Introduction

Navigating the mortgage landscape can feel overwhelming, especially if you don’t have the traditional two years of tax returns to show. We understand that this can be a source of stress. But don’t worry - there are evolving lender requirements and alternative documentation options that can help you secure a mortgage tailored to your unique financial situation.

In this article, we’ll explore essential steps and strategies that empower you to prepare confidently for your mortgage application, even without standard tax documentation. What key actions can you take to enhance your chances of approval while ensuring you’re financially ready? Let’s dive in together and find the support you need.

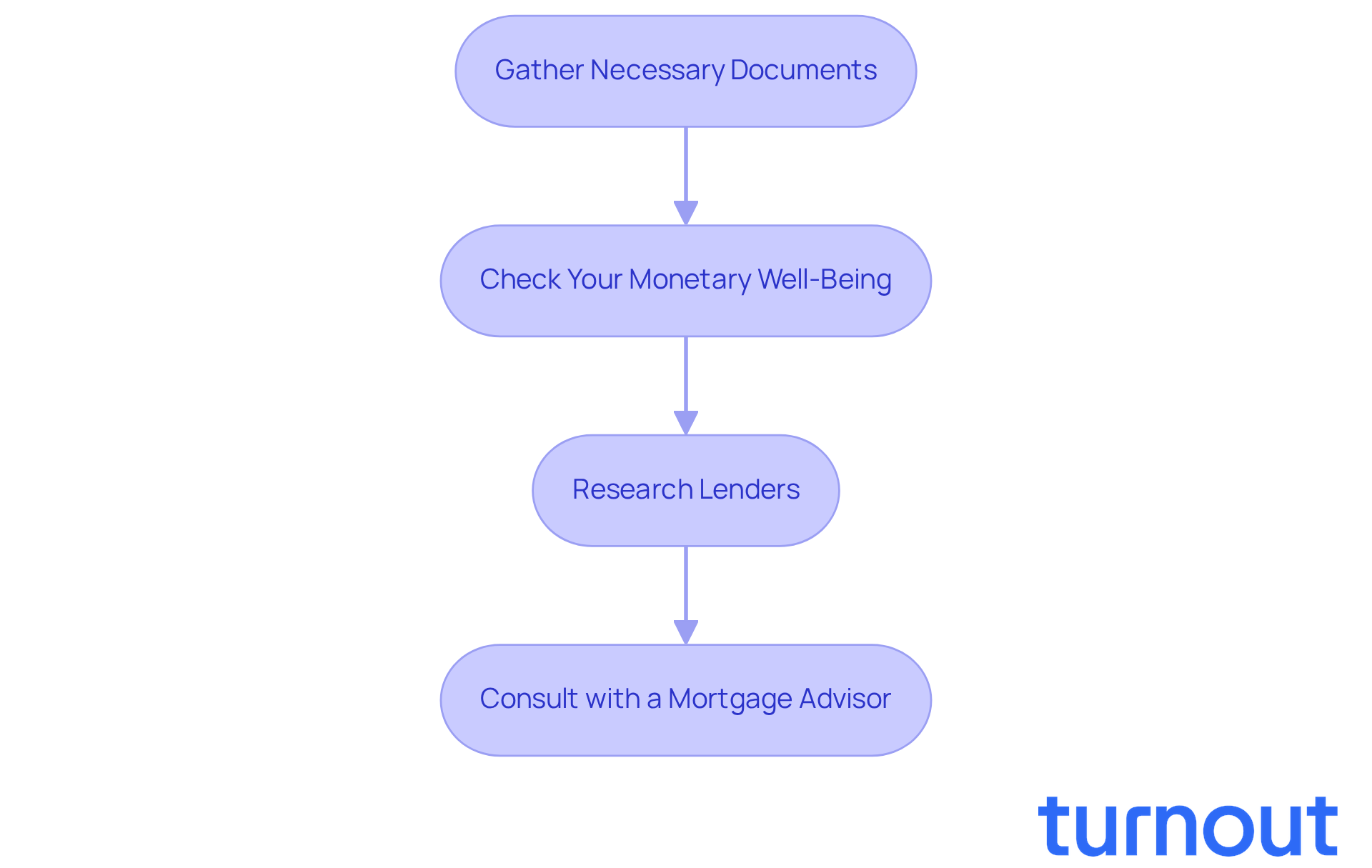

Prepare for Your Mortgage Application

-

Gather Necessary Documents: We understand that starting this process can feel overwhelming. Begin by collecting essential documents like proof of income, bank statements, and identification. This may include recent pay stubs, W-2 forms, and any other financial documentation that lenders typically require. If you have other income sources, such as alimony or child support, be ready to provide that information too. It can really strengthen your application.

-

Check Your Monetary Well-Being: It's common to feel uncertain about your financial situation. Take a moment to evaluate your current economic status, including savings, debts, and credit score. Understanding your financial well-being will give you a clearer picture of what you can afford and help set realistic expectations. Lenders often prefer borrowers with steady income and manageable debt levels, so ensure your profile reflects this.

-

Research Lenders: Finding the right lender can make a big difference. Look for lenders that offer a mortgage without 2 years tax returns. Some, like Guild Mortgage and AmeriHome, specialize in alternative documentation loans, which can be especially helpful for self-employed individuals or those looking for a mortgage without 2 years tax returns. Remember, Fannie Mae has removed its minimum credit score requirement as of November 15, 2025, allowing for a broader assessment of borrower risk. This change makes it easier for those with thin credit files to qualify.

-

Consult with a Mortgage Advisor: If you can, reach out to a mortgage advisor who can provide personalized guidance tailored to your financial situation. They can help you navigate the application process effectively and may suggest strategies to improve your chances of approval. As Lindsay Martinez, a money advisor, wisely notes, patience is key. There may be some back-and-forth with your lender regarding documentation. Also, be prepared to document the source of your down payment, as lenders often ask about this to assess your financial stability. Remember, you're not alone in this journey; we're here to help.

Check Your Credit Report

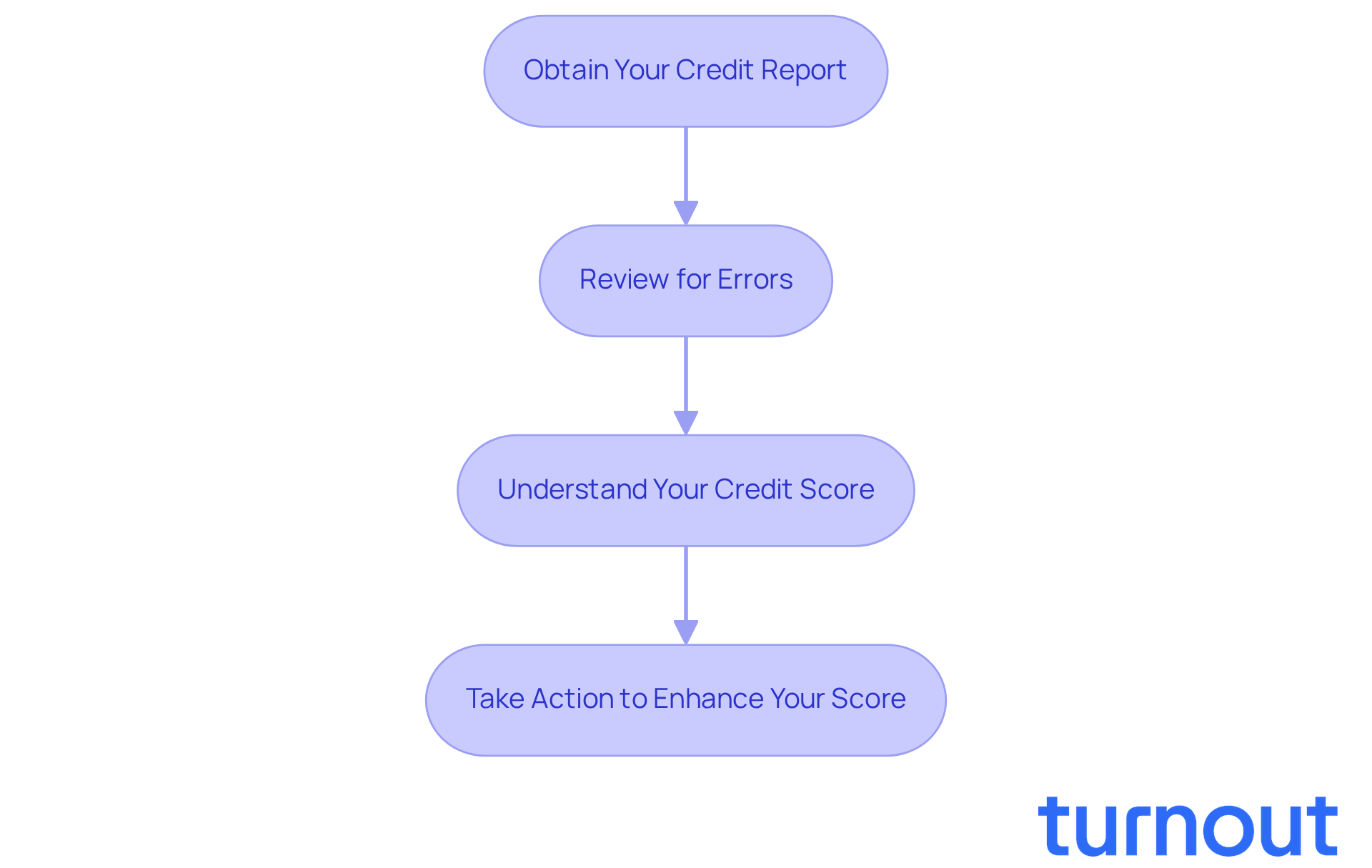

1. Obtain Your Credit Report: We understand that navigating your credit can be overwhelming. Start by requesting a free copy of your credit report from the three major credit bureaus: Equifax, Experian, and TransUnion. Remember, you’re entitled to one free report from each bureau every year.

2. Review for Errors: It’s common to feel anxious about inaccuracies on your report. Take a moment to carefully examine it for any errors that could hurt your score. If you spot any discrepancies, don’t hesitate to dispute them with the credit bureau. You deserve a fair assessment of your credit.

3. Understand Your Credit Score: Familiarizing yourself with your credit score is crucial. Knowing what factors influence it can empower you. A higher score can lead to better loan rates, so understanding where you stand is essential for your financial health.

4. Take Action to Enhance Your Score: If your score isn’t where you’d like it to be, don’t worry; there are steps you can take to improve it. Consider reducing debts, making timely payments, and avoiding new credit inquiries before applying for a loan. Remember, you’re not alone in this journey, and we’re here to help you every step of the way.

Establish Your Budget

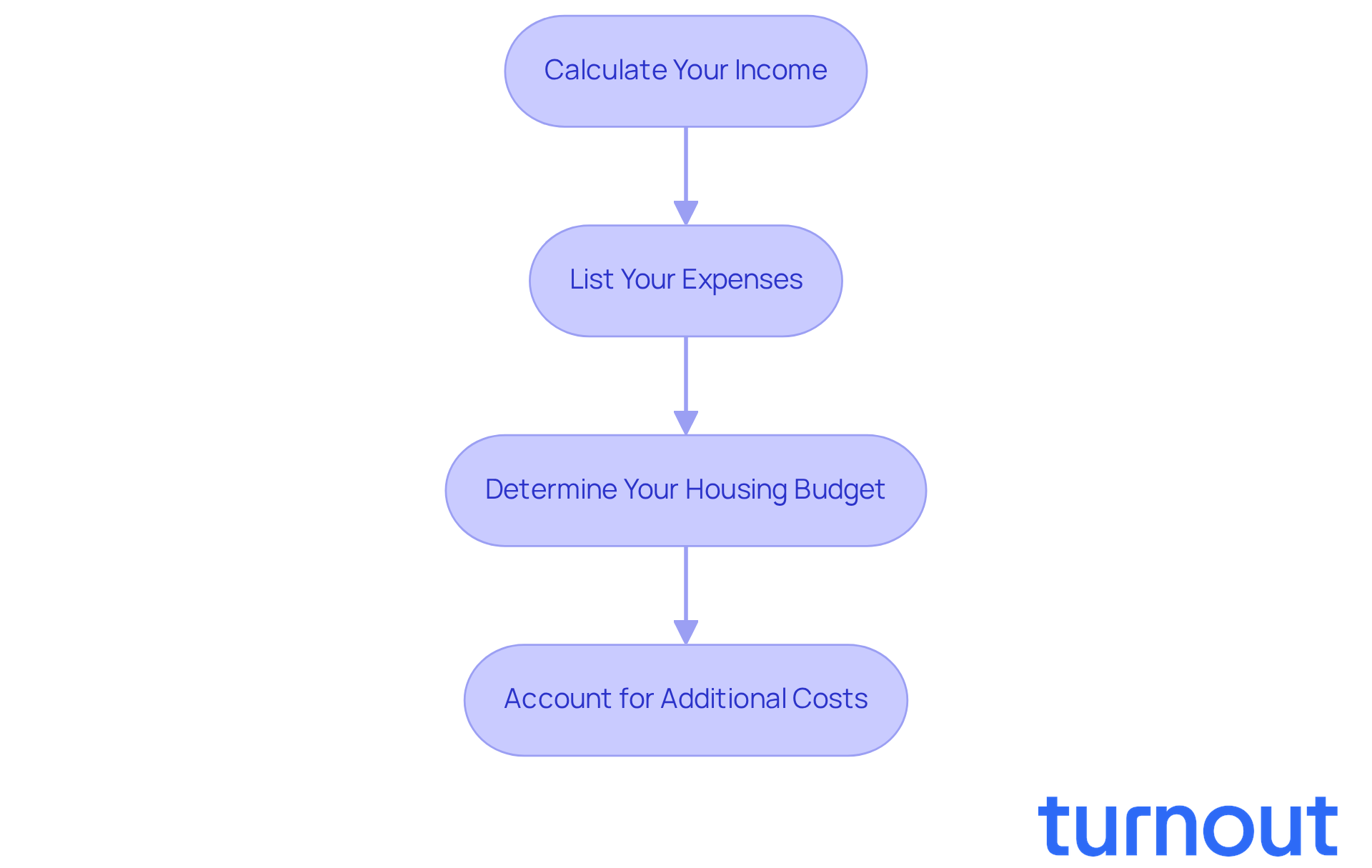

Calculate Your Income: We understand that managing finances can feel overwhelming. Start by determining your total monthly income, including all sources such as salary, bonuses, and any side income. This foundational step is crucial for your budgeting journey.

List Your Expenses: It’s common to feel unsure about where your money goes each month. Document all your monthly expenses, including fixed costs like rent and utilities, as well as variable costs such as groceries and entertainment. This will help you gain clarity on your spending habits.

Determine Your Housing Budget: A helpful guideline is to spend no more than 28-30% of your gross monthly income on housing costs. By using this percentage, you can calculate your potential loan payment, ensuring it aligns with your financial goals.

Account for Additional Costs: Remember, it’s not just about the mortgage. Include property taxes, homeowners insurance, and maintenance costs in your budget. These additional expenses can significantly impact your overall housing costs, and being prepared will help you feel more secure in your decisions.

Understand Total Monthly Housing Costs

-

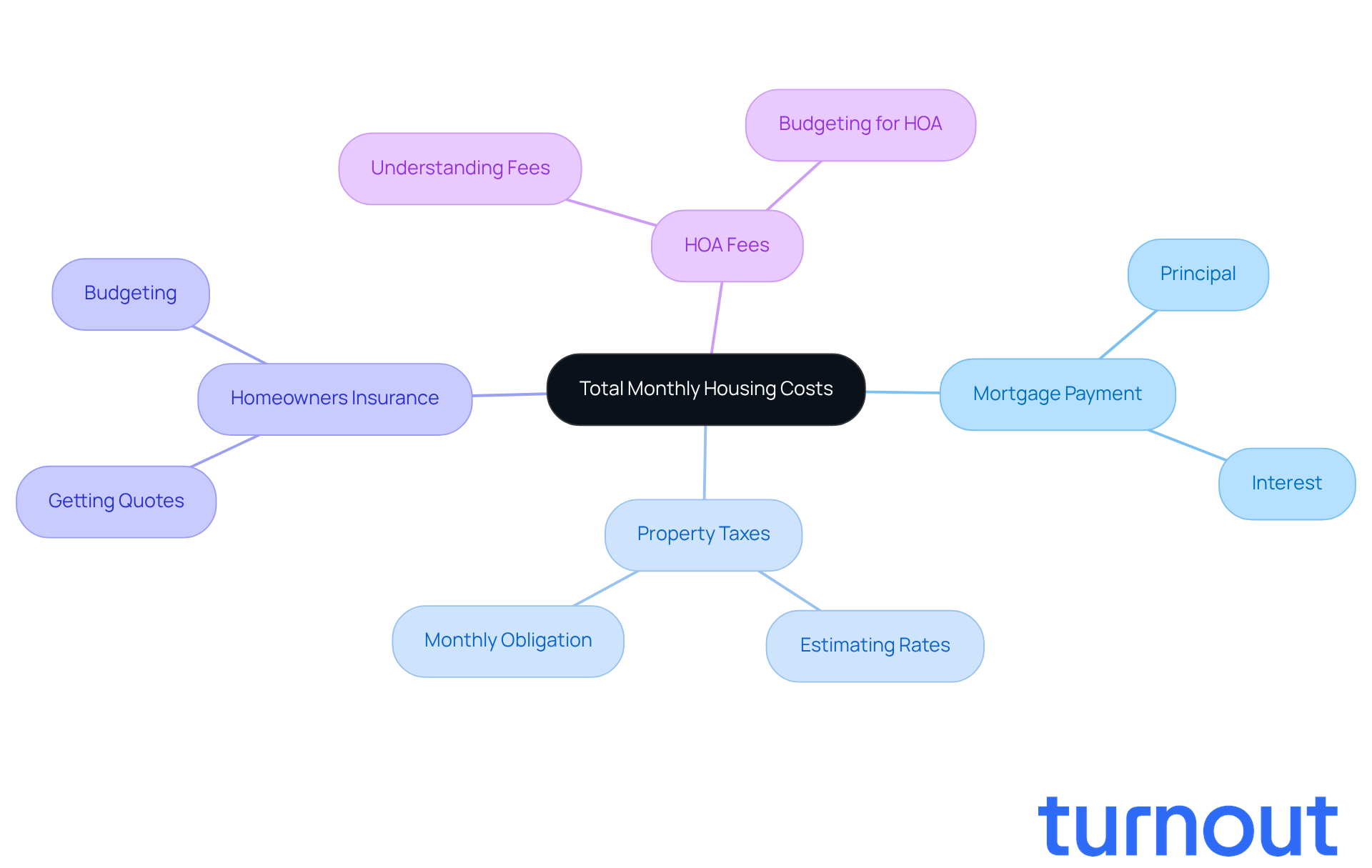

Understanding Your Mortgage Payment: We know that navigating your monthly mortgage payment can feel overwhelming. Typically, it includes principal, interest, property taxes, and homeowners insurance (PITI). It’s important to account for each of these components to avoid surprises down the road.

-

Estimating Property Taxes: Researching property tax rates in your desired area can help you estimate your annual payment. Once you have that figure, simply divide it by 12 to find your monthly tax obligation. We understand that this can be a significant part of your budget, so being prepared is key.

-

Budgeting for Homeowners Insurance: Getting quotes for homeowners insurance is a smart move. This will give you a clearer picture of how much you need to set aside each month for this essential expense. Remember, it’s all about planning for your peace of mind.

-

Considering Homeowners Association (HOA) Fees: If your property is part of a community with an HOA, it’s crucial to factor in any associated fees. These can vary widely, and understanding them upfront can help you manage your finances better. You're not alone in this journey; we're here to help you navigate these details.

Evaluate Your Total Debt Load

-

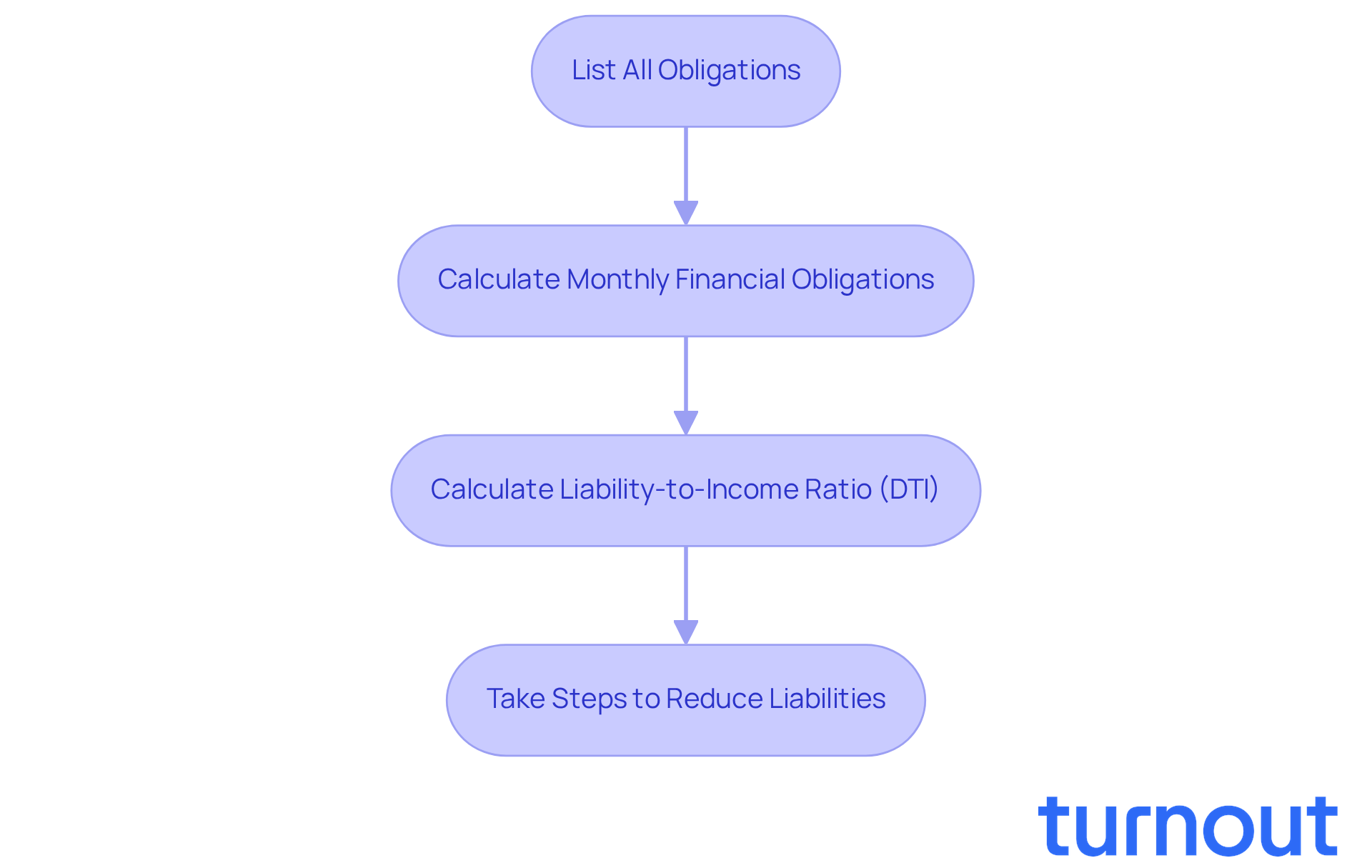

List All Obligations: We understand that managing finances can feel overwhelming. Start by creating a comprehensive list of all your existing liabilities, including credit cards, student loans, auto loans, and any other monetary responsibilities. This overview is crucial for understanding your financial landscape and can help you feel more in control.

-

Calculate Your Monthly Financial Obligations: Take a moment to assess how much you pay each month towards these responsibilities. Knowing your total monthly financial obligations is essential, especially when applying for a mortgage. It’s a step towards clarity and peace of mind.

-

Calculate Your Liability-to-Income Ratio (DTI): To find your DTI ratio, divide your total monthly financial obligations by your gross monthly income. As of 2026, the median yearly DTI ratio in the U.S. is 107%, which means many households owe more than they earn annually. Most lenders prefer a DTI of 33% to 36%, indicating a manageable financial obligation relative to income. Remember, as mortgage advisor Maureen Milliken says, "Understanding your DTI is crucial for securing a mortgage, as it shows lenders your ability to manage monthly payments."

-

Take Steps to Reduce Liabilities: If your DTI exceeds the preferred threshold, don’t worry - there are steps you can take to lower your obligations. Focus on reducing high-interest debts first or consider consolidation options to simplify your payments. For example, if your monthly gross income is $5,000 and your total monthly payment obligations are $2,000, your DTI would be 40%, which is within the acceptable range for many lenders. By actively managing your debt, you can enhance your chances of securing a mortgage without 2 years tax returns. Remember, you’re not alone in this journey; we’re here to help you every step of the way.

Understand the Stress Test Requirements

-

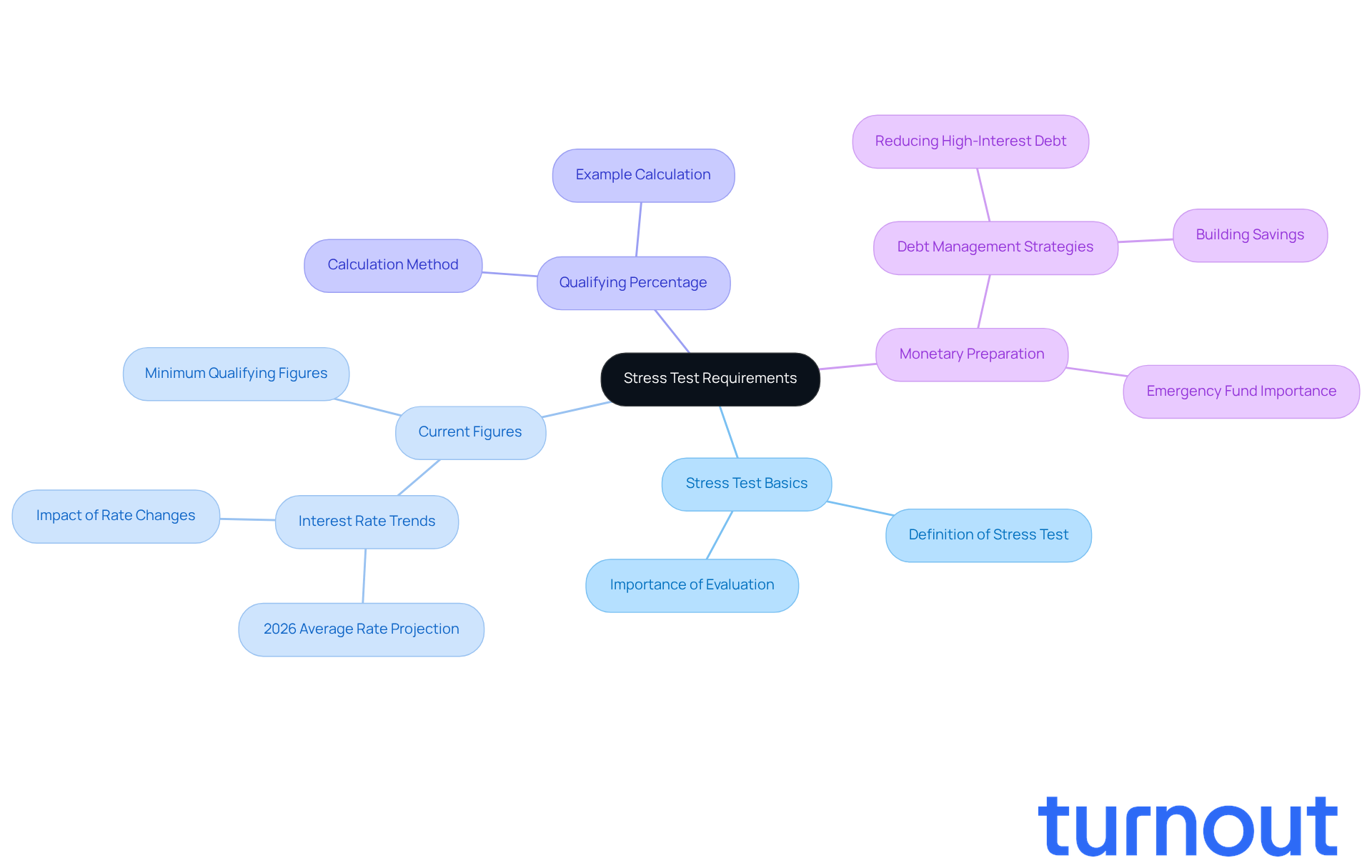

Understand the Stress Test Basics: We know that navigating loan payments can be daunting, especially if interest rates rise. A loan stress examination evaluates your ability to manage these payments under such circumstances. Lenders often require you to qualify at a percentage higher than your actual loan interest - typically adding 2% to the current rate or using a minimum qualifying percentage, whichever is greater. For 2026, the anticipated average loan interest is 6.1%, which means your qualifying figure could be significantly higher depending on your actual loan percentage.

-

Stay Informed on Current Figures: It's essential to keep an eye on current interest rates and the minimum qualifying figures set by lenders. This knowledge empowers you to understand the standards you need to meet for loan qualification. As Greg McBride, former chief financial analyst at Bankrate, points out, grasping these figures can help you navigate the lending landscape more effectively.

-

Calculate Your Qualifying Percentage: Your qualifying percentage is determined by adding 2% to your loan interest or using the lender's minimum qualifying percentage - whichever is higher. For instance, if your loan rate is 6.1%, your qualifying rate would be 8.1%. Knowing this calculation is crucial for assessing your readiness to apply for a mortgage.

-

Monetary Preparation is Essential: To successfully pass the stress test, it's vital to ensure your financial situation is strong. This might involve strategies like reducing existing debts, building savings, or improving your credit score. Clients who manage high-interest debts while keeping low credit card balances often demonstrate greater financial stability, which can enhance their chances of passing the stress test. Additionally, having an emergency fund that covers several months of living expenses can further bolster your refinancing application. As Carl Holman, Communications Manager, emphasizes, addressing high-interest debt first can significantly improve your overall financial health. Remember, the stress test for uninsured mortgages may be removed by early 2026, which could change the qualification landscape. You're not alone in this journey; we're here to help you every step of the way.

Conclusion

Securing a mortgage without two years of tax returns is not just possible; it’s achievable with the right preparation and understanding. We know that navigating this process can feel overwhelming, but gathering the necessary documents and evaluating your financial health can make a significant difference. Choosing the right lender who understands your unique situation is crucial. By following these essential steps, you can approach the mortgage landscape with confidence, even when traditional documentation isn’t available.

Key insights discussed in this guide include:

- The importance of checking your credit report for errors

- Understanding your total monthly housing costs

- Evaluating your overall debt load

Each of these components plays a vital role in determining your mortgage eligibility and can greatly influence the approval process. It’s common to feel uncertain about stress test requirements, but being aware of them and actively working to improve your financial standing can enhance your chances of securing a favorable mortgage deal.

Ultimately, taking proactive steps to prepare financially and understanding the requirements can pave the way for a successful mortgage application. Whether it’s consulting with a mortgage advisor, improving your credit score, or researching lenders who specialize in alternative documentation loans, remember that you’re not alone in this journey. Embrace these strategies and take control of your financial future. You are well-equipped to secure the mortgage that fits your needs.

Frequently Asked Questions

What documents do I need to gather for my mortgage application?

You will need to collect essential documents such as proof of income, bank statements, identification, recent pay stubs, W-2 forms, and any other financial documentation that lenders typically require. If you have additional income sources like alimony or child support, be prepared to provide that information as well.

How can I check my financial well-being before applying for a mortgage?

Evaluate your current financial situation by reviewing your savings, debts, and credit score. Understanding your financial well-being will help you set realistic expectations and show lenders that you have a steady income and manageable debt levels.

How do I find the right lender for my mortgage?

Look for lenders that offer mortgages without requiring 2 years of tax returns. Some lenders, like Guild Mortgage and AmeriHome, specialize in alternative documentation loans, which can benefit self-employed individuals. Additionally, be aware that Fannie Mae has removed its minimum credit score requirement as of November 15, 2025.

Should I consult with a mortgage advisor, and what can they help with?

Yes, consulting with a mortgage advisor can provide you with personalized guidance tailored to your financial situation. They can help you navigate the application process and suggest strategies to improve your chances of approval.

How can I obtain my credit report?

You can request a free copy of your credit report from the three major credit bureaus: Equifax, Experian, and TransUnion. You are entitled to one free report from each bureau every year.

What should I do if I find errors on my credit report?

Carefully examine your credit report for any inaccuracies. If you spot discrepancies, you should dispute them with the credit bureau to ensure you have a fair assessment of your credit.

Why is it important to understand my credit score?

Familiarizing yourself with your credit score is crucial because a higher score can lead to better loan rates. Knowing what factors influence your score can empower you to make informed financial decisions.

What actions can I take to improve my credit score?

To enhance your credit score, consider reducing debts, making timely payments, and avoiding new credit inquiries before applying for a loan.