Introduction

Navigating the complexities of tax returns can often feel like traversing a labyrinth. We understand that dealing with an amended return marked as 'adjusted but not completed' can be particularly daunting. This status signifies that the IRS has acknowledged changes based on your submission, but it also raises important questions about potential refunds or additional taxes owed. Understanding the implications of this status is crucial for anyone seeking clarity and resolution.

It's common to feel uncertain when the IRS remains silent. What steps can you take to ensure your amended return is processed efficiently? You're not alone in this journey, and there are ways to navigate these challenges with confidence. Let's explore the options available to you.

Understand the Meaning of 'Adjusted' Status

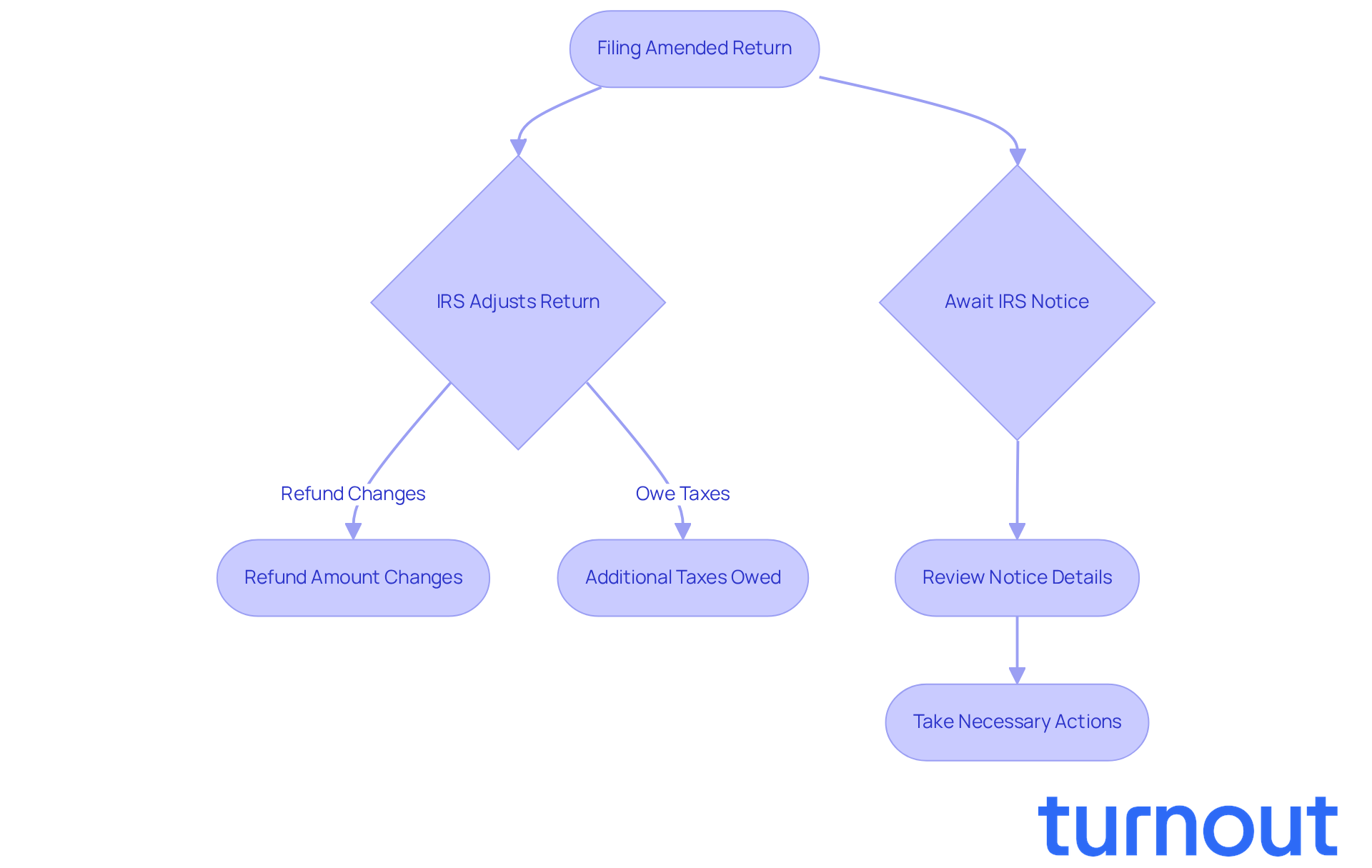

When your revised filing indication is marked as 'adjusted,' it reflects that my amended return says adjusted but not completed, meaning the IRS has made changes based on the information you provided. This adjustment could affect your refund amount or, as my amended return says adjusted but not completed, indicate that you owe additional taxes. We understand that navigating these changes can be stressful, and knowing your status is crucial. It reflects the IRS's acknowledgment of your amendments, as my amended return says adjusted but not completed concerning the adjustments made to your account.

If the IRS sends you a notice about these changes, it will detail the specifics of the adjustments and any actions you may need to take. It's common to feel anxious during this time, especially since revised filings can take longer than 12 weeks to process. Patience is essential, but remember, you’re not alone in this journey.

Did you know that about 3% of taxpayers revise their filings each year? Many find financial advantages through these adjustments, which highlights the importance of addressing any inconsistencies swiftly. When modifying your submission, make sure to use IRS Form 1040-X and attach all necessary supporting documents. This helps avoid processing delays and ensures a smoother experience.

Real-world examples show that many consumers face adjustments that can significantly impact their financial situations. Staying informed and proactive is key. Remember, we're here to help you through this process.

Check Your Amended Return Status Online

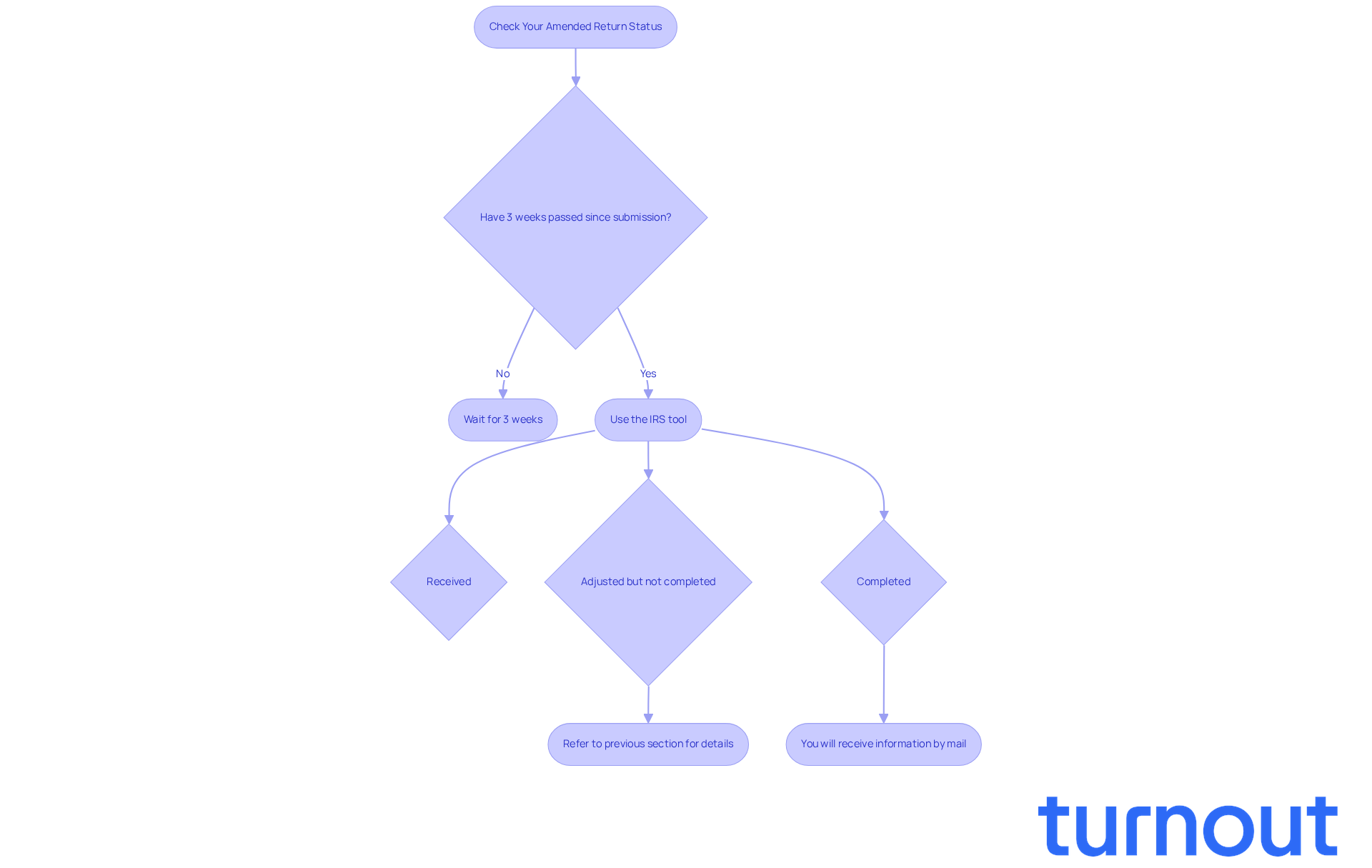

We understand that navigating the tax process can be stressful, especially when it comes to verifying your revised submission. To help ease your concerns, the IRS offers a handy tool called 'Where's My Revised Submission?' available on their website. Just enter your Social Security number, date of birth, and ZIP code to check your status.

It's common to feel anxious about the progress of your submission, so we recommend waiting at least three weeks after sending in your revised return before checking in. This timeframe allows the IRS to process your submission properly. Typically, processing Form 1040-X takes about 8 to 12 weeks, but in some cases, it might extend to 16 weeks. Keeping this in mind can help you manage your expectations as you monitor your progress.

When you use the tool, you’ll see one of three statuses:

- 'Received'

- 'My amended return says adjusted but not completed'

- 'Completed'

If you find that your status is 'Adjusted,' remember that my amended return says adjusted but not completed, so don’t worry-just refer back to the previous section for more details on what that means. If you encounter any issues accessing the tool, remember that you can always reach out to the IRS directly at 1-866-464-2050 for assistance. We're here to help!

Lastly, it’s good to note that the IRS has announced January 26, 2026, as the start of the 2026 filing season. Keeping this date in mind can be helpful as you prepare for your upcoming tax obligations. Remember, prompt follow-up can make a big difference in ensuring your revised submission is processed smoothly.

Identify Common Reasons for Processing Delays

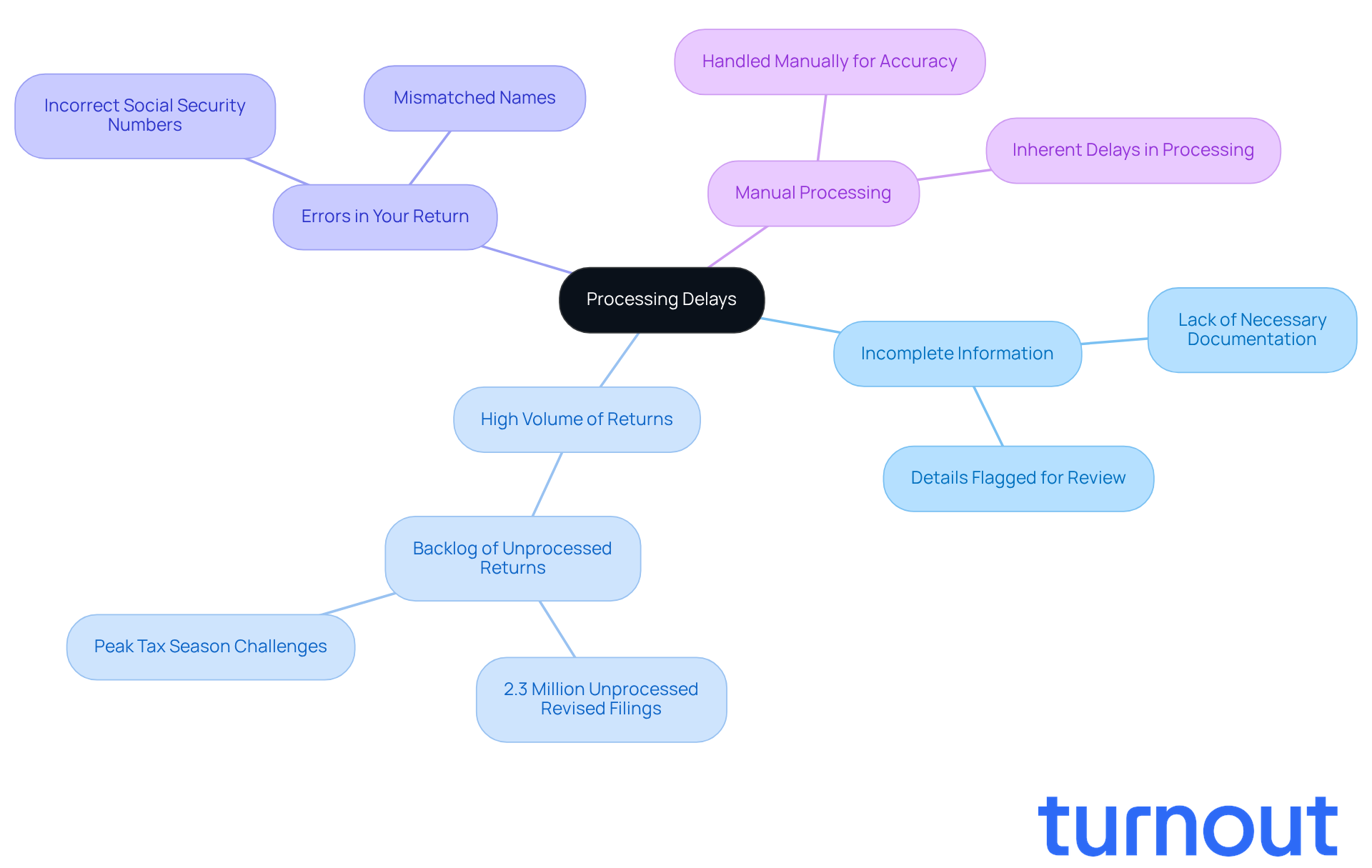

We understand that waiting for my amended return says adjusted but not completed can be stressful. It’s important to know what to expect, especially since my amended return says adjusted but not completed, as several factors can contribute to delays in processing.

- Incomplete Information: Amended returns that lack necessary documentation or details are often flagged for further review. This can significantly extend processing times. In fact, many revised filings experience delays because my amended return says adjusted but not completed.

- High Volume of Returns: The IRS frequently deals with a backlog, especially during peak tax seasons. As of December 2021, there were 2.3 million unprocessed revised individual tax filings. This can lead to longer wait times for you.

- Errors in Your Return: Simple mistakes, like incorrect Social Security numbers or mismatched names, can cause significant delays. These errors often trigger additional reviews, which complicate the process, similar to how my amended return says adjusted but not completed.

- Manual Processing: Unlike typical submissions, revised filings are generally handled manually. While this approach ensures accuracy, it can inherently delay the overall timeline, causing frustration for those awaiting refunds, particularly when my amended return says adjusted but not completed.

As Erin Collins notes, the IRS faces a dilemma in handling claims swiftly while preventing fraud. This adds to the complexity of processing delays. Understanding these possible concerns can help you stay calm and proactive while waiting for your reimbursement to be processed. Remember, you are not alone in this journey, and we’re here to help.

Take Action If Your Amended Return Remains Unresolved

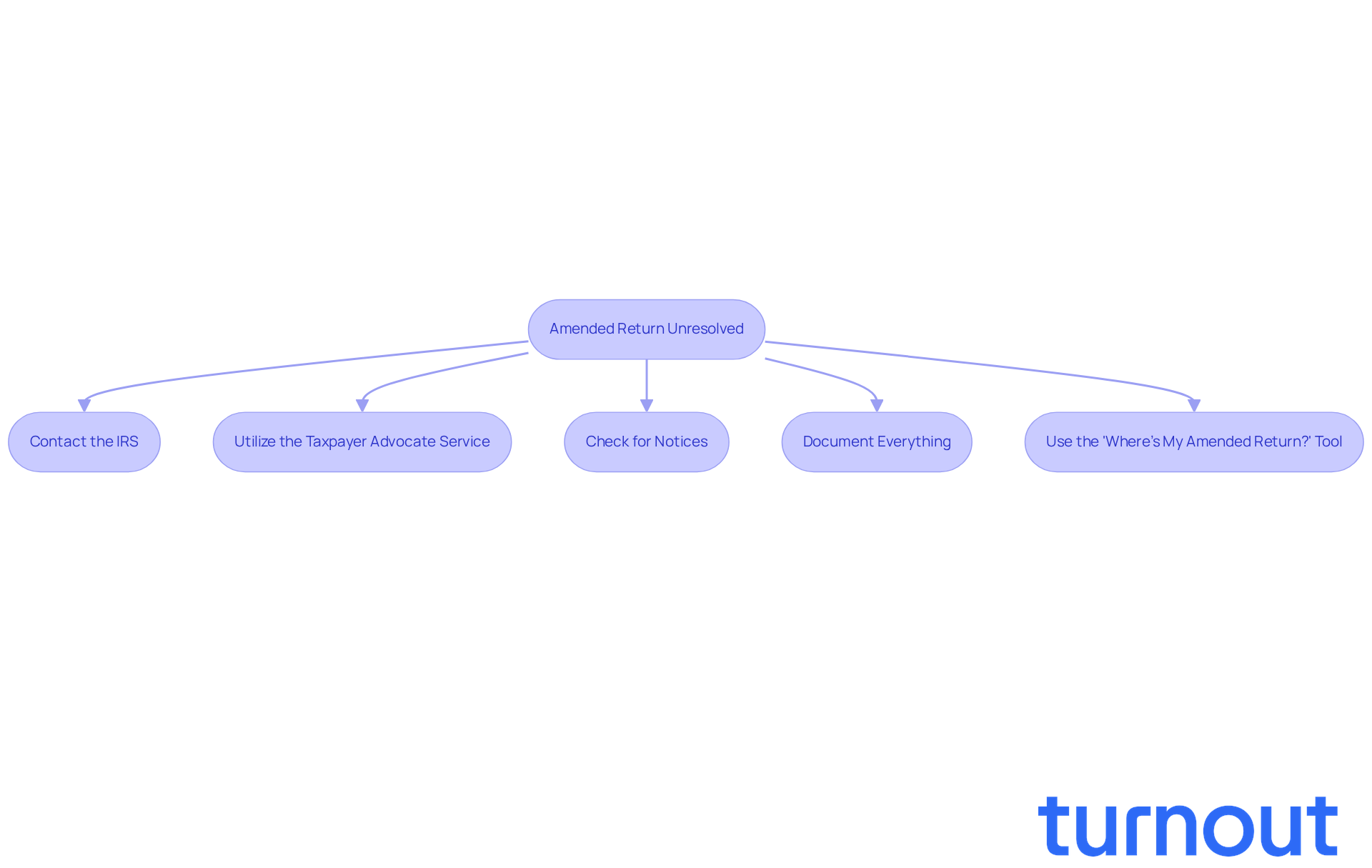

If your amended return remains unresolved after 16 weeks, we understand how frustrating that can be. Here are some steps you can take to help resolve the situation:

-

Contact the IRS: Give the IRS a call at 1-800-829-1040 to check on the status of your filing. Be prepared to share your personal information and details about your revised submission. Remember, it’s common to feel overwhelmed, but persistence is key. The IRS is currently managing a backlog of 3.4 million unprocessed filings, which can lead to delays.

-

Utilize the Taxpayer Advocate Service: If this delay is causing you significant hardship, don’t hesitate to reach out to the Taxpayer Advocate Service. This independent organization within the IRS is here to help you navigate the process and advocate on your behalf, especially if your case has been unresolved for a while.

-

Check for Notices: Make sure you haven’t missed any correspondence from the IRS that might need your attention or additional information. Overlooking notices can prolong the resolution process, and we want to help you avoid that.

-

Document Everything: Keep a detailed record of all communications with the IRS, including dates, times, and the names of representatives you speak with. This documentation is crucial if you need to escalate your case or seek further assistance. You’re not alone in this journey, and having everything documented can make a difference.

-

Use the 'Where's My Amended Return?' Tool: To verify the status of your electronically submitted revised filing, use the 'Where's My Amended Return?' online tool or call the toll-free number 866-464-2050. This can confirm receipt and provide updates on your modified submission's status.

By taking these proactive steps, you can work towards resolving any issues, as my amended return says adjusted but not completed. Remember, we’re here to help you every step of the way, and you deserve a positive outcome.

Conclusion

Navigating the complexities of an amended tax return can feel overwhelming, especially when you encounter an 'adjusted but not completed' status. We understand that this designation can be confusing. It means the IRS has recognized your amendments but hasn’t finalized the processing yet. This situation might lead to changes in your refund or indicate additional taxes owed. Staying informed and proactive is essential during this time.

Patience and diligence are key when dealing with amended returns. Factors like incomplete information, processing backlogs, and manual reviews can cause delays. It’s common to feel frustrated, but utilizing resources like the IRS's online tools and customer service can make a difference. By documenting your communications and following up, you can help ensure your amended return is resolved efficiently.

Taking action when faced with an unresolved amended return is vital. Whether it’s reaching out to the IRS, using the Taxpayer Advocate Service, or simply checking for notifications, being proactive can significantly impact the outcome of your filing. Remember, you’re not alone in this journey. With the right approach, clarity and resolution are within reach.

Frequently Asked Questions

What does it mean when my filing status is marked as 'adjusted'?

When your filing status is marked as 'adjusted,' it indicates that the IRS has made changes to your return based on the information you provided. This status may affect your refund amount or indicate that you owe additional taxes.

What should I do if I receive a notice from the IRS about changes to my return?

If you receive a notice from the IRS regarding changes, it will detail the specifics of the adjustments and any actions you may need to take. It's important to review this notice carefully.

How long does it typically take for revised filings to be processed?

Revised filings can take longer than 12 weeks to process, so patience is essential during this time.

How common is it for taxpayers to revise their filings?

Approximately 3% of taxpayers revise their filings each year.

What form should I use to modify my tax submission?

To modify your submission, you should use IRS Form 1040-X and attach all necessary supporting documents to avoid processing delays.

Why is it important to address inconsistencies in my tax filings promptly?

Addressing inconsistencies swiftly can lead to financial advantages and help avoid complications with the IRS regarding your tax return.

How can I ensure a smoother experience when filing an amended return?

To ensure a smoother experience, make sure to use IRS Form 1040-X, attach all necessary supporting documents, and stay informed about your filing status.