Introduction

Navigating the complexities of Social Security Disability Insurance (SSDI) can feel overwhelming, especially for self-employed individuals. We understand that you face unique hurdles in proving your eligibility. This guide is here to help you every step of the way, offering a comprehensive approach to applying for SSDI. Our goal is to ensure that freelancers and independent workers can access the vital financial support they need.

It's common to feel uncertain with fluctuating incomes and extensive documentation requirements. The landscape of eligibility criteria is always changing, which can add to your stress. So, how can you effectively position yourself for success in this challenging application process? We're here to provide the guidance and support you deserve.

Understand SSDI and Its Importance for Self-Employed Individuals

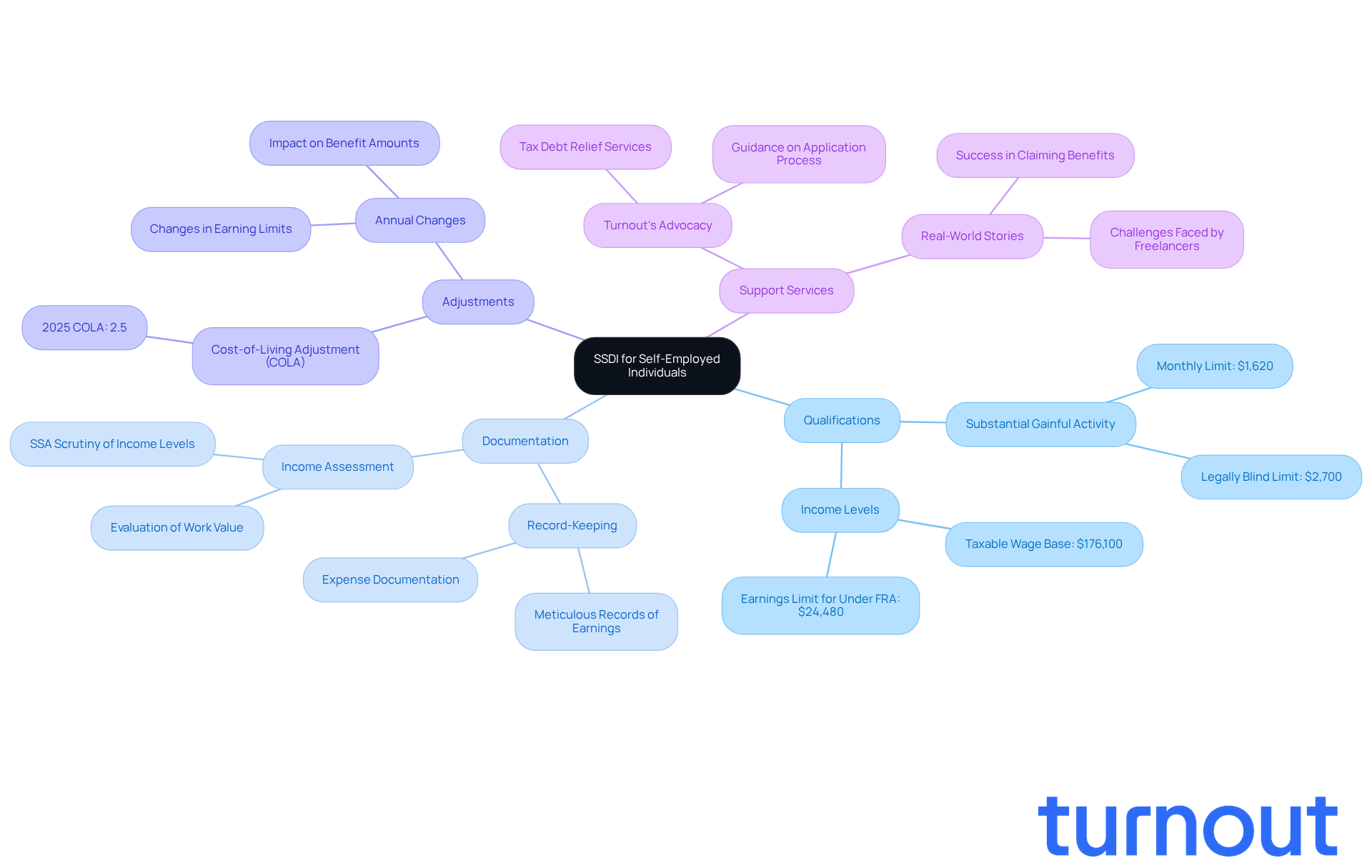

Social Security Disability Insurance is a vital lifeline for those unable to work due to disabilities. If you're a freelancer, navigating the complexities of this insurance can feel overwhelming. Your earnings and work habits differ from traditional employees, making it essential to understand how to qualify. To qualify for self employed SSDI, individuals must prove that their disability prevents them from engaging in substantial gainful activity (SGA), which is defined as earning over $1,620 per month in 2025.

At Turnout, we provide the tools and services you need to navigate this intricate process. Our trained nonlawyer advocates are here to help you understand the application requirements and ensure you're well-prepared to present your case effectively. It's important to note that while we offer guidance, Turnout is not a law firm and does not provide legal advice. Evaluating business income for disability benefits eligibility requires a careful assessment of both the amount and value of work performed. Keeping meticulous records of your earnings and expenses is crucial to substantiate your claims. This documentation is especially important, as the Social Security Administration (SSA) closely scrutinizes income levels, particularly with recent adjustments to earning limits and benefit calculations.

For instance, disability benefit recipients will see a cost-of-living adjustment (COLA) of 2.5% in 2025, reflecting the ongoing inflation affecting living expenses. Additionally, the SSA has increased the taxable wage base for Social Security taxes to $176,100, which impacts how much of your income is subject to taxation. Turnout also offers services related to tax debt relief, providing further support as you navigate your financial challenges.

Real-world stories highlight the hurdles and triumphs freelancers face when applying for Social Security Disability Insurance. Many have successfully claimed benefits by proving their inability to maintain previous income levels due to health issues. As the landscape of disability benefits evolves, understanding these dynamics is crucial for individuals who are self employed SSDI seeking financial assistance. Accurate record-keeping and staying informed about the latest regulations are key to ensuring a successful application and maintaining your benefits. With Turnout's support, you can confidently navigate the disability benefits process, enhancing your chances of securing the financial assistance you need. Remember, you are not alone in this journey; we're here to help.

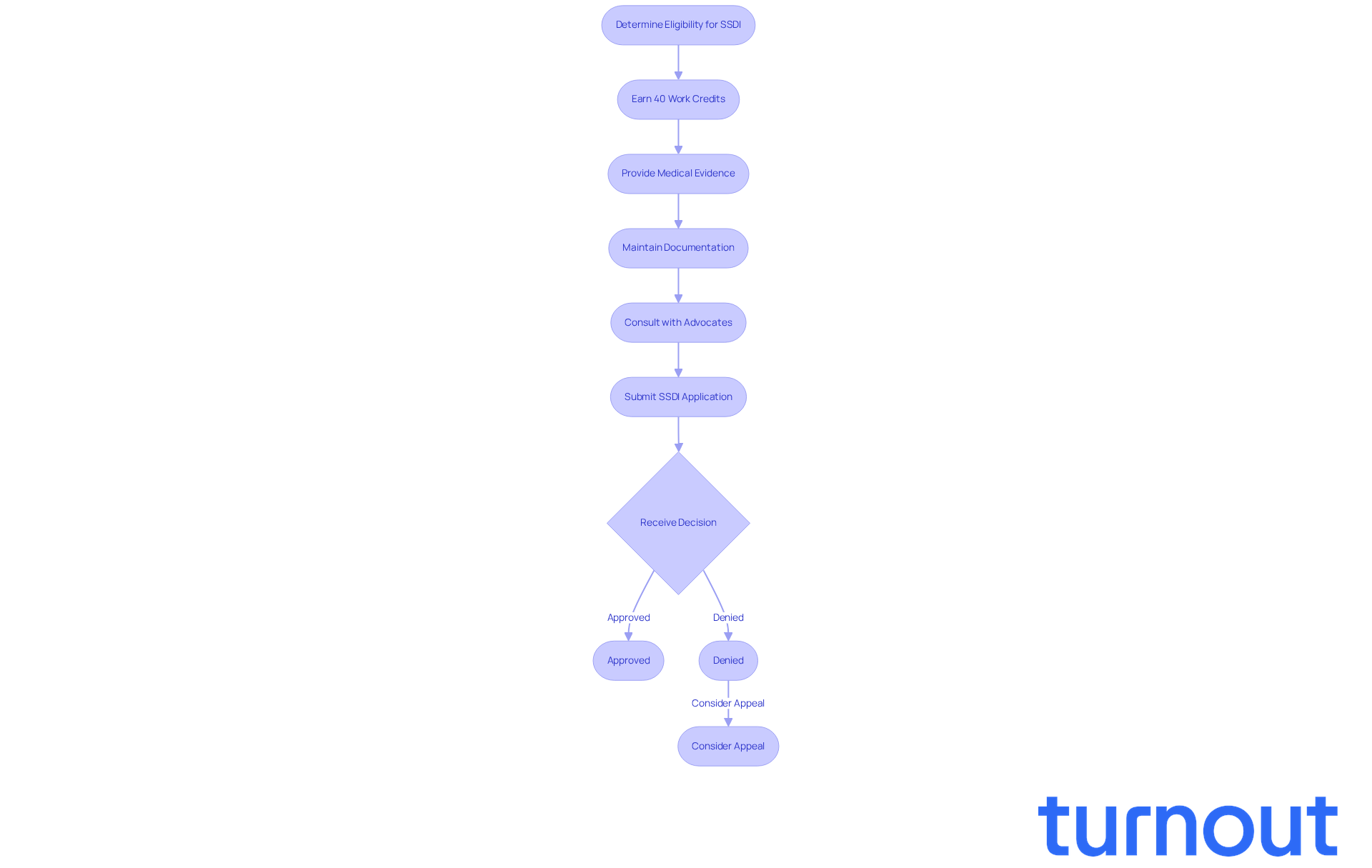

Determine Eligibility Criteria for SSDI as a Self-Employed Individual

Navigating the world of Social Security Disability Insurance can be overwhelming, especially for those who are self employed SSDI recipients. We understand that you may have concerns about meeting the eligibility criteria. To qualify, you typically need to have earned around 40 work credits, with at least 20 of those earned in the last 10 years before your disability began. It’s essential to provide strong medical evidence that clearly shows how your disability prevents you from doing substantial work.

At Turnout, we want to reassure you that while we’re not a law office and don’t provide legal counsel, we do offer trained nonlawyer advocates. These professionals are here to guide you through the disability claims process, helping to improve your chances of approval without the need for legal representation.

If you're a freelancer, keeping track of your income, expenses, and taxes is crucial for calculating your work credits. Each year, the Social Security Administration sets a specific amount of earnings that counts as one work credit. For example, in 2025, earning $1,620 per month qualifies as gainful employment, which can affect how you accumulate credits. It’s important to maintain thorough records of your business activities, including hours worked and roles performed, as this documentation supports your disability claims.

Many individuals who are self employed SSDI have successfully qualified for disability benefits by carefully documenting their medical conditions and demonstrating how their impairments hinder their ability to manage their business effectively. By following these guidelines and ensuring all necessary documentation is in order, you can approach the Social Security Disability Insurance application process with greater confidence. Remember, you’re not alone in this journey; Turnout’s dedicated professionals are here to support you.

Additionally, for those facing tax debt, Turnout collaborates with IRS-licensed enrolled agents to provide comprehensive support. We’re here to help you every step of the way.

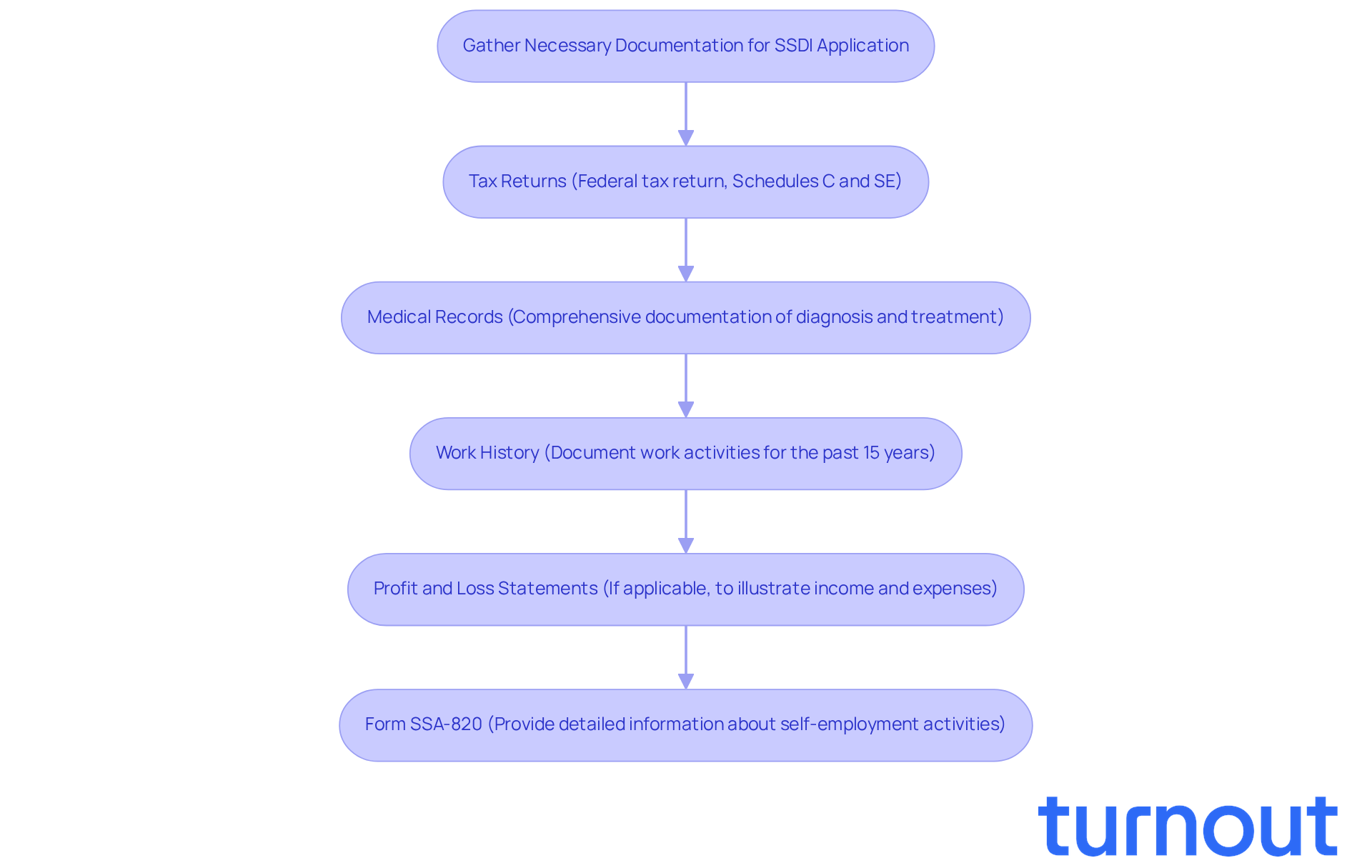

Gather Necessary Documentation for Your SSDI Application

Applying for disability benefits can feel overwhelming, especially for those who are self employed ssdi individuals. We understand that gathering the right documents is crucial for your claim. Here’s a helpful list of what you’ll need:

-

Tax Returns: Start by submitting your federal tax return (IRS Form 1040) from the previous year. Don’t forget to include Schedules C and SE, which detail your business income and self-employment taxes. Accurate tax documentation is essential, as it serves as primary proof of your income and work activity.

-

Medical Records: It’s important to gather comprehensive medical documentation that outlines your diagnosis and treatment history. This evidence will help illustrate how your condition limits your ability to work, establishing the severity of your disability.

-

Work History: Documenting your work history for the past 15 years is vital. Include all self-employment activities to demonstrate your earnings and work credits, which are necessary for self employed ssdi eligibility.

-

Profit and Loss Statements: If applicable, prepare profit and loss statements for your business. These will illustrate your income and expenses, providing a clear picture of your financial situation to support your claim.

-

Complete Form SSA-820 to provide detailed information about your self employed ssdi activities. The SSA will review this to assess your eligibility.

Having these documents organized can simplify the process and significantly increase your chances of a successful claim. Remember, submissions with complete documentation tend to have higher approval rates. By ensuring that all required documentation is in order, you can navigate the disability benefits process with greater confidence and understanding. You are not alone in this journey; we’re here to help.

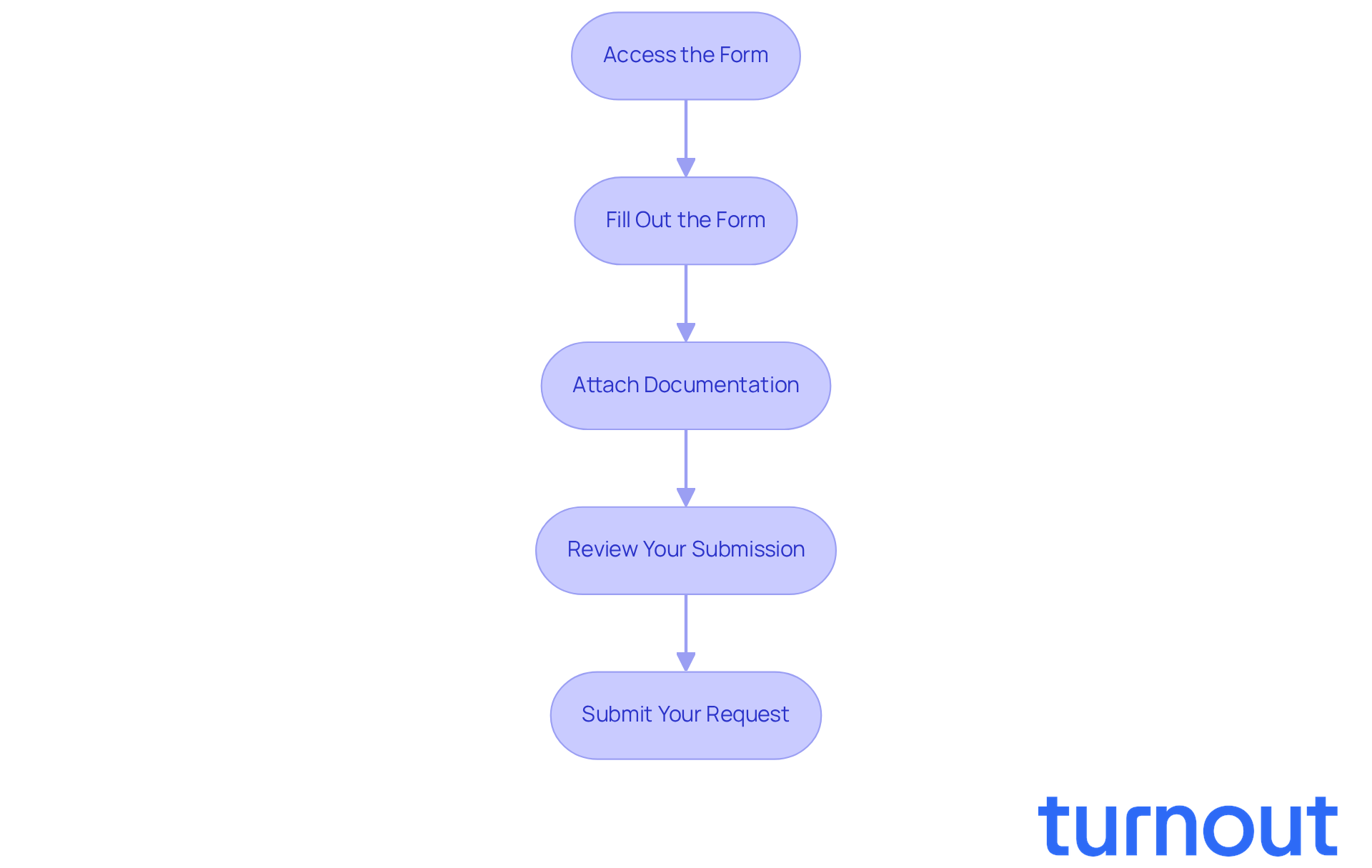

Complete and Submit Your SSDI Application

Navigating the SSDI application process can feel overwhelming, but we're here to help you every step of the way. By following these simple steps, you can make the process smoother and increase your chances of success:

- Access the Form: Start by visiting the Social Security Administration's website or your local SSA office to get the SSDI form (Form SSA-16).

- Fill Out the Form: Take your time to accurately provide your personal details, medical conditions, and work history. Remember, being thorough and honest is crucial - missing information can lead to delays or even denials.

- Attach Documentation: Gather all necessary documents, like tax returns and medical records, that support your claim. Having everything ready can really help streamline your submission.

- Review Your Submission: Before you send it off, double-check your documents for completeness and accuracy. This step is vital to avoid common mistakes that could hinder your application.

- Submit Your Request: You can submit your application online, by mail, or in person at your local SSA office. Don’t forget to keep copies of everything you send; this will be important for tracking your application status.

By following these steps, you can enhance the likelihood of a smooth processing experience for your disability benefits application. Remember, you are not alone in this journey, and taking these steps can make a significant difference.

Navigate Common Challenges in the SSDI Application Process

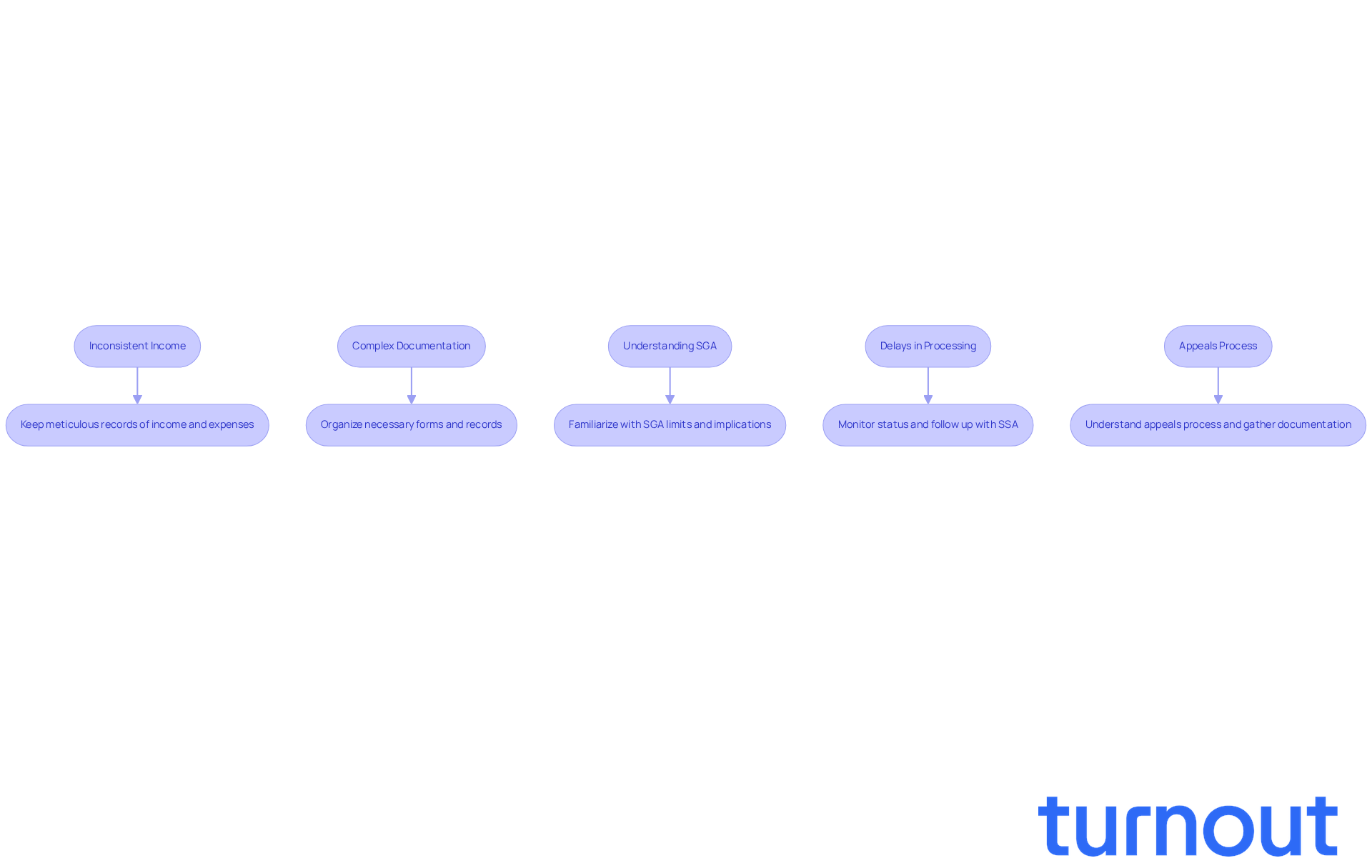

Self-employed individuals often face unique challenges when applying for self employed SSDI. We understand that navigating this process can feel overwhelming. Here are some common issues you might face, along with strategies to help you through:

-

Inconsistent Income: Fluctuating income can make it tough to show consistent earnings. Keeping meticulous records of your income and expenses can provide a clearer picture of your financial situation.

-

Complex Documentation: The paperwork required for independent applicants can be extensive. Organizing all necessary forms and records ahead of time can help streamline your submission process.

-

Understanding SGA: Many self-employed individuals find the concept of Substantial Gainful Activity (SGA) confusing. Familiarizing yourself with the SGA limits and their implications can help you avoid potential pitfalls.

-

Delays in Processing: It’s common to experience delays with SSDI requests, which can be frustrating. Staying proactive by monitoring your status and being ready to follow up with the SSA can make a difference.

-

Appeals Process: If your request is denied, remember that you have the right to appeal. Understanding the appeals process and gathering additional documentation can strengthen your case.

By recognizing these challenges and preparing accordingly, you can significantly improve your chances of a successful self employed SSDI application. Remember, you are not alone in this journey, and we’re here to help.

Conclusion

Navigating the complexities of Social Security Disability Insurance (SSDI) can feel overwhelming, especially for self-employed individuals facing disabilities. We understand that understanding eligibility criteria, gathering necessary documentation, and completing the application process are essential steps in securing the financial support you need during challenging times. With the right knowledge and resources, you can approach this intricate system with greater confidence.

Throughout this guide, we’ve highlighted key points that matter most to you. Maintaining accurate records of income and expenses is crucial, as is having comprehensive medical documentation. We’ve also outlined the steps to complete and submit your SSDI application. It’s common to face challenges as a self-employed applicant, such as inconsistent income and complex documentation. But don’t worry; we’ve offered strategies to help you overcome these hurdles effectively.

Remember, you don’t have to navigate this journey alone. With support from resources like Turnout, you can gain a clearer understanding of the application process and enhance your chances of success. The importance of SSDI for self-employed individuals cannot be overstated; it serves as a vital safety net, providing the financial stability needed to face life’s challenges. Taking proactive steps today can lead to a more secure tomorrow. We’re here to help you every step of the way.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI) and why is it important for self-employed individuals?

SSDI is a crucial financial support system for individuals unable to work due to disabilities. For self-employed individuals, understanding SSDI is essential as their earnings and work habits differ from traditional employees.

How can self-employed individuals qualify for SSDI?

To qualify for SSDI, self-employed individuals must demonstrate that their disability prevents them from engaging in substantial gainful activity (SGA), which is earning over $1,620 per month in 2025.

What role does Turnout play in assisting individuals with SSDI applications?

Turnout provides tools and services to help individuals navigate the SSDI application process. Their trained nonlawyer advocates assist in understanding the requirements and preparing cases effectively, though they do not offer legal advice.

What documentation is necessary for SSDI eligibility as a self-employed individual?

It's crucial to keep meticulous records of earnings, expenses, and work performed. This documentation supports claims and is closely scrutinized by the Social Security Administration (SSA).

What are the recent changes to SSDI benefits and taxable income?

In 2025, disability benefit recipients will receive a cost-of-living adjustment (COLA) of 2.5%. Additionally, the SSA has increased the taxable wage base for Social Security taxes to $176,100.

How can freelancers demonstrate their eligibility for SSDI benefits?

Freelancers can qualify for SSDI by providing strong medical evidence of their disability and documenting how it hinders their ability to maintain previous income levels or manage their business effectively.

What should self-employed individuals do to improve their chances of SSDI approval?

Self-employed individuals should maintain thorough records of their business activities and medical conditions to support their disability claims and ensure all necessary documentation is in order.

Does Turnout provide assistance for tax-related issues as well?

Yes, Turnout offers services related to tax debt relief and collaborates with IRS-licensed enrolled agents to provide comprehensive support for individuals facing financial challenges.