Introduction

Understanding IRS interest rates can feel overwhelming, especially when unpaid taxes are a concern. Each month, the IRS compounds interest on outstanding balances. This makes it essential for taxpayers to understand how these charges accumulate and affect their financial responsibilities.

As rates change with economic conditions, you might wonder: how can you manage these charges effectively and reduce your tax burden? Exploring strategies to navigate IRS interest rates not only empowers you but also opens the door to potential savings.

We understand that facing these financial challenges can be stressful. You're not alone in this journey, and there are ways to tackle these issues head-on. Let's delve into some supportive strategies that can help you take control of your tax situation.

Understand IRS Interest Rates

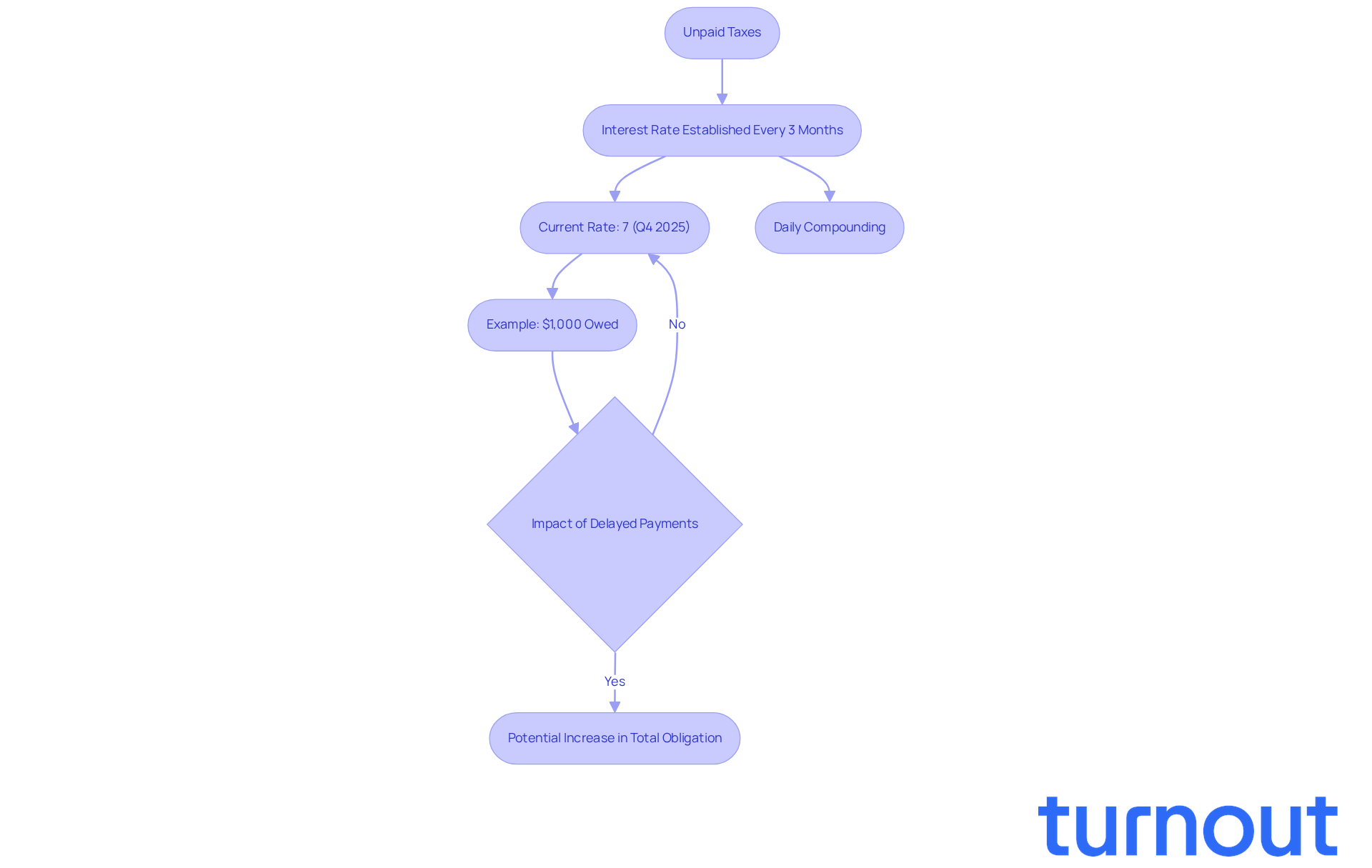

We understand that dealing with unpaid taxes can be overwhelming. To understand how much interest does the IRS charge per month, it's important to note that the IRS establishes charges on unpaid taxes every three months, using the federal short-term figure plus a margin, typically three percentage points. As of the fourth quarter of 2025, the rate for underpayments is set at 7% per year, compounded daily. This daily compounding means that any remaining tax balance can grow significantly over time, which raises the question of how much interest does the IRS charge per month as interest accumulates on both the principal and any previously earned interest. For instance, if you owe $1,000, the daily charge can quickly add up, leading to a much larger amount due if payments are delayed.

It's common to feel anxious about significant corporate underpayments (LCU), particularly when considering how much interest does the IRS charge per month, which is 9% for Q4 2025. This highlights the different rates that apply to various taxpayer categories. Historically, IRS charges have fluctuated based on economic conditions. For example, in 2023, the charge for underpayments was 6%, reflecting a lower federal short-term percentage at that time. The current rate of 7% signals a shift in the economic landscape, reminding us all to stay vigilant about our tax obligations.

In December 2025, the IRS announced that the financial charges would remain unchanged for the upcoming quarter, providing some stability for taxpayers. This consistency allows individuals to plan their finances more effectively, knowing their tax obligations won’t unexpectedly increase due to rising borrowing costs. It’s also important to consider the charges for overpayments, as they can impact overall tax liabilities.

It is crucial for managing your tax responsibilities to understand how much interest does the IRS charge per month. For example, if you delay paying a $5,000 tax bill, you could see your total obligation rise by over $1,000 within a year due to daily compounding. Additionally, fines and charges continue to accumulate until the balance is fully paid, underscoring the importance of timely payments. We recommend regularly checking the IRS website for updates on rates and exploring options like setting up an Installment Agreement to manage payments effectively. By being proactive, you can lessen the impact of charges on your overall tax burden. Remember, you are not alone in this journey; we're here to help.

Calculate Monthly Interest Charges

It can feel overwhelming to calculate how much interest does the IRS charge per month, but we're here to help you through it. Let’s break it down step by step, so you can feel more in control of your finances.

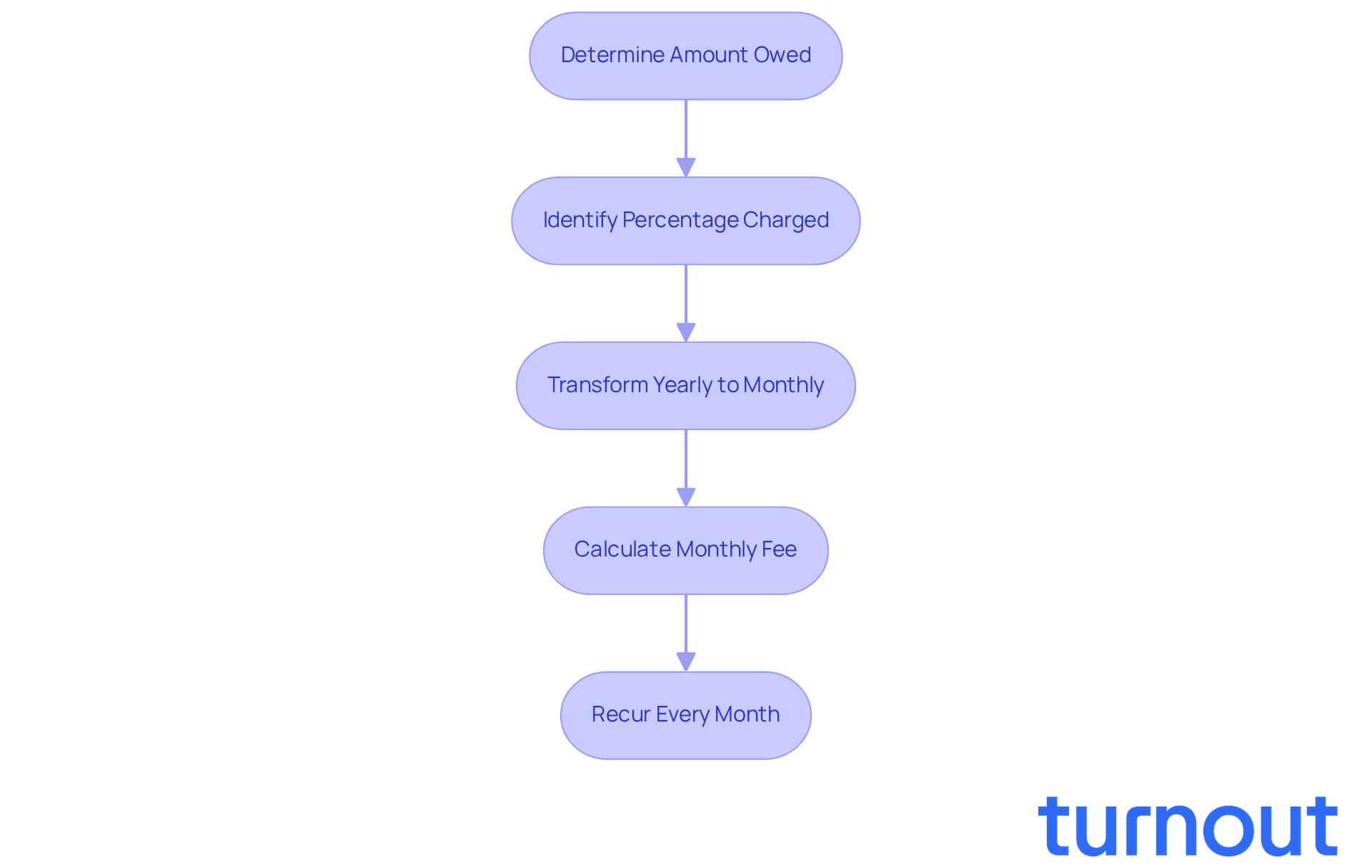

- Determine the amount owed: Start with the total tax amount you owe. Knowing this figure is the first step toward understanding your financial situation.

- Identify the percentage charged: Use the current IRS percentage, which is typically around 7% for underpayments. It’s common to feel uncertain about these numbers, but you’re not alone.

- Transform the yearly amount to a monthly figure: Divide the annual percentage by 12. For instance, a 7% yearly return translates to about 0.583% per month (7% / 12). This makes it easier to grasp how interest accumulates over time.

- Calculate the monthly fee: Multiply the amount owed by the monthly rate. If you owe $1,000, your monthly charge would be $1,000 x 0.00583 = $5.83. This simple calculation can help you anticipate your monthly expenses.

- Recur every month: Each month, recalculate based on the new total due, which includes any prior fees. This ongoing process can help you stay on top of your payments.

It is crucial to understand how much interest does the IRS charge per month to see how your debt increases each month. It empowers you to make informed decisions about your payments and manage your financial health. Remember, you are not alone in this journey, and taking these steps can lead to greater peace of mind.

Identify Factors Affecting Interest Amounts

Understanding tax debt can be overwhelming, but several factors can significantly influence how much interest does the IRS charge per month on the amount you owe.

-

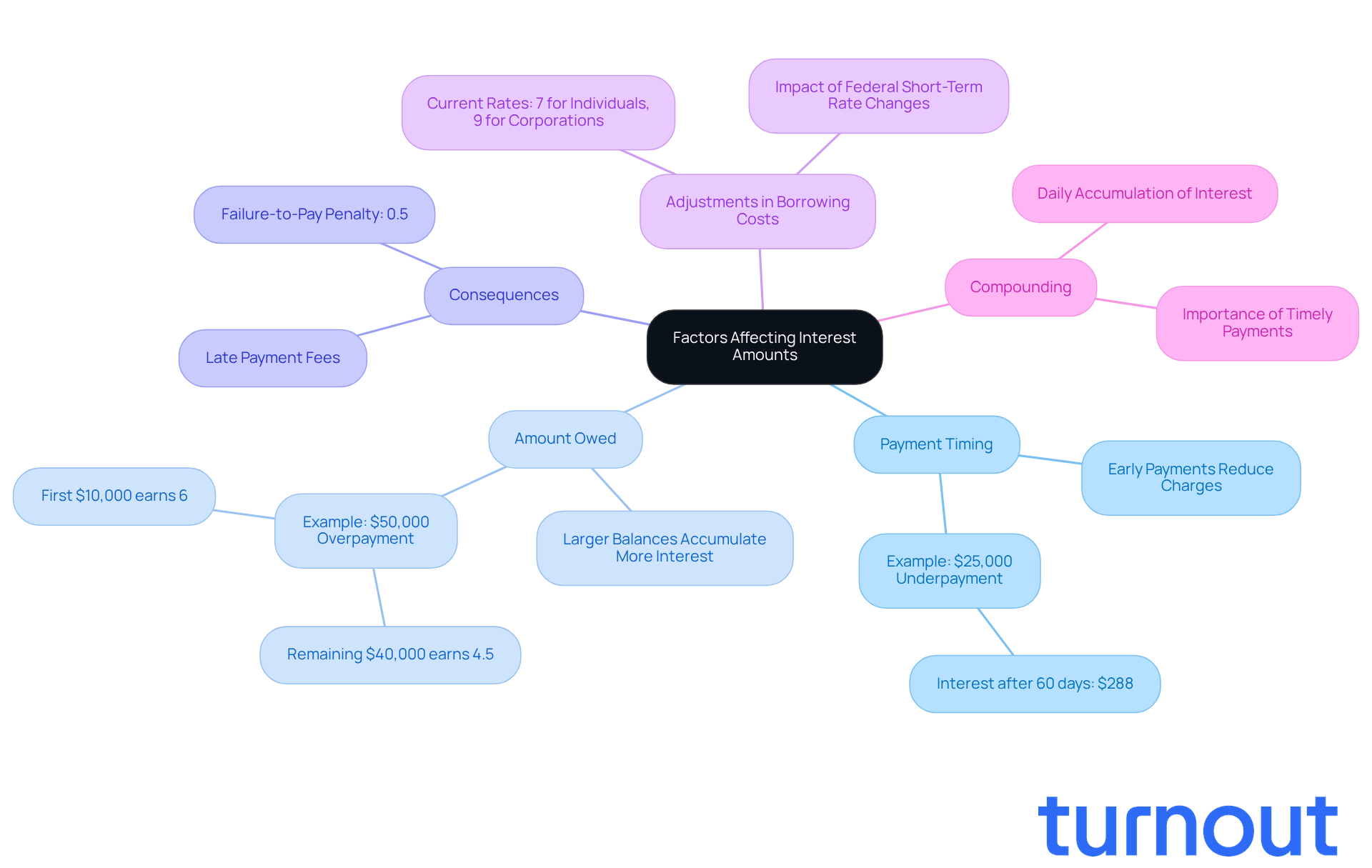

Payment Timing: We understand that settling your tax obligation early can ease your financial burden. When you pay sooner, you reduce the charges that accumulate. Delays in payment can lead to substantial costs, as interest is calculated from the due date until your payment is made, raising the question of how much interest does the IRS charge per month. For instance, if someone underpaid $25,000 in estimated taxes, they might see around $288 in charges after just 60 days, highlighting the importance of knowing how much interest does the IRS charge per month.

-

Amount Owed: It's common to feel anxious about how much you owe. The larger your unpaid balance, the more charges can pile up. Even small amounts can lead to significant gains over time, especially when compounded daily. For example, a corporate client who overpaid $50,000 in taxes would receive only a 6% return on the first $10,000 of a delayed refund, while the remaining $40,000 accrues just 4.5%. This highlights the financial implications of waiting too long to request a refund.

-

Consequences: Late payment fees can add to your overall debt, making the situation feel even more daunting. The failure-to-pay penalty, which compounds your financial burden, is related to how much interest does the IRS charge per month, set at 0.5% of the unpaid tax.

-

Adjustments in Borrowing Costs: Staying informed about quarterly updates from the IRS is crucial. Fluctuations in the federal short-term rate can affect the charges applied to your debt. Currently, the rates are set at 7% for individuals and 9% for large corporate underpayments, which leads to inquiries about how much interest does the IRS charge per month. This higher-rate environment underscores the urgency of addressing tax liabilities promptly.

-

Compounding: It’s important to remember that earnings accumulate daily. Charges apply on previously accrued earnings, which can significantly increase your total debt over time. Making timely payments is essential.

By grasping these elements, you can make informed choices about when and how much to pay. Remember, you’re not alone in this journey, and taking action now can help you conserve funds on fees.

Implement Strategies to Reduce Interest Charges

If you're feeling overwhelmed by tax debt, you're not alone. Many people find themselves in similar situations, and it's completely understandable to seek ways to reduce the burdensome interest charges, particularly wondering how much interest does the IRS charge per month. Here are some compassionate strategies to help you navigate this challenging time:

-

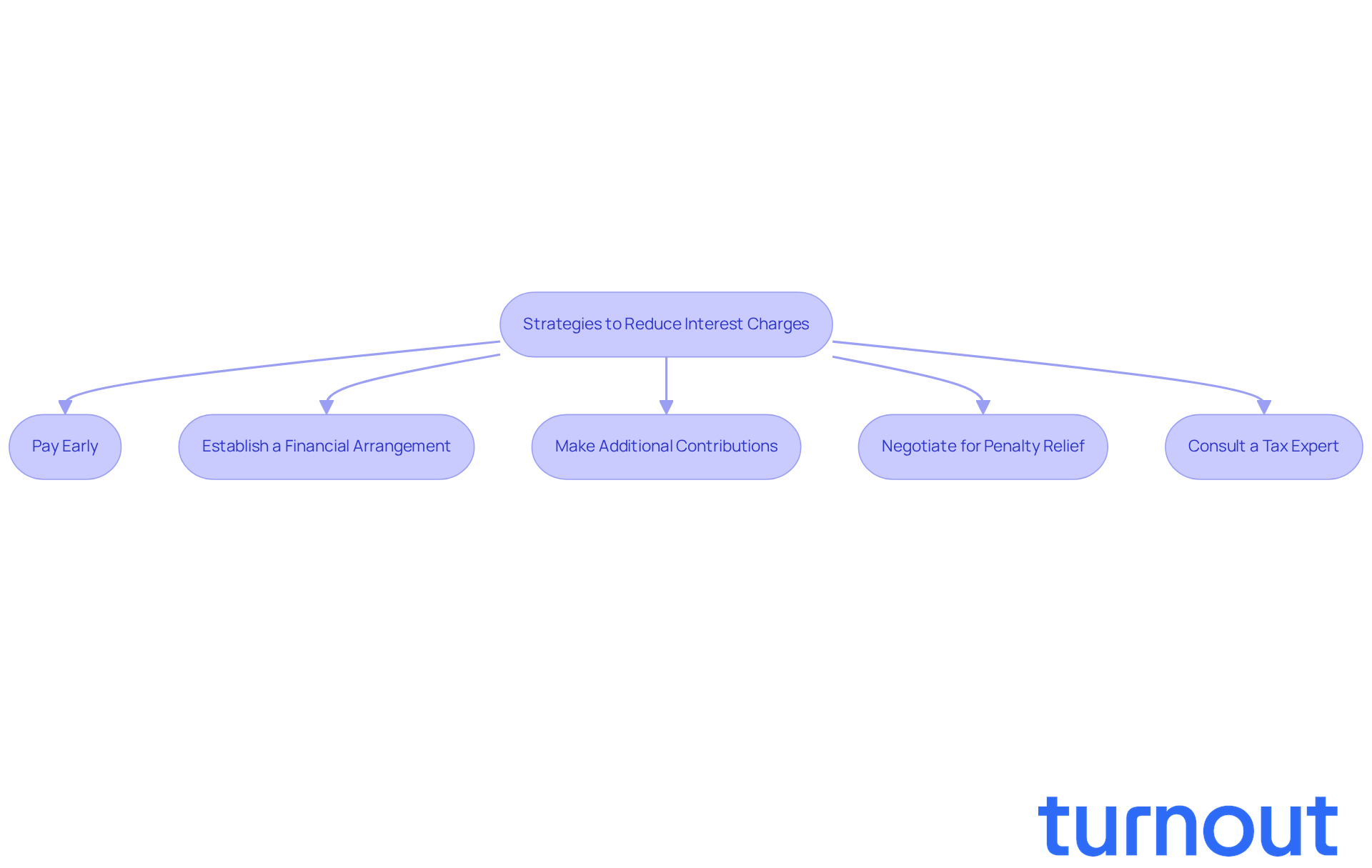

Pay Early: Whenever you can, try to pay your tax liability before the due date. This simple step can help you avoid accruing unnecessary interest.

-

Establish a Financial Arrangement: If paying the full amount isn't feasible, consider setting up an IRS installment plan. This can ease your financial stress and help you avoid additional penalties.

-

Make Additional Contributions: If you have some extra funds, think about putting more towards your tax obligation. By reducing the principal amount owed, you can significantly lessen how much interest the IRS charges per month on future finance charges.

-

Negotiate for Penalty Relief: Life can throw unexpected challenges your way. If you have a valid reason for late payments, such as illness or a natural disaster, you might qualify for penalty relief, which can lower the total amount you owe.

-

Consult a Tax Expert: If your tax situationfeels complicated, reaching out to a tax expert can provide you with tailored strategies to minimize your charges and penalties.

By implementing these strategies, you can take control of your tax debt and work towards a more favorable financial situation. Remember, you're not alone in this journey, and there are resources available to help you every step of the way.

Conclusion

Understanding the monthly interest charged by the IRS is crucial for managing your tax obligations effectively. We know that navigating these financial waters can be overwhelming, especially with rates that fluctuate based on economic conditions. Being aware of how these rates impact unpaid taxes can empower you to make informed decisions and avoid unnecessary financial strain.

Currently, the interest rates for underpayments are set at:

- 7% for individuals

- 9% for large corporate underpayments

It’s important to recognize that timely payments can save you from substantial charges due to daily compounding. Factors like when you make your payment, the amount owed, and changes in borrowing costs all play a significant role in determining your overall interest burden.

Taking proactive steps to manage your tax liabilities can significantly reduce the financial impact of interest charges. By:

- Paying early

- Setting up installment agreements

- Consulting tax experts

You can navigate your tax responsibilities with greater ease. Remember, staying informed and implementing these strategies can lead to a more favorable financial outcome, ensuring that your tax obligations don’t become an overwhelming burden.

You are not alone in this journey. We’re here to help you find the best path forward.

Frequently Asked Questions

How does the IRS determine interest rates on unpaid taxes?

The IRS establishes interest rates on unpaid taxes every three months based on the federal short-term rate plus a margin, typically three percentage points.

What is the current interest rate for underpayments as of Q4 2025?

The interest rate for underpayments is set at 7% per year, compounded daily.

How does daily compounding affect unpaid taxes?

Daily compounding means that any remaining tax balance can grow significantly over time, leading to a larger amount due if payments are delayed.

What is the interest rate for corporate underpayments in Q4 2025?

The interest rate for corporate underpayments is 9% for Q4 2025.

How have IRS interest rates changed historically?

IRS interest rates have fluctuated based on economic conditions; for example, in 2023, the rate for underpayments was 6%, reflecting a lower federal short-term percentage at that time.

What was announced by the IRS in December 2025 regarding interest rates?

The IRS announced that the financial charges would remain unchanged for the upcoming quarter, providing stability for taxpayers.

Why is it important to understand IRS interest charges?

Understanding IRS interest charges is crucial for managing tax responsibilities, as delays in payments can lead to significant increases in total obligations due to daily compounding.

What can happen if you delay paying a tax bill?

If you delay paying a $5,000 tax bill, your total obligation could rise by over $1,000 within a year due to daily compounding.

What should taxpayers do to manage their payments effectively?

Taxpayers should regularly check the IRS website for updates on rates and consider options like setting up an Installment Agreement to manage payments effectively.