Introduction

Tracking the status of an amended tax return is crucial, yet it often feels overwhelming. We understand that with millions of submissions processed each year, it can be challenging to know how to monitor your status effectively. But don’t worry-understanding this process can bring you peace of mind, timely updates, and the ability to address any potential issues swiftly.

Many individuals grapple with the complexities of the IRS system. You might be wondering: what are the best strategies for tracking an amended return and overcoming common hurdles? This guide is here to help you navigate this journey. We’ll provide a step-by-step approach to ensure you stay informed and in control of your amended filings.

You are not alone in this. Let’s demystify the process together.

Understand the Importance of Tracking Your Amended Return

Monitoring your amended return status is essential for several important reasons:

-

Timeliness: We understand that waiting for a response can be stressful. Staying informed about the amend return status of your submission helps you anticipate when to expect a response or refund. The IRS typically handles revised filings within 8 to 12 weeks, although certain situations may require up to 16 weeks due to various factors. In 2024, the IRS processed 266 million filings, highlighting the volume of cases they manage and the potential for delays.

-

Error Resolution: Tracking your modified submission allows you to quickly amend return status and identify any issues that may arise. This proactive approach can prevent further complications and ensure a smoother resolution process.

-

Peace of Mind: Frequent updates on your progress can significantly reduce anxiety and uncertainty. Understanding how to amend return status can offer comfort during what can be a challenging experience.

-

Financial Planning: Knowing when you might receive a refund is crucial for effective financial management, especially if you depend on that money for bills or other expenses. With the IRS issuing $553 billion in refunds in 2024, timely tracking can help you plan accordingly.

-

Direct Resource: You can check the amend return status of your revised submission with the Where's My Revised Submission? tool, available 24 hours a day, except on Mondays from 12 - 3 a.m. Eastern time and occasionally on Sundays from 1 - 7 a.m. Eastern time.

By actively monitoring your revised filing, you empower yourself to stay informed and proactive about your tax status. Remember, you're not alone in this journey, and taking these steps can lead to improved outcomes.

![]()

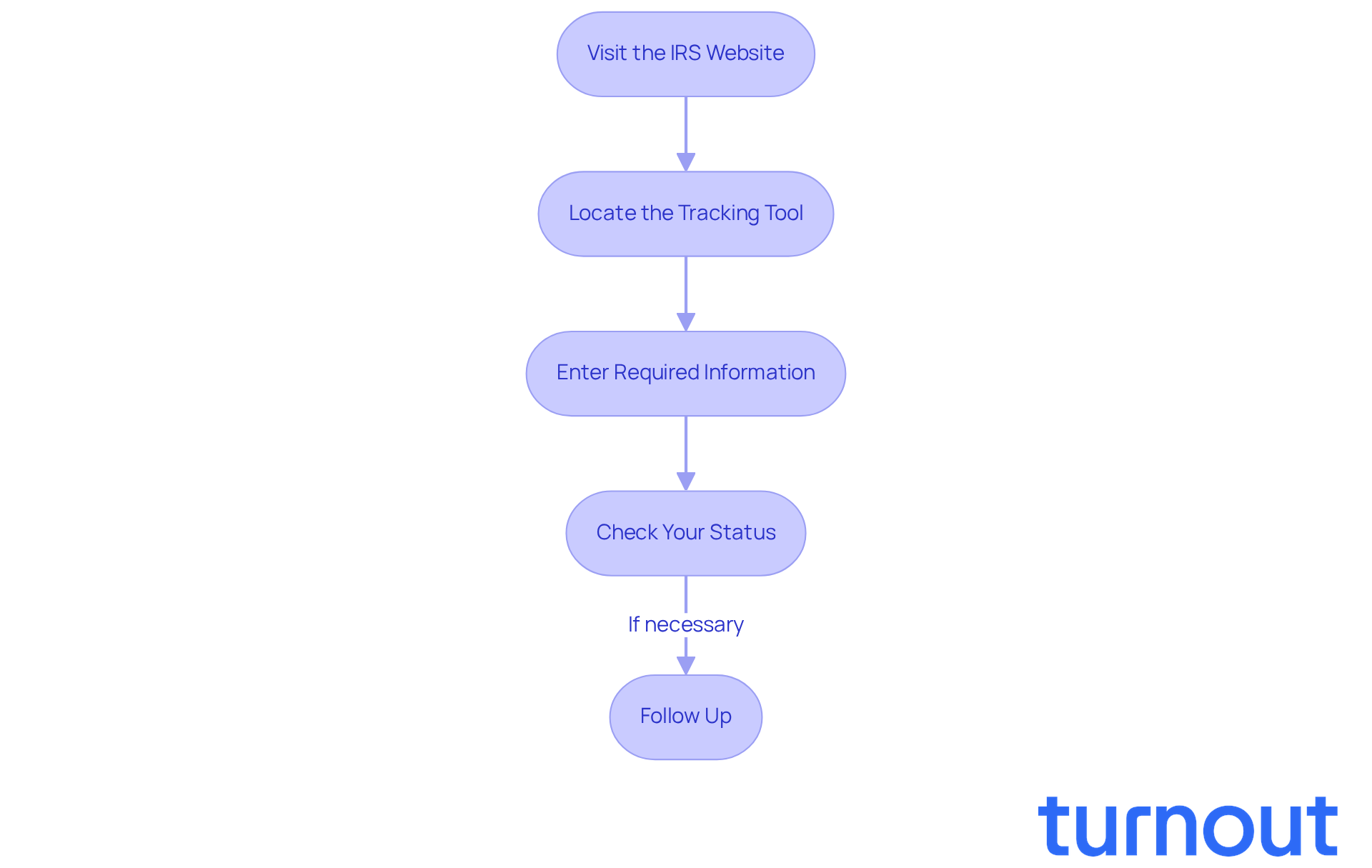

Access the IRS Tracking Tool for Amended Returns

Tracking your amended return status can feel overwhelming, but we're here to help you through it. Follow these simple steps to stay informed:

- Visit the IRS Website: Start by navigating to the IRS's official site at www.irs.gov.

- Locate the Tracking Tool: In the search bar, type "Where's My Amended Return?" and select the link to the tool.

- Enter Required Information: Provide your Social Security number, date of birth, and ZIP code to access your filing details.

- Check Your Status: The tool will show the current status of your modified submission, indicating whether it is pending, processing, or completed. Remember, amended filings can take up to 16 weeks to process, so patience is key.

- Follow Up: If your refund hasn’t been processed after the expected timeframe, don’t hesitate to call the IRS at 1-866-464-2050 for further assistance.

The IRS's 'Where's My Amended Return?' tool is available 24/7, except during maintenance periods, making it easy for you to check your status whenever you need. In 2024, the IRS processed over 266.6 million tax submissions, showcasing the high volume of inquiries managed through this tool. Many taxpayers have successfully used this resource to stay updated on their amend return status, ensuring they receive timely information about their processing progress.

We understand that navigating tax matters can be stressful, but you are not alone in this journey. By utilizing these steps, you can take control of your situation and feel more confident about your amended return.

Troubleshoot Common Issues When Tracking Your Amended Return

If you're having trouble tracking your amended return status, we understand how frustrating that can be. Here are some helpful tips to guide you through the process:

-

Check Your Information: Make sure your Social Security number, date of birth, and ZIP code are correct. Even a small error can prevent you from accessing your refund information.

-

Be Patient: Remember, it’s best to wait at least three weeks after submitting your revised filing before checking its status. If you look too soon, the system might not have the latest updates. The IRS typically takes around seven months to process a revised submission, so patience is key.

-

Watch for System Errors: Sometimes, the IRS website may face technical issues. If you can’t access the tracking tool, don’t hesitate to try again later or reach out to the IRS hotline for help.

-

Reach Out to the IRS: If your filing status hasn’t changed after 12 weeks, it’s a good idea to call the IRS for assistance. Be prepared to share your details and any relevant information about how to amend return status for your revised submission.

-

Understand the Backlog: As of April 2023, there were still 3.4 million unprocessed adjusted filings. Knowing about this backlog can help you set realistic expectations.

By following these suggestions, you can effectively troubleshoot common issues and stay informed about your revised tax submission. Remember, the IRS processes millions of amended filings each year, and understanding the potential challenges can help you navigate the system more easily. You're not alone in this journey, and we're here to help.

![]()

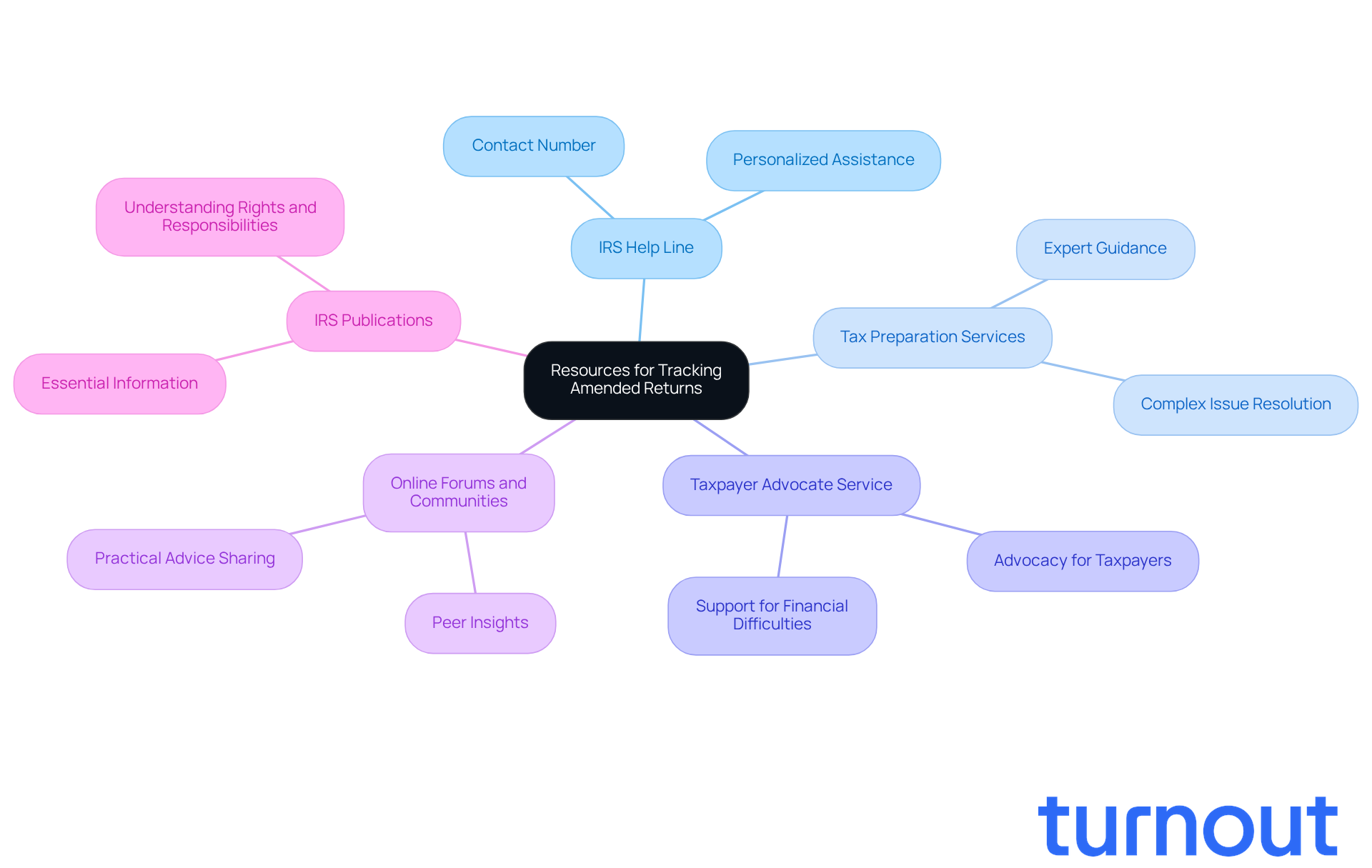

Explore Additional Resources for Tracking Your Amended Return

We understand that navigating tax issues can be overwhelming. In addition to the IRS tracking tool, here are some valuable resources that can offer you the support you need:

-

IRS Help Line: If you have questions about your revised filing status, don’t hesitate to call the IRS at 1-866-464-2050. This line is specifically designed to help you amend return status, providing personalized assistance to address your concerns.

-

Tax Preparation Services: Seeking help from professional tax preparation services can be a game-changer. These experts offer tailored guidance for your unique tax situation, effectively addressing complex issues related to revised submissions. They ensure your filings are accurate and compliant, giving you peace of mind.

-

Taxpayer Advocate Service: If you’re facing significant challenges with the IRS, the Taxpayer Advocate Service is here for you. This independent entity within the IRS supports taxpayers who are experiencing financial difficulties or unresolved tax issues. They can help you understand the complexities of how to amend return status filings and advocate on your behalf.

-

Online Forums and Communities: Engaging with platforms like Reddit or specialized tax forums can be incredibly helpful. You’ll find insights from fellow taxpayers who have successfully navigated similar situations. These communities often share practical advice and personal experiences that can guide you through your journey.

-

IRS Publications: Reviewing IRS publications related to revised filings can provide you with essential information on processes, timelines, and requirements. These resources are crucial for understanding your rights and responsibilities as a taxpayer, particularly when you need to amend return status.

Remember, you have 60 days to request abatement of any IRS adjustments. This timeframe is critical when dealing with amended return status, so keep it in mind as you seek assistance. You're not alone in this journey, and there are resources available to help you every step of the way.

Conclusion

Tracking the status of an amended tax return is essential for taxpayers who want clarity and control over their financial matters. We understand that monitoring the progress of a revised submission can alleviate stress, resolve potential errors, and help you plan your finances effectively. Staying informed throughout this process is key to feeling secure.

This article highlights the importance of tracking an amended return. It emphasizes:

- Timeliness

- Error resolution

- Peace of mind

- Financial planning

You’ll find a clear step-by-step guide on how to access the IRS tracking tool, troubleshoot common issues, and utilize additional resources like tax preparation services and the Taxpayer Advocate Service. Each of these components plays a vital role in empowering you to navigate the complexities of your amended filings.

In conclusion, being proactive about tracking your amended return not only enhances your understanding of your tax status but also fosters confidence in managing your financial obligations. Engaging with available resources and following the outlined steps can lead to a smoother experience during what can often be a challenging process. Remember, taking control of this journey is essential, as it ultimately contributes to better financial health and peace of mind. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

Why is it important to track the status of my amended return?

Tracking your amended return status is important for timeliness, error resolution, peace of mind, and financial planning. It helps you anticipate responses or refunds, identify issues quickly, reduce anxiety, and manage your finances effectively.

How long does it typically take for the IRS to process an amended return?

The IRS typically processes amended returns within 8 to 12 weeks, but in some cases, it may take up to 16 weeks due to various factors.

What can I do if I encounter issues with my amended return?

By tracking your modified submission, you can quickly identify any issues that may arise, allowing you to address them proactively and ensure a smoother resolution process.

How can tracking my amended return provide peace of mind?

Frequent updates on your amended return progress can significantly reduce anxiety and uncertainty, offering comfort during what can be a challenging experience.

Why is knowing the status of my amended return important for financial planning?

Knowing when you might receive a refund is crucial for effective financial management, especially if you rely on that money for bills or other expenses.

How can I check the status of my amended return?

You can check the status of your amended return using the Where's My Revised Submission? tool, which is available 24 hours a day, except on Mondays from 12 - 3 a.m. Eastern time and occasionally on Sundays from 1 - 7 a.m. Eastern time.