Overview

Are you feeling anxious about tracking your Missouri tax refund? You're not alone. Many taxpayers share this concern, and it’s completely understandable. This article is here to guide you through the process, making it easier and less stressful.

First, let’s talk about the steps you need to take. Accuracy and preparation are key. You’ll want to gather all necessary information before accessing the Missouri refund tracking portal. This will help you interpret the status of your refund effectively.

By following these steps, you can navigate the process with confidence. We understand that waiting for your refund can be nerve-wracking, but knowing how to track it can empower you. You deserve to feel in control of your finances.

Remember, you’re not alone in this journey. Many have successfully tracked their refunds and can attest to the relief it brings. If you have any questions or need further assistance, don’t hesitate to reach out. We’re here to help you every step of the way.

Introduction

Navigating the process of tracking a Missouri tax refund can often feel overwhelming. We understand that the complexities involved in tax filings can add to your stress. However, knowing the steps and requirements can significantly lighten this load. This guide is here to help you demystify the refund tracking process, offering essential insights and practical tools to monitor your reimbursements effectively.

But what if you encounter delays or find that your status remains unchanged? It’s common to feel anxious in these situations. By exploring these challenges together, we aim to empower you to take control of your refund journey, ensuring a smoother experience. Remember, you are not alone in this journey, and we're here to help.

Gather Required Information for Tracking Your Refund

Tracking your Missouri refund can feel overwhelming, but we are here to help you through the process. To make this process easier, gather the following essential information:

- Your Social Security Number (SSN): Use the first SSN listed on your tax return.

- Filing Status: Specify whether you filed as single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Exact Reimbursement Amount: Enter the total dollar figure of your expected reimbursement as indicated on your tax return.

- Tax Year: Specify the tax year for which you are monitoring the reimbursement.

Having this information at your fingertips will simplify your monitoring process. We understand that around 66% of Americans receive a tax return, yet many face challenges in tracking them. Tax professionals emphasize that accurate details are crucial for avoiding delays and ensuring a smooth experience. As tax specialist Rippy wisely notes, "If you receive a substantial tax return, what you've essentially done is provided a loan to the government over the past year that you didn't need to provide, and you've done that without interest."

By preparing this information beforehand, you can navigate the monitoring process with greater confidence and efficiency. Consider utilizing the IRS 'Where’s My Refund' tool or the IRS2Go mobile app to track your payment status effectively. As of April 4, 2025, the typical tax return amount is $3,116, highlighting the importance of monitoring your return closely. Remember, you are not alone in this journey, and taking these steps can make a significant difference.

![]()

Access the Missouri Refund Tracking Portal

Accessing the Missouri refund tracking portal is straightforward, and we’re here to help you navigate it. If you’re feeling uncertain about your tax refund, know that you’re not alone. Many people share your concerns, and this portal is designed with your ease in mind.

- Start by launching your web browser and visiting the Missouri Department of Revenue's reimbursement monitoring page: Missouri Return Tracker.

- Look for the 'Get Started!' button prominently displayed on the homepage of the portal.

- Click this button to move on to the information entry page.

This portal offers a simple navigation experience, making it easier for you to monitor your Missouri refund. As more users turn to online tax return monitoring systems, the Missouri refund portal stands out as a valuable resource for addressing your tax questions.

Tax specialists emphasize that a user-friendly tracking system can significantly enhance your experience, allowing for easier access to information about your payment status. However, it’s common to feel anxious about potential delays in reimbursements, which can happen due to math errors or incomplete returns. Refunds for electronically filed returns in Missouri are usually processed within five business days, while paper returns may take up to four weeks for a Missouri refund.

For more detailed information, don’t hesitate to utilize the Missouri Return Inquiry System. Remember, we’re here to support you every step of the way.

![]()

Input Your Information and Track Your Refund

Tracking your Missouri refund can feel overwhelming, but we’re here to help you through the process. Start by visiting the Missouri Refund Tracking Portal and follow these simple steps:

- Enter your Social Security Number in the designated field.

- Select your Filing Status from the dropdown menu.

- Input the Exact Refund Amount you expect to receive.

- Choose the Tax Year for which you’re monitoring the reimbursement.

- After providing all necessary details, click on the Submit button to check your reimbursement status.

We understand that accuracy is crucial. Small errors, like an incorrect Social Security number or a misspelled name, can lead to significant delays in processing. Many taxpayers miss out on timely updates due to simple mistakes. Tax experts emphasize that ensuring all details are entered accurately can help you avoid unnecessary difficulties and keep you informed about your Missouri refund.

It’s also worth noting that more than 90% of individual taxpayers now submit their returns electronically, which greatly speeds up the reimbursement process. However, if your reimbursement status remains unchanged for over 21 days, it’s common to feel anxious. The IRS suggests waiting at least 21 days after filing before making an inquiry. If you still see no updates, it may be wise to double-check your return for errors or reach out to the IRS for assistance.

Utilizing the online tracking tools can empower you to manage your tax return effectively and steer clear of common pitfalls. Remember, you are not alone in this journey, and we’re here to support you every step of the way.

![]()

Interpret Your Refund Status Results

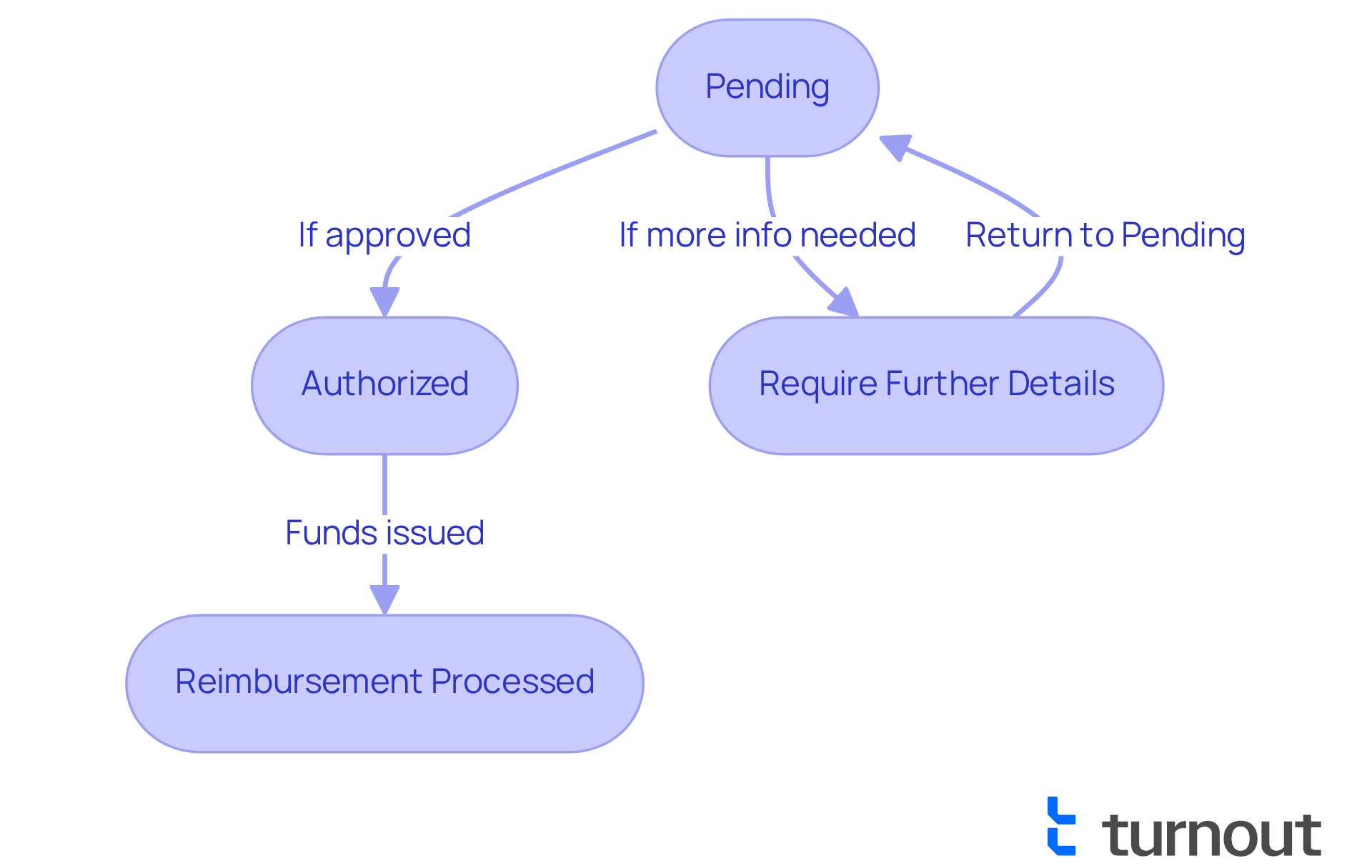

After you provide your details, you’ll receive a status update about your reimbursement. Understanding these results can make a difference in how you manage your expectations:

- Pending: Your refund is still being processed. This means the state is reviewing your submission. It’s perfectly normal to feel anxious, so check back later for updates.

- Authorized: Great news! Your reimbursement has been authorized and will be issued soon. Typically, once approved, you can expect your funds within a few weeks, depending on how you filed.

- Reimbursement Processed: Your reimbursement has been sent out! If you chose direct deposit, look for the funds in your account within five days. If you’re receiving a check in the mail, it may take 6 to 8 weeks to arrive.

- Require Further Details: Sometimes, the state needs a bit more information to process your reimbursement. If you receive this status, please follow any guidelines provided. Delays can happen if the required details aren’t submitted promptly, and we understand how frustrating that can be.

Understanding these statuses can help you navigate this process with more confidence. Many individuals have successfully managed their reimbursement concerns by promptly responding to requests for additional details, ensuring their returns are handled without unnecessary delays. Remember, 90% of taxpayers receive their returns within 21 days of filing, especially if they choose electronic submission methods.

Utilizing tools like the IRS 'Where’s My Refund?' can also provide real-time updates on your refund status. E-filers can check their status within just 24 hours. We’re here to help you through this journey, and you’re not alone in this process.

Conclusion

Tracking your Missouri tax refund can feel overwhelming, but it doesn’t have to be. With the right information and tools, you can navigate this process with confidence. By gathering essential details like your Social Security Number, filing status, expected refund amount, and tax year, you’re already on the right path. We understand that having these foundational elements is crucial for avoiding delays and ensuring a smooth experience.

This article offers a step-by-step guide to accessing the Missouri refund tracking portal. You’ll learn how to input the necessary information and interpret the status results. Remember, accuracy is key! Entering your details correctly can prevent frustrating processing delays. It’s also important to note that refund timelines can vary based on how returns are filed. Many taxpayers find reassurance in knowing that they often receive their refunds within a short period, thanks to the effectiveness of online tracking systems.

Ultimately, navigating the Missouri tax refund process is more than just monitoring a payment; it’s about empowering you to take control of your financial expectations. By following the outlined steps and utilizing available resources, you can demystify the refund tracking experience. Taking proactive measures today can lead to a smoother and more informed journey through the tax refund process. Remember, you’re not alone in this journey—we’re here to help!

Frequently Asked Questions

What information do I need to track my Missouri tax refund?

To track your Missouri tax refund, you need your Social Security Number (SSN), your filing status, the exact reimbursement amount from your tax return, and the tax year for which you are monitoring the refund.

Why is it important to have accurate details when tracking my refund?

Accurate details are crucial for avoiding delays and ensuring a smooth experience when tracking your refund. Many individuals face challenges in this process, so having the correct information can simplify monitoring.

What tools can I use to track my tax refund?

You can utilize the IRS 'Where’s My Refund' tool or the IRS2Go mobile app to effectively track the status of your tax refund.

What is the average tax return amount as of April 4, 2025?

As of April 4, 2025, the typical tax return amount is $3,116.

What does it mean if I receive a substantial tax return?

Receiving a substantial tax return means you have essentially provided a loan to the government over the past year without earning interest on it.