Introduction

Tracking a state tax refund can often feel like navigating a maze, filled with uncertainty and potential pitfalls. We understand that this process can be overwhelming. However, recognizing the importance of monitoring your refund can empower you to make informed financial decisions and avoid unwelcome surprises.

This guide offers a step-by-step approach to tracking a Connecticut state tax refund, highlighting essential resources and troubleshooting tips. But what happens when the expected refund doesn't arrive on time? It's common to feel anxious in such situations. Exploring the nuances of tracking can unveil both challenges and solutions, ultimately leading to a smoother financial journey. Remember, you're not alone in this process; we're here to help.

Understand the Importance of Tracking Your State Tax Refund

Tracking your state tax refund is essential for several important reasons:

-

Stay Informed: We understand that managing finances can be overwhelming. By keeping an eye on your state refund ct status, you can better plan your expenses and avoid unexpected surprises. Research shows that many taxpayers actively monitor their returns, leading to improved financial outcomes.

-

Identify Issues Early: It’s common to feel anxious about potential problems with your refund. By tracking your reimbursement, you can spot any issues early on. This proactive approach allows you to address concerns promptly, helping you avoid unnecessary delays in receiving your state refund ct.

-

Peace of Mind: Knowing where your reimbursement stands in the processing queue can significantly reduce anxiety, especially during tax season when many are eagerly awaiting their returns. As Joe Wadford, an economist at Bank of America Institute, noted, "Larger tax returns could provide those households a lift early this year." This highlights the importance of staying informed about your return status.

-

Financial Planning: Being aware of your state refund ct status is crucial for budgeting and planning future expenses. If you rely on your refund for significant purchases or bill payments, this knowledge becomes even more vital. With federal tax returns in 2026 projected to be 18% to 25% greater than the previous year, monitoring your return can greatly benefit your financial planning.

Recognizing these advantages underscores the importance of the actions outlined in this guide. We're here to help you navigate your tax return process with confidence.

![]()

Access Official Connecticut Tax Refund Tracking Resources

Tracking your state refund CT can feel overwhelming, but we’re here to help you navigate the process with ease. Here are some official resources that can guide you:

-

Connecticut Department of Revenue Services (DRS) Website: Visit the DRS Status Page to check your reimbursement status online. Just enter your Social Security number, tax year, and the exact amount to be returned. This straightforward method ensures you get accurate information quickly.

-

Automated Phone System: If you prefer speaking with a system, you can reach the DRS automated reimbursement system at 800-382-9463. For those outside the Greater Hartford area, the number is +1 860-297-5962. This service is available 24/7, allowing you to verify your reimbursement progress whenever it suits you.

-

myconneCT Portal: Log into the myconneCT portal for a comprehensive view of your tax information, including your reimbursement status. This user-friendly platform makes it easy to stay informed about your tax filings.

Using these resources can significantly enhance your ability to efficiently monitor your state refund CT. In fact, did you know that about 70% of users find the myconneCT portal effective for real-time updates? Tax experts emphasize that utilizing state refund CT monitoring resources can lead to a smoother experience during tax season, helping you stay informed and proactive about your financial affairs.

It’s also important to remember that paper tax returns typically take 10 to 12 weeks to process, while e-filed returns are processed more quickly. You’re not alone in this journey, and with the right tools, you can feel confident about tracking your refund.

![]()

Troubleshoot Common Issues When Tracking Your Refund

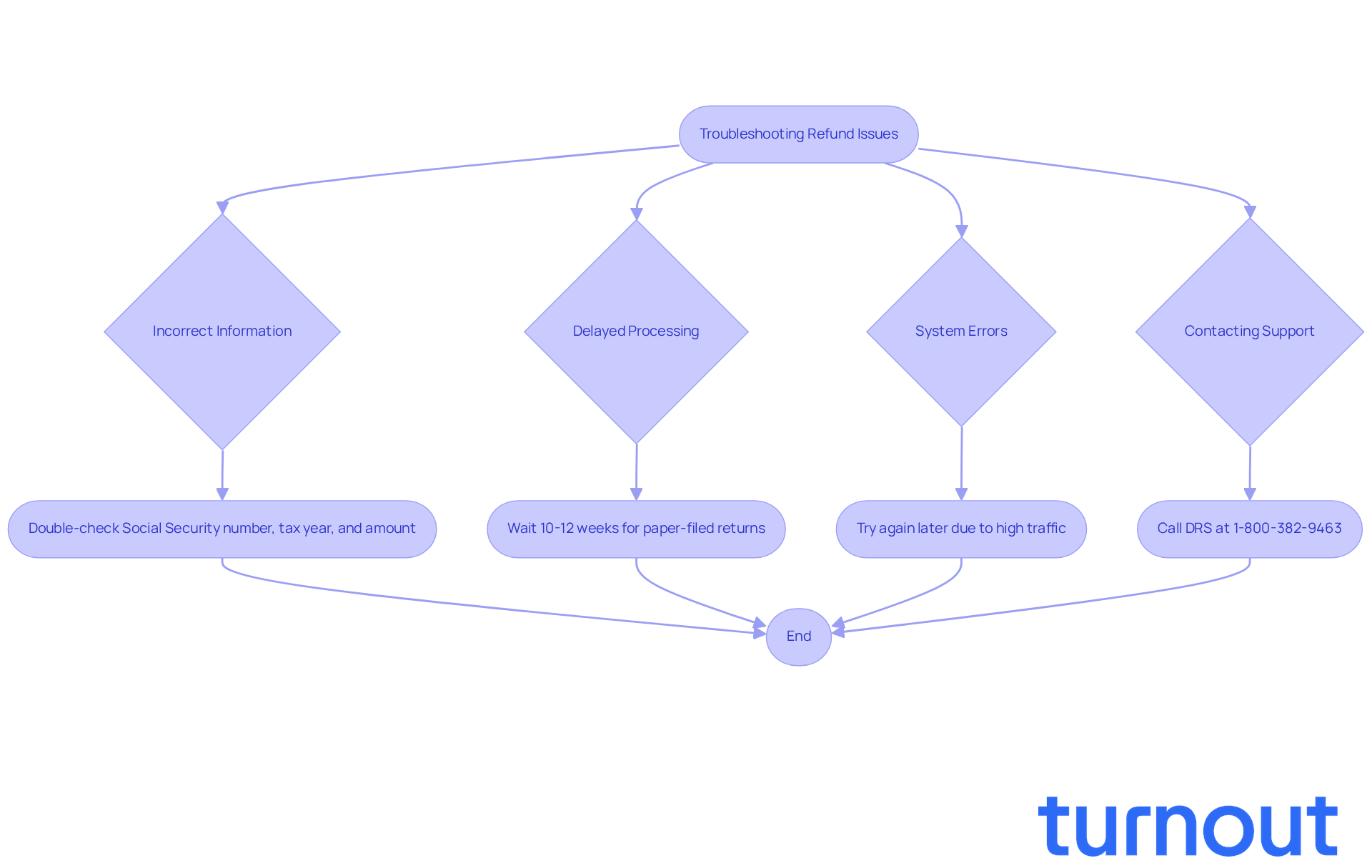

When monitoring your state refund ct, it’s common to run into a few bumps along the way. But don’t worry; we’re here to help you troubleshoot effectively:

-

Incorrect Information: It’s crucial to double-check that you’re entering the right Social Security number, tax year, and amount to be returned. A simple typo can lead to confusion. As tax expert H.L. Mencken noted, 'The average American pays more in taxes than they earn in wages.' This highlights just how important accuracy is in tax matters.

-

Delayed Processing: If your reimbursement status shows it’s still being processed, keep in mind that paper-filed returns often take longer. Most reimbursements for electronically submitted returns are handled within 21 days, so it’s wise to wait at least 10-12 weeks before reaching out again.

-

System Errors: If the online portal or phone system isn’t responding, try again later. High traffic during peak times can cause temporary outages, and it’s perfectly normal to experience this.

-

Contacting Support: If you’re still facing issues, don’t hesitate to contact the Department of Revenue Services (DRS) directly at their customer service number, 1-800-382-9463 or 1-860-297-5962 for the Greater Hartford area. They can provide specific details about your state refund ct reimbursement status.

For example, one customer successfully resolved their reimbursement monitoring issue by confirming their details and reaching out to DRS, leading to a quick resolution. By following these troubleshooting steps, you can navigate any challenges that arise during the monitoring process. Remember, patience is key as you wait for your reimbursement.

Utilize Technology and Tools for Efficient Tracking

If you're feeling a bit anxious about tracking your state refund ct, you're not alone. Many people share this concern, and we're here to help you navigate the process with ease. Consider these helpful tools and technologies that can make your experience smoother:

-

Mobile Apps: The IRS2Go app is a fantastic resource for checking your federal reimbursement progress. Plus, it can provide insights into your state reimbursement when connected. With this app, you can verify your reimbursement status within 24 hours after e-filing, making it a quick and convenient option.

-

DRS myconneCT Portal: For Connecticut taxpayers, the Department of Revenue Services offers the myconneCT portal. By visiting https://drs.ct.gov/eservices and selecting 'Where’s my Reimbursement?', you can monitor your income tax reimbursement in real-time. This tool is essential for staying updated on your state refund ct progress.

-

Email Alerts: Signing up for email notifications from the Connecticut Department of Revenue Services (DRS) ensures you receive timely updates about your reimbursement directly in your inbox. This proactive approach keeps you informed without the hassle of checking manually.

-

Tax Preparation Software: If you used tax software for your filing, many programs come with built-in tracking features that offer real-time updates on your reimbursement status. This integration simplifies the process, allowing you to monitor your reimbursement seamlessly.

-

Social Media Updates: Following the Connecticut DRS on social media platforms can provide you with timely updates and announcements regarding tax returns and processing times. Engaging with these channels can enhance your awareness of any changes or important information.

By utilizing these technological tools, you can streamline the tracking process and stay well-informed about your refund status. Remember, you're not alone in this journey, and with the right resources, the experience can be less stressful and more manageable.

![]()

Conclusion

Tracking your state tax refund isn’t just about curiosity; it’s a vital part of managing your finances effectively. We understand that staying informed about the status of your Connecticut state refund can help you plan better, spot potential issues early, and find peace of mind during the often-stressful tax season.

This guide has shared essential steps and resources for tracking your state refund in Connecticut effectively. By accessing the official Connecticut Department of Revenue Services website, utilizing mobile apps, and setting up email alerts, you have the tools to monitor your refunds proactively. Plus, troubleshooting common issues means that any bumps along the way can be addressed efficiently, leading to a smoother experience.

In conclusion, embracing the practice of tracking your state tax refund can significantly enhance your financial planning and reduce anxiety. By leveraging the resources and technologies discussed, you can take control of your tax refund process, ensuring you remain informed and prepared for any financial decisions ahead. Remember, taking these proactive steps not only aids in immediate financial management but also fosters a more organized approach to future tax filings. You're not alone in this journey; we're here to help!

Frequently Asked Questions

Why is it important to track my state tax refund?

Tracking your state tax refund is important because it helps you stay informed about your finances, identify any issues early, provides peace of mind during tax season, and aids in financial planning.

How can tracking my state tax refund help with financial planning?

Being aware of your state refund status is crucial for budgeting and planning future expenses, especially if you rely on your refund for significant purchases or bill payments.

What are the benefits of staying informed about my state tax refund status?

Staying informed helps you plan your expenses, avoid unexpected surprises, and improve your overall financial outcomes.

How can tracking my refund help me identify issues?

By monitoring your state tax refund, you can spot any potential problems early on, allowing you to address concerns promptly and avoid unnecessary delays in receiving your refund.

What impact does knowing my refund status have on my anxiety during tax season?

Knowing where your reimbursement stands in the processing queue can significantly reduce anxiety, especially during tax season when many are eagerly awaiting their returns.