Overview

Navigating tax levy fees can feel overwhelming, and we understand that many people struggle with this issue. This article aims to shed light on these costs and provide guidance on how to manage and potentially reduce them.

It's crucial to maintain proactive communication with the IRS. Exploring options like payment plans and Offers in Compromise can make a significant difference. Ignoring tax obligations, however, can lead to serious consequences, including wage garnishments and bank seizures, which can create significant financial hardship.

We want you to know that you are not alone in this journey. Many individuals face similar challenges, and there are steps you can take to regain control. By reaching out and discussing your situation, you can find solutions that work for you.

Remember, it's common to feel anxious about tax issues, but taking action is the first step towards relief. We're here to help you navigate this process and find the best path forward.

If you're feeling overwhelmed, consider reaching out for assistance. Together, we can explore your options and help you find a way to manage your tax obligations effectively.

Introduction

Understanding tax levies is crucial for anyone facing financial obligations. These legal actions can lead to the seizure of assets and significant economic hardship. We understand that this can be overwhelming. This article offers valuable insights into the different types of tax levies, their associated fees, and the steps you can take to navigate this complex process effectively.

With millions of taxpayers interacting with the IRS each year, it’s common to feel uncertain about how to manage these challenges. How can you proactively manage and potentially reduce these burdensome costs? You are not alone in this journey, and we’re here to help you find the answers.

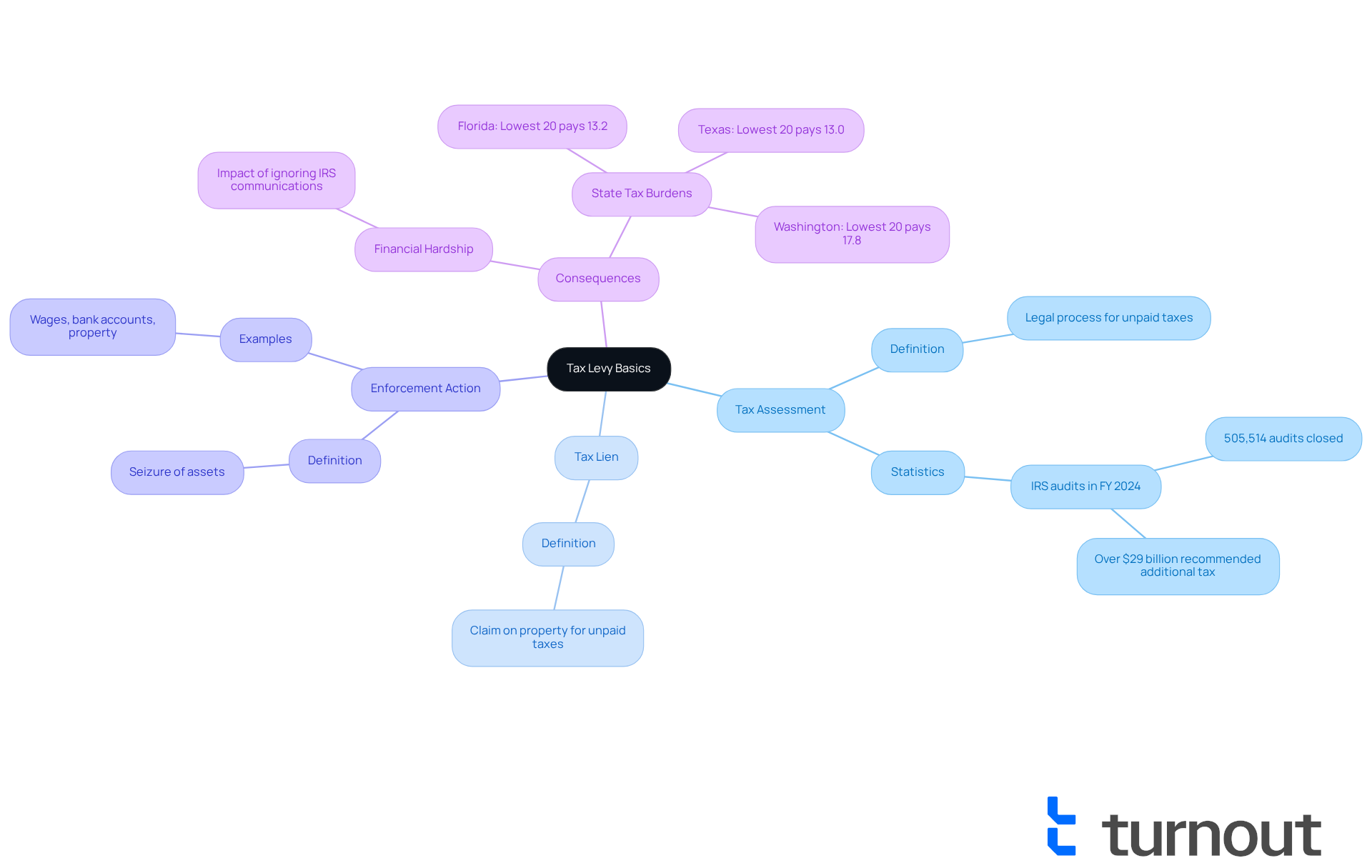

Define Tax Levy: Understanding the Basics

A tax assessment can feel overwhelming, and it’s important to understand what it means for you. Essentially, it’s a legal process that allows the government to take your assets if you have unpaid tax obligations. This is different from a tax lien, which only places a claim on your property. An enforcement action, however, leads to the actual seizure of assets like wages, bank accounts, and property.

We understand that managing financial obligations can be stressful. Recognizing the difference between these terms is crucial, as it underscores the seriousness of the situation and the potential consequences of unpaid dues. For instance, if you’re facing financial challenges and ignore communications from the IRS, they may take action to reclaim what you owe. This could lead to significant financial hardship.

In 2024, the IRS closed over 505,000 tax return audits, resulting in more than $29 billion in recommended additional taxes. This illustrates the agency's commitment to enforcing tax compliance. Each year, millions of Americans face tax charges, highlighting the importance of proactive tax management. In FY 2024, the IRS assisted around 62.2 million taxpayers, showing just how many people interact with the agency.

Tax experts emphasize that neglecting your tax responsibilities can lead to severe economic repercussions. It’s vital to understand your rights and options when faced with a potential seizure. For example, in states like Florida and Texas, the lowest 20% of earners face tax burdens of 13.2% and 13.0%, respectively. This can add to the economic pressure from tax charges.

Remember, you’re not alone in this journey. We’re here to help you navigate these challenges and find the best path forward.

Explore Types of Tax Levies and Associated Fees

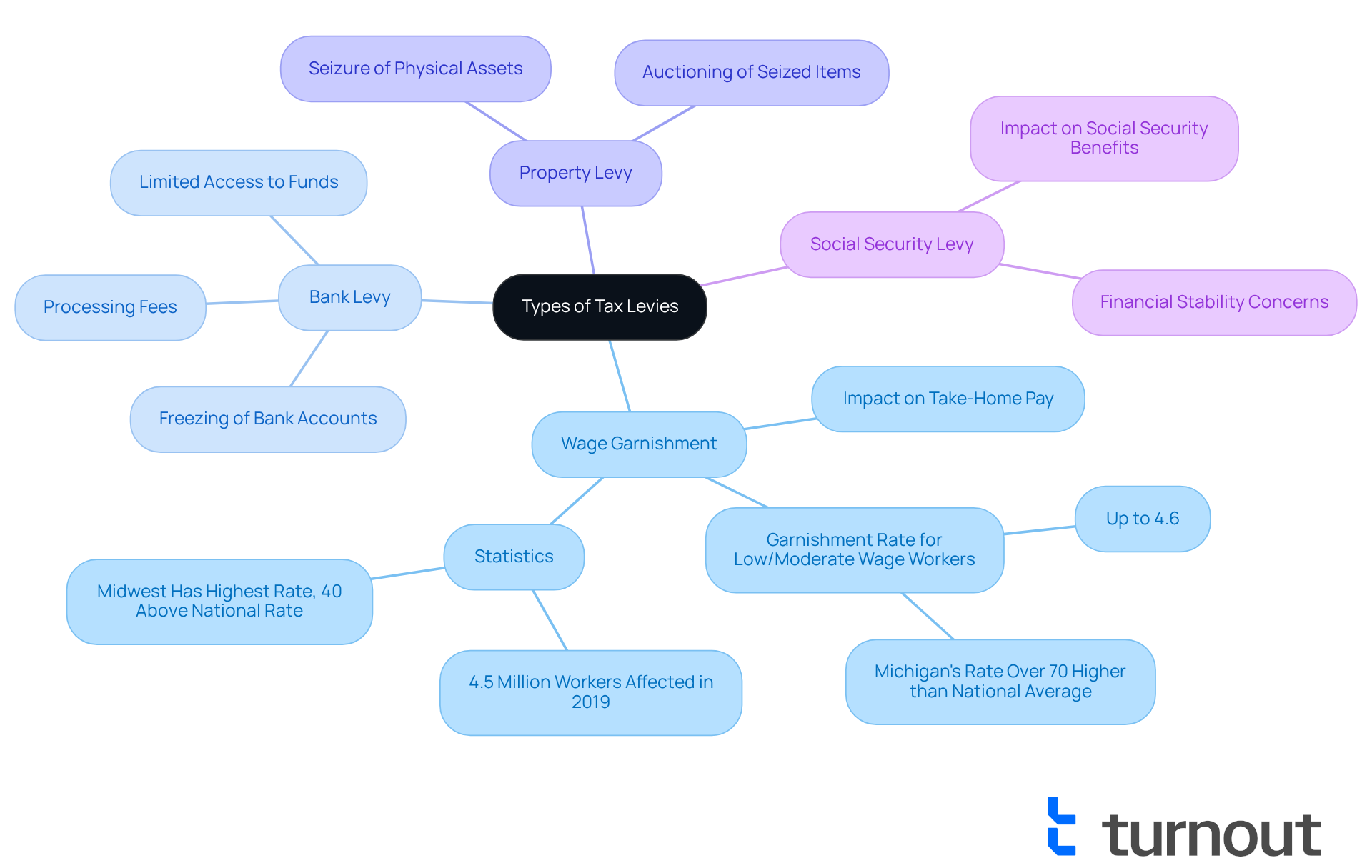

Understanding tax levies can be overwhelming, and it’s important to know what you might face. Here’s a look at the different types of tax levies and how they can impact you:

-

Wage Garnishment: This means the IRS can take a portion of your paycheck to settle tax debts. Your employer must comply, which can lead to a significant drop in your take-home pay. For low and moderate-wage workers earning between $25,000 and $39,999, garnishment rates can reach up to 4.6%. In Michigan, this rate is over 70% higher than the national average, showing how these issues can vary by region.

-

Bank Levy: The IRS has the authority to freeze your bank account and seize funds to cover your tax liability. This can happen without warning, leaving you with limited access to your money and possibly incurring processing fees that add to your financial strain.

-

Property Levy: With this type of levy, the IRS can take physical assets like vehicles or real estate to satisfy tax debts. The seized items may be auctioned off, which can complicate your financial situation even further.

-

Social Security Levy: If you receive Social Security benefits, the IRS can take a portion of these payments to cover unpaid taxes, which can affect your financial stability.

Each levy type may come with additional charges, such as processing fees from banks or employers, which can include a tax levy fee that increases your burden. In 2019, over 4.5 million workers faced wage garnishment for consumer debts. It’s crucial to understand these processes to manage your financial responsibilities effectively.

We understand that dealing with tax issues can be stressful. Proactively engaging with the IRS and exploring collection alternatives can help ease these burdens. As Richard West points out, depending on your situation, you might be able to stop a wage garnishment by negotiating a payment plan with your creditor or demonstrating financial hardship. Remember, you are not alone in this journey, and there are options available to help you navigate these challenges.

Navigate the Tax Levy Process: Steps and Fees Involved

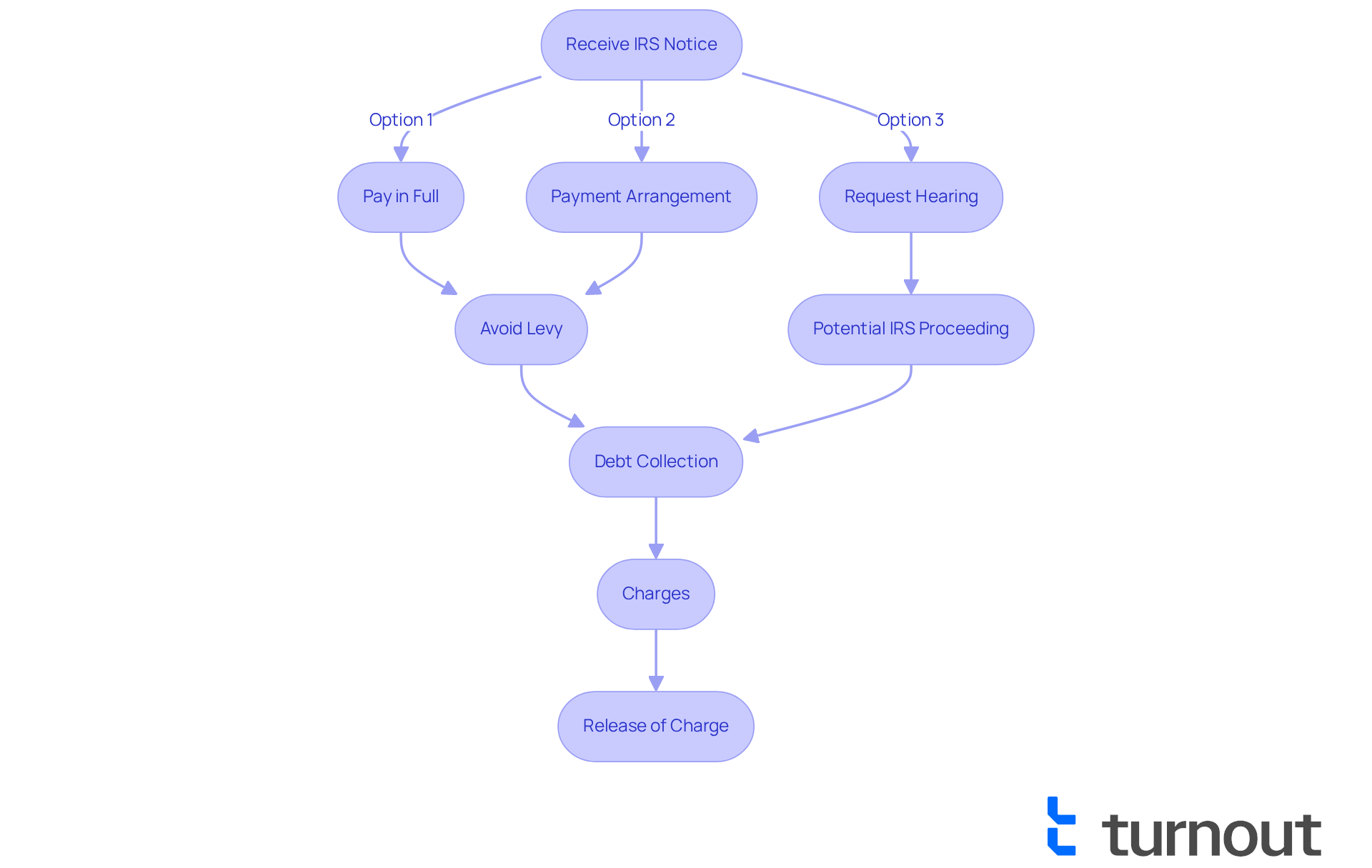

Navigating the tax levy fee process can feel overwhelming, but you’re not alone. Here are some key steps to help you through:

-

Notification: When the IRS sends a notice about your tax debt, it’s crucial to pay attention. This notice informs you of their intention to impose a tax levy fee, providing you with an opportunity to resolve the debt before any seizure occurs. In FY 2024, the IRS issued numerous notices, highlighting the importance of responding promptly.

-

Response Options: Upon receiving a notice, you have several options to consider:

- Pay the owed amount in full to avoid a levy.

- Set up a payment arrangement with the IRS to manage your debt gradually, which can halt collection efforts, including seizures.

- Request a Collection Due Process hearing if you believe the charge is unjustified, allowing you to contest the IRS's actions.

- If your spouse's tax issues are affecting you, consider applying for Innocent Spouse Relief to relieve you from penalties related to incorrect or omitted tax information.

-

Debt Collection: If you don’t respond or settle the debt, the IRS may proceed with the tax levy fee and potential seizure of your assets. This could involve contacting your employer or bank to initiate the seizure of funds, which can be distressing.

-

Charges: Be aware that there may be charges associated with the collection process, including a tax levy fee, bank processing costs, or administrative fees imposed by the IRS. Understanding these costs can help you prepare financially and avoid unexpected burdens.

-

Release of Charge: If you manage to pay your debt or establish a suitable payment plan, you can request the release of the charge. This requires submitting the necessary documentation to the IRS, including proof of economic hardship if applicable. Documentation such as bank statements, pay stubs, and a list of monthly expenses is essential to show that the charge hinders your ability to cover essential living costs. Successfully demonstrating economic difficulty can lead to the removal of the charge, allowing you to regain control over your resources.

Tax resolution specialists emphasize the importance of taking proactive steps when dealing with IRS notices. We understand that ignoring the problem won’t make it go away. Instead, reaching out for assistance can provide clarity and support in navigating these challenges. Remember, we’re here to help you through this journey.

Manage Tax Levies: Strategies to Reduce or Contest Fees

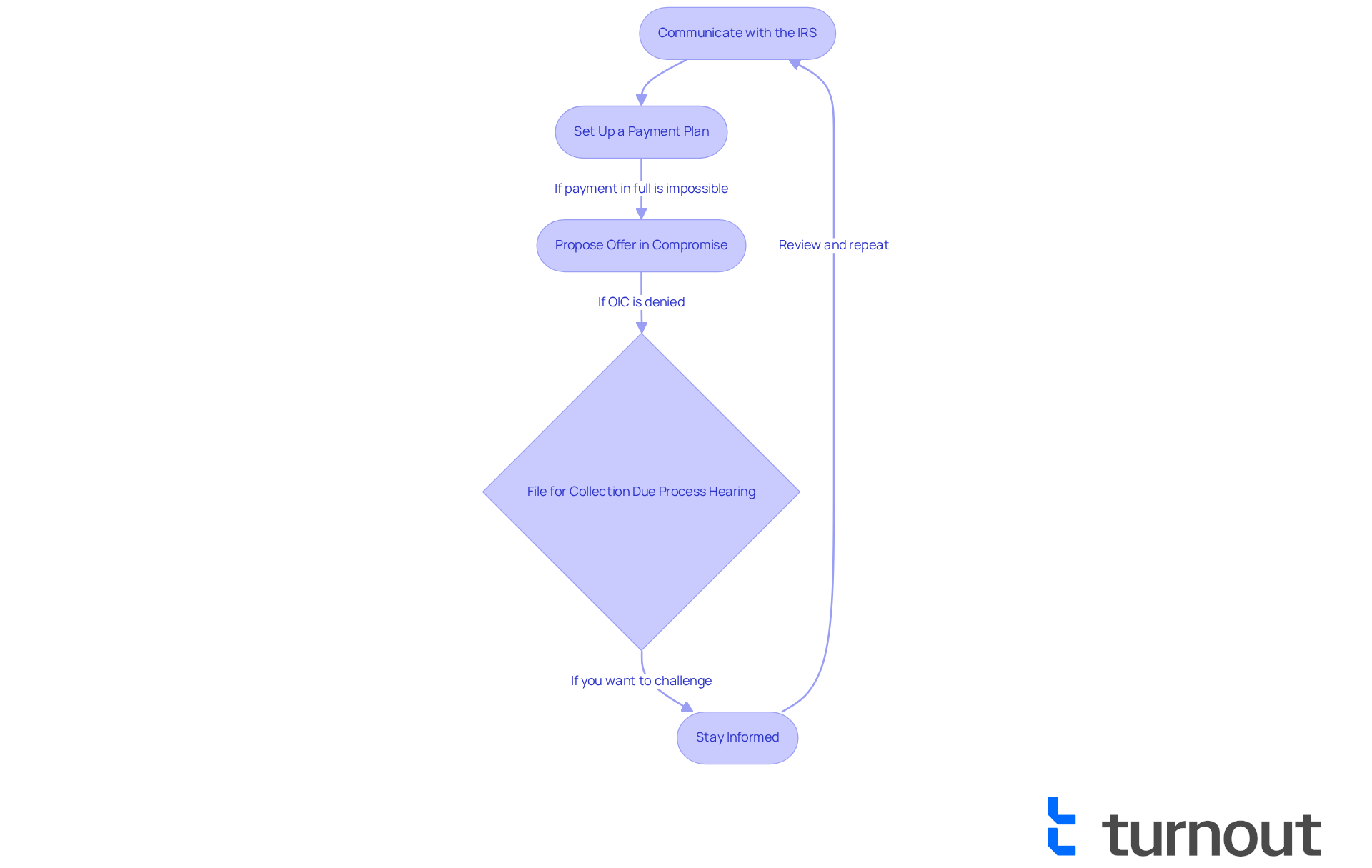

Managing the tax levy fee can feel overwhelming, but with the right strategies, you can navigate this challenge more effectively. Here are some supportive steps to consider:

-

Communicate with the IRS: We understand that reaching out to the IRS can be daunting. However, maintaining open lines of communication is crucial. By clearly explaining your financial difficulties, you can explore potential relief options related to a tax levy fee. Being specific about your situation—like job loss or medical expenses—helps the IRS understand your needs better and can lead to more favorable terms.

-

Set Up a Payment Plan: If paying your tax debt in full feels impossible, establishing a payment plan might be a practical solution. This approach not only helps you manage your payments over time but also prevents additional charges, such as the tax levy fee, allowing you to regain control of your finances.

-

For those who qualify, proposing a tax levy fee Offer in Compromise (OIC) can be a lifeline. This option allows you to settle your tax debt for less than the total amount owed, especially if full payment would cause undue financial hardship. In 2025, the acceptance rate for OIC applications is around 35-45%. Submissions prepared by certified tax professionals have a success rate of about 55-60%, compared to 15-20% for self-prepared applications.

-

File for a Collection Due Process Hearing: If you believe the tax levy fee is unfair, remember that you have the right to request a Collection Due Process hearing. This process gives you the opportunity to present your case and potentially stop the charge, allowing you to challenge the IRS's actions.

-

Stay Informed: Regularly reviewing your tax situation and staying updated on changes in tax laws or IRS policies can empower you to make timely decisions. For instance, taxpayers with existing Installment Agreements now enjoy increased flexibility under IRS COVID-19 relief options, enabling them to add additional balances without defaulting.

By implementing these strategies, you can reduce stress and financial burden. For example, one taxpayer found that persistent communication with the IRS led to a favorable settlement, significantly reducing their tax liability. This illustrates the importance of being proactive and informed in your dealings with tax authorities. Remember, you are not alone in this journey; we're here to help.

Conclusion

Understanding tax levies and their associated fees can feel overwhelming, especially when facing tax obligations. We recognize the complexities involved, and this article has shed light on how tax levies differ from tax liens, as well as the serious consequences of unpaid taxes. By grasping these nuances, you can navigate your financial responsibilities more effectively and take steps to avoid the harsh penalties that can arise from neglecting your tax duties.

Key insights include the various types of tax levies—like wage garnishments, bank levies, and property seizures—and the fees that can accumulate throughout the process. It's crucial to communicate with the IRS in a timely manner, explore payment plans, and consider options such as Offer in Compromise or Collection Due Process hearings. Each of these strategies can serve as a lifeline for those struggling to meet their tax obligations, highlighting the importance of being informed and proactive.

Ultimately, managing tax levies effectively requires understanding the processes involved and taking decisive action. By staying informed and utilizing available resources, you can mitigate the financial strain of tax levies and regain control over your financial future. Remember, engaging with tax professionals or seeking guidance can provide the support you need to navigate this challenging landscape. You are not alone in this journey, and there are people ready to help you face these burdens.

Frequently Asked Questions

What is a tax levy?

A tax levy is a legal process that allows the government to seize your assets if you have unpaid tax obligations.

How does a tax levy differ from a tax lien?

A tax lien places a claim on your property, while a tax levy involves the actual seizure of assets such as wages, bank accounts, and property.

What can happen if I ignore communications from the IRS regarding unpaid taxes?

Ignoring communications from the IRS can lead to enforcement actions, which may result in the seizure of your assets and significant financial hardship.

How many tax return audits did the IRS close in 2024, and what was the financial impact?

In 2024, the IRS closed over 505,000 tax return audits, resulting in more than $29 billion in recommended additional taxes.

How many taxpayers did the IRS assist in FY 2024?

In FY 2024, the IRS assisted around 62.2 million taxpayers.

What are the potential economic repercussions of neglecting tax responsibilities?

Neglecting tax responsibilities can lead to severe economic repercussions, including asset seizure and increased financial stress.

What are the tax burdens for the lowest earners in states like Florida and Texas?

In Florida, the lowest 20% of earners face a tax burden of 13.2%, while in Texas, it is 13.0%.

How can I find support when facing tax challenges?

It’s important to seek help from tax experts who can guide you through the challenges and help you understand your rights and options.