Introduction

Navigating the complexities of disability claims can be overwhelming, and understanding the financial implications of hiring a disability lawyer is crucial. Many attorneys work on a contingency fee basis, which raises important questions about the true costs involved. With new fee structures on the horizon, it’s natural to feel uncertain about what to expect.

As you seek clarity on how much a disability lawyer charges, remember: you’re not alone in this journey. It’s common to wonder how to make a sound financial decision while also aiming for the best possible outcome for your claim. We understand that this can be a daunting process, but we’re here to help you every step of the way.

Understand Disability Lawyer Fee Structures

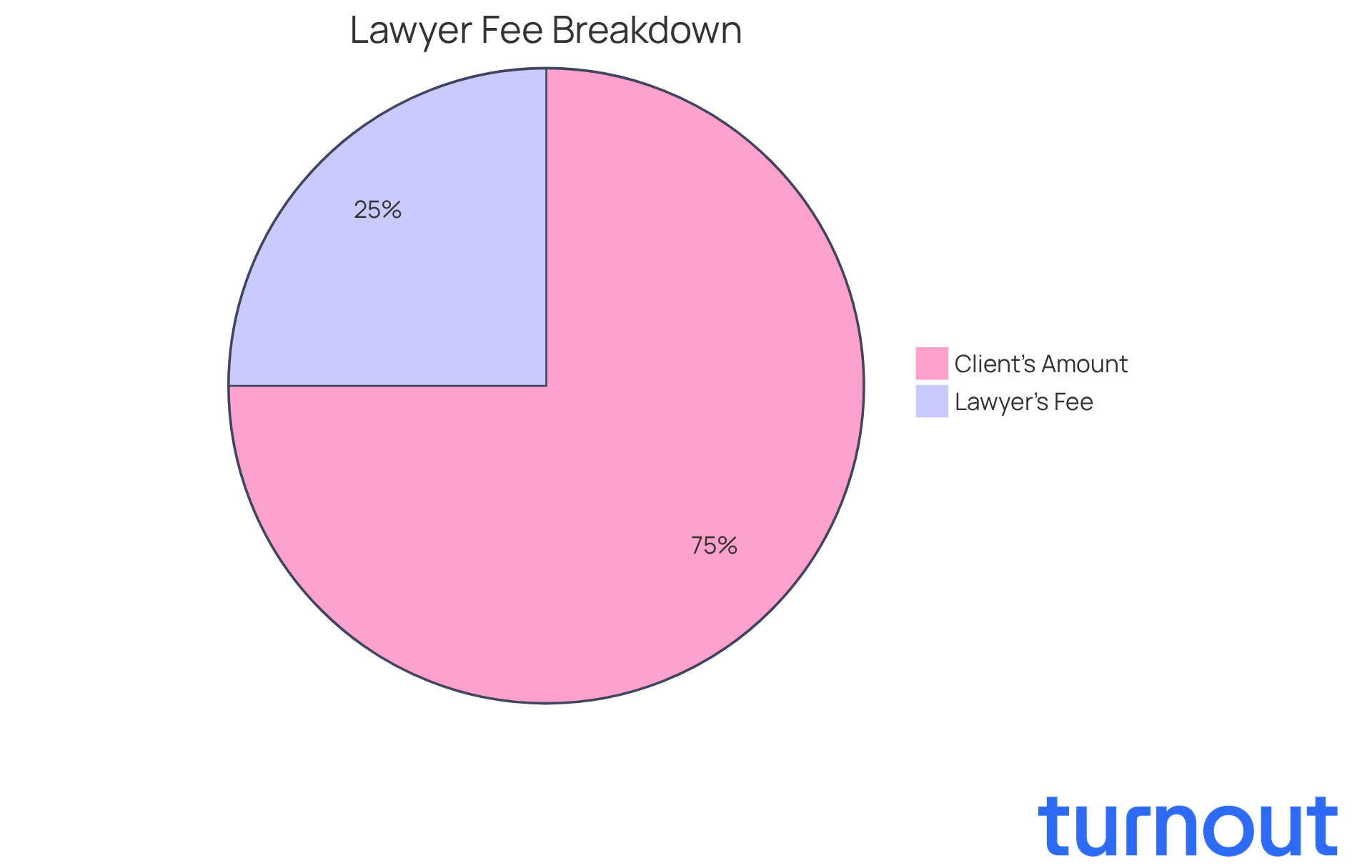

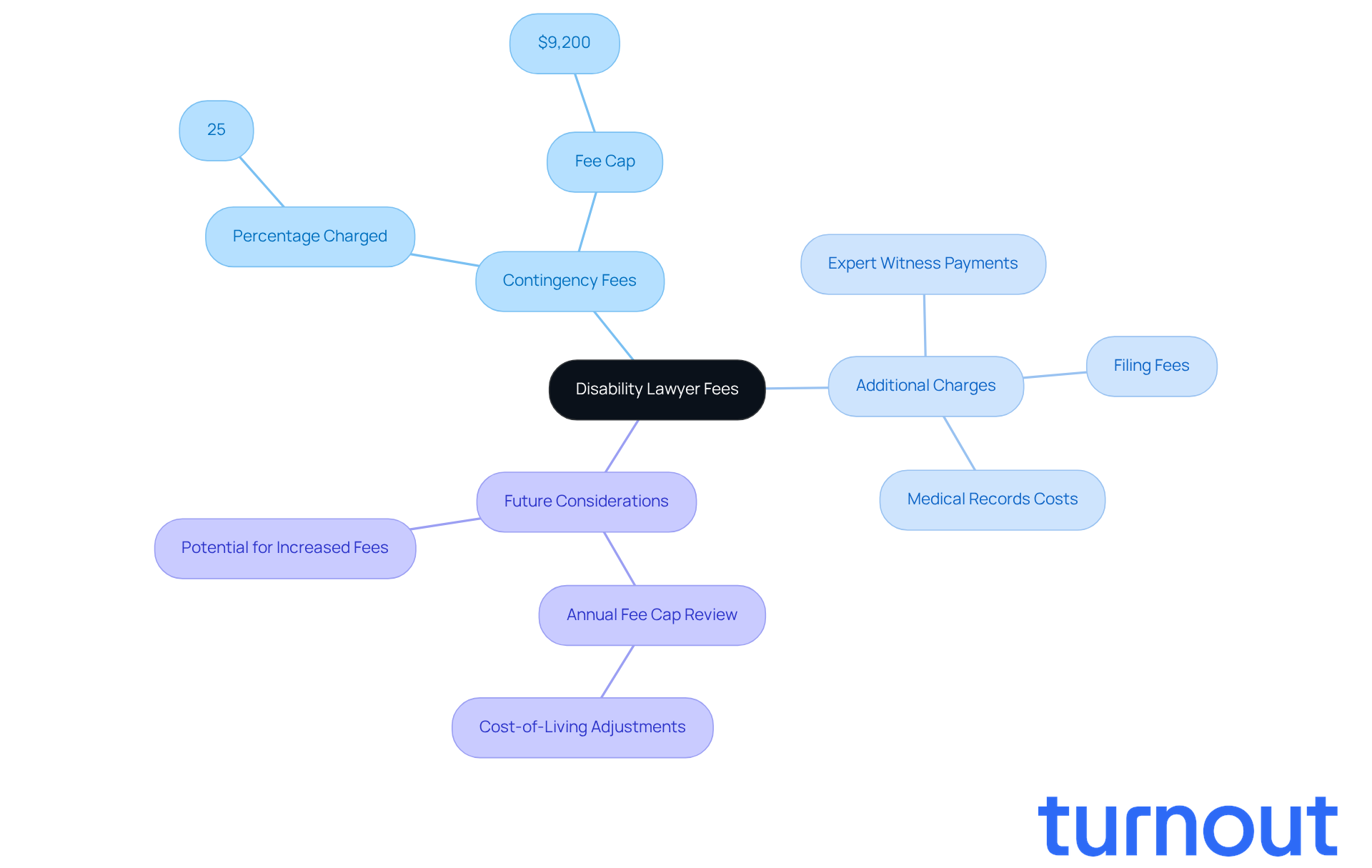

Disability attorneys usually operate on a contingency fee basis, leading to the inquiry of how much does a disability lawyer charge if you win your case. As of 2026, you may wonder how much does a disability lawyer charge, as the standard fee is capped at 25% of your back pay, with a maximum limit of $9,200.

For example, if your back pay totals $30,000, your lawyer would earn $7,500. But if your back pay reaches $40,000, the fee would still be capped at $9,200. This arrangement is designed to ease your financial burden, ensuring you won’t face expenses unless your claim is successful.

It is crucial to understand how much does a disability lawyer charge. It helps you anticipate your financial commitment and avoid any unexpected costs. Remember, Turnout is not a law firm and doesn’t provide legal advice. Instead, we utilize trained nonlawyer advocates to assist with SSD claims, offering support without the costs tied to legal representation.

Additionally, for tax debt relief, Turnout collaborates with IRS-licensed enrolled agents. This partnership enhances the support available to you as you navigate the complexities of government benefits. We're here to help, and you are not alone in this journey.

Explore Common Fee Types and Calculations

Navigating the world of disability claims can be overwhelming, particularly regarding how much does a disability lawyer charge. Typically, disability attorneys work on a contingency basis, which raises the question of how much does a disability lawyer charge, as they take a percentage of your back payments. Starting in 2025, this fee is set at 25%, capped at $9,200. For example, if your back pay amounts to $20,000, your lawyer would receive $5,000.

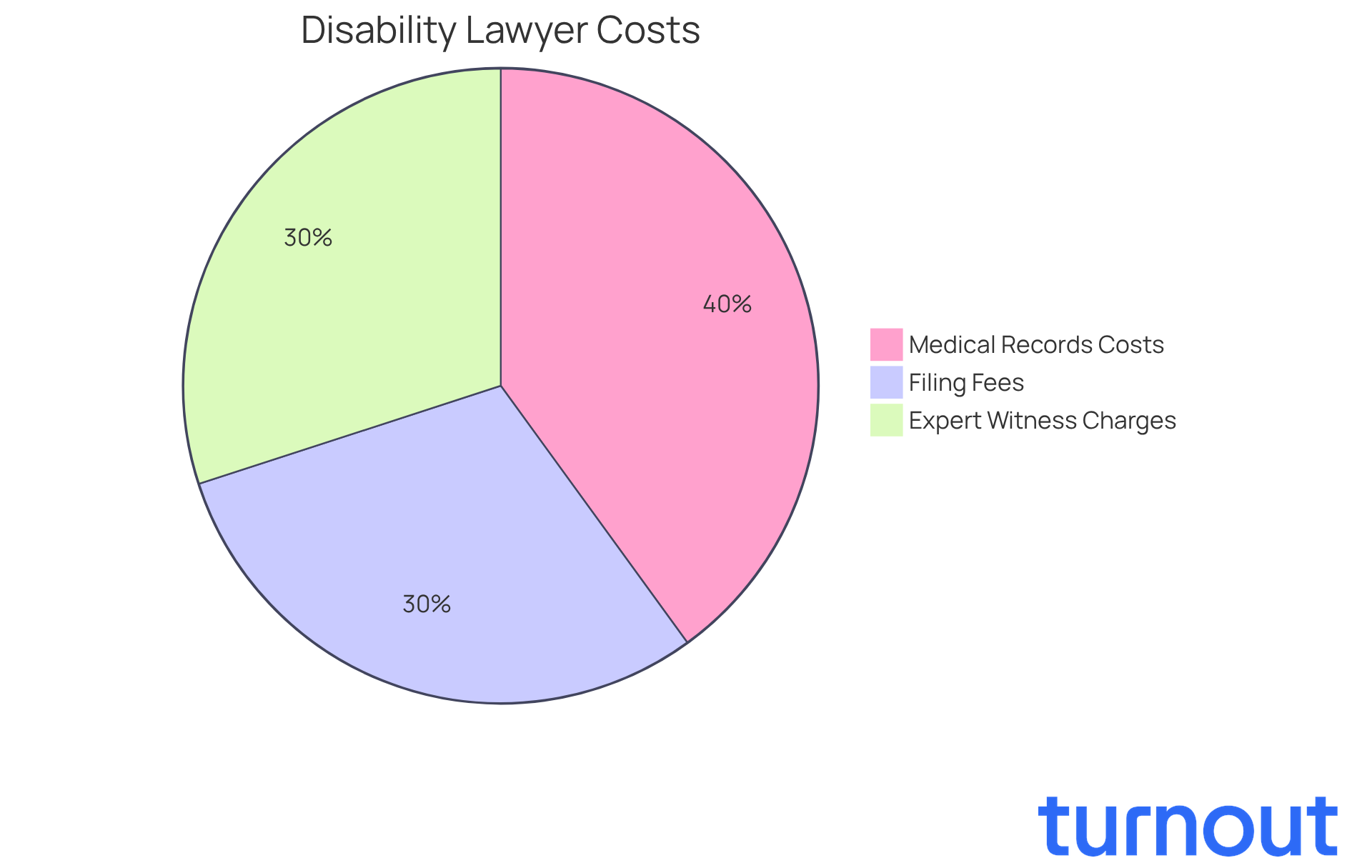

However, we understand that some cases can be quite complex. In these situations, additional charges may arise for specific services. These could include:

- Filing fees

- Payments for expert witnesses

- Other necessary documentation

It’s important to have an open conversation with your lawyer about these potential costs to avoid any surprises down the line. For instance, if your attorney spends $500 to obtain medical records, that amount could be added to your total bill.

The good news is that you only pay your lawyer if you win your case, which can help ease financial concerns during this challenging time. Understanding how much does a disability lawyer charge and any extra expenses is vital for effective financial planning throughout your disability claims process.

Looking ahead, starting in 2026, the SSA will review the attorney fee cap each year to account for cost-of-living adjustments. This ensures that you stay informed about any changes in the fee structure. Remember, you’re not alone in this journey, and we’re here to help you every step of the way.

Identify Additional Costs Beyond Attorney Fees

Navigating the disability claims process can be overwhelming, and we understand that you might be worried about how much does a disability lawyer charge. Along with your lawyer's fees, there are several other expenses that could arise. These may include:

- Costs for obtaining medical records

- Filing fees

- Charges related to expert witnesses

For instance, if your case requires a medical expert to testify, this could add several hundred dollars to your total expenses. During your initial consultation, it’s important to have an open conversation with your legal advisor regarding how much does a disability lawyer charge. This way, you can gain a clear understanding of the financial commitment involved in your case.

Remember, you’re not alone in this journey. We’re here to help you navigate these challenges and ensure you feel supported every step of the way.

Assess the Value of Legal Representation

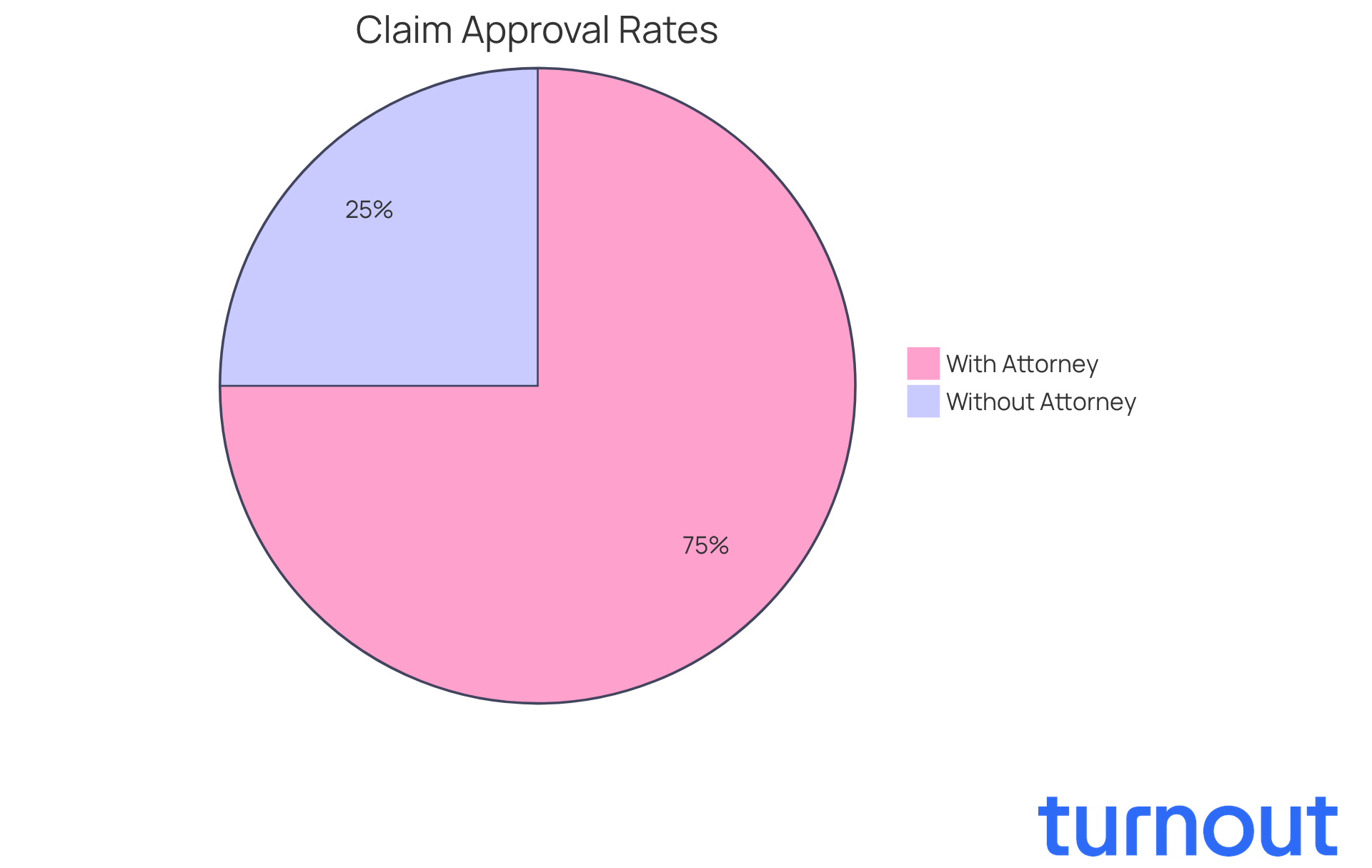

Engaging a disability attorney can significantly improve your chances of securing the benefits you deserve. We understand that navigating the complex system can feel overwhelming. Research shows that individuals with legal representation are nearly three times more likely to have their claims approved compared to those who go it alone. In fact, claimants represented by attorneys see a 23 percentage point increase in the likelihood of initial allowance.

Legal professionals do more than just file paperwork. They gather essential documentation, prepare you for hearings, and provide emotional support throughout this often daunting process. It's common to feel anxious about how much does a disability lawyer charge, which is typically around 25% of past due benefits, capped at $9,200. However, the potential for a successful outcome often far outweighs these expenses.

Consider this: legal representation not only boosts approval rates but also streamlines the claims process, reducing total processing time by over 10 months. Investing in a disability lawyer is a strategic decision that can lead to more favorable results. Remember, you are not alone in this journey; we're here to help you every step of the way.

Conclusion

Navigating the complex landscape of disability claims can be overwhelming, and understanding the costs associated with hiring a disability lawyer is crucial. Most disability attorneys charge a contingency fee, typically capped at 25% of back pay, with a maximum limit of $9,200. This structure alleviates financial pressure, allowing you to seek legal help without upfront costs. You only pay when you achieve a successful outcome.

It's important to be aware of additional expenses that may arise, such as filing fees and costs for expert witnesses. Engaging in open discussions with your attorney about these potential costs can help prevent unexpected financial burdens. Remember, individuals with attorneys are notably more likely to have their claims approved compared to those who do not seek professional help.

Investing in a disability lawyer can be a strategic move that greatly enhances your chances of a favorable outcome. The disability claims process can feel daunting, but having a knowledgeable advocate by your side can make a substantial difference. Understanding these financial aspects is essential, reinforcing the notion that you do not have to navigate this journey alone.

We’re here to help you seek the support you deserve and ensure your rights are protected throughout the process.

Frequently Asked Questions

How do disability lawyers typically charge for their services?

Disability lawyers usually operate on a contingency fee basis, meaning they only get paid if you win your case.

What is the standard fee for a disability lawyer if I win my case?

As of 2026, the standard fee for a disability lawyer is capped at 25% of your back pay, with a maximum limit of $9,200.

Can you provide an example of how the fee structure works?

If your back pay totals $30,000, your lawyer would earn $7,500. However, if your back pay reaches $40,000, the fee would still be capped at $9,200.

Why is it important to understand how much a disability lawyer charges?

Understanding the fee structure helps you anticipate your financial commitment and avoid any unexpected costs.

Does Turnout provide legal advice or representation?

No, Turnout is not a law firm and does not provide legal advice. They utilize trained nonlawyer advocates to assist with SSD claims.

How does Turnout support individuals dealing with tax debt relief?

Turnout collaborates with IRS-licensed enrolled agents to enhance the support available for navigating the complexities of government benefits.