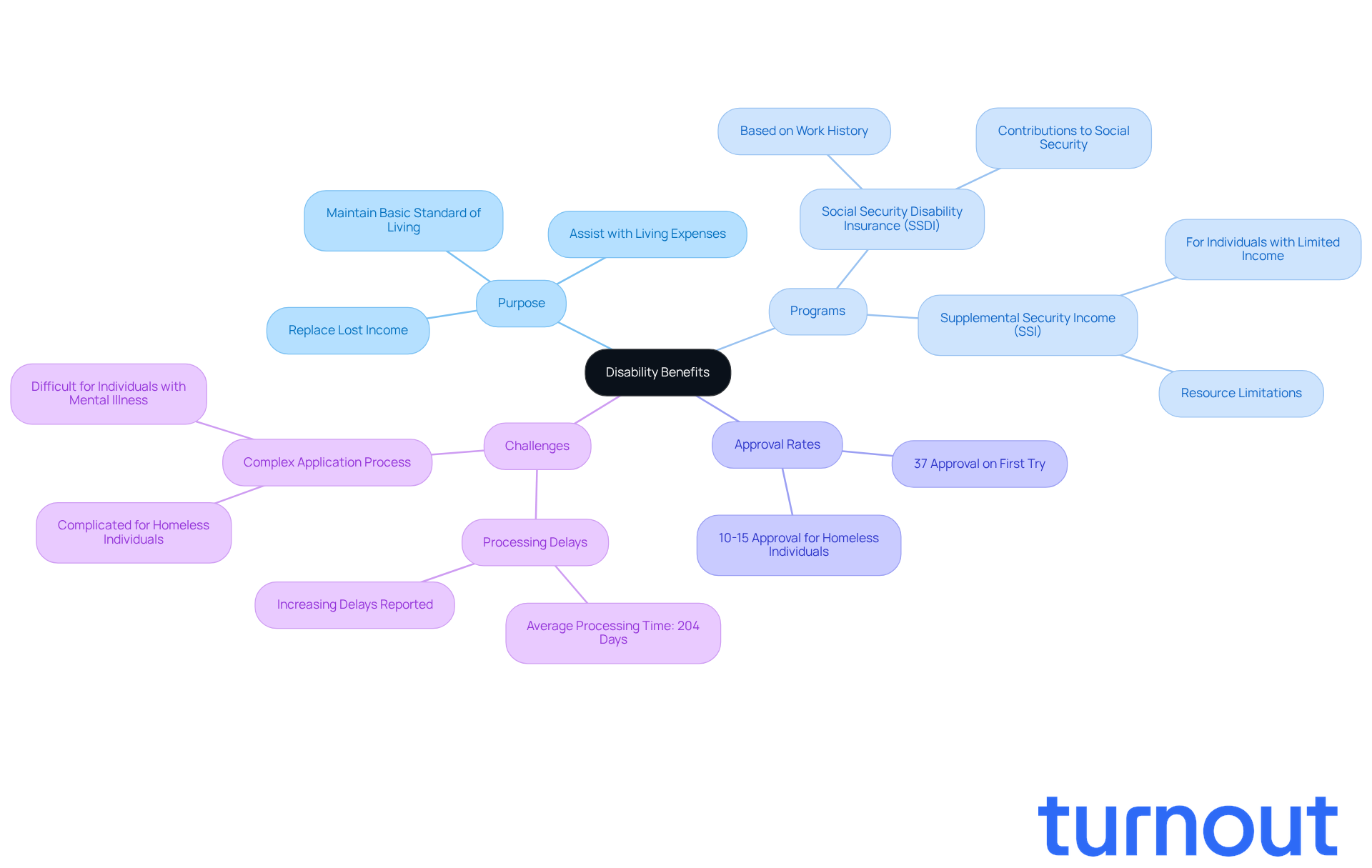

Define Disability Benefits and Their Purpose

The disability check amount provided through disability assistance is a vital lifeline for those unable to work due to a medical condition that is expected to last at least a year or even lead to death. We understand that navigating this process can be overwhelming, but the benefits, such as the disability check amount, are designed to replace lost income and help with essential living expenses. They ensure that individuals can maintain a basic standard of living with the disability check amount, even when work isn’t an option.

The primary programs that provide the disability check amount are Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). SSDI is determined by your work history and contributions to Social Security, whereas the disability check amount for SSI is aimed at individuals with limited income and resources. Understanding these differences is crucial, especially since about 37 percent of applicants receive their disability check amount approved on their first try. However, it’s important to note that approval rates drop significantly for homeless individuals, which can lead to a lower disability check amount, ranging from just 10 to 15 percent. This highlights the additional challenges faced by this vulnerable group related to the disability check amount.

Moreover, the Social Security Administration (SSA) has reported increasing delays in processing times, which can make accessing the disability check amount and other essential services even more difficult. With the SSA projecting a 2.7% increase in the disability check amount for SSDI support in 2026, staying informed about these programs can greatly impact the financial well-being of those in need.

At Turnout, we’re here to help you navigate these processes. Our platform offers guided support from trained nonlawyer advocates and IRS-licensed enrolled agents. Plus, our AI agent, Jake, simplifies communication and tracking, making it easier for you to access government assistance. Remember, Turnout does not provide legal advice, but we ensure you understand the nature of the support we offer. You are not alone in this journey; we’re here to help.

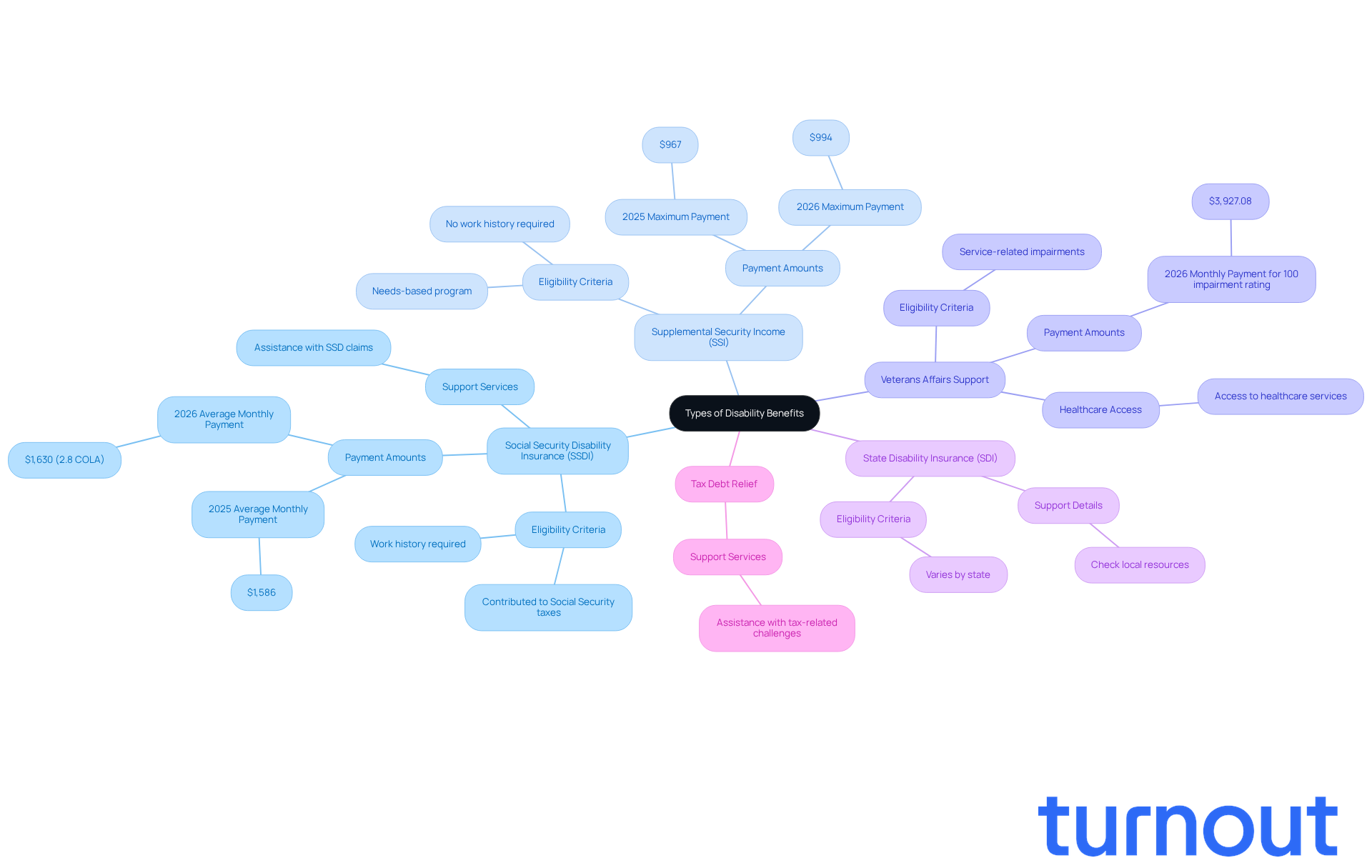

Explore Types of Disability Benefits Available

If you're navigating the challenges of financial support due to disabilities, know that you're not alone. There are several types of benefits available, each tailored to meet different needs:

-

Social Security Disability Insurance (SSDI): This program is for those who have a work history and have contributed to Social Security taxes. SSDI benefits are based on your earnings record, providing a safety net for individuals who can no longer work due to disability. In 2026, the average monthly SSDI payment is expected to rise from $1,586 in 2025 to $1,630, thanks to a 2.8% cost-of-living adjustment (COLA) that helps you keep up with inflation. At Turnout, we offer support with SSD claims through trained nonlawyer advocates, ensuring you can navigate the application process with confidence.

-

Supplemental Security Income (SSI): Unlike SSDI, SSI is a needs-based program designed for individuals with limited income and resources. It provides financial support without considering work history, making it a vital resource for many disabled individuals. In 2026, the maximum federal SSI payment for individuals will increase from $967 to $994 per month, reflecting a commitment to support those in need.

-

Veterans Affairs Support: If you're a veteran with service-related impairments, there are provisions specifically for you. These not only offer financial support but also access to healthcare services. In 2026, veterans with a 100% impairment rating can expect to receive around $3,927.08 per month. It's important to stay informed about the new VA impairment rating regulation, as it may affect your benefits based on how your conditions are treated.

-

State Disability Insurance (SDI): Some states have their own programs for individuals unable to work, providing additional support to residents. These programs vary by state, so it's essential to check local resources for potential assistance.

-

Tax Debt Relief: At Turnout, we also assist with tax debt relief, working alongside IRS-licensed enrolled agents to help you navigate tax-related challenges. This service complements our support for SSD claims, ensuring a comprehensive approach to your financial assistance.

Understanding these options, particularly the disability check amount, is crucial as you navigate the complexities of support programs. Each program has unique eligibility standards and benefits that can significantly impact your financial security. We encourage you to consult a support advisor, like those at Turnout, before making any changes to your work hours. Even small adjustments in how your earnings are counted can greatly influence your financial stability and access to healthcare as a disabled worker. Remember, we're here to help you every step of the way.

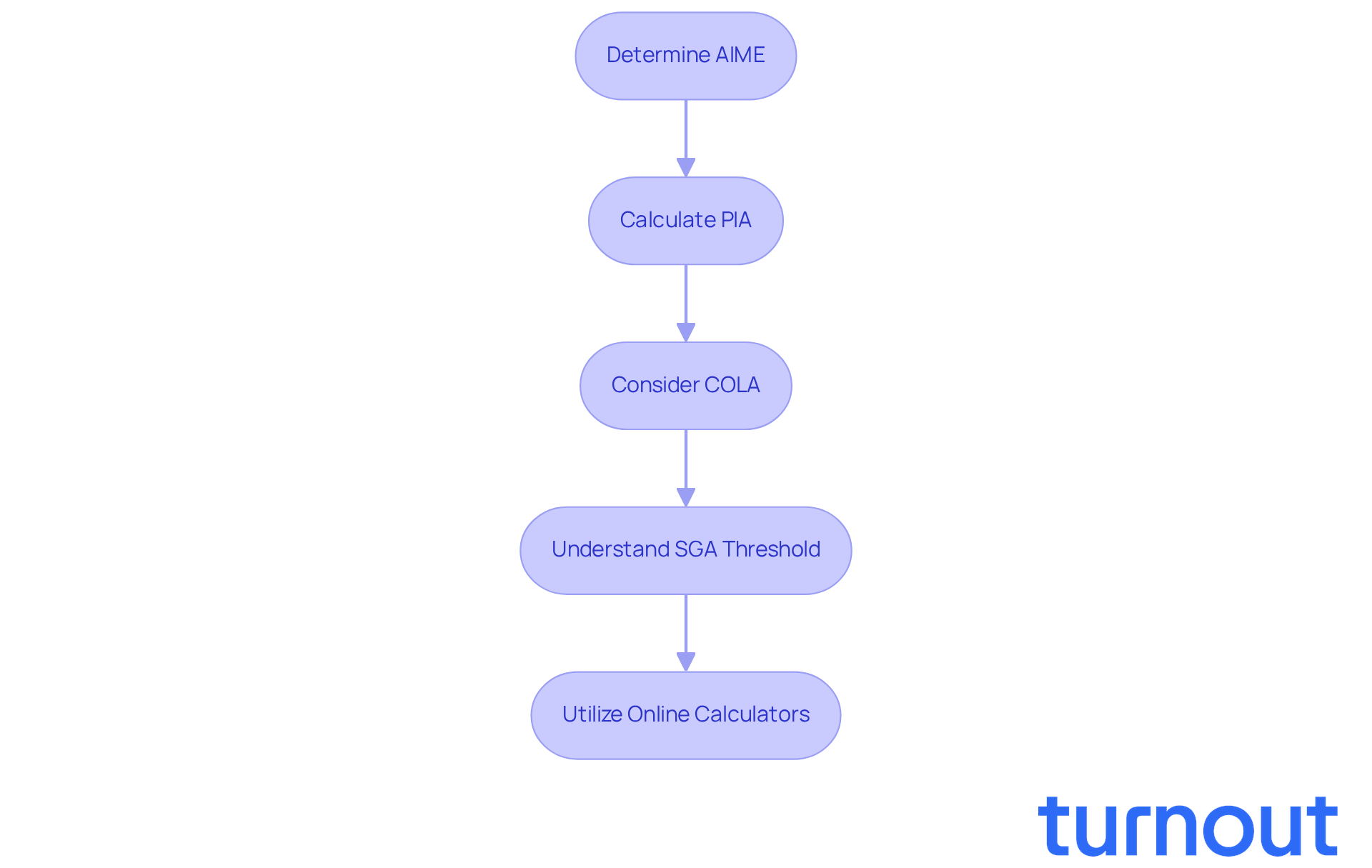

Calculate Your Disability Check Amount

Calculating your disability check amount may seem overwhelming, but we're here to assist you with the process. Follow these steps to gain clarity and confidence in understanding your benefits:

-

Determine Your Average Indexed Monthly Earnings (AIME): This figure reflects your highest-earning years, adjusted for inflation. The Social Security Administration (SSA) uses your earnings history to compute this amount, showing how much you've contributed to the system.

-

Calculate Your Primary Insurance Amount (PIA): Your PIA is derived from your AIME using a specific formula that applies different percentages to portions of your AIME. For 2026, the formula is as follows:

- 90% of the first $1,115 of your AIME,

- 32% of the AIME over $1,115 and up to $6,721,

- 15% of the AIME over $6,721.

-

Consider Cost-of-Living Adjustments (COLA): Each year, the SSA may adjust payments based on inflation, which can significantly influence your monthly amount. In 2026, recipients will see a 2.8% increase in their payments, providing some relief against rising living costs.

-

Understand the Substantial Gainful Activity (SGA) Threshold: In 2026, the SGA threshold for non-blind individuals will increase from $1,620 to $1,690 per month. For statutorily blind disabled individuals, it will rise from $2,700 to $2,830 per month. This change is crucial as it affects your eligibility for assistance.

-

Utilize Online Calculators: The SSA offers helpful tools on their website to estimate your payments based on your earnings history. Using these tools can give you a clearer picture of what to expect, allowing you to plan accordingly.

By understanding these calculations, you can navigate the complexities of your Social Security support, including your disability check amount, with greater ease. Remember, you are not alone in this journey. Turnout is here to assist you, providing expert guidance and tools to simplify your access to government services.

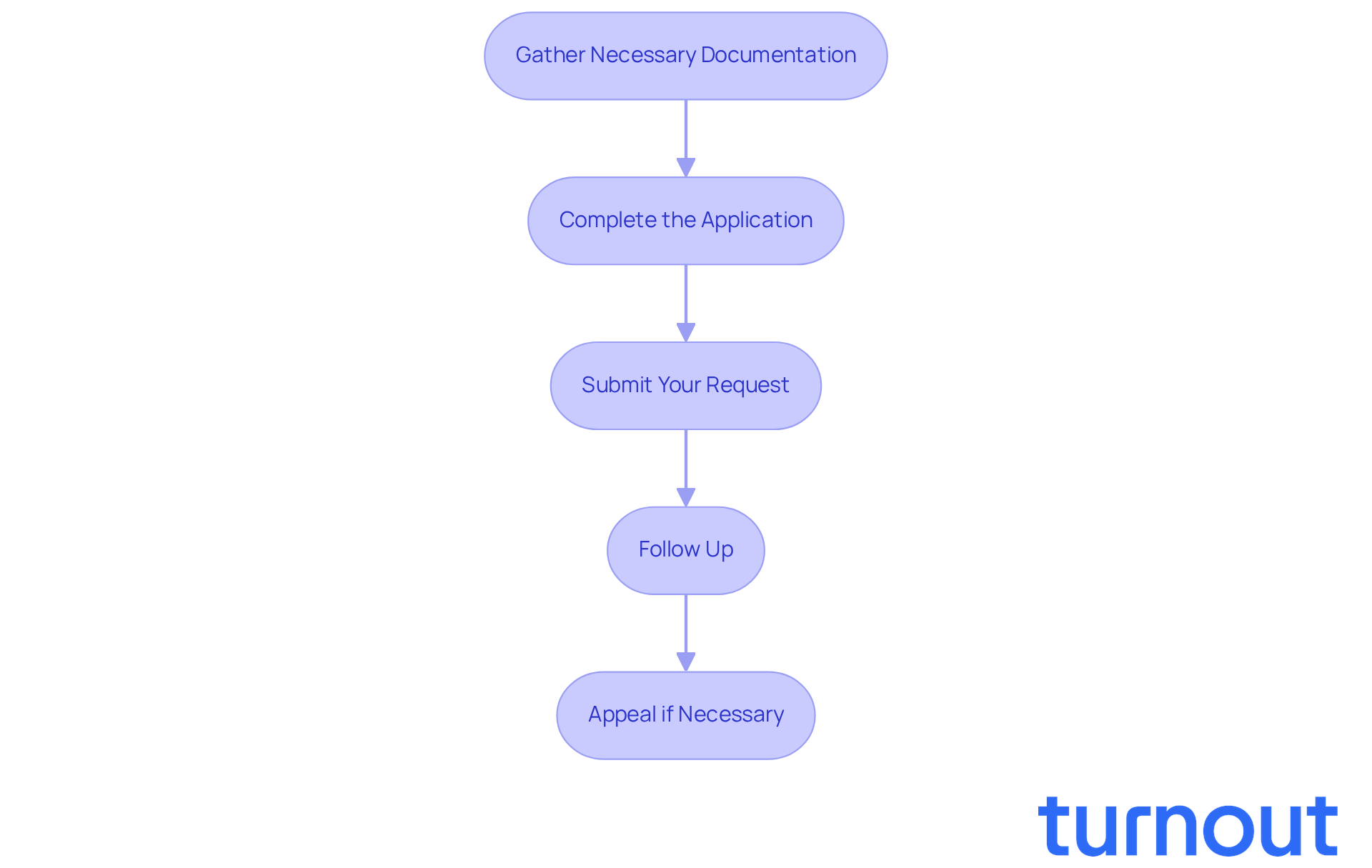

Navigate the Application Process for Disability Benefits

Navigating the application process for disability benefits can feel overwhelming, but you’re not alone. Here are some crucial steps to help you through:

-

Gather Necessary Documentation: Start by collecting your medical records, work history, and any other documents that support your claim. This includes detailed medical reports from your healthcare providers. Remember, the quality and clarity of these records can significantly impact your submission’s success.

-

Complete the Application: You can apply online through the SSA website or by visiting your local SSA office. It’s essential to ensure that all information is accurate and complete to avoid unnecessary delays. Did you know that about 67% of initial SSDI requests are denied? Often, this is due to inadequate medical documentation, so being thorough is key.

-

Submit Your Request: Once you’ve completed the form, send it along with all necessary documentation. Keep copies of everything you send. This will be crucial for tracking your submission and addressing any issues that may arise.

-

Follow Up: After you submit your application, actively monitor its status. You can check online or contact the SSA for updates. It’s common to feel anxious during this time, but be prepared to provide additional information if requested. Timely responses can help prevent delays in processing.

-

Appeal if Necessary: If your request is denied, don’t be discouraged. You have the right to appeal the decision. Familiarize yourself with the appeals process, which can take an additional 6 to 12 months. Gather any further evidence to strengthen your case. Understanding your rights and securing legal representation can significantly improve your chances of a successful appeal.

By following these steps and being proactive in your approach, you can navigate the complexities of the disability benefits application process more effectively. Remember, we’re here to help you every step of the way.

Conclusion

Understanding the complexities of disability benefits is crucial for those who depend on these essential financial resources. We recognize that navigating this landscape can be overwhelming. This article sheds light on the importance of disability check amounts, which provide vital support for individuals unable to work due to long-term medical conditions.

By exploring the types of benefits available, the calculation process, and the application steps, you can gain clarity and confidence. It’s common to feel uncertain, but knowing what to expect can make a significant difference.

Key insights include the differences between programs like Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). Accurate documentation during the application process is essential, and understanding how cost-of-living adjustments can affect your monthly payments is equally important. We want you to feel informed about eligibility criteria and the various factors that influence the disability check amount.

The journey to securing disability benefits may seem daunting, but with the right resources and support, you can navigate this process successfully. Remember, you are not alone in this journey. Staying informed and proactive is vital. Utilize tools and guidance from platforms like Turnout to help maintain your financial stability.

Empowerment through knowledge and assistance is key to overcoming the challenges associated with disability benefits. Together, we can pave the way for a more secure future.

Frequently Asked Questions

What are disability benefits and their purpose?

Disability benefits are financial assistance provided to individuals unable to work due to a medical condition expected to last at least a year or potentially lead to death. They are designed to replace lost income and help with essential living expenses, ensuring individuals can maintain a basic standard of living.

What are the primary programs that provide disability benefits?

The primary programs that provide disability benefits are Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). SSDI is based on an individual's work history and contributions to Social Security, while SSI is aimed at individuals with limited income and resources.

What is the approval rate for disability benefits applications?

Approximately 37 percent of applicants receive their disability benefits approved on their first attempt. However, approval rates are significantly lower for homeless individuals, with only about 10 to 15 percent receiving approval.

Are there any current issues affecting the processing of disability benefits?

Yes, the Social Security Administration (SSA) has reported increasing delays in processing times, which can make accessing disability benefits and other essential services more challenging.

Is there an expected increase in the disability benefits amount?

The SSA has projected a 2.7% increase in the disability benefits amount for SSDI support in 2026.

How can Turnout assist individuals with disability benefits?

Turnout offers guided support from trained nonlawyer advocates and IRS-licensed enrolled agents to help individuals navigate the disability benefits process. Their AI agent, Jake, simplifies communication and tracking to make accessing government assistance easier.