Introduction

Starting a tax preparer franchise offers a wonderful opportunity for aspiring entrepreneurs to engage in a vital service that many individuals depend on each year. We understand that taking this step can feel daunting, but with the right guidance and knowledge, this venture can lead to both financial success and personal fulfillment.

However, it’s common to feel overwhelmed by the complexities involved. From choosing the right business model to navigating legal requirements and crafting effective marketing strategies, the path to establishing a thriving tax preparation business is filled with challenges. What are the essential steps that can turn your idea into a successful franchise? And how can you ensure you’re ready for the journey ahead?

We’re here to help you explore these questions and provide the support you need to succeed.

Identify Your Business Model and Requirements

Starting your journey in the tax preparer business can feel overwhelming, but you’re not alone. It’s important to find a model that resonates with your dreams and goals. Will you join a well-known brand like Jackson Hewitt or Liberty Tax, or do you envision an independent practice? Here are some key considerations to help you navigate this path:

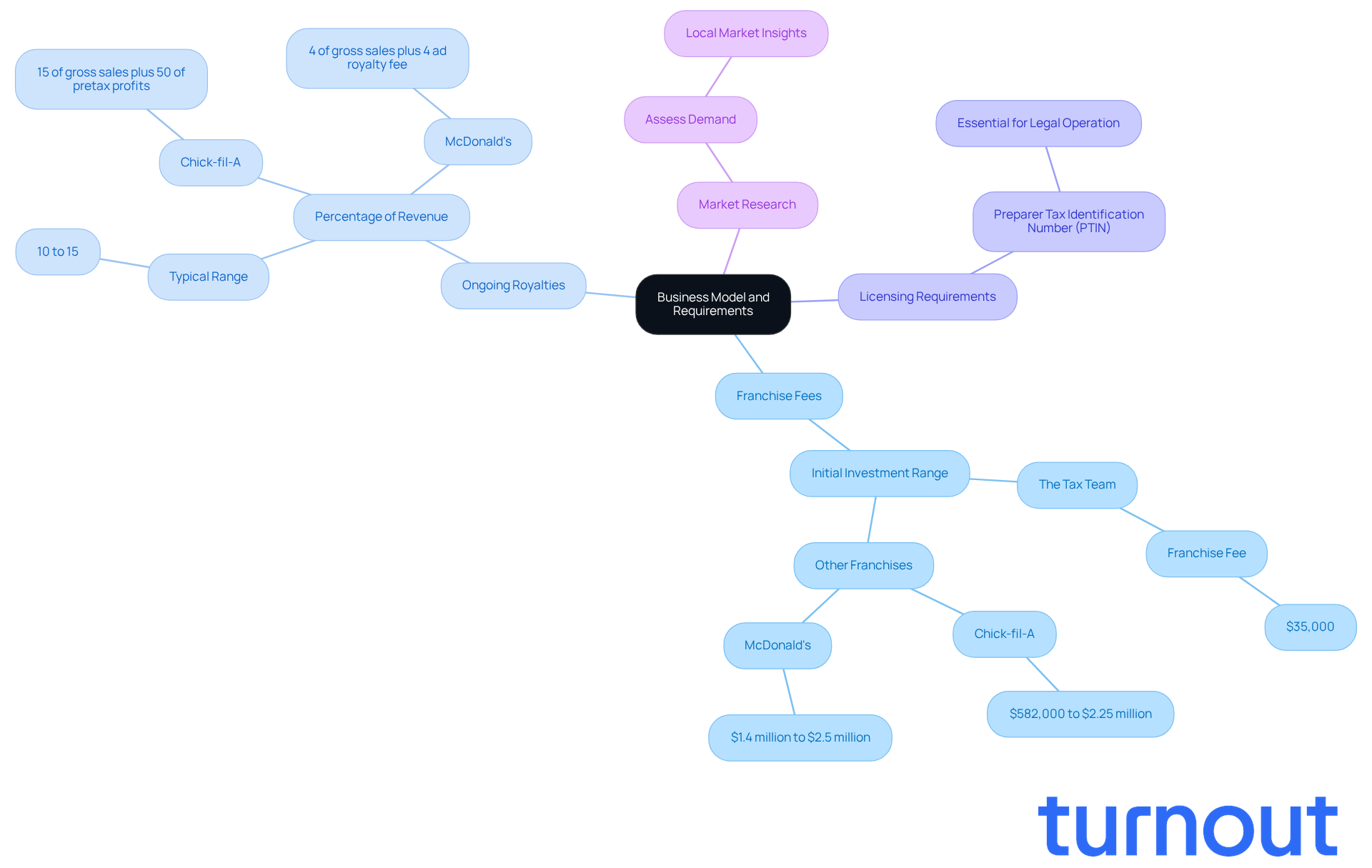

- Franchise Fees: Initial investments for tax preparation franchises in 2026 typically range from $25,000 to $50,000. For example, The Tax Team requires a standard initial franchise fee of $35,000.

- Ongoing Royalties: Be ready for ongoing royalty fees, usually between 10% and 15% of your revenue. Chick-fil-A, for instance, charges 15% of gross sales plus 50% of pretax profits, showing how structures can vary.

- Licensing Requirements: It’s crucial to understand the necessary licenses. Obtaining a Preparer Tax Identification Number (PTIN) from the IRS is essential for operating legally.

- Market Research: Conducting thorough market research is vital. Assess the demand for tax preparation services in your area; this insight will guide your strategy and potential profitability.

By clearly outlining your operational model and understanding these requirements, you’re laying a strong foundation for your venture’s success. Remember, we’re here to help you every step of the way.

Register Your Franchise and Obtain Necessary Licenses

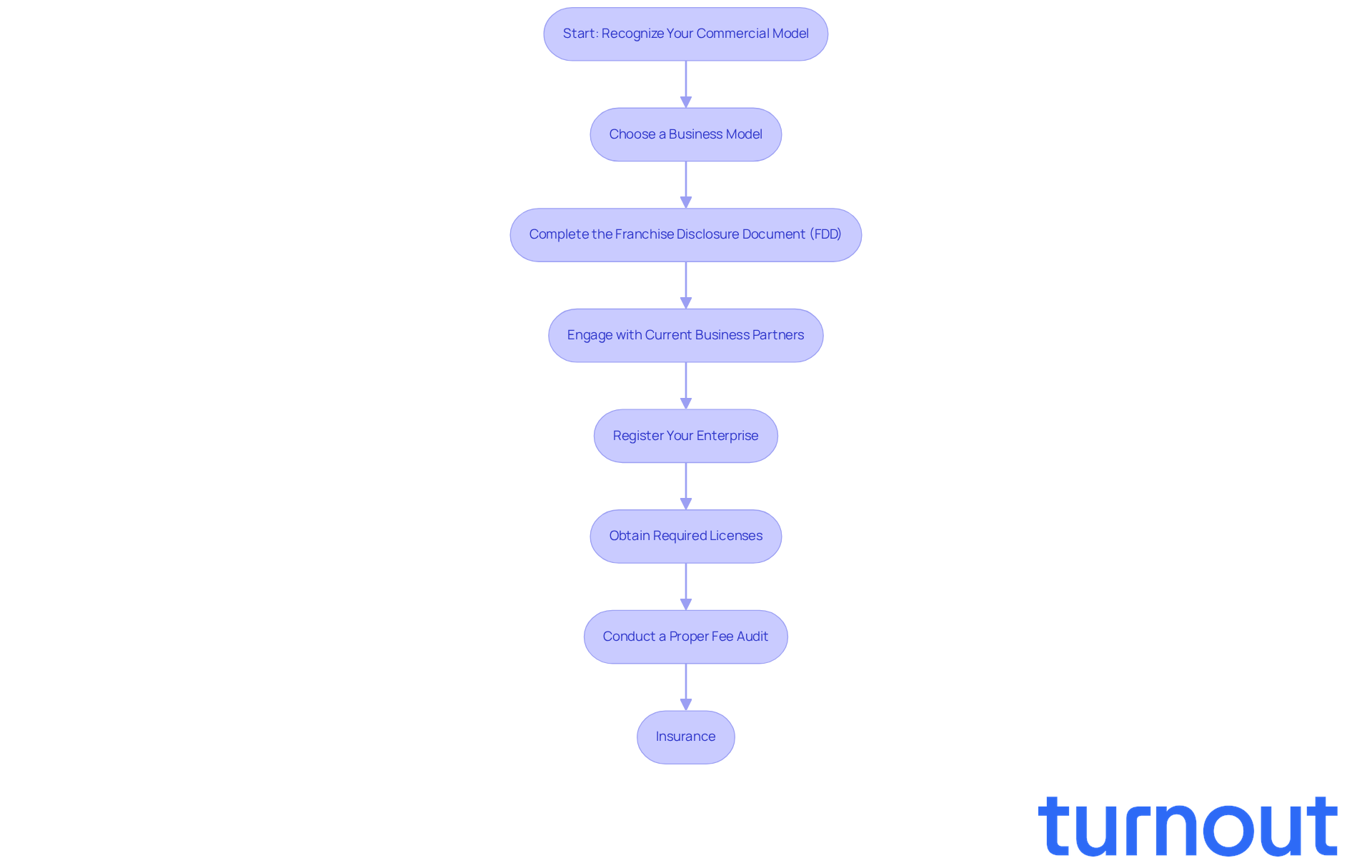

Recognizing your commercial model is just the beginning. The next step is to register your chain and obtain the necessary licenses. We understand that navigating this process can feel overwhelming, but we're here to guide you through it. Here are some essential steps to help you along the way:

-

Choose a Business Model: Start by selecting a business model that truly aligns with your goals and values. It’s important that it resonates with your vision, as this will set the foundation for your journey.

-

Complete the Franchise Disclosure Document (FDD): Take the time to thoroughly review the FDD provided by the franchisor. This document is crucial as it details the terms, conditions, and financial expectations of the agreement. Given the increasing complexity of the FDD renewal process due to economic shifts and regulatory scrutiny in 2026, conducting thorough reviews and ensuring compliance is essential.

-

Engage with Current Business Partners: Don’t hesitate to reach out to existing business partners. Their firsthand experiences can provide valuable insights into the support system and help you understand the operational realities of the franchise. It’s common to feel uncertain, but their guidance can be incredibly reassuring.

-

Register Your Enterprise: When you’re ready, file the required paperwork with your state to legally register your company. This usually involves acquiring a trade license and an Employer Identification Number (EIN). Remember, this step is vital for your business’s legitimacy.

-

Obtain Required Licenses: Depending on your state regulations, you may need specific licenses to operate as a tax preparer. Consulting your local tax authority can help ensure you meet all licensing requirements. You’re not alone in this; many have navigated these waters successfully.

-

Conduct a Proper Fee Audit: It’s advisable to conduct a proper fee audit to gather accurate cost estimates and timelines for the FDD. This step is essential for preparing adequately and understanding the financial commitments involved. Knowing what to expect can ease your mind.

-

Insurance: Lastly, consider obtaining liability insurance. This will safeguard your business against potential claims, providing an additional layer of protection. It’s a smart move that many successful businesses make.

By completing these steps, you’re not just ensuring legal compliance; you’re also setting yourself up for success in operating your tax preparer franchise effectively. Remember, you’re taking important steps towards your goals, and we’re here to support you every step of the way.

Choose Tools and Technology for Efficient Operations

Investing in the right tools and technology is essential to ensure smooth operations in your tax preparer franchise. We understand that navigating this landscape can feel overwhelming, but you’re not alone in this journey. Here are some key considerations to help you along the way:

-

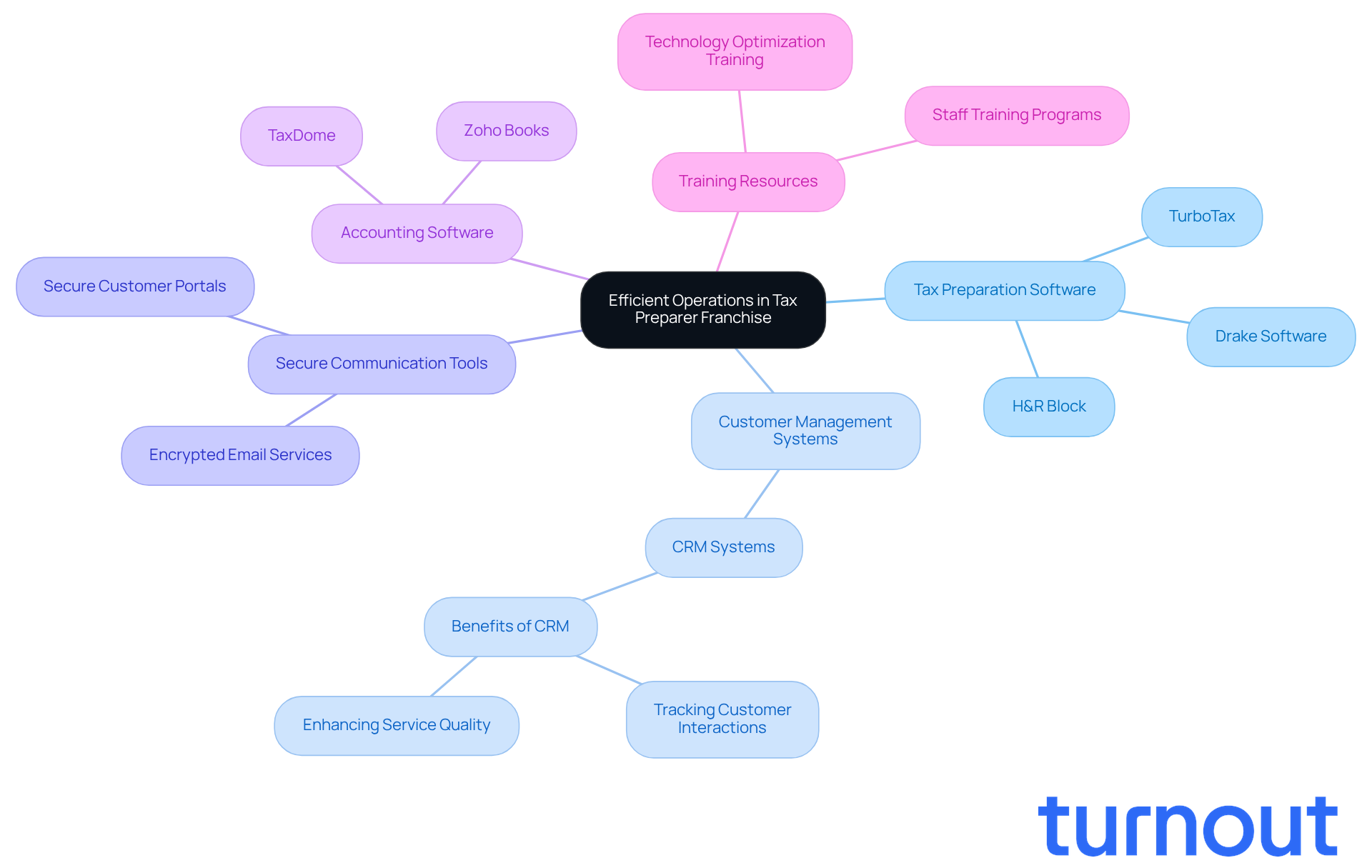

Tax Preparation Software: Choosing reliable tax software that complies with IRS standards is crucial. Options like TurboTax, H&R Block, and Drake Software offer features such as e-filing, customer management, and comprehensive reporting capabilities. These tools are vital for efficient tax processing, making your job easier and more effective.

-

Customer Management Systems: Implementing a robust customer relationship management (CRM) system is vital for tracking customer interactions, appointments, and follow-ups. It’s common to feel that managing customer relationships can be daunting, but effective systems can significantly enhance service quality and operational efficiency. A study even shows that companies can boost profits by nearly 100% by retaining just five percent more of their customers. Imagine the impact that could have on your business!

-

Secure Communication Tools: Safeguarding sensitive customer information is paramount. Utilizing secure communication platforms, such as encrypted email services or secure customer portals, ensures confidentiality and compliance with data protection regulations. Remember, a free consultation with a certified security expert can help you assess your security measures effectively, giving you peace of mind.

-

Accounting Software: Integrating accounting software is essential for managing your finances effectively. This will help you track expenses, generate financial reports, and maintain a clear overview of your business's financial health. Software like Zoho Books and TaxDome, which have high user ratings, can be particularly beneficial in simplifying this process.

-

Training Resources: Providing comprehensive training for you and your staff on the selected tools is crucial. This guarantees that everyone is prepared to optimize the efficiency of the technology, resulting in enhanced customer service and operational success. We’re here to help you every step of the way.

By strategically choosing and applying the appropriate technology, you can streamline operations, enhance customer service, and significantly improve overall efficiency in your tax preparer franchise. Remember, you have the support you need to thrive!

Develop Marketing Strategies to Attract Clients

To attract clients to your tax preparer franchise, we recognize that implementing effective marketing strategies is crucial. Here are some nurturing approaches to consider:

-

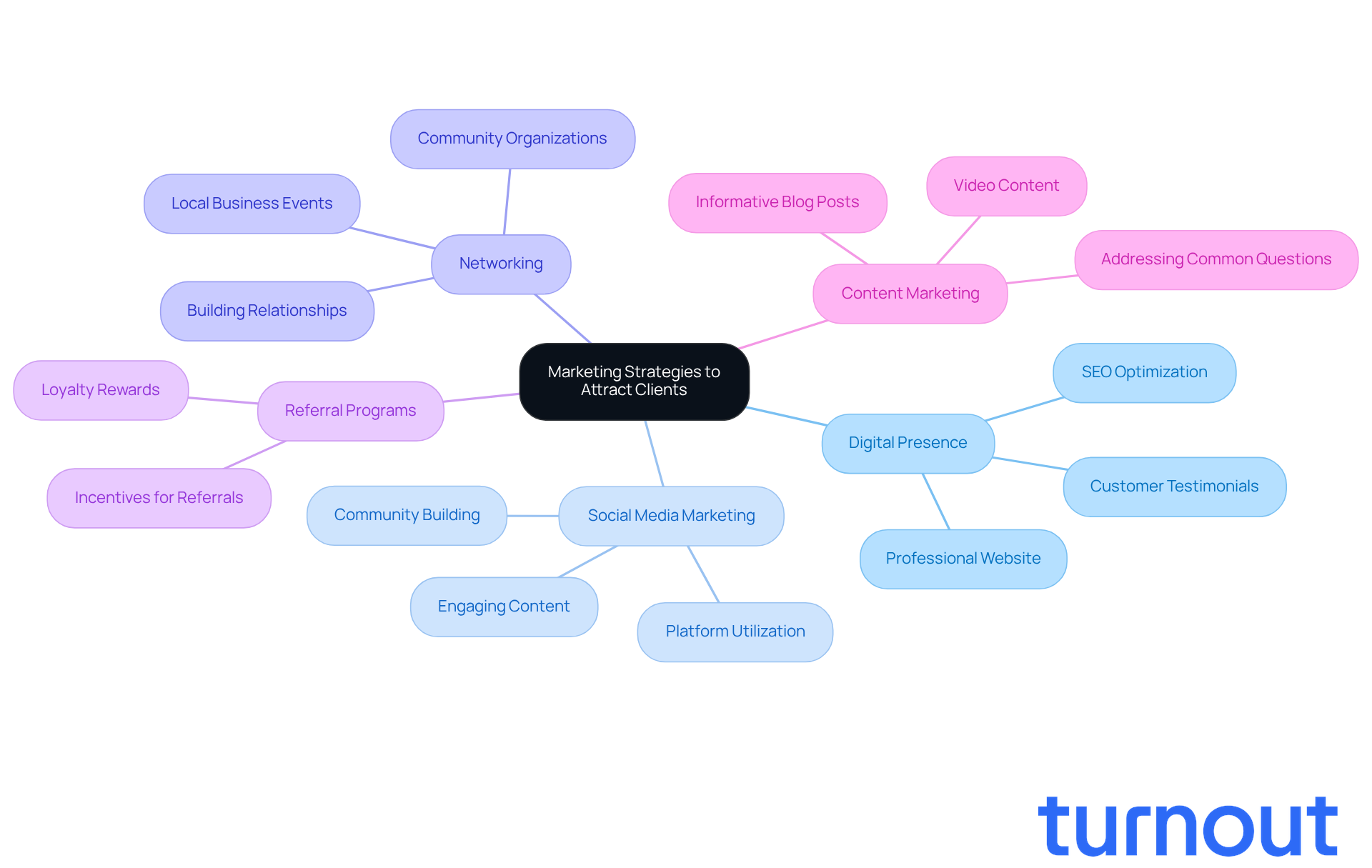

Establish a Digital Presence: Creating a professional website is a great first step. Highlight your services, share customer testimonials, and make sure your contact details are easy to find. Optimizing your site for search engines can help you reach more people who need your help.

-

Social Media Marketing: Platforms like Facebook, LinkedIn, and Instagram can be powerful tools for connecting with potential clients. Share valuable tax tips, updates, and promotions to engage your audience and build a supportive community.

-

Networking: Attending local business events and joining community organizations can help you connect with potential customers and other professionals. It’s common to feel a bit hesitant, but these connections can lead to meaningful relationships.

-

Referral Programs: Encourage satisfied customers to refer their friends and family by offering incentives, like discounts on future services. This not only rewards loyalty but also helps spread the word about your franchise.

-

Content Marketing: Creating informative blog posts or videos that address common tax questions can establish you as an expert in your field. This approach fosters trust and shows that you genuinely care about helping others.

By embracing these marketing strategies, you can effectively attract clients and support the growth of your tax preparer franchise. Remember, you’re not alone in this journey; we’re here to help you succeed.

Conclusion

Starting a tax preparer franchise can feel overwhelming, but you’re not alone in this journey. It’s essential to understand the business landscape and take a strategic approach to ensure your success. By choosing a business model that resonates with your aspirations and navigating the necessary legal requirements, you can build a solid foundation for your future.

In this guide, we’ve outlined key steps to help you along the way. From conducting market research to understanding the registration process, and integrating technology to streamline your operations, each element is designed to support your growth. Effective marketing strategies are also crucial for attracting clients and fostering growth in a competitive environment. Remember, each of these components plays a vital role in establishing a thriving tax preparation business.

Ultimately, launching a tax preparer franchise is about more than just compliance and operations; it’s about creating a brand that clients can trust. By leveraging the insights shared in this guide and taking decisive action, you can position yourself for long-term success in the tax preparation industry. Embrace this opportunity to make a meaningful impact in your community while pursuing your entrepreneurial dreams. We’re here to help you every step of the way.

Frequently Asked Questions

What should I consider when starting a tax preparer business?

You should consider your business model, whether to join a franchise or operate independently, and the associated costs and requirements.

What are the initial investment costs for tax preparation franchises?

Initial investments for tax preparation franchises in 2026 typically range from $25,000 to $50,000, with The Tax Team requiring a standard initial franchise fee of $35,000.

Are there ongoing fees associated with tax preparation franchises?

Yes, ongoing royalty fees usually range between 10% and 15% of your revenue. For example, Chick-fil-A charges 15% of gross sales plus 50% of pretax profits.

What licensing requirements do I need to be aware of?

You need to obtain a Preparer Tax Identification Number (PTIN) from the IRS to operate legally as a tax preparer.

Why is market research important for a tax preparation business?

Conducting thorough market research helps assess the demand for tax preparation services in your area, guiding your strategy and potential profitability.

How can I ensure the success of my tax preparer business?

By clearly outlining your operational model and understanding the necessary requirements, you lay a strong foundation for your venture's success.