Overview

Understanding tax brackets can be challenging, especially when it comes to overtime earnings. Many individuals worry that additional income from overtime might push them into higher tax brackets, resulting in increased tax rates on that income. We understand that this can feel overwhelming.

However, there are strategies to help you manage these tax liabilities effectively. Practical tips, such as adjusting your withholdings and utilizing deductions, can provide relief and clarity. Remember, you're not alone in navigating these financial responsibilities.

By taking proactive steps, you can better prepare for the implications of your overtime income. We’re here to help you through this journey, ensuring that you feel confident in your financial decisions. Together, we can work towards a more secure financial future.

Introduction

Understanding tax brackets can be perplexing, and we know how crucial this aspect of financial planning is, especially when it comes to overtime pay. As you work those extra hours, your total earnings may shift you into higher tax categories, which can lead to increased tax liabilities.

This article explores the intricacies of tax brackets for overtime, offering essential calculations and strategies to help you manage your tax obligations effectively. We understand that navigating the complexities of overtime income can be challenging, but we're here to help you maximize your take-home pay while minimizing unexpected tax burdens.

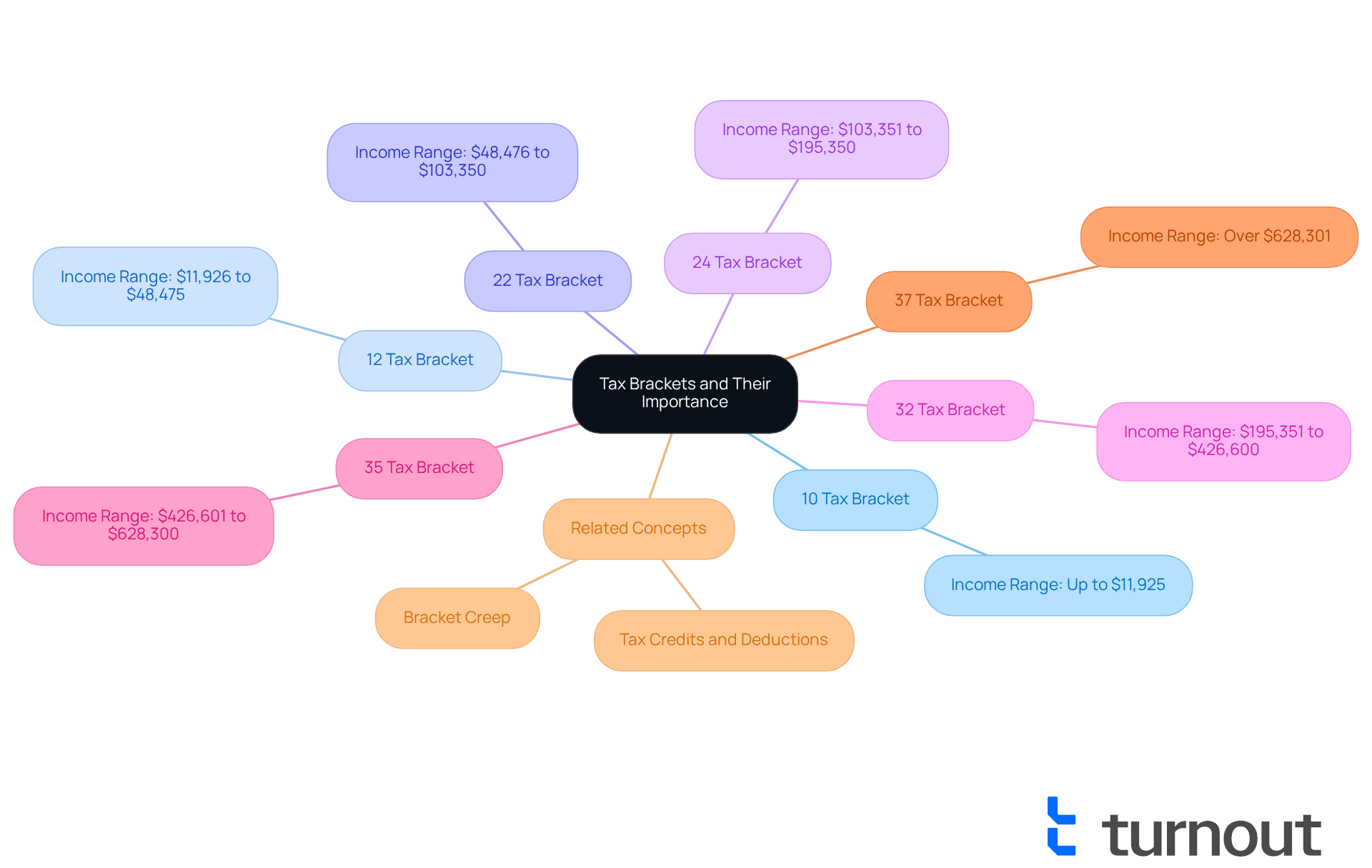

Clarify Tax Brackets and Their Importance

Tax categories represent specific spans of earnings that are subject to particular percentages, and understanding them can feel overwhelming. For the 2025 tax year, the federal income tax rates are structured as follows:

- 10% on income up to $11,925

- 12% on income from $11,926 to $48,475

- 22% on income from $48,476 to $103,350

- 24% on income from $103,351 to $195,350

- 32% on income from $195,351 to $426,600

- 35% on income from $426,601 to $628,300

- 37% on income over $628,301

We understand that as your income increases, the rate at which your additional income is taxed also rises. This progressive taxation system means that not all of your earnings are taxed at the highest rate you qualify for. Instead, each segment of your earnings is taxed at the appropriate level for that category. This concept is particularly important in relation to 'bracket creep,' where inflation can push taxpayers into higher brackets without a real increase in earnings.

Consider this: a single filer with a taxable amount of $50,000 in 2024 pays 10% on the first $11,600, 12% on earnings between $11,601 and $47,150, and 22% on the remainder. This results in an effective tax rate of about 12%. Understanding tax brackets for overtime can empower you to manage your finances more effectively, especially when considering additional work that may elevate you into a higher tax bracket.

Moreover, tax credits and deductions can play a crucial role in potentially reducing taxable earnings. By being aware of these elements, you can avoid transitioning to a higher bracket. Remember, you are not alone in this journey. By making informed decisions about your earnings and tax liabilities, you can lead to more effective financial planning. We're here to help you navigate these complexities.

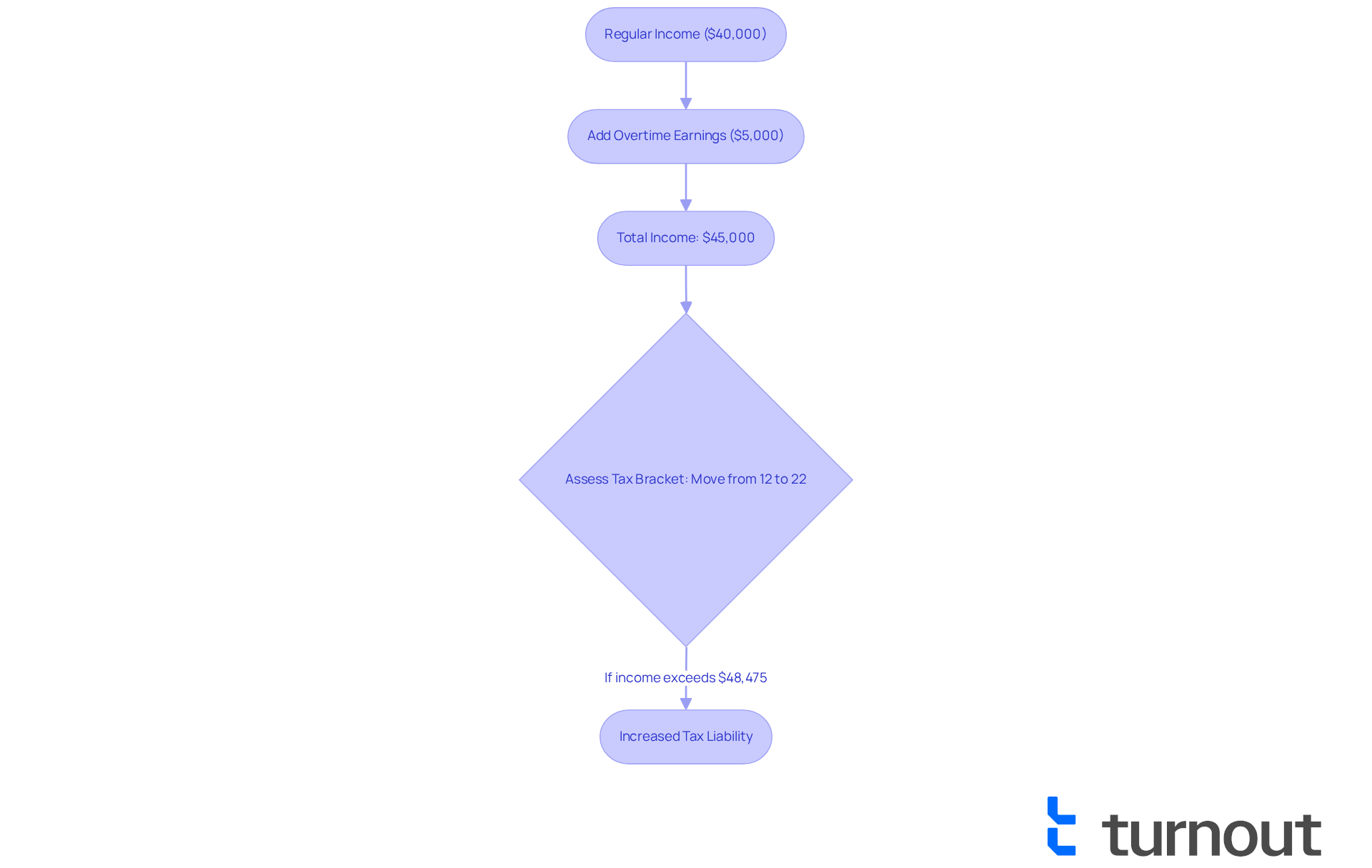

Examine Overtime Pay's Impact on Tax Brackets

When staff members put in extra hours, the supplementary earnings they receive can significantly impact their overall tax circumstances, particularly regarding the tax brackets for overtime. Imagine a person earning $40,000 annually who works extra hours and earns an additional $5,000. This increase raises their total earnings to $45,000. However, this rise may push them into higher tax brackets for overtime, where those extra earnings are taxed at a greater rate.

For instance, if this individual was previously in the 12% tax category, the added earnings might move them into the 22% category for any income exceeding $48,475. This means that while their base earnings are taxed at 12%, the portion that exceeds the threshold is taxed at 22%. It's important to understand that extra pay is subject to the tax brackets for overtime, which are taxed at the same rates as regular income and can lead to a significant increase in overall tax liability.

We understand that grasping these tax consequences can be challenging. It’s essential for employees to foresee their tax obligations, particularly regarding the tax brackets for overtime, and make informed decisions about taking on additional working hours. Based on recent data, only 9% of American households are expected to benefit from the recent tax relief on extra hours worked, with an average yearly benefit of about $1,400. Furthermore, this exemption applies only to federal revenue levies; state and local charges still apply. Consequently, meticulous financial planning is crucial to navigate the complexities of additional income and its effects on tax responsibilities.

You're not alone in this journey. We're here to help you understand how to manage your finances effectively and make the best choices for your situation.

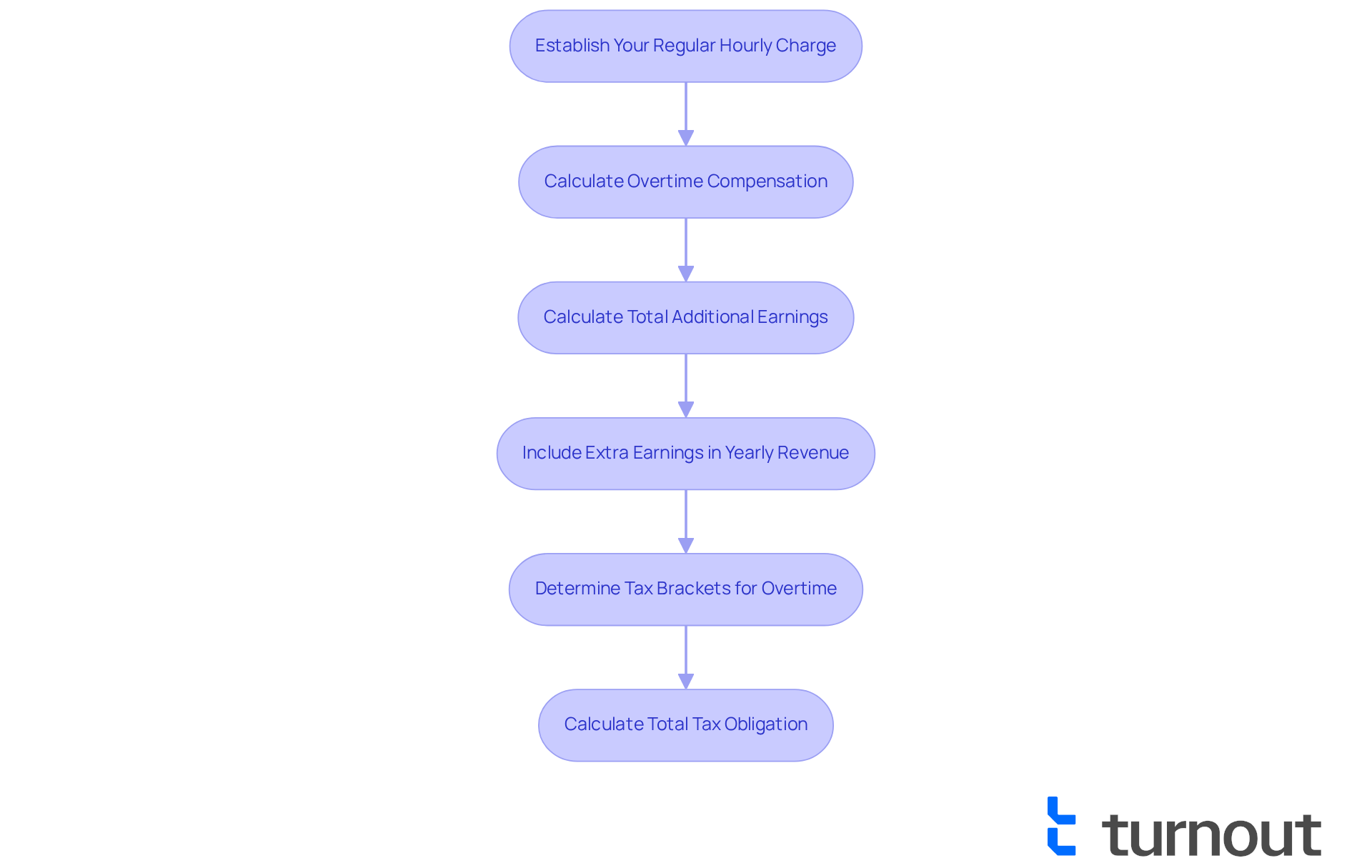

Calculate Taxes on Overtime Pay Effectively

Calculating taxes on overtime pay can feel overwhelming, but we're here to help you navigate through it. Follow these steps to make the process easier:

- Establish Your Regular Hourly Charge: If your yearly salary is $50,000, your regular hourly charge is approximately $24.04 (calculated as $50,000 divided by 2080 hours).

- Calculate Overtime Compensation: Overtime is typically compensated at 1.5 times your regular hourly wage. In this case, your extra hours rate would be $36.06.

- Calculate Total Additional Earnings: If you worked 10 hours of extra time, your total additional earnings would be $360.60 (10 hours multiplied by $36.06).

- Include Extra Earnings in Yearly Revenue: If your overall earnings before the additional hours were $50,000, your updated total revenue is $50,360.60.

- Determine the applicable tax brackets for overtime: Based on your new total earnings, identify which tax bracket you fall into and calculate the tax owed on the additional earnings.

- Calculate Total Tax Obligation: Use the tax brackets for overtime to determine how much tax you are responsible for on your overall earnings, including any additional compensation.

It's important to remember the recent One Big Beautiful Bill Act (OBBBA). This act allows workers to deduct up to $12,500 of extra pay from their federal taxable earnings for tax years 2025 through 2028. If your individual earnings exceed $150,000 or $300,000 for joint filers, this deduction will phase out.

While the federal tax deduction for extra hours starts in the 2025 tax year, payroll and state/local taxes will still apply to your additional earnings. Understanding these calculations is crucial, especially with the recent changes in tax legislation that may impact your overall tax situation.

We understand that navigating taxes can be daunting, but you are not alone in this journey. Take it step by step, and feel free to reach out for assistance if needed.

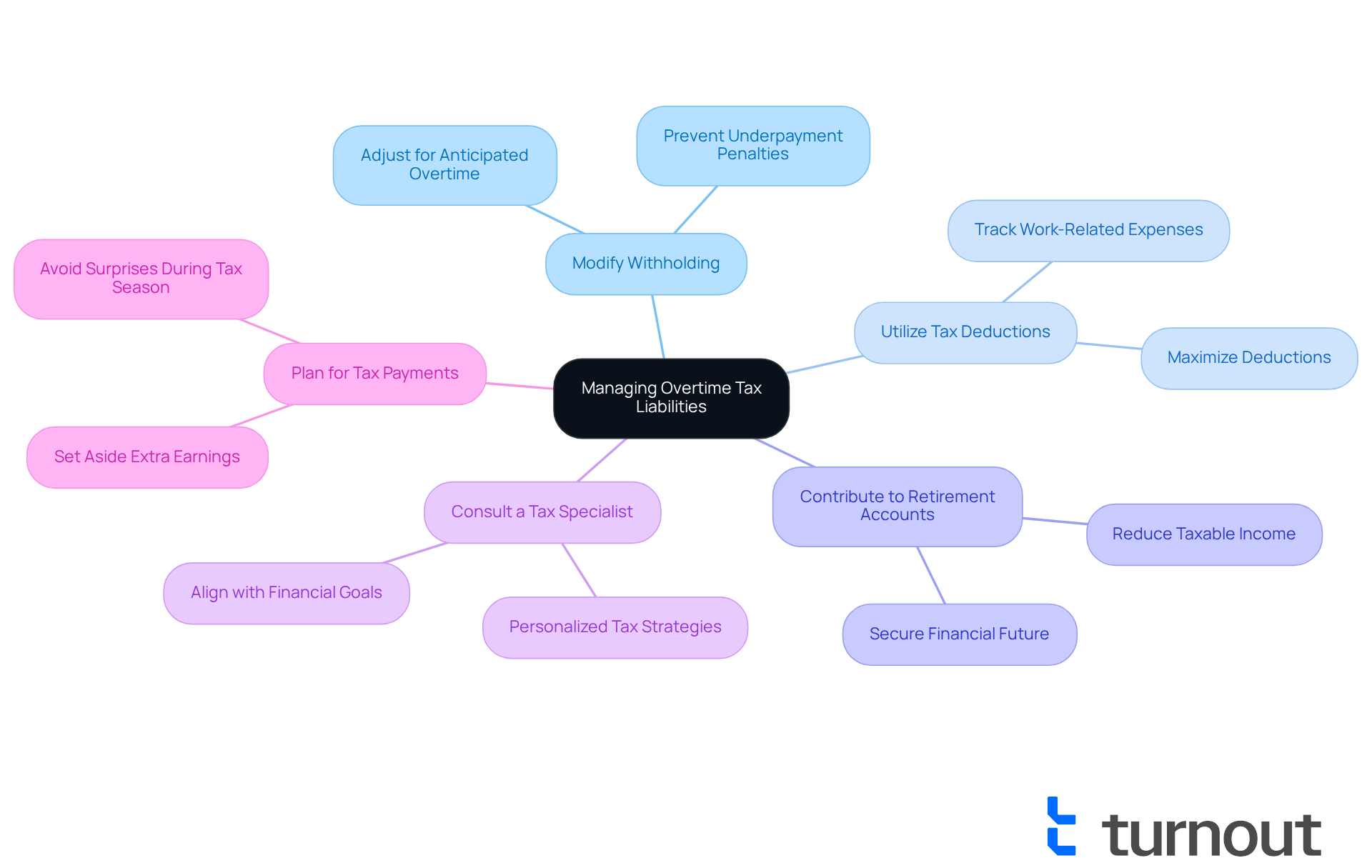

Implement Strategies to Manage Overtime Tax Liabilities

Managing the tax brackets for overtime pay can be challenging, but we're here to help. Consider these supportive strategies to ease your concerns:

- Modify Withholding: If you anticipate earning significant overtime, adjusting your tax withholding can help accommodate those extra earnings. This proactive step can prevent any underpayment penalties when tax season arrives.

- Utilize Tax Deductions: Take advantage of available deductions, such as those for work-related expenses, to lower your taxable income. If you incur job-related costs, be sure to track these expenses carefully to maximize your deductions.

- Contribute to Retirement Accounts: Investing in a retirement account, like a 401(k), can significantly reduce your taxable income. This not only aids in managing your taxes but also helps secure your financial future.

- Consult a Tax Specialist: If your additional earnings significantly impact your tax situation, seeking personalized advice from a tax specialist can offer tailored strategies that align with your financial goals.

- Plan for Tax Payments: Setting aside a portion of your extra earnings for tax payments can help you avoid surprises during tax season. This foresight allows for better financial management and peace of mind.

It's also important to note the new 'no tax on extra hours worked' regulation. This allows employees to deduct federal income taxes paid on additional wages from 2025 to 2028, capped at $12,500 per individual annually (or $25,000 for couples filing together). According to the Tax Policy Center, only 9% of American households will benefit from this tax break, resulting in an average added windfall of roughly $1,400 annually. By implementing these strategies, you can navigate your tax liabilities more effectively and maximize your take-home pay while being aware of the tax brackets for overtime work. Remember, you're not alone in this journey; we're here to support you every step of the way.

Conclusion

Understanding tax brackets is essential for anyone considering overtime work, as they directly influence how additional earnings are taxed. We understand that navigating the complexities of taxes can feel overwhelming. The progressive nature of the tax system means that while increased income can elevate you into a higher tax bracket, it does not mean that all earnings are taxed at the highest rate. Instead, each portion of income is taxed according to its corresponding bracket. Grasping these concepts is crucial for effectively managing your finances.

Throughout this article, we’ve shared key insights regarding the impact of overtime on tax liabilities. It’s common to feel uncertain about how additional earnings from overtime can push you into higher tax brackets, thereby increasing your overall tax burden. But there are strategies you can implement. Adjusting tax withholding, utilizing deductions, and contributing to retirement accounts are actionable steps that can help mitigate these tax implications. Furthermore, with the introduction of new tax regulations, there are opportunities for you to manage your tax responsibilities more effectively.

In light of these insights, it is vital for you to proactively engage with your tax situation, especially when considering overtime work. By understanding tax brackets and implementing strategic financial planning, you can navigate the complexities of tax liabilities while maximizing your take-home pay. Taking the time to evaluate your personal financial strategies and seeking professional advice when necessary can lead to more informed decisions. Remember, you are not alone in this journey, and taking these steps can ultimately lead to greater financial security.

Frequently Asked Questions

What are tax brackets?

Tax brackets represent specific ranges of income that are subject to different tax rates. Each bracket has a corresponding percentage that applies to income within that range.

What are the federal income tax rates for the 2025 tax year?

The federal income tax rates for the 2025 tax year are as follows:

- 10% on income up to $11,925

- 12% on income from $11,926 to $48,475

- 22% on income from $48,476 to $103,350

- 24% on income from $103,351 to $195,350

- 32% on income from $195,351 to $426,600

- 35% on income from $426,601 to $628,300

- 37% on income over $628,301

How does the progressive taxation system work?

In a progressive taxation system, as your income increases, the rate at which your additional income is taxed also rises. This means that not all of your earnings are taxed at the highest rate you qualify for; instead, each segment of your income is taxed at the appropriate rate for that category.

What is 'bracket creep'?

'Bracket creep' refers to the phenomenon where inflation pushes taxpayers into higher tax brackets without a real increase in their earnings, resulting in a higher tax burden.

How does understanding tax brackets help with financial management?

Understanding tax brackets can empower individuals to manage their finances more effectively, especially when considering additional work that may elevate them into a higher tax bracket. It also helps in making informed decisions about earnings and tax liabilities.

What role do tax credits and deductions play in relation to tax brackets?

Tax credits and deductions can potentially reduce taxable earnings, which may help individuals avoid transitioning to a higher tax bracket. Being aware of these elements is crucial for effective financial planning.