Introduction

Navigating the complexities of tax regulations can feel overwhelming, especially when it comes to claiming parents as dependents. We understand that many people struggle with the eligibility criteria and the potential benefits that come with this claim. It’s not just about numbers; it’s about finding financial relief when you need it most.

However, the process isn’t without its challenges. What if you can’t find the necessary documentation? Or what if the IRS raises questions about income discrepancies? These concerns are common, and it’s okay to feel uncertain.

This guide is here to help demystify the steps involved in claiming parents as dependents. We aim to provide clarity and confidence for those looking to maximize their tax benefits. Remember, you are not alone in this journey - we're here to help.

Understand Eligibility Criteria for Claiming Parents as Dependents

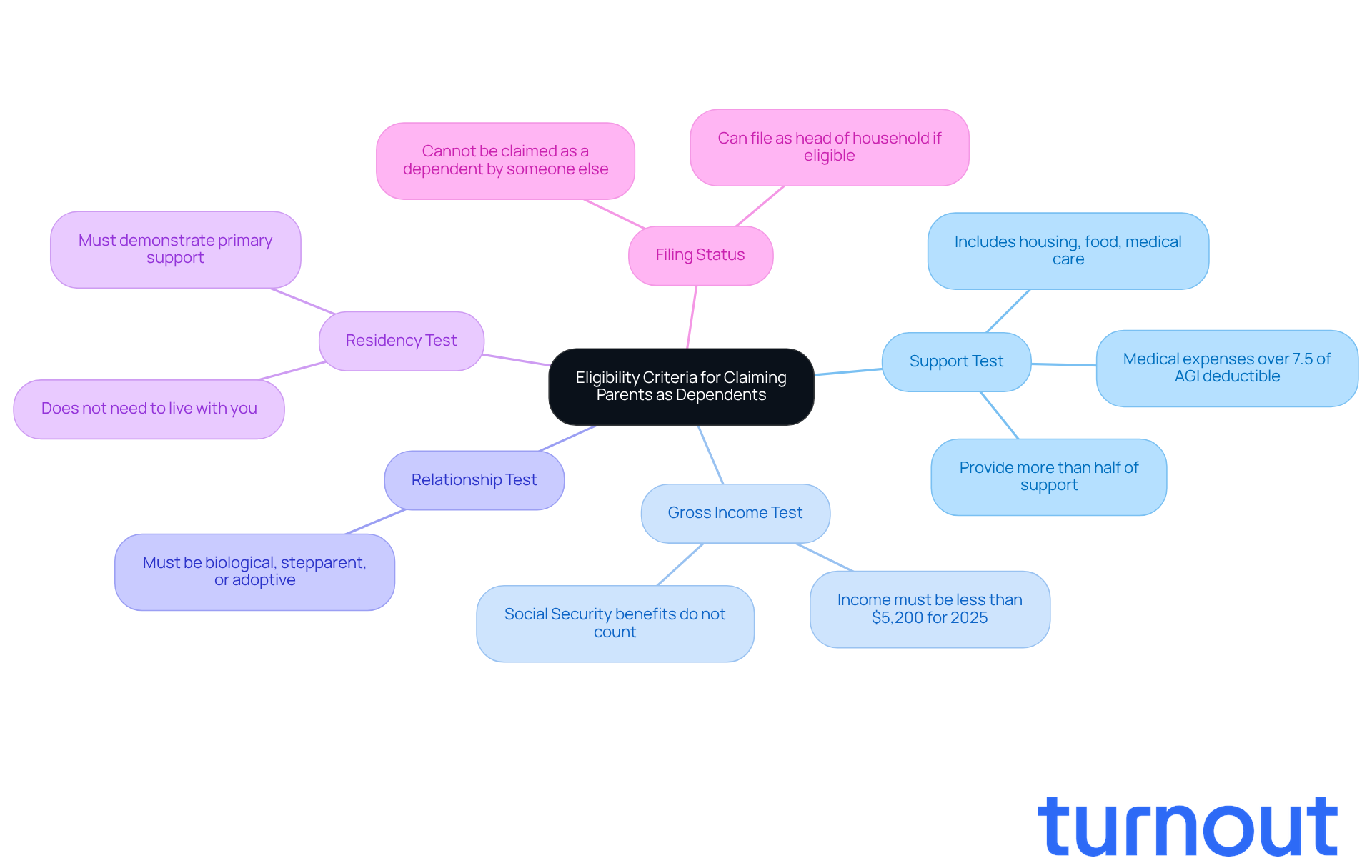

If you're considering whether puedo poner a mis padres como dependientes on your tax return, it's essential to understand the specific eligibility criteria set by the IRS. We know this can feel overwhelming, but we're here to help you navigate through it. Here are the key requirements you need to keep in mind:

-

Support Test: You must provide more than half of your guardian's total support for the year. This includes essential expenses like housing, food, medical care, and other necessities. If you spend over 7.5% of your adjusted gross income on your guardian's medical care, you can claim those costs as an itemized deduction, which can offer you some extra financial relief.

-

Gross Income Test: For the tax year 2025, your guardian's gross income must be less than $5,250. The good news is that Social Security benefits typically don’t count towards this income limit, allowing many caregivers to claim their loved ones despite these benefits. Remember, designating a guardian as a dependent won’t affect their Social Security benefits or Supplemental Security Income (SSI).

-

Relationship Test: Your guardian must be related to you as a biological guardian, stepparent, or adoptive guardian. This connection is crucial for qualifying as a dependent.

-

Residency Test: While your guardian doesn’t need to live with you, you must demonstrate that you provide their primary support. You can do this by documenting your financial contributions.

-

Filing Status: You (and your spouse, if filing jointly) cannot be claimed as a dependent by someone else. This ensures you can designate your guardian as a dependent.

If you meet all these criteria, you can benefit from significant tax advantages, as puedo poner a mis padres como dependientes, which may lead to potential credits and deductions that could enhance your overall tax refund. As Mark Steber, Chief Tax Officer at Jackson Hewitt, wisely notes, "If you are providing more than half of your guardians’ financial support, you may be able to consider your guardians as dependents." Remember, you’re not alone in this journey, and understanding these requirements can make a big difference.

Gather Required Documentation for Your Claim

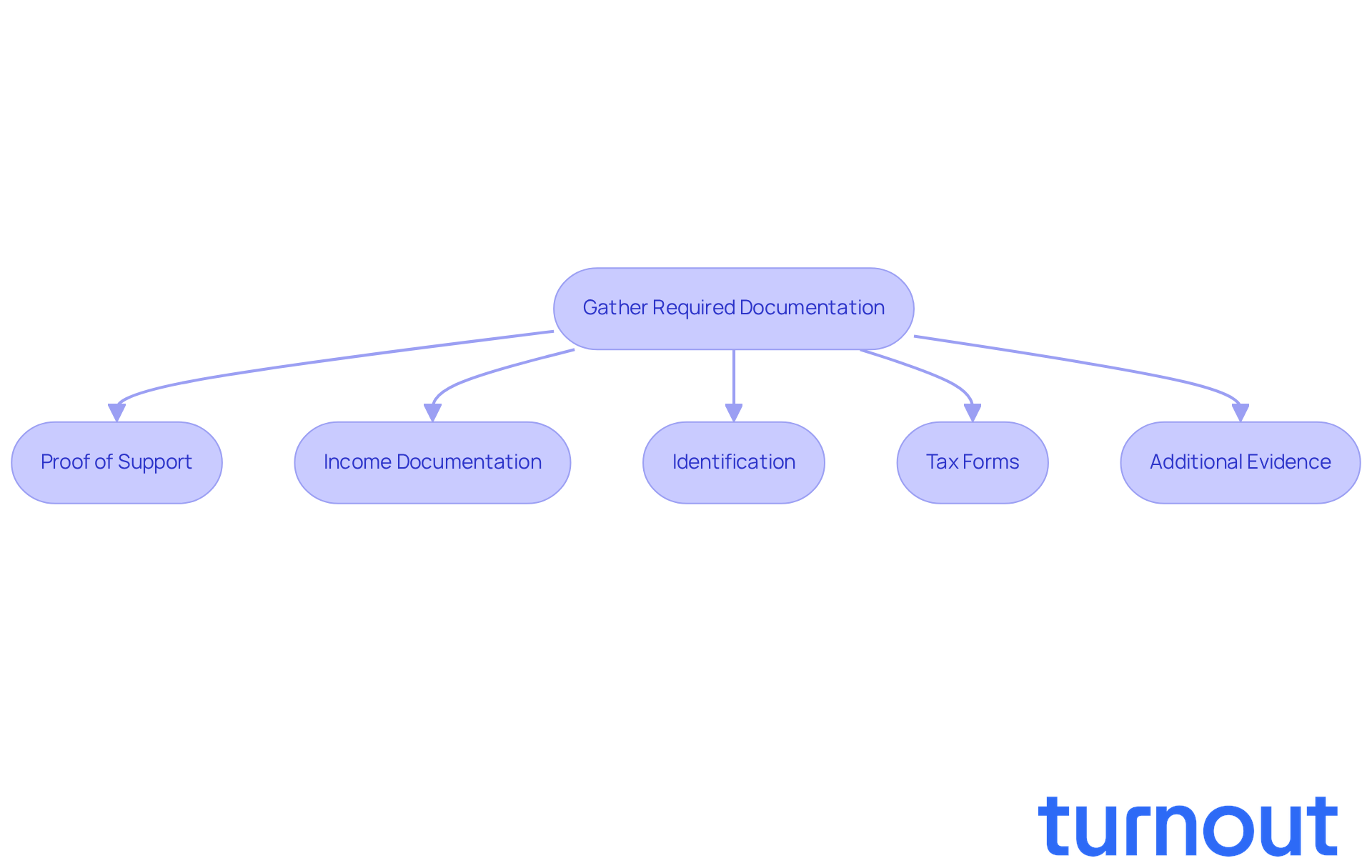

Before you file your claim, it’s essential to gather the necessary documentation to support your eligibility. We understand that this process can feel overwhelming, but having everything in order can make a significant difference. Here’s a checklist of what you’ll need:

-

Proof of Support: Collect receipts, bank statements, or any documentation that shows I puedo poner a mis padres como dependientes because I provided more than half of their support. This can include rent payments, grocery bills, and medical expenses.

-

Income Documentation: Obtain your guardian's income statements, such as Social Security benefit statements (Form SSA-1099) and any other income sources. This will help verify that their gross income is below the threshold. For 2025, each guardian's gross income must be under $5,200 to qualify as a reliant, and Social Security income generally does not count toward this limit.

-

Identification: Make sure you have your guardian's Social Security number and any relevant identification documents, like a driver’s license or state ID.

-

Tax Forms: Prepare to fill out IRS Form 1040, where you’ll indicate your guardian as a dependent. If multiple people are claiming the same guardian, you may also need to complete Form 2120 to clarify the assertions.

-

Additional Evidence: Gather any other documents that can support your claim, such as proof of residency or legal documents that establish your relationship. This can include utility bills in your guardian's name or a lease agreement.

Having these documents ready will streamline the filing process and help avoid complications. It’s common to feel anxious about gathering this information, but being organized can significantly reduce delays. Experts suggest that the average time taken to collect this documentation can vary, but remember, you’re not alone in this journey. According to Mark Steber, Senior Vice President and Chief Tax Officer, "Claiming a guardian as a reliant on your tax return can provide substantial financial benefits." By ensuring you have all necessary proof, I can put my parents as dependents, which will help maximize your potential tax benefits, such as qualifying for head of household status or the $500 nonrefundable Credit for Other Dependents, and simplify your tax filing experience.

File Your Claim: Step-by-Step Instructions

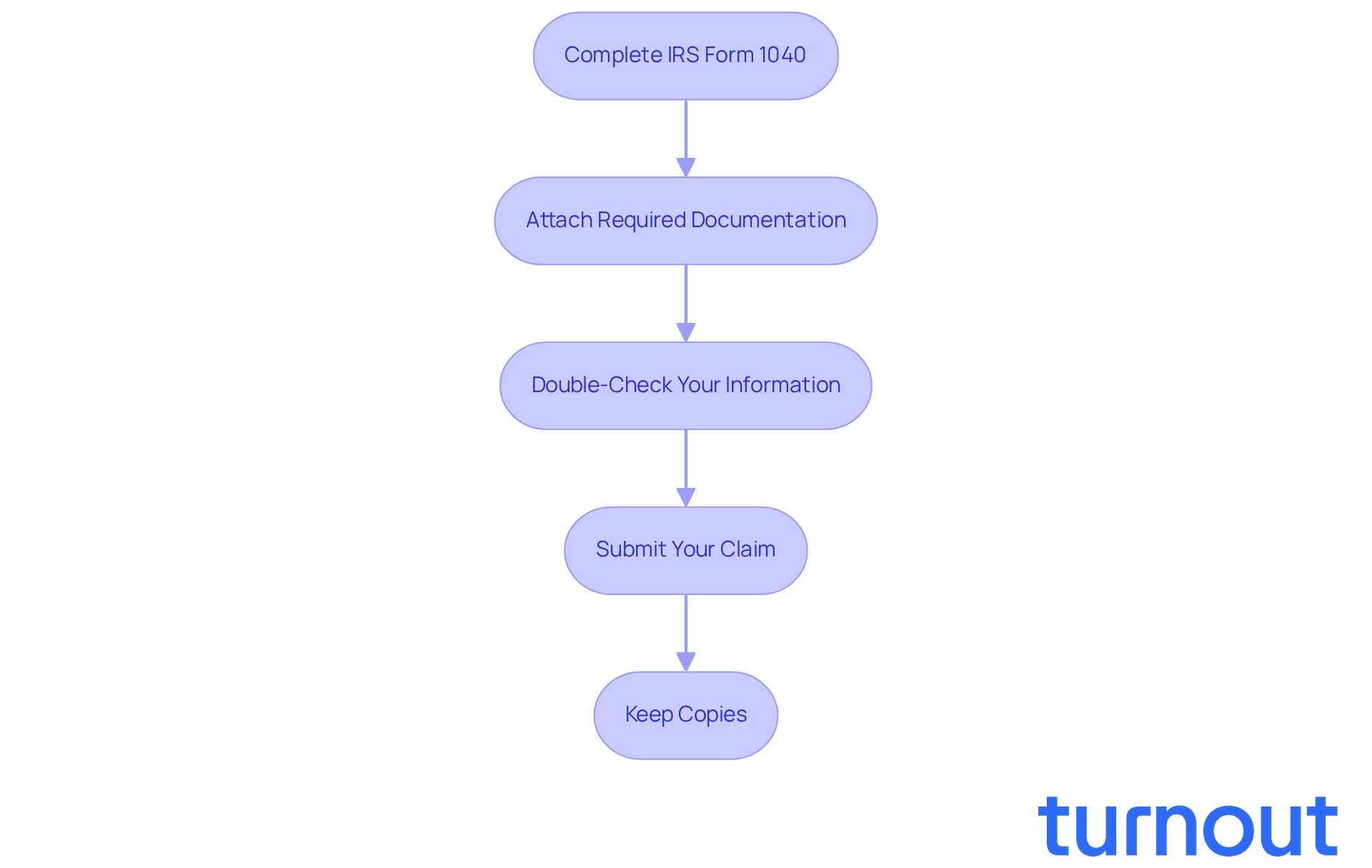

Filing a claim can feel overwhelming, but if you need assistance, remember that puedo poner a mis padres como dependientes. Follow these simple steps to make the process smoother:

-

Complete IRS Form 1040: Start by filling out your tax return with Form 1040. Make sure to clearly indicate that puedo poner a mis padres como dependientes in the designated section. This is an important first step in securing the support you need.

-

Attach Required Documentation: Gather and include copies of necessary documents, like proof of support and income statements. It’s crucial that all documents are clear and legible to help with processing. We understand that gathering paperwork can be a hassle, but it’s worth it for your peace of mind.

-

Double-Check Your Information: Take a moment to carefully review your completed form for accuracy. Verify that your parent's Social Security number and all financial details are correct. This can prevent any processing delays, which can be frustrating.

-

Submit Your Claim: You can file your tax return electronically or by mail. If you choose to mail it, send it to the address specified in the IRS instructions for Form 1040. Remember, submitting your claim is a significant step toward receiving the support you deserve.

-

Keep Copies: Don’t forget to retain copies of your submitted forms and all supporting documents for your records. This is essential in case of any future inquiries or audits by the IRS. Keeping everything organized can help ease your worries.

By following these steps, you can effectively submit your request and potentially qualify for valuable tax deductions or credits, as long as puedo poner a mis padres como dependientes. Remember, you are not alone in this journey, and taking these steps can lead to the support you need.

Troubleshoot Common Issues in the Claiming Process

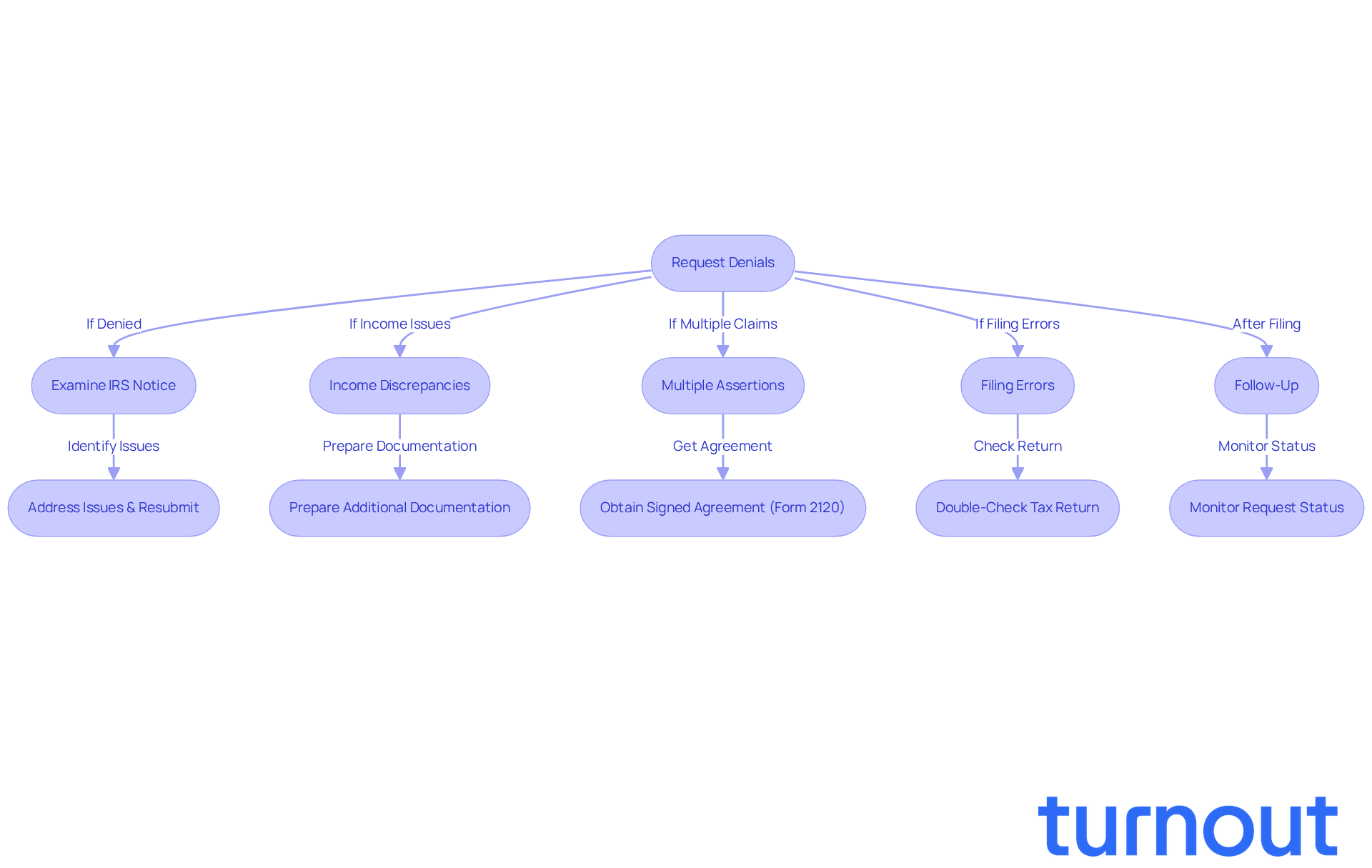

Even with careful preparation, we understand that issues can arise during the claiming process. Here are some common problems you might face and how to troubleshoot them:

-

Request Denials: If your request is denied, take a moment to examine the IRS notice for specific reasons. Common issues include missing documentation or incorrect information. Address these concerns and resubmit your request promptly to avoid delays. Remember, you’re not alone in this.

-

Income Discrepancies: If the IRS inquires about your guardian's income, it’s important to be prepared with additional documentation. Make sure all income sources are accurately reported and that you have supporting evidence ready. We’re here to help you through this.

-

Multiple Assertions: If more than one individual claims the same parent as a dependent, the IRS will require clarification. Ensure you have a signed agreement (Form 2120) from any other claimants to avoid disputes. It’s common to feel overwhelmed, but clarity can ease the process.

-

Filing Errors: Double-check your tax return for any errors before submission. Simple mistakes can lead to delays or rejections. If you’re unsure, consider using tax preparation software or consulting a tax professional. You deserve peace of mind.

-

Follow-Up: After filing, keep an eye on the status of your request. If you don’t receive confirmation from the IRS within a reasonable timeframe, don’t hesitate to follow up. It’s important to ensure your request is being processed.

By being aware of these common issues and knowing how to address them, you can enhance your chances of a successful claim. Remember, we’re here to support you every step of the way.

Conclusion

Understanding how to claim parents as dependents can truly make a difference in your tax situation. It opens the door to potential deductions and credits that can enhance your financial well-being. We know that navigating the eligibility criteria can feel overwhelming, but by following the necessary steps, you can maximize your tax benefits while fulfilling your caregiving responsibilities.

This article has outlined the essential requirements for claiming parents as dependents. These include:

- Support test

- Gross income test

- Relationship test

- Residency test

- Filing status

It’s crucial to gather the right documentation, such as proof of support and income statements, to ensure a smooth filing process. We’ve also provided a step-by-step guide to help you file claims and troubleshoot common issues that may arise, so you feel equipped to tackle any challenges.

Ultimately, claiming parents as dependents is more than just a financial strategy; it reflects your commitment to providing for your loved ones. Taking the time to understand the IRS guidelines and preparing thoroughly can lead to substantial benefits. We understand that this journey may feel daunting, but with the right knowledge and resources, you can confidently navigate the process and secure the support you deserve.

Frequently Asked Questions

What is the support test for claiming parents as dependents?

You must provide more than half of your guardian's total support for the year, which includes essential expenses like housing, food, medical care, and other necessities. If you spend over 7.5% of your adjusted gross income on your guardian's medical care, you can claim those costs as an itemized deduction.

What is the gross income test for claiming parents as dependents?

For the tax year 2025, your guardian's gross income must be less than $5,250. Social Security benefits typically do not count towards this income limit, allowing many caregivers to claim their loved ones.

What is the relationship test for claiming parents as dependents?

Your guardian must be related to you as a biological guardian, stepparent, or adoptive guardian in order to qualify as a dependent.

Is there a residency requirement for claiming parents as dependents?

Your guardian does not need to live with you, but you must demonstrate that you provide their primary support through documentation of your financial contributions.

What is the filing status requirement for claiming parents as dependents?

You (and your spouse, if filing jointly) cannot be claimed as a dependent by someone else to ensure you can designate your guardian as a dependent.

What are the potential benefits of claiming parents as dependents?

If you meet all the eligibility criteria, you can benefit from significant tax advantages, including potential credits and deductions that could enhance your overall tax refund.