Overview

Understanding how much taxes are deducted from your paycheck in Pennsylvania can feel overwhelming. We recognize that navigating the various components of gross pay, applicable taxes, and the calculation of net pay is essential for your financial well-being. Pennsylvania workers face a combination of state income tax, local earned income tax, and federal contributions. These deductions can significantly impact your take-home income.

It's common to feel uncertain about how these deductions affect your finances. Being informed about them is crucial for effective financial planning. By understanding these deductions, you can make more informed decisions about your budget and savings. Remember, you are not alone in this journey; many people share similar concerns.

We encourage you to take the time to learn about your paycheck deductions. Knowledge is empowering, and it can help you achieve your financial goals. We're here to help you navigate this process and support you every step of the way.

Introduction

Understanding the intricacies of paycheck deductions can feel overwhelming for many employees in Pennsylvania. We recognize that various taxes and contributions can significantly impact your take-home pay. Grasping the components of gross pay and the deductions that follow is essential for effective financial planning. As you navigate through state income taxes, local taxes, and federal contributions, you may wonder: how can you accurately calculate your net pay and ensure that you are well-informed about your financial landscape?

This article is here to support you. We aim to demystify the process, offering clear insights and practical tools that empower you to manage your earnings with confidence. You're not alone in this journey; we're here to help you understand and take control of your financial future.

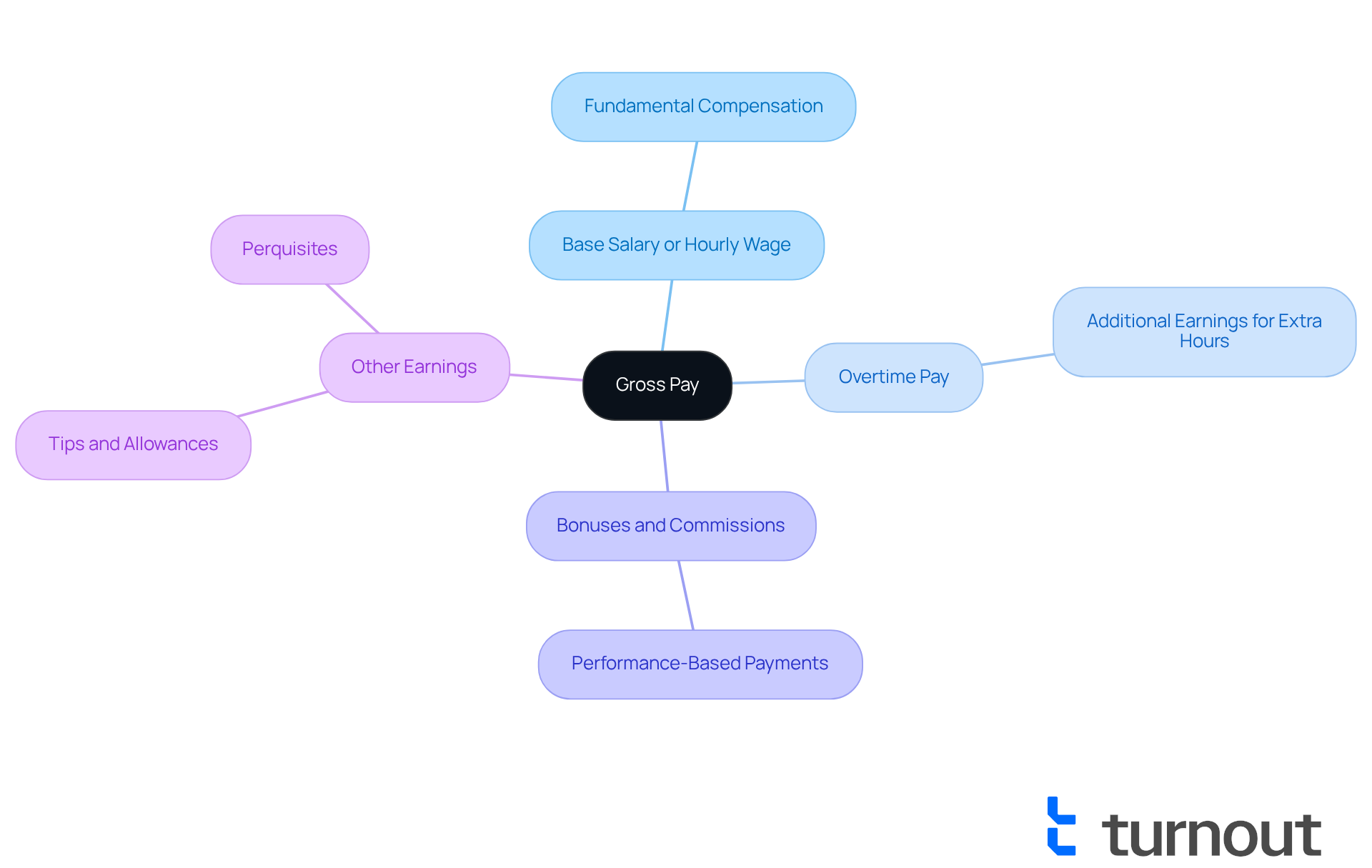

Define Gross Pay and Its Components

Gross pay signifies the total earnings of a worker prior to any subtractions being made. It encompasses several key components that are essential to understand:

- Base Salary or Hourly Wage: This is the fundamental compensation for the work performed, forming the core of gross pay.

- Overtime Pay: Additional earnings accrued for hours worked beyond the standard workweek, reflecting extra effort and time commitment.

- Bonuses and Commissions: These are performance-based payments that reward employees for achieving specific targets or sales goals.

- Other Earnings: This category includes tips, allowances, and any other forms of compensation that contribute to total earnings.

Understanding these elements is crucial, as they lay the groundwork for determining net pay after subtractions. We understand that navigating this can be challenging. For instance, in Pennsylvania, the average gross pay varies by industry, with sectors such as healthcare and technology often offering higher compensation packages.

According to money advisors, a clear understanding of gross pay is essential for effective budgeting and planning, as it directly impacts take-home income and overall economic health. It's common to feel overwhelmed by financial terms, but remember, gross salary is a fixed sum received prior to subtractions. It does not change according to performance or extra hours worked. This distinction between gross salary and in-hand salary, which is the sum left after subtractions, is vital for financial literacy.

You are not alone in this journey; grasping these concepts can empower you to take control of your finances.

Identify Applicable Taxes in Pennsylvania

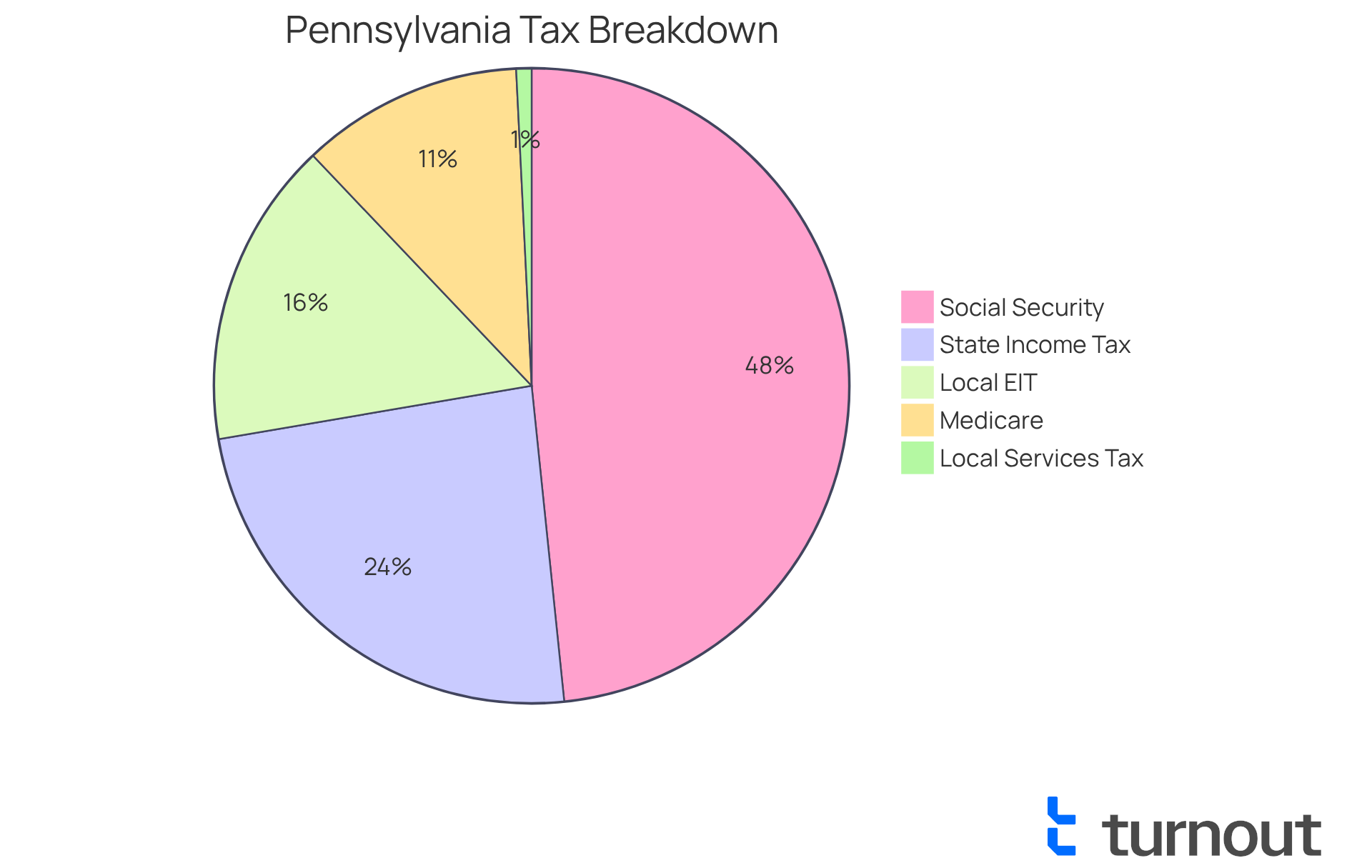

In Pennsylvania, navigating taxes can feel overwhelming, but understanding them is essential for your financial well-being. Here are some key taxes that may be deducted from your paycheck:

- State Income Tax: Pennsylvania imposes a flat income tax rate of 3.07% on taxable income, applicable to all earners, regardless of income level. This means that everyone contributes to the state's resources.

- Local Earned Income Tax (EIT): This tax varies significantly by municipality, with rates ranging from 0.5% to 3.9%. For instance, Philadelphia has the highest local income tax rate at 3.91%, while many other municipalities impose a 1% earned income tax. Employers are required to withhold this tax based on your work location, which can lead to varying deductions depending on where you work. Combined state and local tax rates can reach as high as 6.98% in some areas, which directly influences how much taxes deducted from paycheck pa and ultimately affects your take-home pay.

- Local Services Tax (LST): Typically around $52 annually, this small tax is withheld from employees working in certain municipalities, adding another layer to local tax obligations.

- Federal Contributions: These consist of Social Security and Medicare contributions, which are 6.2% and 1.45%, respectively, on gross earnings.

Additionally, Pennsylvania has an average property tax rate of 1.41%, contributing to the overall tax burden in the state. Understanding how much taxes deducted from paycheck pa is crucial for anticipating your net pay and effectively planning your finances. We recognize that changes in local earned income tax rates are expected in 2025, and staying informed about these variations can help you navigate your financial landscape with confidence. Remember, you are not alone in this journey; we're here to help you every step of the way.

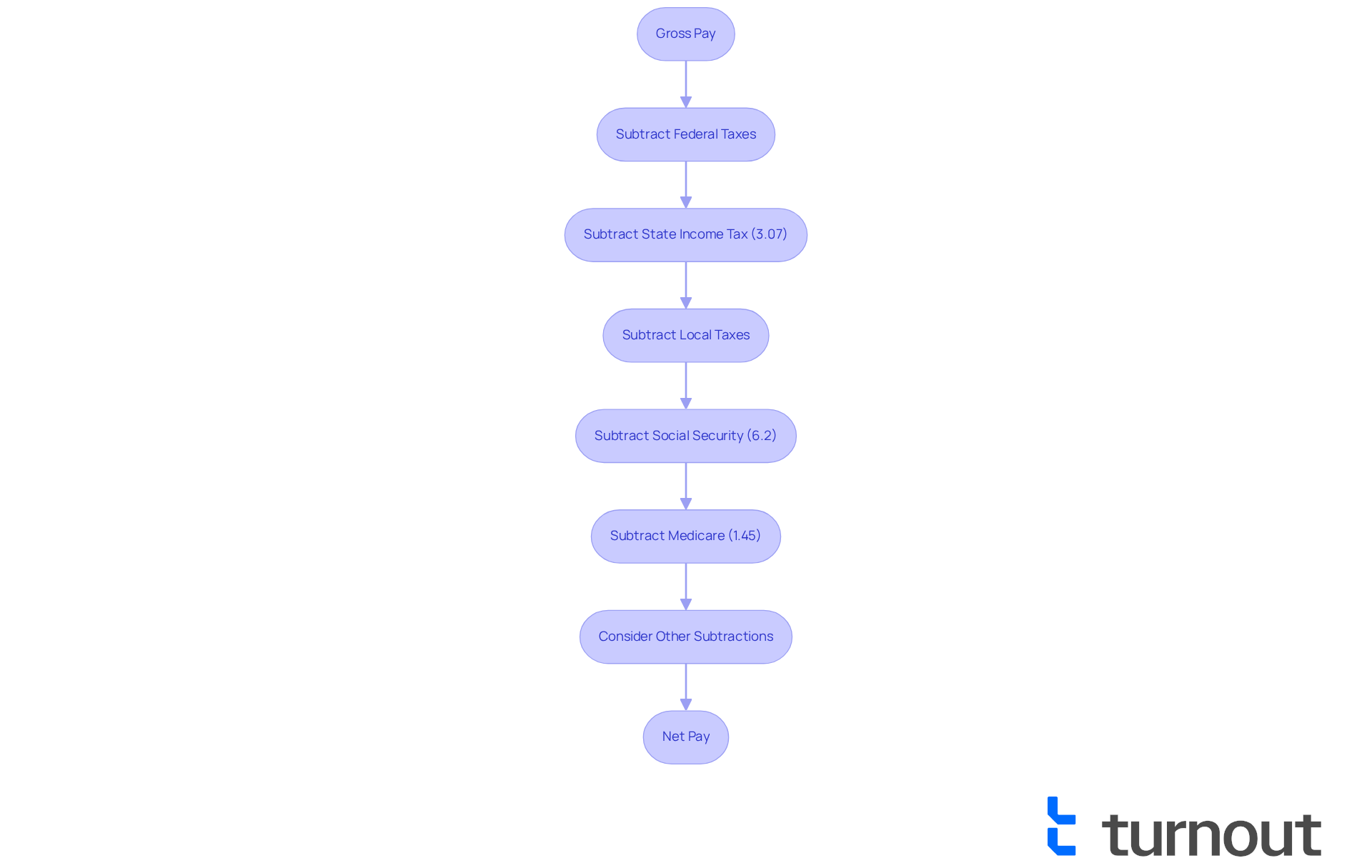

Calculate Net Pay After Deductions

Calculating how much taxes deducted from paycheck pa to find your net pay after deductions in Pennsylvania can feel overwhelming, but we're here to help. Follow these steps to make the process easier:

- Start with Gross Pay: Begin with the total amount from your paycheck.

- Subtract Federal Taxes: Calculate the federal income tax based on your withholding rate and subtract it from your gross pay.

- Subtract State Income Tax: Deduct 3.07% of your gross pay for Pennsylvania state tax.

- Subtract Local Taxes: Depending on your municipality, subtract the applicable Earned Income Tax (EIT) and Local Services Tax (LST).

- Subtract Social Security and Medicare Taxes: Deduct 6.2% for Social Security and 1.45% for Medicare.

- Consider Other Subtractions: Include any additional reductions such as health insurance premiums or retirement contributions.

This formula can be summarized as:

Net Pay = Gross Pay - (Federal Taxes + State Tax + Local Taxes + Social Security + Medicare + Other Deductions)

Understanding this calculation is crucial for your budgeting efforts. For example, if you're a full-time employee earning $52,000 annually and paid bi-weekly, your gross pay would be approximately $2,166.67 per pay period. After accounting for how much taxes deducted from paycheck pa, including federal and state taxes, local taxes, and FICA contributions, your net pay may be significantly lower. This highlights how various deductions can impact your take-home income.

Comprehending these subtractions is essential. Money advisors often emphasize that being aware of your net income empowers you to make informed financial decisions and plan for future expenses. As one financial planner noted, "Understanding your net pay is essential for effective budgeting and financial planning, especially in a complex tax environment like Pennsylvania."

It's common to feel uncertain about recent changes in tax allowances, which may affect your overall tax responsibility. Staying updated on your paycheck computations is vital, and remember, you are not alone in this journey. We're here to support you every step of the way.

Utilize Online Calculators and Resources

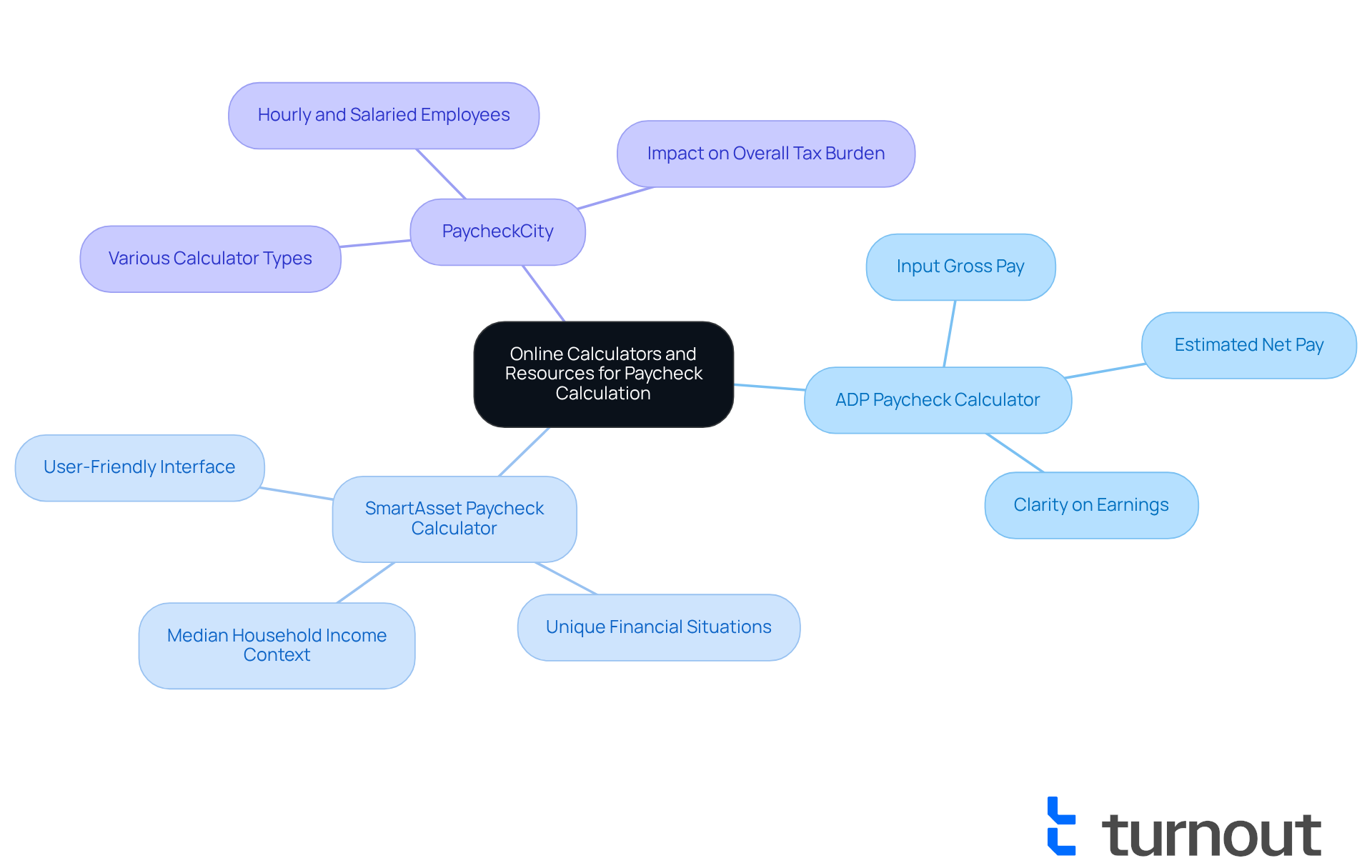

Calculating how much taxes deducted from paycheck pa can feel overwhelming, but we're here to help simplify the process. Consider utilizing these online calculators and resources that can guide you through your financial journey:

- ADP Paycheck Calculator: Input your gross pay, and this tool will show you your estimated net pay after all deductions. It’s a straightforward way to gain clarity on your earnings. We understand that without a paycheck calculator, determining your net income after deductions can be quite challenging, as noted by SmartAsset.

- SmartAsset Paycheck Calculator: Known for its user-friendly interface, this tool helps you calculate your take-home pay based on your unique financial situation. It’s designed to be accessible for everyone. With the 2023 Pennsylvania median household income at $73,824, understanding net pay calculations is crucial for aligning with living standards.

- PaycheckCity: This platform offers various calculators tailored for both hourly and salaried employees, enabling you to estimate your net pay accurately. It provides a clear picture of your finances. Case studies reveal that these calculators effectively consider how much taxes deducted from paycheck pa, which can significantly influence your overall tax burden.

These tools not only facilitate quick and accurate calculations but also empower you to manage your finances more effectively. Financial technology experts emphasize that using paycheck calculators can greatly enhance your understanding of deductions and overall financial planning. Remember, you are not alone in navigating the complexities of payroll in Pennsylvania—these invaluable resources are here to support you on your journey.

Conclusion

Understanding the intricacies of paycheck deductions in Pennsylvania is essential for anyone navigating their financial landscape. We know that managing finances can feel overwhelming at times. This article offers a comprehensive overview of how gross pay is determined, the various taxes that apply, and the steps necessary to calculate net pay after deductions. This knowledge empowers you to make informed financial decisions and plan effectively for your future.

Key points discussed include:

- The definition of gross pay and its components, such as base salary, overtime, and bonuses.

- The specific taxes deducted from paychecks in Pennsylvania, including state income tax, local earned income tax, and federal contributions.

- The encouragement to utilize online calculators to simplify the process of determining net pay, ensuring that you can accurately assess your financial situation.

In a broader context, understanding how much taxes are deducted from paychecks not only aids in personal budgeting but also fosters greater financial literacy. It's common to feel uncertain as tax rates evolve and local regulations change. Staying informed is crucial, and utilizing available resources can significantly enhance your ability to manage finances effectively.

Remember, taking control of your financial knowledge is a vital step toward achieving long-term economic well-being. You're not alone in this journey, and we're here to help you every step of the way.

Frequently Asked Questions

What is gross pay?

Gross pay is the total earnings of a worker before any deductions are made.

What are the main components of gross pay?

The main components of gross pay include base salary or hourly wage, overtime pay, bonuses and commissions, and other earnings such as tips and allowances.

How does overtime pay factor into gross pay?

Overtime pay represents additional earnings for hours worked beyond the standard workweek, reflecting extra effort and time commitment.

What are bonuses and commissions?

Bonuses and commissions are performance-based payments that reward employees for achieving specific targets or sales goals.

Why is understanding gross pay important?

Understanding gross pay is crucial for effective budgeting and planning, as it directly impacts take-home income and overall economic health.

How does gross pay differ from net pay?

Gross pay is the total amount earned before any deductions, while net pay is the amount left after all deductions have been made.

Does gross salary change based on performance or extra hours worked?

No, gross salary is a fixed sum received prior to subtractions and does not change based on performance or extra hours worked.

How does gross pay vary across different industries?

Gross pay can vary by industry; for instance, sectors like healthcare and technology often offer higher compensation packages.