Overview

This article offers a compassionate, step-by-step guide for setting up an installment plan with the IRS. We understand that navigating tax obligations can be overwhelming, and this guide details various payment options and the application process to help ease your concerns. It's important to comply with payment terms, and we provide practical tips to assist you in managing your obligations effectively. Remember, you are not alone in this journey; we’re here to help you resolve your tax liabilities without the burden of stress.

Introduction

Navigating tax obligations can often feel like an uphill battle. We understand that facing the daunting prospect of settling outstanding debts with the IRS can be overwhelming. Fortunately, setting up an installment plan offers a viable solution. This option allows individuals to manage their tax liabilities in a more structured and less stressful manner.

This guide provides a comprehensive overview of the various payment options available. You'll find a step-by-step process for applying, ensuring that you can find a manageable path forward. But what happens if unexpected financial challenges arise during this journey? It's common to feel anxious about whether a payment plan can still offer the relief needed to avoid further complications. We're here to help you navigate these challenges with care and understanding.

Understand IRS Payment Plans

Setting up an installment plan with the IRS allows you to settle your tax liabilities gradually rather than all at once. This option is especially helpful for those who find it challenging to pay their tax bill in full by the due date when considering setting up an . We understand that can be stressful, but grasping the fundamentals of these strategies can provide a structured way to manage your expenses.

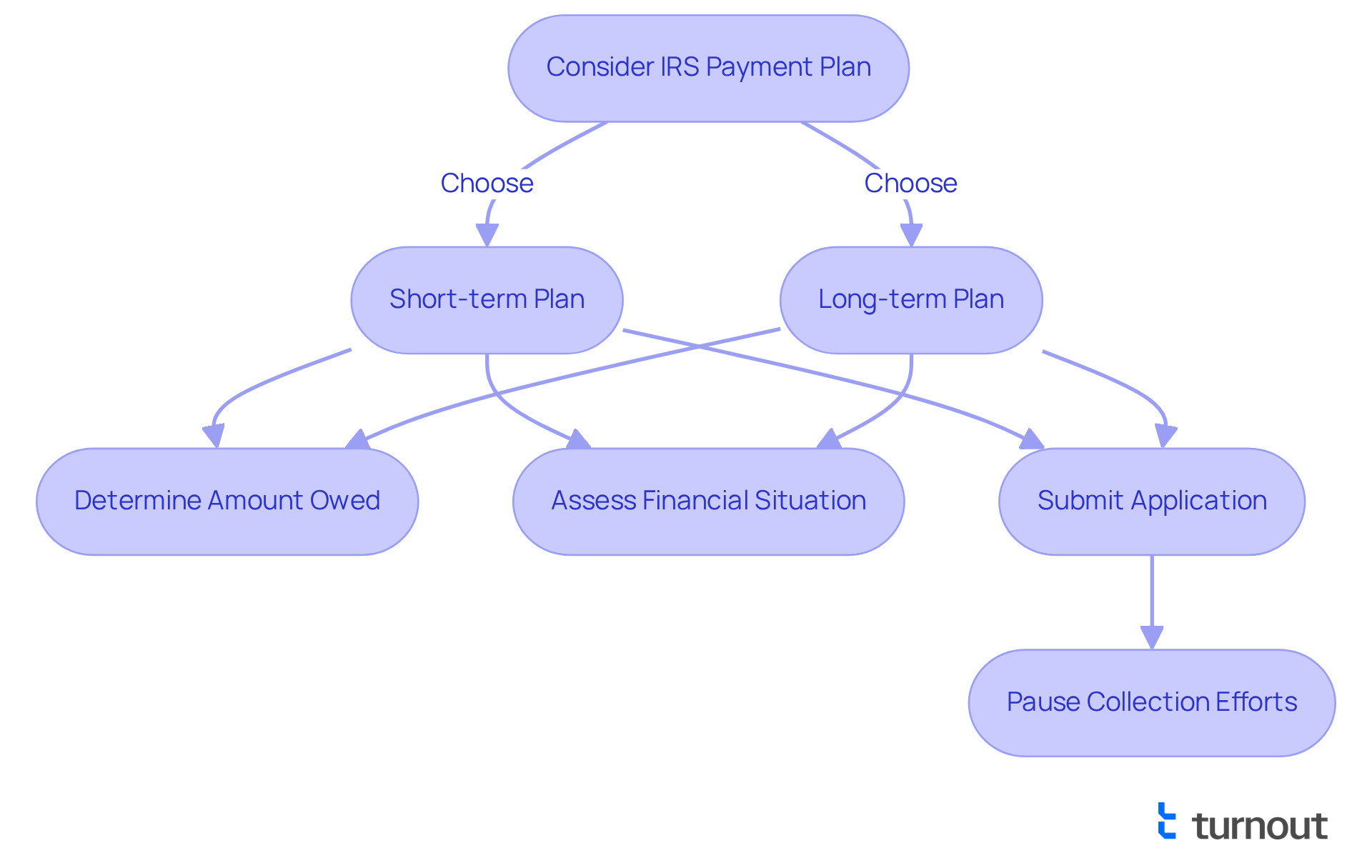

You typically have the choice between short-term and long-term options when it comes to [setting up an installment plan with IRS](https://blog.myturnout.com/10-tax-relief-companies-to-help-you-navigate-debt), depending on how much you owe and your financial situation. It’s common to feel overwhelmed, but entering into a financial arrangement can pause collection efforts, such as wage garnishments or bank levies. This gives you peace of mind as you work towards settling your debts. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Explore Types of IRS Payment Plans

Taxpayers often find themselves navigating challenging financial situations, and it's important to know that can provide several payment options to help. Each option is designed to accommodate different needs, ensuring that you can find a solution that works for you.

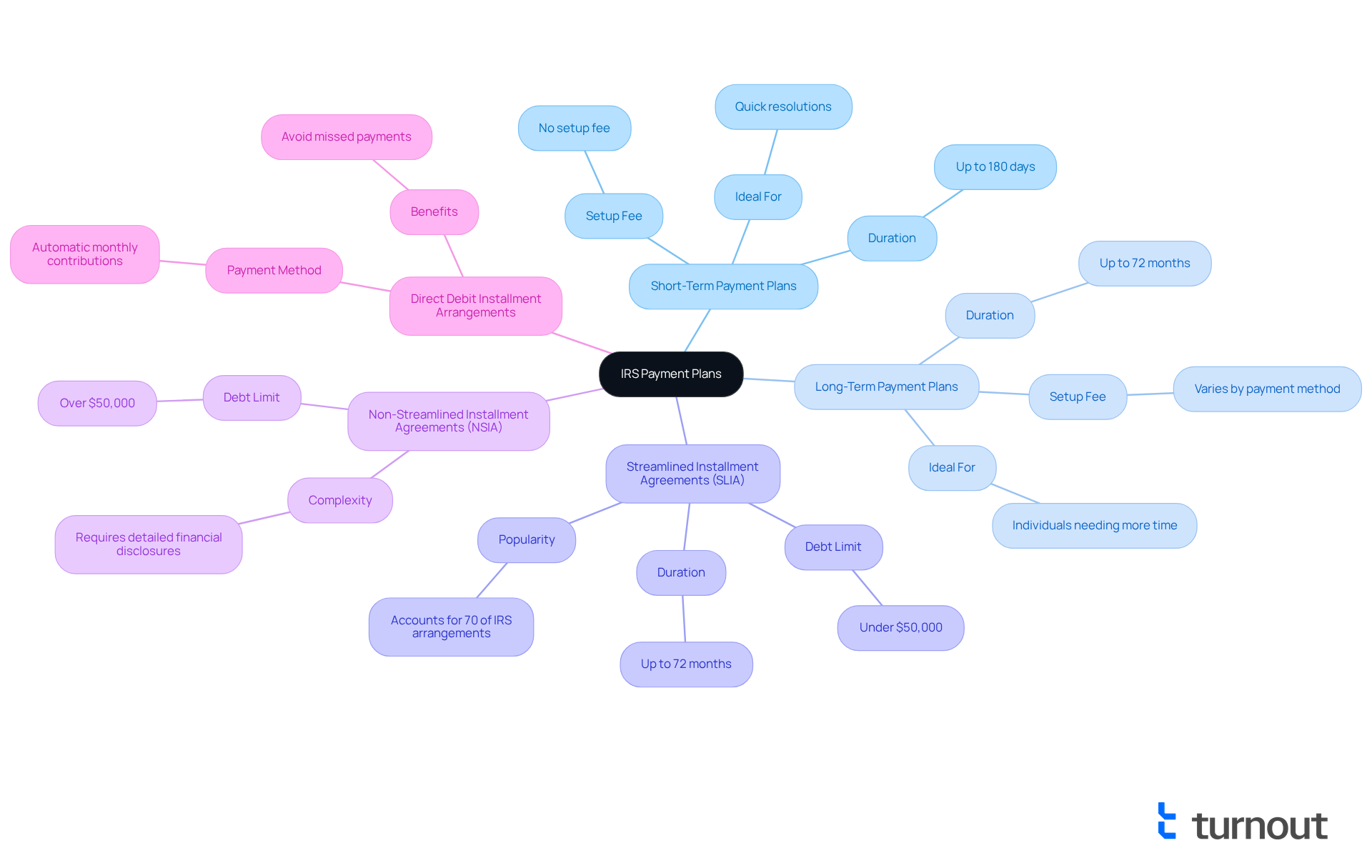

- : If you believe you can settle your balance within 180 days, this option is ideal. It typically incurs no setup fees, making it a cost-effective choice for those looking for quick resolutions.

- : For individuals needing more time, these plans extend up to 72 months. Depending on how you choose to pay, a setup fee may apply, but this flexibility can provide some much-needed breathing room.

- (SLIA): If your debt is under $50,000, SLIA simplifies the application process and allows repayment within 72 months. This strategy is favored by many, as it accounts for almost 70% of all IRS arrangements, helping the 88% of individual filers who owe less than $25,000.

- : If your debts exceed $50,000, NSIA may be necessary. However, be prepared for more detailed financial disclosures, as this option can be more complex.

- : These options allow for automatic monthly contributions from your bank account, helping you avoid missed payments and additional penalties.

Understanding these options is crucial. By selecting the most appropriate strategy based on your financial situation, you can ensure a manageable approach to resolving your tax liabilities by setting up an installment plan with IRS. Remember, it's essential to comply with the conditions of your financial arrangement; failing to do so may lead to the IRS canceling your agreement and requesting the total amount owed, along with fees and interest.

Additionally, keep in mind that the IRS's collection statute usually extends for 10 years from the date of assessment. This highlights the importance of taking prompt action when choosing a settlement option. You're not alone in this journey, and we're here to help you navigate these choices with care and compassion.

Apply for an IRS Payment Plan: Step-by-Step Process

While setting up an installment plan with IRS can feel overwhelming, we're here to help you through it. Just follow these simple steps:

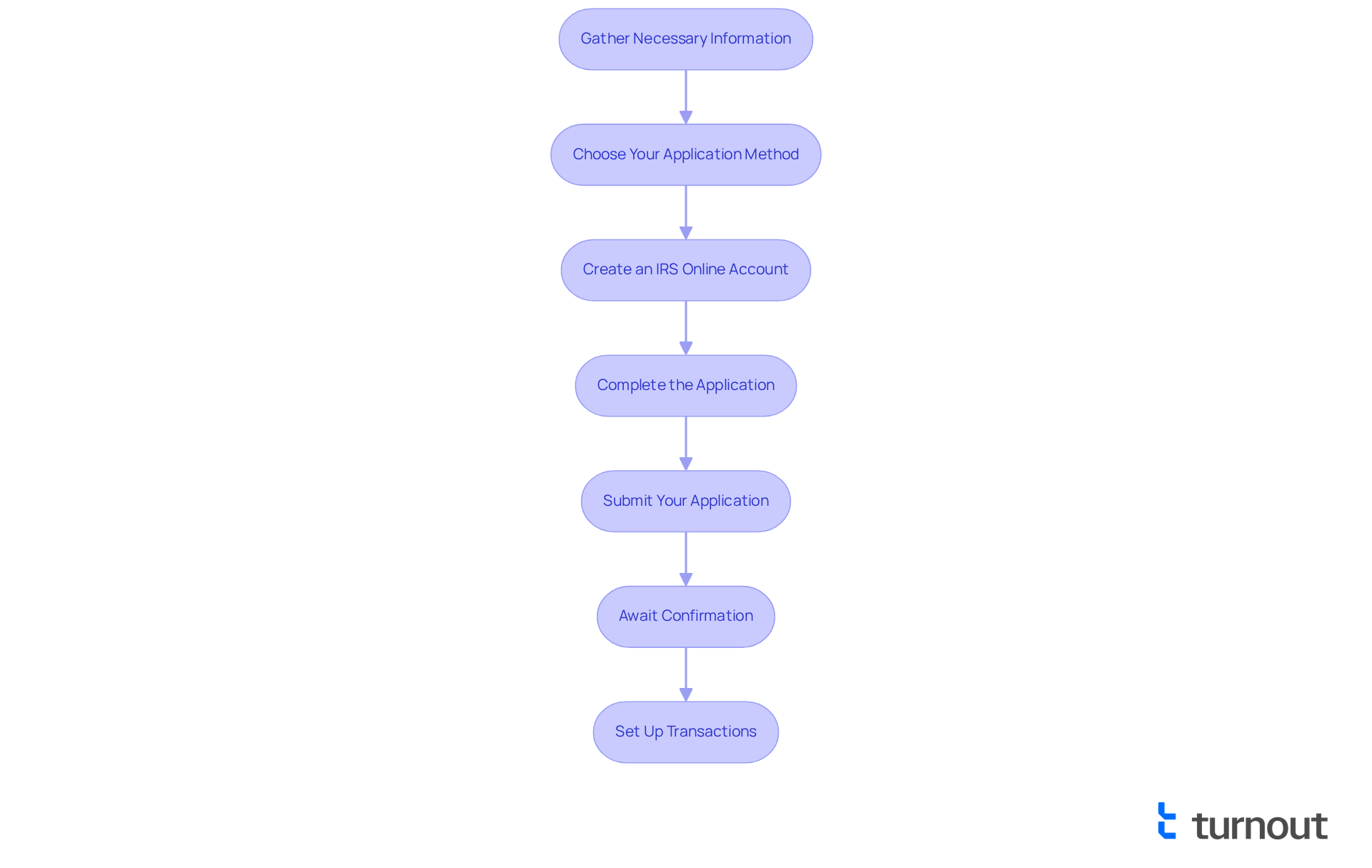

- Gather Necessary Information: Before you begin, take a moment to collect your personal information. This includes your Social Security number, tax return details, and information about your income and expenses. We understand that this can be a lot to manage, but having everything ready will make the process smoother.

- Choose Your Application Method: You have several options for applying—online, by phone, or by mail. The online method is often the quickest and most efficient, allowing you to get started right away.

- Create an : If you decide to apply online, you’ll need to create an IRS Online Account. This requires a valid email address and photo identification. It’s a straightforward process, and we’re here to support you.

- Complete the Application: Fill out the Online Payment Agreement application or Form 9465 (Installment Agreement Request) if you’re applying by mail. Be sure to specify how much you can pay each month. Remember, it’s important to be honest about your financial situation.

- : After completing your application, submit it through your chosen method. If applying online, you’ll receive immediate feedback on your application status, which can provide some peace of mind.

- Await Confirmation: The and send you a verification of your financial arrangement, including the terms and conditions. It’s common to feel anxious during this waiting period, but rest assured, you’re taking the right steps.

- : Once you’re approved, arrange your method of settlement—whether through direct debit or manual transactions. This will help ensure timely payments and avoid any penalties.

By following these steps, you can streamline the application process and increase your chances of setting up an installment plan with IRS. Remember, you are not alone in this journey, and we’re here to support you every step of the way.

Maintain Compliance with Your Payment Plan

To maintain compliance with your , we understand that can sometimes feel overwhelming. Here are some caring tips to help you :

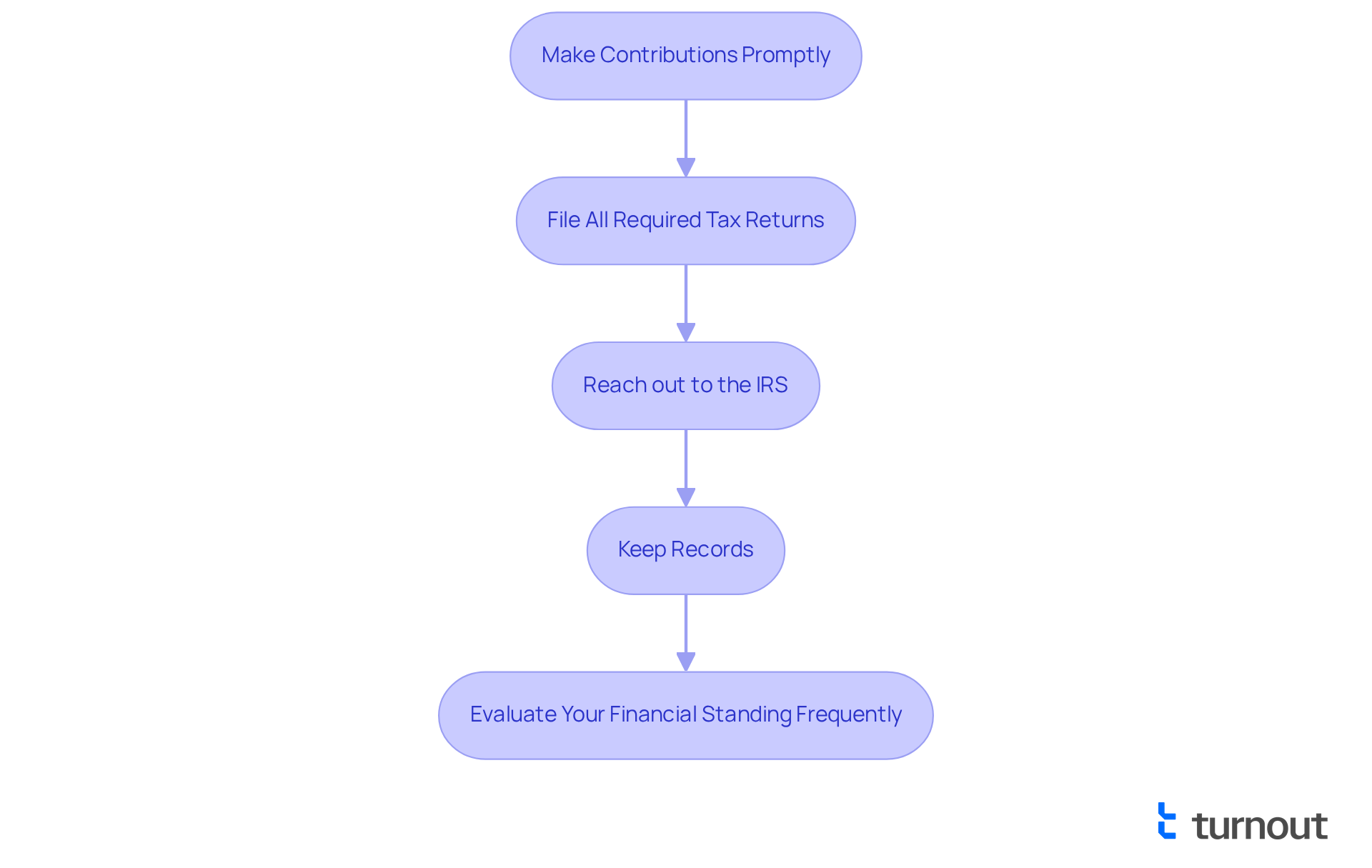

- Make Contributions Promptly: It's essential to fulfill your obligations by the due date each month. Consider setting up automatic transactions to help avoid missed deadlines. Research shows that around 25% of taxpayers fail to submit funds on their installment agreements, which can lead to penalties. Remember, you are not alone in this.

- File All Required Tax Returns: Staying current with your tax filings is crucial. The IRS requires that you submit all necessary returns while enrolled in a repayment plan. Neglecting to do so can put your agreement at risk, and we want to help you avoid that.

- Reach out to the IRS: If you're facing that might affect your ability to pay, don't hesitate to contact the IRS. Timely communication can prevent complications and help you explore your options. Remember, they are there to assist you.

- : It's wise to maintain documentation of all transactions and correspondence with the IRS. This can be invaluable if any disputes arise, ensuring you have a clear history of your compliance.

- Evaluate Your Financial Standing Frequently: Regularly assess your financial situation to ensure your strategy remains feasible. If circumstances change, modifying your financial arrangement can help you avoid defaulting.

As Gary Massey, a CPA, wisely notes, ' and evading penalties.' By following these guidelines, you can stay in good standing with your IRS payment plan while setting up an installment plan with IRS and work towards effectively resolving your tax debt. Remember, we're here to help you through this process.

Conclusion

Setting up an installment plan with the IRS can be a practical and compassionate solution for managing tax liabilities over time. We understand that financial difficulties can be overwhelming, but this process allows individuals to break down their payments into manageable amounts, alleviating the stress that often accompanies tax obligations. By exploring the various types of payment plans available, you can choose the option that best fits your unique financial situation.

Throughout this guide, we have shared key insights into the different types of IRS payment plans, from short-term options that require quick resolution to long-term arrangements that provide extended repayment periods. The step-by-step application process has been outlined, emphasizing the importance of thorough preparation and compliance. Additionally, we have provided practical tips for maintaining adherence to the payment plan, ensuring that you can navigate this journey successfully.

Ultimately, taking action to set up an IRS installment plan is a significant step towards financial stability. By understanding the options available and adhering to the guidelines, you can effectively manage your tax debts while avoiding penalties and complications. Remember, support is available throughout this process, empowering you to regain control over your financial future. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is an IRS payment plan?

An IRS payment plan, or installment plan, allows taxpayers to settle their tax liabilities gradually rather than paying the full amount all at once.

Who can benefit from setting up an IRS payment plan?

Individuals who find it challenging to pay their tax bill in full by the due date can benefit from setting up an IRS payment plan.

What are the options available for IRS payment plans?

Taxpayers typically have the choice between short-term and long-term payment plan options, depending on the amount owed and their financial situation.

What are the advantages of entering into an IRS payment plan?

Entering into a payment plan can pause collection efforts such as wage garnishments or bank levies, providing peace of mind while working towards settling debts.

How can taxpayers get support during the process of setting up a payment plan?

Taxpayers can seek help and guidance throughout the process of setting up an IRS payment plan to ensure they understand their options and obligations.